RegTech Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428649 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

RegTech Market Size

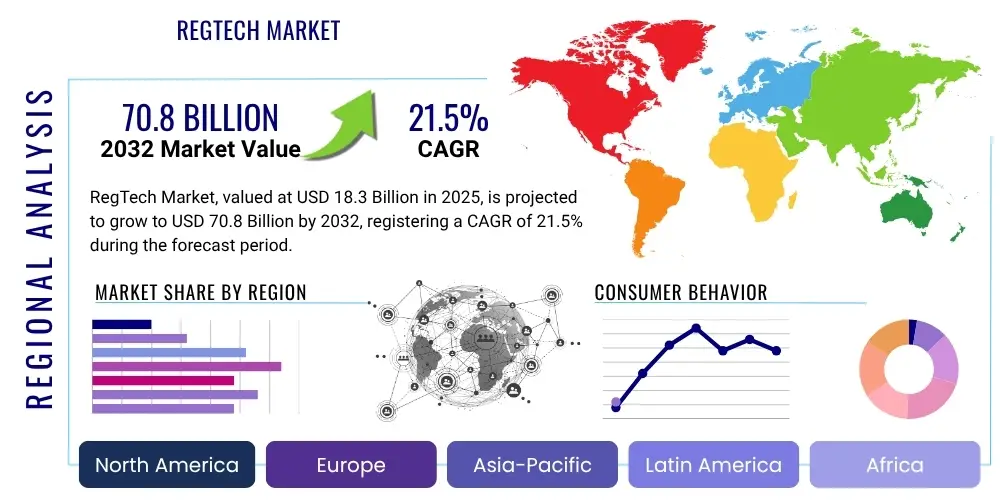

The RegTech Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2025 and 2032. The market is estimated at USD 18.3 Billion in 2025 and is projected to reach USD 70.8 Billion by the end of the forecast period in 2032.

RegTech Market introduction

The RegTech market encompasses a dynamic suite of technological solutions designed to help businesses, primarily within the financial sector, comply with regulatory requirements more efficiently and cost-effectively. RegTech products leverage advanced technologies such as artificial intelligence, machine learning, big data analytics, and blockchain to automate and streamline compliance processes, risk management, and regulatory reporting. These solutions serve a critical function in an increasingly complex and stringent regulatory landscape, offering advantages such as reduced operational costs, enhanced accuracy, real-time monitoring capabilities, and a significant decrease in human error across various regulatory frameworks.

Major applications of RegTech solutions span a wide array of compliance areas, including Anti-Money Laundering (AML), Know Your Customer (KYC), transaction monitoring, regulatory reporting, and risk assessment. The adoption of RegTech is primarily driven by the escalating volume and complexity of global regulations, the rising cost of traditional compliance methods, and the imperative for financial institutions to prevent financial crime and maintain market integrity. Furthermore, the digital transformation sweeping across industries, coupled with the rapid growth of FinTech companies, necessitates robust and agile regulatory technology to ensure adherence to evolving standards while fostering innovation.

The benefits of RegTech are multifaceted, extending beyond mere compliance to strategic business advantages. By automating tedious and repetitive tasks, RegTech solutions free up valuable human resources, allowing them to focus on more complex, strategic issues. They provide actionable insights through advanced data analytics, enabling proactive risk management and informed decision-making. These technologies not only mitigate financial and reputational risks associated with non-compliance but also foster greater transparency and trust with regulators and customers, positioning firms for sustainable growth in a highly regulated environment.

RegTech Market Executive Summary

The RegTech market is experiencing robust expansion, primarily driven by a global surge in regulatory complexity and the imperative for operational efficiency within highly regulated industries, especially financial services. Key business trends indicate a significant shift towards cloud-based RegTech solutions, offering enhanced scalability and accessibility, alongside a growing emphasis on integrating artificial intelligence and machine learning for predictive compliance and automated risk assessment. Strategic partnerships between established financial institutions and agile RegTech startups are becoming increasingly common, fostering innovation and accelerating market adoption of advanced compliance tools. This collaborative environment is fueling the development of more sophisticated, data-driven platforms capable of handling vast amounts of regulatory data with precision and speed, thereby transforming traditional compliance approaches.

Regionally, North America and Europe continue to dominate the RegTech market, largely due to well-established regulatory frameworks, significant investment in technological infrastructure, and a proactive approach to financial crime prevention. However, the Asia Pacific (APAC) region is emerging as a critical growth hub, propelled by rapid digital transformation, expanding financial services sectors, and evolving regulatory landscapes in countries such as China, India, and Singapore. Latin America, the Middle East, and Africa are also demonstrating increasing interest and adoption, albeit from a lower base, as these regions modernize their financial ecosystems and address unique local compliance challenges, often leapfrogging older technologies directly to cloud-native RegTech solutions.

Segmentation trends highlight the continued dominance of the software and solutions segment, which includes core RegTech platforms for AML, KYC, and regulatory reporting, reflecting the demand for comprehensive, integrated systems. Services, encompassing consulting, integration, and ongoing support, are also experiencing substantial growth as organizations seek expert guidance in navigating complex implementations and optimizing their RegTech investments. Within end-user segments, banks and financial institutions remain the largest adopters, driven by stringent capital requirements and anti-financial crime regulations. However, there is an expanding uptake among FinTech companies, insurance providers, and other non-financial entities grappling with industry-specific regulatory burdens, signaling a broader market applicability for RegTech innovations beyond its traditional confines.

AI Impact Analysis on RegTech Market

Users frequently inquire about how AI can enhance the accuracy and efficiency of compliance, the specific applications of AI in regulatory reporting, and the potential risks or ethical considerations associated with AI's deployment in RegTech. There is a strong expectation that AI will automate mundane tasks, reduce the burden on human analysts, and provide predictive insights into emerging regulatory changes. Concerns often revolve around data privacy, the transparency of AI decision-making (explainable AI), and the potential for algorithmic bias, alongside questions about the future role of human expertise in a largely AI-driven compliance environment. Overall, the sentiment is one of cautious optimism, recognizing AI's transformative potential while acknowledging the need for robust governance and oversight.

- Automated Regulatory Reporting: AI streamlines the aggregation and submission of regulatory data, reducing manual effort and errors.

- Enhanced Anti-Money Laundering (AML) and Fraud Detection: AI algorithms analyze vast transaction data to identify suspicious patterns more effectively than traditional rule-based systems.

- Improved Know Your Customer (KYC) Processes: AI-powered identity verification and customer onboarding reduce processing times and enhance accuracy.

- Predictive Compliance: AI models anticipate future regulatory changes and potential compliance breaches, enabling proactive adjustments.

- Natural Language Processing (NLP) for Regulatory Intelligence: AI analyzes complex legal texts to extract key requirements and monitor updates, simplifying regulatory interpretation.

- Risk Assessment and Management: AI provides real-time risk scoring and scenario analysis, offering deeper insights into operational and financial risks.

- Reduced Operational Costs: Automation of compliance tasks leads to significant cost savings for financial institutions.

- Increased Efficiency and Speed: AI processes information much faster than human analysts, accelerating compliance workflows.

DRO & Impact Forces Of RegTech Market

The RegTech market is powerfully shaped by a confluence of drivers, restraints, and opportunities. The primary drivers include the escalating complexity and volume of global regulations, compelling organizations to seek automated and sophisticated compliance solutions. This is further amplified by the continuous digital transformation of financial services, which demands real-time compliance capabilities and robust data management. The inherent need for cost optimization in traditional compliance departments also acts as a significant impetus, as RegTech offers a pathway to reduce operational expenses and improve efficiency, thereby generating substantial interest and investment across the industry. The collective impact of these forces is pushing institutions towards rapid adoption of new regulatory technologies to maintain competitiveness and avoid severe penalties.

However, the market's growth trajectory is not without its impediments. Significant restraints include the high initial implementation costs associated with deploying advanced RegTech solutions, which can be a barrier for smaller institutions or those with limited IT budgets. Data privacy concerns and cybersecurity risks remain paramount, as RegTech solutions often handle sensitive customer and organizational data, necessitating stringent security protocols. Furthermore, the integration challenges with legacy IT systems, which are prevalent in many established financial institutions, can complicate and delay the adoption process. A notable restraint also arises from the scarcity of skilled personnel capable of developing, implementing, and managing sophisticated RegTech platforms, creating a talent gap that requires continuous investment in training and recruitment.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The continuous emergence of new technologies such as blockchain for immutable records and secure data sharing, alongside advancements in AI and machine learning, presents fertile ground for developing novel and more effective RegTech applications. There is also a growing opportunity to expand RegTech solutions beyond the traditional financial services sector into other highly regulated industries like healthcare, pharmaceuticals, and manufacturing. Global efforts towards regulatory harmonization, while slow, could eventually streamline cross-border compliance, creating larger addressable markets. The increasing demand for proactive rather than reactive risk management strategies further opens avenues for RegTech providers to offer predictive analytics and foresight capabilities, distinguishing themselves in a competitive landscape.

Segmentation Analysis

The RegTech market is comprehensively segmented to provide a detailed understanding of its diverse offerings and target audiences. This segmentation allows for precise market analysis based on various operational and technological dimensions, reflecting the varied needs of end-users across different industries and organizational scales. Key dimensions include the components of the solutions, their deployment models, the specific applications they address, the size of the organizations adopting them, and the ultimate end-user industries they serve, each contributing to a nuanced view of market dynamics and growth patterns.

- By Component:

- Solutions/Software

- Services

- Consulting Services

- Integration Services

- Support and Maintenance Services

- By Deployment Model:

- Cloud-Based

- On-Premise

- By Application:

- Anti-Money Laundering (AML)

- Know Your Customer (KYC)

- Regulatory Reporting

- Risk and Compliance Management

- Fraud Detection

- Transaction Monitoring

- Identity Management

- Trade Surveillance

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By End-User:

- Banks and Financial Institutions

- FinTech Companies

- Insurance Companies

- Investment Firms

- Government and Regulatory Bodies

- Non-Financial Industries (e.g., Healthcare, Energy)

- Wealth Management Firms

Value Chain Analysis For RegTech Market

The RegTech market's value chain commences with upstream activities centered around the foundational technologies and data sources critical for building effective compliance solutions. This segment primarily involves technology providers specializing in AI, machine learning, big data analytics, cloud infrastructure, and blockchain, which supply the core components and algorithms. It also includes data providers who offer vast repositories of financial, market, and identity data, essential for robust risk assessment and regulatory adherence. Research and development further upstream play a vital role in innovating new algorithms and platforms that can address emerging regulatory challenges and improve compliance efficiency. These upstream elements form the bedrock upon which all subsequent RegTech solutions are constructed, emphasizing the critical importance of technological prowess and data access.

Moving downstream, the value chain progresses through the development, integration, and deployment of RegTech solutions to various end-users. This involves solution developers who design and build specific RegTech platforms tailored for AML, KYC, regulatory reporting, and risk management. System integrators play a crucial role in customizing these solutions and ensuring seamless integration with existing legacy IT infrastructures of financial institutions and other regulated entities. Post-implementation, ongoing support and maintenance services are provided to ensure optimal performance, regular updates in response to regulatory changes, and continuous technical assistance, which are critical for the long-term efficacy of RegTech deployments.

The distribution channels for RegTech solutions are multifaceted, incorporating both direct and indirect models. Direct distribution typically involves RegTech vendors engaging directly with large enterprises and financial institutions through their sales teams, offering tailored solutions and professional services. This approach allows for deep understanding of client-specific needs and fosters strong, long-term relationships. Indirect distribution, conversely, leverages partnerships with consulting firms, system integrators, and value-added resellers (VARs) who have established client bases and expertise in specific industry verticals. These partners often facilitate broader market reach, particularly for SMEs, and provide localized support and integration services. The choice of channel often depends on the vendor's strategy, target market, and the complexity of the solution being offered, balancing control with market penetration.

RegTech Market Potential Customers

The RegTech market serves a broad and diverse range of potential customers, primarily concentrated within the financial services sector but rapidly expanding into other highly regulated industries. The core end-users include traditional banks, credit unions, and other depository institutions, which face immense pressure from regulatory bodies to comply with ever-evolving mandates concerning financial crime, capital adequacy, and consumer protection. These institutions are major buyers of solutions for Anti-Money Laundering (AML), Know Your Customer (KYC), regulatory reporting, and risk management to mitigate hefty fines and reputational damage. The complex web of global and local regulations necessitates robust technological support for their extensive operations and diverse customer bases.

Beyond traditional banking, the market extends to FinTech companies, insurance firms, and investment and wealth management firms. FinTechs, despite their innovative nature, must adhere to strict regulations, often at speed, making RegTech solutions indispensable for their agile business models and rapid customer acquisition. Insurance companies require RegTech for fraud detection, claims processing compliance, and customer data privacy. Investment and wealth management firms utilize these technologies for trade surveillance, portfolio compliance, and managing client suitability rules. These segments seek solutions that offer both compliance assurance and competitive advantage by streamlining operations and reducing manual oversight.

Furthermore, government and regulatory bodies themselves are increasingly adopting RegTech solutions to enhance their oversight capabilities, streamline supervisory processes, and improve data collection and analysis. Non-financial industries, such as healthcare, energy, telecommunications, and manufacturing, are also emerging as significant potential customers as they grapple with industry-specific regulations related to data privacy (e.g., GDPR, CCPA), environmental compliance, and supply chain transparency. Any organization dealing with sensitive data, cross-border operations, or stringent industry standards represents a viable market for RegTech, highlighting the pervasive need for automated, intelligent compliance and risk management tools across the global economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 18.3 Billion |

| Market Forecast in 2032 | USD 70.8 Billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Thomson Reuters, NICE Actimize, FICO, ComplyAdvantage, Onfido, Trulioo, MetricStream, Wolters Kluwer, Refinitiv (LSEG), Reggora, Ascent RegTech, Global Screening Services, Verafin, Jumio, Kyckr, RegLab, Alyne, Clausematch, Encompass Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

RegTech Market Key Technology Landscape

The RegTech market is fundamentally driven and defined by a sophisticated array of advanced technologies that enable the automation, optimization, and real-time monitoring of regulatory compliance and risk management processes. At its core, Artificial Intelligence (AI) and Machine Learning (ML) play a pivotal role, facilitating predictive analytics for risk assessment, enhancing fraud detection capabilities through pattern recognition, and automating complex decision-making processes in areas like AML and KYC. These AI-powered systems can analyze vast datasets with unprecedented speed and accuracy, identifying anomalies and potential compliance breaches that would be undetectable by traditional methods. This transformative impact positions AI/ML as central to the future evolution of RegTech, moving from reactive to proactive compliance strategies.

Big Data Analytics is another cornerstone technology, essential for processing and interpreting the enormous volumes of structured and unstructured data generated by financial transactions, customer interactions, and regulatory updates. RegTech solutions leverage big data to provide comprehensive insights into market activities, customer behavior, and regulatory adherence, enabling firms to make data-driven compliance decisions. Cloud Computing offers the necessary scalability, flexibility, and cost-efficiency for deploying these data-intensive RegTech platforms, allowing organizations to access powerful computational resources without significant upfront infrastructure investments. The cloud facilitates rapid deployment, easier integration, and secure, centralized data storage, making it an indispensable component of modern RegTech architecture.

Furthermore, technologies such as Blockchain are gaining traction for their potential to provide immutable audit trails, secure data sharing, and enhanced transparency in regulatory reporting and identity management, promising a new era of verifiable compliance. Robotic Process Automation (RPA) is widely used to automate repetitive, rule-based tasks within compliance workflows, significantly reducing human error and improving efficiency. Natural Language Processing (NLP) enables RegTech systems to interpret and analyze complex regulatory texts, extract key obligations, and monitor legislative changes in real-time. Finally, robust API Integration capabilities are crucial for ensuring seamless connectivity between disparate RegTech solutions and existing enterprise systems, facilitating a unified and holistic approach to regulatory technology. This sophisticated technological landscape continuously evolves, pushing the boundaries of what is possible in regulatory compliance.

Regional Highlights

- North America: The RegTech market in North America is highly mature, characterized by strong regulatory enforcement from bodies like the SEC, FINRA, and OCC. Early adoption of advanced technologies, a robust FinTech ecosystem, and significant investments in cybersecurity and data analytics drive substantial market growth. Key countries like the United States and Canada are leading the way in developing and implementing sophisticated RegTech solutions, particularly in AML, KYC, and fraud detection.

- Europe: Europe represents a significant market, largely propelled by stringent regulations such as GDPR (General Data Protection Regulation), PSD2 (Revised Payment Services Directive), and MiFID II (Markets in Financial Instruments Directive). The region demonstrates a strong demand for RegTech solutions that address data privacy, open banking, and capital market compliance. The UK, Germany, France, and Switzerland are prominent hubs for RegTech innovation and adoption, with a focus on cross-border compliance and regulatory harmonization efforts.

- Asia Pacific (APAC): The APAC region is poised for exponential growth, fueled by rapid economic expansion, increasing digital transformation, and evolving regulatory landscapes in emerging economies. Countries like China, India, Singapore, and Australia are witnessing a surge in FinTech adoption and a corresponding increase in regulatory scrutiny, driving demand for RegTech to manage complex local and international compliance requirements, particularly in areas like financial crime and data residency.

- Latin America: The RegTech market in Latin America is in a nascent but rapidly developing stage. Driven by financial inclusion initiatives, efforts to combat financial crime, and a push for digital banking, countries such as Brazil, Mexico, and Colombia are increasingly exploring RegTech solutions. The focus here is often on basic digital compliance, identity verification, and fraud prevention as financial sectors mature and regulatory frameworks strengthen.

- Middle East and Africa (MEA): The MEA region is experiencing growing interest in RegTech, primarily spurred by government initiatives to modernize financial services, attract foreign investment, and combat illicit financial activities. Countries like the UAE, Saudi Arabia, and South Africa are investing in advanced compliance technologies, especially for AML, KYC, and risk management, as they navigate evolving geopolitical landscapes and seek to align with international best practices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the RegTech Market.- IBM

- Thomson Reuters

- NICE Actimize

- FICO

- ComplyAdvantage

- Onfido

- Trulioo

- MetricStream

- Wolters Kluwer

- Refinitiv (LSEG)

- Reggora

- Ascent RegTech

- Global Screening Services

- Verafin

- Jumio

- Kyckr

- RegLab

- Alyne

- Clausematch

- Encompass Corporation

Frequently Asked Questions

What is RegTech?

RegTech, or Regulatory Technology, refers to the use of innovative technology, such as AI, machine learning, and blockchain, to help organizations manage and comply with regulatory requirements more efficiently and effectively. It automates compliance processes, enhances risk management, and streamlines regulatory reporting.

Why is RegTech important for businesses?

RegTech is crucial because it enables businesses to navigate increasingly complex and numerous regulations, reduce compliance costs, mitigate risks of penalties, and improve operational efficiency. It provides real-time insights and automation, transforming reactive compliance into a proactive strategy.

What are the primary benefits of adopting RegTech solutions?

The key benefits include significant cost reduction through automation, enhanced accuracy and consistency in compliance, improved efficiency in regulatory reporting, better fraud detection, real-time risk assessment, and ultimately, a stronger position to avoid regulatory fines and reputational damage.

How does AI impact the RegTech market?

AI revolutionizes RegTech by enabling predictive analytics for risk, automating AML/KYC processes, enhancing fraud detection, and facilitating natural language processing for regulatory text analysis. It boosts efficiency, reduces human error, and provides deeper insights into compliance obligations and potential breaches.

What are the main challenges in RegTech adoption?

Major challenges include high initial implementation costs, difficulties in integrating new RegTech solutions with existing legacy systems, concerns regarding data privacy and cybersecurity, and a shortage of skilled professionals with expertise in both regulatory compliance and advanced technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager