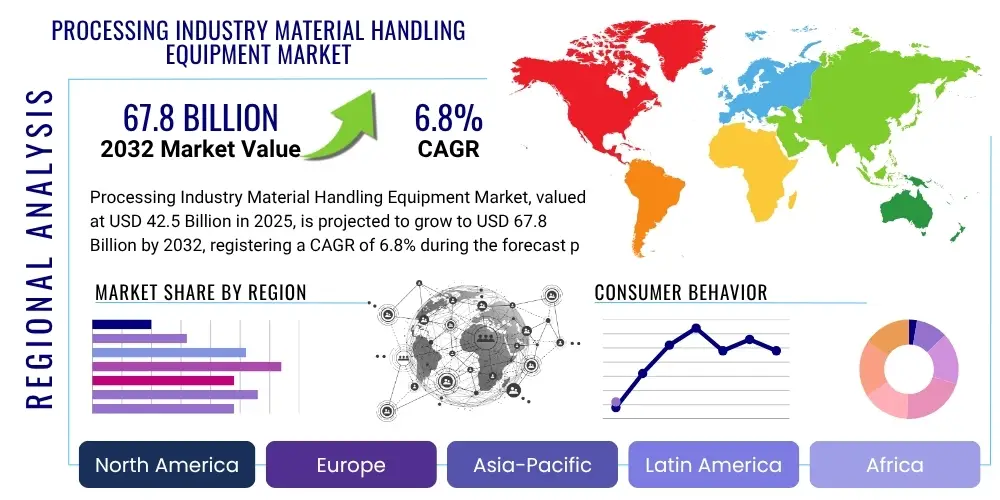

Processing Industry Material Handling Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429085 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Processing Industry Material Handling Equipment Market Size

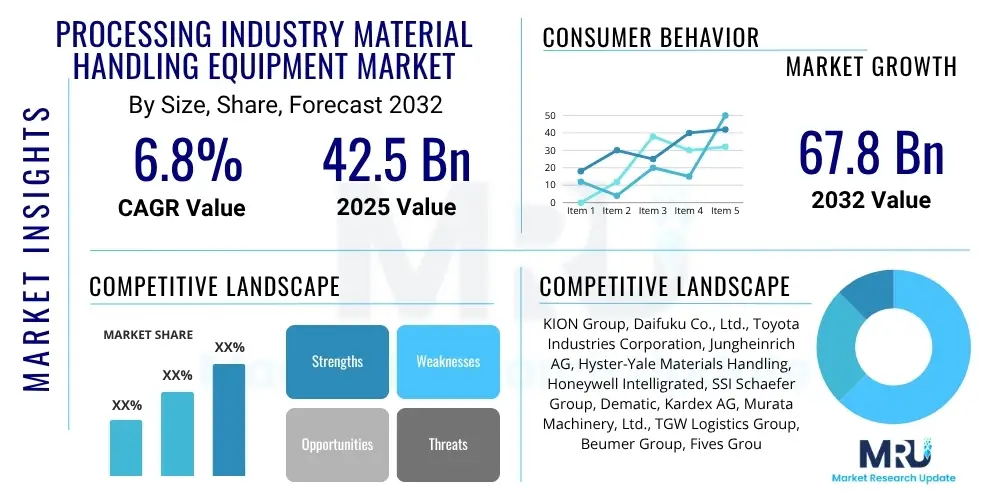

The Processing Industry Material Handling Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $42.5 Billion in 2025 and is projected to reach $67.8 Billion by the end of the forecast period in 2032.

Processing Industry Material Handling Equipment Market introduction

The Processing Industry Material Handling Equipment market encompasses a wide array of machinery and systems designed to facilitate the movement, storage, control, and protection of materials, products, and waste throughout the manufacturing, distribution, consumption, and disposal processes within various processing industries. This equipment is critical for optimizing operational workflows, enhancing safety, and improving overall productivity across sectors such as food and beverage, pharmaceuticals, chemicals, mining, and general manufacturing. The inherent need for efficient material flow in these industries drives the demand for innovative handling solutions.

Products within this market range from conventional tools like forklifts, conveyors, and cranes to advanced automated systems such as Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), and sophisticated Automated Storage and Retrieval Systems (AS/RS). These technologies are continuously evolving to meet the complex demands of modern processing environments, offering solutions for precise material handling, inventory management, and seamless integration with production lines. The primary objective is to reduce manual labor, minimize errors, and accelerate processing times, thereby contributing to significant cost savings and increased throughput.

Major applications for processing industry material handling equipment include raw material intake, in-process material transfer, finished product packaging, warehousing, and logistics. Benefits derived from deploying these systems are substantial, encompassing enhanced worker safety by reducing heavy lifting and repetitive tasks, improved operational efficiency through faster and more accurate material movement, and reduced operational costs by optimizing labor and minimizing product damage. Key driving factors for market growth include the escalating demand for industrial automation, the proliferation of e-commerce necessitating advanced warehousing solutions, increasing labor costs coupled with a shortage of skilled labor, and stringent safety regulations pushing for automated alternatives.

Processing Industry Material Handling Equipment Market Executive Summary

The Processing Industry Material Handling Equipment market is experiencing robust growth, primarily propelled by global manufacturing expansion, the relentless pursuit of operational efficiencies, and the transformative impact of Industry 4.0 technologies. Businesses are increasingly investing in automated and intelligent material handling solutions to counter rising labor costs, address labor shortages, and improve workplace safety. The integration of advanced robotics, artificial intelligence, and IoT into material handling systems is transforming traditional operations, leading to more agile, scalable, and resilient supply chains. This shift towards automation is not merely about replacing human labor but augmenting capabilities, enabling higher precision, faster throughput, and data-driven decision-making in complex processing environments.

From a regional perspective, Asia Pacific continues to dominate the market, driven by rapid industrialization, significant investments in manufacturing infrastructure, and the booming e-commerce sector in countries like China, India, and Japan. North America and Europe are also substantial markets, characterized by early adoption of advanced automation technologies, a strong emphasis on regulatory compliance, and ongoing modernization of existing facilities. These regions are pioneers in implementing cutting-edge solutions like AI-powered AGVs and sophisticated AS/RS, often spurred by high labor costs and a strategic focus on technological leadership. Latin America, the Middle East, and Africa represent emerging markets with considerable growth potential, fueled by increasing foreign direct investment in manufacturing and infrastructure development, alongside a growing awareness of the benefits of automated material handling.

Segment-wise, the market sees significant growth across various product types and applications. Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) are witnessing accelerated adoption due to their flexibility and ability to integrate seamlessly into diverse production layouts. The conveyor systems segment, while mature, continues to innovate with modular designs and energy-efficient operations. Software and control systems, which integrate and manage the entire material flow, are becoming increasingly crucial for maximizing the efficiency of hardware investments. The food and beverage, pharmaceutical, and e-commerce sectors remain primary revenue generators, demonstrating a consistent demand for high-speed, hygienic, and precise material handling solutions to meet escalating consumer demands and regulatory standards.

AI Impact Analysis on Processing Industry Material Handling Equipment Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Processing Industry Material Handling Equipment market frequently revolve around its potential to enhance operational efficiency, reduce costs, and improve safety. There is considerable interest in how AI can facilitate predictive maintenance, optimize routing for AGVs and robots, and enable smarter inventory management. Concerns are often raised about the initial investment required, the complexity of integrating AI into legacy systems, data security implications, and the need for a skilled workforce to manage and maintain these advanced systems. Users are keen to understand the tangible benefits AI offers beyond basic automation, particularly in scenarios requiring adaptability and complex decision-making, while also seeking assurances regarding job displacement and ethical considerations.

AI's influence is transforming material handling from reactive to proactive, enabling systems to learn, adapt, and make intelligent decisions autonomously. This paradigm shift leads to unprecedented levels of operational efficiency and strategic asset management. Predictive analytics, powered by AI, allows equipment to forecast maintenance needs, thereby minimizing downtime and extending asset lifespan, which is a critical concern for continuous processing industries. Furthermore, AI algorithms optimize task allocation, path planning, and collision avoidance for mobile robots, making operations safer and more fluid in dynamic industrial environments.

The adoption of AI also extends to quality control and inventory management, where computer vision and machine learning algorithms can rapidly identify defects, track products with high accuracy, and optimize storage utilization. This level of precision significantly reduces waste and improves product integrity, particularly important in sensitive sectors like food and pharmaceuticals. While initial implementation can be complex and requires specialized expertise, the long-term benefits in terms of enhanced productivity, reduced operational costs, and improved safety protocols position AI as a pivotal technology for the future of material handling in processing industries.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data from equipment to anticipate failures, reducing unplanned downtime and maintenance costs.

- Optimized Robotics and AGVs: AI enables intelligent path planning, dynamic task allocation, and real-time obstacle avoidance for autonomous systems, increasing efficiency and safety.

- Improved Inventory Management: AI-driven systems provide real-time visibility, optimize storage layouts, and forecast demand, leading to reduced stockouts and overstocking.

- Advanced Quality Control: Machine vision and AI detect defects with high accuracy and speed, ensuring product quality and compliance in processing lines.

- Real-time Operational Optimization: AI analyzes vast datasets to identify bottlenecks, suggest process improvements, and enhance overall throughput.

- Enhanced Worker Safety: AI-powered collision detection and autonomous operations minimize human interaction with hazardous machinery, reducing workplace accidents.

- Personalized Automation: AI allows for flexible and reconfigurable material handling systems that can adapt to varying product mixes and production demands.

DRO & Impact Forces Of Processing Industry Material Handling Equipment Market

The Processing Industry Material Handling Equipment market is significantly shaped by a combination of driving forces, inherent restraints, promising opportunities, and overarching impact forces that dictate its trajectory. A primary driver is the accelerating global demand for automation across processing sectors, spurred by the continuous need for enhanced productivity, reduced operational costs, and improved workplace safety. As labor costs rise and skilled labor shortages become more pronounced, businesses are increasingly compelled to invest in automated material handling solutions to maintain competitive advantage. The explosive growth of e-commerce and the subsequent expansion of logistics and warehousing operations further fuel this demand, necessitating high-speed, accurate, and scalable material flow systems. Additionally, stringent regulatory requirements, particularly in industries like pharmaceuticals and food and beverage, often mandate advanced, hygienic, and traceable material handling processes, pushing for technological upgrades.

Despite these strong drivers, the market faces several significant restraints. The substantial initial capital investment required for modern material handling equipment, especially integrated automated systems, can be a major barrier for small and medium-sized enterprises (SMEs) or companies with limited capital. The technical complexity involved in integrating advanced material handling solutions with existing legacy systems poses another challenge, often requiring extensive planning, customization, and specialized expertise. Furthermore, the rapid evolution of technology demands a continuously skilled workforce capable of operating, maintaining, and troubleshooting these sophisticated systems, which can be difficult to source and retain. The potential for operational downtime during system implementation or due to technical malfunctions also presents a risk that organizations must mitigate, impacting productivity and financial performance.

Opportunities for growth are abundant and strategically important for market players. Emerging economies, characterized by ongoing industrialization and urbanization, present vast untapped markets for material handling equipment as they build and modernize their manufacturing and supply chain infrastructures. The increasing adoption of advanced technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and machine learning offers significant opportunities for developing predictive maintenance capabilities, intelligent routing, and real-time operational optimization, enhancing system efficiency and reliability. There is also a growing demand for customized and flexible solutions that can adapt to diverse product types, varying production volumes, and dynamic market conditions. The expansion of specialized logistics, such as cold chain logistics for perishables and pharmaceuticals, opens new niches requiring purpose-built handling equipment. These opportunities drive innovation and strategic expansion for market participants.

Segmentation Analysis

The Processing Industry Material Handling Equipment market is thoroughly segmented to provide a detailed understanding of its diverse components, technologies, and applications. This segmentation allows for precise market analysis, identifying specific growth areas, competitive landscapes, and evolving customer needs. The market is primarily categorized by product type, system type, application, and operation, reflecting the varied requirements and technological advancements across different industrial processes. Each segment addresses unique challenges and offers specialized solutions tailored to particular material handling demands, from bulk raw materials to delicate finished goods. This granular view helps stakeholders in strategic planning and product development.

- By Product Type

- Conveyors (Belt, Roller, Chain, Slat, Gravity, Overhead)

- Cranes (Overhead, Gantry, Jib, Stacker)

- Industrial Trucks (Forklifts, Pallet Trucks, Reach Trucks, Order Pickers, Tow Tractors)

- Automated Storage and Retrieval Systems (AS/RS) (Unit Load, Mini Load, Carousel)

- Robotics (Articulated Robots, SCARA Robots, Delta Robots, Cartesian Robots, Collaborative Robots)

- Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs)

- By System Type

- Unit Load Material Handling (Pallets, Boxes, Containers)

- Bulk Material Handling (Powders, Granules, Liquids, Aggregates)

- Engineered Systems (Custom-designed integrated solutions)

- Automated Systems (Integrated hardware and software solutions)

- By Application

- Food and Beverage Processing

- Pharmaceuticals and Healthcare

- Chemicals and Petrochemicals

- Mining and Metallurgy

- Manufacturing (Automotive, General Manufacturing, Heavy Machinery)

- Retail and E-commerce (Warehousing and Distribution Centers)

- Logistics and Warehousing (General purpose and 3PL)

- Pulp and Paper Industry

- Semiconductor and Electronics Manufacturing

- By Operation

- Automated Material Handling

- Manual Material Handling

Value Chain Analysis For Processing Industry Material Handling Equipment Market

The value chain for the Processing Industry Material Handling Equipment market is a complex network involving multiple stages, from raw material sourcing to end-user deployment and after-sales support. It begins with upstream activities, where raw material suppliers provide essential components such as steel, aluminum, plastics, electronic circuits, and various mechanical parts. These suppliers play a crucial role in ensuring the quality, availability, and cost-effectiveness of the foundational materials. Component manufacturers then transform these raw materials into specialized parts like motors, sensors, actuators, control panels, and intricate robotic components, which are vital for the functionality and performance of the final equipment. The efficiency and reliability of this upstream segment directly impact the quality and pricing of the end product.

Midstream activities involve the core manufacturing of material handling equipment by original equipment manufacturers (OEMs). These manufacturers design, assemble, and test a wide range of products, including conveyors, cranes, industrial trucks, AGVs, AS/RS, and robotics. System integrators are also key players in this stage, often taking various components and equipment from different manufacturers to design, install, and commission complete, customized material handling solutions for specific industrial applications. This stage focuses on innovation, engineering expertise, and adherence to industry standards and safety regulations, ensuring the final product meets the diverse operational requirements of processing industries.

Downstream, the value chain focuses on distribution, sales, installation, and after-sales services. Distribution channels can be both direct and indirect. Direct sales involve manufacturers selling directly to large industrial clients, often for complex, custom-engineered systems that require extensive consultation and support. Indirect channels include a network of authorized distributors, resellers, and third-party logistics (3PL) providers who reach a broader customer base, especially for standard equipment and spare parts. Post-sales services, including maintenance, repairs, spare parts supply, training, and software updates, are critical for ensuring the longevity and optimal performance of the equipment, contributing significantly to customer satisfaction and loyalty. The effectiveness of these distribution and service networks is paramount for market penetration and sustained growth.

Processing Industry Material Handling Equipment Market Potential Customers

The potential customers for Processing Industry Material Handling Equipment are highly diverse, spanning various sectors that rely heavily on efficient and safe material flow for their operational success. End-users and buyers primarily include large-scale manufacturing facilities that produce goods ranging from automotive components to consumer electronics. These manufacturers constantly seek to automate and optimize their production lines, warehouse operations, and intra-logistics to reduce manual labor, minimize errors, and accelerate throughput. The precise and repetitive nature of tasks in manufacturing makes these industries ideal candidates for advanced robotics, conveyor systems, and AS/RS solutions, aiming for lean and agile production environments.

Another significant segment of potential customers comprises logistics and warehousing companies, including e-commerce fulfillment centers. With the exponential growth of online retail, these businesses require high-speed, scalable, and intelligent material handling systems to manage vast inventories, process orders rapidly, and ensure timely delivery. Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) are particularly attractive to these customers for their flexibility in dynamic environments, while AS/RS and complex conveyor networks are crucial for maximizing storage density and processing efficiency. Their investment decisions are often driven by the need to handle increasing volumes with greater accuracy and speed, directly impacting customer satisfaction and operational costs.

Furthermore, processing industries such as food and beverage, pharmaceuticals, chemicals, and mining represent core customer bases. Food processing units demand hygienic and efficient systems for handling raw ingredients, in-process goods, and packaged products, often requiring specialized equipment that can withstand harsh cleaning regimes and maintain strict contamination control. Pharmaceutical companies prioritize precision, traceability, and compliance with rigorous regulatory standards, making automated dispensing, conveying, and packaging systems indispensable. Chemical and mining operations require robust, heavy-duty equipment capable of handling bulk materials, often in hazardous or extreme environments. These sectors seek solutions that not only enhance productivity but also ensure product integrity, worker safety, and regulatory adherence, making them consistent investors in advanced material handling technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $42.5 Billion |

| Market Forecast in 2032 | $67.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KION Group, Daifuku Co., Ltd., Toyota Industries Corporation, Jungheinrich AG, Hyster-Yale Materials Handling, Honeywell Intelligrated, SSI Schaefer Group, Dematic, Kardex AG, Murata Machinery, Ltd., TGW Logistics Group, Beumer Group, Fives Group, Swisslog AG, Bastian Solutions, Viastore Systems GmbH, Knapp AG, Interroll Holding AG, Mecalux S.A., Savoye |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Processing Industry Material Handling Equipment Market Key Technology Landscape

The Processing Industry Material Handling Equipment market is continuously shaped by a dynamic technological landscape, driven by the principles of Industry 4.0 and the increasing need for intelligent automation. The Internet of Things (IoT) serves as a foundational technology, enabling equipment to collect and transmit vast amounts of operational data in real-time. This connectivity allows for comprehensive monitoring of system performance, energy consumption, and equipment health, forming the basis for advanced analytics and predictive maintenance. IoT integration transforms individual pieces of equipment into smart, networked assets that communicate seamlessly within a larger operational ecosystem, thereby enhancing overall efficiency and operational visibility.

Artificial Intelligence (AI) and Machine Learning (ML) are rapidly emerging as transformative technologies within this domain. AI algorithms are employed for optimizing complex processes such as dynamic routing for AGVs and AMRs, intelligent inventory management, and predictive anomaly detection. Machine learning enhances the adaptability and learning capabilities of robotic systems, enabling them to perform tasks with greater precision and handle variations in product type or environment. Computer vision systems, often powered by AI, are critical for automated quality control, object recognition, and precise positioning, ensuring that materials are handled accurately and defects are identified early in the processing chain. These intelligent technologies contribute significantly to reducing errors, improving throughput, and making operations more autonomous.

Beyond connectivity and intelligence, other crucial technologies include advanced robotics, ranging from collaborative robots (cobots) that work alongside humans to highly specialized articulated robots for complex tasks, and sophisticated Automated Storage and Retrieval Systems (AS/RS) that maximize storage density and retrieval speed. Digital twins, which are virtual replicas of physical systems, enable simulation and optimization of material handling workflows before physical implementation, reducing risks and improving design efficiency. Cloud computing provides the scalable infrastructure necessary to process and store large datasets generated by these systems, facilitating remote monitoring and data accessibility. Furthermore, robust cybersecurity measures are becoming imperative to protect interconnected material handling systems from potential threats, ensuring operational integrity and data privacy in increasingly digitalized processing environments.

Regional Highlights

- North America: This region is characterized by early adoption of advanced automation technologies, significant investments in research and development, and a strong focus on enhancing labor productivity. Countries like the United States and Canada are rapidly deploying AI-powered robotics, AGVs, and sophisticated AS/RS in manufacturing, e-commerce, and food processing sectors. The prevalence of high labor costs and a mature industrial base drives the demand for high-end, intelligent material handling solutions.

- Europe: Europe stands out for its emphasis on Industry 4.0 initiatives, strict safety and environmental regulations, and a growing drive towards sustainable material handling practices. Germany, France, and the UK are leading the charge in integrating smart factory concepts, leveraging automation and digitalization to optimize supply chains. The region also sees robust demand for customized and energy-efficient equipment, with a focus on reducing carbon footprints and enhancing circular economy principles.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, propelled by rapid industrialization, massive manufacturing hubs, and the explosive growth of the e-commerce sector. Countries such as China, India, Japan, and South Korea are experiencing significant investments in factory automation and warehouse modernization. The sheer volume of manufacturing output and consumer demand makes this region a critical driver for the global material handling equipment market, with a strong focus on cost-effective yet advanced solutions.

- Latin America: This region is experiencing steady growth, driven by infrastructure development, increasing foreign direct investment in manufacturing, and the expansion of logistics capabilities. Brazil and Mexico are key markets, with rising demand for material handling equipment to support their growing automotive, food and beverage, and consumer goods industries. The focus is often on modernizing existing facilities and improving operational efficiencies to compete on a global scale.

- Middle East and Africa (MEA): The MEA region shows promising potential, with industrial diversification efforts and significant investments in logistics and warehousing infrastructure. Countries in the GCC region, in particular, are investing heavily in advanced port facilities and smart warehouses, driven by their strategic geographical location and ambitions to become global logistics hubs. There is a growing awareness of the benefits of automation in various processing industries, although adoption rates vary across the diverse economic landscape.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Processing Industry Material Handling Equipment Market.- KION Group

- Daifuku Co., Ltd.

- Toyota Industries Corporation

- Jungheinrich AG

- Hyster-Yale Materials Handling

- Honeywell Intelligrated

- SSI Schaefer Group

- Dematic (KION Group subsidiary)

- Kardex AG

- Murata Machinery, Ltd.

- TGW Logistics Group

- Beumer Group

- Fives Group

- Swisslog AG (KUKA Group subsidiary)

- Bastian Solutions (Toyota Advanced Logistics subsidiary)

- Viastore Systems GmbH

- Knapp AG

- Interroll Holding AG

- Mecalux S.A.

- Savoye

Frequently Asked Questions

What is Processing Industry Material Handling Equipment?

Processing Industry Material Handling Equipment refers to a range of machinery and systems designed to facilitate the movement, storage, control, and protection of materials, products, and waste throughout industrial processes, from raw material intake to finished goods dispatch. It includes conveyors, robotics, forklifts, cranes, and automated storage systems.

How does automation benefit processing industries?

Automation in processing industries significantly enhances operational efficiency by increasing throughput, reducing labor costs, minimizing errors, and improving workplace safety. It enables precise, repetitive tasks to be performed consistently, leading to higher productivity and better quality control.

What are the key trends shaping this market?

Key trends include the increasing adoption of Industry 4.0 technologies like AI, IoT, and advanced robotics, a growing demand for customized and flexible

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager