RF Power Dividers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427652 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

RF Power Dividers Market Size

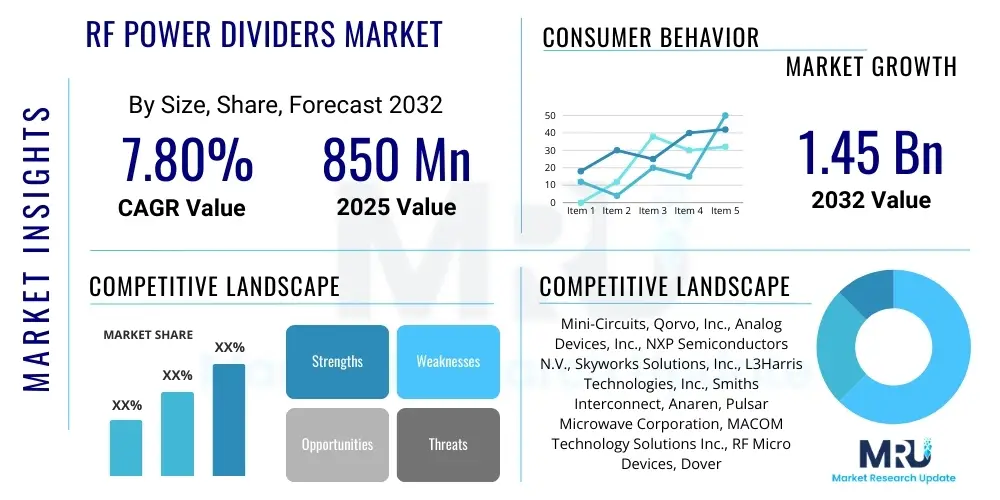

The RF Power Dividers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 850 Million in 2025 and is projected to reach USD 1.45 Billion by the end of the forecast period in 2032.

RF Power Dividers Market introduction

The RF Power Dividers Market encompasses devices essential for distributing high-frequency electrical signals from one input to multiple outputs, or conversely, combining multiple inputs into a single output, while maintaining impedance matching and minimal signal loss. These crucial components are integral to a wide array of electronic systems, enabling the efficient management and routing of radio frequency energy. They are broadly categorized into reactive (e.g., Wilkinson, hybrid couplers) and resistive types, each designed for specific performance characteristics concerning isolation, insertion loss, and power handling capabilities across various frequency bands, from basic RF to advanced millimeter-wave applications. The functional versatility of power dividers makes them indispensable in modern communication infrastructure.

Key applications for RF power dividers span across diverse sectors, including telecommunications, where they facilitate antenna array feeding and signal distribution in base stations and wireless networks, and in aerospace and defense systems for radar, electronic warfare, and satellite communication. Furthermore, they are vital in test and measurement equipment, enabling precise calibration and multi-port testing of RF components and systems, as well as in emerging fields like automotive radar for advanced driver-assistance systems (ADAS) and the rapidly expanding Internet of Things (IoT) ecosystem. Their primary benefits include reliable signal splitting, efficient power distribution, and effective impedance matching, all of which are critical for optimal system performance and integrity.

The markets expansion is fundamentally driven by several overarching technological and economic trends. The global rollout and continuous evolution of 5G and future 6G networks necessitate high-performance RF components capable of handling increased data rates and higher frequencies, directly boosting demand for sophisticated power dividers. The proliferation of satellite communication systems, including Low Earth Orbit (LEO) constellations, and the escalating demand for advanced automotive radar modules also contribute significantly. Additionally, ongoing defense modernization initiatives worldwide, emphasizing advanced electronic warfare and secure communication systems, further fuel market growth by requiring robust and reliable RF power management solutions.

RF Power Dividers Market Executive Summary

The RF Power Dividers Market is experiencing robust growth, propelled by the relentless expansion of global telecommunication networks, particularly the 5G and upcoming 6G deployments, alongside significant advancements in aerospace, defense, and automotive technologies. Business trends indicate a strong emphasis on miniaturization, higher frequency operation (especially millimeter-wave bands), and enhanced power handling capabilities to meet the demands of increasingly complex and compact electronic systems. Manufacturers are focusing on integrating advanced materials and manufacturing processes, such as Monolithic Microwave Integrated Circuits (MMIC) and Gallium Nitride (GaN) technologies, to improve performance metrics and reduce form factors. This drive towards innovation is fostering a competitive landscape where companies are investing heavily in research and development to offer differentiated and high-value solutions to diverse end-users, leading to strategic partnerships and occasional consolidations to leverage specialized expertise and expand market reach. The increasing adoption of IoT devices and the growing need for sophisticated test and measurement solutions further underscore the markets dynamic business environment.

Regional trends highlight Asia-Pacific as a leading growth engine, primarily due to aggressive investments in 5G infrastructure, rapid industrialization, and a burgeoning consumer electronics market, making it a pivotal region for both demand and manufacturing. North America and Europe continue to hold substantial market shares, driven by well-established aerospace and defense industries, significant R&D activities in advanced communication technologies, and the automotive sectors increasing reliance on radar systems for autonomous driving. These regions demonstrate a mature demand for high-performance and specialized RF power dividers, with significant governmental and private sector investments in next-generation communication and security systems. Emerging markets in Latin America and the Middle East & Africa are also showing promising growth, albeit from a smaller base, fueled by expanding mobile communication networks and nascent industrial automation initiatives, gradually contributing to the global market landscape.

Segmentation trends reveal a persistent demand for reactive power dividers, especially Wilkinson and hybrid coupler types, owing to their superior isolation and low insertion loss characteristics, crucial for high-performance applications. Resistive power dividers, while simpler and more broadband, maintain a niche for less demanding applications. Frequency-wise, there is a clear upward trend towards higher frequency bands, including C-band, X-band, Ku-band, Ka-band, and increasingly, millimeter-wave (mmWave) bands, driven by advanced telecommunications, satellite communications, and radar systems requiring broader bandwidths and higher data throughputs. In terms of application, telecommunications remains the largest segment, but aerospace & defense and automotive sectors are exhibiting significant growth, with their specific requirements for ruggedness, reliability, and precision driving innovation in product design and material science. Passive RF power dividers continue to dominate the market; however, active power dividers are gaining traction in applications requiring gain and advanced control features, albeit at a higher cost and complexity.

AI Impact Analysis on RF Power Dividers Market

The integration of Artificial Intelligence (AI) is set to profoundly transform various facets of the RF Power Dividers Market, addressing common user concerns about design complexity, performance optimization, and manufacturing efficiency. Users frequently inquire about how AI can accelerate the design cycle for advanced RF components, enhance the precision and reliability of RF networks, and reduce the overall cost of ownership through predictive maintenance. There is significant interest in AIs role in synthesizing optimal component parameters, managing vast datasets from simulations and real-world performance, and enabling smarter, more adaptive RF systems. The overarching theme revolves around leveraging AI to overcome traditional engineering challenges and unlock new levels of performance and efficiency across the entire product lifecycle.

One of the primary impacts of AI on the RF Power Dividers Market lies in accelerating the design and optimization phases. Traditional RF component design is an iterative and time-consuming process involving extensive simulations and prototyping. AI algorithms, particularly machine learning techniques, can analyze vast datasets of design parameters, material properties, and performance metrics to predict optimal configurations for new power divider designs. This allows engineers to explore a much wider design space more efficiently, identifying configurations that meet stringent performance criteria for specific applications, such as high isolation, low insertion loss, and broad bandwidth, at unprecedented speeds. Furthermore, AI can aid in the intelligent selection of materials and manufacturing processes, contributing to both cost reduction and enhanced device reliability.

Beyond design, AI is poised to revolutionize the operational and maintenance aspects of RF power dividers within larger systems. In complex communication networks, AI-driven analytics can monitor the real-time performance of RF components, including power dividers, predicting potential failures before they occur. This capability translates into significant improvements in network uptime, reduced maintenance costs, and optimized resource allocation. For example, AI can analyze signal degradation patterns or temperature fluctuations to preemptively identify a failing power divider in a 5G base station, enabling proactive replacement and preventing service interruptions. Moreover, AI can contribute to the development of adaptive power dividers that can dynamically adjust their characteristics in response to changing environmental conditions or network demands, offering a new dimension of flexibility and resilience in RF systems.

- AI-driven design optimization for faster iteration and superior performance.

- Predictive modeling for material selection and manufacturing process enhancement.

- Real-time performance monitoring and anomaly detection in RF networks.

- Predictive maintenance for power dividers, extending operational lifespan and reducing downtime.

- Development of adaptive and reconfigurable RF power dividers for dynamic network conditions.

- Enhanced quality control and automated testing through AI-powered vision and data analysis.

- Simulation acceleration and computational electromagnetics optimization.

- Personalized RF component solutions based on specific application requirements.

DRO & Impact Forces Of RF Power Dividers Market

The RF Power Dividers Market is shaped by a complex interplay of drivers, restraints, opportunities, and inherent impact forces. Key drivers include the exponential growth in demand for high-speed data transmission, fueled by the global rollout of 5G and upcoming 6G networks, which necessitate a vast deployment of advanced RF infrastructure. The proliferation of connected devices in the Internet of Things (IoT) ecosystem and the continuous expansion of satellite communication services, including LEO constellations, further amplify the need for efficient and reliable RF power management. Additionally, the increasing sophistication of aerospace and defense systems, requiring robust and high-performance radar, electronic warfare, and secure communication components, significantly boosts market demand. The automotive industrys pivot towards autonomous driving features, relying heavily on advanced radar systems, also presents a substantial growth impetus for specialized RF power dividers.

However, the market also faces several restraints. The high initial research and development costs associated with designing and manufacturing advanced RF components, particularly for millimeter-wave and high-power applications, can be prohibitive for smaller players. Intense market competition from both established giants and emerging specialized firms puts constant pressure on pricing and profit margins. Furthermore, complexities in the global supply chain, exacerbated by geopolitical tensions and raw material scarcities, can lead to production delays and increased costs. Technical challenges such as achieving ultra-low insertion loss, high isolation, and maintaining performance stability across wide frequency ranges and varying environmental conditions in miniaturized packages pose ongoing hurdles for innovation. The need for precise manufacturing and stringent quality control standards also adds to the operational complexities and costs.

Despite these challenges, significant opportunities abound within the RF Power Dividers Market. The exploration of millimeter-wave and sub-THz frequency bands for future communication systems, including 6G and advanced sensing applications, opens up new avenues for specialized product development. The burgeoning quantum computing sector, requiring precise control over RF signals at cryogenic temperatures, represents a niche but high-value opportunity. Furthermore, the expanding domain of space exploration and commercial space ventures drives demand for radiation-hardened and extremely reliable RF components. The continuous evolution of wireless technologies, coupled with the increasing integration of RF front-end modules, offers fertile ground for innovation in compact, multi-functional power dividers, potentially incorporating active features for gain and reconfigurability. Technological advancements, evolving regulatory landscapes governing spectrum allocation, and fluctuating global economic conditions are primary impact forces that continually reshape market dynamics, influencing investment, production, and demand across all segments.

Segmentation Analysis

The RF Power Dividers Market is comprehensively segmented based on various critical parameters, including type, frequency band, application, and end-use, to provide a nuanced understanding of its diverse landscape. This segmentation allows for targeted market analysis, highlighting the growth trajectories and specific demands within each category. The dominant types, reactive and resistive, cater to different performance requirements, while the vast range of frequency bands reflects the broad spectrum of modern wireless communication and sensing technologies. The varied applications demonstrate the pervasive role of RF power dividers across numerous industries, underscoring their fundamental importance in signal management and distribution in both commercial and military contexts.

- By Type:

- Reactive Power Dividers (e.g., Wilkinson, Hybrid Couplers, Branch-Line Couplers)

- Resistive Power Dividers (e.g., Ohmic dividers, Broad-band dividers)

- By Frequency Band:

- L-band

- S-band

- C-band

- X-band

- Ku-band

- Ka-band

- Millimeter-Wave (mmWave) Bands (e.g., V-band, E-band)

- Broadband

- By Application:

- Telecommunications (Base Stations, Antennas, Wireless Infrastructure)

- Aerospace and Defense (Radar, Electronic Warfare, Satellite Communications, Avionics)

- Automotive (Radar, ADAS)

- Test and Measurement

- Industrial

- Consumer Electronics

- Medical

- Research and Development

- By End-Use:

- Commercial

- Military

- Space

- By Power Handling:

- Low Power

- Medium Power

- High Power

RF Power Dividers Market Value Chain Analysis

The value chain for the RF Power Dividers Market begins with upstream activities involving the procurement of fundamental raw materials and specialized components. This stage includes suppliers of semiconductor materials like silicon, gallium arsenide (GaAs), and gallium nitride (GaN), which are crucial for high-frequency and high-power applications. It also encompasses providers of ceramic substrates, various metals (copper, gold, silver), and advanced packaging materials. These raw material providers feed into the component manufacturing ecosystem, where specialized foundries and integrated circuit manufacturers produce active and passive components that are later integrated into power divider designs. Research and development institutions also play a vital upstream role, contributing to material science advancements and innovative design methodologies that push the boundaries of RF performance.

Moving downstream, the value chain progresses through the manufacturing and assembly of RF power dividers, often involving highly specialized processes such as photolithography, thin-film deposition, and precision soldering. These manufactured power dividers are then integrated into larger systems by equipment manufacturers and system integrators. For instance, telecommunication equipment manufacturers embed them into base stations and antenna arrays, aerospace and defense contractors integrate them into radar and electronic warfare systems, and automotive OEMs incorporate them into ADAS modules. Service providers who deploy and maintain these complex systems also represent a critical downstream segment, ensuring the operational efficiency and longevity of the integrated RF components.

The distribution channel for RF power dividers is multifaceted, encompassing both direct and indirect approaches. Direct sales typically involve large-scale transactions between manufacturers and major original equipment manufacturers (OEMs) or government defense contractors, often characterized by custom solutions and long-term supply agreements. Indirect channels involve a network of specialized distributors and resellers who cater to a broader customer base, including smaller businesses, research institutions, and individual engineers. These distributors often provide technical support, inventory management, and logistics services, making high-performance RF components accessible to a wider market. E-commerce platforms are also gaining traction, particularly for standard products and off-the-shelf components, offering convenience and rapid delivery, thereby streamlining the purchasing process for various end-users.

RF Power Dividers Market Potential Customers

The RF Power Dividers Market serves a diverse range of potential customers whose operational needs fundamentally rely on precise and efficient radio frequency signal management. Telecommunication companies represent a massive customer segment, encompassing mobile network operators, internet service providers, and infrastructure developers who utilize power dividers in their base stations, cellular antennas, and broadband wireless access systems to distribute signals effectively. Their continuous investment in upgrading existing networks to 5G and deploying next-generation 6G infrastructure drives sustained demand for high-performance and miniaturized power dividers capable of handling complex modulation schemes and higher frequencies.

Another significant customer base resides within the aerospace and defense sectors. This includes defense contractors, government agencies, and aerospace manufacturers who integrate RF power dividers into critical systems such as radar, electronic warfare systems, secure communication devices, satellite communication payloads, and avionics. These applications demand components that offer extreme reliability, ruggedness, and consistent performance under harsh environmental conditions, often with stringent specifications for size, weight, and power (SWaP) optimization. The ongoing modernization of military equipment and increased spending on national security worldwide ensure a steady demand from this high-value customer group.

Furthermore, the automotive industry has emerged as a rapidly growing customer segment, particularly with the advent of advanced driver-assistance systems (ADAS) and autonomous driving technologies. Automotive OEMs and their tier-1 suppliers utilize RF power dividers in various radar modules (e.g., 24 GHz, 77 GHz) for applications like adaptive cruise control, blind-spot detection, and collision avoidance systems. Test and measurement equipment manufacturers also represent a crucial customer category, as they incorporate power dividers into their spectrum analyzers, network analyzers, and signal generators to facilitate accurate testing and calibration of other RF components and systems. Research institutions and universities, involved in cutting-edge RF and microwave research, also constitute an important niche customer segment, often requiring highly specialized and custom power divider solutions for experimental setups.

RF Power Dividers Market Key Technology Landscape

The RF Power Dividers Market is characterized by a dynamic technology landscape driven by the relentless pursuit of higher performance, greater efficiency, and smaller form factors across various applications. A primary technological trend involves the increasing adoption of Monolithic Microwave Integrated Circuit (MMIC) technology. MMICs allow for the integration of multiple RF functions, including power dividing, on a single semiconductor chip, significantly reducing size, weight, and parasitic losses, while enhancing reliability. This integration is crucial for compact systems in telecommunications, aerospace, and portable test equipment, enabling complex functionalities within minimal physical footprints and facilitating mass production with improved consistency.

Another pivotal technology shaping the market is the utilization of Gallium Nitride (GaN) for high-power RF applications. GaN-based power dividers offer superior power handling capabilities, higher efficiency, and better thermal performance compared to traditional silicon or gallium arsenide (GaAs) components. This makes GaN particularly attractive for demanding applications in defense, radar, and high-power wireless infrastructure where robust performance under high thermal stress is critical. The ability of GaN to operate at higher frequencies and temperatures, combined with its compact size, positions it as a key enabler for next-generation RF systems that require both high power and miniaturization.

Beyond material science, advancements in packaging technologies and design methodologies are paramount. Miniaturization techniques, including system-in-package (SiP) and advanced multi-chip module (MCM) integration, are vital for reducing the overall footprint of RF power dividers, aligning with the industrys drive towards more compact and integrated solutions. Furthermore, the development of wideband and ultra-wideband (UWB) designs allows power dividers to operate effectively across broad frequency ranges, providing versatility for multi-standard communication systems. Innovations in low insertion loss and high isolation designs are continuously pursued to maximize signal integrity and minimize interference, while the exploration of active power dividers, which incorporate amplification or switching elements, aims to offer reconfigurability and gain, albeit with added complexity and power consumption, pushing the boundaries of traditional passive component capabilities.

Regional Highlights

- North America: A mature market characterized by significant investments in defense, aerospace, and advanced telecommunications (5G, satellite). Strong presence of key players and R&D centers, particularly in high-frequency and high-power RF components. Demand is driven by military modernization, automotive radar advancements, and the expansion of national wireless infrastructure.

- Europe: Exhibits robust growth due to a strong aerospace and defense industry, substantial automotive sector, and ongoing deployment of 5G networks. Countries like Germany, France, and the UK are key contributors, focusing on advanced manufacturing and high-reliability RF components for specialized applications. Significant research initiatives in future communication technologies.

- Asia-Pacific: The fastest-growing region, propelled by massive investments in 5G infrastructure, rapid industrialization, and the booming consumer electronics market, especially in China, South Korea, Japan, and India. Large-scale manufacturing capabilities and increasing adoption of IoT devices further accelerate market expansion. Significant opportunities for both high-volume and specialized components.

- Middle East & Africa: An emerging market driven by considerable investments in telecommunication network expansion and diversification of economies away from oil. Growing demand for wireless communication infrastructure and defense modernization efforts contribute to market growth, albeit from a smaller base.

- South America: Shows potential for growth, primarily fueled by the expansion of mobile communication networks and increasing digital transformation initiatives. Adoption rates for advanced RF technologies are rising, although at a slower pace compared to other regions, creating opportunities for cost-effective and reliable solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the RF Power Dividers Market.- Mini-Circuits

- Qorvo, Inc.

- Analog Devices, Inc.

- NXP Semiconductors N.V.

- Skyworks Solutions, Inc.

- L3Harris Technologies, Inc.

- Smiths Interconnect

- Anaren (a TTM Technologies Company)

- Pulsar Microwave Corporation

- MACOM Technology Solutions Inc.

- RF Micro Devices (now part of Qorvo)

- Dover Corporation (through various subsidiaries)

- Diamond Microwave Devices Ltd.

Frequently Asked Questions

What is an RF power divider?

An RF power divider is a passive or active device that takes an input radio frequency signal and splits it into multiple output signals with specific power ratios, while maintaining impedance matching and minimizing signal loss. They are fundamental components in wireless communication, radar, and test & measurement systems.

How do RF power dividers differ from couplers?

While both divide RF power, power dividers are typically designed to split a signal into multiple outputs equally or with specific ratios, and they are usually reciprocal. Directional couplers, on the other hand, extract a small, controlled amount of power from a main transmission line, often used for sampling or monitoring, and offer strong directivity between coupled ports.

What are the primary types of RF power dividers?

The main types are resistive and reactive. Resistive power dividers are simpler, broadband, and offer good amplitude balance but have higher insertion loss. Reactive power dividers, like Wilkinson or hybrid types, use reactive components for improved isolation between output ports and lower insertion loss, but are typically narrower band.

Which industries are the major users of RF power dividers?

The telecommunications industry, including 5G/6G infrastructure, is the largest user. Other significant industries include aerospace and defense (for radar, electronic warfare), automotive (for ADAS and radar), and test & measurement equipment manufacturing. The Internet of Things (IoT) and satellite communication sectors are also rapidly growing end-users.

What are the key technological trends influencing the RF power divider market?

Key trends include miniaturization through MMIC integration, enhanced power handling with GaN technology, development of wideband and millimeter-wave designs for 5G/6G, advanced packaging for compact systems, and continuous efforts to reduce insertion loss and improve isolation for superior signal integrity and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager