Radio Access Network Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428203 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Radio Access Network Market Size

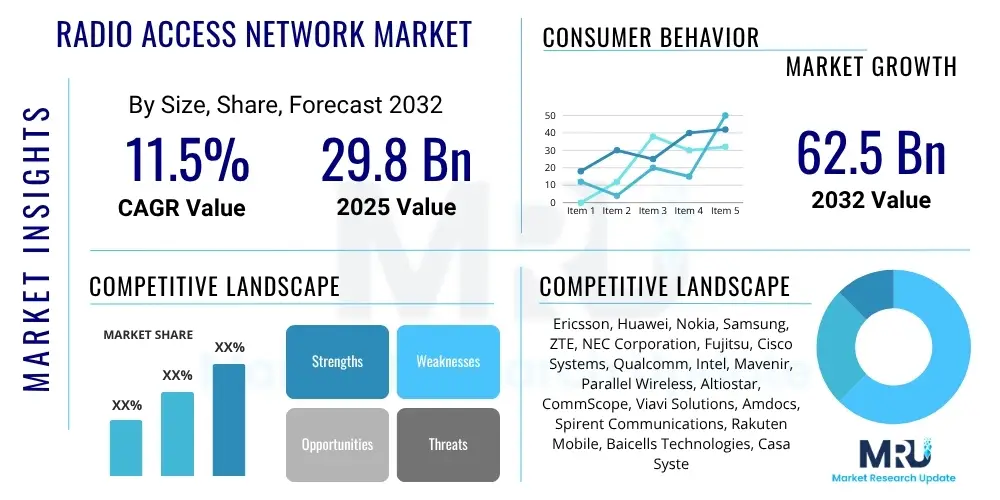

The Radio Access Network Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2025 and 2032. The market is estimated at USD 29.8 billion in 2025 and is projected to reach USD 62.5 billion by the end of the forecast period in 2032.

Radio Access Network Market introduction

The Radio Access Network (RAN) market represents a crucial segment within the broader telecommunications infrastructure industry, serving as the foundational connection between user devices and the core network. It encompasses all the equipment and technology that connect mobile devices like smartphones, tablets, and IoT sensors to the internet and other services through radio signals. Historically, RAN architectures were monolithic and proprietary, dominated by a few large vendors. However, recent years have seen a transformative shift towards more open, virtualized, and disaggregated approaches, driven by the demands of 5G, enhanced connectivity, and operational efficiencies.

The core function of the RAN is to facilitate wireless communication, managing radio resources, handovers, and interference to ensure reliable and high-speed data transmission. Key products within this market include base stations (gNodeBs for 5G, eNodeBs for 4G), remote radio units (RRUs), antennas, baseband units (BBUs), and the associated software and services that enable their operation and management. These components work in concert to convert digital signals from the core network into radio signals that can be transmitted and received by end-user devices, and vice-versa, ensuring seamless connectivity across vast geographical areas.

Major applications of RAN technology span across consumer mobile broadband, enterprise private networks, critical communications, and the rapidly expanding Internet of Things (IoT ecosystem). From enabling high-definition video streaming and online gaming to supporting industrial automation, smart city initiatives, and connected vehicles, RAN is indispensable for modern digital economies. The benefits derived from advanced RAN deployments are extensive, including significantly higher bandwidth, ultra-low latency, massive device connectivity, improved spectral efficiency, and the flexibility to deploy network functions closer to the edge, thereby enhancing user experience and enabling new revenue streams for telecom operators and enterprises alike. The market's growth is primarily driven by the global rollout of 5G networks, the accelerating demand for data, the proliferation of IoT devices, and the strategic advantages offered by network disaggregation and virtualization.

Radio Access Network Market Executive Summary

The Radio Access Network (RAN) market is undergoing a profound transformation, propelled by the relentless demand for high-speed, low-latency connectivity, primarily driven by the global 5G rollout. This executive summary outlines key business, regional, and segment trends shaping the industry. Business trends indicate a strong move towards disaggregated and virtualized RAN (vRAN) and Open RAN architectures, which are fundamentally changing the vendor landscape, fostering innovation, and increasing supply chain diversity. Telecom operators are increasingly seeking solutions that offer greater flexibility, reduced capital expenditure (CapEx), and lower operational expenditure (OpEx) through automation and intelligent network management, pushing traditional vendors to adapt and new players to emerge. Strategic partnerships between hardware manufacturers, software providers, and cloud entities are becoming common, aimed at delivering end-to-end, integrated solutions for next-generation networks. The emphasis on energy efficiency and sustainable network operations is also a growing business imperative, influencing technology choices and deployment strategies.

From a regional perspective, the Asia Pacific region continues to lead in 5G deployment and subscriber growth, with countries like China, South Korea, and Japan exhibiting advanced network infrastructures and ambitious expansion plans. India is also emerging as a significant market, with aggressive 5G rollouts driving substantial RAN investments. North America is characterized by early adoption of advanced 5G technologies, including mmWave, and a strong focus on enterprise private networks and Open RAN trials. Europe is progressing with its 5G deployments, albeit at a more measured pace, with a clear emphasis on vendor diversification and the development of energy-efficient network solutions, often driven by regulatory support for Open RAN. Latin America and the Middle East & Africa regions are experiencing accelerated 5G expansion, focusing on enhancing mobile broadband coverage and supporting economic development through improved connectivity, presenting significant growth opportunities for RAN vendors. These regional dynamics are influenced by diverse regulatory environments, varying levels of economic development, and unique market demands.

Segmentation trends reveal significant shifts across different components, technologies, and end-user verticals. The hardware segment remains foundational but is increasingly being commoditized, with innovation shifting towards more adaptable and software-defined radio units. The software segment, including RAN orchestration, network slicing, and AI/ML-driven optimization, is experiencing rapid growth, reflecting the move towards intelligence and automation within the network. In terms of technology, 5G (both sub-6 GHz and mmWave) is the dominant driver, but 4G LTE continues to see investments for capacity upgrades and coverage expansion, especially in developing markets. The emergence of private 5G networks is creating a new lucrative end-user segment beyond traditional mobile network operators, with enterprises in manufacturing, logistics, healthcare, and energy increasingly deploying dedicated RAN solutions to meet specific operational requirements for security, reliability, and low latency. Services, encompassing deployment, integration, and managed services, are also expanding as network complexity increases, requiring specialized expertise.

AI Impact Analysis on Radio Access Network Market

User inquiries regarding the impact of Artificial intelligence (AI) on the Radio Access Network (RAN) market frequently center on its potential to revolutionize network operations, optimize performance, and enable new service capabilities. Common questions explore how AI can enhance spectral efficiency, automate network management, predict and prevent outages, and facilitate the dynamic allocation of resources. Users are keenly interested in the security implications of AI integration, how AI will support the adoption and management of Open RAN architectures, and the tangible benefits in terms of reduced operational expenditure (OpEx) and improved quality of experience (QoE) for end-users. There's also a strong curiosity about AI's role in enabling advanced features like network slicing, predictive maintenance, and real-time anomaly detection within complex 5G networks.

AI's integration into the RAN is poised to be a game-changer, moving networks from reactive to proactive and self-optimizing systems. By leveraging machine learning algorithms, operators can gain unprecedented insights into network traffic patterns, device behavior, and environmental conditions. This intelligence enables dynamic adjustment of network parameters, intelligent load balancing, and autonomous fault detection and resolution, significantly improving network reliability and efficiency. AI-powered analytics can process vast amounts of operational data, identifying subtle correlations and anomalies that human operators might miss, leading to more effective troubleshooting and preventative maintenance strategies. Furthermore, AI is crucial for optimizing energy consumption within the RAN, which is a major concern for operators due to the increasing density of base stations and the continuous rise in data traffic.

The synergy between AI and Open RAN is particularly strong. AI can manage the complexity introduced by multi-vendor environments in Open RAN, ensuring interoperability and optimal performance across disaggregated components. It facilitates intelligent orchestration and automation of network functions, which is vital for realizing the flexibility and efficiency promises of Open RAN. From predictive scaling of resources to automated configuration of virtualized network functions, AI is the key enabler for fully autonomous and adaptive RAN operations. This integration is expected to accelerate innovation, reduce vendor lock-in, and lower the total cost of ownership (TCO) for telecom operators, ultimately delivering a more agile and responsive network infrastructure capable of supporting future demands.

- AI-driven network optimization enhances spectral efficiency, throughput, and capacity utilization.

- Predictive maintenance and fault detection reduce downtime and operational costs.

- Automated resource allocation and network slicing enable dynamic service delivery.

- Enhanced security through AI-powered anomaly detection and threat prediction.

- Intelligent energy management for greener and more sustainable RAN operations.

- Facilitates seamless orchestration and management in complex Open RAN environments.

- Improves customer experience through proactive performance monitoring and optimization.

- Enables self-organizing networks (SON) for autonomous network configuration and healing.

DRO & Impact Forces Of Radio Access Network Market

The Radio Access Network (RAN) market is profoundly shaped by a confluence of driving factors, inherent restraints, and emerging opportunities, all contributing to significant impact forces across the industry. The primary drivers include the escalating global demand for mobile data traffic, fueled by widespread smartphone adoption, video consumption, and the proliferation of IoT devices. The continuous rollout and expansion of 5G networks worldwide represent a monumental driver, necessitating new RAN infrastructure for both sub-6 GHz and mmWave spectrums to deliver enhanced mobile broadband (eMBB), ultra-reliable low-latency communication (URLLC), and massive machine-type communication (mMTC). Additionally, the imperative for network virtualization (vRAN) and the Open RAN movement are driving innovation and investment, as operators seek greater flexibility, cost efficiency, and vendor diversity. The increasing adoption of edge computing further necessitates the deployment of distributed RAN architectures to bring computation closer to the data source, reducing latency and enabling new applications.

Despite these powerful drivers, the RAN market faces several notable restraints. The exceptionally high capital expenditure (CapEx) associated with deploying and upgrading RAN infrastructure, particularly for 5G, remains a significant barrier for many operators, especially in developing regions. This high cost is compounded by the complexity of integrating new technologies, managing multi-vendor environments in Open RAN, and the ongoing operational expenditure (OpEx) related to power consumption and maintenance. Furthermore, security concerns surrounding the increasing sophistication of cyber threats and the protection of sensitive network data pose a constant challenge, requiring continuous investment in robust security protocols and intelligence. Regulatory hurdles, including spectrum allocation complexities, varied national policies, and stringent deployment timelines, can also impede market growth and technological advancements. The scarcity of skilled professionals capable of designing, deploying, and managing advanced RAN architectures adds another layer of constraint.

However, the market is rich with opportunities that promise substantial growth and innovation. The burgeoning demand for private 5G networks in enterprise verticals such as manufacturing, logistics, healthcare, and mining presents a significant new revenue stream, allowing enterprises to deploy tailored, high-performance, and secure connectivity solutions. The integration of artificial intelligence (AI) and machine learning (ML) for network optimization, automation, and predictive analytics offers immense potential to enhance efficiency, reduce OpEx, and improve service quality. The growing focus on satellite integration with terrestrial RAN, particularly for remote area connectivity and backhaul, opens up new geographical markets and use cases. Moreover, the ongoing densification of urban networks, driven by demand for ubiquitous high-speed coverage, creates opportunities for small cell deployments and innovative spectrum sharing mechanisms. These opportunities, coupled with ongoing technological advancements, underscore the dynamic and evolving nature of the RAN market, where agility and strategic investment are key to success.

Segmentation Analysis

The Radio Access Network (RAN) market is intricately segmented across various dimensions, including components, technology, deployment type, and end-user. This segmentation helps in understanding the diverse landscape of products, services, and applications that collectively define the market. Each segment exhibits unique growth trajectories and influences the overall market dynamics, reflecting different stages of technological maturity, adoption rates, and investment priorities across regions. Analyzing these segments provides a granular view of where innovation is concentrated, where significant demand lies, and how the market is evolving to meet the complex requirements of next-generation wireless communications.

- By Component:

- Hardware: Base Stations (Macrocells, Small Cells, Femtocells), Remote Radio Units (RRUs), Antennas, Baseband Units (BBUs), Processors & Chipsets, Towers & Masts.

- Software: RAN Software (Radio Resource Management, Network Management, Orchestration), Virtualization Software, AI/ML Software for RAN Optimization.

- Services: Professional Services (Network Planning & Design, Deployment & Integration, Consulting), Managed Services, Maintenance & Support Services.

- By Technology:

- 2G/3G RAN: Legacy networks, primarily for voice and basic data.

- 4G (LTE) RAN: Dominant technology for mobile broadband, still undergoing capacity upgrades.

- 5G RAN:

- Sub-6 GHz: Broad coverage, primary band for initial 5G deployments.

- mmWave: Ultra-high capacity, low latency for specific use cases (e.g., dense urban areas, fixed wireless access).

- Satellite RAN: Emerging technology for rural and remote connectivity, backhaul.

- By Deployment Type:

- Indoor RAN: Small cell and distributed antenna systems (DAS) for in-building coverage.

- Outdoor RAN: Macrocells, small cells for wide-area coverage, urban and rural deployments.

- By End-User:

- Telecom Operators: Mobile Network Operators (MNOs), Communication Service Providers (CSPs).

- Enterprises: Manufacturing, Logistics, Healthcare, Energy & Utilities, Mining, Ports, Smart Cities, Retail, Public Safety.

- Government & Public Safety: Dedicated networks for emergency services and public administration.

Value Chain Analysis For Radio Access Network Market

The value chain for the Radio Access Network (RAN) market is characterized by a complex interplay of various stages, from component manufacturing to end-user service delivery, reflecting the multi-faceted nature of modern telecommunications infrastructure. The upstream segment involves the foundational elements that enable RAN deployment. This includes semiconductor manufacturers providing chips and chipsets crucial for baseband processing and radio frequency (RF) components. It also encompasses suppliers of specialized materials, optical fiber, and power solutions. Companies in this stage focus on innovation in silicon design, power efficiency, and component miniaturization, which directly impacts the performance and cost-effectiveness of the final RAN equipment. The increasing adoption of Open RAN is further diversifying this upstream segment, encouraging more specialized hardware and software vendors to contribute discrete components rather than integrated solutions.

Moving downstream, the value chain progresses through the manufacturing and integration of complete RAN systems. This segment is dominated by original equipment manufacturers (OEMs) who design, produce, and assemble base stations, antennas, and related software platforms. These OEMs often collaborate with various component suppliers and develop proprietary or open-source software for network management and radio resource control. The integration phase is critical, involving the deployment, configuration, and testing of RAN equipment within an operator's existing network infrastructure. This requires significant expertise in site acquisition, tower climbing, radio planning, and core network integration. Service providers, including system integrators and telecom operators' in-house teams, play a vital role here, ensuring seamless operation and optimal performance of the deployed RAN. The shift towards virtualization and cloud-native RAN solutions introduces new players like cloud service providers and software developers, adding layers of complexity and new opportunities in the integration phase.

The distribution channels for RAN products and services are primarily direct, involving direct sales and long-term contracts between major equipment vendors and telecom operators. Given the specialized nature, high value, and custom requirements of RAN infrastructure, a direct relationship ensures close collaboration, tailored solutions, and ongoing support. Indirect channels are less common for large-scale RAN deployments but exist for certain smaller components, accessories, or specific regional markets through value-added resellers (VARs) or regional distributors, particularly for enterprise private network solutions. Post-deployment, the value chain extends to ongoing maintenance, optimization, and managed services, where vendors or third-party service providers ensure the network's continuous operation, performance, and security. The entire chain is underpinned by strong research and development (R&D) efforts at every stage, driving technological advancements in areas like 5G-Advanced, 6G, AI/ML for network automation, and energy efficiency, all aimed at delivering enhanced connectivity and enabling future digital services.

Radio Access Network Market Potential Customers

The Radio Access Network (RAN) market serves a diverse array of potential customers, with distinct needs and operational contexts, underpinning the robust demand for advanced wireless communication infrastructure. Historically, mobile network operators (MNOs) and communication service providers (CSPs) have been the predominant buyers, investing heavily in RAN to build, expand, and upgrade their public cellular networks. These operators are constantly seeking solutions that offer higher spectral efficiency, greater capacity, lower latency, and reduced operational costs to meet subscriber demand for ubiquitous, high-speed mobile broadband. Their purchasing decisions are driven by factors such as subscriber growth, data traffic patterns, competitive landscape, regulatory mandates, and the imperative to monetize new services like 5G enterprise solutions and IoT connectivity. The ongoing global rollout of 5G, coupled with the strategic shift towards Open RAN architectures, continues to drive significant procurement cycles within this traditional customer base, making them the largest and most critical segment.

A rapidly expanding segment of potential customers comprises enterprises across various industries. With the advent of private 5G networks, businesses are increasingly deploying their own dedicated RAN infrastructure to gain enhanced control, security, and performance tailored to their specific operational requirements. Industries such as manufacturing (for smart factories and industrial automation), logistics and warehousing (for automated guided vehicles and real-time inventory management), mining (for remote operations and worker safety), ports (for automated cranes and cargo tracking), and healthcare (for telemedicine and connected medical devices) are emerging as significant end-users. These enterprises prioritize ultra-low latency, high reliability, deterministic connectivity, and strong data security, which private 5G RAN solutions are uniquely positioned to deliver. The ability to customize network slices and ensure guaranteed quality of service (QoS) makes private RAN an attractive investment for digital transformation initiatives within these sectors.

Beyond traditional telecom and enterprise, government and public safety agencies also represent a vital customer segment. These entities require highly reliable, secure, and resilient communication networks for critical operations, including emergency services, national defense, and public administration. Governments are investing in dedicated broadband networks (e.g., FirstNet in the U.S. or Emergency Services Network in the UK) that often leverage advanced RAN technologies to ensure seamless communication during crises, support smart city initiatives, and bridge the digital divide in underserved areas. Additionally, emerging customer types include neutral host providers who build shared network infrastructure, often small cells or indoor RAN solutions, to be utilized by multiple operators or enterprises, thereby optimizing deployment costs and expanding coverage in high-traffic or challenging environments. The diversification of RAN customers underscores the technology's pervasive and foundational role in modern society and economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 29.8 billion |

| Market Forecast in 2032 | USD 62.5 billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ericsson, Huawei, Nokia, Samsung, ZTE, NEC Corporation, Fujitsu, Cisco Systems, Qualcomm, Intel, Mavenir, Parallel Wireless, Altiostar, CommScope, Viavi Solutions, Amdocs, Spirent Communications, Rakuten Mobile, Baicells Technologies, Casa Systems, Capgemini, Hewlett Packard Enterprise (HPE), Dell Technologies, Juniper Networks. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Radio Access Network Market Key Technology Landscape

The Radio Access Network (RAN) market's technology landscape is currently undergoing a radical transformation, primarily driven by the advancements and requirements of 5G networks and the strategic shift towards more open and virtualized architectures. The foundational technology remains the base station, which has evolved from traditional macrocells to include a vast array of small cells, femtocells, and picocells, enabling denser networks and improved indoor coverage. Remote Radio Units (RRUs) and Active Antenna Units (AAUs) are critical for efficiently managing radio frequencies and enabling advanced MIMO (Multiple-Input, Multiple-Output) capabilities, which are central to 5G's high-capacity promise. The advancements in antenna technology, including massive MIMO and beamforming, are key enablers for improving spectral efficiency and delivering targeted coverage. Furthermore, robust and energy-efficient chipsets and processors from companies like Qualcomm and Intel are essential for processing the massive data loads and complex algorithms inherent in modern RAN.

Beyond hardware, software-defined networking (SDN) and network function virtualization (NFV) are profoundly reshaping the RAN. Virtualized RAN (vRAN) moves baseband functions from proprietary hardware to commercial off-the-shelf (COTS) servers, allowing greater flexibility, scalability, and cost efficiency. This virtualization enables operators to deploy network functions as software on common computing platforms, reducing the need for specialized hardware and accelerating the deployment of new services. Building upon vRAN, Open RAN (O-RAN) represents a paradigm shift towards open interfaces and disaggregated network components, allowing operators to mix and match hardware and software from different vendors. This open architecture fosters innovation, increases vendor diversity, reduces vendor lock-in, and promises significant CapEx and OpEx savings. Key technologies within Open RAN include the O-RAN Alliance specifications for open interfaces, cloud-native deployments, and the use of artificial intelligence and machine learning (AI/ML) for intelligent network control and optimization.

The increasing importance of artificial intelligence (AI) and machine learning (ML) within the RAN landscape cannot be overstated. AI/ML algorithms are being integrated for various functions, including intelligent radio resource management, predictive maintenance, automated network optimization, and enhanced security. These capabilities enable self-organizing networks (SON), which can autonomously configure, optimize, and heal themselves, drastically reducing human intervention and improving network performance. Edge computing is another pivotal technology, bringing computation and data storage closer to the end-users and devices, thus enabling ultra-low latency applications crucial for IoT, industrial automation, and augmented reality. Other emerging technologies include Non-Terrestrial Networks (NTN) integration for satellite-based RAN, enabling connectivity in remote areas, and advanced security protocols to protect sensitive data and network integrity from evolving cyber threats. The convergence of these technologies is creating a highly dynamic, intelligent, and flexible RAN ecosystem capable of supporting the most demanding future connectivity requirements.

Regional Highlights

- North America: The region is a leader in 5G deployment, characterized by rapid adoption of mmWave technology and significant investments in private 5G networks for enterprise use. Strong emphasis on Open RAN initiatives, driven by major operators and government support, aims to diversify vendor ecosystems and foster innovation. High data consumption rates and a focus on advanced applications like IoT and edge computing continue to drive RAN market growth.

- Europe: European countries are progressing with 5G rollouts, with a strong focus on energy efficiency, sustainability, and vendor diversification. Regulatory bodies often encourage Open RAN adoption to enhance competition and supply chain resilience. The market is also seeing increasing uptake of private 5G networks in industrial sectors, alongside ongoing efforts to improve rural connectivity and digital infrastructure across the continent.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for RAN, spearheaded by rapid 5G deployments in China, South Korea, Japan, and India. These countries are aggressively expanding network coverage and capacity, with substantial government and private sector investments. The region is a hub for telecom innovation, driving advancements in dense urban deployments, massive IoT connectivity, and the development of new RAN technologies and services.

- Latin America: This region is experiencing a significant acceleration in 5G adoption and network modernization. Countries are focusing on expanding mobile broadband access, improving digital inclusion, and leveraging 5G to support economic development. While still in earlier stages compared to APAC or North America, growing investments in infrastructure upgrades and spectrum auctions are propelling RAN market expansion.

- Middle East and Africa (MEA): MEA is an emerging market with increasing investments in 5G infrastructure, driven by high mobile penetration and the demand for enhanced digital services. Governments in the Gulf Cooperation Council (GCC) countries are particularly active in advanced 5G deployments, while other African nations are focused on improving mobile broadband coverage and supporting socio-economic development through connectivity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Radio Access Network Market.- Ericsson

- Huawei

- Nokia

- Samsung

- ZTE

- NEC Corporation

- Fujitsu

- Cisco Systems

- Qualcomm

- Intel

- Mavenir

- Parallel Wireless

- Altiostar

- CommScope

- Viavi Solutions

- Amdocs

- Spirent Communications

- Rakuten Mobile

- Baicells Technologies

- Casa Systems

- Capgemini

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- Juniper Networks

Frequently Asked Questions

What is a Radio Access Network (RAN)?

A Radio Access Network (RAN) is a crucial part of a mobile telecommunication system that connects user devices, like smartphones, to the core network via radio waves. It includes elements such as base stations, antennas, and associated software, enabling wireless communication and managing radio resources for seamless connectivity.

How does 5G impact the RAN market?

5G significantly impacts the RAN market by driving demand for new infrastructure, higher capacity, lower latency, and support for massive device connectivity. It necessitates new radio units (e.g., gNodeBs), advanced antenna technologies like massive MIMO, and promotes virtualization and open architectures (Open RAN) for greater flexibility and efficiency.

What is Open RAN and why is it important?

Open RAN (O-RAN) is an industry initiative for disaggregating traditional RAN into open, interoperable components from different vendors. It's important because it fosters innovation, reduces vendor lock-in, lowers equipment costs, and provides operators with greater flexibility in deploying and managing their networks through standardized interfaces and virtualized functions.

What are the main challenges facing RAN deployment?

Key challenges for RAN deployment include high capital expenditure (CapEx) for infrastructure, complex integration of multi-vendor components, ensuring robust network security, addressing regulatory complexities (e.g., spectrum allocation), managing increased power consumption, and the shortage of skilled personnel for advanced network operations.

How is AI transforming RAN operations?

AI is transforming RAN operations by enabling intelligent automation, predictive maintenance, and real-time network optimization. It enhances spectral efficiency, facilitates dynamic resource allocation, improves security through anomaly detection, and drives energy savings, leading to more efficient, reliable, and self-organizing networks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cloud Radio Access Network Market Size Report By Type (2G/3G, 4G, 5G), By Application (Telecom Operators, Enterprises), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Long Term Evolution And Long Term Evolution Advance Market Size Report By Type (Infrastructure, End-User Device, Evolved Packet Core (EPC), User Equipment (UE), Evolved UMTS Terrestrial Radio Access Network (E-UTRAN), Smartphones, USB Modems, Notebooks, Tablets, Routers, Card Modules), By Application (Video on Demand, VoLTE, High Speed Data Services, Defense and Security, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Virtualized Radio Access Network (vRAN) Market Size Report By Type (Software, Platform), By Application (Dense Area Urban, Enterprise, Public Venue Environments, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Open Radio Access Network Market Size Report By Type (Hardware, Software, Services), By Application (Public, Private), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Virtualized Radio Access Network (vRAN) Market Statistics 2025 Analysis By Application (Dense Area Urban, Enterprise, Public Venue Environments), By Type (Software, Platform, Servers), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager