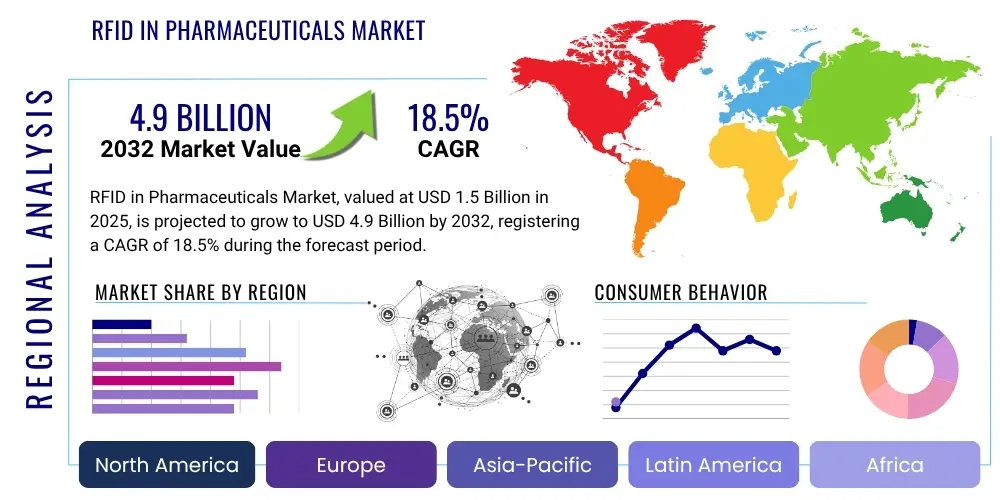

RFID in Pharmaceuticals Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428465 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

RFID in Pharmaceuticals Market Size

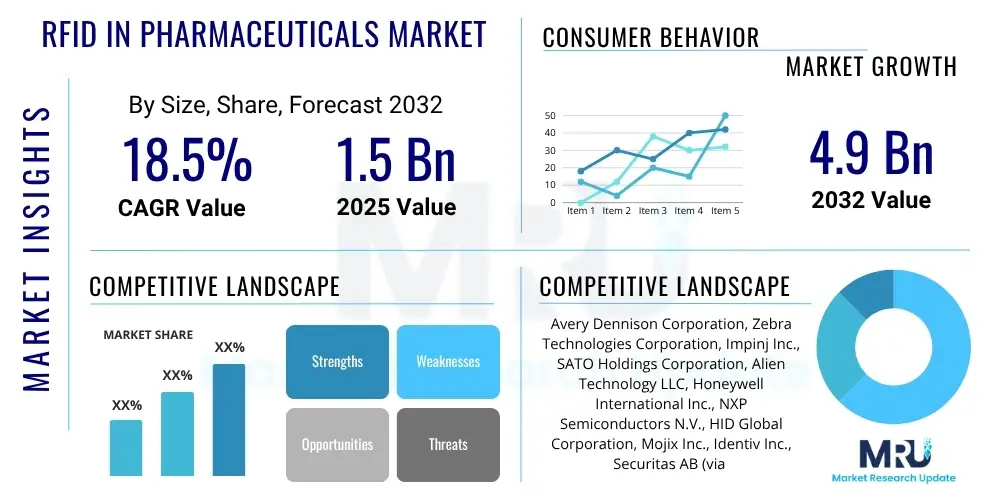

The RFID in Pharmaceuticals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 1.5 Billion in 2025 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2032.

RFID in Pharmaceuticals Market introduction

The RFID in Pharmaceuticals market encompasses the adoption of Radio-Frequency Identification technology across various stages of the pharmaceutical supply chain. This innovative technology utilizes electromagnetic fields to automatically identify and track tags attached to pharmaceutical products, containers, or assets. The core product offering includes RFID tags, readers, antennas, and specialized software solutions that integrate with existing enterprise resource planning (ERP) and supply chain management (SCM) systems.

Major applications of RFID in pharmaceuticals include precise inventory management, enhanced asset tracking, robust anti-counterfeiting measures, and ensuring regulatory compliance for serialization and traceability. The benefits derived from implementing RFID solutions are extensive, ranging from improved operational efficiency and reduced manual errors to increased supply chain visibility and strengthened brand protection. These advantages contribute significantly to mitigating risks associated with product diversion, recalls, and expired inventory.

The market is primarily driven by escalating concerns regarding drug counterfeiting, stringent regulatory mandates for pharmaceutical traceability and serialization, and the growing demand for efficient supply chain management. The inherent capability of RFID to provide real-time data and granular control over pharmaceutical products from manufacturing to patient delivery positions it as a critical technology for the modern pharmaceutical industry, fostering security, accuracy, and operational excellence.

RFID in Pharmaceuticals Market Executive Summary

The RFID in Pharmaceuticals market is experiencing robust growth, propelled by the pharmaceutical industry's increasing emphasis on supply chain integrity, regulatory adherence, and operational efficiency. Key business trends indicate a strong shift towards automation and digital transformation within pharmaceutical logistics, with companies investing in RFID solutions to achieve granular visibility into their extensive product networks. The market is witnessing a surge in demand for integrated solutions that combine RFID with other technologies like IoT and AI for enhanced data analytics and predictive capabilities. Furthermore, there is a growing trend of solution providers offering customized RFID implementations tailored to specific pharmaceutical use cases, such as cold chain monitoring and surgical instrument tracking.

Regionally, North America and Europe continue to dominate the market due to stringent regulatory frameworks, high adoption rates of advanced technologies, and the presence of major pharmaceutical companies and established healthcare infrastructure. The Asia Pacific region is anticipated to exhibit the highest growth rate, driven by expanding pharmaceutical manufacturing bases, rising healthcare expenditure, and increasing awareness of drug counterfeiting issues. Latin America and the Middle East and Africa are also showing nascent growth, as governments and pharmaceutical companies in these regions begin to recognize the imperative for enhanced supply chain security and efficiency.

In terms of segment trends, the market for passive RFID tags continues to hold the largest share due to their cost-effectiveness and versatility, although active RFID tags are gaining traction for high-value asset tracking and real-time location systems. The anti-counterfeiting and inventory management application segments are primary drivers, reflecting the industry's critical need to protect product integrity and optimize stock levels. Across end-user segments, pharmaceutical manufacturers represent the largest adopters, driven by regulatory compliance and large-scale supply chain optimization requirements, while hospitals and pharmacies are increasingly implementing RFID for drug dispensing accuracy and inventory control.

AI Impact Analysis on RFID in Pharmaceuticals Market

User inquiries concerning the impact of AI on the RFID in Pharmaceuticals market frequently revolve around how artificial intelligence can augment existing RFID capabilities, improve data analysis, and automate decision-making. Common themes include questions about AI's role in predictive analytics for inventory management, its potential for enhancing anti-counterfeiting measures through pattern recognition, and how it can streamline data interpretation from large-scale RFID deployments. Users are also keen to understand the extent to which AI can automate tracking processes, reduce human intervention, and offer proactive insights into supply chain anomalies or potential risks. The overarching expectation is that AI will transform RFID data into actionable intelligence, moving beyond mere tracking to sophisticated forecasting and optimization.

- AI enhances RFID data analysis, enabling predictive inventory management and demand forecasting.

- AI-driven pattern recognition strengthens anti-counterfeiting by identifying anomalies in product movement and authenticity.

- Automates RFID data interpretation, converting raw tracking information into actionable insights for logistics and compliance.

- Facilitates real-time anomaly detection in the supply chain, preempting issues like product diversion or temperature excursions.

- Optimizes routing and storage through intelligent algorithms, improving operational efficiency and reducing waste.

- Integrates RFID data with other sources (e.g., IoT sensors, weather data) for comprehensive situational awareness.

DRO & Impact Forces Of RFID in Pharmaceuticals Market

The RFID in Pharmaceuticals market is primarily driven by the escalating need for robust supply chain visibility and security, which is critical in preventing drug counterfeiting and ensuring patient safety. Stringent global regulatory mandates, such as the Drug Supply Chain Security Act (DSCSA) in the US and the Falsified Medicines Directive (FMD) in Europe, compel pharmaceutical companies to implement advanced serialization and traceability solutions, with RFID emerging as a highly effective technology to meet these compliance requirements. Furthermore, the inherent benefits of RFID in streamlining inventory management, reducing manual errors, and optimizing logistics operations are significant growth catalysts, offering substantial cost savings and efficiency gains for manufacturers and distributors alike.

Despite these strong drivers, the market faces notable restraints, particularly the high initial investment costs associated with RFID infrastructure, including tags, readers, software, and system integration. This capital outlay can be a barrier for smaller pharmaceutical companies or those with limited budgets. Additionally, concerns surrounding data privacy and security, as RFID systems collect vast amounts of sensitive product movement data, pose a challenge. The lack of universal standardization across different RFID frequencies and protocols, alongside the potential for tag interference in complex environments, also contributes to implementation complexities and slower adoption rates in certain segments.

Opportunities for growth are abundant, especially with the continuous technological advancements in RFID, leading to more cost-effective, versatile, and miniaturized tags. The increasing integration of RFID with other complementary technologies like the Internet of Things (IoT), artificial intelligence (AI), and blockchain holds immense promise for creating highly intelligent and secure pharmaceutical supply chains. The expansion into emerging markets, coupled with the growing trend of smart packaging and direct-to-patient dispensing models, presents new avenues for RFID adoption. The imperative for cold chain monitoring for sensitive biologics and vaccines further amplifies the demand for specialized RFID solutions that incorporate temperature sensing capabilities, ensuring product integrity throughout transit and storage.

Segmentation Analysis

The RFID in Pharmaceuticals market is comprehensively segmented to provide a detailed understanding of its diverse components and applications. This segmentation allows for targeted analysis of growth opportunities, challenges, and strategic imperatives across various product types, applications, and end-user industries within the pharmaceutical ecosystem. Understanding these segments is crucial for stakeholders to tailor solutions, optimize market entry strategies, and forecast future trends effectively, addressing the specific needs of different market participants.

- By Product Type:

- RFID Tags (Passive Tags, Active Tags)

- RFID Readers (Fixed Readers, Handheld Readers)

- RFID Antennas

- RFID Software and Services (Middleware, Cloud Solutions, Integration Services)

- By Application:

- Inventory Management

- Asset Tracking

- Anti-Counterfeiting and Brand Protection

- Supply Chain and Logistics Management

- Patient Safety and Drug Dispensing

- Regulatory Compliance and Serialization

- Research and Development

- By End-User:

- Pharmaceutical Companies

- Hospitals and Pharmacies

- Biotechnology Companies

- Contract Research Organizations (CROs)

- Blood Banks and Clinical Laboratories

- Retail Pharmacies

Value Chain Analysis For RFID in Pharmaceuticals Market

The value chain for the RFID in Pharmaceuticals market begins with the upstream segment, involving the core technology providers and component manufacturers. This includes semiconductor companies that produce RFID chips, antenna manufacturers, and specialized tag converters who embed these components into various form factors suitable for pharmaceutical applications. These upstream players are critical for innovation in tag design, material science, and miniaturization, directly impacting the performance, cost-effectiveness, and versatility of RFID solutions.

Moving downstream, the value chain progresses to RFID solution providers and system integrators. These entities are responsible for developing complete RFID systems, including readers, software platforms, and middleware that facilitate data collection, processing, and integration with existing enterprise systems like ERP and WMS. System integrators play a crucial role in customizing solutions to meet the specific requirements of pharmaceutical companies, hospitals, and other end-users, ensuring seamless deployment and operational efficiency. Their expertise in network infrastructure, software development, and project management is vital for successful implementation.

The distribution channel encompasses both direct and indirect sales models. Direct sales typically involve larger RFID solution providers engaging directly with major pharmaceutical corporations, offering bespoke solutions and ongoing support. Indirect channels include distributors, value-added resellers (VARs), and technology partners who extend market reach, particularly to smaller and medium-sized enterprises. These partners often provide localized support, training, and supplementary services, enhancing the accessibility and adoption of RFID technology across the diverse pharmaceutical landscape. The effectiveness of these channels significantly influences market penetration and customer satisfaction.

RFID in Pharmaceuticals Market Potential Customers

Potential customers for RFID in Pharmaceuticals solutions primarily consist of entities across the entire pharmaceutical ecosystem that are involved in the manufacturing, distribution, storage, and dispensing of medicinal products. Pharmaceutical manufacturers represent a significant customer base, driven by the imperative to comply with serialization regulations, combat counterfeiting, optimize inventory, and enhance overall supply chain visibility from raw materials to finished goods. Their large-scale operations and complex global supply chains necessitate advanced tracking and management solutions.

Hospitals and pharmacies constitute another crucial segment of potential customers. In these settings, RFID technology is increasingly adopted for accurate drug dispensing, preventing medication errors, managing high-value surgical instruments and medical devices, and maintaining precise inventory levels for controlled substances. The ability to track drugs at the unit level improves patient safety and operational efficiency within healthcare facilities, reducing manual counting and streamlining audits. Additionally, biotechnology companies, which often deal with sensitive and high-value biologics, are keen adopters of RFID for precise temperature monitoring and asset tracking.

Furthermore, contract research organizations (CROs) and clinical laboratories are emerging customers for RFID solutions, particularly for tracking samples, reagents, and equipment used in clinical trials and research. Blood banks also leverage RFID for managing blood bags and ensuring proper storage and distribution. The broader pharmaceutical distribution network, including wholesalers and logistics providers, are investing in RFID to optimize their warehousing, picking, and shipping processes, ensuring product integrity and timely delivery while meeting the stringent regulatory demands of the pharmaceutical industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.5 Billion |

| Market Forecast in 2032 | USD 4.9 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Avery Dennison Corporation, Zebra Technologies Corporation, Impinj Inc., SATO Holdings Corporation, Alien Technology LLC, Honeywell International Inc., NXP Semiconductors N.V., HID Global Corporation, Mojix Inc., Identiv Inc., Securitas AB (via HID Global), Datalogic S.p.A., Thinfilm ASA, Invengo Technology Pte. Ltd., CAEN RFID S.r.l., Nedap N.V., Xerafy Pte. Ltd., SensThys, GAO RFID Inc., Solstice RFID |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

RFID in Pharmaceuticals Market Key Technology Landscape

The RFID in Pharmaceuticals market is characterized by a dynamic technology landscape, primarily leveraging various forms of Radio Frequency Identification. High-Frequency (HF) RFID and Ultra High-Frequency (UHF) RFID are the predominant technologies used, with UHF gaining significant traction due to its longer read ranges and faster data transfer rates, making it ideal for tracking large volumes of products across the supply chain. HF RFID, including Near Field Communication (NFC), is often utilized for item-level authentication and patient engagement applications due to its shorter range and secure data transmission capabilities. The choice between these depends heavily on the specific application, environment, and regulatory requirements.

Beyond the fundamental RFID frequencies, the market is also seeing increased adoption of both passive and active RFID tags. Passive tags, which derive power from the reader's electromagnetic field, are widely used due to their low cost and small size, suitable for expendable items. Active tags, powered by internal batteries, offer extended read ranges, greater data storage capacity, and the ability to incorporate sensors (e.g., temperature, humidity), making them invaluable for tracking high-value pharmaceuticals, cold chain monitoring, and real-time location systems (RTLS) within facilities. The integration of sensor-enabled RFID tags is a key trend, providing critical environmental data alongside location information.

The technological landscape further extends to robust software platforms and cloud-based solutions that manage and analyze the vast amounts of data generated by RFID systems. Middleware solutions bridge the gap between RFID readers and enterprise systems, ensuring seamless data flow. The convergence of RFID with other advanced technologies like the Internet of Things (IoT), artificial intelligence (AI) for predictive analytics, and blockchain for immutable data integrity and enhanced transparency is transforming the pharmaceutical supply chain into an intelligent, interconnected network. These integrations are pivotal in addressing complex challenges such as counterfeiting, supply chain inefficiencies, and compliance with global serialization mandates, ultimately creating a more secure and efficient pharmaceutical ecosystem.

Regional Highlights

- North America: This region holds a significant market share, driven by stringent regulatory frameworks such as the DSCSA, high adoption rates of advanced technologies, and the presence of numerous large pharmaceutical companies. The focus on patient safety, anti-counterfeiting, and supply chain optimization fuels continuous investment in RFID solutions.

- Europe: Europe is another dominant region, largely influenced by the Falsified Medicines Directive (FMD) which mandates serialization and verification. Countries like Germany, the UK, and France are leading in RFID adoption due to well-developed healthcare infrastructure and pharmaceutical manufacturing capabilities.

- Asia Pacific (APAC): Expected to be the fastest-growing region, propelled by expanding pharmaceutical manufacturing bases, increasing healthcare expenditure, and a growing awareness of drug counterfeiting issues. Emerging economies like China and India are rapidly investing in RFID for supply chain integrity and efficiency.

- Latin America: This region is witnessing nascent but steady growth, as countries like Brazil and Mexico address challenges related to drug diversion and supply chain inefficiencies. Government initiatives and increasing investment in healthcare infrastructure are key growth drivers.

- Middle East and Africa (MEA): The MEA region is also showing promising growth, albeit from a smaller base. The adoption of RFID is driven by efforts to modernize healthcare systems, combat drug counterfeiting, and improve inventory management in burgeoning pharmaceutical markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the RFID in Pharmaceuticals Market.- Avery Dennison Corporation

- Zebra Technologies Corporation

- Impinj Inc.

- SATO Holdings Corporation

- Alien Technology LLC

- Honeywell International Inc.

- NXP Semiconductors N.V.

- HID Global Corporation

- Mojix Inc.

- Identiv Inc.

- Securitas AB (via HID Global)

- Datalogic S.p.A.

- Thinfilm ASA

- Invengo Technology Pte. Ltd.

- CAEN RFID S.r.l.

- Nedap N.V.

- Xerafy Pte. Ltd.

- SensThys

- GAO RFID Inc.

- Solstice RFID

Frequently Asked Questions

What is RFID in the pharmaceutical industry?

RFID (Radio-Frequency Identification) in pharmaceuticals uses electromagnetic fields to automatically identify and track tags attached to drugs, medical devices, or assets, enhancing supply chain visibility, preventing counterfeiting, and ensuring regulatory compliance.

How does RFID combat drug counterfeiting?

RFID tags provide unique, serialized identification for each pharmaceutical product. This enables real-time tracking from manufacturing to dispensing, allowing stakeholders to verify authenticity at any point and quickly detect fraudulent items.

What are the primary benefits of RFID for pharmaceutical companies?

Key benefits include improved inventory management, enhanced supply chain transparency, increased operational efficiency, reduced medication errors, compliance with serialization mandates, and robust protection against counterfeiting and diversion.

What challenges does the RFID in Pharmaceuticals market face?

Challenges include high initial implementation costs, ensuring data privacy and security, achieving global standardization across different RFID technologies, and managing potential signal interference in complex environments.

How is AI impacting RFID in the pharmaceutical supply chain?

AI enhances RFID by enabling predictive analytics for inventory, automating data interpretation, strengthening anti-counterfeiting through pattern recognition, and providing real-time insights for optimizing logistics and detecting anomalies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager