Reusable Paper and Cardboard Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430868 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Reusable Paper and Cardboard Packaging Market Size

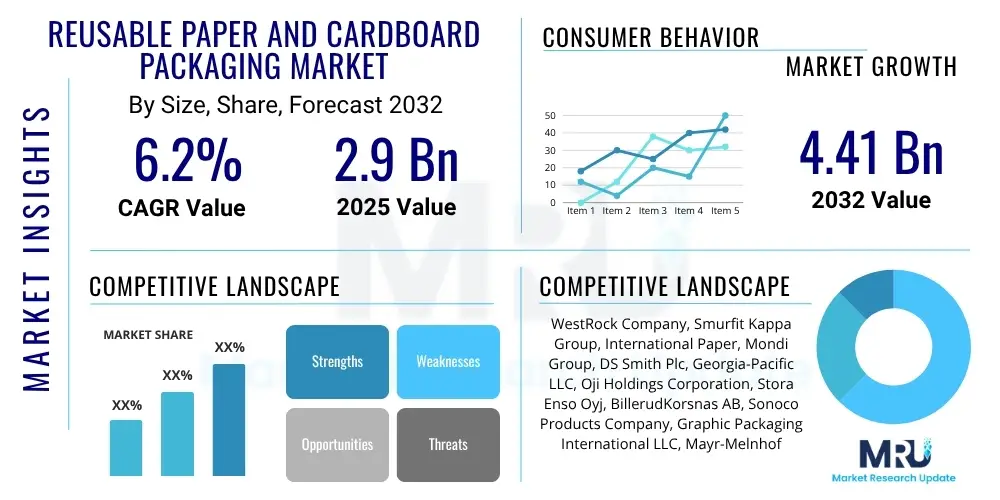

The Reusable Paper and Cardboard Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2032. The market is estimated at USD 2.9 Billion in 2025 and is projected to reach USD 4.41 Billion by the end of the forecast period in 2032.

Reusable Paper and Cardboard Packaging Market introduction

The global Reusable Paper and Cardboard Packaging Market is currently undergoing a transformative phase, experiencing robust expansion driven by an accelerating imperative for environmental sustainability across diverse industrial sectors. This market encapsulates a comprehensive array of packaging solutions meticulously engineered from paper and cardboard materials, primarily designed for extensive reuse cycles. These reusable systems significantly deviate from traditional single-use paradigms by actively aiming to curtail waste generation, minimize raw material consumption, and reduce overall environmental impact throughout their operational lifespan. Such packaging products are frequently characterized by their enhanced structural integrity, modular adaptability, and an intrinsic ease with which they can be either recycled or refurbished, thereby contributing directly to a circular economy model.

The product portfolio within this dynamic market segment is expansive, encompassing resilient corrugated boxes, versatile folding cartons, specialized trays, and protective inserts. These items are predominantly fabricated from either high-quality recycled pulp or responsibly procured virgin fibers, employing advanced manufacturing techniques to ensure they withstand the rigors of repeated handling, transit, and storage. The fundamental utility of these packaging solutions lies in their capacity to offer superior protection for a myriad of goods, ranging from delicate electronics to bulk industrial components, while concurrently upholding paramount environmental objectives. Critical applications for reusable paper and cardboard packaging are extensively observed across a multitude of industries, including the burgeoning e-commerce sector, the expansive food and beverage industry, the precision-driven pharmaceutical domain, the complex automotive manufacturing landscape, and the highly optimized logistics and supply chain operations, all of which are increasingly adopting sustainable practices.

The tangible benefits associated with the widespread adoption of reusable paper and cardboard packaging are multifaceted and far-reaching. These include a substantial reduction in virgin material consumption, a notable decrease in carbon emissions across the supply chain, a significant diversion of packaging waste from landfills, and the potential realization of substantial long-term operational cost savings through optimized procurement and waste management strategies. The market's vigorous growth trajectory is propelled by several pivotal driving factors, such as aggressive corporate sustainability mandates, a discernible shift in consumer preferences towards brands that demonstrate genuine environmental responsibility, continuous technological breakthroughs in material science leading to enhanced packaging durability, and supportive governmental policies that actively champion circular economy models and reinforce extended producer responsibility frameworks. These combined forces are collectively shaping a resilient and rapidly expanding market for reusable paper and cardboard packaging.

Reusable Paper and Cardboard Packaging Market Executive Summary

The global Reusable Paper and Cardboard Packaging Market is poised for remarkable growth, intricately influenced by dynamic business trends that underscore the critical importance of both supply chain efficiency and rigorous environmental stewardship. Corporations across the spectrum are progressively embedding reusable packaging solutions into their core logistical frameworks, not only to meet ambitious sustainability targets but also to bolster their brand reputation and market differentiation. This fundamental paradigm shift is a potent catalyst for extensive innovation in advanced packaging design, the development of sophisticated material composites, and the integration of cutting-edge tracking technologies, all aimed at optimizing the arduous reuse cycles and mitigating potential damage rates during transit and handling. Furthermore, the market is witnessing an increasing prevalence of strategic alliances and collaborative ventures between prominent packaging manufacturers, key logistics service providers, and diverse end-user industries, collectively fostering the establishment of robust closed-loop systems and accelerating industry-wide adoption of sustainable packaging practices.

Geographically, the market landscape reveals distinct patterns of growth and maturity. Europe and North America currently hold dominant positions, primarily attributed to their proactive early adoption of comprehensive environmental regulations, the presence of highly advanced waste management infrastructures, and a consistently strong consumer demand for ethically produced and sustainable product offerings. Conversely, the Asia Pacific region is rapidly emerging as the foremost growth engine for this market. This accelerated expansion is largely driven by unprecedented rates of industrialization, the exponential growth of e-commerce platforms, and increasingly supportive governmental policies advocating for sustainable practices in economic powerhouses such as China and India. Emerging markets in Latin America, the Middle East, and Africa are also demonstrating promising, albeit foundational, growth trajectories, stimulated by rapid urbanization, rising disposable incomes, and a nascent yet growing awareness regarding environmental conservation.

A granular analysis of market segmentation reveals diverse opportunities and trends. The market is comprehensively segmented by intrinsic product characteristics (e.g., advanced corrugated boxes, sophisticated folding cartons, specialized trays), by the primary material source (e.g., meticulously recycled content, sustainably sourced virgin fiber), by the specific end-use industry application (e.g., high-volume e-commerce, complex food and beverage logistics, demanding automotive supply chains), and by the functional application within the packaging hierarchy (e.g., primary containment, secondary bundling, tertiary transit packaging). The e-commerce sector is unequivocally projected to exhibit the most substantial growth, propelled by the sheer volumetric expansion of online shipments and the pressing imperative for environmentally sound delivery solutions. Moreover, continuous advancements in the development of hyper-durable paperboard and innovative protective coatings are significantly enhancing the longevity and multi-use capability of products across all delineated segments, thereby ensuring sustained market momentum and fostering long-term resilience.

AI Impact Analysis on Reusable Paper and Cardboard Packaging Market

There is considerable user interest in understanding how Artificial Intelligence (AI) will fundamentally transform the operational efficiency, traceability, and environmental performance of reusable packaging systems, specifically within the paper and cardboard domain. Common inquiries frequently center on AI's capacity to significantly optimize the intricate processes of reverse logistics, accurately predict the remaining lifespan and optimal maintenance schedule of packaging assets, enhance the precision of material sorting for recycling and reuse streams, and even contribute to the intelligent personalization of packaging designs based on usage data. Users are increasingly seeking AI-driven solutions for real-time tracking of individual reusable assets, minimizing systemic losses, and rigorously ensuring that packaging units maintain optimal levels of cleanliness, structural integrity, and aesthetic appeal for their subsequent reuse cycles. The overarching expectation from AI is its ability to furnish actionable, data-driven insights that will profoundly influence sustainable procurement strategies, streamline operational workflows, and ultimately reduce the overall costs inherently associated with the comprehensive management of a large-scale, distributed reusable packaging fleet, thereby contributing significantly to both economic and ecological benefits.

- Optimized Reverse Logistics: AI algorithms drive the efficient planning and execution of collection routes and return processes for used packaging, minimizing transportation costs and carbon emissions.

- Predictive Maintenance and Lifespan: AI analyzes historical usage data to forecast individual packaging unit wear-and-tear, scheduling proactive maintenance or identifying optimal retirement points for recycling.

- Enhanced Quality Control: Computer vision and machine learning identify damage, contamination, or structural weaknesses in reusable packaging, ensuring only suitable units re-enter the supply chain, reducing waste.

- Automated Sorting and Segregation: AI-powered systems accurately sort different types of paper and cardboard packaging, as well as separate them from non-recyclable components, significantly improving recycling rates and material purity for reuse.

- Real-time Asset Tracking and Inventory Management: Integration of AI with IoT sensors and RFID tags provides precise, real-time visibility into the location, status, and availability of every reusable packaging unit, optimizing inventory levels and preventing loss.

- Supply Chain Optimization: AI analyzes demand patterns and logistics data to optimize packaging replenishment, storage, and distribution, reducing lead times and improving overall operational fluidity.

- Sustainable Design Feedback: AI can process usage data to provide insights into packaging performance, informing designers on how to create more durable, efficient, and easily reusable paper and cardboard solutions.

- Fraud Detection and Loss Prevention: AI monitors usage patterns to detect anomalies or potential theft of reusable packaging assets, safeguarding investments within the circular system.

DRO & Impact Forces Of Reusable Paper and Cardboard Packaging Market

The Reusable Paper and Cardboard Packaging Market is intricately influenced by a powerful combination of drivers, significant restraints, and compelling opportunities that collectively dictate its growth trajectory and competitive landscape. A primary driver is the pervasive and escalating global emphasis on environmental sustainability, which permeates governmental policies, corporate strategies, and consumer purchasing decisions. This is augmented by a robust and growing consumer demand for products delivered in eco-friendly packaging, compelling brands to adopt sustainable alternatives. Furthermore, the proliferation of stringent governmental regulations, such as extended producer responsibility schemes and targets for packaging waste reduction, actively promotes the transition towards circular economy models. These external pressures, coupled with internal corporate commitments to drastically reduce carbon footprints and minimize landfill waste, alongside the quantifiable potential for long-term operational cost savings derived from reduced virgin material procurement and waste disposal fees, serve as formidable motivators for widespread market adoption. The inherent advantages of paper and cardboard as renewable, biodegradable, and highly recyclable resources further solidify their appeal within this evolving market.

Despite these potent drivers, the market navigates several discernible restraints that could potentially temper its expansive growth. A significant barrier involves the substantial initial capital investment often required to establish and scale comprehensive reusable packaging infrastructures. This includes not only the procurement of durable packaging units but also the development of sophisticated reverse logistics networks encompassing dedicated facilities for collection, rigorous cleaning, precise sorting, and efficient redistribution. Another critical restraint pertains to the inherent durability concerns associated with paper-based materials, particularly when subjected to repeated exposure to moisture, fluctuating temperatures, or heavy mechanical stresses over multiple use cycles. While significant advancements are being made, ensuring consistent performance under varied conditions remains a technical challenge. Moreover, the operational complexity of managing reverse logistics, which involves the coordination of collection from diverse points, ensuring effective cleaning protocols, and seamless redistribution across vast geographical areas, demands highly sophisticated and often expensive management systems, posing implementation hurdles for many businesses.

Notwithstanding the existing challenges, the market is replete with substantial and transformative opportunities. The exponential growth of the global e-commerce sector presents an immense potential for the large-scale integration of reusable delivery packaging solutions, offering a viable alternative to the enormous volumes of single-use waste currently generated by online retail. Continuous innovations in advanced material science, such as the development of cutting-edge water-resistant coatings, bio-based barrier films, and high-strength fiber compositions, are profoundly enhancing the longevity, structural integrity, and overall performance attributes of paper and cardboard products, thereby extending their effective lifespan for multiple reuse cycles. Furthermore, the rapid evolution and deployment of advanced tracking technologies, including state-of-the-art RFID, NFC, and sophisticated Internet of Things (IoT) sensors, are poised to revolutionize reverse logistics by providing unprecedented real-time visibility and control. These technological advancements promise to streamline operations, improve asset utilization rates, and enhance overall efficiency within reusable packaging systems, unlocking new avenues for sustained market expansion, fostering deeper industry collaborations, and ultimately driving significant value creation across the entire supply chain.

Segmentation Analysis

The comprehensive segmentation analysis of the Reusable Paper and Cardboard Packaging Market offers invaluable granularity, enabling a nuanced understanding of its intricate dynamics and diverse growth trajectories. This methodical dissection of the market into distinct categories is fundamental for crafting precision-targeted market entry strategies, identifying emergent demand patterns, and gaining a clearer, more actionable perspective on the specific requirements of various industrial sectors. The primary analytical dimensions typically revolve around crucial parameters such as the intrinsic product type, the foundational material source, the specific end-use industry application, and the functional role within the packaging hierarchy. Each of these segments exhibits unique characteristics, distinct market drivers, and varying growth potentials, collectively contributing to the market's overarching expansion and resilience within the broader sustainable packaging ecosystem.

Understanding the interplay between these segments is paramount for all stakeholders, from raw material suppliers to end-users, facilitating informed strategic planning and investment decisions. For instance, the demand for corrugated boxes in e-commerce differs significantly from the requirements for folding cartons in retail, necessitating specialized design and material properties. Similarly, the choice between recycled and virgin fiber-based materials is often dictated by regulatory compliance, brand sustainability goals, and specific performance criteria. Analyzing these segments not only helps in identifying the most lucrative niches but also aids in forecasting future trends, anticipating shifts in consumer preferences, and preparing for regulatory changes, thereby allowing companies to adapt their product offerings and operational models effectively to capture market share.

- Product Type: Categorization based on the structural design and application format of the packaging.

- Corrugated Boxes: High-strength, multi-layered cardboard boxes often used for shipping, storage, and e-commerce.

- Folding Cartons: Lightweight, foldable paperboard boxes common for retail product packaging, offering good printability.

- Trays and Inserts: Custom-molded or folded paperboard components used for product protection, separation, and organization within larger packages.

- Bags and Sacks: Robust paper bags designed for multiple uses, particularly in retail and grocery sectors as alternatives to plastic.

- Other Specialty Products: Includes custom-designed reusable containers, protective dividers, and innovative modular systems for specific industry needs.

- Material Source: Classification based on the origin of the paper and cardboard fibers.

- Recycled Paper and Cardboard: Made from post-consumer or post-industrial waste, emphasizing circularity and resource efficiency.

- Virgin Fiber Paper and Cardboard: Sourced directly from sustainably managed forests, often chosen for specific strength or aesthetic requirements.

- End-Use Industry: Segmentation based on the primary sector utilizing the packaging.

- E-commerce: Packaging for direct-to-consumer shipments, requiring durability for transit and ease of return.

- Food and Beverage: Transport and secondary packaging for food items, often requiring food-grade coatings or specific hygiene standards.

- Retail: Packaging used within retail environments for product display, in-store logistics, and consumer carry-home solutions.

- Automotive: Robust containers for transporting components and parts within automotive supply chains.

- Pharmaceuticals and Healthcare: Specialized packaging for medical supplies, often demanding strict cleanliness and traceability.

- Logistics and Transportation: General-purpose reusable containers for inter-warehouse transfers and supply chain optimization.

- Consumer Goods: Packaging for a broad range of non-food consumer products, focusing on brand appeal and protection.

- Industrial: Heavy-duty packaging for bulk materials, machinery components, and industrial supplies.

- Application: Classification based on the packaging's function in relation to the product.

- Primary Packaging: Direct containment of the product, often consumer-facing and designed for multiple uses.

- Secondary Packaging: Bundles primary packages, provides branding, and adds further protection for retail or transit.

- Tertiary Packaging: Bulk packaging for transport and warehousing (e.g., pallets, large shipping containers), optimized for logistics efficiency.

Value Chain Analysis For Reusable Paper and Cardboard Packaging Market

The value chain for the Reusable Paper and Cardboard Packaging Market is a complex, circular ecosystem that begins with meticulous upstream activities focused on raw material procurement and initial processing. This foundational stage involves the responsible sourcing of sustainable virgin wood fibers from certified, well-managed forests, or, more significantly, the collection, sorting, and pre-processing of post-consumer and post-industrial recycled paper and cardboard waste. Specialized pulp and paper mills then transform these raw materials into various forms of paperboard sheets, linerboard, and corrugated mediums, which serve as the essential feedstock for subsequent manufacturing processes. Critical research and development efforts at this initial stage are intensely concentrated on innovating material compositions to enhance strength, improve moisture resistance, and ensure exceptional overall durability, which are all paramount characteristics for packaging designed to withstand numerous use cycles, thereby contributing directly to resource conservation and minimizing environmental impact.

Midstream activities within the value chain encompass the intricate processes of design, manufacturing, and final assembly of the reusable packaging products. Highly specialized packaging converters employ advanced converting machinery and sophisticated fabrication techniques to precisely cut, score, fold, print, and often laminate the prepared paperboard into a diverse array of functional forms, including robust corrugated boxes, elegantly designed folding cartons, and highly protective, custom-engineered trays and inserts. This phase frequently incorporates principles of innovative design for modularity, facilitating ease of assembly and disassembly, and reinforcing structural integrity to guarantee prolonged reusability. Subsequent to manufacturing, the efficient movement of finished packaging to end-users is managed through well-established logistics and distribution channels, which include both direct supply relationships with large industrial clients and indirect networks leveraging distributors and wholesalers to reach a broader, more diversified market segment. Concurrently, the crucial reverse logistics infrastructure for the seamless collection and return of used packaging is meticulously established and operated.

Downstream activities are centered on the actual end-use of the packaging, followed by its critical re-entry into the circular economy loop through collection, refurbishment, or recycling. Once the reusable packaging has completed its primary function for brands or consumers, it is systematically inducted into a reverse logistics network for efficient collection, a process often facilitated by dedicated third-party logistics (3PL) providers or strategically located return points. The collected packaging then undergoes rigorous inspection, thorough cleaning, and necessary repair processes to meticulously restore its pristine condition and functional integrity, rendering it ready for subsequent reuse cycles. Packaging units that are deemed damaged beyond economical repair or unsuitable for further reuse are responsibly channeled into specialized recycling facilities. Here, the materials are meticulously processed and transformed back into raw pulp, thereby re-entering the upstream supply chain as recycled content, effectively closing the loop and exemplifying the core tenets of a truly circular economy. Direct distribution channels are typically employed when manufacturers supply directly to major industrial clients or large retail chains with consistent, high-volume requirements. Conversely, indirect channels, involving a network of distributors, wholesalers, and specialized packaging brokers, are utilized to efficiently serve a more fragmented market, including small and medium-sized enterprises (SMEs) and those requiring highly specialized or customized packaging solutions.

Reusable Paper and Cardboard Packaging Market Potential Customers

The potential customer base for reusable paper and cardboard packaging solutions is remarkably extensive and highly diversified, spanning nearly every sector that necessitates the efficient, secure, and sustainable packing, transportation, and storage of goods. The primary demographic of end-users or buyers comprises a broad spectrum of entities, ranging from multinational corporations to nimble small and medium-sized enterprises (SMEs), all of whom share a common strategic imperative: a steadfast commitment to sustainability initiatives, a proactive desire to significantly reduce their environmental footprint, or a pressing need to rigorously comply with an ever-evolving landscape of packaging regulations. This includes, but is not limited to, businesses operating within high-volume industries where the generation of packaging waste represents both a significant environmental concern and a considerable operational cost, making reusable options economically and ecologically attractive.

The burgeoning e-commerce sector represents an exceptionally dynamic and rapidly expanding customer segment. Online retailers, parcel delivery services, and third-party logistics companies are increasingly seeking innovative, durable, and easily returnable packaging solutions to effectively manage the escalating volume of direct-to-consumer deliveries and the inherent complexities of reverse logistics. Similarly, a wide array of food and beverage manufacturers constitutes another pivotal customer group, particularly for business-to-business (B2B) transport packaging applications. These companies are driven by stringent hygiene standards, the critical need for robust yet sustainable delivery systems that protect perishable goods, and a growing consumer demand for environmentally responsible product delivery. Furthermore, prominent players within the automotive and various industrial manufacturing sectors extensively utilize robust reusable cardboard containers for the secure and efficient transport of components and parts throughout their intricate supply chains, placing high value on their inherent strength, stackability, and long-term cost-effectiveness.

Beyond these established segments, pharmaceutical companies are increasingly exploring reusable options for intra-logistics and secondary packaging, driven by the critical need for product integrity and environmental responsibility. General consumer goods manufacturers and large retail chains are also progressively adopting reusable paper and cardboard packaging, not only for internal logistics and point-of-sale displays but also for consumer-facing applications, aligning seamlessly with their overarching corporate social responsibility objectives. Additionally, third-party logistics (3PL) providers are emerging as crucial indirect customers, as they integrate these sustainable packaging solutions into their core service offerings to assist their diverse clientele in achieving ambitious sustainability targets and concurrently optimizing complex supply chain operations. The converging forces of a relentless pursuit of cost efficiency, coupled with increasingly stringent environmental mandates and evolving consumer values, continue to dramatically expand and redefine the landscape of potential customers for reusable paper and cardboard packaging solutions globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $2.9 Billion |

| Market Forecast in 2032 | $4.41 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WestRock Company, Smurfit Kappa Group, International Paper, Mondi Group, DS Smith Plc, Georgia-Pacific LLC, Oji Holdings Corporation, Stora Enso Oyj, BillerudKorsnas AB, Sonoco Products Company, Graphic Packaging International LLC, Mayr-Melnhof Karton AG, SCA Forest Products AB, Packaging Corporation of America, Cascades Inc., Huhtamaki Oyj, Schur Flexibles Group, Sappi Limited, Kotkamills Oy, ACME Box Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reusable Paper and Cardboard Packaging Market Key Technology Landscape

The key technology landscape underpinning the Reusable Paper and Cardboard Packaging Market is characterized by continuous innovation aimed at enhancing material performance, streamlining reuse operations, and improving asset management efficiency. Significant advancements in material science are paramount, focusing on the development of intrinsically stronger, more moisture-resistant, and abrasion-tolerant paperboards. This involves pioneering fiber treatments, the integration of bio-based or recyclable barrier coatings, and sophisticated lamination techniques. These innovations are crucial for extending the functional lifespan of packaging units, enabling them to withstand numerous handling cycles, exposure to varying environmental conditions, and the stresses of repeated cleaning processes, thereby ensuring sustained structural integrity and significantly reducing the overall consumption of raw materials and associated waste generation. The emphasis is on creating materials that are not only durable but also maintain their aesthetic and protective qualities over time, which is vital for brand perception and product safety.

Beyond the foundational material innovations, the strategic integration of smart packaging technologies is profoundly transforming the way reusable assets are managed throughout their complex lifecycle. This encompasses the widespread adoption of advanced identification and tracking solutions such as Radio-Frequency Identification (RFID) tags, unique Quick Response (QR) codes, and sophisticated Internet of Things (IoT) sensors, which are either seamlessly embedded within the packaging structures or securely affixed to individual units. These cutting-edge technologies empower stakeholders with unparalleled real-time visibility into the location, movement, and condition of each reusable package across the entire supply chain. This real-time data flow is instrumental for optimizing inventory levels, meticulously monitoring individual use cycles, enabling precise location tracking for efficient reverse logistics operations, and identifying potential bottlenecks or inefficiencies. Such digital solutions play a critical role in dramatically reducing asset losses, optimizing retrieval and delivery routes for enhanced sustainability, and providing invaluable data-driven insights into the actual performance and utilization rates of the packaging fleet.

Furthermore, the increasing deployment of automation and robotics is playing a pivotal role in augmenting the efficiency and scalability of reusable paper and cardboard packaging systems. Automated handling systems facilitate the rapid and gentle movement of packaging units through various stages, including washing, inspection, and sorting. Advanced robotic systems, equipped with computer vision, are utilized for precise quality control checks, efficiently separating damaged items that need to be recycled from those that are suitable for immediate reuse, thereby maximizing the utilization of viable assets. Data analytics and sophisticated Artificial Intelligence (AI) algorithms are extensively employed to analyze the vast amounts of operational data generated by these systems. This analysis enables the optimization of logistics networks, accurate prediction of maintenance requirements, and identification of the most effective packaging designs and reuse models. Collectively, these technological advancements are driving unprecedented levels of operational efficiency, fostering greater economic viability, and accelerating the realization of true sustainability within the reusable paper and cardboard packaging market, positioning it as a cornerstone of the future circular economy.

Regional Highlights

- North America: This region represents a mature and highly developed market, characterized by robust environmental regulations, a high degree of consumer environmental awareness, and significant growth in the e-commerce sector. The United States and Canada are leading the adoption of reusable paper and cardboard packaging, supported by advanced recycling infrastructures, strong corporate sustainability mandates, and a general societal push towards reducing single-use waste. Innovation in smart packaging and efficient reverse logistics systems is also prominent here.

- Europe: Europe stands as a pioneering region for sustainable packaging, driven by some of the world's most comprehensive circular economy initiatives and stringent packaging waste reduction directives, such as the EU's Extended Producer Responsibility (EPR) schemes. Countries like Germany, the United Kingdom, and the Nordic nations are at the forefront of implementing widespread reusable packaging systems, buoyed by high consumer demand for eco-friendly options and significant investment in sustainable logistics and infrastructure.

- Asia Pacific (APAC): The Asia Pacific region is rapidly emerging as the fastest-growing market segment, primarily fueled by unprecedented rates of industrialization, the continuous expansion of its manufacturing bases, and the explosive growth of the e-commerce sector across diverse economies. Economic powerhouses such as China, India, Japan, and South Korea are key drivers, benefiting from increasing governmental focus on waste reduction, green packaging initiatives, and substantial investments in modernizing supply chain infrastructure to support sustainable practices.

- Latin America: This region represents an emerging market with progressively increasing environmental awareness and a steadily expanding logistics infrastructure. Brazil and Mexico are leading the way in increased adoption, particularly within their burgeoning industrial, agricultural, and fast-moving consumer goods (FMCG) sectors. The market here is driven by a combination of multinational corporate sustainability mandates and a growing understanding of the economic benefits of reusable packaging.

- Middle East and Africa (MEA): The MEA region is a nascent market exhibiting substantial potential, primarily driven by ongoing economic diversification efforts, rapid urbanization, and increasing foreign direct investment into sustainable infrastructure projects. The Gulf Cooperation Council (GCC) countries are at the forefront of regional adoption, spurred by national visions for sustainable development and efforts to reduce reliance on traditional linear economic models, paving the way for greater integration of reusable packaging solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reusable Paper and Cardboard Packaging Market.- WestRock Company

- Smurfit Kappa Group

- International Paper

- Mondi Group

- DS Smith Plc

- Georgia-Pacific LLC

- Oji Holdings Corporation

- Stora Enso Oyj

- BillerudKorsnas AB

- Sonoco Products Company

- Graphic Packaging International LLC

- Mayr-Melnhof Karton AG

- SCA Forest Products AB

- Packaging Corporation of America

- Cascades Inc.

- Huhtamaki Oyj

- Schur Flexibles Group

- Sappi Limited

- Kotkamills Oy

- ACME Box Company

Frequently Asked Questions

What precisely defines reusable paper and cardboard packaging?

Reusable paper and cardboard packaging encompasses diverse products such as corrugated boxes, folding cartons, and specialized trays, meticulously crafted from paper-based materials. These are specifically engineered for multiple cycles of use, transport, and storage before ultimately being directed towards recycling or composting. Their design prioritizes enhanced durability and integration into efficient circular supply chains.

What key factors are propelling the growing popularity of reusable paper packaging solutions?

The surging popularity is fundamentally driven by escalating global environmental concerns, a pronounced shift in consumer preferences towards genuinely sustainable products, increasingly stringent governmental and industry regulations aimed at waste reduction, and the compelling potential for significant long-term cost efficiencies for businesses through reduced material procurement and waste disposal expenditures.

Which specific industrial sectors are demonstrating the most significant adoption of reusable cardboard packaging?

Leading industrial adopters prominently include the rapidly expanding e-commerce sector, the expansive food and beverage industry, the precision-driven automotive manufacturing sector, the highly regulated pharmaceutical industry, and general logistics and supply chain operations. These sectors notably benefit from the robust durability and inherent environmental advantages offered by reusable packaging solutions for their intricate transport and distribution needs.

What are the principal challenges encountered during the adoption and scaling of reusable paper packaging systems?

The primary challenges include the substantial initial capital investment required for establishing comprehensive reverse logistics infrastructure, persistent concerns regarding the long-term material durability of paper-based packaging under repeated stress and varied conditions, and the inherent operational complexity involved in efficiently managing the collection, meticulous cleaning, and precise redistribution processes across extensive networks.

How is Artificial Intelligence (AI) actively influencing and transforming the reusable paper and cardboard packaging market?

AI is strategically impacting the market by optimizing reverse logistics planning, accurately predicting packaging lifespan and maintenance needs, significantly enhancing quality control through automated inspection, improving the efficiency of automated sorting for reuse, and providing advanced real-time inventory tracking. These AI-driven applications collectively contribute to greater operational efficiency, cost reduction, and heightened sustainability across the entire packaging ecosystem.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager