Rigid Plastic Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429319 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Rigid Plastic Packaging Market Size

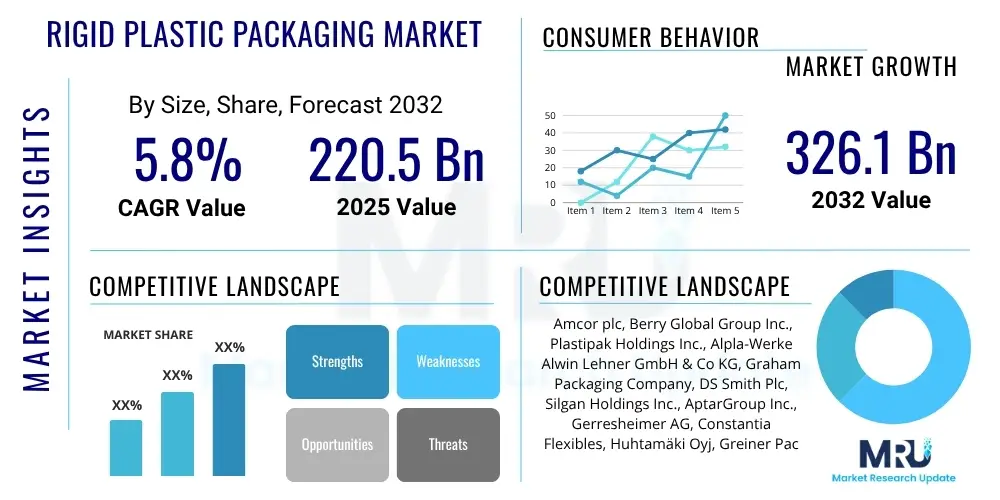

The Rigid Plastic Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 220.5 Billion in 2025 and is projected to reach USD 326.1 Billion by the end of the forecast period in 2032. This growth trajectory underscores the sustained demand across various end-use industries, driven by evolving consumer preferences and technological advancements in material science and manufacturing processes. The market's expansion is intrinsically linked to global economic growth, urbanization, and the proliferation of packaged consumer goods, particularly in emerging economies.

The consistent increase in market valuation reflects the crucial role rigid plastic packaging plays in modern supply chains. Its attributes such as durability, lightweight nature, cost-effectiveness, and versatile design capabilities make it indispensable for sectors ranging from food and beverages to pharmaceuticals and personal care. Innovations aimed at enhancing sustainability, such as increased recycled content and recyclability, are further solidifying its market position, adapting to a landscape increasingly focused on environmental responsibility.

Rigid Plastic Packaging Market introduction

The Rigid Plastic Packaging Market encompasses a diverse range of containers and enclosures crafted from various plastic polymers, characterized by their sturdy and inflexible forms. These products are engineered to provide robust protection, containment, and preservation for a wide array of goods across numerous industries. Key materials utilized include Polyethylene Terephthalate (PET), High-Density Polyethylene (HDPE), Polypropylene (PP), Polyvinyl Chloride (PVC), and Polystyrene (PS), each offering distinct properties suited to specific application requirements such as barrier protection, clarity, and chemical resistance. The extensive application of rigid plastic packaging spans critical sectors, predominantly the food and beverage industry, pharmaceuticals, personal care and cosmetics, and industrial chemicals, where product integrity and consumer convenience are paramount.

The primary benefits driving the pervasive adoption of rigid plastic packaging include its exceptional strength-to-weight ratio, which reduces transportation costs and carbon footprint. Its inherent durability protects products from physical damage, contamination, and spoilage, thereby extending shelf life. Furthermore, plastics offer unparalleled design flexibility, allowing for innovative shapes, sizes, and dispensing mechanisms that enhance brand differentiation and consumer usability. The cost-effectiveness of plastic compared to alternatives like glass or metal, coupled with efficient high-volume manufacturing processes, significantly contributes to its market dominance. These factors collectively establish rigid plastic packaging as an economical and high-performing choice for packaging solutions.

Several pivotal factors are driving the sustained growth of the rigid plastic packaging market. The burgeoning global population, coupled with increasing disposable incomes, particularly in developing regions, fuels demand for packaged food and beverage products. The exponential expansion of e-commerce platforms necessitates robust and lightweight packaging solutions capable of withstanding the rigors of transit, a role perfectly suited for rigid plastics. Moreover, the growth of the pharmaceutical and personal care industries, driven by an aging global populace and heightened health consciousness, consistently demands high-quality, safe, and tamper-evident packaging. Ongoing innovations in material science, focusing on enhanced barrier properties, lightweighting, and incorporating recycled content, are also instrumental in propelling market expansion and addressing evolving regulatory and environmental concerns.

Rigid Plastic Packaging Market Executive Summary

The Rigid Plastic Packaging Market is experiencing dynamic shifts influenced by several overarching business, regional, and segmental trends. Globally, the industry is navigating a complex landscape shaped by increasing consumer demand for convenience and portability, alongside mounting pressure for sustainable packaging solutions. Key business trends include a heightened focus on circular economy principles, leading to significant investments in advanced recycling technologies and the integration of post-consumer recycled (PCR) content into new packaging formats. Manufacturers are actively pursuing lightweighting initiatives to reduce material usage and logistics costs, simultaneously improving their environmental profiles. Strategic collaborations and mergers and acquisitions are frequently observed as companies seek to consolidate market share, enhance technological capabilities, and expand their geographic reach, particularly into rapidly growing emerging markets.

Regional trends reveal distinct market dynamics and growth patterns. Asia Pacific stands as the largest and fastest-growing market, driven by its vast population, rapid industrialization, and burgeoning middle class with increasing purchasing power. Countries like China and India are at the forefront, witnessing robust demand from the food and beverage, pharmaceutical, and personal care sectors. North America and Europe, while mature markets, are leading in terms of sustainable packaging innovations, stringent regulatory frameworks, and consumer preference for eco-friendly options. These regions are characterized by a strong emphasis on advanced recycling infrastructure, bio-based plastics, and smart packaging technologies. Latin America and the Middle East & Africa regions are also showing considerable potential, fueled by expanding manufacturing bases and improving economic conditions, attracting significant investment from global players.

Segmental trends highlight the prevailing preferences and growth areas within the rigid plastic packaging market. By product type, bottles and jars continue to dominate due to their widespread use in beverages, personal care products, and pharmaceuticals, offering excellent barrier properties and design versatility. Containers, including tubs and cups, are also witnessing robust growth, particularly in the dairy, ready-to-eat meals, and confectionary sectors, driven by convenience and single-serve trends. In terms of material, PET remains a cornerstone, favored for its clarity, strength, and recyclability, especially in beverage applications. HDPE and PP are integral to various other applications, from detergents to food storage, owing to their chemical resistance and durability. The food and beverage end-use segment consistently holds the largest share, propelled by global consumption patterns and the need for safe, extended shelf-life packaging solutions. Pharmaceuticals and personal care are also significant and rapidly expanding segments, requiring specialized, high-integrity packaging.

AI Impact Analysis on Rigid Plastic Packaging Market

The integration of Artificial Intelligence (AI) across the rigid plastic packaging market is a focal point for many stakeholders, sparking discussions around enhanced operational efficiency, sustainability, and competitive advantages. Common user questions often revolve around how AI can optimize production processes, reduce waste, and improve material quality and traceability. There is significant interest in AI's role in predictive maintenance for manufacturing equipment, its capacity to streamline supply chain logistics, and its potential to revolutionize packaging design through advanced simulation and material selection. Users are also keen to understand how AI can aid in the development and implementation of sustainable packaging solutions, from identifying optimal recycled content ratios to improving sorting and recycling processes. Concerns often include the initial investment costs, the complexity of data integration, and the need for a skilled workforce to leverage AI capabilities effectively within the existing infrastructure of packaging operations.

- AI-driven optimization of manufacturing processes, leading to reduced waste, increased throughput, and lower energy consumption through predictive analytics and adaptive control systems.

- Enhanced quality control and defect detection utilizing computer vision and machine learning algorithms, ensuring consistent product quality and minimizing recalls.

- Optimized supply chain and logistics management through AI-powered demand forecasting, inventory management, and route optimization, reducing transportation costs and lead times.

- Revolutionized packaging design and material innovation by employing AI to simulate performance, test material combinations, and identify optimal structures for lightweighting and barrier properties.

- Improved sustainability efforts through AI applications in sorting and recycling facilities, enhancing the accuracy and efficiency of plastic waste segregation, thus boosting recycled content integration.

- Personalized and smart packaging development, enabling features like freshness monitoring and anti-counterfeiting measures through AI-embedded sensors and data analysis.

- Predictive maintenance for machinery, significantly reducing downtime and operational costs by forecasting equipment failures before they occur, improving overall equipment effectiveness (OEE).

DRO & Impact Forces Of Rigid Plastic Packaging Market

The Rigid Plastic Packaging Market is influenced by a powerful combination of drivers, restraints, and opportunities that collectively shape its trajectory and competitive landscape. A primary driver is the relentless growth of the food and beverage industry, especially in emerging economies, fueled by urbanization, increasing disposable incomes, and the global demand for convenience foods and beverages. The robust expansion of e-commerce platforms also acts as a significant catalyst, as online retail necessitates lightweight, durable, and protective packaging solutions capable of withstanding complex logistics chains. Furthermore, the burgeoning pharmaceutical and personal care sectors, driven by an aging global population and heightened health consciousness, consistently demand high-integrity, safe, and often tamper-evident rigid plastic packaging, thereby underpinning sustained market growth. These factors collectively amplify the demand for rigid plastic solutions, demonstrating their indispensable role in modern consumer goods delivery.

However, the market faces considerable restraints that temper its expansion. Environmental concerns surrounding plastic waste and pollution represent the most significant challenge, leading to stringent governmental regulations targeting single-use plastics and promoting circular economy principles. This regulatory pressure often results in increased compliance costs for manufacturers and shifts in consumer preference towards more sustainable alternatives. The inherent volatility of raw material prices, primarily petroleum-based resins, poses another significant restraint, impacting profit margins and creating unpredictability in production costs. Additionally, the rigid plastic packaging market faces intense competition from alternative packaging materials, notably flexible packaging, which often offers lower material usage and reduced logistical expenses, posing a direct threat to market share in certain applications. These challenges necessitate continuous innovation and adaptation from market players to maintain relevance and competitiveness.

Despite these restraints, numerous opportunities are emerging that promise to redefine and invigorate the rigid plastic packaging market. The accelerating development and adoption of sustainable packaging solutions, including packaging made from recycled content (PCR), bio-based plastics, and fully recyclable mono-material designs, present a substantial growth avenue. Innovations in smart packaging technologies, such as embedded sensors for product freshness monitoring or QR codes for enhanced traceability, offer added value and consumer engagement, opening new premium market segments. Moreover, the vast untapped potential in emerging economies across Asia Pacific, Latin America, and Africa, characterized by rapidly growing consumer bases and developing retail infrastructures, provides significant geographical expansion opportunities for market participants. Investing in these areas allows companies to leverage lower production costs and cater to escalating regional demand, thus ensuring long-term market vitality and growth.

Segmentation Analysis

The rigid plastic packaging market is comprehensively segmented to provide granular insights into its diverse components, aiding in strategic decision-making and market analysis. These segmentations typically classify the market based on the type of material used, the specific product form, and the end-use industry that utilizes the packaging. Each segment exhibits unique characteristics in terms of growth drivers, technological advancements, and competitive dynamics, reflecting the varied requirements and applications across the global packaging landscape. Understanding these distinctions is crucial for identifying lucrative niches, assessing market potential, and formulating targeted business strategies. The inherent versatility of rigid plastics allows for extensive customization, leading to a complex yet highly functional market structure.

- By Material:

- Polyethylene Terephthalate (PET): Widely used for beverages, food, and personal care due to its clarity, barrier properties, and recyclability.

- High-Density Polyethylene (HDPE): Known for its stiffness, chemical resistance, and impact strength, commonly found in milk jugs, detergent bottles, and industrial containers.

- Polypropylene (PP): Offers excellent heat resistance, chemical inertness, and durability, prevalent in yogurt cups, medical devices, and microwaveable containers.

- Polyvinyl Chloride (PVC): Used for blister packaging, medical packaging, and certain food wraps due to its transparency and barrier properties, though its use is declining in some regions due to environmental concerns.

- Polystyrene (PS): Often used for disposable cups, deli containers, and protective packaging inserts, valued for its stiffness and low cost.

- Others: Includes engineering plastics, bio-plastics, and blends tailored for niche applications.

- By Product Type:

- Bottles & Jars: Dominant segment, used extensively for beverages, pharmaceuticals, personal care products, and sauces.

- Containers: Encompasses various forms like tubs, pots, and clamshells, popular for dairy products, ready-to-eat meals, and fresh produce.

- Tubs & Cups: Specifically designed for dairy products, desserts, and single-serve portions, emphasizing convenience and portion control.

- Trays: Utilized for packaging fresh meat, poultry, seafood, and bakery products, offering protective containment and display functionality.

- Others: Includes closures, caps, pails, and other specialized rigid plastic components.

- By End-Use Industry:

- Food & Beverage: The largest segment, covering beverages, dairy, processed foods, fresh produce, and confectionery, driven by consumption patterns and preservation needs.

- Pharmaceutical & Healthcare: Requires high-purity, tamper-evident, and sterile packaging for medicines, medical devices, and healthcare products.

- Personal Care & Cosmetics: Focuses on aesthetic appeal, functional dispensing, and product protection for shampoos, lotions, makeup, and perfumes.

- Industrial & Chemical: Encompasses packaging for chemicals, lubricants, paints, and other industrial products, demanding robustness and chemical resistance.

- Consumer Goods: Includes packaging for household cleaning products, toys, electronics, and various other non-food consumer items.

- Others: Covers diverse applications like automotive parts, agricultural products, and retail packaging.

Value Chain Analysis For Rigid Plastic Packaging Market

The value chain for the rigid plastic packaging market is a complex ecosystem involving several interconnected stages, commencing from raw material extraction and culminating in the delivery of packaged goods to end-consumers. The upstream segment primarily involves petrochemical companies that produce the foundational plastic resins such as PET, HDPE, PP, PVC, and PS from crude oil and natural gas derivatives. These raw material suppliers are critical, as the quality, availability, and pricing of their resin products directly impact the cost structure and production capabilities of packaging manufacturers. Innovation in this segment focuses on developing advanced polymer grades with enhanced barrier properties, lightweighting capabilities, and increased suitability for recycling or bio-based alternatives, thereby setting the foundational performance characteristics of the final packaging products. Strategic partnerships and long-term supply agreements between resin producers and packaging converters are common to ensure supply stability and manage price volatility, which is a perennial concern in the industry.

Moving downstream, the value chain encompasses packaging converters and manufacturers who transform raw plastic resins into finished rigid packaging products through various processes like injection molding, blow molding, thermoforming, and extrusion. This stage involves significant investment in advanced machinery, technological expertise, and research and development to create innovative designs, improve manufacturing efficiency, and meet stringent quality and safety standards. Converters often specialize in particular product types or materials, catering to specific industry demands. Following manufacturing, the distribution channel plays a crucial role in linking packaging producers with their diverse clientele, which includes brand owners and end-use industries. Distribution can be direct, where large manufacturers supply directly to major clients, or indirect, involving a network of distributors, wholesalers, and packaging solution providers who offer a broader range of products and services to smaller or regional clients. The choice of distribution channel often depends on the scale of operation, geographical reach, and the specific needs of the end-user, ensuring efficient market penetration and timely delivery of packaging solutions.

The final segment of the value chain involves the end-use industries, such as food and beverage, pharmaceutical, personal care, and industrial sectors, which integrate the rigid plastic packaging into their product lines. These industries are the ultimate buyers, dictating specific requirements for packaging performance, design, and sustainability. Their feedback and evolving needs drive innovation back up the value chain, influencing resin development and manufacturing processes. The effectiveness of the entire value chain hinges on seamless collaboration, transparent communication, and a shared commitment to quality and sustainability among all participants. The increasing focus on circular economy principles has introduced new complexities, requiring greater integration and cooperation across the entire chain, from design for recyclability at the manufacturing stage to efficient collection and reprocessing of post-consumer waste, ultimately closing the loop and reducing environmental impact. Each link in this chain contributes significantly to the overall efficiency and sustainability of the rigid plastic packaging market.

Rigid Plastic Packaging Market Potential Customers

Potential customers for rigid plastic packaging are diverse and span across numerous industrial and consumer-facing sectors, primarily driven by the fundamental need for reliable product containment, protection, and display. The largest and most influential segment of these customers originates from the food and beverage industry. This includes major multinational corporations producing soft drinks, bottled water, dairy products, processed foods, sauces, condiments, and snack items, as well as smaller artisanal producers. These entities require packaging that ensures product freshness, extends shelf life, withstands transportation, and offers consumer convenience, making rigid plastics an ideal choice for bottles, jars, tubs, and trays. The pervasive demand for packaged edibles and potable liquids globally ensures this segment remains a dominant force, constantly seeking innovative, cost-effective, and increasingly sustainable rigid plastic solutions to maintain competitiveness and meet evolving consumer preferences for health, convenience, and eco-friendliness.

Another critically important customer base resides within the pharmaceutical and healthcare sectors. Companies in this domain, ranging from global pharmaceutical giants to specialized medical device manufacturers, demand rigid plastic packaging solutions that meet rigorous regulatory standards for safety, sterility, tamper-evidence, and child resistance. Packaging for medicines, medical devices, diagnostic kits, and personal protective equipment often utilizes high-performance plastics like PP and PET for bottles, blister packs, and specialized containers. The emphasis here is on precision, material purity, and robust barrier properties to protect sensitive contents from contamination, moisture, and light, thereby preserving efficacy and ensuring patient safety. As the global healthcare landscape expands and regulatory scrutiny intensifies, the demand for sophisticated and compliant rigid plastic packaging from this sector continues to grow, driving innovation in material science and production techniques to meet increasingly complex requirements.

Furthermore, the personal care and cosmetics industry represents a significant and rapidly expanding customer segment. Leading beauty brands, cosmetic manufacturers, and personal hygiene product companies frequently opt for rigid plastic packaging for items such as shampoos, conditioners, lotions, creams, serums, and makeup. Packaging in this sector demands a strong aesthetic appeal, ergonomic design, and compatibility with various chemical formulations. PET and HDPE bottles, PP jars, and specialized dispensing solutions are widely used to enhance brand image, provide consumer convenience, and ensure product integrity. Beyond these core sectors, industrial and chemical manufacturers, as well as producers of various household and consumer goods, also constitute substantial potential customers. These range from industrial chemical producers requiring robust containers for safe transport and storage, to manufacturers of household cleaning products, toys, and electronics, all benefiting from the durability, cost-effectiveness, and design versatility offered by rigid plastic packaging. The ongoing diversification of product offerings and the continuous evolution of consumer markets ensure a broad and expanding base of potential customers for rigid plastic packaging solutions globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 220.5 Billion |

| Market Forecast in 2032 | USD 326.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, Berry Global Group Inc., Plastipak Holdings Inc., Alpla-Werke Alwin Lehner GmbH & Co KG, Graham Packaging Company, DS Smith Plc, Silgan Holdings Inc., AptarGroup Inc., Gerresheimer AG, Constantia Flexibles, Huhtamäki Oyj, Greiner Packaging International GmbH, Faerch Plast A/S, Bemis Company (now part of Amcor), Pactiv Evergreen Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rigid Plastic Packaging Market Key Technology Landscape

The rigid plastic packaging market is continuously evolving, driven by advancements in manufacturing technologies that enhance efficiency, versatility, and sustainability. Core processing technologies include injection molding, widely used for producing closures, caps, and preforms for blow-molded bottles, known for its precision and ability to create complex shapes. Blow molding, encompassing extrusion blow molding and injection blow molding, is critical for manufacturing hollow plastic products like bottles and jars of various sizes and designs, offering excellent material distribution and barrier properties. Thermoforming is another significant technology, primarily utilized for producing trays, cups, and clamshells from plastic sheets, valued for its cost-effectiveness in high-volume production and suitability for customized packaging solutions. These foundational technologies form the backbone of rigid plastic packaging manufacturing, enabling the creation of a vast array of products tailored to diverse industrial needs and consumer preferences.

Beyond these primary forming methods, several advanced technologies are significantly impacting the market. Multilayer co-extrusion and co-injection technologies enable the creation of packaging with enhanced barrier properties by combining different plastics in distinct layers. This is crucial for extending the shelf life of oxygen-sensitive food products and pharmaceuticals, offering superior protection against gas, moisture, and UV light. Lightweighting technologies, often achieved through advanced mold designs, material optimization, and foam injection molding, are paramount for reducing material consumption and transportation costs, simultaneously contributing to environmental sustainability goals. Furthermore, in-mold labeling (IML) and digital printing techniques are gaining traction for high-quality, durable, and aesthetically appealing decoration directly during the manufacturing process, enhancing brand visibility and consumer engagement without additional post-production steps, thereby streamlining the overall packaging workflow and reducing production lead times.

The increasing emphasis on sustainability is also propelling technological innovation within the rigid plastic packaging sector. Advanced recycling technologies, such as chemical recycling that breaks down plastics to their monomer level, are emerging to complement traditional mechanical recycling, allowing for the creation of virgin-quality resins from mixed plastic waste. The development of bio-based plastics, derived from renewable resources like corn starch or sugarcane, offers alternatives to fossil fuel-based polymers, addressing environmental concerns and reducing carbon footprint. Additionally, the integration of smart packaging technologies, involving embedded sensors, NFC tags, or QR codes, is enhancing functionalities such as product traceability, freshness indicators, and anti-counterfeiting measures. These innovations leverage digital connectivity to provide added value, improve consumer interaction, and support more efficient supply chain management. This dynamic technological landscape underscores the industry's commitment to meeting both functional demands and growing environmental responsibilities, driving continuous evolution and diversification of rigid plastic packaging solutions.

Regional Highlights

- Asia Pacific: Emerging as the largest and fastest-growing market, driven by rapidly expanding economies like China, India, and Southeast Asian nations. This region benefits from a massive consumer base, increasing urbanization, rising disposable incomes, and the exponential growth of the e-commerce sector. Manufacturing capabilities are robust, with significant investments in packaging infrastructure and a growing demand from the food and beverage, pharmaceutical, and personal care industries.

- North America: A mature market characterized by high consumer spending and a strong emphasis on innovation and sustainability. The region is a leader in adopting recycled content, lightweighting, and advanced packaging technologies. Strict regulations and a heightened consumer environmental consciousness are driving demand for eco-friendly rigid plastic solutions, particularly in the food, beverage, and personal care sectors.

- Europe: Similar to North America, Europe is a highly developed market with stringent environmental regulations and a strong focus on circular economy principles. Countries like Germany, France, and the UK are at the forefront of implementing advanced recycling schemes and promoting bio-based plastics. The market is driven by innovation in barrier packaging, smart packaging, and the integration of post-consumer recycled (PCR) materials, especially within the food, dairy, and pharmaceutical industries.

- Latin America: An emerging market exhibiting significant growth potential, particularly in Brazil, Mexico, and Argentina. Economic development, increasing industrialization, and a growing middle class are boosting demand for packaged consumer goods. The region offers opportunities for market expansion, especially with cost-effective and durable rigid plastic packaging solutions for beverages and household products.

- Middle East and Africa (MEA): This region is experiencing steady growth, fueled by economic diversification, increasing population, and improvements in retail infrastructure. Countries in the GCC and South Africa are leading the adoption of modern packaging solutions. Demand from the food and beverage sector, coupled with investments in industrial and personal care manufacturing, is driving market expansion, with a growing focus on convenience and hygiene.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rigid Plastic Packaging Market.- Amcor plc

- Berry Global Group Inc.

- Plastipak Holdings Inc.

- Alpla-Werke Alwin Lehner GmbH & Co KG

- Graham Packaging Company

- DS Smith Plc

- Silgan Holdings Inc.

- AptarGroup Inc.

- Gerresheimer AG

- Constantia Flexibles

- Huhtamäki Oyj

- Greiner Packaging International GmbH

- Faerch Plast A/S

- Bemis Company (now part of Amcor)

- Pactiv Evergreen Inc.

Frequently Asked Questions

Analyze common user questions about the Rigid Plastic Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current market size and projected growth rate of the Rigid Plastic Packaging Market?

The Rigid Plastic Packaging Market is estimated at USD 220.5 Billion in 2025 and is projected to reach USD 326.1 Billion by 2032. It is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period. This growth is primarily fueled by increasing demand from various end-use industries, particularly food and beverage, pharmaceuticals, and personal care, alongside ongoing innovations in packaging technology and material science to enhance sustainability and performance.

What are the primary drivers accelerating the growth of the Rigid Plastic Packaging Market?

The market's growth is predominantly driven by the expanding global food and beverage industry, fueled by increasing population and urbanization, and the rise of e-commerce necessitating robust, lightweight packaging. Additionally, the flourishing pharmaceutical and personal care sectors consistently demand high-quality, protective packaging. The inherent benefits of rigid plastics, such as durability, cost-effectiveness, and design versatility, further contribute to its widespread adoption across these critical sectors, ensuring sustained market momentum.

What are the key challenges or restraints faced by the Rigid Plastic Packaging Market?

The Rigid Plastic Packaging Market faces significant restraints, primarily stemming from escalating environmental concerns over plastic waste, leading to stringent governmental regulations targeting single-use plastics and promoting recycling initiatives. Volatility in raw material prices, largely petroleum-based resins, poses another challenge by impacting production costs and profit margins. Furthermore, intense competition from alternative packaging materials, notably flexible packaging and glass, creates pressure on market share in specific applications, necessitating continuous innovation from manufacturers to maintain competitiveness and relevance.

How is sustainability influencing the Rigid Plastic Packaging Market?

Sustainability is profoundly impacting the Rigid Plastic Packaging Market, driving significant innovation and strategic shifts. There is an increasing focus on developing packaging solutions with higher recycled content (PCR), utilizing bio-based plastics, and creating designs that are fully recyclable or compostable. Manufacturers are investing in advanced recycling technologies and lightweighting initiatives to reduce material consumption and carbon footprint. Consumer demand for eco-friendly options and evolving regulatory frameworks are compelling the industry towards a more circular economy model, prioritizing environmental responsibility throughout the entire product lifecycle.

Which end-use industries are the major consumers of rigid plastic packaging?

The major consumers of rigid plastic packaging are diverse, with the Food & Beverage industry leading due to extensive use in bottling beverages, dairy products, processed foods, and fresh produce. The Pharmaceutical & Healthcare sector is another critical consumer, requiring high-purity, tamper-evident packaging for medicines and medical devices. Additionally, the Personal Care & Cosmetics industry heavily relies on rigid plastics for aesthetic appeal and product protection in shampoos, lotions, and makeup. The Industrial & Chemical sector also uses robust rigid plastic containers for various chemicals and industrial products, highlighting the broad applicability of these packaging solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager