Rugged Servers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430306 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Rugged Servers Market Size

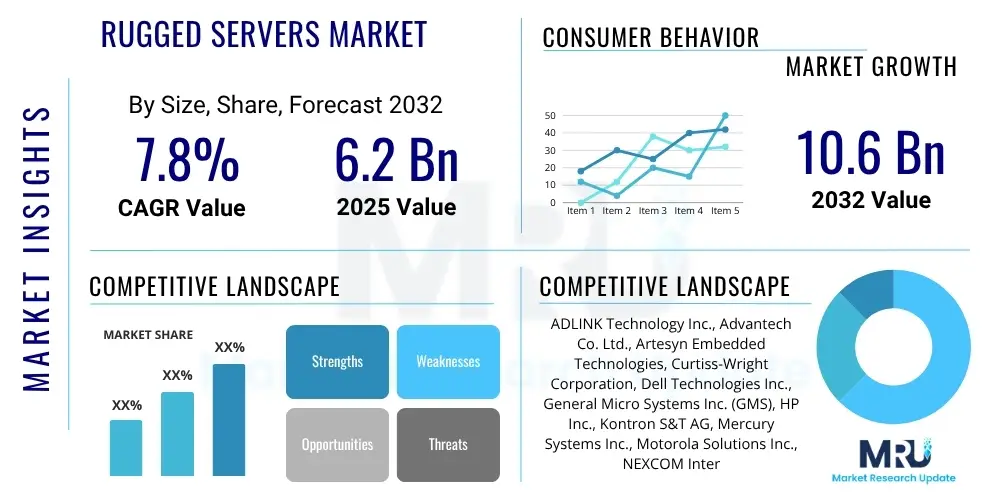

The Rugged Servers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 6.2 Billion in 2025 and is projected to reach USD 10.6 Billion by the end of the forecast period in 2032.

Rugged Servers Market introduction

Rugged servers are specialized computing systems engineered to operate reliably and maintain performance in extreme environmental conditions that would typically damage or degrade standard enterprise servers. These conditions include significant temperature fluctuations, high levels of shock and vibration, dust, humidity, electromagnetic interference, and potential liquid ingress. Designed for mission-critical applications where continuous operation and data integrity are paramount, rugged servers provide robust computational power in environments ranging from battlefields and factory floors to oil rigs and remote telecommunication sites. Their robust construction and specialized components ensure longevity and stability where commercial-grade equipment would fail.

The core product features of rugged servers include reinforced chassis, advanced thermal management systems, solid-state storage, sealed enclosures, and specialized connectors, all conforming to rigorous industrial or military standards such as MIL-STD-810G, IP65, or DO-160. Their primary applications span defense and aerospace for command and control systems, industrial automation for real-time process monitoring, oil and gas for exploration and drilling operations, and transportation for railway and maritime systems. Key benefits derived from deploying rugged servers include enhanced operational uptime, reduced maintenance costs in challenging settings, improved data security and integrity, and the capability to deploy high-performance computing closer to the data source at the edge, enabling faster decision-making. The increasing demand for edge computing, the proliferation of IoT devices in harsh industrial settings, and ongoing modernization initiatives in defense and infrastructure sectors are significant driving factors fueling the growth of the rugged servers market.

Rugged Servers Market Executive Summary

The global rugged servers market is currently experiencing significant expansion, driven by an escalating need for robust computing solutions across various demanding industries. Business trends indicate a strong shift towards miniaturization, modularity, and increased processing power within ruggedized form factors, enabling more flexible deployment scenarios at the tactical edge. There is also a growing emphasis on enhanced cybersecurity features and remote management capabilities to address the unique challenges of distributed and often isolated operational environments. Strategic partnerships between hardware manufacturers and software providers are becoming more common, aiming to offer integrated solutions that simplify deployment and maintenance for end-users. The market is also witnessing innovations in cooling technologies, allowing higher performance processors to operate effectively within compact, sealed enclosures.

Regional trends reveal North America and Europe as dominant markets, primarily due to substantial defense spending, advanced industrial automation infrastructure, and early adoption of IoT technologies in harsh environments. However, the Asia Pacific region is rapidly emerging as a high-growth market, propelled by fast-paced industrialization, infrastructure development, and increasing investments in smart manufacturing and defense modernization initiatives, particularly in countries like China, India, and South Korea. Latin America, the Middle East, and Africa are also demonstrating growth, largely driven by investments in oil and gas exploration, mining operations, and telecommunications network expansion in challenging geographical areas. Each region presents distinct demand patterns influenced by local economic conditions, regulatory landscapes, and technological readiness.

Segmentation trends highlight the continued dominance of rackmount and blade server types in larger installations, while small form factor (SFF) and embedded rugged servers are gaining traction for space-constrained and mobile applications. The defense and aerospace sector consistently remains the largest end-user segment, with substantial demand for mission-critical data processing and command systems. Industrial automation is another rapidly growing segment, fueled by Industry 4.0 initiatives requiring robust control systems at the factory floor. The telecommunications segment is experiencing a surge due to the global rollout of 5G infrastructure, necessitating durable servers for edge computing and network functions in outdoor or remote base stations. Technological advancements, such as the integration of artificial intelligence and machine learning capabilities directly into rugged server hardware, are also shaping segment growth and creating new application opportunities across various industries.

AI Impact Analysis on Rugged Servers Market

Common user questions regarding AI's impact on the Rugged Servers Market often revolve around how these robust systems can facilitate AI deployments at the edge, the specific hardware requirements for running AI workloads in harsh environments, and the benefits of integrating AI into mission-critical rugged applications. Users are keen to understand the challenges of maintaining AI model integrity and performance under extreme conditions, as well as the security implications of processing sensitive AI-driven data in remote or exposed locations. There is also significant interest in how rugged servers can support autonomous systems and advanced analytics, thereby enabling real-time decision-making without reliance on central cloud infrastructure. Key themes include the need for powerful yet resilient computing for edge AI, secure data handling, and the ability to operate AI algorithms continuously in challenging operational settings.

- Edge AI Processing: Rugged servers are becoming critical platforms for deploying AI and machine learning models directly at the data source in remote or harsh environments, enabling real-time analytics and decision-making without latency associated with cloud connectivity.

- Enhanced Sensor Data Analytics: Their robust nature allows for the deployment of AI-powered analytics to process vast amounts of sensor data from industrial IoT, surveillance, and autonomous vehicles, improving predictive maintenance, anomaly detection, and situational awareness.

- Support for Autonomous Systems: Rugged servers provide the dependable computational backbone for autonomous vehicles, drones, and robotics operating in challenging terrains, facilitating navigation, object recognition, and complex decision processes.

- Improved Operational Efficiency: AI running on rugged servers can optimize industrial processes, energy consumption, and logistics in extreme conditions, leading to greater efficiency and reduced operational costs.

- Predictive Maintenance: AI algorithms analyze data from machinery in harsh environments to predict potential failures, allowing for proactive maintenance and minimizing downtime, a critical advantage in remote or inaccessible locations.

- Cybersecurity and Threat Detection: AI capabilities integrated into rugged servers enhance their ability to detect and respond to cyber threats in real-time, safeguarding critical data and operations in vulnerable edge deployments.

DRO & Impact Forces Of Rugged Servers Market

The Rugged Servers market is significantly influenced by a confluence of drivers, restraints, and opportunities that shape its growth trajectory and competitive landscape. A primary driver is the accelerating demand for computing at the edge, fueled by the proliferation of IoT devices and the need for real-time data processing in environments ranging from factory floors to remote surveillance sites. This is further amplified by increasing defense budgets globally, with modernization efforts necessitating high-performance, durable computing systems for military vehicles, tactical operations centers, and intelligent weaponry. The industrial automation sector's push towards Industry 4.0 also contributes significantly, requiring robust control and data acquisition systems that can withstand harsh operational conditions. Furthermore, critical infrastructure projects in energy, transportation, and telecommunications demand reliable server solutions that ensure continuous operation and data integrity in challenging outdoor or remote locations.

Despite these strong drivers, the market faces several notable restraints. The inherently high cost associated with designing, manufacturing, and certifying rugged servers acts as a barrier to entry for some applications, especially in price-sensitive markets. The complex design and manufacturing processes required to meet stringent military and industrial standards contribute to these elevated costs and extend development cycles. Additionally, limitations in space, weight, and power (SWaP) in certain highly mobile or constrained applications present significant engineering challenges for integrating high-performance components while maintaining ruggedization. Cybersecurity concerns are also paramount, as these systems often operate in exposed environments, making them potential targets for sophisticated cyberattacks, thereby necessitating continuous investment in advanced security features. The specialized nature of rugged server technology means a smaller talent pool for development and maintenance compared to commercial IT.

Opportunities for growth are abundant within the Rugged Servers market. The global rollout of 5G infrastructure is creating substantial demand for ruggedized edge servers to support low-latency computing and network functions at base stations and remote aggregation points. The emergence of autonomous vehicles, smart city initiatives, and advanced robotics further opens avenues for rugged server deployment, requiring dependable computational power for critical decision-making in diverse and often unpredictable environments. Additionally, the growing focus on renewable energy projects, particularly wind and solar farms located in remote and harsh climates, necessitates robust monitoring and control servers. Integration with hybrid cloud architectures, enabling seamless data flow and management between edge deployments and centralized cloud resources, presents another significant opportunity for value creation. Impact forces such as rapid technological advancements in processor performance and cooling solutions continue to reshape product offerings, while evolving regulatory compliance, especially in defense and safety-critical industries, drives innovation in system reliability and certification. Economic fluctuations can influence defense and industrial spending, and geopolitical stability can affect international market access and supply chains, making these external forces critical considerations for market players.

Segmentation Analysis

The rugged servers market is comprehensively segmented across various dimensions including type, form factor, component, and end-user industry, providing a granular view of market dynamics and application-specific demands. This segmentation allows for a detailed understanding of where growth opportunities lie and how different product configurations cater to distinct operational requirements. Each segment reflects specific technological needs, environmental tolerances, and performance expectations from various industries, ensuring that manufacturers can tailor their offerings to address precise market niches. The diversity in segmentation underscores the versatility and critical importance of rugged computing across a wide range of challenging applications.

- By Type

- Standard Rugged Servers

- Custom Rugged Servers

- By Form Factor

- Rackmount Rugged Servers

- Box/Embedded Rugged Servers

- Blade Rugged Servers

- Small Form Factor (SFF) Rugged Servers

- By Component

- Hardware (Processors, Memory, Storage, Enclosures, Power Supplies, Cooling Systems)

- Software (Operating Systems, Management Software)

- Services (Integration, Maintenance, Support)

- By End-User

- Military & Defense

- Industrial Automation

- Oil & Gas

- Telecommunications

- Transportation (Automotive, Rail, Marine, Aerospace)

- Energy & Utilities

- Mining

- Medical

- Other Industrial Applications

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Rugged Servers Market

The value chain for the Rugged Servers market commences with upstream activities involving the sourcing of highly specialized and robust components. This includes the procurement of high-performance, low-power processors from leading semiconductor manufacturers like Intel and AMD, industrial-grade memory modules, solid-state storage devices designed for extreme temperatures and vibration, and advanced power management units. Furthermore, manufacturers source specialized rugged enclosures made from durable alloys, advanced thermal management solutions such as conduction cooling and liquid cooling components, and military-grade connectors and I/O modules. The rigorous selection of these components, often requiring specific certifications for extended temperature ranges, shock, and vibration, is critical to the final product's reliability and compliance with industry standards. Research and development also represent a significant upstream activity, focusing on new materials, cooling technologies, and miniaturization techniques to enhance product performance and reduce footprint.

Midstream activities involve the design, assembly, and testing of the rugged server systems. This phase integrates the sourced components into a complete, hardened system, adhering to strict industrial and military specifications. Manufacturing processes often involve advanced techniques for shock mounting, vibration isolation, and sealing against ingress of dust and water, alongside sophisticated thermal management strategies. Rigorous testing and validation, including environmental stress screening (ESS), MIL-STD-810G compliance testing, and EMC/EMI certification, are crucial to ensure the server meets its specified operating parameters in harsh conditions. Quality control and assurance are paramount at every stage to guarantee the reliability and longevity of the final product. Customization services, where servers are tailored to specific client requirements concerning form factor, I/O configuration, or software integration, are also a significant part of this value-added stage.

Downstream activities focus on the distribution, sales, and post-sales support of rugged servers to end-users. Distribution channels are typically a mix of direct sales from manufacturers to large enterprise or government clients, and indirect channels through a network of value-added resellers (VARs), system integrators, and specialized distributors. These partners often provide additional integration services, software solutions, and localized support, particularly for complex projects in specific industrial or defense sectors. Direct sales are common for high-volume or highly customized orders, allowing for close collaboration between the manufacturer and the end-user. Post-sales support, including installation, maintenance, repair services, and technical assistance, is a critical component of the value chain, ensuring the continuous operation and lifecycle management of these critical systems. The effectiveness of these downstream channels directly impacts market reach, customer satisfaction, and repeat business, especially in sectors where long-term reliability and support are non-negotiable.

Rugged Servers Market Potential Customers

The primary end-users and buyers of rugged servers are diverse sectors that operate in challenging, mission-critical environments where standard commercial-grade IT equipment would fail. The largest segment remains the Military and Defense industry, encompassing army, navy, air force, and intelligence agencies, which utilize rugged servers for tactical command and control, battlefield communications, surveillance, data acquisition in unmanned systems, and onboard processing in aircraft, ships, and ground vehicles. These customers prioritize extreme durability, security, and performance under combat or deployment conditions. Industrial Automation is another significant customer base, including manufacturing plants, process industries like chemicals and pharmaceuticals, and heavy industries such as mining and construction. Here, rugged servers are essential for real-time control systems, SCADA systems, machine vision, and data logging in environments characterized by dust, vibration, and temperature extremes.

The Oil & Gas sector represents a critical market, with exploration, drilling, and production sites often located in remote, hazardous environments subject to extreme temperatures, corrosive elements, and explosive risks. Rugged servers are deployed for seismic data processing, wellhead monitoring, pipeline management, and remote operational control, ensuring safety and efficiency in critical infrastructure. Telecommunications companies are increasingly adopting rugged servers for edge computing infrastructure, particularly with the rollout of 5G networks, where robust servers are needed in outdoor base stations, remote network nodes, and data aggregation points that must withstand harsh weather conditions and physical exposure. Transportation industries, including automotive (for autonomous vehicle development and testing), railway (for signaling and onboard control), marine (for navigation and communication), and aerospace (for air traffic control and flight testing), rely on rugged servers to ensure reliable operations in high-vibration and often mobile settings.

Beyond these core sectors, other potential customers include various public safety organizations for emergency response and mobile command centers, energy and utilities companies for smart grid management and remote power station monitoring, and even certain medical applications requiring mobile or field-deployable computing for diagnostics and data management in challenging healthcare environments. The common thread among all these end-users is the non-negotiable requirement for computing reliability, data integrity, and operational continuity in conditions where failure is not an option. The increasing trend of pushing computational power closer to the data source (edge computing) across all these sectors further solidifies and expands the customer base for rugged servers, as the need for robust, high-performance edge infrastructure becomes paramount.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 6.2 Billion |

| Market Forecast in 2032 | USD 10.6 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ADLINK Technology Inc., Advantech Co. Ltd., Artesyn Embedded Technologies, Curtiss-Wright Corporation, Dell Technologies Inc., General Micro Systems Inc. (GMS), HP Inc., Kontron S&T AG, Mercury Systems Inc., Motorola Solutions Inc., NEXCOM International Co. Ltd., One Stop Systems Inc., Systel Inc., Trenton Systems Inc., Aetina Corporation, Crystal Group Inc., ECRIN Systems, Eurotech S.p.A., Lockheed Martin Corporation, Rockwell Automation Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rugged Servers Market Key Technology Landscape

The technology landscape for the rugged servers market is characterized by continuous innovation aimed at enhancing performance, durability, and operational efficiency in challenging environments. Core to this landscape are high-performance embedded processors, typically from Intel (e.g., Xeon D, Atom) and AMD (e.g., EPYC Embedded), which offer robust computational power while optimizing for power consumption and heat generation within compact, sealed enclosures. These processors are often combined with substantial amounts of industrial-grade ECC memory (Error-Correcting Code) to ensure data integrity and system stability. Advanced data storage solutions, predominantly solid-state drives (SSDs) and NVMe (Non-Volatile Memory Express) flash storage, are critical for their resilience against shock and vibration, faster data access, and broad operating temperature ranges, replacing traditional spinning hard drives that are unsuitable for rugged applications.

Thermal management is another pivotal technological area, involving sophisticated cooling systems such as conduction cooling, liquid cooling, and fanless designs, which effectively dissipate heat from high-density components without compromising the system's sealed integrity against contaminants. Robust mechanical design is paramount, incorporating reinforced chassis construction, shock and vibration isolation mounts, and sealed I/O connectors that meet military (e.g., MIL-STD-810G, MIL-STD-461) and industrial (e.g., IP ratings) standards. Power management technologies are crucial, featuring wide-range DC power inputs, transient voltage protection, and uninterruptible power supply (UPS) capabilities to ensure stable operation in fluctuating power environments. Furthermore, cybersecurity features are increasingly integrated directly into the hardware and firmware, including secure boot, trusted platform modules (TPMs), and advanced encryption capabilities to protect sensitive data and prevent unauthorized access in potentially exposed deployments.

Network connectivity relies on ruggedized Ethernet ports, often supporting higher bandwidths like 10GbE or 25GbE, alongside options for fiber optic, Wi-Fi 6/6E, and 5G cellular communication to ensure reliable data transmission in remote or mobile settings. Virtualization technologies are commonly employed to consolidate multiple workloads onto a single physical server, enhancing resource utilization and system flexibility. Modular designs, using OpenVPX or other industry-standard form factors, allow for easier customization, upgrades, and maintenance, reducing overall lifecycle costs. The integration of AI acceleration hardware, such as GPUs and FPGAs, is also gaining traction, enabling on-device inference for edge AI applications without relying on cloud connectivity. These technological advancements collectively contribute to rugged servers becoming more powerful, versatile, and essential for mission-critical operations across diverse industrial, defense, and telecommunications landscapes.

Regional Highlights

- North America: This region holds a significant share of the rugged servers market, driven by substantial defense expenditures, extensive industrial automation, and the early adoption of advanced technologies like AI and IoT in challenging environments. The presence of major aerospace and defense contractors, coupled with ongoing modernization efforts within military infrastructure, fuels consistent demand. The United States, in particular, is a dominant market due to its large industrial base and robust investment in edge computing solutions for critical infrastructure and tactical applications.

- Europe: The European market is characterized by strong growth in industrial automation, smart manufacturing initiatives, and significant investments in transportation and telecommunications infrastructure. Countries like Germany, France, and the UK are key contributors, driven by a mature industrial sector and increasing military modernization. The region's emphasis on high-reliability systems for energy management, railway networks, and maritime operations further propels the demand for rugged servers.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market for rugged servers, primarily due to rapid industrialization, increasing defense spending, and expanding telecommunications infrastructure, especially in countries like China, India, Japan, and South Korea. The proliferation of IoT devices and the growing need for edge computing in smart cities and industrial facilities are major market drivers. Investments in renewable energy and mining operations also contribute to the demand for durable computing solutions.

- Latin America: This region is experiencing steady growth, largely influenced by investments in natural resource extraction industries such as oil and gas, mining, and agriculture, which require robust computing solutions for remote monitoring and operational control. Developing telecommunications infrastructure and increasing focus on public safety and defense modernization in countries like Brazil and Mexico also contribute to market expansion.

- Middle East and Africa (MEA): The MEA market is witnessing growth driven by substantial investments in the oil and gas sector, particularly in the Gulf Cooperation Council (GCC) countries, where rugged servers are crucial for exploration, production, and pipeline management. Additionally, the region's focus on diversifying its economies, coupled with growing defense budgets and infrastructure development projects, creates new opportunities for rugged server deployments in challenging desert and offshore environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rugged Servers Market.- ADLINK Technology Inc.

- Advantech Co. Ltd.

- Artesyn Embedded Technologies

- Curtiss-Wright Corporation

- Dell Technologies Inc.

- General Micro Systems Inc. (GMS)

- HP Inc.

- Kontron S&T AG

- Mercury Systems Inc.

- Motorola Solutions Inc.

- NEXCOM International Co. Ltd.

- One Stop Systems Inc.

- Systel Inc.

- Trenton Systems Inc.

- Aetina Corporation

- Crystal Group Inc.

- ECRIN Systems

- Eurotech S.p.A.

- Lockheed Martin Corporation

- Rockwell Automation Inc.

Frequently Asked Questions

What are rugged servers?

Rugged servers are specialized computers designed to operate reliably in harsh environmental conditions, such as extreme temperatures, high shock and vibration, dust, humidity, and electromagnetic interference, where standard IT equipment would fail.

Who primarily uses rugged servers?

Major users include the military and defense, industrial automation, oil and gas, telecommunications, and transportation sectors, all requiring dependable computing in challenging or mission-critical environments.

What are the key features of rugged servers?

Key features include reinforced chassis, advanced thermal management, solid-state storage, sealed enclosures, specialized connectors, and compliance with military (e.g., MIL-STD-810G) or industrial IP standards.

How is AI impacting the rugged servers market?

AI is driving demand for rugged servers as platforms for edge computing, enabling real-time data analytics, autonomous systems, and predictive maintenance directly in harsh or remote environments, minimizing reliance on cloud connectivity.

What is the future outlook for the rugged server market?

The market is poised for strong growth, fueled by the expansion of edge computing, 5G network rollouts, increased defense spending, and industrial automation initiatives, particularly in emerging regions like Asia Pacific.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager