Protein A Resins Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427550 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Protein A Resins Market Size

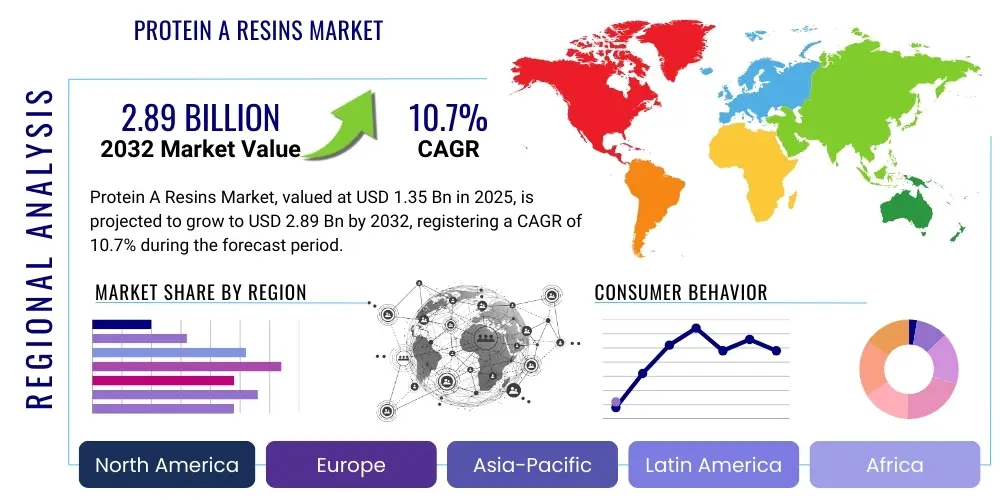

The Protein A Resins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.7% between 2025 and 2032. The market is estimated at USD 1.35 billion in 2025 and is projected to reach USD 2.89 billion by the end of the forecast period in 2032.

Protein A Resins Market introduction

The Protein A Resins Market is a pivotal segment within the biopharmaceutical industry, serving as the gold standard for the purification of monoclonal antibodies (mAbs) and Fc-fusion proteins. These specialized chromatography resins leverage the high affinity of Protein A, a bacterial cell wall protein, for the Fc region of immunoglobulins. This intrinsic selectivity allows for highly efficient and specific capture of therapeutic antibodies from complex cell culture broths, making them indispensable in downstream bioprocessing. The technology ensures the removal of process-related impurities such as host cell proteins, DNA, and other contaminants, which is critical for the safety and efficacy of biotherapeutic drugs.

Major applications of Protein A resins include the purification of innovator mAbs, biosimilar antibodies, and various antibody fragments used in diverse therapeutic areas such as oncology, autoimmune diseases, and infectious diseases. The benefits of using Protein A resins are substantial, encompassing high purity, excellent yield recovery, and scalability from research and development phases to large-scale commercial manufacturing. Their robust performance and consistent results are crucial for meeting stringent regulatory requirements globally, ensuring that biopharmaceutical products are safe and effective for patient use.

The markets growth is predominantly driven by the escalating demand for biopharmaceuticals, particularly the continuous proliferation of novel monoclonal antibody therapies and the expanding pipeline of biosimilars. Advancements in protein engineering, cell culture technologies leading to higher titers, and the increasing focus on developing advanced therapeutic modalities further propel the need for efficient and high-capacity purification solutions. These factors collectively underscore the critical role Protein A resins play in enabling the rapid development and production of life-saving biological drugs.

Protein A Resins Market Executive Summary

The Protein A Resins Market is experiencing robust expansion, primarily fueled by the accelerating growth of the global biopharmaceutical industry and the increasing demand for therapeutic monoclonal antibodies. Key business trends include the continuous innovation in resin technology, focusing on developing higher capacity, alkali-stable, and cost-effective resins to meet the evolving needs of biomanufacturing. The market is also witnessing a significant shift towards single-use chromatography systems, which offer enhanced flexibility, reduced cross-contamination risks, and lower capital investment for biopharmaceutical companies, particularly Contract Development and Manufacturing Organizations (CDMOs).

Regionally, North America and Europe continue to dominate the market due to their mature biopharmaceutical industries, extensive research and development activities, and significant investments in healthcare infrastructure. However, the Asia-Pacific region is emerging as the fastest-growing market, driven by rising healthcare expenditures, increasing government support for biopharmaceutical research, and the establishment of new manufacturing facilities in countries like China, India, and South Korea. This regional shift is also influenced by the growing production of biosimilars and the expanding presence of global biopharmaceutical players in these developing economies.

In terms of segmentation, recombinant Protein A resins hold the largest share owing to their enhanced stability and specificity compared to native forms. Agarose-based matrices remain popular, but innovation in organic polymer and glass matrices is creating new opportunities for improved flow properties and dynamic binding capacities. The monoclonal antibody purification segment dominates applications, reflecting the significant volume of therapeutic antibodies in development and production. End-user trends show biopharmaceutical companies as the primary consumers, with a notable increase in adoption by CDMOs and academic research institutes due to outsourcing trends and expanding research initiatives.

AI Impact Analysis on Protein A Resins Market

User inquiries regarding the impact of Artificial Intelligence on the Protein A Resins Market primarily revolve around its potential to revolutionize bioprocessing efficiency, reduce development timelines, and optimize purification costs. Users are keen to understand how AI can enhance the predictability of resin performance, facilitate automated process design, and integrate seamlessly into existing chromatography workflows. There is significant interest in AIs role in predictive analytics for process optimization and its capacity to manage complex data generated during purification, thereby ensuring consistent product quality. Concerns often center on the practical challenges of AI implementation, including data quality requirements, the need for specialized expertise, and the potential disruption to established protocols. Nonetheless, expectations are high for AI to accelerate drug development, streamline manufacturing, and ultimately contribute to more accessible biotherapeutics.

The integration of AI technologies is anticipated to bring a paradigm shift to various aspects of Protein A resin utilization and bioprocessing. AI algorithms can analyze vast datasets from historical purification runs, including parameters like load concentration, flow rates, buffer compositions, and temperature, to predict optimal operating conditions for subsequent batches. This predictive capability minimizes the need for extensive experimental trials, significantly shortening process development times. Furthermore, AI-driven models can assist in designing more robust and efficient chromatography processes, identifying critical process parameters that have the greatest impact on yield and purity, and ensuring scalability.

AIs influence extends beyond process optimization to areas like real-time monitoring and control, where it can detect deviations from optimal performance and trigger immediate adjustments, thereby preventing costly batch failures. Its application in virtual screening and selection of novel Protein A ligands or resin matrices could also accelerate the development of next-generation purification tools. While the immediate impact is largely in process development and optimization, AIs long-term potential lies in creating fully autonomous biomanufacturing facilities where Protein A purification steps are intelligently controlled and continuously improved, leading to higher productivity and reduced operational expenditures.

- Predictive analytics for optimizing chromatography conditions, enhancing yield and purity.

- Automated design of experiments (DoE) for accelerated process development and scale-up.

- Real-time process monitoring, control, and anomaly detection to ensure consistent quality.

- Data-driven insights for selecting and developing novel Protein A ligands and resin matrices.

- Improved supply chain management and demand forecasting for Protein A resins.

- Accelerated R&D by simulating purification outcomes and identifying optimal candidates.

DRO & Impact Forces Of Protein A Resins Market

The Protein A Resins Market is shaped by a complex interplay of drivers, restraints, opportunities, and broader impact forces. A primary driver is the burgeoning global demand for biopharmaceuticals, particularly the sustained growth in the number of approved monoclonal antibodies and the expansive pipeline of biosimilars. The inherent specificity and efficiency of Protein A resins in purifying these therapeutic proteins make them indispensable for pharmaceutical companies aiming to meet stringent purity and safety standards. Furthermore, advancements in cell culture technologies, leading to higher protein titers, necessitate more robust and higher-capacity purification solutions, thereby increasing the demand for advanced Protein A resins capable of handling greater loads.

However, the market faces significant restraints, notably the high cost associated with Protein A resins, which can constitute a substantial portion of the overall downstream processing expenses. This cost factor prompts ongoing research into more economical purification alternatives, though few match Protein As performance for mAbs. Stringent regulatory approval processes for new biopharmaceutical products also contribute to market complexities, requiring extensive validation of purification methods and materials, which can be time-consuming and expensive for resin manufacturers and end-users alike. Additionally, supply chain vulnerabilities, as highlighted by recent global events, can impact the availability and pricing of critical raw materials for resin production, posing challenges to market stability and growth.

Opportunities for market expansion are abundant, particularly with the emergence of novel Protein A variants designed for improved alkali stability, higher binding capacity, and enhanced selectivity, addressing current limitations. The growing adoption of single-use chromatography systems represents a significant opportunity, offering flexibility and reduced cleaning validation costs for biomanufacturers. Furthermore, the expansion of gene and cell therapies, which often require specific affinity purification steps for associated adeno-associated viruses (AAVs) or other vectors, presents new application areas where Protein A-like affinity ligands could play a crucial role. The increasing trend of outsourcing biopharmaceutical manufacturing to Contract Development and Manufacturing Organizations (CDMOs) also fuels demand, as these organizations scale up production for multiple clients.

Impact forces on the market include technological innovation, which continuously pushes the boundaries of resin performance, leading to the development of resins with larger pore sizes, improved flow dynamics, and greater chemical stability. The evolving regulatory landscape, especially regarding quality control and purity requirements for novel biologics, directly influences product development and market acceptance. Global health crises, such as pandemics, can significantly impact the market by accelerating research and development into vaccines and antibody-based therapeutics, leading to surges in demand for Protein A resins. Economic factors, including R&D spending by pharmaceutical companies and venture capital investments in biotechnology startups, also play a critical role in shaping the markets trajectory and the pace of innovation within the Protein A resins sector.

Segmentation Analysis

The Protein A Resins Market is comprehensively segmented across various parameters, allowing for a detailed understanding of market dynamics and growth opportunities. These segments typically include distinctions based on product type, matrix type, application, and end-user, each reflecting specific technological capabilities and market demands. Analyzing these segments provides crucial insights into market penetration, competitive landscapes, and emerging trends. The markets diverse segmentation highlights the varied needs within the biopharmaceutical purification space, from high-capacity solutions for large-scale manufacturing to specialized resins for research and development.

Understanding the interplay between these segments is vital for stakeholders, including resin manufacturers, biopharmaceutical companies, and research institutions, to strategically position themselves and innovate effectively. For instance, the growth in recombinant Protein A resins signifies a shift towards more engineered and stable purification tools, while the prominence of monoclonal antibody purification underscores the markets core application. Similarly, the expanding role of CDMOs as end-users indicates a broader outsourcing trend in biomanufacturing, impacting how resins are procured and utilized across the industry.

- Product Type:

- Recombinant Protein A Resins

- Native Protein A Resins

- Matrix Type:

- Agarose-based Resins

- Glass-based Resins

- Organic Polymer-based Resins

- Other Matrices (e.g., Ceramic)

- Application:

- Monoclonal Antibody Purification

- Fc-Fusion Protein Purification

- Immunoprecipitation

- Others (e.g., vaccine purification, antibody fragment purification)

- End-User:

- Biopharmaceutical Companies

- Contract Research Organizations (CROs) & Contract Development and Manufacturing Organizations (CDMOs)

- Academic & Research Institutes

- Others (e.g., diagnostic companies)

Protein A Resins Market Value Chain Analysis

The value chain for Protein A Resins begins with upstream activities involving the sourcing and processing of raw materials. This includes the production of recombinant Protein A ligands, often through microbial fermentation processes, and the manufacturing of chromatography matrix materials such as agarose, glass, or synthetic polymers. Specialized chemical suppliers provide cross-linking agents and other reagents crucial for the robust immobilization of Protein A onto the matrix. These raw material suppliers and specialized chemical providers form the foundational layer of the value chain, ensuring the quality and availability of essential components that dictate the performance and stability of the final resin product.

Moving downstream, the core of the value chain involves the resin manufacturers who take these raw materials and undertake the complex process of synthesizing, functionalizing, and packaging the Protein A resins. This stage includes critical steps like ligand attachment, purification, and quality control to ensure the resins meet stringent specifications for binding capacity, selectivity, and chemical stability. These manufacturers invest heavily in research and development to innovate new resin chemistries, improve manufacturing efficiency, and develop high-performance variants, often tailoring products to specific application requirements or customer needs. The quality and performance characteristics established at this stage directly influence the efficiency of subsequent bioprocessing steps.

The distribution channel plays a vital role in connecting resin manufacturers with end-users. Direct distribution involves manufacturers selling directly to large biopharmaceutical companies or CDMOs, often through dedicated sales teams and technical support. This direct approach allows for closer customer relationships, customized solutions, and faster technical assistance. Indirect distribution channels utilize third-party distributors, often covering broader geographical areas and catering to smaller research institutions or academic labs. These distributors often maintain local inventories and provide logistical support. Both direct and indirect channels are essential for market penetration, ensuring timely delivery and widespread access to Protein A resins across the global biopharmaceutical landscape, thereby supporting the continuous production of critical therapeutic proteins.

Protein A Resins Market Potential Customers

The primary potential customers for Protein A resins are organizations deeply involved in the research, development, and manufacturing of biopharmaceutical products. Biopharmaceutical companies constitute the largest segment of end-users, particularly those engaged in the production of monoclonal antibodies, which represent a significant portion of the global biologics market. These companies rely heavily on Protein A resins for the efficient and high-purity capture of their therapeutic antibodies from complex cell culture supernatants, ensuring the safety and efficacy of their drug candidates from clinical trials through commercial production. Their demand is driven by the continuous expansion of their pipelines and the need for scalable and robust purification solutions.

Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) represent another substantial and rapidly growing customer base. As biopharmaceutical companies increasingly outsource their R&D and manufacturing activities to specialized third-party service providers, CDMOs, in particular, require significant quantities of Protein A resins to serve multiple clients across various projects. These organizations often seek versatile, high-capacity, and cost-effective resins that can be rapidly integrated into diverse bioprocessing workflows, accommodating different antibody types and production scales. Their demand is amplified by the trend towards flexible manufacturing and rapid turnaround times for client projects.

Furthermore, academic and government research institutes, alongside university laboratories, are key consumers of Protein A resins. These institutions utilize the resins for fundamental research in immunology, protein science, and the early-stage development of novel antibody-based therapeutics. Although their individual purchase volumes may be smaller than those of large biopharmaceutical companies, their collective demand is significant for driving innovation and understanding antibody-antigen interactions. Vaccine manufacturers also represent a growing segment of potential customers, especially with the increased focus on recombinant protein-based vaccines and antibody-based prophylactic treatments, where efficient purification is paramount for product quality and safety.

Protein A Resins Market Key Technology Landscape

The technology landscape for Protein A resins is characterized by continuous innovation aimed at improving purification efficiency, reducing costs, and enhancing process robustness. A significant area of focus is the development of high-capacity resins, which can bind a greater amount of target protein per unit volume of resin. This directly translates to smaller column sizes, reduced buffer consumption, and increased throughput, leading to more economical and efficient manufacturing processes. Resin manufacturers are achieving this through advancements in ligand density, pore structure engineering of the matrix, and optimizing ligand-protein interactions to maximize dynamic binding capacity without compromising flow properties.

Another critical technological advancement is the introduction of alkali-stable Protein A ligands. Traditional Protein A ligands are sensitive to harsh cleaning-in-place (CIP) conditions involving high pH, which can lead to ligand degradation and reduced resin lifetime. Alkali-stable variants, often engineered through genetic modification or chemical modification of the Protein A molecule, can withstand repeated exposure to alkaline solutions (e.g., 0.1-1.0 M NaOH). This significantly extends the operational lifetime of the resin, reduces resin replacement costs, and simplifies cleaning validation protocols, making them highly attractive for large-scale biopharmaceutical manufacturing where column regeneration is frequent.

Beyond ligand and matrix improvements, the broader technological landscape encompasses innovations in chromatography systems themselves, such as continuous chromatography (e.g., multi-column chromatography or simulated moving bed (SMB) systems). These systems integrate high-performance Protein A resins to enable continuous capture of antibodies, offering further improvements in productivity and flexibility over traditional batch processing. The rise of single-use chromatography systems, where pre-packed Protein A resin columns are disposable after a single or limited number of uses, also represents a significant technological shift, offering advantages in terms of reduced cleaning validation, faster changeovers, and lower capital investment for facilities. Additionally, advancements in ligand immobilization techniques, designed to prevent ligand leaching and maintain selectivity over many cycles, contribute to the overall reliability and performance of Protein A resins in bioprocessing.

Regional Highlights

- North America: Dominates the Protein A Resins Market due to a well-established biopharmaceutical industry, extensive R&D investments in biologics, and the presence of numerous key market players and research institutions. The region benefits from robust government funding for life sciences and a high concentration of monoclonal antibody production facilities.

- Europe: Holds a significant market share, driven by a strong focus on biosimilar development, advanced biomanufacturing capabilities, and supportive regulatory frameworks. Countries like Germany, Switzerland, and the UK are at the forefront of biopharmaceutical innovation and production, contributing substantially to market growth.

- Asia-Pacific: Projected to be the fastest-growing region, fueled by expanding healthcare infrastructure, increasing outsourcing of biomanufacturing to CDMOs, and rising investments in biotechnology in countries such as China, India, Japan, and South Korea. The regions large patient population and growing demand for affordable biologics are key drivers.

- Latin America: Experiences steady growth, primarily led by increasing access to healthcare, growing investments in biopharmaceutical R&D, and the development of local manufacturing capabilities, particularly in Brazil and Mexico.

- Middle East & Africa: Represents an emerging market with nascent but growing biopharmaceutical sectors. Government initiatives to diversify economies and improve healthcare access are expected to drive future growth in demand for advanced purification solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Protein A Resins Market.- Cytiva (a Danaher company)

- Merck KGaA

- Repligen Corporation

- Sartorius AG

- Bio-Rad Laboratories Inc.

- Tosoh Bioscience LLC

- Purolite (now a DuPont company)

- Astrea Bioseparations

- JSR Life Sciences

- Avantor, Inc.

Frequently Asked Questions

What are Protein A resins primarily used for in bioprocessing?

Protein A resins are predominantly utilized for the affinity purification of monoclonal antibodies (mAbs) and Fc-fusion proteins, serving as the gold standard in downstream biopharmaceutical manufacturing due to their high specificity and efficiency.

Why are Protein A resins considered indispensable for biopharmaceutical production?

Their high selectivity for the Fc region of antibodies ensures exceptional purity and yield, crucial for meeting stringent regulatory standards and ensuring the safety and efficacy of therapeutic biopharmaceuticals.

What are the key technological advancements driving the Protein A Resins Market?

Major advancements include the development of high-capacity resins, alkali-stable Protein A ligands for extended resin lifetime, and integration into continuous and single-use chromatography systems, all aimed at improving efficiency and reducing costs.

Which geographical region exhibits the fastest growth in the Protein A Resins Market?

The Asia-Pacific region is projected to be the fastest-growing market, propelled by increasing biopharmaceutical R&D investments, expanding manufacturing capabilities, and growing healthcare demand in countries like China and India.

How is Artificial Intelligence impacting the Protein A Resins Market and bioprocessing workflows?

AI is influencing the market through predictive analytics for process optimization, automated design of experiments, real-time monitoring, and accelerating R&D, leading to more efficient and cost-effective purification strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager