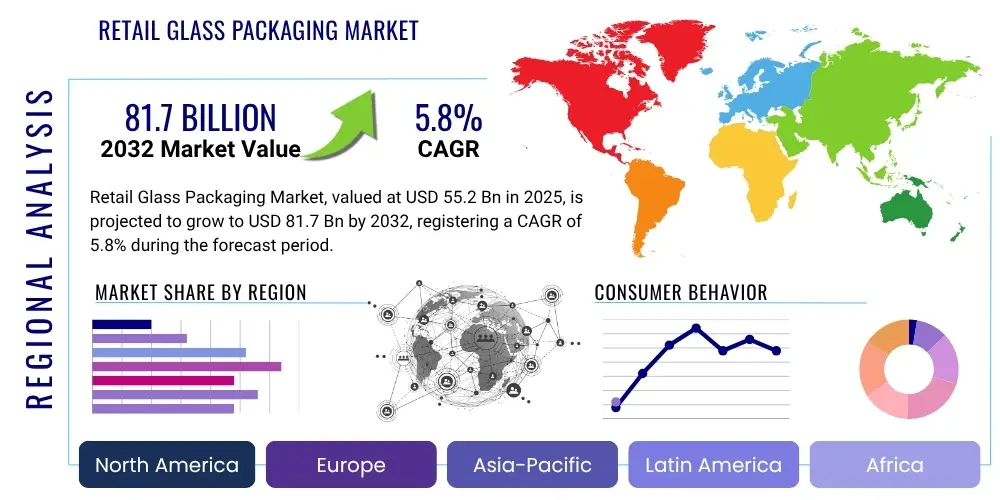

Retail Glass Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430019 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Retail Glass Packaging Market Size

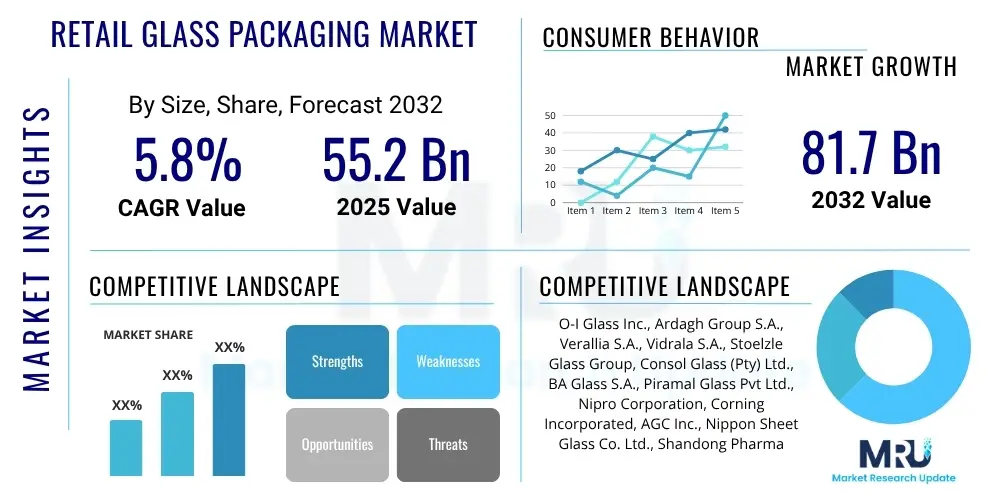

The Retail Glass Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 55.2 Billion in 2025 and is projected to reach USD 81.7 Billion by the end of the forecast period in 2032.

Retail Glass Packaging Market introduction

The Retail Glass Packaging Market encompasses the global production, distribution, and consumption of glass containers specifically designed for direct sale to consumers across a diverse range of industries. This market is characterized by the unique properties of glass, including its pristine clarity, chemical inertness, and impermeable barrier capabilities, which are crucial for preserving the quality, purity, and shelf life of various products. Glass is also highly prized for its aesthetic appeal, offering a premium and sophisticated presentation that significantly enhances brand perception and consumer appeal, particularly in high-value segments.

The product portfolio within this market is extensive, ranging from standard and specialty bottles for beverages such as spirits, wines, beers, and soft drinks, to jars used for food items like sauces, jams, and baby food. Beyond comestibles, glass packaging is vital for pharmaceutical vials and ampoules, ensuring drug stability and safety, as well as for cosmetic and personal care containers that exude elegance and protect sensitive formulations. The primary benefits driving the adoption of glass packaging include its exceptional recyclability, allowing for infinite reuse without degradation, its non-reactive surface that prevents interaction with contents, and its ability to offer superior product visibility, contributing to informed consumer choices.

Growth in the retail glass packaging market is propelled by several macro and microeconomic factors. A significant driver is the increasing global consumer demand for sustainable packaging alternatives amidst growing environmental concerns, positioning glass as a highly favorable choice due to its circular economy potential. Furthermore, the rising premiumization trend across various consumer goods sectors, where brands leverage glass packaging to signify quality and luxury, strongly supports market expansion. Other contributing factors include expanding global populations, rising disposable incomes in emerging economies, and the continuous innovation in glass manufacturing processes that enhance design versatility, lightweighting, and cost-effectiveness, making glass a competitive option against other packaging materials.

Retail Glass Packaging Market Executive Summary

The Retail Glass Packaging Market is currently experiencing a dynamic growth phase, fueled by a confluence of evolving consumer preferences, stringent regulatory frameworks, and technological advancements. Business trends underscore a pronounced emphasis on sustainability, leading to widespread adoption of recycled glass content (cullet) and the development of lightweight packaging solutions that reduce both material consumption and transportation-related carbon footprints. Furthermore, brand owners are increasingly investing in distinctive glass designs and decoration techniques to achieve significant shelf standout and reinforce their premium product positioning, creating a competitive environment focused on innovation and aesthetic appeal.

Regional dynamics play a crucial role in shaping market growth. The Asia Pacific region is emerging as a dominant force, driven by rapid industrialization, expanding urban populations, and a burgeoning middle class with increasing purchasing power, leading to a surge in demand for packaged food and beverages. Europe maintains its position as a key market, characterized by mature recycling infrastructures, strong consumer inclination towards sustainable products, and a significant presence of premium brands in the alcoholic beverage and cosmetics sectors. North America is also witnessing robust growth, particularly in the craft brewing, spirits, and health-conscious food segments, where glass is favored for its perceived purity and eco-friendly attributes.

Segmentation analysis reveals that the beverage industry continues to be the largest end-user segment for retail glass packaging, especially for alcoholic beverages like beer, wine, and spirits, where glass contributes to the ritual and premium experience. The food sector, including categories like sauces, condiments, and specialty foods, also demonstrates consistent and growing demand due to glass's ability to preserve freshness and enhance product visibility. Additionally, the pharmaceutical and cosmetics industries are significant contributors, leveraging glass for its inertness, barrier properties, and sophisticated appearance. Ongoing diversification of product offerings and the customization capabilities of glass manufacturers are key trends observed across these end-use sectors.

AI Impact Analysis on Retail Glass Packaging Market

Common user questions regarding AI's impact on the Retail Glass Packaging Market frequently inquire about its potential to revolutionize operational efficiency, enhance product quality, streamline supply chain management, and contribute to sustainability goals. Users are keen to understand how AI-driven analytics can optimize glass furnace operations, predict maintenance needs for machinery, and improve precision in the forming and inspection processes. Concerns often center around the significant capital expenditure required for AI integration, the necessity for a highly skilled workforce to manage these advanced systems, and the potential for job displacement due to increased automation. However, there is a strong expectation that AI will unlock new levels of efficiency, reduce waste, and enable greater flexibility in responding to dynamic market demands, ultimately fostering a more intelligent and sustainable packaging industry.

- Enhanced production line automation and efficiency through AI-powered robotics for handling, sorting, and packaging.

- Predictive maintenance for glass manufacturing machinery, reducing downtime and extending equipment lifespan.

- Improved quality control with advanced AI vision systems capable of detecting minuscule defects at high speeds.

- Optimized raw material blending and furnace temperature control, leading to significant energy savings and reduced emissions.

- Supply chain optimization through AI algorithms for demand forecasting, inventory management, and logistics routing.

- Personalized glass packaging design and customization capabilities utilizing generative AI for rapid prototyping and aesthetic variations.

- Development of smart packaging solutions that integrate AI for real-time tracking, anti-counterfeiting measures, and consumer interaction.

- Advanced data analytics for identifying market trends, consumer preferences, and optimizing product development cycles.

- Facilitation of sustainable practices by optimizing cullet usage and improving the efficiency of glass recycling processes.

DRO & Impact Forces Of Retail Glass Packaging Market

The Retail Glass Packaging Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, alongside various external impact forces that collectively dictate its growth trajectory and competitive landscape. A primary driver for market expansion is the escalating global emphasis on sustainability and circular economy principles, positioning glass as an environmentally superior packaging material due to its infinite recyclability without loss of quality. This environmental advantage resonates strongly with eco-conscious consumers and supports brand image. Furthermore, the enduring consumer perception of glass as a premium, safe, and inert material, particularly for preserving taste and freshness in food and beverages, significantly boosts its demand across high-value product categories. The continuous growth of the food and beverage industry, coupled with rising disposable incomes in developing regions, further amplifies the need for sophisticated and reliable glass packaging solutions.

Conversely, the market faces notable restraints that can impede its growth. The inherent fragility of glass poses significant logistical challenges, leading to higher rates of breakage during transportation and handling, which translates into increased costs and potential product losses for manufacturers and retailers. Glass is also considerably heavier than alternative packaging materials such as plastic or aluminum, resulting in higher freight costs and a larger carbon footprint during shipping, which can diminish its competitive edge, especially for long-distance distribution. Moreover, the glass manufacturing process is notoriously energy-intensive, requiring high temperatures that contribute to substantial energy consumption and associated greenhouse gas emissions, presenting a challenge for companies striving to achieve stringent environmental targets and reduce operational expenses.

Despite these challenges, numerous opportunities exist for market players to innovate and expand. The development and widespread adoption of lightweight glass packaging technologies, such as Narrow Neck Press and Blow (NNPB) and Advanced Press and Blow (APB), offer a significant avenue to mitigate issues of weight and fragility, making glass more competitive and sustainable. Enhanced utilization of recycled glass content (cullet) in manufacturing processes represents a crucial opportunity to reduce reliance on virgin raw materials, lower energy consumption, and decrease production costs, aligning with circular economy goals. Furthermore, the growing demand for personalized and aesthetically unique packaging designs, driven by branding and consumer engagement strategies, opens doors for advancements in decoration techniques like digital printing and specialized coatings, allowing for greater customization and premium differentiation on retail shelves. Exploring untapped emerging markets with burgeoning consumer bases and developing their glass recycling infrastructure also presents substantial long-term growth potential.

Segmentation Analysis

The Retail Glass Packaging Market is meticulously segmented to provide a granular understanding of its diverse components, offering insights into market structure, consumer preferences, and growth opportunities across various categories. These segmentations are critical for businesses to develop targeted strategies, optimize their product portfolios, and effectively address the specific needs of different end-use sectors and geographic regions. The market is typically analyzed based on product type, reflecting the different forms of glass containers; end-use industry, indicating the primary sectors consuming these packages; and color, which often relates to product protection and aesthetic appeal.

Understanding these distinct segments allows for a more precise evaluation of market trends. For instance, the beverage industry often favors bottles, while the food industry relies heavily on jars. Pharmaceutical applications demand high-quality vials and ampoules, underscoring the specialized nature of demand within each end-use category. Similarly, clear (flint) glass is preferred where product visibility is paramount, whereas amber glass is essential for light-sensitive contents. The comprehensive segmentation analysis provides a strategic framework for identifying niche markets, assessing competitive landscapes, and forecasting future growth trajectories within the dynamic retail glass packaging ecosystem.

- By Product Type

- Bottles: Widely used for beverages (alcoholic, non-alcoholic), pharmaceuticals, and cosmetics, offering high aesthetic appeal and brand differentiation.

- Jars: Predominantly used in the food industry for preserves, sauces, baby food, and specialty items, valued for storage and display.

- Vials: Essential for pharmaceutical applications, including injectable drugs and diagnostic reagents, ensuring sterility and precise dosing.

- Ampoules: Small, sealed glass containers primarily used for single-dose pharmaceuticals, providing a sterile environment.

- Containers (other): Includes various specialized glass packaging forms tailored for specific industrial or consumer applications.

- By End-Use Industry

- Food Industry: Encompasses a broad range of products requiring safe and durable packaging, maintaining freshness and flavor.

- Dairy: Glass bottles for milk and dairy drinks, offering purity and premium perception.

- Fruits and Vegetables: Jars for preserves, pickles, and canned vegetables, extending shelf life.

- Meat, Poultry, and Seafood: Specialty jars for patés and premium seafood products.

- Other Food Products: Includes condiments, sauces, spreads, and baby food.

- Beverage Industry: The largest segment, relying on glass for brand image, taste preservation, and sustainability.

- Alcoholic Beverages: Beer, wine, and spirits bottles, known for enhancing brand value and consumer experience.

- Non-Alcoholic Beverages: Soft drinks, water, and juices, chosen for purity and premium appeal.

- Pharmaceutical Industry: Critical for drug integrity, sterility, and patient safety, utilizing vials, ampoules, and bottles.

- Cosmetics and Personal Care Industry: Leverages glass for luxury branding, product protection, and aesthetic design for perfumes, lotions, and creams.

- Chemicals and Other Industries: Includes specialty chemicals, laboratory reagents, and certain household products requiring inert and robust packaging.

- Food Industry: Encompasses a broad range of products requiring safe and durable packaging, maintaining freshness and flavor.

- By Color

- Flint (Clear): Offers maximum product visibility, preferred for showcasing contents and enhancing aesthetic appeal.

- Amber: Provides UV protection, crucial for light-sensitive products in pharmaceuticals, beer, and certain food items.

- Green: Traditionally used for wines and some beers, offering a classic aesthetic and some light protection.

- Blue: Used for specific cosmetic and beverage products, often chosen for its unique branding and premium feel.

- Other Colors: Custom colors developed for specific brand differentiation and marketing strategies.

Value Chain Analysis For Retail Glass Packaging Market

The value chain of the Retail Glass Packaging Market is a comprehensive network of interconnected activities, beginning with the extraction and processing of fundamental raw materials. Upstream activities are centered on the procurement of high-quality silica sand, soda ash, and limestone, which are the primary components of glass. These raw materials undergo rigorous purification and blending processes to ensure the consistency and optical clarity of the final glass product. Energy, predominantly in the form of natural gas and electricity, constitutes a critical and substantial input for the high-temperature melting furnaces, representing a significant portion of manufacturing costs. Key suppliers in this segment focus on reliability, material quality, and environmental compliance, impacting both the economic viability and ecological footprint of glass production.

Midstream activities encompass the sophisticated manufacturing processes involved in transforming raw materials into finished glass containers. This stage includes melting the batch ingredients at extremely high temperatures, followed by precise forming processes (such as blow and blow, press and blow, or narrow neck press and blow methods) to create bottles, jars, and vials of desired shapes and sizes. Subsequent annealing processes carefully cool the glass to remove internal stresses, enhancing durability. Finishing processes involve surface treatments for scratch resistance and strength, along with thorough inspection for defects. Manufacturers invest heavily in advanced machinery, automation, and quality control systems to ensure product integrity and optimize operational efficiency. Innovations in lightweighting and the incorporation of higher percentages of recycled cullet (recycled glass) are pivotal at this stage to improve sustainability and reduce production costs.

The downstream segment of the value chain involves the distribution, end-use application, and eventual recycling of glass packaging. Manufactured glass containers are transported to various end-use industries, including food and beverage, pharmaceuticals, and cosmetics, where they are filled, capped, labeled, and prepared for retail. Distribution channels can be direct, involving large-scale contracts between glass manufacturers and major consumer goods companies, or indirect, utilizing wholesalers and distributors to reach smaller businesses and specialized markets. Efficient logistics and warehousing are paramount to minimize breakage and ensure timely delivery. Post-consumer, the value chain extends to collection, sorting, and processing of used glass as cullet, which is then fed back into the upstream manufacturing process. The effectiveness of recycling infrastructure is a key determinant in achieving a truly circular economy for glass packaging, reducing landfill waste and conserving natural resources.

Retail Glass Packaging Market Potential Customers

The Retail Glass Packaging Market caters to a diverse and expansive customer base across multiple industries, all of whom seek reliable, aesthetically pleasing, and protective packaging solutions for their products. The largest segment of potential customers resides within the food and beverage industry. This includes global conglomerates and local artisanal producers of alcoholic beverages (beer, wine, spirits), non-alcoholic drinks (juices, soft drinks, water), dairy products, and a vast array of food items such as sauces, jams, preserves, oils, and baby food. These customers prioritize glass for its inertness, which prevents chemical migration and preserves the original taste and quality of contents, alongside its ability to elevate brand perception and offer an appealing shelf presence.

Another critically important customer segment is the pharmaceutical industry, where glass packaging is indispensable for ensuring the safety, stability, and efficacy of sensitive medical products. Pharmaceutical companies extensively utilize glass vials, ampoules, and bottles for injectable drugs, vaccines, and various liquid or solid medications. The stringent regulatory requirements for drug packaging, coupled with glass's superior barrier properties against oxygen, moisture, and contaminants, make it the material of choice. The industry relies on specialized, high-purity glass types to prevent any interaction with pharmaceutical formulations, ensuring product integrity throughout its shelf life.

The cosmetics and personal care sector also represents a substantial and growing customer base for retail glass packaging. Brands in this industry, from luxury perfume houses to high-end skincare lines, frequently choose glass for its inherent elegance, tactile quality, and ability to convey a sense of premiumness and sophistication. Glass bottles, jars, and other containers are used for perfumes, serums, lotions, creams, and nail polishes. The aesthetic versatility of glass, allowing for intricate designs, custom colors, and various finishing techniques, enables cosmetic companies to create distinctive packaging that reinforces their brand identity and appeals directly to discerning consumers who associate glass with quality and luxury. Furthermore, the chemical inertness of glass ensures product stability, particularly for delicate formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 55.2 Billion |

| Market Forecast in 2032 | USD 81.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | O-I Glass Inc., Ardagh Group S.A., Verallia S.A., Vidrala S.A., Stoelzle Glass Group, Consol Glass (Pty) Ltd., BA Glass S.A., Piramal Glass Pvt Ltd., Nipro Corporation, Corning Incorporated, AGC Inc., Nippon Sheet Glass Co. Ltd., Shandong Pharmaceutical Glass Co. Ltd., Bormioli Rocco S.p.A., Heye International GmbH, Vitro S.A.B. de C.V., Hindustan National Glass & Industries Ltd., Vetropack Holding AG, Gerresheimer AG, Wiegand-Glas GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Retail Glass Packaging Market Key Technology Landscape

The Retail Glass Packaging Market is continuously being shaped by a dynamic and evolving technological landscape, with innovations primarily focused on enhancing manufacturing efficiency, product performance, and environmental sustainability. A cornerstone of this technological progress lies in advanced furnace designs and operational optimization. Modern glass furnaces increasingly incorporate oxy-fuel combustion technology, which uses pure oxygen instead of air for combustion, leading to higher flame temperatures, reduced fuel consumption, and significant reductions in nitrogen oxide (NOx) emissions. Electric melting furnaces and hybrid systems are also gaining traction, particularly in regions with access to renewable energy, offering a path towards decarbonization of glass production. Furthermore, sophisticated raw material preheating systems and cullet (recycled glass) beneficiation technologies are being employed to maximize the incorporation of recycled content, thereby lowering virgin material use and overall energy demand.

Product innovation is heavily driven by lightweighting technologies, which enable the production of glass containers that are significantly lighter yet maintain comparable strength and durability. Techniques such as Narrow Neck Press and Blow (NNPB) and Advanced Press and Blow (APB) allow for the creation of intricate, sophisticated designs with thinner walls, reducing material usage by up to 30-40% for certain applications. This not only decreases the environmental footprint but also lowers transportation costs for both manufacturers and end-users. Surface treatment technologies are also crucial, involving the application of hot-end coatings (e.g., tin oxide) and cold-end coatings (e.g., polyethylene waxes or stearate-based solutions) to enhance scratch resistance, lubricity, and overall strength of the glass, minimizing breakage during high-speed filling lines and extending product lifecycle.

Digitalization, automation, and smart manufacturing principles are fundamentally transforming the glass packaging industry. Robotic systems are widely deployed for precision handling, high-speed inspection, and automated palletizing, leading to increased throughput and reduced labor costs. Advanced vision systems, often powered by artificial intelligence and machine learning algorithms, are capable of detecting even microscopic defects at extremely high speeds, ensuring unparalleled quality control and minimizing product rejects. Moreover, innovative decoration technologies, including multi-color digital printing, laser engraving, and specialized frosting or embossing, allow for greater design complexity and customization, empowering brands to create highly distinctive and premium packaging that captures consumer attention. The integration of smart packaging features, such as QR codes, NFC tags, and even embedded sensors, is an emerging trend enabling enhanced traceability, anti-counterfeiting measures, and interactive consumer engagement experiences, further differentiating glass packaging in a competitive market.

Regional Highlights

- North America: This region demonstrates a strong and consistent demand for high-quality, aesthetically pleasing, and sustainable glass packaging. Growth is particularly robust in the craft beverage sector (beer, spirits, non-alcoholic artisanal drinks) and specialty food segments, where glass is preferred for its premium perception and purity. Innovations in lightweighting and the increased use of recycled content are key trends, driven by evolving consumer environmental consciousness and the expanding e-commerce landscape that requires durable yet lighter packaging solutions.

- Europe: A highly mature and influential market for retail glass packaging, characterized by some of the world's highest glass recycling rates and stringent environmental regulations. European consumers exhibit a strong preference for glass in premium food, alcoholic beverages, and high-end cosmetics, valuing its quality, tradition, and environmental benefits. The region is a hub for technological advancements in sustainable glass production, including energy-efficient furnaces and advanced cullet processing, reflecting a deep commitment to circular economy principles.

- Asia Pacific (APAC): Positioned as the fastest-growing region in the retail glass packaging market. This rapid expansion is primarily fueled by accelerated urbanization, significant increases in disposable incomes, and the burgeoning growth of the packaged food and beverage industries across countries like China, India, and Southeast Asian nations. There is substantial investment in establishing new manufacturing capacities and adopting advanced glassmaking technologies to meet the burgeoning domestic and export demands. The shift towards premium products also drives demand for sophisticated glass solutions.

- Latin America: The market here is experiencing steady growth, propelled by a rising middle class, increasing consumption of both alcoholic and non-alcoholic beverages, and the expansion of the food processing industry. There is a notable focus on strengthening local production capabilities and reducing reliance on imports. Opportunities are emerging particularly in the adoption of more sustainable packaging solutions, including lightweight glass and increased recycling initiatives, as environmental awareness grows among consumers and industries alike.

- Middle East and Africa (MEA): Represents an emerging market with considerable potential for glass packaging growth. Demand is influenced by factors such as significant population growth, economic diversification efforts, and rising urbanization. Key sectors driving adoption include the food and beverage industry, particularly for premium bottled water, juices, and traditional food items, alongside the growing perfume and cosmetics markets. Efforts to develop and enhance local recycling infrastructures are underway, which will be crucial for the sustainable expansion of glass packaging in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Retail Glass Packaging Market.- O-I Glass Inc.

- Ardagh Group S.A.

- Verallia S.A.

- Vidrala S.A.

- Stoelzle Glass Group

- Consol Glass (Pty) Ltd.

- BA Glass S.A.

- Piramal Glass Pvt Ltd.

- Nipro Corporation

- Corning Incorporated

- AGC Inc.

- Nippon Sheet Glass Co. Ltd.

- Shandong Pharmaceutical Glass Co. Ltd.

- Bormioli Rocco S.p.A.

- Heye International GmbH

- Vitro S.A.B. de C.V.

- Hindustan National Glass & Industries Ltd.

- Vetropack Holding AG

- Gerresheimer AG

- Wiegand-Glas GmbH

Frequently Asked Questions

Why is glass considered a sustainable packaging option?

Glass is highly sustainable because it is 100% and infinitely recyclable without any loss in quality or purity, allowing for continuous reuse in a closed loop. It is produced from abundant natural raw materials like sand, soda ash, and limestone. Its inert composition also ensures it does not leach harmful chemicals into products or the environment.

What are the primary challenges faced by the retail glass packaging market?

Key challenges include glass's inherent fragility, leading to breakage during transit and handling which increases costs; its heavier weight compared to alternatives, resulting in higher transportation expenses and a larger carbon footprint; and the significant energy required for its manufacturing process, impacting production costs and environmental emissions.

How is technology impacting glass packaging?

Technology is profoundly impacting glass packaging through innovations like lightweighting techniques to reduce material usage, advanced furnace designs (e.g., oxy-fuel) for energy efficiency and emission reduction, and automation/AI-powered vision systems for enhanced quality control and production efficiency. Digital printing also enables greater customization and aesthetic differentiation.

Which industries are the largest consumers of retail glass packaging?

The food and beverage industries are the largest consumers, extensively utilizing glass for alcoholic and non-alcoholic drinks, sauces, jams, and baby food, valuing its preservation qualities and premium aesthetic. The pharmaceutical and cosmetics sectors also heavily rely on glass for its inertness, barrier properties, and sophisticated presentation.

What are the future trends in the retail glass packaging market?

Future trends include a continued strong focus on lightweighting and maximizing recycled content (cullet) to enhance sustainability. There is also a growing adoption of smart packaging features, such as QR codes for traceability and consumer engagement, personalized design capabilities driven by advanced decoration, and strategic expansion into high-growth emerging markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager