Premature Rupture of Membranes Testing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429769 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Premature Rupture of Membranes Testing Market Size

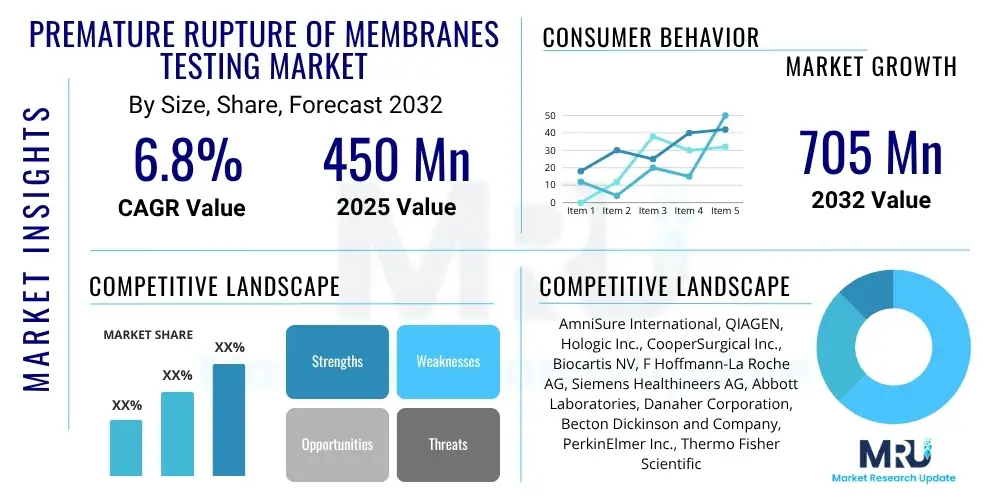

The Premature Rupture of Membranes Testing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $450 Million in 2025 and is projected to reach $705 Million by the end of the forecast period in 2032.

Premature Rupture of Membranes Testing Market introduction

The Premature Rupture of Membranes (PROM) Testing Market encompasses diagnostic solutions aimed at identifying the rupture of fetal membranes before the onset of labor. PROM is a critical obstetric complication, occurring in approximately 10% of pregnancies, significantly increasing the risk of preterm birth, maternal infections, and fetal distress. Early and accurate diagnosis of PROM is paramount for timely clinical intervention, which can prevent severe maternal and neonatal morbidity and mortality, thereby improving pregnancy outcomes. The products involved in this market range from simple pH tests and fern tests to advanced biomarker assays and molecular diagnostics.

These specialized diagnostic tools are designed to detect the leakage of amniotic fluid, which is indicative of a membrane rupture. Major applications include confirmatory diagnosis in suspected cases, risk stratification for expectant management, and guiding decisions regarding hospitalization, antibiotic prophylaxis, and induction of labor. The primary benefits of these tests lie in their ability to provide rapid and reliable results, aiding healthcare providers in making informed clinical judgments swiftly. This reduces the incidence of misdiagnosis, prevents unnecessary interventions, and ensures appropriate management strategies are employed to safeguard both mother and fetus. The rising global incidence of preterm births, coupled with continuous advancements in diagnostic technologies and growing awareness among healthcare professionals regarding the importance of early detection, are significant driving factors for market expansion.

The market also benefits from increasing research and development activities focused on non-invasive, highly sensitive, and specific testing methods. The goal is to minimize patient discomfort while maximizing diagnostic accuracy. Additionally, improved access to maternal healthcare services in developing regions and initiatives to reduce maternal and infant mortality contribute to the expanding adoption of PROM testing. As healthcare systems globally prioritize comprehensive prenatal care and risk management for high-risk pregnancies, the demand for sophisticated and efficient PROM testing solutions is anticipated to continue its upward trajectory, fostering innovation and market growth.

Premature Rupture of Membranes Testing Market Executive Summary

The Premature Rupture of Membranes Testing Market is witnessing robust growth driven by increasing global preterm birth rates and technological advancements in diagnostic methodologies. Business trends indicate a strong focus on developing rapid, accurate, and non-invasive point-of-care (POC) testing solutions, fostering strategic partnerships and collaborations between diagnostic companies and healthcare providers. Companies are investing heavily in research and development to introduce novel biomarkers and integrated diagnostic platforms that offer enhanced sensitivity and specificity, thereby improving clinical utility and patient outcomes. Regulatory approvals for these innovative products are also shaping competitive landscapes, encouraging market entry and expansion by both established players and emerging biotechnology firms.

Regional trends highlight North America and Europe as significant markets due to advanced healthcare infrastructure, high awareness, and substantial research funding. However, the Asia Pacific region is emerging as a rapidly growing market, propelled by increasing healthcare expenditure, rising birth rates, and improving access to diagnostic services in countries like China and India. Latin America, the Middle East, and Africa are also showing potential, albeit with slower adoption rates, as healthcare infrastructure develops and awareness campaigns gain traction. The demand for cost-effective and accessible testing solutions is particularly pronounced in these developing regions, influencing product development strategies.

Segment trends underscore the dominance of immunoassay-based tests and kits and reagents due to their ease of use and widespread adoption. However, molecular diagnostics are gaining traction owing to their high precision and ability to detect specific markers. End-user segments, particularly hospitals and diagnostic centers, remain the largest consumers of PROM tests, driven by high patient volumes and the need for immediate, reliable results. The home care settings segment is projected to experience accelerated growth, fueled by the demand for patient-centric and convenient testing options, especially for high-risk pregnancies requiring continuous monitoring. Overall, the market is characterized by innovation, strategic expansion, and a strong emphasis on improving diagnostic accuracy and accessibility.

AI Impact Analysis on Premature Rupture of Membranes Testing Market

Users frequently inquire about artificial intelligence's potential to revolutionize PROM testing, focusing on enhanced accuracy, speed, and predictive capabilities. Common themes include how AI can process complex biomarker data, integrate with imaging techniques, and identify subtle patterns missed by traditional methods, leading to earlier and more reliable diagnoses. There are expectations that AI could streamline workflows, reduce human error, and even predict PROM risk in asymptomatic pregnancies. Concerns often revolve around the validation of AI algorithms, data privacy and security, the potential for algorithmic bias, and the practical challenges of integrating AI into existing clinical infrastructure, including the need for specialized training for healthcare professionals. Stakeholders also ponder the cost-effectiveness and scalability of AI solutions in diverse healthcare settings, from advanced hospitals to remote clinics.

- Enhanced diagnostic accuracy through advanced image analysis (e.g., ultrasound interpretation).

- Development of predictive models for PROM risk stratification using patient history and biomarker data.

- Faster and automated interpretation of complex laboratory results, reducing turnaround times.

- Integration with electronic health records (EHR) for comprehensive patient management and insights.

- Personalized treatment recommendations based on individual patient risk profiles.

- Optimized resource allocation in maternity wards through intelligent scheduling and risk assessment.

- Facilitation of remote monitoring and telehealth consultations for high-risk pregnancies.

- Identification of novel biomarkers through machine learning analysis of extensive datasets.

- Reduction in false positives and false negatives through sophisticated pattern recognition.

- Improved training and education for healthcare professionals using AI-driven simulation tools.

DRO & Impact Forces Of Premature Rupture of Membranes Testing Market

The Premature Rupture of Membranes (PROM) Testing Market is significantly influenced by a dynamic interplay of driving forces, restraining factors, and emerging opportunities, all shaped by broader impact forces. Key drivers include the persistently high global incidence of preterm births, which necessitates accurate and timely diagnosis of PROM to mitigate associated risks. Technological advancements, particularly in molecular diagnostics and immunoassay techniques, are continuously improving test sensitivity and specificity, making these diagnostics more reliable and accessible. Growing awareness among healthcare providers and pregnant individuals about the importance of early PROM detection for better maternal and fetal outcomes also fuels market expansion. Additionally, supportive government initiatives and non-governmental organization programs aimed at reducing infant mortality and improving maternal health contribute to the adoption of these testing solutions, especially in developing regions.

Conversely, several restraints impede market growth. The high cost associated with advanced diagnostic tests, particularly for molecular and point-of-care solutions, can be a significant barrier to widespread adoption, especially in low-income settings or for uninsured populations. A lack of comprehensive reimbursement policies in some regions further exacerbates this issue. Moreover, limited awareness and inadequate healthcare infrastructure in certain developing countries pose challenges to the availability and accessibility of PROM testing. The need for specialized training for healthcare professionals to effectively utilize and interpret advanced diagnostic technologies also acts as a restraint, as improper use can lead to misdiagnosis. Regulatory complexities and the stringent approval processes for new diagnostic products can also delay market entry and innovation.

Opportunities for growth are abundant within the market. The increasing focus on point-of-care (POC) testing offers a substantial opportunity, as POC devices provide rapid results at the bedside, enabling immediate clinical decisions. The discovery and validation of novel biomarkers for PROM detection hold immense potential for developing more accurate and less invasive tests. Emerging markets in Asia Pacific, Latin America, and Africa present significant untapped potential due to their large populations and improving healthcare infrastructure. Strategic collaborations and partnerships between diagnostic companies, research institutions, and healthcare providers can accelerate product development and market penetration. Furthermore, the integration of digital health solutions and telemedicine can enhance remote monitoring and accessibility of PROM testing services, expanding the market reach and improving patient care. These opportunities, coupled with ongoing technological innovations, are set to redefine the landscape of PROM testing.

Segmentation Analysis

The Premature Rupture of Membranes (PROM) Testing Market is meticulously segmented across various parameters, allowing for a granular understanding of its dynamics, growth drivers, and evolving trends. This segmentation helps identify distinct market niches, consumer preferences, and technological adoption patterns, thereby guiding strategic business decisions for market participants. The primary bases for segmentation include the type of test, the product components involved, the end-user facilities, and geographical regions, each revealing unique insights into market behavior and demand. Analyzing these segments provides a comprehensive overview of where demand is concentrated and where future growth opportunities are likely to emerge, enabling targeted market strategies and resource allocation.

The market's segmentation by test type highlights the prevalence and technological sophistication of different diagnostic approaches, ranging from basic bedside tests to advanced laboratory analyses. Product segmentation delineates the various components and instruments that constitute the testing ecosystem, from consumable kits to sophisticated automated analyzers. End-user segmentation categorizes the diverse healthcare settings where PROM tests are performed, reflecting the varied operational requirements and patient populations. Finally, geographical segmentation provides a regional perspective on market penetration, growth rates, and the impact of local healthcare policies and economic conditions. This multi-faceted segmentation ensures that the market report offers a holistic and actionable understanding of the PROM testing landscape.

- By Test Type

- Immunoassay Tests

- Spectrophotometric Tests

- Molecular Diagnostics

- Microscopic Tests (Fern Test, Nitrazine Test)

- Other Advanced Biomarker Tests

- By Product Type

- Kits and Reagents

- Analyzers and Instruments

- Consumables and Accessories

- By End User

- Hospitals

- Diagnostic Centers and Laboratories

- Specialty Clinics (Maternity Clinics, OB/GYN Practices)

- Home Care Settings

- Ambulatory Surgical Centers

- By Region

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Australia, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (South Africa, GCC Countries, Rest of MEA)

Value Chain Analysis For Premature Rupture of Membranes Testing Market

The value chain for the Premature Rupture of Membranes (PROM) Testing Market encompasses a series of interconnected activities that add value from the conceptualization of a diagnostic test to its final use by an end-user. This chain typically begins with upstream activities, involving research and development (R&D) to identify novel biomarkers and develop diagnostic technologies. This stage includes sourcing raw materials such as antibodies, enzymes, and chemical reagents from specialized suppliers. Manufacturers then transform these raw materials into finished diagnostic kits, reagents, and instruments, adhering to stringent quality control and regulatory standards. Innovation in this upstream segment, particularly in biomarker discovery and assay development, is critical for competitive advantage and market differentiation.

Moving downstream, the products are distributed to various healthcare facilities. The distribution channel is multifaceted, involving both direct and indirect routes. Direct distribution involves manufacturers selling directly to large hospitals or diagnostic laboratory chains, often accompanied by comprehensive technical support and training. Indirect distribution, which is more common, involves wholesalers, distributors, and third-party logistics providers who facilitate the movement of products from manufacturers to smaller clinics, pharmacies, and even for home care use. Effective supply chain management and a robust distribution network are crucial for ensuring product availability and timely delivery, especially given the time-sensitive nature of PROM diagnosis. This often includes specialized warehousing for temperature-sensitive reagents and efficient inventory management to minimize waste.

Finally, the value chain culminates with the end-users – hospitals, diagnostic centers, specialty clinics, and increasingly, home care settings – who utilize these tests for patient diagnosis and management. The efficiency of the entire value chain is pivotal; any disruptions, from raw material shortages to inefficient distribution, can impact patient care and market dynamics. The integration of digital platforms for order management, inventory tracking, and customer support further optimizes this value chain, enhancing transparency and responsiveness. Collaborations across different stages of the value chain, such as partnerships between R&D firms and manufacturers, or between manufacturers and large distribution networks, are essential for driving innovation and market penetration. The complexity and criticality of PROM testing demand a highly integrated and responsive value chain to meet diverse clinical needs.

Premature Rupture of Membranes Testing Market Potential Customers

The primary potential customers for Premature Rupture of Membranes (PROM) testing solutions are diverse healthcare entities and professionals involved in maternal and fetal care. Hospitals, particularly their obstetrics and gynecology departments, labor and delivery units, and emergency rooms, represent the largest segment of end-users. These facilities handle a high volume of pregnant patients, including those presenting with suspected PROM, and require rapid, reliable diagnostic tools to manage these cases effectively. Diagnostic centers and independent clinical laboratories also constitute a significant customer base, as they process samples referred by physicians and clinics, offering specialized PROM testing services with advanced instrumentation and expertise. The demand from these institutions is driven by the necessity for accurate diagnosis, efficient patient flow, and adherence to clinical guidelines for managing at-risk pregnancies.

Beyond institutional settings, specialty clinics focusing on maternal-fetal medicine, prenatal care, and general obstetrics and gynecology practices are crucial potential customers. These clinics cater to a substantial population of pregnant individuals who undergo routine screenings or present with symptoms suggestive of PROM. For these smaller practices, ease of use, cost-effectiveness, and rapid results are often key purchasing criteria. Moreover, as healthcare paradigms shift towards decentralized care, pregnant individuals themselves, particularly those identified as high-risk, are emerging as potential buyers for home-based PROM testing kits. This trend is driven by the desire for convenience, privacy, and continuous monitoring outside traditional clinical environments, supported by telehealth consultations. Pharmacists and retail medical suppliers also act as intermediaries, stocking and distributing these tests to both clinics and individual consumers.

Government health agencies and non-governmental organizations involved in public health initiatives, especially those focused on reducing maternal and infant mortality, also represent a significant customer segment. These organizations may procure PROM testing solutions for large-scale screening programs or for distribution to underserved populations in remote or developing regions. Their purchasing decisions are often influenced by the affordability, simplicity, and scalability of the tests. Ultimately, the market for PROM testing extends to any entity or individual seeking to improve diagnostic accuracy and clinical outcomes for pregnancies complicated by membrane rupture, underscoring the broad applicability and critical importance of these diagnostic tools across the healthcare continuum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $450 Million |

| Market Forecast in 2032 | $705 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AmniSure International, QIAGEN, Hologic Inc., CooperSurgical Inc., Biocartis NV, F Hoffmann-La Roche AG, Siemens Healthineers AG, Abbott Laboratories, Danaher Corporation, Becton Dickinson and Company, PerkinElmer Inc., Thermo Fisher Scientific Inc., Beckman Coulter (a Danaher company), Sysmex Corporation, Fuji Rebio Inc., Nipro Corporation, Medix Biochemica, Eiken Chemical Co Ltd, Quidel Corporation, Sekisui Diagnostics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Premature Rupture of Membranes Testing Market Key Technology Landscape

The Premature Rupture of Membranes (PROM) Testing Market is characterized by a dynamic and evolving technological landscape, driven by the continuous quest for enhanced accuracy, speed, and ease of use in diagnostic methods. Traditional methods, such as the nitrazine paper test and fern test, have long been staples, relying on visual inspection of amniotic fluid characteristics. While these methods are simple and inexpensive, their limitations in terms of sensitivity and specificity, particularly in the presence of confounding factors like blood or semen, have spurred the development of more advanced technologies. Current key technologies predominantly involve the detection of specific biochemical markers present in amniotic fluid that are typically absent or present in very low concentrations in cervicovaginal secretions.

Immunoassay-based tests represent a significant segment of the market, utilizing monoclonal antibodies to detect amniotic fluid-specific proteins such as placental alpha-microglobulin-1 (PAMG-1) and insulin-like growth factor binding protein-1 (IGFBP-1). These tests offer high sensitivity and specificity, providing rapid results, often within minutes, making them suitable for point-of-care (POC) applications. Spectrophotometric methods, though less common for direct PROM diagnosis, play a role in quantitative analysis of certain markers. Molecular diagnostics are emerging as a highly promising technology, offering unparalleled precision by detecting fetal DNA or RNA in cervicovaginal fluid, which is a definitive indicator of PROM. This technology addresses the limitations of protein-based assays by providing genetic-level confirmation, though it typically involves a longer turnaround time and requires specialized laboratory infrastructure.

The future technology landscape is expected to be dominated by further advancements in microfluidics for highly integrated, portable, and automated diagnostic platforms that can perform multiplex detection of multiple biomarkers simultaneously. Artificial intelligence and machine learning algorithms are also being integrated to improve the interpretation of complex diagnostic data, enhance predictive analytics for PROM risk, and streamline workflow in clinical settings. Furthermore, non-invasive imaging techniques and novel biosensors capable of detecting PROM early and continuously are under active research. These technological shifts are aimed at developing solutions that are not only highly accurate but also user-friendly, cost-effective, and adaptable to various healthcare environments, ultimately improving global access to critical PROM diagnostic capabilities and enhancing patient outcomes.

Regional Highlights

- North America: This region holds a dominant share in the PROM testing market, primarily due to advanced healthcare infrastructure, high healthcare expenditure, significant research and development activities, and a high awareness among healthcare professionals regarding the importance of early diagnosis. The presence of major market players and favorable reimbursement policies further contribute to market growth. The U.S. leads the market in terms of technology adoption and innovation.

- Europe: Europe represents a substantial market share, driven by rising incidences of preterm births, increasing government initiatives to improve maternal and child health, and the adoption of advanced diagnostic technologies. Countries like Germany, the U.K., and France are key contributors, characterized by well-established healthcare systems and robust research capabilities. Regulatory bodies are also actively involved in standardizing and promoting effective diagnostic tools.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market during the forecast period. This growth is attributable to improving healthcare infrastructure, increasing disposable incomes, a large population base, rising birth rates, and growing awareness about prenatal care. Countries such as China, India, Japan, and Australia are investing heavily in healthcare, leading to increased adoption of advanced PROM testing solutions. The demand for cost-effective and accessible tests is particularly high here.

- Latin America: This region demonstrates steady growth, influenced by improving access to healthcare services, increasing awareness regarding maternal health, and a rising prevalence of high-risk pregnancies. Brazil and Mexico are significant markets within this region, though market penetration for advanced tests is somewhat limited by economic constraints and varying healthcare policies.

- Middle East and Africa (MEA): The MEA region is expected to witness gradual growth. Healthcare infrastructure development, increasing investment in the healthcare sector, and efforts to reduce infant and maternal mortality are driving the market. However, challenges such as limited access to advanced diagnostics in remote areas and lower awareness levels in some parts of the region still exist, presenting both opportunities for growth and barriers to rapid expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Premature Rupture of Membranes Testing Market.- AmniSure International

- QIAGEN

- Hologic Inc.

- CooperSurgical Inc.

- Biocartis NV

- F Hoffmann-La Roche AG

- Siemens Healthineers AG

- Abbott Laboratories

- Danaher Corporation

- Becton Dickinson and Company

- PerkinElmer Inc.

- Thermo Fisher Scientific Inc.

- Beckman Coulter (a Danaher company)

- Sysmex Corporation

- Fuji Rebio Inc.

- Nipro Corporation

- Medix Biochemica

- Eiken Chemical Co Ltd

- Quidel Corporation

- Sekisui Diagnostics

Frequently Asked Questions

What is Premature Rupture of Membranes (PROM)?

PROM occurs when the amniotic sac breaks before labor begins, potentially leading to preterm birth and increased risks of infection for both mother and baby. Early detection is crucial for proper medical management and improved outcomes.

How is PROM typically diagnosed?

Diagnosis often involves a combination of patient history, physical examination, and various diagnostic tests such as nitrazine paper test, fern test, and biochemical assays that detect specific amniotic fluid markers like PAMG-1 or IGFBP-1. These tests help confirm the leakage of amniotic fluid.

What are the benefits of early PROM detection?

Early detection of PROM enables timely medical intervention, which can reduce the risk of maternal and fetal infections, minimize the incidence of preterm birth, and facilitate appropriate management strategies like antibiotic prophylaxis or corticosteroids for fetal lung maturation. This significantly improves both maternal and neonatal health outcomes.

What types of PROM tests are available in the market?

The market offers various types of PROM tests, including microscopic tests (fern test, nitrazine test), immunoassay-based tests (detecting PAMG-1 or IGFBP-1), spectrophotometric tests, and advanced molecular diagnostics. Point-of-care (POC) tests are also increasingly popular for rapid, bedside results.

How is AI impacting the PROM testing market?

AI is set to enhance PROM testing by improving diagnostic accuracy through advanced image and data analysis, developing predictive models for risk assessment, and automating test interpretation. It aims to offer more personalized management strategies and streamline clinical workflows for better patient care.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager