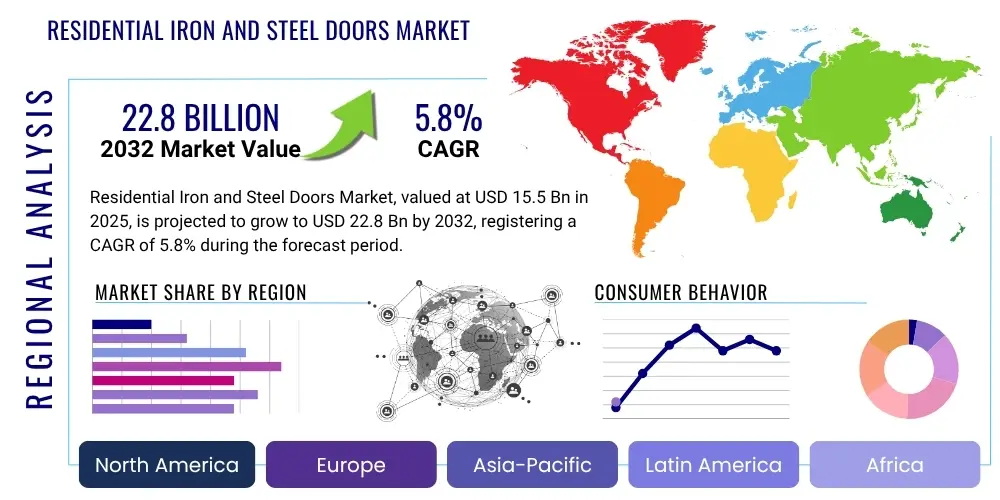

Residential Iron and Steel Doors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431291 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Residential Iron and Steel Doors Market Size

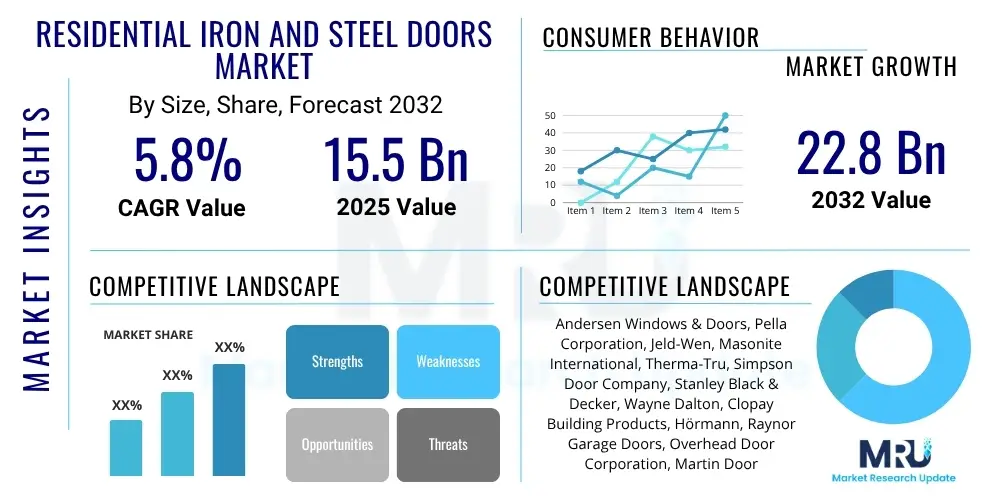

The Residential Iron and Steel Doors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 15.5 Billion in 2025 and is projected to reach USD 22.8 Billion by the end of the forecast period in 2032.

Residential Iron and Steel Doors Market introduction

The Residential Iron and Steel Doors Market encompasses the manufacturing, distribution, and sale of various types of doors made primarily from iron and steel materials for use in residential properties. These doors are renowned for their superior strength, durability, security features, and aesthetic versatility, making them a popular choice for homeowners seeking long-lasting and visually appealing entry points or internal access solutions. Products within this market range from robust entry doors and elegant patio doors to fortified security doors and custom-designed interior accents, all fabricated to meet stringent performance and design specifications.

Major applications for residential iron and steel doors include main entryways, enhancing home security, improving energy efficiency, and providing distinctive architectural elements for new constructions and renovation projects. The inherent benefits of these doors, such as exceptional resistance to forced entry, fire resistance, weather durability, and low maintenance, significantly contribute to their market appeal. Key driving factors propelling market growth include the escalating demand for enhanced home security, increasing disposable incomes leading to higher investment in home aesthetics and quality, a growing trend in home renovation and remodeling activities, and a sustained boom in global residential construction.

Residential Iron and Steel Doors Market Executive Summary

The Residential Iron and Steel Doors Market is poised for substantial growth, driven by a confluence of evolving consumer preferences, technological advancements, and a robust global construction sector. Business trends indicate a strong emphasis on customization, with homeowners increasingly seeking bespoke designs that align with unique architectural styles and personal tastes. Manufacturers are responding by offering a broader array of finishes, glass options, and hardware, alongside integrating smart home capabilities such as keyless entry systems and remote access controls. The focus on energy efficiency is also shaping product development, with innovations in insulation and thermal breaks becoming standard to meet modern building codes and consumer demand for sustainable living.

Regional trends reveal dynamic growth across various geographies. North America and Europe continue to represent significant market shares, characterized by mature housing markets and a consistent demand for high-quality, durable doors, particularly in renovation and luxury segments. However, the Asia Pacific region is emerging as a critical growth engine, propelled by rapid urbanization, burgeoning middle-class populations, and large-scale residential development projects in countries like China and India. Latin America and the Middle East and Africa are also experiencing steady expansion, fueled by increasing investment in residential infrastructure and a growing awareness of modern housing solutions. These regions offer lucrative opportunities for market players to expand their footprint and cater to diverse consumer needs.

Segment trends highlight the dominance of steel doors due to their cost-effectiveness, strength, and versatility in design, though wrought iron doors maintain their niche in high-end, custom architectural applications. Security doors are experiencing heightened demand globally as homeowners prioritize safety, leading to innovations in multi-point locking systems and reinforced structures. Furthermore, the market is witnessing a shift towards doors that offer a blend of aesthetic appeal and functional performance, prompting manufacturers to invest in research and development to create products that are both visually striking and technologically advanced. The commercialization of smart doors, featuring integrated IoT solutions, is expected to further redefine consumer expectations and market dynamics in the coming years, pushing the boundaries of traditional door functionality.

AI Impact Analysis on Residential Iron and Steel Doors Market

User inquiries regarding AI's influence on the Residential Iron and Steel Doors Market often revolve around how artificial intelligence can enhance security, streamline manufacturing processes, personalize design, and improve overall product functionality. Common themes include the integration of AI for advanced access control systems, predictive maintenance capabilities for smart doors, and leveraging AI in design software for custom aesthetic solutions. Users frequently express interest in how AI might contribute to energy efficiency by optimizing insulation properties or by enabling doors to adapt to environmental conditions. There is also a keen interest in whether AI can make these sophisticated door systems more affordable and accessible to a wider residential market, balancing innovation with cost-effectiveness.

- AI-powered smart access control: Integration of facial recognition, fingerprint scanning, and voice commands for enhanced security and convenience.

- Predictive maintenance: AI algorithms analyze sensor data from smart doors to anticipate wear and tear, scheduling maintenance proactively.

- Automated manufacturing and quality control: AI and machine learning optimize production lines, detect defects, and ensure consistent product quality.

- Personalized design and customization: AI-driven software assists homeowners and designers in creating bespoke door designs, finishes, and configurations.

- Energy efficiency optimization: AI can analyze usage patterns and environmental data to optimize thermal performance and insulation features in real-time.

- Supply chain optimization: AI enhances logistics, inventory management, and raw material sourcing, leading to more efficient production and delivery.

- Enhanced security features: AI integration with surveillance systems for anomaly detection and real-time threat alerts through door sensors.

DRO & Impact Forces Of Residential Iron and Steel Doors Market

The Residential Iron and Steel Doors Market is significantly influenced by a dynamic interplay of driving forces, inherent restraints, and emerging opportunities, all shaped by broader impact forces. Key drivers include the robust growth in global residential construction, particularly in developing economies, which fuels demand for new building materials. The increasing emphasis on home security, driven by rising crime rates and homeowner awareness, positions iron and steel doors as a primary choice due to their superior strength and resistance to forced entry. Furthermore, a growing consumer preference for durable, low-maintenance, and aesthetically pleasing building components, coupled with rising disposable incomes, encourages investment in premium door solutions. The ongoing trend of home renovation and remodeling also contributes substantially to market expansion, as homeowners upgrade their properties with modern and secure doors.

However, the market faces several restraints that could impede its growth trajectory. The relatively high initial cost of iron and steel doors compared to traditional wood or fiberglass alternatives can deter budget-conscious consumers. The substantial weight of these doors often necessitates reinforced framing and specialized installation, adding to overall project costs and complexity. Furthermore, while generally low maintenance, iron doors may require periodic rust prevention treatments in certain climates, and steel doors can be prone to dents if not properly handled, which can be a point of concern for some homeowners. Market penetration in certain regions is also limited by traditional preferences for alternative materials or by local building codes that may not fully accommodate these heavier door types.

Despite these challenges, numerous opportunities are emerging within the sector. The integration of smart home technologies, such as advanced locking mechanisms, biometric access, and remote monitoring systems, presents a significant avenue for innovation and market differentiation. The growing demand for customizable and bespoke door solutions, allowing homeowners to tailor designs, finishes, and glass inserts, caters to the luxury and architectural segments. Advancements in material science and coating technologies are leading to the development of lighter, more corrosion-resistant, and energy-efficient iron and steel doors, addressing previous drawbacks. Moreover, expanding distribution channels, including online retail and partnerships with large-scale homebuilders, offer new pathways for market penetration and consumer reach, particularly in untapped or rapidly developing regions. These opportunities, coupled with ongoing technological advancements and evolving consumer demands, are critical in shaping the future landscape of the market.

Segmentation Analysis

The Residential Iron and Steel Doors Market is comprehensively segmented based on various attributes including material type, application, design, mechanism, and sales channel, providing a detailed understanding of market dynamics and consumer preferences. This granular segmentation allows for a precise analysis of specific market niches, growth drivers, and competitive landscapes across different product categories and end-user requirements. Each segment reflects unique characteristics in terms of production processes, target demographics, and market potential, enabling stakeholders to identify lucrative opportunities and tailor their strategies effectively within the diverse residential construction and renovation sectors.

- By Material:

- Wrought Iron Doors

- Steel Doors

- By Application:

- Entry Doors

- Patio Doors

- Security Doors

- Interior Doors

- Garage Doors

- By Design:

- Traditional Designs

- Modern Designs

- Custom Designs

- By Mechanism:

- Hinged Doors

- Sliding Doors

- Bi-fold Doors

- Pivot Doors

- By Sales Channel:

- Direct Sales (Manufacturer to Consumer)

- Distributors and Wholesalers

- Retail Stores (Home Improvement Stores)

- Online Retail

- Contractors and Builders

Value Chain Analysis For Residential Iron and Steel Doors Market

The value chain for the Residential Iron and Steel Doors Market begins with upstream activities focused on the sourcing and processing of raw materials. This involves the extraction and refinement of iron ore to produce steel, and the procurement of other essential components such as glass, insulation materials, hardware (hinges, locks, handles), and various coatings. Key upstream players include steel mills, glass manufacturers, and component suppliers, whose efficiency and quality directly impact the cost and performance of the final door product. Effective management of these upstream processes, including sustainable sourcing and quality control, is crucial for maintaining competitive pricing and ensuring the structural integrity and aesthetic appeal of the doors. Innovation in material science at this stage can also lead to enhanced durability, lighter weight, and improved thermal efficiency.

Midstream activities involve the manufacturing and assembly of the doors. This stage includes processes such as cutting, welding, bending, and shaping of iron and steel components, followed by the integration of glass panels, insulation, and hardware. Manufacturers often employ advanced technologies like CAD/CAM systems, laser cutting, and robotic welding to achieve precision and efficiency. Customization plays a significant role here, with manufacturers offering a wide array of designs, finishes, and dimensions to meet specific residential requirements. Quality assurance and rigorous testing are integral to ensure products meet industry standards for security, durability, and energy performance. After manufacturing, doors are typically transported to distribution centers, either owned by the manufacturer or by third-party logistics providers.

Downstream activities encompass distribution, sales, and installation, reaching the end-user. Distribution channels are varied, including direct sales from manufacturers to consumers, sales through a network of independent distributors and wholesalers, large home improvement retail chains, and specialized contractors or builders. Direct and indirect channels each offer unique benefits; direct sales allow for greater control over customer service and pricing, while indirect channels provide wider market reach and localized installation expertise. Installation services, often provided by third-party contractors or specialized installers, are a critical part of the value chain, ensuring proper fit, functionality, and security. Post-sales services, such as warranty support and maintenance, further enhance customer satisfaction and contribute to brand loyalty, completing the comprehensive value delivery to residential customers.

Residential Iron and Steel Doors Market Potential Customers

The primary potential customers and end-users for residential iron and steel doors are homeowners who are either building new residences or undertaking renovation and remodeling projects. These individuals seek durable, secure, and aesthetically appealing door solutions that contribute to the overall value, safety, and curb appeal of their homes. Homeowners with a focus on long-term investment often prioritize the robust construction and low maintenance benefits of iron and steel, especially for main entry doors and security applications. The demographic includes both high-income individuals investing in custom luxury homes and middle-income families upgrading their existing properties for enhanced security and energy efficiency.

Beyond individual homeowners, custom home builders and residential developers represent a significant customer segment. These professionals frequently specify iron and steel doors for their projects, recognizing the superior quality, security, and architectural distinction they offer. Architects and interior designers also act as influential buyers, recommending these doors to their clients to achieve specific design aesthetics, improve structural integrity, or meet particular performance requirements for high-end residential designs. Their purchasing decisions are often driven by design flexibility, material quality, and the ability of manufacturers to deliver bespoke solutions that align with their creative visions and project specifications, making them crucial intermediaries in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.5 Billion |

| Market Forecast in 2032 | USD 22.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Andersen Windows & Doors, Pella Corporation, Jeld-Wen, Masonite International, Therma-Tru, Simpson Door Company, Stanley Black & Decker, Wayne Dalton, Clopay Building Products, Hörmann, Raynor Garage Doors, Overhead Door Corporation, Martin Door, Delmarva Iron & Steel, Iron Doors Unlimited, Applegate Doors, Portella Steel Doors & Windows, Panda Windows & Doors, LaCantina Doors, Sun Mountain Custom Doors |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Residential Iron and Steel Doors Market Key Technology Landscape

The Residential Iron and Steel Doors market leverages a diverse array of advanced technologies across its entire lifecycle, from design and manufacturing to installation and end-user functionality. In the design phase, Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) software are indispensable, enabling engineers and designers to create intricate and precise door specifications, perform structural analyses, and visualize custom configurations before physical production. This digital tooling facilitates rapid prototyping, reduces design errors, and allows for extensive customization, meeting the growing demand for bespoke architectural solutions in residential properties. The integration of 3D modeling and rendering further enhances the visualization process, providing homeowners with realistic previews of their chosen door designs and finishes.

Manufacturing processes are increasingly automated, incorporating technologies such as laser cutting, CNC (Computer Numerical Control) machining, and robotic welding. Laser cutting offers high precision and efficiency in shaping metal sheets, minimizing material waste and achieving complex patterns that were previously challenging. Robotic welding ensures consistent weld quality, strength, and speed, significantly improving production throughput and structural integrity. Advanced coating technologies, including powder coating, electrostatic painting, and specialized anti-corrosion treatments, are crucial for enhancing durability, weather resistance, and aesthetic appeal, extending the lifespan of the doors and reducing maintenance requirements for homeowners. These technologies not only improve product quality but also contribute to more sustainable manufacturing practices through optimized material usage and reduced waste generation.

Furthermore, the market is experiencing a significant technological shift with the integration of smart home features into residential iron and steel doors. This includes advanced locking systems such as biometric scanners (fingerprint or facial recognition), keyless entry keypads, and smart locks that can be controlled remotely via smartphone applications. These systems often incorporate wireless connectivity (Wi-Fi, Bluetooth, Zigbee) to seamlessly integrate with broader smart home ecosystems, offering enhanced security, convenience, and monitoring capabilities. Sensors for intrusion detection, door status (open/closed), and even environmental conditions are becoming common, allowing for proactive security alerts and energy management. These technological advancements are transforming doors from simple barriers into sophisticated security and access points, greatly enhancing their value proposition for modern residential consumers.

Regional Highlights

- North America: A mature market characterized by high demand for premium, customized, and energy-efficient iron and steel doors, particularly in the renovation and luxury home segments. The U.S. and Canada are significant contributors, driven by strong residential construction activity and an emphasis on security and aesthetic value.

- Europe: Exhibits consistent growth, with countries like Germany, the UK, and France leading the adoption of advanced security doors and thermally efficient steel doors. Strict building regulations and a focus on sustainable construction further drive market demand.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid urbanization, increasing disposable incomes, and large-scale residential development projects in China, India, and Southeast Asian countries. Growing awareness of security and modern aesthetics is boosting market penetration.

- Latin America: Showing steady growth, with Brazil and Mexico as key markets. The region benefits from increasing investments in housing infrastructure and a rising preference for durable and secure door solutions.

- Middle East and Africa (MEA): Emerging market driven by burgeoning real estate sectors, particularly in the UAE, Saudi Arabia, and South Africa. High-end residential projects and a focus on robust security solutions contribute to market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Residential Iron and Steel Doors Market.- Andersen Windows & Doors

- Pella Corporation

- Jeld-Wen

- Masonite International

- Therma-Tru

- Simpson Door Company

- Stanley Black & Decker

- Wayne Dalton

- Clopay Building Products

- Hörmann

- Raynor Garage Doors

- Overhead Door Corporation

- Martin Door

- Delmarva Iron & Steel

- Iron Doors Unlimited

- Applegate Doors

- Portella Steel Doors & Windows

- Panda Windows & Doors

- LaCantina Doors

- Sun Mountain Custom Doors

Frequently Asked Questions

What are the primary benefits of installing residential iron and steel doors?

Residential iron and steel doors offer superior security against forced entry, exceptional durability, resistance to fire, and require minimal maintenance. They also provide significant aesthetic versatility, enhancing a home's curb appeal and architectural style.

How does AI impact the security features of modern residential doors?

AI integration enhances door security through smart access control systems like biometric scanners (fingerprint, facial recognition), remote monitoring, and anomaly detection. These systems provide advanced threat alerts and allow homeowners to manage access from anywhere.

What are the main factors driving growth in the Residential Iron and Steel Doors Market?

Key growth drivers include rising demand for enhanced home security, increasing residential construction and renovation activities, growing disposable incomes, and a strong consumer preference for durable, aesthetically pleasing, and low-maintenance building materials.

Are residential iron and steel doors energy efficient?

Modern residential iron and steel doors can be highly energy-efficient, especially when designed with insulated cores, thermal breaks, and low-emissivity glass. Manufacturers are increasingly focusing on these features to meet energy efficiency standards and consumer demand for reduced utility costs.

What distinguishes wrought iron doors from steel doors in residential applications?

Wrought iron doors are typically known for their intricate, ornate designs and handcrafted appeal, often favored for high-end custom homes seeking a classic or luxurious aesthetic. Steel doors, while also customizable, are generally more prevalent for their robust strength, cost-effectiveness, and versatility in modern and contemporary designs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager