Process Plants Gas Turbine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428273 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Process Plants Gas Turbine Market Size

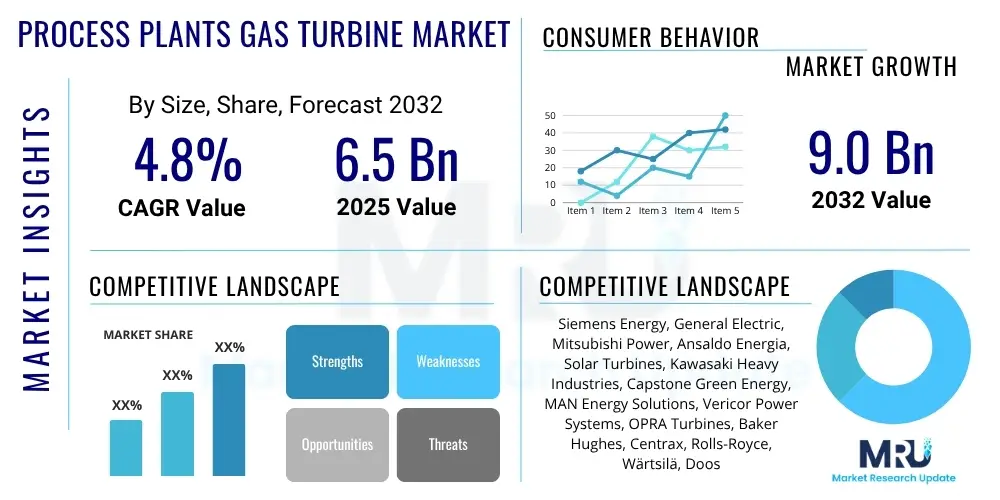

The Process Plants Gas Turbine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at USD 6.5 Billion in 2025 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2032.

Process Plants Gas Turbine Market introduction

The Process Plants Gas Turbine Market centers on the manufacturing, deployment, and servicing of gas turbines specifically engineered for integration within diverse industrial process plants globally. These advanced machines are fundamental for generating mechanical power to drive essential equipment like high-capacity compressors and pumps, and for on-site electricity generation. Often integrated into combined heat and power (CHP) systems, they provide both electrical and valuable thermal energy from their exhaust gases, enabling significant operational efficiency and energy independence. Their robust design, high efficiency, and ability to operate on diverse fuel types ensure reliable, continuous, and high-performance operation in demanding industrial environments, making them indispensable assets for modern industrial infrastructure. Their versatility and durability are paramount for sustaining complex, energy-intensive processes.

Key applications of these turbines span a wide array of foundational industries. In the oil and gas sector, they are critical for upstream operations on offshore platforms and onshore sites, for driving compressors in midstream pipelines and LNG terminals, and for power generation in downstream refineries and petrochemical facilities. Within the chemical and petrochemical industries, gas turbines provide the necessary power and heat for synthesizing a vast range of products. They are also vital in other heavy industries such as fertilizer production, metals processing, and pulp and paper manufacturing, where a consistent and reliable supply of power and process heat is non-negotiable for uninterrupted production cycles. The precise control and rapid response capabilities of these turbines are ideal for processes requiring tight operational parameters and high energy intensity, ensuring optimal output and product quality across various industrial applications.

Strategic benefits for industrial operators include significantly enhanced energy security, reducing reliance on external grids, and substantially reduced operational costs through superior fuel efficiency, particularly in combined cycle or CHP configurations that maximize thermal energy utilization. Environmentally, modern gas turbines offer improved emissions profiles, aiding compliance with stringent regulations and supporting decarbonization efforts. The market's growth is propelled by escalating global energy demand, pervasive industrialization in emerging economies, and the continuous need to modernize and optimize existing process plants for greater efficiency and sustainability. The inherent flexibility and scalability of gas turbine technology further solidify their indispensable role in the evolving industrial energy landscape, adapting to varied power requirements and application types.

Process Plants Gas Turbine Market Executive Summary

The Process Plants Gas Turbine Market is navigating a dynamic landscape driven by pivotal business trends. A primary force is the intensifying global focus on energy transition and sustainability, which compels industrial players to adopt more environmentally friendly and energy-efficient power generation solutions. This leads to increased demand for advanced gas turbines offering lower emissions and greater fuel flexibility, including the capacity to utilize alternative fuels like hydrogen. Significant global investments in critical infrastructure and manufacturing hubs are also fueling new installations and facility expansions. The growing integration of digitalization, encompassing Industrial Internet of Things (IIoT), artificial intelligence (AI), and machine learning (ML), is a transformative trend. This integration enhances predictive maintenance, optimizes performance, and improves operational reliability, collectively reducing the total cost of ownership for end-users. A discernible shift towards more modular and scalable solutions is also evident, catering to varied industrial requirements and promoting distributed power generation architectures.

Regionally, the market exhibits diverse growth patterns influenced by local economic conditions, regulatory frameworks, and industrial development stages. Asia Pacific continues to be the epicenter of growth, propelled by rapid industrialization, massive infrastructure projects, and burgeoning energy consumption in economies such as China, India, and Indonesia. These nations are witnessing substantial investments in oil and gas, chemicals, and manufacturing sectors, driving direct consumption of gas turbine technology. North America and Europe, as mature markets, demonstrate steady demand, primarily driven by the modernization of aging industrial assets, replacement of less efficient legacy systems, and compliance with stricter environmental policies favoring cleaner-burning gas turbines. The Middle East and Africa regions remain strategically important due to vast hydrocarbon resources and extensive downstream processing projects that necessitate reliable, high-capacity power generation and mechanical drive systems. Latin America also shows promising growth, especially in countries with expanding mining, oil & gas, and manufacturing sectors investing in energy independence and efficiency.

Market segmentation analysis reveals distinct trends. Heavy-duty gas turbines maintain a substantial share in large-scale industrial applications due to their proven reliability, robust power output, and long operational lifespans for continuous process operations. However, aeroderivative gas turbines are experiencing accelerated adoption for their advantages such as lighter weight, faster start-up times, and superior power-to-weight ratios, making them ideal for flexible operations, peaking power, and mobile applications in dynamic process plants. Demand across capacities is diversified, with activity in both the 10-50 MW range for medium-to-large facilities and smaller capacities (1-10 MW) for distributed generation. Regarding fuel type, natural gas remains predominant, but there's a clear trend towards turbines capable of multi-fuel operation and growing interest in hydrogen-ready designs for future decarbonization. The end-use industry segment highlights continued strong demand from oil & gas and chemical sectors, alongside increasing adoption in manufacturing and captive power generation, driven by the desire for enhanced energy autonomy and efficiency.

AI Impact Analysis on Process Plants Gas Turbine Market

User inquiries regarding AI's impact on the Process Plants Gas Turbine Market frequently explore its potential to revolutionize operational efficiency, predictive maintenance capabilities, and overall system reliability, while also considering challenges such as data integration and cybersecurity. Users are keen to understand how AI can optimize fuel consumption, reduce emissions, and extend turbine lifespans through advanced analytics and real-time monitoring. Significant interest exists in AI's role in autonomous operations, rapid fault detection, and intelligent control systems adaptable to varying load and environmental conditions. Concerns typically focus on the complexity of AI implementation, the need for specialized personnel, and ensuring robust data privacy and system security within critical industrial infrastructure. These themes collectively shape the expectations and reservations surrounding AI's influence in this specialized domain, driving demand for intelligent, secure, and user-friendly solutions.

- Predictive Maintenance & Asset Health: AI analyzes real-time and historical sensor data (vibration, temperature) to forecast equipment failures, enabling proactive maintenance, minimizing unscheduled downtime, and extending asset lifecycles, thereby reducing costs.

- Operational Optimization: AI-driven control systems dynamically fine-tune turbine parameters for peak fuel efficiency, reduced emissions (NOx, CO), and enhanced power output across varied load conditions.

- Real-time Monitoring & Anomaly Detection: AI platforms continuously ingest high-volume data, identify subtle deviations from normal operating patterns, and provide early warnings of nascent issues to operators.

- Automated Fault Diagnostics: Leveraging pattern recognition, AI swiftly pinpoints root causes of operational issues, accelerating troubleshooting and supporting faster, more effective repairs.

- Enhanced Safety & Risk Mitigation: AI continuously assesses operational data against safety parameters, identifying potential risks and predicting scenarios that could lead to failures, improving overall safety.

- Optimized Resource Allocation: AI assists in intelligently scheduling maintenance, managing spare parts inventory based on predicted demand, and efficiently deploying skilled personnel.

- Digital Twins: AI combined with digital twin technology creates virtual replicas for comprehensive simulations, testing optimization strategies, and gaining deeper insights into turbine behavior without impacting live assets.

- Integrated Energy Management: AI systems integrate turbine operations with broader plant energy grids, optimizing energy consumption and distribution, and enhancing overall energy resilience and cost-effectiveness.

- Cybersecurity & Threat Detection: AI-driven tools employ machine learning to detect unusual network traffic, identify potential cyber threats, and respond to security breaches in real-time, protecting critical industrial assets.

DRO & Impact Forces Of Process Plants Gas Turbine Market

The Process Plants Gas Turbine Market is profoundly influenced by a complex interplay of dynamic drivers, persistent restraints, promising opportunities, and overarching impact forces. Key drivers include escalating global energy demand, particularly from industrial sectors, and the urgent need for reliable, efficient, and flexible power generation solutions. The continuous expansion of the oil and gas industry, along with growth in petrochemical and chemical processing, underpins a steady demand for gas turbines for mechanical drive and power generation. Furthermore, stringent environmental regulations worldwide are pushing industries towards cleaner combustion technologies and highly efficient combined heat and power (CHP) systems, where gas turbines excel in efficiency and lower emissions. Investments in industrial infrastructure modernization and the pursuit of energy independence also serve as potent market boosters.

However, the market faces notable restraints such as high initial capital expenditure associated with gas turbine installation and the complexities involved in their maintenance. The fluctuating prices of natural gas and other fuel sources can impact operational costs and investment decisions, while geopolitical instabilities and trade tensions can disrupt supply chains and project timelines. Additionally, the increasing global focus on renewable energy sources, though complementary in many aspects, presents competitive pressure, particularly for standalone power generation applications where intermittency can be managed. The long lead times for project execution and the need for specialized technical expertise for operation and maintenance also pose significant challenges for many industrial clients.

Opportunities in this market are substantial, primarily driven by the potential for integrating gas turbines with advanced digital technologies such as AI, IoT, and predictive analytics to enhance operational efficiency, reduce downtime, and extend asset lifespans. The development of turbines capable of operating on alternative fuels like hydrogen, biogas, and synthetic fuels opens new avenues for decarbonization and caters to future energy landscapes. Furthermore, the growth of distributed power generation, microgrids, and the increasing demand for energy recovery systems in industrial processes create fertile ground for innovative gas turbine applications. Emerging economies with burgeoning industrial sectors and significant infrastructure gaps offer substantial growth prospects. The market also benefits from strategic collaborations between turbine manufacturers, technology providers, and end-users to develop customized and integrated solutions, addressing specific industrial needs and operational challenges.

Segmentation Analysis

The Process Plants Gas Turbine Market is comprehensively segmented to provide granular insights into its diverse components, reflecting varying operational needs, capacities, technological preferences, and end-use applications across the global industrial landscape. This segmentation allows for a detailed understanding of market dynamics, competitive positioning, and growth trajectories within specific niches, enabling stakeholders to identify precise opportunities and tailor their strategies effectively. The analysis considers various critical parameters that influence purchasing decisions and technological adoption within the process industries, from the type of turbine and its power output to the primary fuel source and the specific industrial sector it serves.

- By Type:

- Heavy-Duty Gas Turbines

- Aeroderivative Gas Turbines

- By Capacity:

- Less than 1 MW

- 1-10 MW

- 10-50 MW

- More than 50 MW

- By End-Use Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemicals & Petrochemicals

- Power Generation (Captive Power Plants)

- Manufacturing (Fertilizers, Metals, Pulp & Paper)

- Other Process Industries

- By Technology:

- Open Cycle Gas Turbines

- Combined Cycle Gas Turbines (CCGT)

- Cogeneration (CHP - Combined Heat and Power)

- By Fuel Type:

- Natural Gas

- Liquefied Natural Gas (LNG)

- Syngas

- Propane & Butane

- Hydrogen & Hydrogen Blends

- Other Fuels

Value Chain Analysis For Process Plants Gas Turbine Market

The value chain for the Process Plants Gas Turbine Market is an intricate network involving multiple stages, from raw material sourcing to end-user deployment and ongoing services, highlighting the interdependencies among various stakeholders. The upstream segment primarily involves the extraction and advanced processing of specialized raw materials such as high-performance alloys (e.g., nickel-based superalloys) and composite materials crucial for manufacturing turbine components. It also includes the production of sophisticated electronic controls, instrumentation, and advanced coatings. Key suppliers in this stage provide critical components like turbine blades, combustors, compressors, rotors, and stator assemblies, which require precision engineering and high-grade materials to withstand extreme operational conditions. Their expertise ensures the foundational quality and durability required for turbine performance.

Midstream activities focus on the design, manufacturing, assembly, and rigorous testing of the gas turbines. This stage is dominated by major Original Equipment Manufacturers (OEMs) who integrate components from various suppliers, leveraging extensive R&D to innovate in areas like efficiency, emissions reduction, and fuel flexibility. Manufacturing processes are highly specialized, involving advanced machining, coating technologies, and stringent quality control measures to ensure reliability and performance. OEMs often collaborate with Engineering, Procurement, and Construction (EPC) firms for comprehensive project execution, integrating the turbines into complete power generation or mechanical drive systems within process plants. This collaboration ensures seamless project delivery from design through to construction and commissioning.

Downstream activities encompass distribution, installation, commissioning, and, critically, long-term maintenance and servicing of the gas turbines. Distribution channels typically involve direct sales from OEMs to large industrial end-users or through a network of specialized distributors and agents for smaller-scale applications. Post-installation services, including reliable spare parts supply, scheduled overhauls, emergency repairs, performance upgrades, and digital service contracts (e.g., remote monitoring, predictive maintenance), represent a significant and recurring revenue stream. These services are vital for ensuring the sustained operation and optimal performance of the turbines throughout their lifecycle, maximizing asset uptime and protecting customer investments. Both direct and indirect channels are essential for market penetration and customer satisfaction, catering to diverse needs and geographical reach.

Process Plants Gas Turbine Market Potential Customers

Potential customers for the Process Plants Gas Turbine Market span a wide array of heavy industries and energy-intensive sectors requiring reliable, efficient, and continuous power generation or mechanical drive solutions for their core operations. The primary end-users are large industrial complexes and facilities where energy supply directly impacts productivity, safety, and profitability. These customers typically operate on a large scale, demanding robust, high-performance equipment capable of withstanding harsh industrial environments and operating continuously for extended periods, minimizing costly downtime and ensuring consistent output.

Key segments of potential buyers include the global oil and gas industry, encompassing upstream (exploration and production platforms, FPSOs), midstream (pipelines, LNG terminals, gas processing plants), and downstream (refineries, petrochemical complexes) operations. These entities utilize gas turbines for driving compressors and pumps, as well as for power generation to support extensive infrastructure. The chemicals and petrochemicals sector is another significant customer base, relying on gas turbines for process heat, power, and mechanical drives in the production of a vast range of chemicals and plastics, where continuous operation and precise energy control are critical.

Beyond oil, gas, and chemicals, other significant end-users include independent power producers (IPPs) and utilities developing captive power plants for industrial parks and large manufacturing facilities (e.g., fertilizer plants, metal processing, pulp and paper mills). Industries requiring combined heat and power (CHP) systems for maximum energy efficiency are also key customers. Emerging industrial hubs in developing economies represent a growing customer segment as they invest heavily in new infrastructure and industrial capacity, driving demand for new installations and upgrades. The overarching desire for enhanced energy autonomy, operational resilience, and cost-efficiency drives these diverse industrial operators to invest in gas turbine technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 6.5 Billion |

| Market Forecast in 2032 | USD 9.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy, General Electric, Mitsubishi Power, Ansaldo Energia, Solar Turbines, Kawasaki Heavy Industries, Capstone Green Energy, MAN Energy Solutions, Vericor Power Systems, OPRA Turbines, Baker Hughes, Centrax, Rolls-Royce, Wärtsilä, Doosan Heavy Industries & Construction, Harbin Electric, Bharat Heavy Electricals Limited (BHEL), EthosEnergy, Siemens Gamesa, Dresser-Rand |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Process Plants Gas Turbine Market Key Technology Landscape

The technological landscape of the Process Plants Gas Turbine Market is characterized by continuous innovation aimed at enhancing efficiency, reducing emissions, improving reliability, and extending operational flexibility. A cornerstone of this evolution is the advancement in combustion technology, including lean-burn combustors and dry low NOx (DLN) systems, which significantly reduce nitrogen oxide emissions, meeting increasingly stringent environmental standards. Material science plays a crucial role, with the development of advanced superalloys, high-temperature coatings, and ceramic matrix composites (CMCs) allowing turbines to operate at higher temperatures. This boosts thermal efficiency and power output while improving durability and reducing cooling air requirements, optimizing the entire combustion process for superior performance and longevity.

Digitalization and smart technologies are profoundly transforming the market. The integration of Industrial Internet of Things (IIoT) sensors enables real-time data collection from various turbine components, feeding into advanced analytics platforms. These platforms leverage artificial intelligence (AI) and machine learning (ML) algorithms to provide predictive maintenance insights, optimize operational parameters, and identify potential issues before costly downtime. Digital twin technology, creating virtual replicas of physical turbines, allows for comprehensive simulations and performance analysis, enabling better design, testing of operational scenarios, and lifecycle management, thereby enhancing operational intelligence and asset optimization.

Furthermore, there is a strong focus on fuel flexibility, enabling gas turbines to operate on a broader range of fuels beyond natural gas, including liquefied natural gas (LNG), syngas, and increasingly, hydrogen or hydrogen-natural gas blends. This diversification supports decarbonization efforts and provides greater energy security for process plants. Advancements in aerodynamics and computational fluid dynamics (CFD) are continually optimizing compressor and turbine blade designs for improved efficiency and performance across all operating envelopes. Lastly, the development of smaller, modular, and highly efficient aeroderivative turbines is expanding the market to applications requiring compact, rapid-start, and flexible power solutions, catering to a wider array of industrial needs and distributed generation scenarios, broadening the market's application scope significantly.

Regional Highlights

- North America: A mature market driven by replacement demand, modernization of existing infrastructure, and a robust oil & gas sector. Increasing focus on efficiency and lower emissions.

- Europe: Emphasis on decarbonization, energy efficiency, and transition towards hydrogen-ready turbines. Stringent environmental regulations drive innovation and adoption of advanced technologies.

- Asia Pacific (APAC): Fastest-growing region due to rapid industrialization, increasing energy demand, and significant investments in petrochemicals and power generation, particularly in China, India, and Southeast Asian countries.

- Latin America: Growth spurred by expanding oil & gas projects, new industrial plant developments, and the need for reliable power infrastructure in countries like Brazil and Mexico.

- Middle East and Africa (MEA): Strong demand from the vast oil & gas industry, coupled with major infrastructure projects and industrial expansion initiatives, especially in GCC countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Process Plants Gas Turbine Market.- Siemens Energy

- General Electric

- Mitsubishi Power

- Ansaldo Energia

- Solar Turbines

- Kawasaki Heavy Industries

- Capstone Green Energy

- MAN Energy Solutions

- Vericor Power Systems

- OPRA Turbines

- Baker Hughes

- Centrax

- Rolls-Royce

- Wärtsilä

- Doosan Heavy Industries & Construction

- Harbin Electric

- Bharat Heavy Electricals Limited (BHEL)

- EthosEnergy

- Siemens Gamesa

- Dresser-Rand

Frequently Asked Questions

What are the primary applications of gas turbines in process plants?

Gas turbines in process plants are primarily used for mechanical drive applications (powering compressors and pumps) and electricity generation, often in combined heat and power (CHP) configurations to maximize energy efficiency for industrial operations in sectors like oil & gas, chemicals, and petrochemicals.

How do gas turbines contribute to energy efficiency in industrial processes?

Gas turbines significantly enhance energy efficiency through their high thermal performance and suitability for combined cycle and cogeneration (CHP) systems, where waste heat from the turbine exhaust is recovered to produce steam or additional power, reducing overall energy consumption and operational costs.

What are the key drivers for the growth of the Process Plants Gas Turbine Market?

Key drivers include escalating global energy demand from industrial sectors, the need for reliable and efficient power solutions, expansion of oil & gas and chemical industries, and increasing adoption of cleaner energy technologies driven by stringent environmental regulations and decarbonization efforts.

What role does digitalization play in modern gas turbine operations?

Digitalization, through IIoT, AI, and digital twin technology, enables real-time performance monitoring, predictive maintenance, operational optimization, and enhanced safety, leading to improved reliability, reduced downtime, and increased efficiency for modern gas turbine operations in process plants.

What future trends are expected to impact the Process Plants Gas Turbine Market?

Future trends include increased adoption of alternative fuels like hydrogen and syngas, further integration of AI and machine learning for autonomous operations, development of more modular and flexible turbine designs, and a continued focus on ultra-low emission technologies to meet evolving environmental mandates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager