Renewable Methanol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428107 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Renewable Methanol Market Size

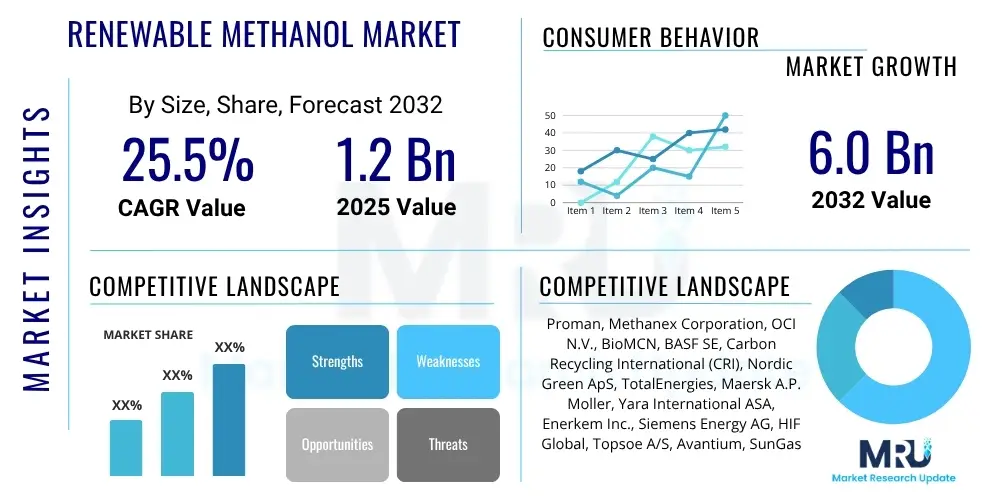

The Renewable Methanol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2025 and 2032. The market is estimated at USD 1.2 billion in 2025 and is projected to reach USD 6.0 billion by the end of the forecast period in 2032.

Renewable Methanol Market introduction

The Renewable Methanol Market is rapidly emerging as a cornerstone of the global energy transition, offering a versatile and sustainable alternative to fossil-derived fuels and chemical feedstocks. This market encompasses methanol produced from non-fossil carbon sources, primarily biomass, municipal solid waste, and captured carbon dioxide (CO2) combined with green hydrogen. The product, often referred to as green methanol or e-methanol, significantly reduces greenhouse gas emissions compared to conventional methanol, aligning with stringent global decarbonization targets. Its clean-burning properties, ease of handling, and established infrastructure for conventional methanol make it an attractive option across various industrial sectors. This market introduction is crucial for understanding the foundational elements and strategic importance of renewable methanol within the broader sustainable economy. The increasing urgency to mitigate climate change and the growing corporate commitment to environmental, social, and governance (ESG) principles are pivotal in driving the expansion of this market, compelling industries to adopt more sustainable practices across their operations and supply chains.

Major applications for renewable methanol span a diverse range of industries, showcasing its versatility. As a marine fuel, it offers a viable pathway to decarbonize the shipping sector, which is under immense pressure to reduce its carbon footprint. In the chemical industry, it serves as a crucial building block for numerous derivatives, including formaldehyde, acetic acid, and various plastics, enabling manufacturers to produce greener end-products. Beyond these, renewable methanol finds utility in power generation, acting as a clean-burning fuel in specialized engines or fuel cells, and as a component in gasoline blending, reducing the overall carbon intensity of transportation fuels. The benefits of renewable methanol are multi-faceted: it provides a sustainable solution for reducing carbon emissions, fosters a circular economy by utilizing waste and captured CO2, and diversifies energy sources away from fossil fuels. Its liquid state at ambient temperatures also simplifies storage and transportation, leveraging existing infrastructure, which is a significant advantage over other alternative fuels like hydrogen.

Several robust factors are driving the growth of the renewable methanol market. Foremost among these are the escalating global mandates and regulatory frameworks aimed at decarbonization, particularly in the maritime sector through initiatives like the IMO's GHG reduction strategy, and in the chemical industry through carbon pricing mechanisms. The increasing corporate sustainability commitments and consumer demand for eco-friendly products are also playing a significant role, pushing companies to invest in renewable feedstocks and processes. Furthermore, technological advancements in catalytic conversion, electrolysis for green hydrogen production, and carbon capture technologies are continuously improving the efficiency and cost-effectiveness of renewable methanol synthesis. The growing investment in renewable energy infrastructure, which provides the necessary green electricity for e-methanol production, coupled with the rising cost of carbon emissions, further enhances the economic viability and competitive advantage of renewable methanol, positioning it as a key enabler for a net-zero future.

Renewable Methanol Market Executive Summary

The Renewable Methanol Market is experiencing dynamic growth, propelled by a confluence of evolving business trends, significant regional developments, and distinct segment-specific trajectories. Business trends are largely characterized by substantial investments from energy majors, chemical producers, and shipping lines, all aiming to secure their future in a decarbonized economy. Strategic partnerships and joint ventures are increasingly common, designed to pool resources for large-scale production facilities and integrated supply chains. Innovations in production technologies, particularly in electro-fuels (e-methanol) derived from green hydrogen and captured CO2, are attracting considerable venture capital and research funding. Furthermore, there's a growing emphasis on lifecycle assessments and traceability to ensure the genuine "green" credentials of the product, responding to increasing scrutiny from regulators and end-users. The market is also witnessing the emergence of new business models focused on carbon circularity and integrated biorefineries, aiming to optimize resource utilization and minimize waste generation. This comprehensive strategic reorientation across industries underscores the profound shift towards sustainable practices and resource management in the pursuit of long-term economic and environmental viability.

Regional trends reveal varied paces and foci of development. Europe is a frontrunner, driven by ambitious decarbonization targets, robust policy support such as the EU's Fit for 55 package, and significant investments in green hydrogen infrastructure which is crucial for e-methanol production. Countries like Denmark, Germany, and the Netherlands are at the forefront of developing large-scale renewable methanol projects, often targeting the maritime and chemical sectors. Asia Pacific, particularly China, Japan, and South Korea, is also demonstrating strong growth, fueled by rapid industrial expansion, increasing energy demand, and a growing recognition of the need for sustainable industrial feedstocks and fuels. These countries are investing heavily in both biomass-to-methanol and e-methanol projects, often leveraging their manufacturing prowess and scaling capabilities. North America, while having significant renewable energy potential, is seeing slower but steady adoption, with initiatives gaining momentum through federal incentives and state-level renewable fuel standards. Latin America and the Middle East and Africa are emerging as regions with vast potential for green hydrogen production due to abundant renewable energy resources, positioning them as future key players in the global renewable methanol supply chain, particularly for export markets.

Segment trends highlight specific areas of intensified activity. By feedstock, the e-methanol segment, utilizing green hydrogen and captured CO2, is projected to witness the fastest growth due to its scalability and potential for ultra-low carbon intensity, although it requires substantial investments in renewable electricity and electrolysis. Bio-methanol, derived from biomass and waste streams, continues to be a crucial segment, especially for smaller, localized production facilities, benefiting from existing waste management infrastructure. In terms of applications, marine fuel is arguably the most dynamic segment, with major shipping companies placing orders for methanol-powered vessels and establishing dedicated supply partnerships. The chemical feedstock segment remains foundational, driven by the broad utility of methanol in various industrial processes and the increasing demand for sustainable chemical precursors. Power generation and gasoline blending, while smaller, are also showing steady uptake as countries seek to diversify their energy mix and improve fuel efficiency. The interplay between these business, regional, and segment trends collectively paints a picture of a burgeoning market poised for significant expansion, underpinned by global sustainability imperatives and technological innovation across various critical sectors.

AI Impact Analysis on Renewable Methanol Market

The integration of Artificial Intelligence (AI) into the Renewable Methanol market is sparking considerable interest and conversation, with common user questions often revolving around how AI can optimize production efficiency, reduce operational costs, and accelerate the development of advanced synthesis technologies. Users are keen to understand AI's role in feedstock optimization, especially for complex and variable biomass sources, and its potential in predicting and managing the volatile energy inputs required for green hydrogen production. There's also a strong expectation for AI to enhance the overall sustainability footprint by enabling more precise process control, minimizing waste, and facilitating smarter supply chain logistics. Concerns frequently arise regarding the data infrastructure needed to support AI applications, the cybersecurity risks associated with interconnected systems, and the availability of skilled personnel capable of deploying and managing these advanced AI solutions within the industrial environment. Ultimately, the overarching theme is a strong anticipation that AI will be a transformative force, enabling the renewable methanol industry to overcome existing challenges related to cost, scale, and efficiency, thereby accelerating its journey towards mainstream adoption and enhancing its competitiveness against fossil-derived alternatives. This will involve sophisticated modeling for optimal reaction conditions and predictive maintenance for complex machinery.

- AI-driven optimization of reaction conditions in methanol synthesis, leading to higher yields and reduced energy consumption.

- Predictive maintenance for critical equipment in renewable methanol plants, minimizing downtime and operational costs.

- Enhanced feedstock management and blending strategies, especially for diverse and variable biomass sources, using AI algorithms.

- AI-powered simulation and modeling for R&D of novel catalysts and process designs, accelerating innovation.

- Optimization of green hydrogen production through AI, ensuring efficient utilization of renewable energy sources for electrolysis.

- Supply chain optimization, including logistics, inventory management, and demand forecasting for renewable methanol distribution.

- AI integration in carbon capture technologies to improve efficiency and reduce the energy penalty of CO2 sequestration.

- Real-time monitoring and control of plant operations, enabling rapid adjustments to fluctuating conditions and ensuring quality.

- Data analytics for market intelligence, identifying emerging trends, and supporting strategic investment decisions in the renewable methanol sector.

- Automation of complex operational tasks, reducing human error and improving safety standards within production facilities.

DRO & Impact Forces Of Renewable Methanol Market

The Renewable Methanol Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by various Impact Forces. Key drivers include the escalating global demand for decarbonization across sectors, particularly maritime shipping and the chemical industry, which are under increasing pressure to adopt sustainable alternatives. Stringent environmental regulations and carbon pricing mechanisms enacted by governments worldwide further incentivize the shift towards renewable methanol. Additionally, technological advancements in green hydrogen production (electrolysis using renewable energy) and carbon capture utilization (CCU) are significantly improving the economic viability and scalability of renewable methanol synthesis. The growing corporate sustainability agendas and investor focus on ESG criteria are also compelling companies to invest in and utilize renewable methanol, fostering a positive market environment. These drivers collectively create a robust impetus for the market's expansion, demonstrating a clear path forward for industries seeking to reduce their carbon footprint and align with global climate goals, thereby encouraging substantial capital allocation towards sustainable energy solutions and industrial processes. The continuous innovation in catalyst technology further enhances production efficiency and cost-effectiveness.

However, significant restraints temper this growth. The high capital expenditure (CAPEX) required for setting up large-scale renewable methanol production facilities, particularly those relying on green hydrogen, remains a substantial barrier. The cost competitiveness of renewable methanol against traditional fossil-derived methanol is another challenge, although this gap is narrowing with carbon pricing and technological improvements. Furthermore, ensuring a consistent and economically viable supply of sustainable feedstocks, such as certified biomass, municipal solid waste, or adequately priced green hydrogen, can be complex. The energy intensity of certain production processes, especially for green hydrogen, also raises concerns about overall energy efficiency and the true net environmental benefit if not powered by entirely renewable sources. Technical challenges in scaling up nascent technologies, along with the need for extensive research and development to optimize processes and develop more efficient catalysts, also contribute to the market's constraints, requiring coordinated efforts across the value chain to overcome these hurdles. The need for specialized logistics and storage solutions adapted to a growing, yet still niche, product further adds to the operational complexities and investment requirements for market players.

Despite the restraints, substantial opportunities exist. The expanding applications of renewable methanol beyond traditional uses, such as in fuel cells for heavy-duty vehicles or as a component in synthetic jet fuels (e-fuels), present new avenues for market growth. The potential for carbon capture and utilization (CCU) technologies to turn industrial CO2 emissions into valuable renewable methanol offers a circular economy solution, creating value from waste. Furthermore, geographical expansion into regions with abundant renewable energy resources and strong policy support for green industrial development, such as parts of Africa, Latin America, and Australia, presents significant investment prospects. The development of innovative financing mechanisms, government subsidies, and international collaborations can help mitigate the high CAPEX and accelerate project deployment. The market is also poised to benefit from increasing public awareness and governmental pressures regarding climate change, driving stronger policy support and incentives. These opportunities, when strategically capitalized upon, can unlock significant value and propel the renewable methanol market towards becoming a key player in the global energy transition, providing resilient and sustainable solutions for energy and chemical industries worldwide.

Segmentation Analysis

The Renewable Methanol Market is segmented across various dimensions, providing a granular view of its structure and growth dynamics. These segmentations are critical for understanding market drivers, identifying niche opportunities, and formulating targeted business strategies. The primary ways the market is categorized include feedstock type, application, and end-use industry, each revealing distinct growth patterns and competitive landscapes. Analyzing these segments helps stakeholders to discern where investment is most concentrated, where technological advancements are having the greatest impact, and which end-user industries are leading the adoption curve. This multi-faceted approach to market segmentation ensures a comprehensive understanding of the market's current state and its potential future trajectories, allowing for more informed decision-making and strategic resource allocation in a rapidly evolving sustainable energy landscape.

- By Feedstock:

- Biomass (Agricultural Waste, Forestry Residues, Black Liquor)

- Municipal Solid Waste (MSW)

- Captured Carbon Dioxide (CO2)

- Industrial Waste Gases

- Renewable Energy (via Green Hydrogen)

- By Application:

- Chemical Feedstock (Formaldehyde, Acetic Acid, MTO/MTP, MTBE)

- Marine Fuel

- Automotive Fuel (Fuel Blending, Direct Use)

- Power Generation

- Wastewater Treatment

- Other Applications (e.g., fuel cells, solvents)

- By Type:

- Bio-methanol

- E-methanol

Value Chain Analysis For Renewable Methanol Market

A comprehensive understanding of the Renewable Methanol Market's value chain is essential for identifying key players, understanding cost structures, and pinpointing areas for optimization and strategic investment. The value chain begins with upstream analysis, which primarily focuses on the sourcing and preparation of various feedstocks. For bio-methanol, this involves collecting, processing, and sometimes pre-treating biomass (e.g., agricultural residues, forestry waste, black liquor from pulp mills) or municipal solid waste. For e-methanol, the upstream segment is dominated by the production of green hydrogen through electrolysis powered by renewable electricity (solar, wind) and the capture of CO2 from industrial emissions or direct air capture. The efficiency and cost-effectiveness of these upstream processes are critical determinants of the final product's cost and carbon footprint, making investments in renewable energy infrastructure and advanced carbon capture technologies pivotal. This initial stage requires significant capital expenditure and robust supply chain management to ensure consistent and sustainable availability of raw materials, which are often geographically dispersed and can be subject to seasonal variations or price volatility. Long-term contracts and strategic partnerships with feedstock suppliers and renewable energy providers are thus paramount to securing operational stability and economic viability across the entire value chain, fostering resilient and integrated production ecosystems that can adapt to evolving market dynamics and regulatory landscapes.

Moving through the value chain, the midstream segment involves the actual production of renewable methanol through various synthesis pathways, followed by purification. This includes gasification and subsequent catalytic conversion for biomass/waste-to-methanol processes, or the hydrogenation of captured CO2 with green hydrogen for e-methanol production. These processes demand advanced engineering, specialized catalysts, and significant energy inputs, often requiring large-scale industrial facilities to achieve economies of scale. The downstream analysis focuses on the distribution, storage, and ultimate consumption of renewable methanol. Given its liquid state at ambient temperatures, renewable methanol can leverage existing infrastructure built for conventional methanol, including pipelines, tankers, storage tanks, and bunkering facilities. However, dedicated logistics may be required for specific end-use applications like marine fuel, necessitating investments in new bunkering facilities at major ports. The distribution channels can be broadly categorized into direct and indirect routes. Direct distribution involves producers selling directly to large industrial end-users, such as major chemical companies, shipping lines, or power generators. This typically involves bulk contracts and long-term supply agreements, ensuring stability for both producers and consumers. Indirect channels involve distributors, traders, and bunkering operators who manage smaller volumes and cater to a wider array of end-users, including smaller chemical manufacturers, independent fuel blenders, or niche automotive applications, thereby broadening market access and optimizing logistical efficiencies.

The interplay between these upstream and downstream activities, facilitated by efficient distribution channels, defines the overall competitiveness and sustainability of the renewable methanol market. Direct channels offer greater control over pricing and supply chain integrity, fostering strong relationships between producers and key strategic customers. This is particularly relevant for sectors like shipping, where long-term fuel contracts are common. Indirect channels, on the other hand, provide market liquidity and reach a broader customer base, crucial for market penetration and scaling. Optimizing the entire value chain requires continuous innovation at each stage, from improving feedstock conversion efficiencies and developing more robust catalysts to enhancing distribution network reliability and expanding bunkering capabilities globally. Furthermore, integrating digital technologies and real-time monitoring across the value chain can significantly improve operational efficiency, reduce waste, and enhance traceability. Strategic collaborations between feedstock suppliers, technology providers, methanol producers, logistics companies, and end-users are paramount to building a resilient, cost-effective, and environmentally sustainable renewable methanol ecosystem capable of meeting the escalating global demand for green industrial fuels and feedstocks, thereby ensuring its pivotal role in the global energy transition toward a circular and decarbonized economy.

Renewable Methanol Market Potential Customers

The Renewable Methanol Market caters to a diverse range of potential customers, all seeking sustainable solutions to decarbonize their operations and meet evolving environmental mandates. The primary end-users and buyers of renewable methanol are found across several key industrial sectors that traditionally rely heavily on fossil fuels or conventional methanol. Foremost among these are the global shipping companies, which are under immense pressure to reduce greenhouse gas emissions in line with the International Maritime Organization's (IMO) targets. These companies represent a significant and growing customer base, actively investing in methanol-powered vessels and establishing supply agreements for bunkering. The chemical industry forms another foundational customer segment, as methanol is a critical building block for hundreds of chemicals, including formaldehyde, acetic acid, and plastics. Chemical manufacturers are increasingly looking to replace fossil-derived methanol with its renewable counterpart to green their production processes and meet corporate sustainability goals. These diverse customer segments underscore the broad applicability and strategic importance of renewable methanol in driving a more sustainable global industrial landscape, enabling a significant shift away from carbon-intensive feedstocks and fuels, thereby promoting a more environmentally responsible future across various key economic sectors. The regulatory landscape, coupled with corporate social responsibility initiatives, plays a crucial role in expanding this customer base, pushing industries towards more sustainable choices.

Beyond these major segments, the automotive sector also represents a noteworthy potential customer base, particularly for fuel blending applications, where renewable methanol can reduce the carbon intensity of gasoline. While direct use in vehicles is currently niche, advancements in fuel cell technology and internal combustion engine modifications could expand this market. Power generation companies, especially those in remote areas or seeking flexible power solutions, are exploring renewable methanol as a clean-burning fuel for turbines and generators. Additionally, wastewater treatment facilities can be potential customers, as methanol is sometimes used as a carbon source for denitrification processes. The increasing demand for sustainable products across the consumer goods sector also indirectly drives the demand for renewable methanol, as it enables the production of greener materials and chemicals. As regulatory frameworks become more stringent and the cost of carbon emissions increases, the attractiveness of renewable methanol as a compliance and sustainability tool will continue to grow, drawing in a broader array of industrial and commercial entities seeking to future-proof their operations against climate-related risks and capitalize on the burgeoning green economy. The long-term adoption hinges on consistent supply, competitive pricing, and continued policy support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2032 | USD 6.0 Billion |

| Growth Rate | 25.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Proman, Methanex Corporation, OCI N.V., BioMCN, BASF SE, Carbon Recycling International (CRI), Nordic Green ApS, TotalEnergies, Maersk A.P. Moller, Yara International ASA, Enerkem Inc., Siemens Energy AG, HIF Global, Topsoe A/S, Avantium, SunGas Renewables Inc., Wastefront AS, Mitsui O.S.K. Lines, Inc., Repsol S.A., Saudi Basic Industries Corporation (SABIC) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Renewable Methanol Market Key Technology Landscape

The Renewable Methanol Market is underpinned by a diverse and evolving technology landscape, with continuous innovation driving improvements in efficiency, scalability, and cost-effectiveness. One of the primary technological pathways for bio-methanol production involves thermochemical processes such as gasification. This technology converts various forms of biomass, municipal solid waste, or industrial waste gases into a syngas (a mixture of hydrogen and carbon monoxide), which is then catalytically converted into methanol. Advanced gasification techniques, including fluidized bed gasifiers and entrained flow gasifiers, are being refined to handle a wider range of feedstocks and achieve higher conversion efficiencies. Another significant technology for bio-methanol involves biological pathways like fermentation, where microorganisms convert organic waste into methanol, offering a potentially lower-temperature and lower-pressure alternative, though often with slower reaction rates and lower yields. These established and emerging technologies are crucial for leveraging diverse waste streams, ensuring resource circularity and minimizing reliance on fresh virgin resources, thereby contributing significantly to the sustainability goals of the industry, while also presenting unique engineering challenges that drive further research and development in process optimization and catalyst design.

For e-methanol production, which is gaining significant traction due to its potential for ultra-low carbon intensity, the key technological pillars are green hydrogen production and carbon dioxide hydrogenation. Green hydrogen is generated through electrolysis, where water is split into hydrogen and oxygen using electricity derived entirely from renewable sources like solar and wind power. Advances in electrolyzer technology, particularly Proton Exchange Membrane (PEM) and Solid Oxide Electrolyzer Cells (SOEC), are crucial for improving efficiency and reducing the cost of green hydrogen. The captured CO2, sourced from industrial emissions or increasingly from direct air capture (DAC) technologies, is then reacted with green hydrogen in a catalytic process to synthesize methanol. Catalyst development is a critical area here, with ongoing research focused on enhancing the activity, selectivity, and stability of catalysts to operate under milder conditions and achieve higher conversion rates. Innovative reactor designs, such as microchannel reactors and intensified process equipment, are also being explored to optimize the CO2 hydrogenation process, reduce footprint, and improve energy integration. The synergy between renewable electricity generation, efficient electrolysis, advanced carbon capture, and highly selective catalytic conversion forms the technological core of the e-methanol pathway, enabling scalable and environmentally superior production.

Beyond the core production technologies, several supporting technologies are vital for the overall success and expansion of the renewable methanol market. These include advanced purification techniques to ensure product quality suitable for various applications, robust process control systems often incorporating AI and machine learning for real-time optimization, and specialized materials science for plant construction to withstand corrosive environments and high-temperature operations. Carbon capture utilization and storage (CCUS) technologies play an increasingly important role, not only for sourcing CO2 but also for managing residual emissions, ensuring the lowest possible carbon footprint throughout the methanol lifecycle. Furthermore, technologies for integrating renewable energy into methanol plants, such as smart grid solutions and energy storage systems, are essential for ensuring a stable and reliable power supply, especially for the energy-intensive electrolysis process. The ongoing convergence of these various technological advancements, coupled with robust research and development efforts in fields like heterogeneous catalysis, reactor engineering, and process intensification, will be instrumental in driving down production costs, improving efficiency, and ultimately positioning renewable methanol as a mainstream sustainable fuel and chemical feedstock. This holistic technological ecosystem is critical for accelerating the transition to a net-zero industrial economy and establishing resilience against fluctuating fossil fuel markets.

Regional Highlights

- Europe: Leading the renewable methanol market with ambitious decarbonization targets, robust policy support (e.g., EU's Fit for 55 package, Renewable Energy Directive), and significant investments in green hydrogen infrastructure. Countries like Denmark, Germany, the Netherlands, and Sweden are pioneering large-scale production projects, particularly for marine fuel and chemical feedstock applications. The region benefits from strong governmental incentives and a proactive industry aiming for climate neutrality.

- Asia Pacific (APAC): Experiencing rapid growth driven by industrial expansion, increasing energy demand, and growing environmental awareness in countries such as China, Japan, South Korea, and India. China is a major producer and consumer, investing in both biomass-to-methanol and e-methanol projects. The region's large manufacturing base and growing maritime sector make it a crucial market for renewable methanol adoption, balancing economic growth with sustainability goals.

- North America: Demonstrating steady but accelerating growth, spurred by federal incentives (e.g., Inflation Reduction Act in the US), state-level renewable fuel standards, and increasing corporate sustainability commitments. Significant R&D efforts and investment in carbon capture technologies and biomass conversion facilities are notable. Canada also presents opportunities with its vast forestry resources for biomass-based production.

- Latin America: Emerging as a region with immense potential due to abundant renewable energy resources (hydro, solar, wind) for green hydrogen production. Countries like Chile and Brazil are attracting foreign investment for large-scale e-methanol projects aimed at both domestic use and export to demand-heavy regions. Proximity to major shipping routes also positions it strategically for marine bunkering.

- Middle East and Africa (MEA): Poised for significant growth, especially in green hydrogen production due to abundant solar resources, making it a potential hub for e-methanol exports. Countries like Saudi Arabia and UAE are investing heavily in large-scale renewable energy projects and hydrogen derivatives, including renewable methanol. The region is also exploring biomass opportunities from agricultural waste in certain areas, diversifying its energy transition strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Renewable Methanol Market.- Proman

- Methanex Corporation

- OCI N.V.

- BioMCN

- BASF SE

- Carbon Recycling International (CRI)

- Nordic Green ApS

- TotalEnergies

- Maersk A.P. Moller

- Yara International ASA

- Enerkem Inc.

- Siemens Energy AG

- HIF Global

- Topsoe A/S

- Avantium

- SunGas Renewables Inc.

- Wastefront AS

- Mitsui O.S.K. Lines, Inc.

- Repsol S.A.

- Saudi Basic Industries Corporation (SABIC)

Frequently Asked Questions

Analyze common user questions about the Renewable Methanol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is renewable methanol?

Renewable methanol, also known as green methanol or e-methanol, is a sustainable liquid fuel and chemical feedstock produced from non-fossil carbon sources like biomass, municipal solid waste, or captured carbon dioxide combined with green hydrogen. It significantly reduces greenhouse gas emissions compared to fossil-derived methanol.

How is renewable methanol produced?

Renewable methanol is primarily produced via two main routes: bio-methanol, which uses biomass or waste streams converted into syngas and then catalytically synthesized; and e-methanol, which combines green hydrogen (produced via electrolysis with renewable electricity) with captured carbon dioxide (CO2) through a catalytic hydrogenation process.

What are the main applications of renewable methanol?

The primary applications include marine fuel for decarbonizing the shipping industry, a versatile chemical feedstock for producing numerous derivatives (e.g., formaldehyde, acetic acid, plastics), automotive fuel blending, and power generation. Its liquid form allows for easy integration into existing infrastructure.

What are the key benefits of using renewable methanol?

Key benefits include significant reduction in greenhouse gas emissions and air pollutants, fostering a circular economy by utilizing waste and captured CO2, diversification of energy sources, and compatibility with existing infrastructure for storage and transportation due to its liquid nature, offering a practical path to decarbonization.

What are the challenges facing the renewable methanol market?

Challenges include the high capital expenditure required for production facilities, particularly for e-methanol, competition with lower-cost fossil-derived methanol, ensuring a consistent and cost-effective supply of sustainable feedstocks (biomass, green hydrogen, captured CO2), and scaling up nascent production technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager