Rapid Diagnostics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428715 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Rapid Diagnostics Market Size

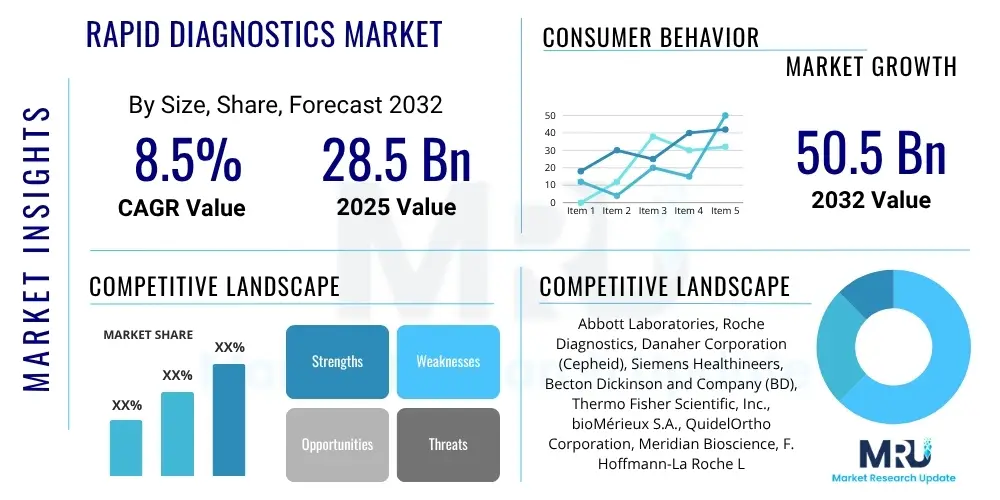

The Rapid Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at $28.5 Billion in 2025 and is projected to reach $50.5 Billion by the end of the forecast period in 2032.

Rapid Diagnostics Market introduction

The Rapid Diagnostics Market encompasses a broad range of medical tests designed to provide quick and accurate results, typically at the point of care or within a short timeframe. These tests are crucial for timely disease detection, monitoring, and management, significantly impacting public health outcomes. Products often include user-friendly kits and devices that minimize the need for complex laboratory infrastructure, making them indispensable in diverse healthcare settings, from remote clinics to emergency rooms and even home use. The inherent speed and simplicity of these diagnostics contribute directly to faster clinical decision-making and immediate patient care.

Rapid diagnostic products cover a spectrum of technologies, including lateral flow assays, immunoassays, and molecular diagnostic platforms, each tailored for specific analytes and diagnostic needs. Their major applications span infectious disease detection, such as influenza, COVID-19, HIV, and malaria, as well as chronic disease management, drug abuse testing, pregnancy detection, and various critical care scenarios. The key benefits derived from these technologies include their ability to deliver results within minutes to hours, often requiring minimal training for operation, thereby facilitating decentralized testing and reducing turnaround times. This immediacy is vital for controlling outbreaks, initiating prompt treatment, and alleviating the burden on central laboratories.

The market is primarily driven by the increasing global prevalence of infectious and chronic diseases, which necessitates widespread and accessible diagnostic tools. Furthermore, the growing demand for point-of-care (POC) testing, especially in resource-limited settings and during public health crises, significantly propels market expansion. Technological advancements leading to enhanced sensitivity, specificity, and multiplexing capabilities in rapid diagnostic platforms are further accelerating adoption. Governments and non-governmental organizations are also increasingly investing in rapid diagnostic programs to improve disease surveillance and management, reinforcing the market's robust growth trajectory.

Rapid Diagnostics Market Executive Summary

The Rapid Diagnostics Market is experiencing robust growth, primarily fueled by an escalating global burden of infectious and chronic diseases and the surging demand for immediate, actionable diagnostic insights at the point of care. Business trends indicate a strong focus on strategic partnerships, mergers and acquisitions, and significant investments in research and development to introduce next-generation rapid tests. Key players are constantly innovating to improve test accuracy, expand multiplexing capabilities, and integrate digital health solutions, aiming to enhance the overall efficiency and accessibility of diagnostic services. The market dynamics are characterized by intense competition and a continuous drive towards more user-friendly, cost-effective, and technologically advanced solutions to address diverse healthcare needs across the globe.

Regionally, North America and Europe continue to dominate the market due to well-established healthcare infrastructures, high adoption rates of advanced diagnostic technologies, and substantial R&D spending. However, the Asia Pacific region is emerging as the fastest-growing market, driven by its large patient population, improving healthcare facilities, increasing awareness about early disease diagnosis, and rising government initiatives to combat infectious diseases. Latin America, the Middle East, and Africa are also showing considerable potential, supported by investments in healthcare infrastructure and a growing demand for affordable diagnostic solutions, particularly for endemic infectious diseases. These regional trends highlight a global shift towards decentralized diagnostics and localized manufacturing capabilities to meet specific market demands and regulatory landscapes.

From a segmentation perspective, infectious disease diagnostics remains the largest and most dynamic segment, particularly with ongoing global health challenges requiring swift and accurate identification of pathogens. Product-wise, test kits and reagents hold a dominant share, while instruments are becoming more sophisticated, offering greater automation and connectivity. In terms of technology, lateral flow assays are widely adopted for their simplicity and cost-effectiveness, though molecular diagnostics and advanced immunoassay techniques are gaining traction for their higher sensitivity and specificity. End-user segments such as hospitals, clinics, and diagnostic laboratories continue to be major consumers, with home care testing experiencing a significant surge, reflecting the broader trend towards patient self-management and convenience in diagnostics. This multifaceted growth across segments underscores the market's adaptability and responsiveness to evolving healthcare demands.

AI Impact Analysis on Rapid Diagnostics Market

Users frequently inquire about artificial intelligence's potential to revolutionize rapid diagnostics, particularly regarding enhancing accuracy, accelerating result interpretation, and integrating seamlessly into existing healthcare workflows. Common questions revolve around how AI can improve the sensitivity and specificity of diagnostic tests, reduce false positives or negatives, and handle complex data patterns beyond human capabilities. There is significant interest in AI's role in developing novel biomarkers, predicting disease progression, and personalizing treatment strategies based on rapid diagnostic outcomes. Furthermore, concerns are often raised about the regulatory pathways for AI-powered diagnostic tools, data privacy and security, the ethical implications of autonomous decision-making, and the financial investment required for widespread adoption, highlighting a blend of optimism for innovation and caution regarding implementation challenges.

- Enhanced diagnostic accuracy and precision through advanced image analysis and pattern recognition.

- Accelerated data interpretation and reporting, reducing turnaround times for complex rapid tests.

- Development of novel biomarkers and diagnostic algorithms for earlier and more specific disease detection.

- Integration with telehealth and remote monitoring platforms, enabling decentralized and accessible care.

- Personalized medicine enablement by correlating rapid test results with patient historical data and treatment responses.

- Automation of laboratory processes, minimizing human error and increasing throughput in high-volume settings.

- Predictive analytics for disease outbreaks and progression, facilitating proactive public health interventions.

- Streamlined regulatory compliance through AI-assisted data validation and documentation.

DRO & Impact Forces Of Rapid Diagnostics Market

The Rapid Diagnostics Market is significantly shaped by a confluence of powerful drivers, persistent restraints, compelling opportunities, and external impact forces. A primary driver is the accelerating global prevalence of infectious diseases, including newly emerging pathogens and antibiotic-resistant strains, alongside the rising burden of chronic conditions like diabetes and cardiovascular diseases. This necessitates widespread and immediate diagnostic capabilities to facilitate timely intervention and disease control. Concurrently, the increasing demand for decentralized point-of-care (POC) testing, driven by patient convenience, efforts to reduce healthcare costs, and the need for rapid results in emergency settings, serves as a crucial catalyst for market expansion. Furthermore, continuous technological advancements, such as the development of more sensitive biosensors, multiplexing capabilities, and integration with digital health platforms, enhance the utility and accessibility of rapid diagnostic solutions, pushing the market forward.

Despite robust growth drivers, the market faces several significant restraints. High development and manufacturing costs associated with innovative rapid diagnostic platforms can hinder their affordability and widespread adoption, particularly in developing economies. Stringent regulatory approval processes in various regions pose substantial barriers, often leading to prolonged market entry timelines and increased R&D expenditures for manufacturers. Additionally, issues related to the accuracy and specificity of some rapid tests, particularly in early stages of infection or for complex conditions, can sometimes lead to skepticism among healthcare professionals. Limited reimbursement policies for certain rapid diagnostic tests in specific healthcare systems also act as a constraint, impacting market penetration and profitability for companies.

Opportunities within the Rapid Diagnostics Market are abundant and diverse, offering pathways for substantial growth. The burgeoning demand for home-based testing, accelerated by the recent pandemic and a growing consumer preference for self-monitoring, represents a significant avenue for product innovation and market penetration. Untapped potential in emerging economies, characterized by improving healthcare infrastructures, increasing disposable incomes, and a high disease burden, offers lucrative expansion prospects for manufacturers. Furthermore, the integration of rapid diagnostics with artificial intelligence (AI) and machine learning (ML) technologies promises to enhance diagnostic accuracy, streamline data interpretation, and enable personalized medicine approaches. The ongoing discovery of novel biomarkers for various diseases also presents continuous opportunities for developing highly specific and sensitive rapid diagnostic tests, expanding the market's clinical utility.

Several impact forces exert considerable influence on the trajectory of the Rapid Diagnostics Market. The global regulatory landscape plays a pivotal role, with evolving guidelines and approval standards shaping product development, market access, and commercialization strategies. Healthcare infrastructure development, particularly in remote and underserved areas, directly impacts the deployment and accessibility of rapid diagnostic devices. Economic conditions, including healthcare spending budgets and public health investments, significantly influence market demand and the affordability of diagnostic solutions. Public health emergencies and disease outbreaks, such as pandemics, serve as critical accelerants, dramatically increasing the demand for rapid testing and prompting rapid innovation. Finally, shifting demographic trends, including an aging global population and changes in disease epidemiology, continuously reshape the diagnostic needs, thereby influencing product development and market focus for rapid diagnostic solutions.

Segmentation Analysis

The Rapid Diagnostics Market is comprehensively segmented to provide granular insights into its diverse components, allowing for a detailed understanding of market dynamics, competitive landscapes, and growth opportunities. This segmentation helps in analyzing market performance across different product types, technological platforms, application areas, and end-user categories, enabling stakeholders to identify key growth drivers and strategic investment areas. The detailed breakdown provides a clear picture of how various segments contribute to the overall market valuation and where future innovations are likely to emerge, catering to specific diagnostic needs and healthcare settings.

- Product Type

- Kits and Reagents

- Instruments

- Technology

- Lateral Flow Assays

- Rapid Immunoassays

- Molecular Diagnostics (e.g., RT-PCR, Isothermal Nucleic Acid Amplification)

- Microfluidics-Based Diagnostics

- Digital Diagnostics

- Biosensors

- Application

- Infectious Disease Testing (e.g., COVID-19, HIV, Influenza, Malaria, Hepatitis, TB, STIs)

- Cardiology Testing

- Oncology Testing

- Drug Abuse Testing

- Pregnancy and Fertility Testing

- Glucose Monitoring

- Toxicology Testing

- Other Applications (e.g., Autoimmune Diseases, Gastrointestinal Disorders)

- End User

- Hospitals and Clinics

- Diagnostic Laboratories

- Home Care Settings

- Physician Offices

- Research Institutes

- Ambulatory Care Centers

- Emergency Medical Services (EMS)

Value Chain Analysis For Rapid Diagnostics Market

The value chain for the Rapid Diagnostics Market is a multifaceted system involving several critical stages, beginning with upstream activities focused on research, raw material sourcing, and component manufacturing. This initial phase is crucial for innovation, ensuring the development of high-quality diagnostic platforms and reagents. Upstream suppliers include manufacturers of antibodies, antigens, enzymes, nucleic acid primers, membranes, and plastic components, all of which are fundamental to the construction of rapid diagnostic kits and instruments. Strong relationships with these specialized suppliers are essential to maintain product quality, ensure supply chain stability, and control manufacturing costs. Investment in robust R&D activities at this stage drives the next generation of rapid diagnostic solutions, improving sensitivity, specificity, and user-friendliness.

Moving through the midstream, the core activities involve the design, development, manufacturing, and assembly of the rapid diagnostic devices and test kits. This stage includes stringent quality control, regulatory compliance, and packaging. Companies in this segment often leverage advanced manufacturing techniques, automation, and economies of scale to produce tests efficiently and cost-effectively. The distribution channel then plays a critical role in connecting these manufactured products with end-users. Distribution can occur through direct sales channels, where manufacturers directly sell to large hospitals, government bodies, or specific healthcare networks. This approach allows for greater control over product messaging and customer relationships but requires significant logistical infrastructure.

Conversely, indirect distribution channels involve various intermediaries such as third-party distributors, wholesalers, pharmacies, and online retail platforms. These channels offer wider market reach, especially in geographically diverse or fragmented markets, leveraging existing networks and reducing the logistical burden on manufacturers. Downstream activities involve the actual application and consumption of rapid diagnostics by end-users, which include hospitals, clinics, diagnostic laboratories, physician offices, and increasingly, individual consumers for home care. Post-sales support, technical assistance, and continuous feedback loops from these end-users are vital for product improvement, market responsiveness, and maintaining customer satisfaction. The efficiency and reliability of each stage in this value chain are paramount to the successful development, delivery, and adoption of rapid diagnostic solutions.

Rapid Diagnostics Market Potential Customers

The potential customers for rapid diagnostic products are incredibly diverse, reflecting the broad utility and accessibility of these tests across various healthcare and consumer segments. Hospitals and clinics represent a significant end-user base, utilizing rapid diagnostics for immediate patient triage, emergency care, infectious disease screening, and point-of-care testing in inpatient and outpatient settings. Their demand is driven by the need for quick results to inform treatment decisions, improve patient flow, and reduce the risk of nosocomial infections. Diagnostic laboratories also rely heavily on rapid tests, often as an initial screening tool before more complex confirmatory tests, enhancing throughput and efficiency in high-volume environments.

Individual consumers and home care settings are rapidly emerging as a crucial customer segment, propelled by the convenience, privacy, and accessibility offered by self-testing kits. This includes tests for pregnancy, fertility monitoring, glucose monitoring for diabetic patients, and infectious diseases, particularly highlighted during global health crises. Public health agencies and government organizations are also major buyers, employing rapid diagnostics for large-scale disease surveillance, outbreak management, and screening programs in community health initiatives. Furthermore, research institutions and academic centers utilize these diagnostics for various studies, including epidemiology, clinical trials, and developing new diagnostic methodologies, contributing to the advancement of medical science and public health. These diverse customer groups underscore the market's widespread impact and continuous growth potential.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $28.5 Billion |

| Market Forecast in 2032 | $50.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Roche Diagnostics, Danaher Corporation (Cepheid), Siemens Healthineers, Becton Dickinson and Company (BD), Thermo Fisher Scientific, Inc., bioMérieux S.A., QuidelOrtho Corporation, Meridian Bioscience, F. Hoffmann-La Roche Ltd., Luminex Corporation (a part of DiaSorin S.p.A.), Bio-Rad Laboratories, Inc., Hologic, Inc., Sekisui Diagnostics, Trinity Biotech plc, OraSure Technologies, Inc., AccuBioTech Co., Ltd., Eiken Chemical Co., Ltd., Chembio Diagnostics, Inc., Fujirebio. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rapid Diagnostics Market Key Technology Landscape

The Rapid Diagnostics Market is characterized by a dynamic and evolving technology landscape, continuously pushing the boundaries of speed, accuracy, and accessibility. Lateral flow immunoassays remain a foundational technology, widely appreciated for their simplicity, low cost, and ability to deliver rapid results for a broad range of analytes, from infectious agents to hormones. Recent advancements in lateral flow aim to enhance sensitivity through signal amplification techniques and enable quantitative analysis, moving beyond simple qualitative detection. These innovations ensure that lateral flow continues to be a cornerstone for point-of-care testing in diverse settings, including resource-limited environments and home diagnostics.

Molecular diagnostics, particularly real-time Polymerase Chain Reaction (RT-PCR) and isothermal amplification methods, represent another critical technology segment. While traditionally lab-based, these nucleic acid amplification techniques are increasingly miniaturized and integrated into rapid, cartridge-based systems for near-patient testing, offering unparalleled sensitivity and specificity for direct pathogen detection. The convergence of microfluidics and biosensor technologies is also transforming the market, allowing for complex multi-analyte detection on compact platforms with minimal sample volumes. These microfluidic devices, often incorporating electrochemical or optical biosensors, enable rapid, automated, and highly parallelized analyses, paving the way for advanced multiplexed rapid tests.

Furthermore, the integration of digital health solutions, artificial intelligence (AI), and smartphone-based platforms is revolutionizing the interpretation and dissemination of rapid diagnostic results. AI algorithms can enhance the objectivity and accuracy of result interpretation, especially for visually ambiguous tests, and facilitate the development of predictive models. Smartphone compatibility allows for easy data capture, geolocation, and seamless integration with electronic health records and telehealth services, thereby expanding the reach and impact of rapid diagnostics, particularly in remote monitoring and public health surveillance. The ongoing development of CRISPR-based diagnostics also holds immense promise for highly specific and rapid nucleic acid detection, potentially offering new avenues for rapid testing against a wider array of targets with unprecedented simplicity.

Regional Highlights

- North America: This region is a dominant force in the Rapid Diagnostics Market, primarily due to its highly advanced healthcare infrastructure, significant investments in research and development, and the swift adoption of innovative diagnostic technologies. A high prevalence of chronic and infectious diseases, coupled with robust government support for diagnostic initiatives and favorable reimbursement policies, further drives market expansion. The presence of numerous key market players and a strong focus on personalized medicine contribute substantially to the region's leading position.

- Europe: Europe holds a substantial share in the global market, characterized by an aging population, increasing awareness regarding early disease diagnosis, and well-established regulatory frameworks. Countries like Germany, the UK, and France are at the forefront of adopting advanced rapid diagnostic solutions, particularly in the areas of infectious disease management and oncology. Government funding for healthcare research and public health programs also plays a crucial role in fostering market growth and technological advancements across the continent.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate during the forecast period, fueled by its large and diverse patient pool, improving healthcare infrastructure, and rising disposable incomes. Emerging economies such as China, India, and Japan are witnessing a surge in demand for affordable and accessible diagnostic solutions, especially for infectious diseases. Increasing government initiatives to enhance public health, coupled with growing medical tourism, are significant drivers for the rapid diagnostics market in this dynamic region.

- Latin America: This region is experiencing steady growth in the rapid diagnostics market, driven by increasing healthcare expenditure, improving access to healthcare services, and a rising prevalence of infectious diseases. Countries like Brazil and Mexico are leading the adoption of rapid diagnostic tests, particularly in public health campaigns and efforts to combat diseases like dengue and Zika. Collaborations between international organizations and local governments are helping to bridge diagnostic gaps and expand market reach.

- Middle East and Africa (MEA): The MEA region presents considerable growth opportunities, largely due to developing healthcare infrastructure, a high burden of infectious diseases (e.g., HIV, malaria, tuberculosis), and increasing awareness about early diagnosis. Investments in modernizing healthcare systems, particularly in countries like Saudi Arabia and UAE, are paving the way for greater adoption of rapid diagnostic technologies. However, challenges such as limited reimbursement policies and fragmented healthcare access in some areas continue to shape the market landscape.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rapid Diagnostics Market.- Abbott Laboratories

- Roche Diagnostics

- Danaher Corporation (Cepheid)

- Siemens Healthineers

- Becton Dickinson and Company (BD)

- Thermo Fisher Scientific, Inc.

- bioMérieux S.A.

- QuidelOrtho Corporation

- Meridian Bioscience

- F. Hoffmann-La Roche Ltd.

- Luminex Corporation (a part of DiaSorin S.p.A.)

- Bio-Rad Laboratories, Inc.

- Hologic, Inc.

- Sekisui Diagnostics

- Trinity Biotech plc

- OraSure Technologies, Inc.

- AccuBioTech Co., Ltd.

- Eiken Chemical Co., Ltd.

- Chembio Diagnostics, Inc.

- Fujirebio

Frequently Asked Questions

What are rapid diagnostics and why are they important?

Rapid diagnostics are medical tests that provide quick results, often within minutes, typically at the point of care or with minimal laboratory processing. They are crucial for timely disease detection, immediate treatment decisions, public health surveillance, and managing infectious disease outbreaks, significantly improving patient outcomes and healthcare efficiency.

What are the primary applications of rapid diagnostic tests?

Rapid diagnostic tests are widely used across various applications, including infectious disease detection (e.g., COVID-19, HIV, influenza, malaria), pregnancy and fertility testing, chronic disease monitoring (e.g., glucose levels), drug abuse screening, and certain cancer markers, enabling quick assessments in diverse clinical and home settings.

How is artificial intelligence impacting the rapid diagnostics market?

AI is significantly impacting rapid diagnostics by enhancing test accuracy through advanced image analysis, accelerating data interpretation, aiding in the discovery of novel biomarkers, and facilitating personalized medicine. It helps streamline workflows, predict disease patterns, and integrate diagnostics with digital health platforms for broader accessibility and efficiency.

What are the key drivers for growth in the rapid diagnostics market?

Key drivers include the rising global prevalence of infectious and chronic diseases, increasing demand for convenient point-of-care testing, continuous technological advancements improving test performance, and growing government and public health initiatives focused on early disease detection and prevention worldwide.

Which regions are leading the adoption of rapid diagnostic solutions?

North America and Europe currently lead the market due to robust healthcare infrastructures and significant R&D investments. However, the Asia Pacific region is rapidly emerging as a high-growth market, driven by large patient populations, improving healthcare access, and increasing awareness about diagnostic testing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager