Returnable Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430806 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Returnable Packaging Market Size

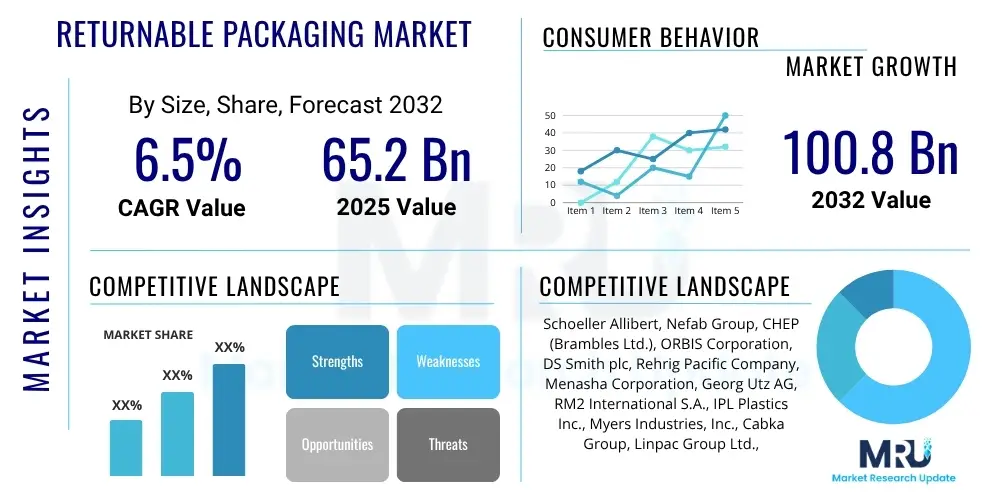

The Returnable Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 65.2 Billion in 2025 and is projected to reach USD 100.8 Billion by the end of the forecast period in 2032.

Returnable Packaging Market introduction

The Returnable Packaging Market encompasses reusable packaging solutions, including containers, pallets, racks, and dunnage, designed for multiple trips within a supply chain. These robust and durable packaging types are primarily manufactured from materials such as plastic, metal, and wood, offering significant advantages over single-use alternatives. Their core function is to facilitate the safe and efficient transport of goods while minimizing waste generation and reducing overall packaging costs over their lifecycle. The inherent reusability of these products contributes directly to circular economy principles, making them an increasingly attractive option for industries globally.

Major applications for returnable packaging span a wide array of sectors, with prominent usage in automotive, food and beverage, consumer goods, and industrial manufacturing. In the automotive industry, for example, returnable containers and racks are crucial for transporting components between suppliers and assembly plants. Benefits derived from adopting returnable packaging include enhanced product protection, optimized logistics, improved inventory management, and substantial reductions in environmental impact. The shift towards sustainable business practices, coupled with stringent environmental regulations and the rising cost of disposable packaging, acts as a significant driving factor for market expansion. This paradigm shift emphasizes long-term value creation and operational resilience.

The increasing focus on supply chain efficiency and the digitalization of logistics further propel the adoption of returnable packaging. Companies are continually seeking ways to streamline operations, reduce waste, and demonstrate corporate social responsibility. Returnable packaging directly addresses these objectives by offering a standardized, durable, and environmentally friendly solution that can be integrated into automated systems. The robust design of these packaging units often leads to lower product damage rates, enhancing customer satisfaction and reducing costs associated with product returns or replacements. This integrated approach to packaging and logistics underscores its growing importance in modern global supply chains.

Returnable Packaging Market Executive Summary

The global Returnable Packaging Market is experiencing robust growth driven by converging trends in business sustainability, supply chain optimization, and regional regulatory pressures. Businesses are increasingly prioritizing environmental, social, and governance (ESG) factors, leading to a greater adoption of reusable packaging solutions to reduce waste and carbon footprint. This strategic shift is influencing procurement decisions across various industries, pushing manufacturers to invest in more durable and sustainable logistics assets. The trend towards automation and smart logistics further integrates returnable packaging, as these systems benefit from standardized and robust container designs, enhancing efficiency and reducing manual handling requirements.

Regionally, the market exhibits diverse growth patterns. Asia Pacific is emerging as a significant growth hub, fueled by rapid industrialization, expanding manufacturing sectors, and increasing awareness of sustainable practices, particularly in countries like China and India. Europe, with its advanced environmental regulations and strong emphasis on circular economy initiatives, continues to be a mature market with consistent demand for sophisticated returnable packaging solutions. North America is also witnessing substantial adoption, propelled by large-scale industries such as automotive and food and beverage, which are keen on cost savings and efficiency gains through optimized supply chains.

Segment-wise, plastic returnable packaging holds a dominant share due to its versatility, durability, and cost-effectiveness, though metal and wood alternatives also maintain their niche. Pallets and containers represent the largest product segments, essential for unit load handling and efficient material flow. The automotive industry remains a key end-user, relying heavily on returnable packaging for just-in-time delivery and inter-plant logistics. However, the food and beverage and e-commerce sectors are showing accelerated growth in adopting returnable solutions, driven by consumer demand for sustainable products and the need to manage reverse logistics efficiently. The overall market trajectory indicates a clear move towards integrated, technologically advanced, and environmentally conscious packaging ecosystems.

AI Impact Analysis on Returnable Packaging Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the efficiency, sustainability, and cost-effectiveness of returnable packaging systems. Key concerns often revolve around AI's capability to optimize asset tracking, predict maintenance needs for packaging units, and enhance overall supply chain visibility. There is a strong expectation that AI will provide smarter inventory management solutions, minimize loss or damage of returnable assets, and improve the efficiency of collection and redistribution processes. Users are keen to understand AI's role in improving the entire lifecycle management of reusable packaging, from optimizing routes for returns to extending the lifespan of assets through predictive analytics, ultimately leading to greater operational savings and a reduced environmental footprint.

- Enhanced Asset Tracking and Visibility: AI-powered analytics integrate data from RFID, IoT sensors, and GPS to provide real-time location and status of returnable packaging units, reducing loss and optimizing utilization.

- Predictive Maintenance: AI algorithms analyze usage patterns and sensor data to forecast potential wear and tear, scheduling maintenance proactively to extend the lifespan of packaging assets and prevent operational disruptions.

- Optimized Logistics and Route Planning: AI-driven software dynamically optimizes collection and delivery routes for returnable packaging, minimizing fuel consumption, transit times, and associated logistics costs.

- Demand Forecasting and Inventory Management: AI improves the accuracy of forecasting demand for packaging units, ensuring optimal inventory levels, reducing excess stock, and preventing shortages.

- Quality Control and Damage Detection: Computer vision and AI can automate the inspection of returned packaging, quickly identifying damage or contamination and streamlining the sorting and repair processes.

- Improved Sustainability Metrics: AI can track and report on environmental benefits, such as carbon emission reductions and waste diversion, attributed to returnable packaging, aiding sustainability reporting.

- Automated Sorting and Cleaning: AI-enabled robotics and vision systems can automate the sorting and cleaning of various returnable packaging types, increasing throughput and hygiene standards.

DRO & Impact Forces Of Returnable Packaging Market

The Returnable Packaging Market is significantly shaped by a combination of key drivers, inherent restraints, and emerging opportunities, all interacting with various impact forces that influence its trajectory. One primary driver is the escalating global emphasis on sustainability and circular economy principles, pushing industries to minimize waste and resource consumption. This is further bolstered by stringent environmental regulations and corporate sustainability initiatives that favor reusable solutions over single-use packaging. The tangible cost savings associated with reusable packaging over its lifecycle, stemming from reduced material procurement and waste disposal costs, also acts as a powerful economic driver for businesses seeking operational efficiencies. Additionally, the need for enhanced product protection and standardized logistics across complex supply chains promotes the adoption of durable, multi-trip packaging.

Despite these strong drivers, the market faces several restraints that can impede its growth. The initial capital investment required for purchasing high-quality, durable returnable packaging can be substantial, especially for smaller businesses, acting as a barrier to entry. Managing the logistics of reverse flows – collecting, inspecting, cleaning, and redistributing used packaging – adds complexity to supply chain operations and can be a significant logistical challenge. Lack of standardization across different industries or regions for packaging dimensions and tracking technologies can also create interoperability issues, limiting widespread adoption. Furthermore, concerns regarding hygiene, especially in food and pharmaceutical applications, necessitate rigorous cleaning and inspection protocols, which add to operational costs and complexity.

Opportunities for market expansion are abundant, particularly in emerging economies undergoing rapid industrialization and infrastructure development. Technological advancements, such as the integration of IoT, RFID, and AI for smart tracking and management of packaging assets, present significant growth avenues, enhancing efficiency and reducing operational overhead. Expanding the application of returnable packaging into new sectors like e-commerce, where efficient reverse logistics are critical, offers substantial untapped potential. Collaborative pooling systems and third-party logistics (3PL) providers specializing in returnable packaging management also represent a growing opportunity, helping businesses overcome the initial investment and logistical complexities. The ongoing global push for supply chain resilience and optimization, exacerbated by recent disruptions, further highlights the value proposition of robust, reusable packaging solutions.

Segmentation Analysis

The Returnable Packaging Market is comprehensively segmented based on various critical attributes including material type, product type, and end-use industry. This segmentation provides a detailed understanding of market dynamics, growth opportunities, and the specific needs of different sectors. Each segment reflects distinct characteristics in terms of durability, cost, application suitability, and environmental impact, allowing for a nuanced analysis of market trends and consumer preferences. The intricate interplay between these segments defines the competitive landscape and informs strategic decisions for manufacturers and end-users alike, highlighting areas of specialization and broader market adoption patterns.

- By Material

- Plastic (HDPE, PP, PET)

- Metal (Steel, Aluminum)

- Wood

- Others (Composite, Fabric)

- By Product

- Pallets

- Containers (Handheld, Bulk)

- Racks

- Drums

- Crates

- Dunnage

- Intermediate Bulk Containers (IBCs)

- Others

- By End-Use Industry

- Automotive

- Food & Beverage

- Consumer Goods

- Industrial Manufacturing

- Healthcare & Pharmaceutical

- Chemicals

- Retail & E-commerce

- Electronics

- Logistics & Transportation

- Others

Value Chain Analysis For Returnable Packaging Market

The value chain for the Returnable Packaging Market begins with upstream activities primarily involving raw material procurement. This segment includes suppliers of plastics such as HDPE, PP, and PET granules, metals like steel and aluminum, and wood from sustainable forestry. These raw material providers form the foundational layer, dictating the quality, cost, and environmental footprint of the final packaging products. Strategic partnerships with these suppliers are crucial for ensuring a consistent supply, managing cost volatility, and promoting sustainable sourcing practices. The innovation in material science at this stage, particularly in developing lighter yet stronger plastics or recycled content, significantly influences the properties and market appeal of returnable packaging.

Further along the value chain, manufacturing and assembly convert raw materials into finished returnable packaging products. This includes injection molding for plastic containers, welding and fabrication for metal racks, and woodworking for pallets. Manufacturers often specialize in specific product types and materials, leveraging advanced production technologies to ensure durability, precision, and cost-effectiveness. The midstream also involves value-added services such as customization, branding, and the integration of tracking technologies like RFID or IoT sensors. Post-manufacturing, the distribution channel plays a pivotal role. Direct sales from manufacturers to large end-users are common, particularly for highly customized solutions. However, the market heavily relies on indirect channels, including third-party logistics (3PL) providers and specialized pooling service companies.

Downstream activities center around the end-users and the management of the packaging lifecycle. This includes the initial deployment of packaging units into the supply chain, their use in transporting goods, and the subsequent collection, inspection, cleaning, repair, and redistribution processes. Logistics companies and pooling providers manage these complex reverse logistics, ensuring the efficient recovery and reuse of assets. These entities often employ sophisticated tracking and management systems to optimize inventory and reduce loss. The end-users, encompassing various industries, are the ultimate beneficiaries, integrating returnable packaging into their operational flows to achieve cost savings and sustainability goals. The efficiency of the entire value chain is interdependent on effective communication and collaboration between all stakeholders, from raw material suppliers to end-use industries, to maximize the economic and environmental benefits of returnable packaging.

Returnable Packaging Market Potential Customers

The primary potential customers and end-users of returnable packaging solutions are diverse, spanning a wide array of industrial and commercial sectors that prioritize supply chain efficiency, sustainability, and cost optimization. At the forefront are industries with high-volume, repetitive shipping needs for components or finished goods, such as the automotive manufacturing sector, which relies heavily on returnable containers and racks for just-in-time delivery and inter-plant logistics. Similarly, the food and beverage industry frequently utilizes returnable crates, pallets, and intermediate bulk containers for the transportation of raw materials, ingredients, and finished products, driven by stringent hygiene requirements and the need to reduce packaging waste in their extensive distribution networks.

Beyond these established sectors, the consumer goods industry represents a substantial customer base, adopting returnable solutions for internal logistics, supplier networks, and increasingly for direct-to-consumer delivery models where reverse logistics are managed efficiently. Industrial manufacturing companies, dealing with heavy machinery parts, electronics components, and other high-value items, also form a significant segment, valuing the robust protection and long-term cost benefits offered by returnable packaging. The healthcare and pharmaceutical sectors are emerging as key customers, particularly for sensitive and regulated goods, where sterile, reusable containers can ensure product integrity and reduce waste in clinical and laboratory settings.

Furthermore, the logistics and transportation sector itself, including third-party logistics (3PL) providers and warehousing companies, are integral customers. They often invest in returnable packaging to offer value-added services to their clients, optimizing their own operational efficiency and contributing to sustainable supply chains. The rapid expansion of e-commerce also presents a growing opportunity, with companies exploring innovative returnable solutions for last-mile delivery and reverse logistics, driven by consumer demand for eco-friendly shipping options. In essence, any business seeking to enhance its supply chain's economic and environmental performance through durable, reusable asset management is a potential customer for returnable packaging.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 65.2 Billion |

| Market Forecast in 2032 | USD 100.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schoeller Allibert, Nefab Group, CHEP (Brambles Ltd.), ORBIS Corporation, DS Smith plc, Rehrig Pacific Company, Menasha Corporation, Georg Utz AG, RM2 International S.A., IPL Plastics Inc., Myers Industries, Inc., Cabka Group, Linpac Group Ltd., Clip-Lok SimPak, Loadhog, TranPak Inc., Polymer Solutions International, Inc., SSI Schaefer, Craemer GmbH, GEFCO. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Returnable Packaging Market Key Technology Landscape

The Returnable Packaging Market is increasingly being shaped by the integration of advanced technologies designed to enhance efficiency, traceability, and asset management throughout the supply chain. Central to this technological evolution is the widespread adoption of Internet of Things (IoT) devices, including RFID tags and GPS trackers. These technologies enable real-time monitoring of returnable assets, providing precise location data, movement history, and even environmental conditions within containers. This level of visibility is crucial for optimizing logistics, reducing loss rates, improving inventory accuracy, and ensuring the timely return and reuse of packaging units. The data collected from these sensors forms the foundation for more intelligent management decisions, driving operational improvements across the entire lifecycle of reusable packaging.

Further enhancing the technological landscape is the application of data analytics and artificial intelligence (AI) and machine learning (ML). These powerful tools process the vast amounts of data generated by IoT sensors to identify patterns, predict maintenance needs, and optimize various aspects of returnable packaging operations. AI algorithms can forecast demand for packaging, determine optimal routing for collection and delivery, and even assess the lifespan of individual assets based on usage and historical wear patterns. This predictive capability allows businesses to move from reactive to proactive management, minimizing downtime, extending asset life, and achieving significant cost savings. Blockchain technology is also gaining traction, offering immutable record-keeping for asset ownership, tracking, and transactions, thereby enhancing transparency and trust in complex multi-stakeholder pooling systems.

Automation and robotics are also playing a transformative role, particularly in warehousing, sorting, and cleaning processes for returnable packaging. Automated guided vehicles (AGVs) and robotic arms can handle, sort, and stack packaging units with greater speed and accuracy than manual methods, reducing labor costs and improving throughput. Vision systems integrated with AI can perform rapid quality inspections, identifying damaged or contaminated units for repair or cleaning, ensuring hygienic standards are maintained for food and pharmaceutical applications. These technological advancements collectively contribute to a smarter, more efficient, and sustainable returnable packaging ecosystem. They enable better resource utilization, reduce operational complexities, and provide a competitive edge to companies that strategically integrate them into their supply chain operations.

Regional Highlights

- North America: This region is a mature market driven by the strong presence of the automotive, food and beverage, and retail industries. Key factors include a focus on supply chain optimization, robust infrastructure, and increasing sustainability mandates. The United States and Canada are leading the adoption, with a growing emphasis on smart returnable packaging solutions.

- Europe: Europe stands out due to stringent environmental regulations and a strong commitment to circular economy initiatives. Countries like Germany, the UK, and France are pioneering innovative returnable packaging systems, often supported by government policies and a well-established pooling infrastructure. The region prioritizes eco-friendly materials and advanced tracking technologies.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapid industrialization, expanding manufacturing sectors, and increasing consumer awareness regarding sustainability. China, India, and Japan are significant contributors, with burgeoning automotive and electronics industries. Investment in logistics infrastructure and a growing middle class further fuel demand.

- Latin America: This region is experiencing steady growth, largely driven by the expansion of manufacturing and agricultural sectors. Brazil and Mexico are key markets, with increasing adoption in the food and beverage and automotive industries. Economic development and a focus on efficiency are critical drivers.

- Middle East and Africa (MEA): The MEA market is in its nascent stages but shows promising growth potential, particularly in the UAE, Saudi Arabia, and South Africa. Investments in logistics infrastructure, diversification of economies, and rising environmental consciousness are contributing to the gradual uptake of returnable packaging solutions across various industrial sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Returnable Packaging Market.- Schoeller Allibert

- Nefab Group

- CHEP (Brambles Ltd.)

- ORBIS Corporation

- DS Smith plc

- Rehrig Pacific Company

- Menasha Corporation

- Georg Utz AG

- RM2 International S.A.

- IPL Plastics Inc.

- Myers Industries, Inc.

- Cabka Group

- Linpac Group Ltd.

- Clip-Lok SimPak

- Loadhog

- TranPak Inc.

- Polymer Solutions International, Inc.

- SSI Schaefer

- Craemer GmbH

- GEFCO

Frequently Asked Questions

What is returnable packaging and why is it important?

Returnable packaging refers to durable, reusable containers, pallets, or racks designed for multiple trips within a supply chain. It is crucial for reducing waste, lowering operational costs over time, and enhancing environmental sustainability by promoting a circular economy model in logistics and manufacturing.

Which industries are the primary users of returnable packaging?

The automotive industry is a leading user, alongside food and beverage, consumer goods, and industrial manufacturing sectors. These industries benefit from the robust protection, cost savings, and logistical efficiencies offered by reusable packaging solutions for high-volume, repetitive shipments.

How do current environmental regulations influence the Returnable Packaging Market?

Stringent environmental regulations globally, coupled with a growing corporate focus on sustainability, are significantly driving the demand for returnable packaging. These regulations often incentivize or mandate waste reduction and the adoption of reusable solutions to minimize ecological impact.

What technological advancements are impacting returnable packaging?

Key technological advancements include the integration of IoT and RFID for real-time tracking, AI and machine learning for optimized logistics and predictive maintenance, and automation in handling and inspection processes. These technologies boost efficiency, traceability, and overall asset management.

What are the main challenges faced by the Returnable Packaging Market?

Challenges include the high initial capital investment, the complexity of managing reverse logistics (collection, cleaning, redistribution), and the lack of universal standardization across different industries and regions. Ensuring hygiene, especially for sensitive goods, also adds operational complexity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager