Railroad Tie Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430818 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Railroad Tie Market Size

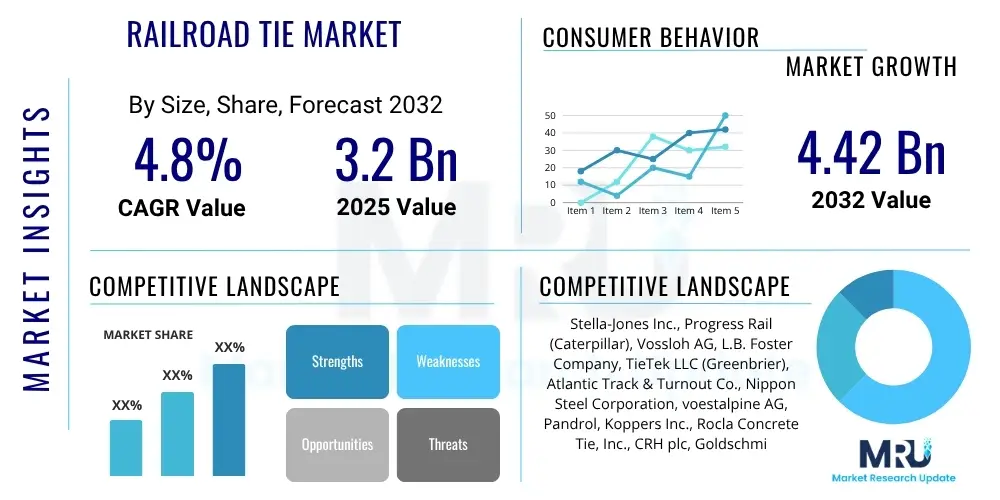

The Railroad Tie Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at USD 3.2 billion in 2025 and is projected to reach USD 4.42 billion by the end of the forecast period in 2032.

Railroad Tie Market introduction

The railroad tie market is a fundamental component of global railway infrastructure, providing critical support for railway tracks. Railroad ties, also known as sleepers or crossties, are positioned perpendicularly beneath the rails to hold them at a fixed gauge, transfer loads from the rails to the ballast, and maintain track stability. The integrity of railroad ties is paramount for the safe and efficient operation of trains, influencing both freight and passenger transport networks worldwide. The market encompasses a variety of materials, including traditional timber, durable concrete, and innovative steel and composite options, each offering distinct advantages in terms of cost, longevity, and environmental impact.

Major applications for railroad ties span a broad spectrum of railway systems. These include heavy-haul freight lines that transport bulk commodities over long distances, high-speed passenger rail networks requiring exceptional stability and precision, urban transit systems like subways and light rail, and industrial sidings and port railways used for specialized cargo movement. The benefits derived from robust railroad ties are numerous, primarily enhancing track stability, ensuring consistent track gauge, and effectively distributing the immense loads imposed by passing trains across the underlying ballast. This load distribution minimizes wear and tear on the track bed and prolongs the lifespan of the entire railway infrastructure.

Several key factors are driving the growth of the railroad tie market. Significant government and private sector investments in infrastructure development, particularly in emerging economies, are fueling demand for new rail lines and the modernization of existing networks. The increasing volume of freight transportation globally, driven by economic expansion and supply chain demands, necessitates resilient and high-capacity railway infrastructure. Furthermore, the global trend of urbanization, leading to the expansion of urban transit systems, and the imperative for sustainable and efficient transportation solutions are contributing substantially to the market’s positive trajectory. These intertwined factors collectively underscore the vital role of railroad ties in supporting a burgeoning global railway ecosystem.

Railroad Tie Market Executive Summary

The railroad tie market is currently undergoing significant transformation, driven by a confluence of evolving business trends, regional development priorities, and segment-specific innovations. A prominent business trend is the growing emphasis on sustainability, pushing manufacturers and railway operators towards eco-friendly materials and production processes. This involves a shift away from traditional creosote-treated timber ties, which face environmental scrutiny, towards alternatives like concrete, steel, and advanced composite ties. Furthermore, the market is witnessing an increased adoption of lifecycle costing models, where initial tie cost is balanced against long-term maintenance, replacement frequencies, and operational efficiency, thereby favoring more durable and less maintenance-intensive options.

Regional trends exhibit diverse dynamics shaping the market landscape. Asia Pacific, particularly countries like China and India, represents a primary growth engine due to massive ongoing and planned railway expansion projects, driven by rapid urbanization and industrialization. North America, with its vast and aging freight rail network, primarily focuses on replacement demand and infrastructure upgrades to handle increasing freight volumes efficiently. Europe is characterized by a strong emphasis on high-speed rail development and a commitment to sustainable infrastructure, leading to the widespread adoption of concrete and, increasingly, composite ties. Latin America and the Middle East and Africa are emerging as significant markets, fueled by commodity transport needs and foundational infrastructure development initiatives, respectively.

Segment trends within the railroad tie market highlight distinct preferences and technological advancements. The concrete tie segment is experiencing robust growth due to its superior durability, extended lifespan, and suitability for high-speed and heavy-haul applications, despite higher initial installation costs. Wood ties, while facing challenges, maintain their niche in specific applications due to flexibility, ease of installation, and cost-effectiveness in certain geographies, particularly for lighter loads and curve sections. The composite tie segment, though smaller, is gaining traction owing to its environmental benefits, resistance to decay, and ability to recycle materials, offering a promising future for sustainable railway construction. Steel ties are primarily used in specific regions and for switch and crossing applications where their strength and slim profile are advantageous.

AI Impact Analysis on Railroad Tie Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is poised to significantly revolutionize the railroad tie market by enhancing operational efficiency, improving safety standards, and optimizing maintenance practices. Common user questions related to AI's impact on this sector often revolve around its potential to facilitate predictive maintenance, automate inspection processes, and optimize supply chain logistics for tie replacement. Users are keenly interested in how AI can move railway infrastructure management from reactive repairs to proactive interventions, thereby reducing costly disruptions and extending the service life of railroad ties. Concerns also include the accuracy and reliability of AI-driven systems in detecting subtle defects and the investment required for implementation, alongside the potential for job displacement or skill evolution within the workforce.

Ultimately, the consensus among industry stakeholders is that AI offers substantial benefits in terms of data analysis, decision-making support, and automation. By leveraging AI, railway operators can anticipate failures, prioritize repairs, and manage inventory more effectively, leading to a more resilient and efficient rail network. The technology promises to create smarter infrastructure that adapts to changing conditions and demands, ensuring greater safety and economic viability for railroad operations. The move towards AI-driven solutions is not merely about technological adoption but about fundamentally transforming how railroad tie assets are managed and maintained throughout their lifecycle.

- AI-powered predictive maintenance for railroad ties, analyzing sensor data and historical performance to forecast tie degradation and schedule replacements proactively.

- Enhanced autonomous inspection systems utilizing AI for image recognition and anomaly detection, identifying defects like cracks, rot, and gauge deviations more accurately and rapidly than manual inspections.

- Optimization of railroad tie production and supply chain logistics through AI algorithms, forecasting demand, managing inventory levels, and streamlining transportation routes for raw materials and finished products.

- Improved quality control in the manufacturing process of concrete, composite, and steel ties by using AI to monitor production parameters and detect inconsistencies in real-time, ensuring higher product reliability.

- Development of digital twins for railway tracks, where AI models simulate the behavior and wear of different tie types under various operational stresses, aiding in material selection and long-term planning.

- AI-driven optimization of track geometry maintenance, recommending precise adjustments to ties and ballast to maintain optimal alignment and reduce stress on the track system.

DRO & Impact Forces Of Railroad Tie Market

The railroad tie market is subject to a complex interplay of drivers, restraints, and opportunities, alongside significant impact forces that shape its growth trajectory and competitive landscape. A primary driver is the extensive global investment in railway infrastructure development and modernization, fueled by economic growth, urbanization, and the increasing demand for efficient freight and passenger transport. The expansion of high-speed rail networks, particularly in Asia and Europe, and the ongoing need for maintenance and replacement of aging infrastructure in established markets like North America, further bolster demand. Additionally, the growing emphasis on sustainable and resilient transportation systems is propelling demand for advanced and environmentally friendly tie materials, contributing to market expansion.

However, the market also faces notable restraints. The high initial capital expenditure associated with new rail projects and the replacement of existing ties can be a significant barrier, especially for alternative materials like concrete and composites which often have a higher upfront cost than traditional wood. Environmental regulations, particularly regarding the use of creosote-treated wood ties, impose limitations and increase compliance costs for manufacturers and operators. Volatility in raw material prices, such as timber, cement, and steel, can impact production costs and overall market profitability. Furthermore, the lengthy approval processes and stringent safety standards in the railway industry can delay project timelines and hinder the adoption of new technologies and materials.

Opportunities within the railroad tie market primarily lie in the continuous innovation of materials and manufacturing processes. The development and increasing acceptance of sustainable composite ties, made from recycled plastics and other materials, offer a greener alternative with extended lifespans and reduced maintenance requirements. The integration of smart technologies, such as IoT sensors embedded in ties for real-time monitoring of track conditions and AI-driven predictive maintenance, presents significant avenues for enhancing operational efficiency and safety. Moreover, the expanding rail networks in emerging economies across Asia Pacific, Latin America, and Africa provide substantial untapped potential for both new installations and infrastructure upgrades. External impact forces, including global economic cycles, geopolitical stability affecting trade routes, and regulatory shifts concerning environmental standards and railway safety, exert considerable influence on market dynamics, dictating investment levels and material choices.

Segmentation Analysis

The railroad tie market is comprehensively segmented to provide a detailed understanding of its diverse components, allowing for targeted strategic planning and market analysis. These segmentations typically involve categorizing the market based on the type of material used for the ties, the specific application where they are deployed, and the end-user or buyer group. Each segment presents unique growth drivers, technological preferences, and market dynamics, reflecting the varied requirements of global railway systems. Understanding these distinctions is crucial for identifying market niches, assessing competitive landscapes, and forecasting future demand patterns across different regions and railway operations.

The choice of railroad tie material is often dictated by factors such as climate conditions, expected train loads, desired lifespan, and environmental considerations. For instance, concrete ties are preferred for high-speed and heavy-haul lines due to their durability, while wood ties remain popular in regions where timber is abundant and for less demanding applications. Application-based segmentation differentiates between the needs of mainline freight, passenger transit, and specialized industrial uses, each requiring specific tie characteristics. End-user segmentation helps categorize the primary purchasers, ranging from large Class I railroads to municipal transit authorities, each with distinct procurement processes and operational scales. This multi-dimensional approach to segmentation offers a holistic view of the market's structure and potential for growth across its various dimensions.

- By Material:

- Wood Ties (Creosote-treated, Untreated)

- Concrete Ties (Monoblock, Twoblock)

- Steel Ties

- Composite Ties

- By Application:

- Heavy Haul Freight Lines

- High-Speed Passenger Rail

- Urban Transit Systems (Subway, Light Rail)

- Industrial and Port Railways

- Mining and Logging Railways

- By End-User:

- Class I Railroads

- Shortline Railroads

- Industrial Rail Operators

- Government/Public Transit Authorities

- Construction and Maintenance Companies

Value Chain Analysis For Railroad Tie Market

The value chain for the railroad tie market is a complex network of interconnected activities, beginning with the sourcing of raw materials and extending through manufacturing, distribution, installation, and end-of-life management. Upstream analysis focuses on the suppliers of primary materials essential for tie production. For wood ties, this involves timber harvesting companies and sawmills; for concrete ties, it includes cement, aggregate, and steel rebar manufacturers; for steel ties, steel mills are key; and for composite ties, suppliers of recycled plastics, fiberglass, and other polymers are critical. The quality and availability of these raw materials directly impact the cost and final properties of the railroad ties, making stable relationships with upstream suppliers crucial for manufacturers. Price volatility in these commodities can significantly affect the profitability margins throughout the chain.

Midstream activities primarily involve the manufacturing and processing of railroad ties. This includes specialized facilities that treat wood ties with preservatives, plants that cast and cure concrete ties, steel fabricators for steel ties, and composite tie manufacturers utilizing advanced molding and extrusion techniques. These manufacturers often invest heavily in research and development to improve tie durability, reduce environmental impact, and enhance performance characteristics to meet stringent railway standards. Downstream analysis encompasses the distribution, installation, and maintenance services. Distribution channels can be direct, with large manufacturers selling directly to major railway operators or government agencies, or indirect, involving a network of distributors and wholesalers who cater to smaller railroads, industrial clients, and construction companies. The efficiency of the distribution network is vital for timely delivery and cost-effectiveness, especially given the heavy and bulky nature of the product.

Installation and ongoing maintenance are critical downstream activities that ensure the longevity and safety of railway infrastructure. Specialized railway construction and maintenance companies are often contracted for tie replacement and track rehabilitation projects. These firms employ skilled labor and specialized machinery for efficient installation. The lifecycle management also includes the eventual removal and disposal or recycling of old ties, with increasing emphasis on sustainable practices to minimize environmental impact. The direct channel offers manufacturers greater control over sales and customer relationships, often preferred for large-volume contracts. Indirect channels, through regional distributors and value-added resellers, are essential for market penetration into diverse segments and for providing localized support, forming a comprehensive value delivery system that underpins the entire railroad tie market.

Railroad Tie Market Potential Customers

The potential customer base for the railroad tie market is diverse and spans various sectors that rely heavily on robust railway infrastructure for their operational needs. These end-users or buyers are primarily entities responsible for constructing, maintaining, or operating railway lines, ranging from vast national networks to specialized industrial tracks. The primary segment comprises national railway operators and freight companies, which manage extensive rail networks for both passenger and freight transportation. These entities require large volumes of ties for new line construction, routine maintenance, and extensive replacement programs for aging infrastructure. Their purchasing decisions are often influenced by factors such as tie lifespan, load-bearing capacity, maintenance costs, and compliance with stringent national safety and environmental regulations.

Another significant customer segment includes urban transit agencies and municipal authorities responsible for metropolitan subway, light rail, and tram systems. With global urbanization trends, investment in urban transit is consistently growing, leading to demand for ties suitable for high-frequency, lower-speed operations, often with considerations for noise reduction and aesthetic integration. Industrial plants, such as mining operations, logging companies, manufacturing facilities, and port authorities, represent another substantial group of buyers. These entities operate their own private rail sidings and internal networks for transporting raw materials and finished goods, necessitating ties that can withstand specific operational stresses and environmental conditions prevalent in industrial settings. Their procurement often involves balancing durability with cost-effectiveness for localized, heavy-duty applications.

Furthermore, various government bodies, especially departments of transportation and railway development boards, act as key customers by funding and overseeing major infrastructure projects. These governmental entities are often involved in procuring ties for new national rail lines, high-speed rail corridors, and large-scale modernization initiatives. Construction and railway engineering contractors, who are awarded these large-scale projects, also represent indirect buyers as they purchase ties as part of their project execution. Lastly, shortline railroads, which operate smaller regional networks, and railway maintenance service providers also contribute to the demand, often requiring more flexible and cost-effective tie solutions for their specific operational scales and budgetary constraints. This broad array of end-users collectively drives the consistent demand for railroad ties across the globe.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 3.2 Billion |

| Market Forecast in 2032 | USD 4.42 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stella-Jones Inc., Progress Rail (Caterpillar), Vossloh AG, L.B. Foster Company, TieTek LLC (Greenbrier), Atlantic Track & Turnout Co., Nippon Steel Corporation, voestalpine AG, Pandrol, Koppers Inc., Rocla Concrete Tie, Inc., CRH plc, Goldschmidt Thermit Group, Greenrail Srl, Axion Structural Innovations, Nara Kiko, RailWorks Corporation, Wegh Group, Hi-Force, Railone |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Railroad Tie Market Key Technology Landscape

The railroad tie market is increasingly influenced by significant technological advancements aimed at improving durability, sustainability, and operational efficiency of railway infrastructure. One crucial area of innovation is in material science, leading to the development of advanced composite ties that utilize recycled plastics, rubber, and fiber reinforcements. These composites offer superior resistance to rot, insect infestation, and weathering compared to traditional wood, while also being lighter and often recyclable at the end of their service life. Manufacturers are continuously refining these formulations to enhance structural integrity, fire resistance, and performance under varying climatic conditions, making them a viable alternative to conventional materials in a broader range of applications.

Another pivotal technological trend is the integration of smart monitoring and Internet of Things (IoT) sensors directly into railroad ties. These embedded sensors can provide real-time data on critical parameters such as track vibration, temperature fluctuations, load distribution, and subtle deformations. This data is invaluable for implementing predictive maintenance strategies, allowing railway operators to identify potential issues with ties before they escalate into costly failures or safety hazards. The information gathered through these smart ties, when combined with sophisticated analytics and AI algorithms, enables proactive scheduling of repairs and replacements, optimizing maintenance cycles and extending the overall lifespan of railway assets, thereby significantly reducing operational costs and improving network reliability.

Furthermore, automation in manufacturing processes and the adoption of advanced engineering design tools are transforming the production of railroad ties. Automated casting and curing processes for concrete ties ensure consistent quality and faster production cycles, while robotic systems are being employed for precise treatment and handling of wood ties. Digital twin technology is also emerging as a powerful tool, creating virtual replicas of railway tracks that can simulate the performance and wear of different tie materials under various operational scenarios. This allows engineers to optimize tie designs, predict maintenance needs, and plan for future infrastructure expansions with greater accuracy and efficiency, ultimately driving innovation across the entire railroad tie market ecosystem.

Regional Highlights

- North America: This region boasts one of the most extensive freight rail networks globally, leading to a substantial demand for railroad ties primarily driven by replacement and maintenance activities. The aging infrastructure necessitates continuous investment in track upgrades and rehabilitation. The market here is characterized by a strong presence of Class I railroads that prioritize durable materials like concrete and wood, with a growing interest in composite ties for specific applications. Regulatory compliance and safety standards are key drivers for material selection and operational practices.

- Europe: Characterized by a highly developed and integrated rail network, Europe exhibits a robust demand for railroad ties, particularly for high-speed passenger rail and urban transit systems. The region places a strong emphasis on sustainability and environmental protection, driving the adoption of concrete and innovative composite ties. Governments and railway operators are actively investing in modernizing infrastructure and expanding high-speed lines, contributing to a steady market growth.

- Asia Pacific (APAC): The APAC region is the fastest-growing market for railroad ties, fueled by massive government investments in new railway projects, rapid urbanization, and industrial expansion. Countries like China and India are undertaking extensive network expansions, including high-speed rail, metro systems, and dedicated freight corridors. This demand is primarily for new installations, with concrete ties being heavily utilized due to their durability and suitability for heavy-haul and high-speed applications.

- Latin America: This region is witnessing steady growth in the railroad tie market, largely driven by infrastructure development related to commodity transportation, such as mining and agriculture. Countries are investing in upgrading and expanding their rail networks to improve logistics and facilitate trade. Both wood and concrete ties are in demand, with local availability and cost-effectiveness playing significant roles in material selection for regional projects.

- Middle East and Africa (MEA): The MEA region is an emerging market with substantial potential, as several countries are undertaking ambitious rail infrastructure projects to diversify their economies and improve connectivity. Investments in new freight lines, passenger railways, and urban transit systems are creating a growing demand for railroad ties. Concrete ties are often preferred due to their durability in harsh climatic conditions, alongside a focus on modern, low-maintenance solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Railroad Tie Market.- Stella-Jones Inc.

- Progress Rail (Caterpillar)

- Vossloh AG

- L.B. Foster Company

- TieTek LLC (Greenbrier)

- Atlantic Track & Turnout Co.

- Nippon Steel Corporation

- voestalpine AG

- Pandrol

- Koppers Inc.

- Rocla Concrete Tie, Inc.

- CRH plc

- Goldschmidt Thermit Group

- Greenrail Srl

- Axion Structural Innovations

- Nara Kiko

- RailWorks Corporation

- Wegh Group

- Hi-Force

- Railone

Frequently Asked Questions

What are the primary types of railroad ties used today?

The primary types of railroad ties include wood, concrete, steel, and composite ties. Wood ties are traditional, concrete ties offer superior durability for heavy-haul and high-speed applications, steel ties are used for specific track configurations, and composite ties provide eco-friendly and long-lasting alternatives.

What factors are driving the growth of the railroad tie market?

Key growth drivers include significant global investments in railway infrastructure development, increasing demand for freight and passenger transportation, expansion of high-speed rail networks, and a growing emphasis on sustainable and resilient transportation solutions worldwide.

How do environmental concerns impact the railroad tie market?

Environmental concerns are significantly impacting the market by driving a shift away from creosote-treated wood ties towards greener alternatives like concrete, steel, and especially composite ties made from recycled materials. Regulations and sustainability goals are fostering innovation in material science and production processes.

What role do composite ties play in the future of railway infrastructure?

Composite ties are emerging as a crucial component for future railway infrastructure due to their environmental benefits, extended lifespan, resistance to decay and insects, and lower maintenance requirements. They offer a sustainable and durable alternative to traditional materials, gaining traction in various applications.

Which regions are showing the most significant growth in railroad tie installations?

The Asia Pacific region, particularly countries like China and India, is exhibiting the most significant growth due to extensive railway expansion projects, rapid urbanization, and industrialization. North America also sees substantial demand driven by replacement and maintenance of its vast freight network.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager