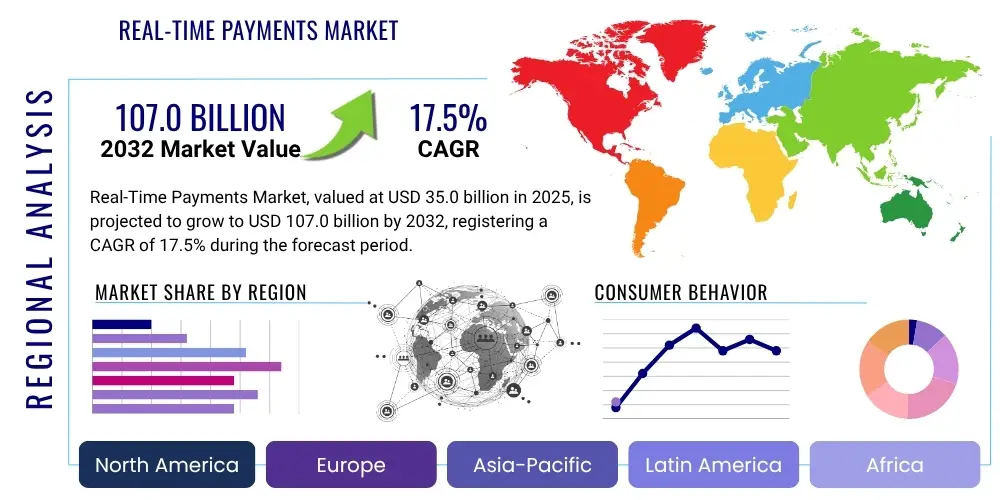

Real-Time Payments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428877 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Real-Time Payments Market Size

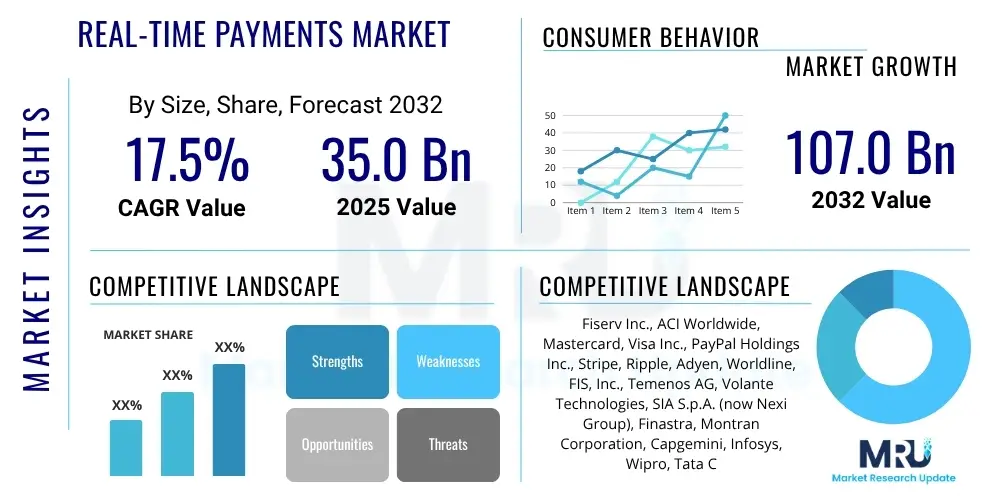

The Real-Time Payments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.5% between 2025 and 2032. The market is estimated at USD 35.0 billion in 2025 and is projected to reach USD 107.0 billion by the end of the forecast period in 2032.

Real-Time Payments Market introduction

The Real-Time Payments (RTP) market represents a transformative shift in global financial transactions, enabling the instantaneous transfer of funds between accounts, typically within seconds. Unlike traditional payment systems that often involve delays due to batch processing or interbank clearing cycles, RTP systems facilitate immediate availability of funds to the recipient. This immediacy extends to confirmation and reconciliation, offering unparalleled speed and transparency across various transaction types. The proliferation of digital technologies and the increasing demand for instant gratification across consumer and business interactions are fundamental drivers for this market’s expansion, redefining expectations for payment efficiency and convenience.

Real-Time Payment products encompass a sophisticated ecosystem of technological solutions and services designed to process transactions with unrivaled speed and finality. These solutions typically involve advanced API integration, cloud-based infrastructure, and robust cybersecurity protocols to ensure secure and seamless operations. Key components include payment gateways for transaction initiation, processing engines for rapid clearing and settlement, fraud detection systems, and compliance modules tailored to meet regulatory requirements. The inherent irrevocability of real-time transactions necessitates stringent security measures and fraud prevention mechanisms, making these technologies critical to the trust and integrity of the system.

The major applications of Real-Time Payments span across diverse sectors, including Person-to-Person (P2P) transfers, Person-to-Business (P2B) payments for retail purchases and bill payments, and increasingly, Business-to-Business (B2B) transactions for supply chain financing and payroll. The benefits are extensive, ranging from improved liquidity management for businesses, enhanced customer satisfaction through instant service delivery, reduced operational costs, and increased financial inclusion for previously underserved populations. Driving factors include the global push for digitalization, the exponential growth of e-commerce, strong regulatory support for modernizing payment infrastructures, and the evolving consumer and business expectation for immediate financial services in an always-on digital economy.

Real-Time Payments Market Executive Summary

The Real-Time Payments market is undergoing robust expansion, driven by global digital transformation initiatives and the pervasive demand for instantaneous financial transactions. This growth is evident across various business segments, with a significant shift from traditional batch processing to real-time settlement capabilities, enhancing operational efficiencies and customer experiences. Business trends indicate a strong focus on API-driven payment solutions, enabling seamless integration into diverse platforms, and fostering innovation in areas such as embedded finance and instant lending. The competitive landscape is intensifying with both established financial institutions and agile fintech companies vying for market share by offering differentiated real-time payment solutions and services.

Regional trends highlight dynamic growth patterns, with Asia Pacific emerging as a powerhouse due to its large, mobile-first population, government-backed initiatives like India's UPI, and rapid e-commerce expansion. North America and Europe continue to mature, propelled by national real-time payment schemes such as FedNow and SEPA Instant Credit Transfer, emphasizing interoperability and broader adoption. Emerging markets in Latin America and the Middle East & Africa are also witnessing significant growth, spurred by financial inclusion efforts and investments in modern payment infrastructure. These regions often leverage real-time payments to leapfrog legacy systems, providing accessible digital financial services to unbanked and underbanked populations.

Segment trends underscore the evolving landscape of real-time payment adoption. While Person-to-Person (P2P) payments remain a foundational component, the Business-to-Business (B2B) segment is experiencing an accelerated uptake, driven by the need for optimized cash flow, supply chain efficiency, and automated reconciliation. The retail and e-commerce sectors are leveraging real-time payments to enhance checkout experiences and facilitate instant refunds, thereby improving customer loyalty. Furthermore, the deployment of real-time payment solutions is increasingly shifting towards cloud-based models, offering greater scalability, flexibility, and cost-effectiveness compared to traditional on-premise deployments, attracting a wider array of businesses, from startups to large enterprises.

AI Impact Analysis on Real-Time Payments Market

User inquiries about AI's impact on Real-Time Payments frequently center on its role in fraud prevention, enhancing operational efficiency, personalizing user experiences, and managing risk. Users are keen to understand how AI algorithms can detect sophisticated fraudulent activities in real-time, given the irreversible nature of these payments. There is also significant interest in AI's potential to automate reconciliation, streamline customer service, and provide predictive analytics for transaction patterns. Concerns often revolve around data privacy, algorithmic bias, and the ethical implications of autonomous decision-making in financial transactions, alongside the challenge of integrating complex AI systems with existing real-time payment infrastructures.

Artificial intelligence is becoming an indispensable tool for fortifying the security and optimizing the operational framework of real-time payment systems. Its capabilities in machine learning and deep learning enable the analysis of vast datasets to identify anomalous transaction behaviors, thereby significantly bolstering fraud detection mechanisms. AI-powered systems can learn from past transaction patterns and user profiles to flag suspicious activities instantaneously, providing a crucial layer of defense against financial crime in a low-latency environment. Beyond security, AI facilitates intelligent routing of payments, optimizes network performance, and automates many back-office operations, contributing to a more resilient and cost-efficient payment ecosystem.

The integration of AI also profoundly influences the customer experience within the real-time payments domain. AI-driven personalization allows financial institutions to offer tailored payment solutions and insights, enhancing engagement and satisfaction. For example, AI can analyze spending habits to suggest optimal payment methods or provide proactive alerts regarding upcoming bill payments. Furthermore, AI-powered chatbots and virtual assistants provide instant support, resolving queries related to real-time transactions around the clock. As the market evolves, AI is expected to drive the development of predictive payment services, intelligent treasury management, and more sophisticated risk assessment models, continuously pushing the boundaries of what is possible in instantaneous financial exchanges.

- Enhanced Fraud Detection and Prevention: AI algorithms analyze transaction data in real-time to identify and flag suspicious activities.

- Improved Risk Assessment: AI models assess transaction risk instantaneously, enabling faster decision-making for high-value payments.

- Personalized User Experience: AI tailors payment recommendations and services based on individual user behavior and preferences.

- Operational Efficiency and Automation: AI automates reconciliation, settlement processes, and customer support, reducing manual effort.

- Predictive Analytics: AI forecasts transaction volumes and liquidity needs, optimizing treasury and network management.

- Cybersecurity Fortification: AI strengthens defenses against evolving cyber threats specific to real-time transaction environments.

- Compliance and Regulatory Adherence: AI assists in monitoring transactions for adherence to AML and KYC regulations in real-time.

DRO & Impact Forces Of Real-Time Payments Market

The Real-Time Payments market is primarily driven by the escalating demand for faster, more transparent, and highly efficient payment solutions across both consumer and business segments. The global surge in e-commerce and digital transactions necessitates immediate fund transfers to facilitate quicker settlement and improve cash flow for online merchants and purchasers alike. Furthermore, supportive government initiatives and regulatory mandates aimed at modernizing national payment infrastructures are compelling financial institutions to adopt and integrate real-time payment capabilities. The inherent benefits of instant payments, such as enhanced liquidity management for businesses, reduced operational costs, and superior customer experiences, collectively act as powerful catalysts for market expansion, pushing financial ecosystems towards an instantaneous future.

Despite its significant growth potential, the Real-Time Payments market faces several notable restraints. Foremost among these are the persistent concerns surrounding security and fraud, particularly given the irreversible nature of real-time transactions. The instantaneous finality of payments leaves little room for error or recall, making robust fraud prevention mechanisms and cybersecurity infrastructure paramount and challenging to implement at scale. Interoperability issues also pose a significant hurdle, as diverse legacy systems and varying standards across different payment networks can impede seamless cross-border or even domestic real-time transfers. Moreover, the substantial upfront capital investment required for implementing or upgrading to real-time payment infrastructure, coupled with the complexity of integrating with existing systems, presents a barrier for many financial institutions, particularly smaller ones.

Opportunities within the Real-Time Payments market are abundant and transformative. The expansion into cross-border real-time payments represents a vast untapped potential, addressing the inefficiencies and high costs associated with traditional international remittances. The integration of emerging technologies like blockchain and distributed ledger technology (DLT) holds promise for enhancing security, transparency, and efficiency in real-time settlement processes. Furthermore, real-time payments offer a crucial pathway to financial inclusion, enabling access to digital financial services for the unbanked and underbanked populations globally. The market is also being shaped by significant impact forces including rapid technological advancements in payment processing, an evolving global regulatory landscape that promotes faster payments, intense competitive pressures among fintechs and traditional banks, and a fundamental shift in consumer and business behavior towards digital and instant financial interactions.

Segmentation Analysis

The Real-Time Payments market is comprehensively segmented to provide a granular understanding of its diverse components, types, deployment models, and end-user applications. This segmentation allows for a detailed analysis of market dynamics, growth drivers, and challenges across various operational and functional dimensions. The intricate interplay between solutions and services, different payment types from peer-to-peer to business-to-government, and the choice between on-premise and cloud deployment significantly influences market strategies and product development. Understanding these distinct segments is crucial for stakeholders to identify lucrative opportunities and tailor offerings to specific market needs, ensuring relevant innovation and strategic positioning within this rapidly evolving financial landscape.

Each segment reveals unique adoption patterns and growth trajectories. The solutions segment, comprising payment gateways, fraud management, and security, is experiencing continuous innovation to address sophisticated threats and optimize transaction flows. Services, including professional and managed services, are essential for seamless implementation and ongoing maintenance of real-time payment systems. The burgeoning B2B payment type is notably gaining traction, signaling a maturity beyond consumer-centric transactions, driven by corporations seeking efficiency and liquidity. Furthermore, the increasing preference for cloud-based deployment models underscores a broader trend towards scalable, agile, and cost-effective infrastructure, enabling financial institutions and businesses of all sizes to participate in the real-time payment revolution without massive upfront hardware investments.

- By Component:

- Solutions

- Payment Gateways

- Payment Processing

- Fraud Management

- Security & Compliance

- Reporting & Analytics

- Services

- Professional Services

- Managed Services

- Solutions

- By Payment Type:

- Person-to-Person (P2P)

- Person-to-Business (P2B)

- Business-to-Business (B2B)

- Government-to-Citizen (G2C)

- Business-to-Government (B2G)

- By Deployment Model:

- On-Premise

- Cloud

- By End-User:

- BFSI (Banking, Financial Services, and Insurance)

- Retail and E-commerce

- IT and Telecom

- Healthcare

- Government

- Media and Entertainment

- Transportation and Logistics

- Others

Value Chain Analysis For Real-Time Payments Market

The value chain for the Real-Time Payments market begins with upstream activities focused on foundational technology and infrastructure. This segment primarily involves core banking software providers, specialized payment technology vendors, cloud service providers, and hardware manufacturers that deliver the essential components for building and maintaining real-time payment systems. These upstream players develop the critical software solutions, APIs, and network infrastructure that enable instant processing, security, and interoperability. Their innovation in areas like distributed ledger technology, artificial intelligence, and advanced encryption directly underpins the capabilities and efficiency of the entire real-time payment ecosystem, providing the fundamental building blocks for instant financial transfers.

Moving downstream, the value chain encompasses the financial institutions and payment service providers (PSPs) who leverage these technologies to offer real-time payment services to end-users. This includes traditional banks, challenger banks, fintech startups, and specialized payment processors. These entities are responsible for integrating the upstream technologies into their existing systems, managing regulatory compliance, ensuring robust fraud detection, and delivering the actual real-time transaction experience to consumers and businesses. Their role involves extensive operational capabilities, customer support, and strategic partnerships to expand the reach and utility of real-time payments across various customer segments and geographies, translating raw technology into tangible financial services.

The distribution channels for Real-Time Payments are multifaceted, incorporating both direct and indirect approaches. Direct channels typically involve banks and PSPs offering real-time payment functionalities directly through their own mobile banking applications, online portals, or API integrations with enterprise resource planning (ERP) systems for corporate clients. Indirect channels involve third-party payment gateways, digital wallets, and other fintech platforms that aggregate various payment options, including real-time capabilities, to offer a streamlined user experience to merchants and consumers. The collaborative nature of this value chain, involving technology providers, financial intermediaries, and various distribution partners, is crucial for fostering a comprehensive, efficient, and widely accessible real-time payment network that benefits all participants in the digital economy.

Real-Time Payments Market Potential Customers

The Real-Time Payments market serves a vast and diverse array of potential customers, ranging from individual consumers to large multinational corporations and governmental bodies. At the individual level, consumers are increasingly seeking immediate gratification and convenience, driving the adoption of Person-to-Person (P2P) payments for splitting bills, transferring funds to family, or making instant purchases. The burgeoning gig economy also heavily relies on real-time payments to ensure freelancers and contractors receive their earnings promptly. This segment values speed, accessibility, and the elimination of delays associated with traditional payment methods, influencing financial service providers to prioritize instant transaction capabilities to retain and attract a digitally-savvy customer base.

For businesses, Real-Time Payments offer transformative benefits across various scales and sectors. Small and medium-sized enterprises (SMEs) are critical end-users, leveraging real-time capabilities for immediate invoice payments, faster supplier settlements, and improved cash flow management, which is vital for their operational agility and financial health. Large enterprises, on the other hand, utilize real-time Business-to-Business (B2B) payments for optimizing supply chain finance, automating payroll, managing liquidity across multiple accounts, and accelerating international trade transactions. Industries such as retail and e-commerce benefit from instant refunds and seamless checkout experiences, while logistics and transportation companies can pay drivers and suppliers instantly, thereby enhancing operational efficiency and fostering stronger partner relationships within their complex networks.

Beyond individual consumers and commercial enterprises, governmental agencies and non-profit organizations represent significant potential customers for Real-Time Payments. Governments can utilize these systems for efficient disbursement of benefits, disaster relief funds, and tax refunds to citizens (G2C), ensuring that aid reaches recipients without delay during critical times. This also improves transparency and reduces administrative overhead. Furthermore, Real-Time Payments facilitate smoother transactions for B2G (Business-to-Government) payments, enabling quicker processing of taxes, fees, and government procurement. The overarching appeal of real-time payments lies in their ability to foster financial inclusion, streamline operations, and provide immediate value, making them indispensable for any entity looking to modernize its financial interactions and enhance stakeholder satisfaction in today's fast-paced digital world.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 35.0 billion |

| Market Forecast in 2032 | USD 107.0 billion |

| Growth Rate | 17.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fiserv Inc., ACI Worldwide, Mastercard, Visa Inc., PayPal Holdings Inc., Stripe, Ripple, Adyen, Worldline, FIS, Inc., Temenos AG, Volante Technologies, SIA S.p.A. (now Nexi Group), Finastra, Montran Corporation, Capgemini, Infosys, Wipro, Tata Consultancy Services, Oracle Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Real-Time Payments Market Key Technology Landscape

The Real-Time Payments market is fundamentally shaped by a sophisticated array of core technologies that ensure the speed, security, and reliability of instant transactions. At its heart lies robust API (Application Programming Interface) integration, which allows disparate financial systems, payment gateways, and applications to communicate seamlessly and initiate real-time transfers. Cloud computing infrastructure provides the necessary scalability, resilience, and agility for handling high volumes of transactions with minimal latency, moving away from traditional on-premise solutions. Advanced cybersecurity protocols, including multi-factor authentication, tokenization, and end-to-end encryption, are paramount to protect sensitive financial data and prevent fraud in an environment where transactions are irreversible. These foundational technologies form the bedrock upon which the entire real-time payment ecosystem operates, enabling instant value exchange with confidence.

Beyond the core infrastructure, emerging technologies are continuously enhancing the capabilities and expanding the potential of real-time payments. Blockchain and Distributed Ledger Technology (DLT) are being explored for their ability to offer enhanced transparency, immutability, and potentially lower costs in cross-border real-time settlements, by reducing reliance on intermediaries. Artificial Intelligence (AI) and Machine Learning (ML) play a critical role in sophisticated fraud detection, real-time risk assessment, and predictive analytics for liquidity management, ensuring system integrity and optimizing operational efficiency. The integration of the Internet of Things (IoT) is also opening new avenues for embedded payments, where devices can autonomously initiate real-time transactions, further automating and streamlining payment processes in various industries from smart homes to connected vehicles, extending the reach of instant payments into everyday objects.

The interoperability and standardization of these technologies across different payment schemes and national borders are crucial for the global expansion of the Real-Time Payments market. Technologies supporting ISO 20022 messaging standards are becoming increasingly important for facilitating richer data exchange and seamless communication between diverse payment systems worldwide. Furthermore, mobile payment platforms and digital wallets are key enablers, leveraging real-time infrastructure to provide user-friendly interfaces for instant transactions on the go. The continuous innovation in these technological domains, from advanced data analytics to cutting-edge security measures and network infrastructure, is not only driving the growth of the real-time payments market but also creating a more interconnected, efficient, and inclusive global financial system that adapts to the demands of the digital age.

Regional Highlights

- North America: This region is a significant market for real-time payments, driven by strong consumer demand for digital convenience and initiatives from financial institutions. The launch of FedNow in the United States has substantially accelerated the adoption and availability of instant payments, complementing existing solutions and fostering greater interoperability. Canada is also progressing with its Real-Time Rail (RTR) project, aiming to modernize its payment infrastructure. North America benefits from a robust technological landscape and a high penetration of digital banking services, making it a fertile ground for the continued growth and innovation in real-time payment solutions across various sectors, particularly P2P and B2B transactions.

- Europe: Europe stands as a pioneering region in real-time payments, primarily propelled by the Single Euro Payments Area (SEPA) Instant Credit Transfer (SCT Inst) scheme. This scheme mandates instantaneous credit transfers across participating European countries, driving widespread adoption and standardization. Regulatory initiatives, combined with a strong focus on open banking and API integrations, are fostering a highly competitive environment for fintechs and traditional banks alike. The region emphasizes cross-border interoperability within the Eurozone, improving efficiency and reducing costs for both businesses and consumers. Emerging trends include the integration of real-time payments with mobile wallets and enhanced fraud prevention technologies to safeguard instant transactions.

- Asia Pacific (APAC): The APAC region is experiencing the most explosive growth in the real-time payments market, largely attributable to its vast, digitally-native population and the rapid expansion of mobile and e-commerce platforms. Countries like India, with its Unified Payments Interface (UPI), and Singapore, with PayNow, have demonstrated immense success in establishing highly efficient and inclusive real-time payment ecosystems. China's dominant mobile payment landscape, though distinct, also exemplifies instant transaction capabilities. The region's growth is further fueled by government initiatives promoting financial inclusion, the proliferation of smartphone usage, and the increasing adoption of digital wallets, making APAC a critical hub for innovation and market expansion in real-time payments.

- Latin America: Latin America is rapidly emerging as a dynamic market for real-time payments, with significant government-led initiatives transforming the financial landscape. Brazil's Pix system is a prime example, achieving remarkable adoption rates and fundamentally altering payment behaviors across the country. Other nations in the region are following suit, recognizing the potential of real-time payments to enhance financial inclusion, reduce transaction costs, and boost economic efficiency. The market is characterized by a strong push for digital transformation, efforts to unbank large populations, and a growing fintech sector that is leveraging real-time capabilities to deliver innovative financial services, thereby addressing long-standing inefficiencies in traditional payment systems.

- Middle East and Africa (MEA): The MEA region presents substantial growth opportunities for real-time payments, driven by robust digital transformation agendas, government visions for smart economies, and efforts to diversify away from traditional revenue streams. Countries in the GCC, such as the UAE and Saudi Arabia, are investing heavily in modernizing their payment infrastructures and launching their own instant payment schemes. In Africa, real-time payment systems are crucial for bridging the financial inclusion gap, enabling efficient remittances, and supporting the burgeoning mobile money ecosystem. The region's young, tech-savvy population and increasing smartphone penetration are key factors accelerating the adoption of real-time payment solutions, with significant potential for P2P and cross-border payment innovations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager

Our Clients

About us

Market Research Update is market research company that perform demand of large corporations, research agencies, and others. We offer several services that are designed mostly for Healthcare, IT, and CMFE domains, a key contribution of which is customer experience research. We also customized research reports, syndicated research reports, and consulting services.

Usefull Links

Contact Us

Market Research UpdateIndia : Office no - 406, 4th floor, Suratwala Mark Plazzo, Hinjewadi, Pune 411057

Japan: 16-8, Higashi 1-chome, Shibuya-ku, Tokyo 150-0011, Japan

(UK) +1-252-552-1404

sales@marketresearchupdate.com

SUBSCRIBE

Get the latest news and insights from MRU delivered to your inbox

Trust Online