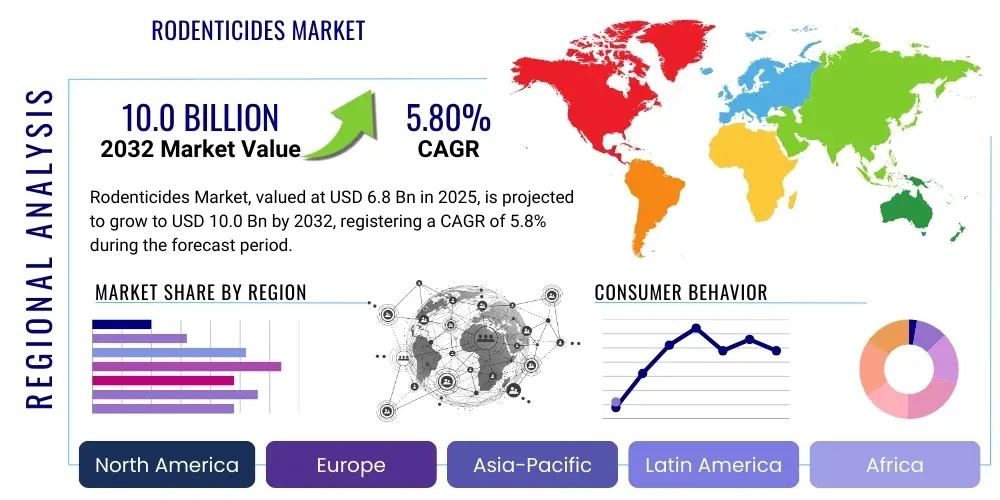

Rodenticides Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427276 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Rodenticides Market Size

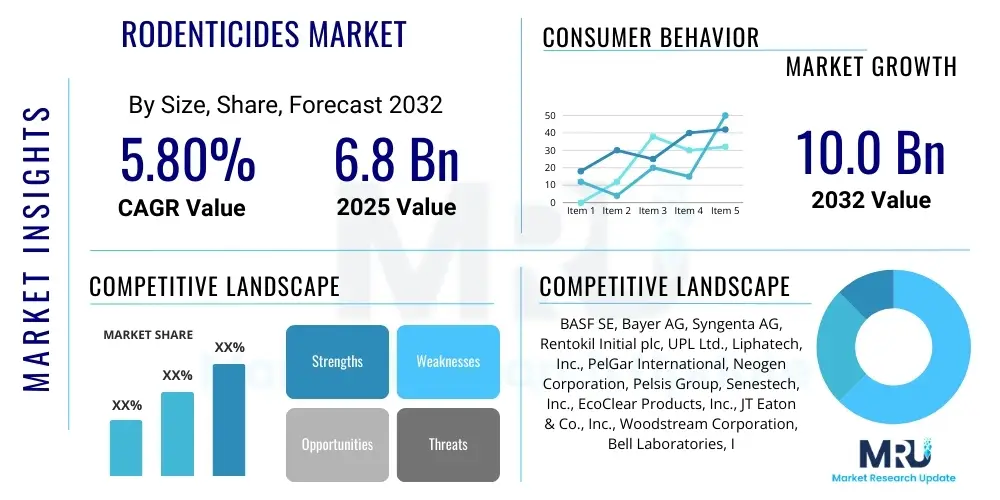

The Rodenticides Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 6.8 billion in 2025 and is projected to reach USD 10.0 billion by the end of the forecast period in 2032. This substantial growth is primarily driven by an escalating global rodent population, which directly correlates with increasing urbanization, climate change affecting natural habitats, and expanding agricultural activities requiring robust pest management solutions.

The consistent rise in demand is further bolstered by the significant economic losses incurred due to rodent infestations, impacting agricultural yields, stored food products, and critical infrastructure. Public health concerns associated with rodent-borne diseases also play a pivotal role, compelling governments, public health organizations, and individual consumers to invest in effective rodent control measures, thereby fueling the sustained expansion of the market throughout the forecast period.

Rodenticides Market introduction

Rodenticides are a crucial category of chemical and biological agents specifically designed to control and eliminate rodent populations, including rats, mice, and other pest species. These formulations play a critical role in safeguarding human health, protecting agricultural produce, and preventing extensive damage to infrastructure across residential, commercial, industrial, and public health sectors. The market encompasses a diverse range of products, varying in their active ingredients, mechanisms of action, and application methods, all aimed at effectively mitigating the pervasive threat posed by rodents globally.

The primary product descriptions within the rodenticides market typically categorize them into anticoagulants and non-anticoagulants. Anticoagulants, which include both first-generation (e.g., warfarin, chlorophacinone) and second-generation (e.g., bromadiolone, brodifacoum) compounds, work by interfering with the blood clotting process. Non-anticoagulants, such as bromethalin, cholecalciferol, and zinc phosphide, employ different toxicological pathways. Major applications span vast agricultural fields where rodents cause substantial crop losses, urban and suburban residential areas protecting homes from infestations, commercial establishments like restaurants and warehouses ensuring hygiene and safety, and public health initiatives focused on controlling disease vectors.

The multifaceted benefits of rodenticides are undeniable, ranging from preserving food security by minimizing agricultural and post-harvest losses to preventing the spread of over 35 diseases, including leptospirosis, hantavirus, and salmonellosis. Furthermore, they protect invaluable infrastructure from gnawing damage to electrical wiring, pipes, and structural elements, preventing costly repairs and potential hazards. Key driving factors propelling this market include the global increase in rodent populations due to environmental changes and human activities, heightened awareness of public health risks, and stringent regulatory frameworks mandating pest control in various industries, all contributing to a robust demand landscape.

Rodenticides Market Executive Summary

The Rodenticides Market is characterized by dynamic business trends, marked by a dual focus on enhanced efficacy and increased environmental responsibility. Innovations are continually emerging in bait formulations to combat growing resistance in rodent populations, alongside a strategic shift towards integrated pest management (IPM) systems that combine chemical, biological, and mechanical methods. Market players are increasingly engaging in strategic partnerships and collaborations to accelerate research and development of novel, low-risk active ingredients and smart pest control technologies. There is also a significant trend towards product differentiation, with an emphasis on single-feed rodenticides and tamper-resistant bait stations to improve safety and effectiveness, while simultaneously navigating evolving regulatory landscapes that demand more sustainable solutions.

Regionally, the market exhibits varied growth trajectories and consumption patterns. Asia-Pacific stands out as the fastest-growing region, driven by its expansive agricultural sector, rapid urbanization leading to increased human-rodent interaction, and a burgeoning awareness of public health and hygiene. In contrast, mature markets in North America and Europe, while substantial, are characterized by more stringent environmental regulations. This regulatory pressure is fostering demand for eco-friendlier alternatives, such as biopesticides and non-anticoagulant formulations, and encouraging the adoption of sophisticated monitoring and data-driven pest control solutions, pushing innovation in a highly regulated environment.

Segmentation trends within the rodenticides market underscore the continued dominance of second-generation anticoagulants (SGARs) due to their high potency and single-feed efficacy, making them a preferred choice for professional pest control operators and agricultural applications. However, a noticeable shift is occurring towards non-anticoagulant rodenticides, driven by concerns over secondary poisoning and environmental impact, reflecting a growing consumer and regulatory preference for safer alternatives. The market is also witnessing an increased adoption of professional pest control services across residential and commercial sectors, as individuals and businesses seek expert solutions for complex infestations, contributing significantly to the overall market growth and evolution of application methods.

AI Impact Analysis on Rodenticides Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the rodenticides market frequently revolve around its potential to transform traditional pest control methodologies. Common questions explore how AI can enhance the detection and monitoring of rodent activity, optimize the placement and effectiveness of bait stations, and ultimately reduce the reliance on conventional chemical rodenticides. Users are keenly interested in the practical applications of AI-driven analytics for predicting infestation patterns and the development of smart traps that provide real-time data, aiming for more precise, efficient, and environmentally conscious pest management solutions that minimize human intervention and non-target species exposure.

These inquiries reveal a collective expectation that AI will usher in an era of precision pest control, moving beyond reactive measures to proactive intervention. Concerns often surface regarding the cost-effectiveness and accessibility of such advanced technologies, especially for smaller agricultural operations or residential users. There are also discussions about the ethical considerations of deploying AI-powered devices, potential data privacy implications from extensive monitoring, and the balance between technological advancement and the environmental footprint of these systems. Users expect AI to not only improve efficacy but also to address the ecological and safety challenges associated with existing rodenticide use, thereby setting a new standard for responsible pest management.

AIs influence in the rodenticides market is poised to deliver significant advancements by addressing these expectations and concerns through sophisticated data analysis and automation. AI algorithms can process vast amounts of environmental data, historical infestation records, and sensor inputs to generate highly accurate predictive models for rodent outbreaks, enabling targeted interventions before infestations become severe. This capability translates into optimized resource allocation, reduced chemical usage, and enhanced protection for non-target species. Furthermore, AI-powered smart traps and monitoring systems can provide continuous surveillance, identify species, and even assess resistance levels, facilitating adaptive strategies that are both effective and environmentally sound, thereby reshaping the future landscape of rodent control.

- Enhanced predictive analytics for infestation forecasting, allowing proactive rather than reactive pest control strategies.

- Development of smart traps with integrated IoT sensors for real-time monitoring and identification of rodent activity, location, and species.

- Optimized bait and trap placement using machine learning algorithms that analyze environmental factors and rodent behavior patterns.

- Real-time reporting and alerts on rodent captures or activity, enabling rapid response and reducing manual inspection efforts.

- Automated data collection and analysis to inform decision-making, evaluate efficacy, and adapt treatment plans with greater precision.

- Integration with broader Integrated Pest Management (IPM) systems for a holistic and sustainable approach to rodent control.

- Potential for reduced overall rodenticide usage through highly targeted and efficient application, minimizing environmental impact.

DRO & Impact Forces Of Rodenticides Market

The rodenticides market is primarily driven by several critical factors that underscore the persistent need for effective pest control. A significant driver is the escalating global rodent population, which has been exacerbated by rapid urbanization, climate change-induced shifts in habitats, and increased waste generation in human settlements, providing abundant food and shelter. This demographic expansion of rodents leads to substantial economic losses, particularly in the agricultural sector through widespread crop damage and contamination of stored food products, and extensive damage to essential infrastructure such as electrical systems and buildings. Furthermore, the imperative to mitigate public health risks associated with numerous rodent-borne diseases, like leptospirosis, hantavirus, and plague, acts as a powerful catalyst, compelling both individual consumers and public health authorities to utilize rodenticides.

Conversely, the market faces considerable restraints, largely stemming from environmental and safety concerns. Stringent environmental regulations, particularly in developed regions, aim to curb the adverse ecological impact of rodenticides, primarily addressing issues like non-target species poisoning and secondary toxicity through the food chain. The continuous development of rodenticide resistance in pest populations necessitates ongoing research and development into novel, more effective active ingredients, which significantly increases R&D costs and poses a challenge to maintaining product efficacy. Additionally, growing public awareness and demand for humane and eco-friendly pest control methods are pushing for a reduction in the reliance on traditional chemical solutions, fostering a complex regulatory and social environment for manufacturers.

Despite these challenges, the rodenticides market is ripe with opportunities for innovation and growth. The development and commercialization of novel, safer active ingredients, including biopesticides and botanical extracts, represent a substantial avenue for market expansion, aligning with environmental and safety mandates. The increasing integration of rodenticides within comprehensive Integrated Pest Management (IPM) strategies offers new growth prospects by combining chemical interventions with cultural, biological, and mechanical control methods for more sustainable solutions. Furthermore, expansion into developing regions, characterized by high agricultural dependency, rapid urbanization, and nascent public health infrastructure, presents fertile grounds for market penetration, augmented by the emergence of smart pest control technologies that offer precision and efficiency in monitoring and application.

Segmentation Analysis

The rodenticides market is comprehensively segmented to address the diverse needs and regulatory landscapes across various applications and geographies. This granular categorization allows for a detailed understanding of market dynamics, enabling stakeholders to identify specific growth opportunities, refine product development strategies, and tailor marketing efforts to distinct consumer groups. Segmentation provides critical insights into the evolving preferences for product types, formulations, and end-user applications, reflecting the complex interplay of efficacy, safety, and environmental considerations that define the global pest control industry.

- Product Type:

- Anticoagulants: These are the most common type, working by inhibiting blood clotting. They are further divided into:

- First-Generation Anticoagulants (FGARs): Require multiple feedings for a lethal dose (e.g., Warfarin, Chlorophacinone). They generally have lower toxicity to non-target animals but require sustained baiting.

- Second-Generation Anticoagulants (SGARs): Highly potent, single-feed rodenticides (e.g., Brodifacoum, Bromadiolone, Difenacoum, Flocoumafen). They are more effective against resistant strains but pose higher risks of secondary poisoning to non-target wildlife.

- Non-Anticoagulants: These act through different mechanisms, offering alternatives for resistance management or specific applications. Examples include:

- Bromethalin: A neurotoxin that affects the central nervous system.

- Cholecalciferol: A vitamin D3 analog that causes hypercalcemia.

- Zinc Phosphide: A fast-acting acute toxicant, often used for burrow baiting.

- Other types: Less common or emerging alternatives focusing on different modes of action.

- Anticoagulants: These are the most common type, working by inhibiting blood clotting. They are further divided into:

- Form: Rodenticides are available in various physical forms to suit different application environments and target rodent behaviors.

- Pellets: Small, palatable particles, easy to distribute in various locations.

- Blocks: Weather-resistant, durable bait forms suitable for outdoor use and secured bait stations.

- Meal/Bait: Loose grain or meal formulations that appeal to rodents preferring to hoard or carry food.

- Powder: Designed for tracking where rodents contact the powder and ingest it during grooming.

- Sprays/Liquids: Less common for direct rodenticide application, but liquid baits are used where water is scarce.

- End-Use: The market serves a broad spectrum of end-users with distinct requirements for rodent control.

- Agriculture: Protecting crops, stored grains, and livestock feed from significant damage and contamination.

- Residential: Homeowners and property managers addressing infestations in private dwellings and surrounding areas.

- Commercial: Businesses such as restaurants, retail stores, hotels, and offices maintaining hygiene and structural integrity.

- Industrial: Warehouses, manufacturing facilities, and food processing plants requiring stringent pest management for compliance and safety.

- Public Health: Governmental and municipal agencies managing urban rodent populations to prevent disease transmission and enhance public sanitation.

- Professional Pest Control Operators: Specialized services offering comprehensive rodent management solutions to various clients.

- Region: Geographical segmentation highlights regional disparities in rodent populations, agricultural practices, urbanization levels, and regulatory frameworks.

- North America: Characterized by a mature market with high adoption of professional pest control and increasing demand for regulated, safer products.

- Europe: Driven by stringent environmental regulations, a focus on Integrated Pest Management (IPM), and a growing preference for non-chemical or low-risk solutions.

- Asia-Pacific: The fastest-growing market, fueled by expanding agriculture, rapid urbanization, and rising awareness of public health concerns related to rodents.

- Latin America: Exhibits significant growth due to expanding agricultural sectors and increasing public health initiatives in developing economies.

- Middle East & Africa: An emerging market with growing demand driven by urbanization, industrial expansion, and public health programs.

Rodenticides Market Value Chain Analysis

The upstream segment of the rodenticides market value chain is predominantly focused on extensive research and development (R&D) activities, crucial for discovering and synthesizing novel active ingredients and improving existing formulations. This stage involves significant investment in chemical engineering, toxicology, and biological studies to ensure product efficacy, target specificity, and minimal environmental impact. Raw material suppliers, primarily chemical manufacturers, provide the fundamental components for rodenticide production, adhering to rigorous quality standards and regulatory compliance. Innovation in this phase is paramount for developing compounds that overcome rodent resistance and meet increasingly strict safety and environmental regulations, laying the scientific and material groundwork for the entire value chain.

Moving downstream, the midstream activities encompass the manufacturing, formulation, and packaging of rodenticide products. Manufacturers transform raw chemicals into finished products, whether pellets, blocks, meals, or powders, through complex blending and processing techniques. Quality control and assurance are critical at this stage to ensure product consistency, stability, and adherence to labeled concentrations and safety guidelines. Once manufactured, these products enter various distribution channels, which include large-scale wholesalers, specialized agricultural retailers, hardware stores, and general merchandise outlets. The efficiency of this distribution network is vital for ensuring widespread availability and market penetration, especially in diverse geographical areas with varying logistical challenges.

The final segment of the value chain involves end-users and the various routes through which products reach them. Direct distribution channels often include sales to large agricultural enterprises, governmental public health bodies, or professional pest control companies that purchase in bulk directly from manufacturers or major distributors. Indirect channels, which form a substantial portion of the market, leverage a network of local agro-chemical stores, supermarket chains, online retail platforms, and pest control service providers to reach individual consumers and smaller commercial entities. The effectiveness of these channels in providing access, technical support, and product education directly impacts market reach and consumer adoption, ensuring that a diverse range of customers can access appropriate rodent control solutions.

Rodenticides Market Potential Customers

The Rodenticides Market caters to an exceptionally broad and diverse spectrum of potential customers, all united by the critical need to manage and eradicate rodent infestations. These customers range from individual homeowners seeking to protect their personal property and health from domestic pests to expansive agricultural enterprises safeguarding vast crop yields and livestock feed. The universal threat posed by rodents across various environments ensures a consistent and pervasive demand for effective control solutions, making this market indispensable for public health, economic stability, and environmental preservation efforts globally.

Key end-user segments represent distinct customer profiles with specific needs and purchasing behaviors. Farmers constitute a significant customer base, requiring robust and cost-effective rodenticides to prevent substantial pre- and post-harvest crop damage, which can lead to severe economic losses. Commercial establishments, including food service industries, retail outlets, and hospitality sectors, are vital customers, relying on rodenticides to maintain stringent hygiene standards, comply with health regulations, and protect their reputation. Industrial facilities, such as warehouses, manufacturing plants, and processing units, frequently face large-scale infestations and demand powerful, long-lasting solutions. Public health agencies and municipalities are crucial buyers, deploying rodenticides for large-scale urban pest control and disease vector management. Furthermore, professional pest control operators serve as a pivotal customer group, acting as intermediaries who purchase and apply rodenticides for a multitude of residential, commercial, and industrial clients, requiring a diverse portfolio of specialized products.

Rodenticides Market Key Technology Landscape

The rodenticides markets technology landscape is undergoing a significant transformation, moving beyond conventional bait and trap methods to embrace more sophisticated and integrated approaches. Current advancements include the development of advanced chemical formulations designed to enhance palatability, increase efficacy at lower doses, and reduce environmental persistence. A key focus is on single-feed rodenticides that offer a lethal dose in one consumption, thereby minimizing the duration of exposure and the risk of secondary poisoning to non-target wildlife. Furthermore, research into encapsulating active ingredients is improving stability and targeted delivery, ensuring longer shelf life and more controlled release.

A burgeoning area of technological innovation involves the integration of smart technologies, prominently featuring Internet of Things (IoT) enabled smart traps and monitoring systems. These devices provide real-time data on rodent activity, population levels, and trap status, transmitting alerts and analytics directly to pest management professionals. Such remote monitoring capabilities facilitate more precise and efficient pest control strategies, reducing the need for manual inspections and optimizing resource allocation. This data-driven approach allows for adaptive management, where treatments can be tailored based on actual infestation patterns, significantly improving the overall effectiveness and cost-efficiency of rodent control programs.

Looking ahead, the technological landscape is expanding to include non-toxic and biological rodent control methods, representing a substantial shift towards more sustainable solutions. This encompasses research into fertility control agents that aim to reduce rodent reproduction rates, and specific biological agents that can target rodent populations without impacting other species. Additionally, advanced delivery systems, such as drone technology, are being explored for surveillance and precise application in large or inaccessible areas, particularly in agriculture. This holistic approach, combining chemical refinement, digital intelligence, and biological innovation, defines the contemporary and future trajectory of rodenticide technology, aiming for more integrated, effective, and environmentally responsible pest management.

Regional Highlights

- North America: This region represents a mature and technologically advanced market for rodenticides, characterized by significant investment in research and development and a high adoption rate of professional pest control services. Stringent environmental regulations, particularly concerning product safety and non-target species protection, drive demand for innovative, low-risk solutions. Both the residential and commercial sectors contribute substantially to market demand, with a strong focus on effective and compliant pest management strategies.

- Europe: The European rodenticides market is heavily influenced by the Biocidal Products Regulation (BPR), which promotes the use of integrated pest management (IPM) and prioritizes non-chemical or less hazardous methods. This regulatory environment fosters a growing preference for eco-friendly and low-risk rodenticides, including biopesticides and non-anticoagulant options. There is also a strong emphasis on responsible use and comprehensive risk mitigation measures, encouraging innovation in bait station design and application techniques.

- Asia-Pacific: Emerging as the fastest-growing region, Asia-Pacific is fueled by its expansive agricultural sector, which suffers significant crop losses due to rodent infestations. Rapid urbanization across countries like China and India leads to increased human-rodent interactions and heightened public health concerns. Growing awareness of hygiene and pest-borne diseases, coupled with improving public health infrastructure, contributes to a robust and expanding demand for effective rodent control solutions.

- Latin America: The Latin American market for rodenticides is experiencing substantial growth, primarily driven by its vast agricultural landscapes that require constant protection against rodent damage to crops and stored produce. Increasing awareness of public health issues and a growing focus on food safety standards in emerging economies are also contributing factors. While regulations may be less stringent than in developed markets, there is a gradual shift towards more effective and safer pest control practices.

- Middle East & Africa (MEA): This region is an emerging market characterized by increasing urbanization and industrialization, which naturally lead to higher rodent populations and the need for pest control in commercial and residential areas. Public health initiatives aimed at combating vector-borne diseases are also propelling demand for rodenticides. However, challenges such as limited regulatory enforcement and awareness in some areas, alongside logistical hurdles, impact market penetration and growth rates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rodenticides Market.- BASF SE

- Bayer AG

- Syngenta AG

- Rentokil Initial plc

- UPL Ltd.

- Liphatech, Inc.

- PelGar International

- Neogen Corporation

- Pelsis Group

- Senestech, Inc.

- EcoClear Products, Inc.

- JT Eaton & Co., Inc.

- Woodstream Corporation

- Bell Laboratories, Inc.

- Killgerm Group Ltd.

Frequently Asked Questions

What are rodenticides and how do they function to control pest populations?

Rodenticides are chemical or biological agents specifically formulated to eliminate or control rodents like rats and mice. They typically work through various mechanisms, most commonly by acting as anticoagulants that interfere with blood clotting, leading to internal bleeding. Other types include neurotoxins that affect the central nervous system or compounds that cause hypercalcemia. Their function is to reduce rodent populations that pose threats to agriculture, public health, and infrastructure, by inducing a lethal response upon ingestion, often through highly palatable bait formulations.

Are rodenticides safe for the environment and non-target animals, including pets?

The safety of rodenticides for the environment and non-target animals is a significant concern, leading to stringent regulations and ongoing research into safer formulations. Traditional rodenticides, particularly second-generation anticoagulants, pose risks of secondary poisoning to predators and scavengers that consume affected rodents. They can also harm pets if ingested directly or indirectly. Responsible use involves following label instructions precisely, deploying baits in tamper-resistant stations, and choosing products with lower environmental persistence or specific modes of action to minimize unintended exposure and ecological impact.

What are the primary types of rodenticides available in the market today?

The rodenticides market primarily offers two main types: anticoagulants and non-anticoagulants. Anticoagulants are further divided into first-generation (FGARs), which require multiple feedings for effect, and second-generation (SGARs), which are more potent and typically lethal with a single feeding. Non-anticoagulants include compounds like bromethalin (a neurotoxin), cholecalciferol (a vitamin D analog causing hypercalcemia), and zinc phosphide (an acute toxicant). Each type has distinct characteristics regarding efficacy, speed of action, and safety profile, catering to different pest control needs and regulatory contexts.

How should rodenticides be used responsibly and safely to minimize risks?

Responsible and safe use of rodenticides is paramount to protect human health, pets, and wildlife. This involves strictly following all instructions on the product label, including application rates, placement, and disposal guidelines. Baits should always be placed in secure, tamper-resistant bait stations inaccessible to children, pets, and non-target animals. Personal protective equipment (PPE) should be worn during handling. Regular monitoring of bait stations is crucial, and dead rodents should be promptly and safely removed and disposed of to prevent secondary poisoning. Consulting with a professional pest control operator is recommended for complex or large-scale infestations.

What is the future outlook for the rodenticides market, considering environmental concerns and technological advancements?

The future outlook for the rodenticides market is shaped by a strong push towards sustainability, innovation, and integrated solutions. While traditional chemical rodenticides will remain relevant, there will be increasing emphasis on developing safer, more targeted, and environmentally friendly alternatives, including biopesticides and fertility control agents. Technological advancements like AI-powered smart traps and real-time monitoring systems will revolutionize precision pest control, reducing overall chemical usage. The market is moving towards comprehensive Integrated Pest Management (IPM) strategies that combine chemical, biological, and mechanical methods, driven by evolving environmental regulations and a growing demand for more humane and eco-conscious rodent control solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Rodenticides Market Size Report By Type (Non-Anticoagulant, Anticoagulant), By Application (Pellets, Powder & Spray, Block), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Rodenticides Market Size Report By Type (Anticoagulants, Non-anticoagulants), By Application (Agriculture, Domestic/Industrial/Public Health), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Rodenticides Market Statistics 2025 Analysis By Application (Agriculture, Domestic/Industrial/Public Health), By Type (Anticoagulants, Non-Anticoagulants), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager