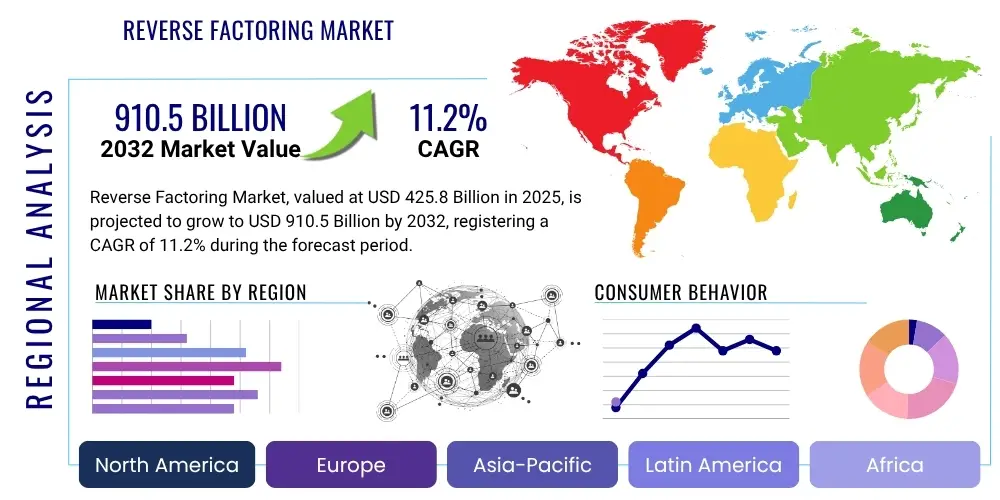

Reverse Factoring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429083 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Reverse Factoring Market Size

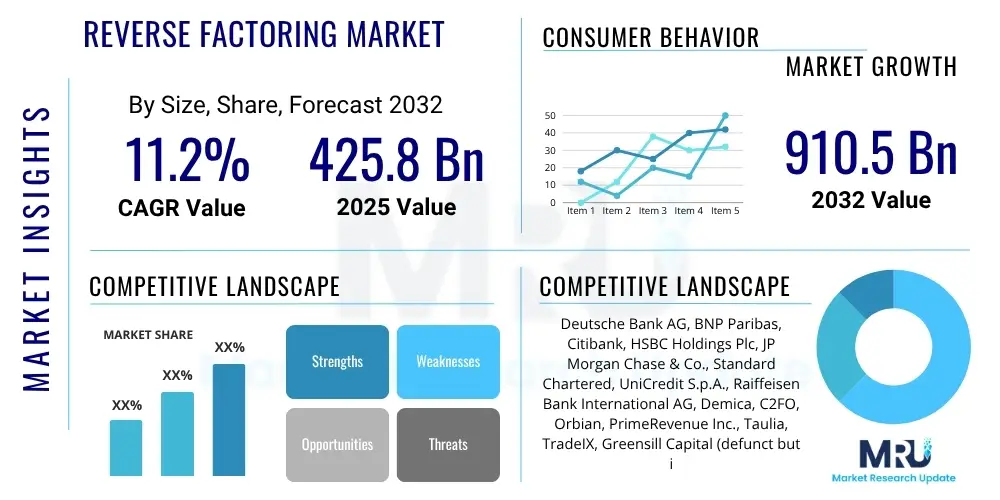

The Reverse Factoring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.2% between 2025 and 2032. The market is estimated at $425.8 Billion in 2025 and is projected to reach $910.5 Billion by the end of the forecast period in 2032.

Reverse Factoring Market introduction

The Reverse Factoring Market, also known as supply chain finance, represents a financial solution designed to optimize working capital and enhance liquidity across the supply chain. This mechanism is initiated by a buyer, typically a large corporation, to enable their suppliers to receive early payment on invoices at a discounted rate. The core product involves a financial institution acting as a factor, paying the supplier upfront, and then collecting the full amount from the buyer on the original invoice due date. Major applications span across diverse industries such as manufacturing, retail, automotive, and technology, where large buyers seek to strengthen supplier relationships and improve their own cash flow management while offering a crucial financial lifeline to their vendors.

The primary benefits of reverse factoring are multifaceted. For suppliers, it provides immediate access to capital, improving their cash flow, reducing financial uncertainty, and potentially allowing them to offer better terms or volume discounts to their buyers. For buyers, it fosters stronger, more stable supply chains by ensuring their critical suppliers remain financially healthy. This also allows buyers to extend their payment terms without negatively impacting supplier liquidity, optimizing their own working capital. Key driving factors for market expansion include the increasing globalization of supply chains, the imperative for supply chain resilience, and the rapid digitalization of financial services which makes these solutions more accessible and efficient.

Additionally, the rising demand for efficient working capital management strategies in a volatile economic landscape further propels the adoption of reverse factoring. Companies are actively seeking ways to stabilize their financial ecosystems, and reverse factoring offers a robust solution for achieving this. The continuous evolution of regulatory frameworks supporting supply chain finance, coupled with technological advancements that streamline the onboarding and transaction processes, contribute significantly to the market's growth trajectory and broader acceptance among businesses of all sizes.

Reverse Factoring Market Executive Summary

The Reverse Factoring Market is characterized by dynamic business trends driven by digitalization and the increasing focus on supply chain resilience. Emerging business models emphasize platform-based solutions, integrating various financial services into a single ecosystem, enhancing transparency and accessibility. Companies are increasingly recognizing the strategic value of optimizing payment flows to foster stronger supplier relationships and mitigate supply chain disruptions, leading to higher adoption rates across various enterprise scales. Furthermore, there is a growing demand for sustainable supply chain finance options, where reverse factoring can be structured to incentivize environmentally and socially responsible supplier practices.

Regionally, the market exhibits varied growth patterns. North America and Europe continue to be significant contributors, driven by established financial infrastructures and high adoption rates among large corporations. However, the Asia Pacific region is demonstrating the most robust growth, fueled by rapid economic expansion, increasing trade volumes, and a burgeoning number of small and medium-sized enterprises (SMEs) seeking working capital solutions. Latin America and the Middle East and Africa regions are also witnessing nascent but accelerating adoption, as businesses in these areas mature and seek advanced financial instruments to compete globally. Local regulatory environments and the availability of diverse financial providers play a crucial role in shaping regional market dynamics.

Segmentation trends indicate strong growth in the FinTech provider segment, which leverages advanced technologies to offer flexible and scalable solutions, often challenging traditional banking dominance. The manufacturing and retail sectors remain major end-users, given their complex and extensive supply chains, but adoption is expanding rapidly into other industries like IT and healthcare. There is a notable trend towards offering tailored solutions based on enterprise size, with specific products designed to meet the distinct needs of large corporations versus small and medium-sized enterprises, addressing both buyer-led and supplier-centric requirements. The increasing integration of services with core enterprise resource planning (ERP) systems is also a key trend.

AI Impact Analysis on Reverse Factoring Market

Users frequently inquire about AI's transformative potential in reverse factoring, focusing on its ability to enhance efficiency, improve risk assessment, and automate processes. Common questions revolve around how AI can streamline onboarding, predict payment behaviors, detect fraud, and personalize financing options for suppliers. There is also significant interest in AI's role in improving data analytics for better decision-making within supply chain finance, particularly in optimizing cash flow for both buyers and suppliers. Concerns often arise regarding data privacy, the transparency of AI algorithms, and the potential for job displacement, alongside expectations for AI to deliver more dynamic and responsive financial solutions.

- Enhanced Risk Assessment: AI algorithms analyze vast datasets, including historical payment behavior, macroeconomic indicators, and supplier financial health, to provide more accurate and dynamic risk profiles, enabling better credit decisions and pricing.

- Automated Onboarding and Due Diligence: AI-powered tools automate the collection and verification of supplier data, accelerating the onboarding process and reducing manual errors, which significantly cuts down administrative costs and time.

- Predictive Analytics for Cash Flow Optimization: AI models forecast future cash flow trends for both buyers and suppliers, allowing for proactive financial planning and optimized working capital management across the supply chain.

- Fraud Detection and Prevention: AI systems can identify anomalous transaction patterns and potential fraudulent activities in invoices and supplier profiles, enhancing security and reducing financial losses.

- Personalized Financing Solutions: AI enables providers to offer highly customized financing terms and rates to suppliers based on their specific financial needs, risk profiles, and relationship with the buyer, leading to more competitive and attractive offers.

- Operational Efficiency: Automation of routine tasks like invoice processing, reconciliation, and payment scheduling through AI and Robotic Process Automation (RPA) frees up human resources for more strategic activities.

- Improved Data Insights: AI consolidates and analyzes complex financial and supply chain data, providing actionable insights into supplier performance, payment trends, and overall supply chain health, aiding strategic decision-making.

DRO & Impact Forces Of Reverse Factoring Market

The Reverse Factoring Market is propelled by several key drivers, primarily the escalating need for efficient working capital management among businesses of all sizes, especially as global supply chains become more complex and extended. The imperative for supply chain resilience, driven by recent disruptions, encourages buyers to ensure their suppliers' financial stability. Furthermore, the increasing digitalization of financial services makes reverse factoring platforms more accessible and user-friendly, expanding their reach. The push for greater transparency in payment flows and the desire to strengthen buyer-supplier relationships also act as significant growth catalysts.

Despite these drivers, the market faces notable restraints. A lack of awareness and understanding of reverse factoring, particularly among smaller suppliers, can hinder adoption. Regulatory complexities across different jurisdictions present challenges for global expansion and standardization. The initial implementation costs and integration efforts required to connect reverse factoring platforms with existing ERP systems can be prohibitive for some companies. Additionally, the inherent reliance on the buyer's creditworthiness means that the availability and terms of reverse factoring can be limited for suppliers of less creditworthy buyers, restricting market reach.

Opportunities for market expansion are abundant, particularly in targeting the vast, untapped market of small and medium-sized enterprises (SMEs) which often struggle with access to affordable financing. The integration of advanced technologies such as blockchain for enhanced transparency and smart contracts, along with AI for improved risk assessment and automation, presents avenues for innovation and efficiency. Customization of reverse factoring solutions to cater to specific industry needs and the growth in emerging economies with developing financial infrastructures also offer significant growth prospects. Economic volatility and fluctuating interest rates can simultaneously act as both drivers, by increasing the need for working capital solutions, and restraints, by impacting the cost of financing, highlighting the dynamic nature of these impact forces.

Segmentation Analysis

The Reverse Factoring Market is broadly segmented based on various attributes to provide a comprehensive understanding of its structure and dynamics. These segments help in identifying key market characteristics, potential growth areas, and the specific needs of different stakeholders. The market can be analyzed by components, which include the financial solutions offered and the supporting services; by provider type, differentiating between traditional banks and modern FinTech companies; by end-user industries, reflecting the diverse application base; and by enterprise size, distinguishing between the requirements of large corporations and small and medium-sized enterprises. Each segmentation reveals unique trends and opportunities within the reverse factoring ecosystem.

- By Component

- Solutions (Software and Platform offerings)

- Services (Consulting, Implementation, Support, Risk Management)

- By Provider

- Banks (Traditional financial institutions)

- FinTechs (Technology-driven financial service providers)

- Other Financial Institutions (Specialized factors, Private Equity firms)

- By End User

- Manufacturing

- Retail and E-commerce

- Automotive

- IT and Telecom

- Healthcare and Pharmaceuticals

- Consumer Goods

- Construction

- Others (Energy, Logistics, etc.)

- By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Value Chain Analysis For Reverse Factoring Market

The value chain for the Reverse Factoring Market begins with upstream activities, primarily involving technology providers and financial institutions. Technology providers develop and maintain the digital platforms and software solutions that facilitate reverse factoring operations, including systems for invoice management, risk assessment, and payment processing. Financial institutions, on the other hand, provide the necessary capital for funding the early payments to suppliers. These institutions, whether traditional banks or agile FinTech firms, are crucial for the liquidity provision and credit assessment capabilities that underpin the entire reverse factoring process. Their ability to integrate seamlessly with various enterprise systems is a key upstream factor.

Midstream activities involve the core reverse factoring process itself, where buyers initiate the financing process for their suppliers' approved invoices, and the financial provider pays the supplier early at a discount. Downstream activities focus on the end-users: the buyers and their suppliers. Buyers are the corporate clients leveraging reverse factoring to optimize their working capital and enhance supplier relationships. Suppliers, particularly SMEs, are the beneficiaries who receive early payment, improving their cash flow and financial stability. The effectiveness of the solution is measured by its impact on these downstream stakeholders, ensuring both parties derive tangible benefits from the arrangement.

Distribution channels for reverse factoring solutions are typically direct and indirect. Direct channels involve financial institutions and FinTech providers engaging directly with corporate buyers to offer their services. This often includes dedicated sales teams, online platforms, and direct marketing efforts. Indirect channels involve partnerships with consulting firms, enterprise resource planning (ERP) providers, or supply chain management software vendors, who integrate reverse factoring solutions into their broader offerings. These partnerships allow for wider market reach and embedded finance solutions, making reverse factoring a more accessible and integrated part of a company's financial operations.

Reverse Factoring Market Potential Customers

Potential customers in the Reverse Factoring Market primarily consist of large corporate buyers with extensive, global supply chains, and their myriad suppliers, particularly small and medium-sized enterprises (SMEs). Large corporations are the initiators, seeking to optimize their own working capital by extending payment terms without negatively impacting their suppliers. These buyers operate across various industries, including manufacturing, retail, automotive, consumer goods, and technology, where maintaining stable and healthy supplier relationships is critical for operational continuity and innovation. The sheer volume of transactions and the strategic importance of their supplier base make these large enterprises ideal candidates for implementing reverse factoring programs.

On the other hand, the key beneficiaries and, therefore, another crucial segment of potential customers are the suppliers, especially SMEs, within these corporate buyers' supply chains. These suppliers often face cash flow constraints due to long payment cycles from their larger clients. Reverse factoring offers them a reliable and often cheaper source of liquidity compared to traditional borrowing, enabling them to meet operational expenses, invest in growth, and manage seasonal fluctuations. The solution is particularly attractive to suppliers who might otherwise struggle to access affordable credit, empowering them to improve their financial health and become more resilient partners in the supply chain.

Beyond the direct buyer-supplier relationship, other potential customers include specific industries that have complex and high-volume supply chains, or those facing unique financial challenges. For instance, the construction sector, with its project-based nature and often delayed payments, can greatly benefit. Healthcare and pharmaceutical companies also manage vast networks of suppliers for critical goods, making them strong candidates. Essentially, any enterprise with a significant, diverse supplier base that values supply chain stability and working capital optimization stands to gain from adopting reverse factoring, both as a buyer and as a supplier within a buyer-led program.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $425.8 Billion |

| Market Forecast in 2032 | $910.5 Billion |

| Growth Rate | CAGR 11.2% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deutsche Bank AG, BNP Paribas, Citibank, HSBC Holdings Plc, JP Morgan Chase & Co., Standard Chartered, UniCredit S.p.A., Raiffeisen Bank International AG, Demica, C2FO, Orbian, PrimeRevenue Inc., Taulia, TradeIX, Greensill Capital (defunct but influential), Santander, Commerzbank AG, Société Générale, Mizuho Financial Group, Mitsubishi UFJ Financial Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reverse Factoring Market Key Technology Landscape

The Reverse Factoring Market heavily relies on a sophisticated technology landscape to ensure efficiency, security, and scalability. Digital platforms form the backbone, providing a centralized hub for buyers, suppliers, and financial institutions to manage invoices, submit financing requests, and track payments. These platforms often feature robust interfaces, comprehensive dashboards, and real-time reporting capabilities. Cloud computing is fundamental, offering the necessary infrastructure for these platforms to be accessible from anywhere, handle large transaction volumes, and provide secure data storage, enabling rapid deployment and continuous updates without significant upfront IT investment from users.

Artificial Intelligence (AI) and Machine Learning (ML) are increasingly pivotal in enhancing various aspects of reverse factoring. AI algorithms are employed for advanced risk assessment, analyzing vast datasets to determine supplier creditworthiness and predict payment behaviors more accurately than traditional methods. This leads to better pricing of financing and reduced exposure to default. ML also drives automation in document processing, such as invoice validation and reconciliation, significantly reducing manual errors and operational costs. These intelligent technologies are transforming how providers identify suitable candidates for reverse factoring and tailor solutions to specific needs.

Furthermore, blockchain technology is emerging as a critical enabler for enhanced transparency and trust within the reverse factoring ecosystem. By creating immutable and distributed ledgers for transactions and invoice data, blockchain can significantly reduce fraud, streamline verification processes, and provide an unparalleled level of transparency across the supply chain. Application Programming Interfaces (APIs) are essential for seamless integration of reverse factoring platforms with existing Enterprise Resource Planning (ERP) systems, accounting software, and other financial tools, allowing for automated data exchange and real-time updates. This interoperability ensures that reverse factoring solutions can be easily embedded into a company's broader financial and operational workflows, maximizing their utility and adoption.

Regional Highlights

- North America: A mature market characterized by high adoption among large corporations and a robust financial sector. The United States and Canada lead in innovation and digitalization, with increasing integration of AI and analytics in supply chain finance solutions. Regulatory frameworks are generally supportive, and there is a strong emphasis on leveraging technology for greater efficiency and risk management.

- Europe: Europe showcases a diverse market, with Western European countries like the UK, Germany, and France having well-established reverse factoring markets driven by both traditional banks and a growing number of FinTechs. The region benefits from a strong focus on regulatory compliance and the stability of its financial institutions. There's also a rising interest in sustainable supply chain finance.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid economic development, increasing trade volumes, and a vast number of SMEs. Countries like China, India, Japan, and Australia are key contributors, driven by digitalization initiatives, government support for SME financing, and the increasing complexity of regional supply chains. The demand for working capital solutions is exceptionally high.

- Latin America: An emerging market for reverse factoring, experiencing growing awareness and adoption. Countries like Brazil, Mexico, and Argentina are seeing increased interest due to economic volatility and the need for businesses to optimize cash flow. Challenges include varying regulatory landscapes and a developing financial infrastructure, but opportunities are significant as economies mature.

- Middle East and Africa (MEA): This region presents nascent but promising growth prospects. The GCC countries (e.g., UAE, Saudi Arabia) are investing in economic diversification and digital transformation, driving the adoption of advanced financial solutions. Africa's market is primarily driven by the need to support growing trade and improve financial access for SMEs, with considerable potential for future expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reverse Factoring Market.- Deutsche Bank AG

- BNP Paribas

- Citibank

- HSBC Holdings Plc

- JP Morgan Chase & Co.

- Standard Chartered

- UniCredit S.p.A.

- Raiffeisen Bank International AG

- Demica

- C2FO

- Orbian

- PrimeRevenue Inc.

- Taulia

- TradeIX

- Santander

- Commerzbank AG

- Société Générale

- Mizuho Financial Group

- Mitsubishi UFJ Financial Group

Frequently Asked Questions

What is reverse factoring?

Reverse factoring is a buyer-led supply chain finance solution where a financial institution pays a supplier's invoice early at a discount, then collects the full amount from the buyer on the original due date. It primarily helps suppliers gain early access to cash and buyers to optimize working capital.

How does reverse factoring benefit suppliers?

Suppliers benefit from improved cash flow through early payments, reduced financial risk, and potentially lower financing costs compared to traditional lending. It helps them stabilize operations, invest in growth, and maintain strong relationships with key buyers.

What are the advantages for buyers implementing reverse factoring?

Buyers gain advantages by strengthening supplier relationships, ensuring supply chain stability, and optimizing their own working capital by potentially extending payment terms without negatively impacting their vendors' liquidity. It can also lead to better pricing from healthier suppliers.

Is reverse factoring suitable for Small and Medium-sized Enterprises (SMEs)?

Yes, reverse factoring is highly suitable for SMEs, particularly as suppliers to large corporations. It provides them with access to financing based on the buyer's creditworthiness, which can be more affordable and accessible than traditional SME loans, addressing common cash flow challenges.

What role does technology play in the Reverse Factoring Market?

Technology, including digital platforms, AI, machine learning, and blockchain, is crucial. It automates processes, enhances risk assessment, provides real-time data insights, ensures security, and facilitates seamless integration with existing enterprise systems, driving efficiency and broader adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager