Robotic Warfare Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428505 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Robotic Warfare Market Size

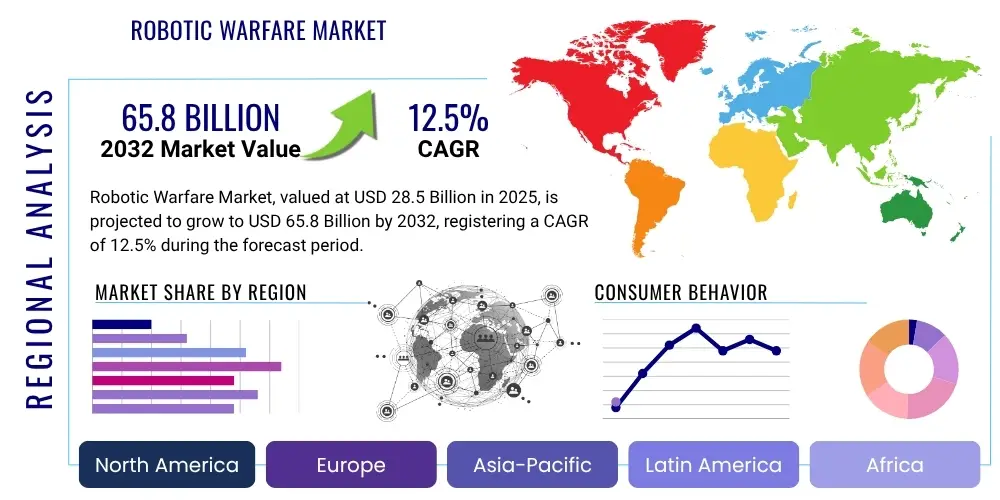

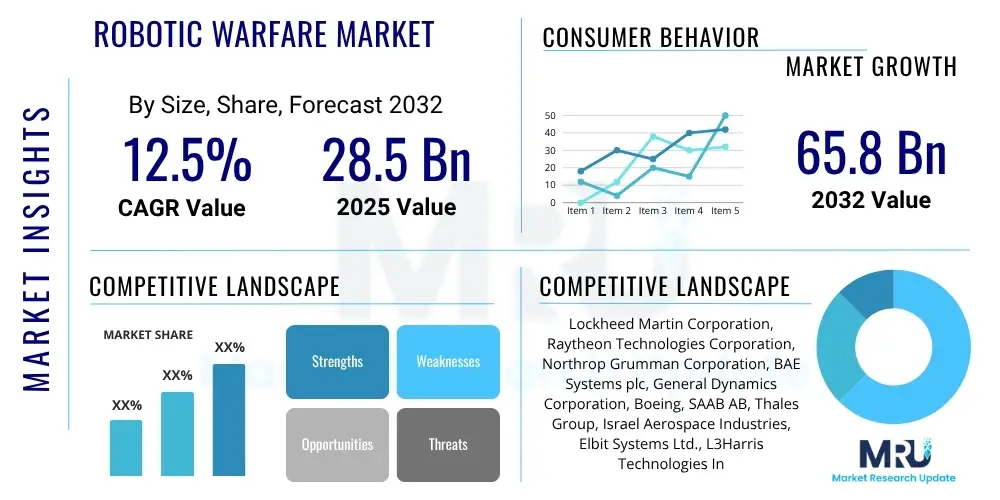

The Robotic Warfare Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 28.5 Billion in 2025 and is projected to reach USD 65.8 Billion by the end of the forecast period in 2032.

Robotic Warfare Market introduction

The Robotic Warfare Market represents a transformative segment within the global defense industry, dedicated to the innovation, manufacturing, and strategic deployment of autonomous and semi-autonomous systems designed for a broad spectrum of military and security operations. These cutting-edge platforms, which encompass unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), unmanned surface vehicles (USVs), and unmanned undersea vehicles (UUVs), are increasingly becoming indispensable assets for modern armed forces. Leveraging breakthroughs in artificial intelligence, advanced sensor fusion, sophisticated navigation, and robust communication technologies, these systems are fundamentally redefining the doctrines of contemporary warfare. They are engineered to execute tasks with unprecedented precision and endurance, ranging from covert intelligence gathering and persistent surveillance to direct combat support, logistical resupply, and critical infrastructure protection, thereby augmenting human capabilities and mitigating risks to personnel in hazardous zones.

The product offerings within this dynamic market are characterized by their varying degrees of operational autonomy, spanning from remotely piloted systems that require constant human oversight to highly autonomous platforms capable of executing complex missions with minimal human intervention. This spectrum of autonomy allows for flexible integration into diverse operational scenarios and strategic objectives. Major applications include enhancing intelligence, surveillance, and reconnaissance (ISR) capabilities, enabling precision strike operations with reduced collateral damage, securing vast border territories, executing complex mine countermeasures (MCM), and performing critical search and rescue (SAR) missions in disaster-stricken areas. The strategic benefits conferred by robotic warfare systems are profound, including significantly extended mission durations, superior situational awareness across multiple domains, enhanced lethality and precision in engagements, and a paramount reduction in human casualties, making them a cornerstone of future defense strategies.

Several powerful driving factors are propelling the robust expansion of this market. Geopolitical instabilities and an escalating global arms race are leading nations to substantially increase their defense expenditures, prioritizing investments in advanced, force-multiplying technologies like robotic warfare. Concurrently, a universal demand persists for military solutions that minimize human exposure to the inherent dangers of combat, making autonomous systems highly attractive. The relentless pace of technological innovation in fields such as AI, robotics, cybernetics, and advanced materials continues to unlock new capabilities and improve the performance-to-cost ratio of these systems, making them more accessible and effective. Furthermore, the increasing complexity of modern threats, including asymmetric warfare and cyberattacks, necessitates sophisticated, multi-domain robotic solutions, cementing their critical role in shaping the future security landscape.

Robotic Warfare Market Executive Summary

The Robotic Warfare Market is poised for substantial expansion, underpinned by a complex interplay of emerging business trends, distinct regional market dynamics, and significant advancements across its various segments. A pivotal business trend shaping the industry is the accelerating convergence of defense capabilities with cutting-edge commercial technologies, particularly in artificial intelligence, machine learning, and advanced data analytics. This synergistic integration is fostering the development of more intelligent, adaptive, and predictive robotic systems, moving beyond simple automation to sophisticated cognitive platforms capable of complex, real-time decision-making. Strategic alliances between traditional defense primes and agile tech startups are becoming commonplace, driving faster innovation cycles and encouraging disruptive technological breakthroughs. Furthermore, the focus on developing robust cybersecurity measures for autonomous systems is intensifying, recognizing the critical need to protect these high-value assets from sophisticated adversarial threats, thereby influencing procurement priorities and R&D investments.

From a regional perspective, the market exhibits varied growth trajectories and investment patterns. North America, spearheaded by the United States, maintains its stronghold due to unparalleled defense spending, a mature defense industrial base, and a strong emphasis on integrating advanced robotics into its military operations. This region is a hotbed for R&D in AI-powered autonomous systems. Conversely, the Asia Pacific region is rapidly emerging as the principal growth engine, fueled by the aggressive military modernization programs of countries like China, India, and South Korea, coupled with rising geopolitical tensions in the Indo-Pacific. European nations are collaboratively investing in next-generation robotic capabilities through initiatives such as the Permanent Structured Cooperation (PESCO), aiming for greater interoperability and shared technological advancements. The Middle East and Africa present a growing, albeit fragmented, market driven by persistent security challenges and a reliance on international suppliers for advanced defense solutions.

Segment-wise, the market is witnessing significant shifts and expansions. The Unmanned Aerial Vehicles (UAVs) segment continues to command the largest share, propelled by their proven efficacy in diverse roles from surveillance to precision strikes. However, Unmanned Ground Vehicles (UGVs) are projected to experience rapid growth, particularly as their capabilities expand into complex combat support, logistics, and hazardous materials handling. Unmanned Maritime Vehicles (UMVs), encompassing both surface and undersea platforms, are also seeing increased investment for naval operations, mine warfare, and maritime domain awareness. The market is increasingly trending towards higher levels of autonomy, with semi-autonomous and fully autonomous systems gaining prominence as technological maturity and trust in AI-driven decision-making grow, reflecting a strategic pivot towards reduced human burden and enhanced operational efficiency across all defense domains.

AI Impact Analysis on Robotic Warfare Market

Common user inquiries regarding AI's influence on the Robotic Warfare Market frequently center on critical aspects such as the future of human control in military decision-making, the ethical implications of autonomous lethal systems, and the potential for unintended escalation in conflicts. There is a palpable curiosity about how AI will enhance the operational effectiveness and tactical advantages of robotic platforms, improve real-time situational awareness, and reduce cognitive load on human operators. Simultaneously, deep concerns are expressed about the accountability framework for AI-driven actions, the reliability of AI in unpredictable combat scenarios, and the necessity for robust safeguards against algorithmic bias or malicious exploitation. Users generally expect AI to be a game-changer, but with a strong emphasis on the need for rigorous ethical guidelines, international regulations, and transparent development processes to ensure responsible deployment and mitigate existential risks associated with increasingly autonomous military technologies.

- AI enables sophisticated, real-time tactical decision-making for autonomous systems.

- Dramatically improves target recognition, classification, and tracking precision.

- Facilitates complex multi-robot coordination and swarming capabilities.

- Enhances predictive maintenance, reducing downtime and improving readiness.

- Powers advanced data fusion from diverse sensors for superior situational awareness.

- Accelerates development of adaptive mission planning and execution capabilities.

- Creates novel opportunities for symbiotic human-robot teaming (HRT).

- Introduces profound ethical dilemmas regarding human responsibility and control.

- Demands advanced cybersecurity to protect AI models and data from adversaries.

- Drives the evolution of robotic platforms towards greater autonomy and intelligence.

DRO & Impact Forces Of Robotic Warfare Market

The Robotic Warfare Market's trajectory is sculpted by a powerful combination of drivers, restraints, opportunities, and pervasive impact forces. A primary driver is the accelerating global defense expenditure, spurred by persistent geopolitical tensions, regional conflicts, and the imperative for nations to maintain a technological edge. The demand for systems that significantly reduce human exposure to hazardous combat zones, thereby minimizing casualties, further fuels adoption. Concurrent technological advancements in artificial intelligence, machine learning, advanced sensor fusion, miniaturization, and robust materials science are continuously expanding the capabilities and operational envelopes of robotic platforms, making them increasingly versatile and cost-effective for a wider array of military missions. The strategic advantage offered by persistent surveillance, precision strike capabilities, and enhanced logistical support provided by these systems is a compelling force for market growth.

However, the market also contends with significant restraints that temper its expansion. Foremost among these are the profound ethical, legal, and societal concerns surrounding lethal autonomous weapons systems (LAWS) and the broader debate over delegating life-or-death decisions to machines. These debates could lead to stringent international regulations, arms control agreements, or public backlash, potentially hindering development and deployment. The exceptionally high research, development, and procurement costs associated with advanced robotic warfare platforms can be a substantial barrier, particularly for nations with limited defense budgets. Furthermore, inherent technical challenges, including cybersecurity vulnerabilities, the reliability of autonomous systems in unpredictable combat environments, and the complexities of operating in highly contested electronic warfare (EW) landscapes, pose operational risks that require continuous and sophisticated mitigation strategies, adding to the overall cost and complexity.

Despite these challenges, numerous opportunities exist to drive future market expansion and innovation. The continued development of sophisticated human-robot teaming (HRT) models, where humans and robots collaborate synergistically with humans maintaining ultimate supervisory control, promises to unlock new levels of operational effectiveness. The exploration of dual-use technologies, where military innovations find applications in civilian sectors such as disaster response, critical infrastructure inspection, or remote monitoring, could diversify revenue streams and foster broader technological adoption. Further opportunities lie in developing more energy-efficient robotic platforms for extended endurance, enhancing stealth capabilities, and creating more resilient, anti-jamming communication links. The overarching impact forces shaping this market include the relentless pace of technological innovation, significant geopolitical shifts influencing defense doctrines, intense ethical and legal scrutinies, and the ever-present pressures of national defense budgets and strategic military priorities.

Segmentation Analysis

The Robotic Warfare Market is meticulously segmented to provide a granular understanding of its diverse components, technological applications, and end-user requirements, which are crucial for strategic analysis and informed decision-making. This multi-dimensional segmentation allows for a detailed examination of market dynamics, highlighting key areas of growth, emerging technological niches, and critical investment pathways. The framework typically categorizes the market based on the type of platform deployed, the degree of autonomy exhibited by these systems, their specific military applications, and the primary end-users or purchasing entities within the defense and security sectors. Each segment and sub-segment contributes uniquely to the market's overarching structure and competitive landscape.

Segmentation by platform, for instance, delineates the various physical forms these robotic systems take, including Unmanned Aerial Vehicles (UAVs) for airborne operations, Unmanned Ground Vehicles (UGVs) for terrestrial missions, Unmanned Surface Vehicles (USVs) for naval surface deployments, and Unmanned Undersea Vehicles (UUVs) for submerged operations. Within each platform category, further sub-segmentation exists, such as fixed-wing versus rotary-wing UAVs, or small versus heavy UGVs, reflecting specialized design and operational capabilities. The autonomy level segmentation is equally critical, distinguishing between human-in-the-loop systems (requiring continuous human input), human-on-the-loop systems (semi-autonomous with human supervision), and human-out-of-the-loop systems (fully autonomous within predefined parameters), which directly influences regulatory considerations and technological development priorities.

Moreover, the market is segmented by application, illustrating the wide array of tasks these systems are designed to perform, from intelligence gathering and combat roles to logistics, mine clearance, and security functions, each driven by distinct operational needs. The end-user segmentation primarily differentiates between military forces (armies, navies, air forces) and homeland security agencies, acknowledging their varied procurement processes, budgetary constraints, and mission-specific requirements. This comprehensive segmentation framework is indispensable for stakeholders to accurately assess market opportunities, anticipate technological shifts, tailor product development, and formulate effective market entry and growth strategies in this rapidly evolving and highly specialized defense sector.

- By Platform:

- Unmanned Aerial Vehicles (UAVs)

- Fixed-Wing UAVs: Used for long-endurance surveillance, reconnaissance, and strike missions.

- Rotary-Wing UAVs: Employed for vertical take-off/landing, close-range reconnaissance, and cargo delivery.

- Hybrid UAVs: Combine fixed-wing efficiency with rotary-wing versatility for diverse missions.

- Unmanned Ground Vehicles (UGVs)

- Small UGVs: Ideal for reconnaissance, explosive ordnance disposal (EOD), and hazardous material handling in confined spaces.

- Medium UGVs: Used for combat support, light transport, and armed reconnaissance.

- Heavy UGVs: Designed for main battle operations, heavy transport, and perimeter defense.

- Unmanned Surface Vehicles (USVs)

- Large USVs: For long-duration maritime surveillance, anti-submarine warfare, and cargo transport.

- Small USVs: Used for port security, mine countermeasures, and intelligence gathering in littoral waters.

- Unmanned Undersea Vehicles (UUVs)

- Autonomous Underwater Vehicles (AUVs): Capable of independent operation for mapping, surveillance, and mine detection.

- Remotely Operated Vehicles (ROVs): Tethred vehicles for inspection, manipulation, and recovery operations.

- Unmanned Aerial Vehicles (UAVs)

- By Autonomy Level:

- Human-in-the-Loop: Requires human operator decision-making for every critical action.

- Human-on-the-Loop (Semi-Autonomous): Operates autonomously but allows human intervention or override.

- Human-out-of-the-Loop (Autonomous): Executes missions independently based on pre-programmed parameters, with no direct human intervention in real-time decision-making.

- By Application:

- Surveillance and Reconnaissance: Gathering intelligence and monitoring enemy activities.

- Combat Operations: Direct engagement with enemy forces, precision strikes.

- Logistics and Transportation: Resupply, convoy support, cargo delivery.

- Mine Countermeasures (MCM): Detection and neutralization of sea and land mines.

- Explosive Ordnance Disposal (EOD): Remote handling and disposal of explosive devices.

- Search and Rescue (SAR): Locating and aiding personnel in distress.

- Border Security: Monitoring and protecting national borders against illicit activities.

- Critical Infrastructure Protection: Securing vital assets like power plants, ports, and data centers.

- By End-User:

- Military (Defense Forces): Armies, navies, air forces, special operations commands.

- Homeland Security: Border patrol, law enforcement, coast guard, emergency services.

Value Chain Analysis For Robotic Warfare Market

The value chain within the Robotic Warfare Market is an intricate network of specialized activities, spanning from conceptualization and foundational research to the ultimate deployment and sustainment of advanced robotic platforms. At the upstream segment, the chain begins with an extensive ecosystem of research institutions, technology developers, and component manufacturers. These entities are responsible for pioneering breakthroughs in core technologies such as artificial intelligence algorithms, advanced sensor suites (e.g., LiDAR, high-resolution EO/IR cameras, multi-spectral sensors), robust microprocessors, specialized robotic actuators, innovative energy storage solutions, and cutting-edge communication modules. Suppliers of advanced materials, including composites and stealth coatings, also play a crucial role. This segment is characterized by intensive R&D investment and a high degree of specialization, often involving both established defense contractors and agile commercial tech firms pushing the envelope of technological possibility.

Moving downstream into the midstream activities, the value chain is dominated by system integrators and prime defense contractors. These organizations consolidate the diverse components and technologies sourced from upstream suppliers, designing, developing, and manufacturing the complete robotic warfare platforms. Their expertise lies in intricate system engineering, software integration, payload customization, and ensuring the interoperability and resilience of the final product to stringent military specifications and environmental conditions. This phase involves rigorous testing, prototyping, and validation processes to guarantee performance, reliability, and cybersecurity against evolving threats. It is also where proprietary software and control systems are developed and refined, transforming disparate technologies into cohesive, mission-ready autonomous systems. The complexity of these integration tasks requires vast capital investment, highly skilled engineering talent, and extensive manufacturing capabilities.

The downstream segment of the value chain focuses on market access, delivery, and lifecycle support. Distribution channels for robotic warfare systems are predominantly direct, involving government-to-government agreements and direct contractual relationships between prime contractors and national defense ministries or procurement agencies. This direct engagement ensures tailored solutions, classified information handling, and secure delivery. While less common, indirect channels may include authorized integrators or resellers for specific components or support services in certain regions. Post-sales support is a critical component, encompassing comprehensive training for military personnel on system operation and maintenance, ongoing software updates, hardware upgrades, spare parts logistics, and long-term technical assistance. This extended support ensures the sustained operational readiness, effectiveness, and longevity of these strategic defense assets throughout their demanding service life, which is paramount given their high acquisition cost and strategic importance.

Robotic Warfare Market Potential Customers

The Robotic Warfare Market caters primarily to an exclusive clientele comprising national defense forces and a range of governmental homeland security agencies across the globe. Military organizations, encompassing armies, navies, air forces, and special operations commands, represent the largest and most significant segment of potential buyers. Their demand is driven by the overarching strategic imperative to modernize capabilities, achieve tactical superiority, enhance force projection, and mitigate risks to human personnel in increasingly complex and lethal operational environments. These customers seek highly capable, resilient, and technologically advanced robotic systems that can address critical operational gaps in intelligence, surveillance, reconnaissance (ISR), combat, logistical support, and various specialized missions, ranging from conventional warfare scenarios to counter-insurgency and asymmetric threats. The strategic procurement decisions of these entities are influenced by geopolitical landscapes, evolving threat assessments, and the pursuit of asymmetric advantages over adversaries.

Beyond traditional military forces, various homeland security agencies constitute another substantial segment of potential customers. These agencies, including border patrol units, national guard forces, coast guards, law enforcement agencies, and critical infrastructure protection teams, increasingly leverage robotic solutions for internal security missions. Their requirements often focus on applications such as persistent surveillance of borders and critical assets, hazardous material detection and disposal, explosive ordnance disposal (EOD) in urban environments, search and rescue operations in disaster zones, and crowd control. The impetus for adoption in this sector stems from the need to enhance public safety, improve operational efficiency in dangerous situations, and expand monitoring capabilities across vast or inaccessible areas, thereby reducing human exposure to risk and optimizing resource allocation for national security objectives.

Furthermore, emerging buyer segments include government research and development agencies, aiming to push the boundaries of robotic autonomy and integration, and even select private security contractors operating under government mandates in specific defense support capacities. These customers prioritize systems that offer high reliability, advanced levels of autonomy, robust cybersecurity features, and seamless interoperability with existing command and control infrastructures. The common thread across all potential customer segments is the pursuit of technological solutions that provide a decisive operational advantage, enhance the safety and effectiveness of personnel, and contribute significantly to national security and defense objectives in a rapidly evolving global threat landscape. Their purchasing decisions are often long-term investments, prioritizing proven performance, lifecycle cost-effectiveness, and the ability to adapt to future challenges.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 28.5 Billion |

| Market Forecast in 2032 | USD 65.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, BAE Systems plc, General Dynamics Corporation, Boeing, SAAB AB, Thales Group, Israel Aerospace Industries, Elbit Systems Ltd., L3Harris Technologies Inc., Kratos Defense & Security Solutions Inc., Rheinmetall AG, Oshkosh Defense LLC, Textron Systems, QinetiQ Group plc, Kongsberg Gruppen, AeroVironment Inc., Boston Dynamics, Teledyne FLIR. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Robotic Warfare Market Key Technology Landscape

The Robotic Warfare Market is profoundly shaped by an intricate and rapidly advancing technological landscape, where innovations from diverse scientific and engineering disciplines converge to create increasingly sophisticated and autonomous military systems. Central to this landscape are advancements in Artificial Intelligence (AI) and Machine Learning (ML), which empower robotic platforms with critical capabilities such as real-time situational awareness, autonomous decision-making, pattern recognition, and predictive analytics. AI algorithms enable robots to interpret complex sensor data, identify targets, navigate intricate terrains, and adapt their behavior to dynamic combat environments. This includes deep learning for enhanced computer vision, natural language processing for human-robot interaction, and reinforcement learning for optimizing mission performance, all of which contribute to a higher degree of autonomy and effectiveness.

Another foundational element is the continuous evolution of advanced sensor technologies, which serve as the eyes and ears of these robotic systems. This includes high-resolution electro-optical/infrared (EO/IR) cameras for day and night operations, sophisticated Synthetic Aperture Radar (SAR) for all-weather ground mapping, Light Detection and Ranging (LiDAR) systems for precise 3D environmental mapping, acoustic sensors for detecting underwater or subterranean activities, and chemical, biological, radiological, and nuclear (CBRN) detectors for hazardous environment monitoring. The integration and fusion of data from these diverse sensor types create a comprehensive and robust perception system, enabling robotic platforms to operate effectively in cluttered, contested, and unpredictable operational theaters, thereby providing superior intelligence and targeting capabilities.

Furthermore, critical technological pillars include robust and secure communication systems, enabling resilient data transfer and command-and-control even in highly contested electromagnetic spectrums, often incorporating satellite communications, encrypted mesh networks, and anti-jamming capabilities. Propulsion and power management innovations, such as advanced battery technologies, fuel cells, and hybrid powerplants, are crucial for extending operational endurance and range. Miniaturization allows for smaller, stealthier, and more agile platforms, while advanced materials science provides lightweight yet highly durable and survivable structures. The overarching trend is towards seamless human-machine interfaces (HMIs) for intuitive control, advanced cybersecurity frameworks to protect against adversarial exploitation, and modular open system architectures (MOSA) to facilitate rapid upgrades and interoperability, all driving the exponential growth and increasing sophistication within the robotic warfare domain.

Regional Highlights

- North America: Exhibits the largest market share, predomina

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager