Recreational and Outdoor Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429851 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Recreational and Outdoor Products Market Size

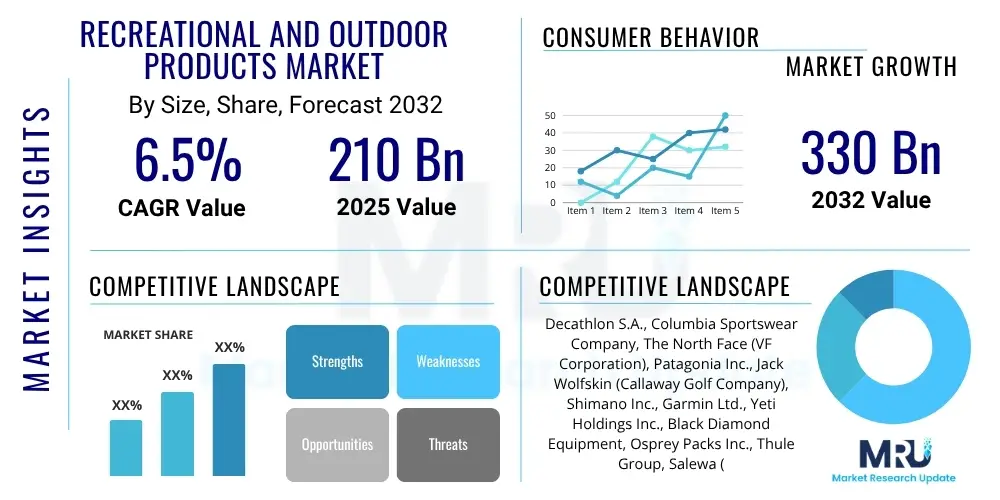

The Recreational and Outdoor Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 210 Billion in 2025 and is projected to reach USD 330 Billion by the end of the forecast period in 2032.

Recreational and Outdoor Products Market introduction

The Recreational and Outdoor Products Market encompasses a vast array of goods and services designed to support leisure activities undertaken outdoors. This dynamic market is characterized by a growing global interest in adventure sports, nature exploration, and general outdoor pursuits. Products range from essential camping gear and hiking equipment to specialized items for water sports, winter sports, and cycling, catering to both casual enthusiasts and professional athletes. The market's growth is inherently linked to evolving consumer lifestyles that increasingly prioritize health, wellness, and experiential spending over material possessions, fostering a deeper connection with natural environments and active living.

The primary applications of these products span personal recreation, professional sports, tourism, and educational programs focusing on outdoor skills. Benefits derived from engaging with recreational and outdoor products are extensive, including improved physical fitness, enhanced mental well-being, stress reduction, and opportunities for social interaction and skill development. These activities also encourage environmental awareness and appreciation. The driving factors behind the market's expansion are multifaceted, including rising disposable incomes in developing economies, increased leisure time in many industrialized nations, and a heightened global awareness of the health advantages associated with outdoor physical activity. Technological advancements also play a crucial role, introducing lighter, more durable, and smarter equipment that enhances user experience and safety.

Furthermore, urbanization trends, while seemingly contradictory, paradoxically fuel the desire for escapes into nature, prompting demand for accessible and convenient outdoor solutions. The digital revolution has also transformed how consumers discover, purchase, and experience outdoor products, with online platforms and social media serving as vital channels for information, community building, and sales. The market's diverse offerings mean it appeals to a broad demographic, from families seeking weekend excursions to extreme adventurers pushing personal limits, ensuring sustained demand across various segments.

Recreational and Outdoor Products Market Executive Summary

The Recreational and Outdoor Products Market is experiencing robust growth, driven by shifting consumer preferences towards active and experience-based lifestyles. Current business trends highlight a significant emphasis on sustainability, with brands increasingly focusing on eco-friendly materials, ethical manufacturing processes, and circular economy initiatives. The rise of e-commerce platforms continues to revolutionize distribution, making a wider range of products accessible globally and allowing niche brands to thrive. Personalization and customization are also emerging as key differentiators, as consumers seek products tailored to their specific needs and aesthetic preferences. Moreover, there is a strong trend towards product innovation, integrating smart technologies and advanced materials to enhance performance, safety, and user comfort.

Regionally, North America and Europe remain dominant markets, characterized by high consumer spending power, established outdoor cultures, and well-developed infrastructure for outdoor activities. However, the Asia Pacific region is rapidly emerging as a significant growth engine, fueled by increasing disposable incomes, a growing middle class, and rising awareness of health and fitness. Countries like China and India are witnessing a surge in participation in outdoor activities, leading to substantial market expansion. Latin America and the Middle East and Africa also present nascent but promising opportunities, as outdoor tourism develops and recreational infrastructure improves, attracting both domestic and international enthusiasts.

Segment-wise, the camping and hiking equipment segment continues to be a cornerstone of the market, benefiting from its broad appeal and accessibility. Water sports equipment, including kayaking, paddleboarding, and surfing gear, is experiencing accelerated growth due to increased interest in aquatic recreation and wellness. Winter sports equipment also maintains a steady demand, especially with innovations in gear design and expansion of ski resorts globally. The market is also seeing a diversification of demand within segments, with a notable uptick in specialized gear for niche activities such as bikepacking, trail running, and bouldering, indicating a maturing and fragmenting consumer base that values specific, high-performance equipment over general-purpose items. This intricate interplay of trends across business, regional, and segment levels defines the competitive landscape and future trajectory of the recreational and outdoor products industry.

AI Impact Analysis on Recreational and Outdoor Products Market

User inquiries concerning the impact of Artificial Intelligence on the Recreational and Outdoor Products Market frequently revolve around how AI can enhance product functionality, personalize consumer experiences, optimize supply chains, and improve safety. Users are keen to understand how smart technologies will integrate into outdoor gear, offering benefits from predictive analytics for weather and terrain to personalized training insights and automated safety features. There is also significant interest in AI's role in sustainable manufacturing and waste reduction, as well as its application in virtual try-ons and immersive retail experiences. Overall, the consensus points to AI as a transformative force, capable of making outdoor activities more accessible, safer, more efficient, and deeply personalized for individuals while simultaneously improving operational aspects for businesses.

- Smart Product Development: AI-powered design tools for optimizing gear ergonomics, material use, and performance, leading to lighter, stronger, and more efficient products.

- Personalized Consumer Experience: AI algorithms analyze user data to provide tailored product recommendations, customized adventure itineraries, and personalized training plans.

- Predictive Analytics for Safety: AI models process environmental data, biometric feedback, and user behavior to offer real-time risk assessments and preventative safety alerts during outdoor activities.

- Supply Chain Optimization: AI enhances inventory management, demand forecasting, and logistics, reducing waste, improving efficiency, and ensuring timely product availability.

- Enhanced Retail and Marketing: AI-driven chatbots, virtual assistants, and augmented reality (AR) try-on experiences improve online shopping, customer service, and targeted marketing campaigns.

- Sustainability and Resource Management: AI aids in identifying sustainable material sourcing, optimizing manufacturing processes to minimize waste, and tracking product lifecycle for recycling and reuse.

DRO & Impact Forces Of Recreational and Outdoor Products Market

The Recreational and Outdoor Products Market is significantly shaped by a confluence of drivers, restraints, opportunities, and inherent impact forces. Key drivers propelling market growth include a global surge in health and wellness consciousness, leading more individuals to embrace outdoor physical activities. Rising disposable incomes, particularly in emerging economies, enable consumers to invest in higher-quality gear and more adventurous experiences. Furthermore, increased urbanization often creates a stronger desire for natural escapes, boosting participation in hiking, camping, and other outdoor pursuits. Technological advancements also act as a strong driver, introducing innovative materials and smart features that enhance product performance, safety, and user experience, making outdoor activities more appealing and accessible to a wider demographic.

Despite robust growth, the market faces several restraints. The highly seasonal nature of many outdoor activities leads to fluctuating demand patterns, posing challenges for inventory management and production planning. Environmental concerns, such as the impact of manufacturing on natural resources and the footprint of outdoor tourism, can also constrain market expansion as consumers and regulators increasingly demand sustainable practices. High initial costs of specialized equipment can deter new entrants or casual participants, limiting market penetration in certain segments. Additionally, global economic uncertainties and geopolitical instability can significantly impact consumer discretionary spending, directly affecting sales of recreational products. Regulatory hurdles related to environmental protection, product safety standards, and land use for outdoor activities also present complex challenges for manufacturers and service providers.

Opportunities for growth are abundant within the market. The expansion of ecotourism and adventure tourism globally opens new avenues for specialized gear and services, attracting both domestic and international travelers. The integration of smart technology into outdoor equipment, ranging from GPS-enabled devices to wearable fitness trackers, presents significant innovation potential, appealing to tech-savvy consumers. Emerging markets in Asia Pacific, Latin America, and Africa offer untapped consumer bases with rapidly increasing purchasing power and a growing interest in outdoor lifestyles. Moreover, the increasing adoption of digital platforms for product sales, rental services, and community building provides brands with direct access to consumers, fostering loyalty and facilitating market reach. The growing emphasis on sustainable and ethically produced goods also represents a substantial opportunity for brands that prioritize environmental responsibility, attracting a discerning consumer base.

Segmentation Analysis

The Recreational and Outdoor Products Market is broadly segmented based on product type, distribution channel, and end-user, each offering distinct insights into market dynamics and consumer behavior. Product segmentation categorizes the diverse range of equipment and apparel available, from essentials for camping and hiking to specialized gear for extreme sports. This categorization helps manufacturers tailor their offerings and marketing strategies to specific activity niches, addressing the varied needs and preferences of outdoor enthusiasts. The ongoing innovation in materials science and electronics continues to diversify these product categories, offering lighter, more durable, and technologically advanced options across the board. Understanding these segments is crucial for identifying market gaps and emerging trends, enabling businesses to strategically position themselves.

Distribution channels delineate how these products reach the end consumer, reflecting the evolving retail landscape. Traditional brick-and-mortar stores, including specialty outdoor retailers, hypermarkets, and department stores, continue to play a vital role, offering hands-on product experience and expert advice. However, the rapid expansion of online retail platforms, including brand-specific websites and large e-commerce marketplaces, has dramatically increased accessibility and convenience, especially for consumers in remote areas or those seeking specific niche products. Direct-to-consumer (DTC) models are also gaining traction, allowing brands to build stronger relationships with their customers and control the entire purchasing journey. The choice of distribution channel often depends on the product's complexity, price point, and the target audience's shopping habits, requiring a multi-channel approach for optimal market penetration.

End-user segmentation differentiates between various consumer groups, such as individual enthusiasts, families, and commercial entities like tour operators or rental services. Individual consumers form the largest segment, driven by personal interests in health, adventure, and leisure. Families represent a growing segment, seeking durable and safe products for group activities and educational experiences. Commercial end-users, while smaller in number, often purchase in bulk and require high-durability, professional-grade equipment for their operations, such as guided tours, outdoor education programs, or rental fleets. Analyzing these end-user profiles allows for targeted product development and marketing efforts, ensuring that specific demographic and commercial needs are met with appropriate product lines and service offerings.

- By Product Type:

- Camping and Hiking Equipment (Tents, Sleeping Bags, Backpacks, Cookware, Navigation Devices)

- Cycling Equipment (Bicycles, Helmets, Apparel, Accessories)

- Water Sports Equipment (Kayaks, Canoes, Paddleboards, Surfboards, Diving Gear, Wetsuits)

- Winter Sports Equipment (Skis, Snowboards, Boots, Bindings, Apparel, Protective Gear)

- Climbing and Mountaineering Gear (Ropes, Harnesses, Helmets, Carabiners, Ice Axes)

- Apparel and Footwear (Outerwear, Base Layers, Hiking Boots, Trail Running Shoes)

- Fitness and Activity Trackers (GPS Watches, Heart Rate Monitors)

- Other Recreational Products (Hunting and Fishing Gear, Outdoor Furniture, Portable Grills)

- By Distribution Channel:

- Online Retail (E-commerce Websites, Brand Stores)

- Specialty Stores (Dedicated Outdoor Retailers, Sports Goods Stores)

- Hypermarkets and Supermarkets

- Department Stores

- Direct to Consumer (DTC)

- By End-User:

- Individual

- Commercial (Tour Operators, Rental Services, Educational Institutions)

- Family

Value Chain Analysis For Recreational and Outdoor Products Market

The value chain for the Recreational and Outdoor Products Market begins with the upstream activities involving raw material sourcing and component manufacturing. This stage is critical, as the performance, durability, and sustainability of outdoor products heavily depend on the quality of materials used, such as specialized fabrics, lightweight metals, durable plastics, and advanced composites. Suppliers in this segment often focus on innovation to provide materials with enhanced properties like waterproofing, breathability, insulation, and strength-to-weight ratios. Ethical sourcing and environmental certifications are increasingly important, reflecting growing consumer and regulatory demands for sustainable practices. The efficiency and reliability of these upstream partners directly impact the final product's quality and cost-effectiveness, setting the foundation for the entire value chain.

Following the manufacturing and assembly of products, the value chain progresses to distribution channels, which bridge the gap between producers and end-users. This midstream segment includes warehousing, logistics, and inventory management. The distribution network can be quite complex, involving multiple layers of wholesalers, distributors, and agents, especially for international markets. The choice of distribution strategy depends on factors like market reach, brand positioning, and logistical capabilities. Increasingly, brands are exploring hybrid models that combine traditional wholesale with direct-to-consumer (DTC) approaches, aiming to optimize efficiency and customer engagement. Effective distribution ensures that products are available in the right quantities, at the right time, and in the right locations, minimizing stockouts and maximizing sales opportunities across various retail formats.

The downstream activities primarily involve retail and after-sales services, which are crucial for customer satisfaction and brand loyalty. Retail distribution encompasses a diverse landscape including specialty outdoor stores, large sporting goods chains, hypermarkets, department stores, and, most significantly, online retail platforms. Online channels, including brand-specific e-commerce sites and major marketplaces, have expanded consumer access and convenience, driving significant sales growth. Direct and indirect distribution strategies coexist; direct channels involve brands selling directly to consumers, fostering deeper relationships and often better profit margins, while indirect channels leverage third-party retailers for broader market penetration. Post-purchase services, such as warranties, repairs, and customer support, further enhance brand reputation and contribute to long-term customer relationships, completing the entire value chain cycle.

Recreational and Outdoor Products Market Potential Customers

The Recreational and Outdoor Products Market caters to a diverse range of potential customers, each with unique motivations, preferences, and purchasing behaviors. At its core, the market serves individual adventure enthusiasts and casual outdoor goers who seek products for personal enjoyment, health benefits, and stress relief. This broad category includes hikers, campers, cyclists, climbers, paddlers, and skiers, ranging from beginners exploring local parks to experienced adventurers undertaking multi-day expeditions. These individuals often prioritize performance, durability, comfort, and increasingly, the sustainability credentials of the products they choose. They are influenced by peer recommendations, expert reviews, and content from outdoor influencers, frequently engaging with brands through social media and specialized online communities.

Another significant segment comprises families looking for equipment suitable for group activities and creating shared outdoor experiences. This demographic often emphasizes safety, ease of use, versatility, and value for money, as they typically purchase multiple items for different family members. Their purchasing decisions are often driven by convenience and the desire to introduce children to outdoor recreation, fostering a love for nature and active lifestyles from a young age. Brands targeting families often focus on multi-functional products, comprehensive kits, and solutions that simplify planning and execution of outdoor trips, alongside emphasizing family-friendly features and durability to withstand varied use.

Beyond individual and family consumers, a substantial portion of the market serves commercial entities. This includes tour operators, adventure travel companies, outdoor education programs, summer camps, and rental services that require durable, professional-grade equipment in bulk. These businesses prioritize reliability, safety certifications, ease of maintenance, and the ability of products to withstand rigorous use across diverse environments. Their purchasing decisions are driven by operational efficiency, compliance with safety regulations, and the need to provide high-quality experiences to their clients. Additionally, governmental agencies, search and rescue teams, and military organizations also represent potential customers for specialized, high-performance outdoor gear, requiring products that meet stringent specifications for extreme conditions and critical missions, forming a niche but high-value segment within the broader market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 210 Billion |

| Market Forecast in 2032 | USD 330 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Decathlon S.A., Columbia Sportswear Company, The North Face (VF Corporation), Patagonia Inc., Jack Wolfskin (Callaway Golf Company), Shimano Inc., Garmin Ltd., Yeti Holdings Inc., Black Diamond Equipment, Osprey Packs Inc., Thule Group, Salewa (Oberalp AG), Arc'teryx (Amer Sports Corporation), Mammut Sports Group AG, Merrell (Wolverine World Wide Inc.), REI Co-op, Keen Footwear, Coleman (The Coleman Company Inc.), O'Neill Wetsuits, Under Armour Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recreational and Outdoor Products Market Key Technology Landscape

The Recreational and Outdoor Products Market is consistently evolving through the integration of cutting-edge technologies, significantly enhancing product functionality, durability, and user experience. A primary area of innovation lies in advanced materials science, with the development of lighter, stronger, and more sustainable fabrics and composites. This includes high-performance synthetic insulation, waterproof-breathable membranes, recycled and bio-based textiles, and ultra-lightweight alloys. These materials not only improve the performance of gear, making it more resilient to extreme conditions and comfortable for prolonged use, but also address growing consumer demand for environmentally responsible products. The ongoing research in nanotechnology and smart textiles promises further advancements, offering materials with integrated sensors, self-cleaning properties, and adaptive thermal regulation, pushing the boundaries of what outdoor gear can achieve.

The proliferation of smart electronics and connectivity has profoundly impacted product development within this market. GPS and GNSS technologies are now standard in navigation devices, fitness trackers, and even integrated into apparel, offering precise location tracking and performance monitoring. Wearable technology, equipped with biometric sensors, provides real-time data on heart rate, elevation, speed, and other crucial metrics, empowering users to optimize their activities and enhance safety. Furthermore, the integration of Bluetooth and Wi-Fi allows for seamless connectivity between devices, enabling data sharing, remote control, and integration with smartphone applications. This technological convergence not only enriches the outdoor experience but also offers valuable data for product improvement and personalized user insights, creating a more interconnected and responsive ecosystem for outdoor enthusiasts.

Manufacturing techniques are also undergoing a significant transformation, with automation, 3D printing, and advanced data analytics playing pivotal roles. Additive manufacturing, or 3D printing, enables the creation of customized, complex, and lightweight components, allowing for rapid prototyping and mass customization of products like shoe soles, helmet inserts, and specialized equipment parts. Robotics and automation in production lines improve efficiency, reduce labor costs, and enhance precision in manufacturing, leading to higher quality and more consistent products. Concurrently, big data analytics and artificial intelligence are being employed throughout the product lifecycle, from predicting consumer trends and optimizing inventory to identifying design flaws and personalizing marketing campaigns. These technological advancements collectively contribute to a more dynamic, efficient, and responsive market that is better equipped to meet the diverse and evolving needs of outdoor consumers.

Regional Highlights

- North America: A mature and dominant market characterized by high consumer spending on outdoor recreation, a deeply ingrained outdoor culture, and well-developed infrastructure for activities like hiking, camping, skiing, and water sports. The United States and Canada lead in innovation and product adoption, with significant growth in adventure tourism and sustainable outdoor practices.

- Europe: A diverse market with strong regional preferences for various outdoor activities, from alpine sports in the Alps to water sports along the Mediterranean. Countries like Germany, France, and the UK are major contributors, with a strong emphasis on sustainability, quality craftsmanship, and brand heritage. Ecotourism and outdoor wellness retreats are particularly popular.

- Asia Pacific (APAC): The fastest-growing region, fueled by rising disposable incomes, urbanization, and a burgeoning middle class in countries such as China, India, Japan, and Australia. There is increasing participation in outdoor activities, alongside a growing demand for both premium and affordable gear. The region presents significant opportunities for market expansion and new product introductions.

- Latin America: An emerging market with considerable potential, driven by rich natural landscapes conducive to adventure tourism and a growing interest in outdoor activities among younger populations. Brazil, Mexico, and Argentina are key markets, with increasing investment in recreational infrastructure and a rising awareness of health and fitness driving demand for outdoor products.

- Middle East and Africa (MEA): A developing market with nascent but growing interest in outdoor recreation, particularly in countries with diverse landscapes suitable for desert safaris, hiking, and watersports. Investment in tourism infrastructure and diversification of leisure activities are key growth factors, though market penetration for specialized products remains relatively low compared to other regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recreational and Outdoor Products Market.- Decathlon S.A.

- Columbia Sportswear Company

- The North Face (VF Corporation)

- Patagonia Inc.

- Jack Wolfskin (Callaway Golf Company)

- Shimano Inc.

- Garmin Ltd.

- Yeti Holdings Inc.

- Black Diamond Equipment

- Osprey Packs Inc.

- Thule Group

- Salewa (Oberalp AG)

- Arc'teryx (Amer Sports Corporation)

- Mammut Sports Group AG

- Merrell (Wolverine World Wide Inc.)

- REI Co-op

- Keen Footwear

- Coleman (The Coleman Company Inc.)

- O'Neill Wetsuits

- Under Armour Inc.

Frequently Asked Questions

What are the primary growth drivers for the Recreational and Outdoor Products Market?

The market's growth is primarily driven by increasing health and wellness consciousness, rising disposable incomes, urbanization leading to a desire for nature escapes, and continuous technological advancements enhancing product performance and user experience.

How is technology influencing product development in outdoor gear?

Technology is crucial, leading to innovations in advanced materials for durability and lightweight design, smart electronics for navigation and performance tracking, and manufacturing techniques like 3D printing for customization and efficiency. AI also plays a role in personalized recommendations and supply chain optimization.

What are the key challenges facing the Recreational and Outdoor Products Market?

Key challenges include the seasonal nature of many outdoor activities, the high initial cost of specialized equipment, increasing environmental concerns regarding sustainability, and potential impacts from global economic uncertainties affecting consumer discretionary spending.

Which regions offer the most significant growth opportunities for outdoor products?

The Asia Pacific region, particularly countries like China and India, offers the most significant growth opportunities due to rapidly increasing disposable incomes, a burgeoning middle class, and a growing interest in outdoor recreation and health awareness.

How important is sustainability in the Recreational and Outdoor Products Market?

Sustainability is critically important, influencing consumer purchasing decisions, driving product innovation towards eco-friendly materials and ethical manufacturing, and shaping brand strategies to reduce environmental impact across the entire value chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager