Renewable Energy Carbon Credit Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430079 | Date : Nov, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Renewable Energy Carbon Credit Market Size

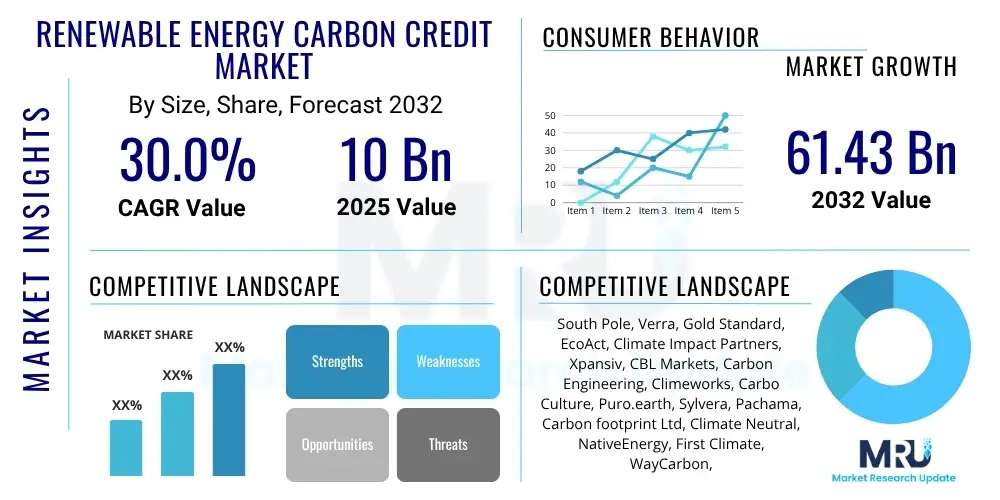

The Renewable Energy Carbon Credit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 30% between 2025 and 2032. The market is estimated at USD 10 Billion in 2025 and is projected to reach USD 61.43 Billion by the end of the forecast period in 2032.

Renewable Energy Carbon Credit Market introduction

The Renewable Energy Carbon Credit Market facilitates the trading of verified greenhouse gas emission reductions achieved through renewable energy projects. These credits, often termed carbon offsets, represent one metric ton of carbon dioxide equivalent (tCO2e) emissions prevented or removed from the atmosphere. By purchasing these credits, entities can offset their unavoidable emissions, contributing to global decarbonization efforts while supporting the development of sustainable energy infrastructure.

The product, a renewable energy carbon credit, is generated by projects such as solar farms, wind power plants, hydroelectric facilities, and biomass energy systems that displace fossil fuel-based electricity generation. These projects undergo rigorous third-party verification against internationally recognized standards like the Verified Carbon Standard (VCS) or the Gold Standard to ensure additionality, permanence, and avoid double-counting. Major applications span both compliance and voluntary carbon markets, catering to corporations, governments, and individuals striving to meet emissions reduction targets or enhance their environmental stewardship. The market offers significant benefits, including channeling finance towards renewable energy projects in developing economies, fostering technological innovation in clean energy, and providing a verifiable mechanism for organizations to achieve their sustainability commitments.

Key driving factors for the market's expansion include the escalating global awareness of climate change, the proliferation of corporate net-zero targets, increasingly stringent environmental regulations, and favorable government policies promoting renewable energy and carbon pricing mechanisms. The integration of ESG (Environmental, Social, and Governance) criteria into investment strategies further amplifies demand, as businesses seek credible ways to demonstrate their commitment to sustainability and mitigate climate-related risks. Technological advancements in renewable energy generation, coupled with improved methodologies for measurement, reporting, and verification (MRV), are also bolstering market confidence and efficiency.

Renewable Energy Carbon Credit Market Executive Summary

The Renewable Energy Carbon Credit Market is experiencing robust growth, driven by escalating global climate action and corporate sustainability mandates. Business trends indicate a significant uptick in corporate demand for high-quality, verifiable credits to meet ambitious net-zero targets, alongside increasing interest from financial institutions for portfolio decarbonization. The voluntary carbon market (VCM) is seeing substantial innovation, with new project types and digital platforms enhancing liquidity and transparency. There is also a heightened focus on credit integrity, with buyers demanding credits that demonstrate genuine additionality and sustainable development co-benefits, leading to a premium for credits from projects with strong social and environmental impacts beyond carbon reduction.

Regional trends reveal diverse dynamics. Europe continues to lead with its established compliance markets like the EU ETS, while the voluntary market within the region also shows strong growth due to corporate commitments. North America, particularly the United States, is witnessing expanding state-level initiatives and a vibrant voluntary market fueled by technology companies and large corporations. The Asia Pacific region is rapidly emerging as both a major supplier and demander of carbon credits, driven by massive renewable energy deployment and the development of domestic compliance markets in countries like China and South Korea. Latin America and the Middle East and Africa are significant for project development, particularly in nature-based solutions and new renewable capacity, attracting international investment for credit generation.

Segmentation trends highlight the increasing importance of project types beyond traditional large-scale renewables, such as smaller distributed generation, energy efficiency, and innovative bioenergy solutions. While large-scale solar and wind projects remain foundational, there is a growing appreciation for projects that deliver tangible community benefits and contribute to multiple Sustainable Development Goals (SDGs). End-user segmentation shows continued dominance from the energy, industrial, and technology sectors, with an emerging interest from the financial services and transportation industries. The market is also seeing a shift towards more sophisticated trading mechanisms and a demand for enhanced due diligence and transparency across all segments, pushing for greater standardization and robust MRV frameworks.

AI Impact Analysis on Renewable Energy Carbon Credit Market

User inquiries concerning AI's influence on the Renewable Energy Carbon Credit Market frequently revolve around its potential to enhance data accuracy, streamline verification processes, and increase overall market transparency. There is considerable interest in how AI can address prevalent issues such as additionality, permanence, and the risk of double-counting, which have historically presented challenges. Users also express expectations regarding AI's capability to predict carbon credit prices, identify fraudulent activities, and optimize project development and management, ultimately leading to a more efficient and trustworthy market. Concerns, however, often include data privacy, algorithmic bias in credit allocation, and the need for robust regulatory frameworks to govern AI's deployment in this complex domain.

- AI can significantly improve the accuracy and efficiency of Measurement, Reporting, and Verification (MRV) for renewable energy projects, utilizing sensor data, satellite imagery, and weather patterns to precisely quantify emission reductions.

- Predictive analytics powered by AI can forecast carbon credit supply, demand, and price fluctuations, offering valuable insights for project developers, investors, and buyers to make informed trading decisions.

- AI can enhance due diligence and fraud detection by analyzing vast datasets to identify inconsistencies, non-compliance, and potential instances of greenwashing, thereby boosting market integrity and buyer confidence.

- Optimization of renewable energy project design and operation is possible through AI, leading to higher efficiency in energy generation and, consequently, greater volumes of verifiable carbon credits.

- Smart contract implementation on blockchain, often combined with AI for automated data validation, can create highly transparent and immutable records of carbon credit generation and transfer, reducing transactional friction and increasing trust.

- AI tools can aid in assessing the additionality of projects more rigorously by simulating baseline scenarios and evaluating what would have occurred without carbon finance, ensuring credits represent genuine emission reductions.

DRO & Impact Forces Of Renewable Energy Carbon Credit Market

The Renewable Energy Carbon Credit Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, collectively forming its impact forces. Primary drivers include increasingly ambitious global climate policies and national decarbonization targets, which necessitate verifiable emission reductions. Corporate net-zero commitments and strong ESG investment mandates are also propelling demand, as companies seek credible mechanisms to offset their carbon footprint and demonstrate environmental responsibility. Furthermore, the tangible benefits of carbon finance, such as funding for renewable energy infrastructure in developing regions and technological advancements in clean energy, act as significant market accelerants, attracting both project developers and buyers.

However, the market faces considerable restraints. Concerns around the integrity of carbon credits, particularly regarding additionality (whether the project would have happened anyway), permanence, and the potential for greenwashing, can undermine buyer confidence and suppress demand. A lack of universal standardization across different carbon credit registries and methodologies complicates market navigation and can lead to price discrepancies. Regulatory uncertainty in nascent markets and the inherent volatility of carbon prices, influenced by political decisions and economic cycles, also pose significant challenges for long-term planning and investment within the sector. These factors often lead to increased scrutiny and due diligence requirements, which can slow down transaction processes.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The growing recognition of nature-based solutions, which often integrate renewable energy components, offers new avenues for credit generation that also provide biodiversity and community benefits. Digitalization, particularly the application of blockchain technology for enhanced transparency and traceability of carbon credits, presents a transformative opportunity to overcome current integrity issues and streamline market operations. Emerging economies, with their vast untapped renewable energy potential, represent significant frontiers for new project development and credit supply. Furthermore, an increasing focus on co-benefits beyond carbon reduction, such as job creation and improved public health, can attract a broader base of buyers interested in holistic sustainability impacts, strengthening the market's social license to operate.

Segmentation Analysis

The Renewable Energy Carbon Credit Market is comprehensively segmented to provide a granular understanding of its diverse components and dynamics. This segmentation helps in analyzing market trends, identifying key growth areas, and understanding the specific needs and behaviors of various participants. The market can be broadly categorized by the type of carbon market, the specific project technology generating the credits, the end-user industry purchasing the credits, and the certification standards governing their issuance and verification. Each segment contributes uniquely to the overall market structure and influences pricing, demand, and supply dynamics.

Detailed segmentation allows stakeholders to target specific niches and develop tailored strategies. For instance, understanding the demand for credits from specific renewable energy technologies can guide project development. Similarly, analyzing end-user preferences helps credit originators align their offerings with corporate sustainability goals. The differing requirements and price points within compliance versus voluntary markets also necessitate distinct approaches. Geographical segmentation further refines this view, highlighting regional policy drivers, market maturity, and the supply-demand balance of renewable energy carbon credits across the globe.

- By Market Type

- Compliance Carbon Market (e.g., EU ETS, California Cap-and-Trade)

- Voluntary Carbon Market

- By Project Type

- Solar Power Projects

- Wind Power Projects

- Hydropower Projects

- Bioenergy Projects (e.g., biomass, biogas)

- Geothermal Energy Projects

- Waste-to-Energy Projects

- Energy Efficiency Projects (e.g., industrial, residential)

- Nature-Based Solutions (NBS) with renewable energy components

- By End User Industry

- Power and Energy Sector

- Industrial Sector (e.g., manufacturing, chemicals, cement, steel)

- Transportation Sector (e.g., aviation, shipping, logistics)

- Building and Construction Sector

- Technology and Telecommunications Sector

- Financial Services Sector

- Retail and Consumer Goods Sector

- Agriculture and Forestry Sector

- Others (e.g., public sector, educational institutions)

- By Standard Type

- Verified Carbon Standard (VCS/Verra)

- Gold Standard

- American Carbon Registry (ACR)

- Climate Action Reserve (CAR)

- United Nations Clean Development Mechanism (CDM)

- Other National/Regional Standards

Value Chain Analysis For Renewable Energy Carbon Credit Market

The value chain for the Renewable Energy Carbon Credit Market encompasses several distinct stages, beginning with the upstream development and verification of emission reduction projects and extending through to the downstream sale and retirement of carbon credits. Upstream activities primarily involve project developers, who identify, design, and implement renewable energy projects that generate verifiable emission reductions. These developers engage with technology providers for the necessary infrastructure and equipment, alongside specialized Measurement, Reporting, and Verification (MRV) consultants and auditors to ensure projects adhere to rigorous international standards. The integrity and quality of credits are largely determined at this initial stage, through detailed methodologies and independent third-party assessments.

Midstream activities in the value chain focus on the aggregation, registration, and initial trading of carbon credits. After verification, credits are issued by registry bodies (e.g., Verra, Gold Standard) and then often aggregated by carbon credit project developers or specialized brokers. These brokers play a crucial role in connecting project originators with potential buyers, providing market intelligence, and facilitating transactions. Distribution channels are diverse, ranging from direct sales between project developers and large corporate buyers, over-the-counter (OTC) trades facilitated by brokers, to transactions occurring on established carbon exchanges like CBL Markets or Xpansiv. These platforms offer varying levels of liquidity, price discovery, and transparency, catering to different buyer preferences and market maturity levels.

Downstream activities center on the end-users and the final retirement of carbon credits. End-users, primarily corporations seeking to meet sustainability goals or regulatory obligations, purchase these credits to offset their emissions. Financial institutions also participate as investors or intermediaries. The ultimate step involves the retirement of the purchased credits on a public registry, permanently removing them from circulation and ensuring they cannot be double-counted. This entire process involves both direct transactions, where buyers might engage directly with project developers or through a primary issuance, and indirect transactions, which occur in the secondary market through brokers or exchanges. The increasing complexity and demand for transparency are driving innovation in all segments of this value chain, with a growing emphasis on digital solutions and enhanced traceability.

Renewable Energy Carbon Credit Market Potential Customers

The potential customers for renewable energy carbon credits represent a broad spectrum of entities, all driven by various motivations ranging from regulatory compliance to ambitious corporate sustainability targets. A significant segment comprises large corporations across diverse industries, including manufacturing, energy, technology, and transportation, which are committed to achieving net-zero emissions or reducing their carbon footprint as part of their environmental, social, and governance (ESG) strategies. These buyers often seek high-quality, verifiable credits to offset emissions that cannot yet be eliminated through operational changes, thus bridging the gap to full decarbonization and enhancing their public image.

Beyond corporations, financial institutions and investment funds are increasingly emerging as key purchasers, both for their own operational emissions and as part of investment portfolios focused on sustainable assets. Governments and public sector entities also participate, particularly in compliance markets, where they may acquire credits to meet national or sub-national emissions reduction targets. Furthermore, as climate awareness grows, smaller businesses and even individual consumers are showing a rising interest in purchasing carbon credits to mitigate their personal or operational impact, often through direct platforms or integrated into sustainable product offerings. This diverse customer base underscores the market's broad appeal and its critical role in global climate action.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 10 Billion |

| Market Forecast in 2032 | USD 61.43 Billion |

| Growth Rate | CAGR 30% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | South Pole, Verra, Gold Standard, EcoAct, Climate Impact Partners, Xpansiv, CBL Markets, Carbon Engineering, Climeworks, Carbo Culture, Puro.earth, Sylvera, Pachama, Carbon footprint Ltd, Climate Neutral, NativeEnergy, First Climate, WayCarbon, 3Degrees, Renature. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Renewable Energy Carbon Credit Market Key Technology Landscape

The Renewable Energy Carbon Credit Market is increasingly leveraging advanced technologies to enhance transparency, improve verification accuracy, and streamline transactional processes. Central to this technological evolution is the growing adoption of blockchain technology, which provides an immutable and transparent ledger for recording carbon credit issuance, ownership, and retirement. This distributed ledger technology (DLT) effectively addresses concerns about double-counting and ensures the integrity of credits, building trust among market participants. Smart contracts, often integrated with blockchain platforms, automate various stages of the credit lifecycle, from issuance based on verified data to automated transfers upon conditions being met, significantly reducing manual effort and potential for error.

Beyond blockchain, Artificial Intelligence (AI) and Machine Learning (ML) are playing a transformative role in the Measurement, Reporting, and Verification (MRV) processes of renewable energy projects. AI algorithms can analyze vast datasets from IoT sensors embedded in renewable energy infrastructure, satellite imagery, and meteorological data to accurately quantify emission reductions in real-time or near real-time. This capability significantly enhances the precision of credit generation and reduces the costs associated with traditional, labor-intensive auditing. Predictive analytics powered by AI also helps in forecasting market trends, optimizing project performance, and identifying potential risks or fraudulent activities within the carbon market ecosystem, thereby increasing market efficiency and security.

The utilization of Geographic Information Systems (GIS) and remote sensing technologies, particularly satellite imagery and aerial photography, further supports the verification of large-scale renewable energy projects and nature-based solutions. These tools allow for comprehensive monitoring of project sites, ensuring that installations are operational as claimed and that land-use changes or deforestation are accurately tracked, particularly relevant for hybrid projects that combine renewable energy with afforestation or reforestation components. Digital registries, often cloud-based and integrated with these technologies, serve as central repositories for all carbon credit data, providing accessible and verifiable information to all stakeholders, thus fostering greater accountability and credibility across the entire renewable energy carbon credit market.

Regional Highlights

- North America: The North American market, particularly the United States and Canada, shows strong growth in the voluntary carbon market, driven by ambitious corporate sustainability goals and increasing investment in renewable energy. Regional compliance markets, such as California's Cap-and-Trade program, also play a significant role. The region benefits from a robust innovation ecosystem, leading to advanced MRV technologies and market platforms, attracting a diverse range of buyers from tech, energy, and finance sectors.

- Europe: Europe remains a leading region, primarily due to the mature and expansive EU Emissions Trading System (ETS), the world's largest carbon market, which influences both compliance and voluntary market dynamics. Strong governmental policies, ambitious decarbonization targets, and a high level of environmental awareness among consumers and businesses contribute to consistent demand for renewable energy carbon credits. The region is also a hub for carbon project development and verification standards, with organizations like Gold Standard and Verra having strong operational bases here.

- Asia Pacific (APAC): The Asia Pacific region is experiencing rapid growth as both a major generator and buyer of renewable energy carbon credits. Countries like China, India, and Southeast Asian nations are heavily investing in renewable energy infrastructure to meet energy demands and reduce pollution, leading to a substantial supply of credits. Simultaneously, developing domestic carbon markets in countries like China and South Korea, coupled with increasing corporate sustainability commitments, are driving regional demand. This region presents significant opportunities for market expansion and project development.

- Latin America: Latin America holds immense potential for renewable energy carbon credit generation, especially through hydropower, wind, and solar projects, as well as significant nature-based solutions that can be integrated with renewable energy initiatives. The region is attracting international finance for carbon projects due to its rich natural resources and developing economies, though regulatory frameworks are still maturing in many areas. Brazil and Mexico are notable markets with growing interest and capacity for carbon credit generation.

- Middle East and Africa (MEA): The MEA region is emerging as a significant area for renewable energy development and, consequently, carbon credit generation. Driven by diversification strategies away from fossil fuels, countries in the Middle East are investing heavily in large-scale solar projects, while Africa possesses vast untapped potential for solar, wind, and geothermal energy. Increasing international and regional collaborations are supporting project development and market infrastructure, making MEA an important future hub for carbon credit supply.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Renewable Energy Carbon Credit Market.- South Pole

- Verra

- Gold Standard

- EcoAct

- Climate Impact Partners

- Xpansiv

- CBL Markets

- Carbon Engineering

- Climeworks

- Carbo Culture

- Puro.earth

- Sylvera

- Pachama

- Carbon footprint Ltd

- Climate Neutral

- NativeEnergy

- First Climate

- WayCarbon

- 3Degrees

- Renature

Frequently Asked Questions

What is a renewable energy carbon credit?

A renewable energy carbon credit, also known as a carbon offset, is a transferable instrument representing one metric ton of carbon dioxide equivalent (tCO2e) emissions reduced or removed from the atmosphere by a renewable energy project. These credits are generated when projects, such as solar or wind farms, displace fossil fuel-based electricity, and are independently verified against stringent international standards.

How does the Renewable Energy Carbon Credit Market work?

The market operates by allowing entities to purchase credits generated by renewable energy projects to offset their own unavoidable greenhouse gas emissions. Project developers quantify and verify their emission reductions, which are then registered as carbon credits. These credits are then bought by corporations, governments, or individuals, either directly or through brokers and exchanges, and retired to ensure permanent removal from the carbon cycle, supporting global decarbonization.

Who are the primary buyers of renewable energy carbon credits?

Primary buyers include large corporations aiming to achieve net-zero emissions or meet sustainability targets as part of their ESG strategies, financial institutions for portfolio decarbonization, and governments or regulated entities for compliance with emissions caps. Individuals and smaller businesses also increasingly participate to offset their carbon footprint voluntarily.

What drives the growth of the Renewable Energy Carbon Credit Market?

Market growth is primarily driven by increasing global climate action, the proliferation of corporate net-zero and science-based targets, stricter environmental regulations, and rising investor demand for sustainable assets. Additionally, technological advancements in renewable energy and enhanced methodologies for credit verification contribute to market expansion.

What are the key challenges facing the Renewable Energy Carbon Credit Market?

Key challenges include concerns over credit integrity and additionality, potential for greenwashing, lack of universal standardization across different registries, regulatory uncertainties in nascent markets, and inherent price volatility. Addressing these issues through robust verification, transparency, and regulation is crucial for sustained market growth and credibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager