SAARC Transmission Lines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429747 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

SAARC Transmission Lines Market Size

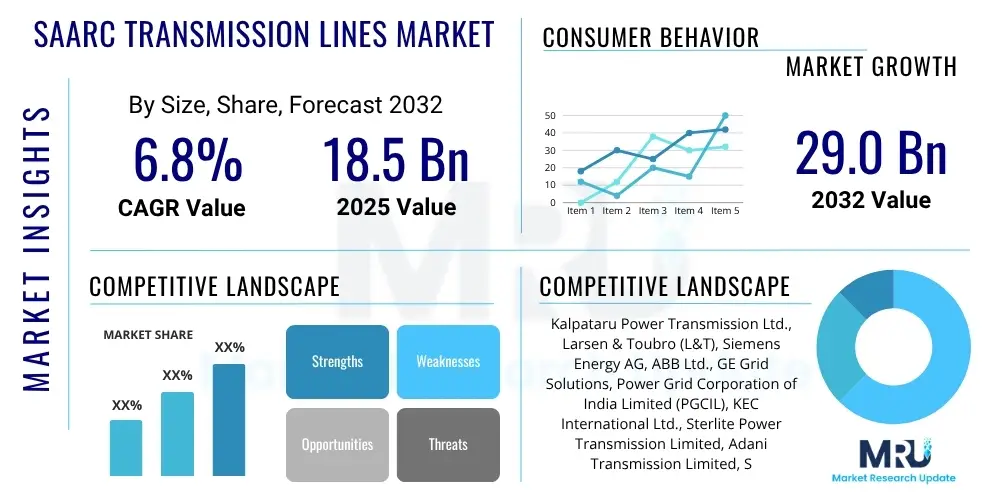

The SAARC Transmission Lines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 18.5 Billion in 2025 and is projected to reach USD 29.0 Billion by the end of the forecast period in 2032.

SAARC Transmission Lines Market introduction

The SAARC (South Asian Association for Regional Cooperation) Transmission Lines Market encompasses the infrastructure dedicated to bulk power transfer across long distances and between different regions within the member states. This critical infrastructure includes high-voltage transmission lines, towers, substations, and associated equipment necessary for the efficient and reliable delivery of electricity from generation points to distribution networks and ultimately to end-users. Transmission lines are the backbone of any modern power system, facilitating economic growth by ensuring energy security and access.

The primary product within this market segment involves the design, engineering, procurement, construction, and maintenance of various types of transmission lines, including High Voltage Alternating Current (HVAC) and High Voltage Direct Current (HVDC) systems, operating at voltage levels ranging from 132 kV to Ultra-High Voltage (UHV) capacities. These lines are crucial for connecting power generation plants, such as thermal, hydro, and renewable energy facilities, to demand centers. Major applications include integrating renewable energy sources into national grids, strengthening inter-regional grid connectivity, facilitating cross-border energy trade, and providing reliable power for industrialization and urbanization.

The benefits derived from a robust transmission lines market are manifold, including enhanced energy security, reduced transmission losses, improved grid stability, and lower electricity costs due to better resource utilization. Key driving factors propelling this market in the SAARC region include rapid industrialization, increasing urbanization, ambitious renewable energy targets set by member countries, growing cross-border energy trade initiatives, and significant government investments in upgrading and expanding existing transmission infrastructure to meet escalating electricity demand. Furthermore, the push for smart grid technologies and grid modernization also plays a pivotal role in market expansion.

SAARC Transmission Lines Market Executive Summary

The SAARC Transmission Lines Market is experiencing robust growth driven by a confluence of favorable business trends, evolving regional dynamics, and significant advancements across various market segments. Business trends indicate a strong shift towards digitalization of grid operations, the adoption of smart grid technologies for enhanced efficiency and reliability, and increasing private sector participation through public-private partnerships (PPPs) in large-scale transmission projects. There is also a notable emphasis on developing resilient transmission infrastructure capable of withstanding extreme weather events and integrating diverse generation sources, including a growing share of renewable energy, which necessitates significant upgrades and expansions of existing networks.

Regionally, India remains the dominant market player due to its vast geographical size, ambitious economic development plans, and extensive renewable energy integration targets, leading to massive investments in grid expansion and strengthening. However, other SAARC nations such as Bangladesh, Pakistan, and Nepal are also exhibiting significant growth potential, fueled by industrial development, increasing electrification rates, and cross-border energy trade initiatives, particularly in hydropower development and export. These countries are actively seeking to modernize their grids and improve energy access, which directly translates into demand for new transmission lines and associated infrastructure. The emphasis on regional grid interconnections, such as the proposed SAARC grid, further highlights the collaborative efforts to enhance energy security and reliability across the subcontinent.

From a segmentation perspective, the market is witnessing strong demand for Extra-High Voltage (EHV) and Ultra-High Voltage (UHV) lines to facilitate long-distance, high-capacity power transfer, especially for integrating large-scale renewable energy projects located in remote areas. The adoption of High Voltage Direct Current (HVDC) technology is gaining traction for asynchronous interconnections and minimizing losses over very long distances. While overhead transmission lines remain the predominant type due to cost-effectiveness, there is an increasing trend for underground transmission in urban and environmentally sensitive areas. Furthermore, the market for advanced conductors, such as high-temperature low-sag (HTLS) conductors, is expanding as utilities seek to enhance line capacity without requiring new rights-of-way, reflecting a broader trend towards efficiency and optimal utilization of existing assets.

AI Impact Analysis on SAARC Transmission Lines Market

User inquiries concerning AI's impact on the SAARC Transmission Lines Market primarily revolve around its potential to enhance operational efficiency, improve grid reliability, enable predictive maintenance, and address the complexities of integrating renewable energy. Common questions include how AI can optimize power flow, prevent blackouts, detect faults faster, and manage the variability of solar and wind power. Users are also keen to understand the technological advancements, implementation challenges, data security implications, and the workforce adaptation required for AI integration within the region's diverse grid infrastructure. There is a clear expectation that AI will transform traditional grid management into a more proactive, intelligent, and resilient system, despite concerns about initial investment costs and the availability of skilled personnel. The key themes highlight a strong desire for solutions that can reduce operational expenditures, minimize downtime, and contribute to a more sustainable energy future, underscoring AI's role as a critical enabler for modernizing the SAARC power grid.

- Predictive maintenance and fault detection: AI algorithms analyze sensor data from transmission lines and equipment to predict potential failures before they occur, enabling proactive maintenance and reducing downtime.

- Grid optimization and power flow management: AI-driven systems optimize power flow in real-time, balancing supply and demand, managing congestion, and minimizing transmission losses, especially crucial with intermittent renewable sources.

- Enhanced operational efficiency: AI automates routine tasks, monitors grid performance, and provides data-driven insights, leading to more efficient resource allocation and reduced operational costs for utilities.

- Improved grid stability and resilience: AI helps identify and respond to grid disturbances quickly, preventing cascading failures and enhancing the overall stability and resilience of the transmission network.

- Data analytics and visualization: AI processes vast amounts of operational data to provide actionable insights through advanced analytics and intuitive visualizations, aiding decision-making for grid operators.

- Cybersecurity enhancements: AI algorithms can detect unusual patterns and potential cyber threats in grid control systems, bolstering the security of critical transmission infrastructure.

- Renewable energy integration: AI facilitates the seamless integration of variable renewable energy sources by forecasting generation, managing fluctuations, and optimizing grid dispatch.

- Asset management and lifecycle optimization: AI supports better asset management by providing insights into equipment health, remaining useful life, and optimal replacement schedules.

DRO & Impact Forces Of SAARC Transmission Lines Market

The SAARC Transmission Lines Market is significantly influenced by a dynamic interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the accelerating economic growth across SAARC nations, which fuels industrialization and urbanization, consequently leading to a surge in electricity demand. This increased demand necessitates substantial investments in new transmission infrastructure and the expansion of existing networks. Furthermore, the ambitious renewable energy targets set by countries like India, Bangladesh, and Pakistan, aimed at decarbonizing their energy sectors, mandate extensive transmission line development to connect geographically dispersed renewable generation sites to load centers. Growing regional energy cooperation and cross-border energy trade agreements also act as strong drivers, promoting the development of interconnected grids to enhance energy security and facilitate power exchange.

However, the market faces several significant restraints that could impede its growth trajectory. High capital expenditure required for transmission line projects, coupled with complex financing arrangements, presents a substantial barrier, especially for developing economies within the region. Land acquisition challenges, including social and environmental protests, regulatory complexities, and obtaining necessary permits, often lead to project delays and increased costs. Environmental concerns, such as the impact of transmission lines on ecosystems, biodiversity, and human habitats, necessitate rigorous environmental impact assessments and mitigation measures, adding to project timelines and expenses. The volatility of raw material prices, particularly for steel, aluminum, and copper, also introduces cost uncertainties for manufacturers and project developers.

Despite these restraints, the market is replete with significant opportunities. The widespread adoption of smart grid technologies and digitalization initiatives across SAARC countries offers avenues for enhancing grid efficiency, reliability, and resilience, driving demand for advanced transmission solutions. The increasing interest in High Voltage Direct Current (HVDC) technology for long-distance power transmission and asynchronous interconnections presents a lucrative opportunity for specialized players, as HVDC minimizes losses and enhances stability. Moreover, the growing trend of Public-Private Partnerships (PPPs) in infrastructure development can help overcome financing challenges and leverage private sector expertise, accelerating project execution. Enhanced regional grid integration, with the vision of a unified SAARC power grid, opens up new avenues for cross-border projects and collaborative infrastructure development, fostering greater energy security and trade.

Several impact forces exert influence on the market. Government policies and regulatory frameworks play a crucial role, as supportive policies for infrastructure development, renewable energy, and regional cooperation can significantly boost market growth, while restrictive or inconsistent regulations can stifle investment. Technological advancements in materials science, conductor technology (e.g., HTLS conductors), and smart grid components continuously redefine market capabilities and introduce more efficient solutions. Global and regional raw material prices directly impact project costs and profitability. Geopolitical stability and inter-country relations within the SAARC region also influence the viability and progress of cross-border transmission projects, making regional cooperation a critical factor for sustained market development.

Segmentation Analysis

The SAARC Transmission Lines Market is segmented comprehensively to provide a granular understanding of its various components, operational characteristics, and application areas. This segmentation helps identify specific growth pockets, emerging trends, and the competitive landscape across different dimensions of transmission line infrastructure. Key segments typically include voltage level, type of transmission line, material used for conductors, specific components, application areas, and ownership models, each presenting unique dynamics and growth prospects within the SAARC region.

- By Voltage Level

- High Voltage (HV)

- 132 kV to 220 kV

- Extra-High Voltage (EHV)

- 400 kV to 765 kV

- Ultra-High Voltage (UHV)

- >800 kV

- High Voltage (HV)

- By Type

- Overhead Transmission Lines

- Underground Transmission Lines

- High Voltage Direct Current (HVDC)

- High Voltage Alternating Current (HVAC)

- By Material

- Aluminum Conductors

- AAC (All Aluminum Conductor)

- AAAC (All Aluminum Alloy Conductor)

- ACSR (Aluminum Conductor Steel Reinforced)

- ACCC (Aluminum Conductor Composite Core)

- HTLS (High-Temperature Low-Sag) Conductors

- Copper Conductors

- Optical Ground Wire (OPGW)

- Aluminum Conductors

- By Component

- Conductors

- Towers and Structures

- Insulators

- Hardware and Accessories

- Substation Equipment

- Protection & Control Systems

- By Application

- Renewable Energy Integration

- Grid Expansion and Upgrades

- Cross-Border Interconnections

- Industrial Power Supply

- Urban and Rural Electrification

- Smart Grid Deployment

- By Ownership

- Government Owned Utilities

- Private Utilities

- Public-Private Partnerships (PPPs)

- By End-User

- Power Utilities

- Independent Power Producers (IPPs)

- Industrial Sector

- Commercial Sector

Value Chain Analysis For SAARC Transmission Lines Market

The value chain for the SAARC Transmission Lines Market is complex, involving multiple stages from raw material sourcing to the final operation and maintenance of the transmission infrastructure. The upstream segment primarily consists of raw material suppliers, including manufacturers of steel for towers, aluminum and copper for conductors, and specialized producers of insulators (ceramic, glass, composite), hardware, and accessories. These suppliers are critical for the quality and cost-effectiveness of the final transmission line components, with price volatility in global commodity markets directly impacting their input costs. The ability to source high-quality materials consistently and competitively is a key factor for success in this initial stage of the value chain, often involving a global supply network for specialized components.

Midstream activities involve the design, engineering, manufacturing, and construction of transmission line projects. This stage is dominated by Engineering, Procurement, and Construction (EPC) contractors, who undertake the overall project management, including detailed engineering, procurement of all necessary equipment, and the physical construction of lines and substations. Equipment manufacturers, ranging from conductor and insulator producers to specialized tower fabricators and substation equipment suppliers, form a vital part of this stage. The downstream segment of the value chain primarily involves the end-users and operators of the transmission lines, which are predominantly national and regional power utilities, independent power producers (IPPs), and large industrial consumers who depend on reliable power supply for their operations. This segment also includes ongoing maintenance and operational services, ensuring the long-term reliability and efficiency of the grid infrastructure.

Distribution channels for transmission line projects are primarily direct, involving direct engagement between EPC contractors or equipment manufacturers and the end-user utilities or government agencies through competitive bidding processes for large-scale projects. Indirect channels may involve consultants, integrators, or smaller contractors who support specific project phases or provide niche solutions, particularly for regional or localized grid upgrades. Government tenders and public sector procurement are highly significant, as a substantial portion of transmission line development in the SAARC region is driven by public utilities and state-owned enterprises. Private sector players, including IPPs and private utilities, also engage directly with manufacturers and EPC firms, especially for captive power evacuation or independent transmission projects, fostering a mix of direct and indirect engagement models across the market.

SAARC Transmission Lines Market Potential Customers

The SAARC Transmission Lines Market serves a diverse range of potential customers, predominantly comprising entities involved in the generation, transmission, and distribution of electricity. The most significant end-users and buyers are national and regional power utilities, which are responsible for developing, owning, and operating the bulk of the transmission infrastructure within their respective countries. These utilities, often state-owned or highly regulated, drive demand for new transmission lines for grid expansion, capacity upgrades, and the integration of new power generation sources to meet growing electricity demand and ensure grid stability across their service territories. Their procurement processes typically involve large-scale tenders for EPC contracts and equipment supply, making them central to market activity.

Another crucial segment of potential customers includes Independent Power Producers (IPPs). As the energy sector increasingly liberalizes and diversified generation assets come online, IPPs require robust transmission infrastructure to evacuate the power they generate from their power plants to the national grid connection points. This demand can range from dedicated short-distance lines to connect to the nearest substation to more complex arrangements for large-scale renewable energy parks located in remote areas. These producers often engage with transmission line developers and equipment manufacturers to ensure efficient and timely power evacuation, forming a significant private sector demand component within the market.

Furthermore, large industrial facilities and Special Economic Zones (SEZs) constitute another segment of potential buyers. These entities often have substantial and critical power requirements, sometimes necessitating dedicated or reinforced transmission connections to ensure a reliable and stable power supply that meets their operational demands. While their direct procurement of transmission lines might be less frequent than utilities, their growing energy needs indirectly drive demand for grid expansion and strengthening by utility providers. Government infrastructure agencies and regional development bodies also act as buyers, particularly for cross-border interconnection projects aimed at fostering regional energy trade and enhancing collective energy security among SAARC member states, underscoring the collaborative aspect of infrastructure development in the region.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 18.5 Billion |

| Market Forecast in 2032 | USD 29.0 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kalpataru Power Transmission Ltd., Larsen & Toubro (L&T), Siemens Energy AG, ABB Ltd., GE Grid Solutions, Power Grid Corporation of India Limited (PGCIL), KEC International Ltd., Sterlite Power Transmission Limited, Adani Transmission Limited, Skipper Limited, BHEL (Bharat Heavy Electricals Limited), EMCO Ltd., Tata Projects Ltd., Gammon India Ltd., CIELEC Ltd., NCC Limited, Hindustan Construction Company (HCC), Transrail Lighting Limited, Jyoti Structures Ltd., Larsen & Toubro Construction Power Transmission & Distribution (L&T PT&D) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SAARC Transmission Lines Market Key Technology Landscape

The SAARC Transmission Lines Market is witnessing significant technological advancements aimed at enhancing efficiency, reliability, and capacity while minimizing environmental impact. One of the most prominent technologies is High Voltage Direct Current (HVDC) transmission, which is increasingly adopted for long-distance bulk power transfer, especially for connecting remote renewable energy sources or for asynchronous interconnections between different grids. HVDC technology offers advantages such as reduced transmission losses, improved grid stability, and the ability to connect grids with different frequencies or operating characteristics, making it crucial for regional energy integration initiatives and complex power evacuation projects. The evolution of Voltage Source Converters (VSC-HVDC) further enhances control and flexibility, allowing for more dynamic grid management.

Another critical area of technological innovation is the development and deployment of Smart Grid technologies. This involves integrating digital communication technologies with power infrastructure to enable real-time monitoring, control, and optimization of the electricity network. Key components include advanced sensors, Wide Area Measurement Systems (WAMS), Supervisory Control and Data Acquisition (SCADA) systems, and Intelligent Electronic Devices (IEDs). These technologies facilitate proactive fault detection, predictive maintenance, optimal power flow management, and improved grid resilience, all of which are vital for managing the increasing complexity of modern power systems and integrating intermittent renewable energy sources efficiently. The deployment of smart grid solutions is transforming traditional transmission operations into more data-driven and automated processes.

Furthermore, advancements in conductor materials and tower designs are significantly impacting the market. High-Temperature Low-Sag (HTLS) conductors, such as Aluminum Conductor Composite Core (ACCC) and others, allow for increased power transfer capacity over existing rights-of-way without the need for new lines or significant tower modifications. This technology helps defer costly investments in new infrastructure and reduces land acquisition challenges. Modern composite insulators are replacing traditional ceramic and glass insulators, offering better performance in polluted environments, reduced weight, and enhanced resistance to vandalism. The use of Geographic Information Systems (GIS) and Global Positioning Systems (GPS) for precise mapping, route optimization, and asset management, coupled with drone-based inspection and maintenance, are also becoming standard practices, improving operational efficiency, reducing human risk, and ensuring the longevity of transmission assets. These technological shifts are driving the modernization of the SAARC grid infrastructure, making it more robust, efficient, and future-ready.

Regional Highlights

- India: As the largest economy and population in the SAARC region, India dominates the transmission lines market. The country has aggressive targets for renewable energy integration (e.g., 500 GW by 2030) and vast infrastructure development plans, necessitating massive investments in EHV and UHV transmission lines and inter-regional grid strengthening projects. Initiatives like the Green Energy Corridors and "One Sun, One World, One Grid" further highlight its role in regional grid expansion.

- Bangladesh: Driven by rapid industrialization, urbanization, and a growing energy deficit, Bangladesh is significantly expanding its transmission network. The country is investing in high-voltage lines to connect new power plants, including imported power from India and domestic facilities, and to improve grid stability, particularly for industrial zones and growing urban centers.

- Pakistan: Pakistan's transmission sector is undergoing substantial upgrades and expansion to address persistent power shortages and improve the reliability of its grid. Investments under the China-Pakistan Economic Corridor (CPEC) are particularly significant, involving new HVDC and HVAC lines to evacuate power from large-scale power projects and connect to remote regions.

- Nepal: With immense hydropower potential, Nepal's transmission line development is primarily focused on evacuating power from hydroelectric projects to domestic consumption centers and for cross-border export, primarily to India. The development of high-voltage cross-border interconnections is a key area of investment, aiming to monetize its renewable energy resources.

- Sri Lanka: Sri Lanka is focusing on strengthening its national grid to improve reliability and reduce transmission losses. Investments include upgrading existing lines, expanding the network to new growth areas, and integrating renewable energy projects, particularly solar and wind, into the national grid to achieve energy independence goals.

- Afghanistan, Bhutan, Maldives: While smaller markets, these countries are also pursuing transmission line projects tailored to their specific needs. Bhutan focuses on hydropower export lines, Afghanistan on rebuilding and expanding its grid with international support, and Maldives on submarine cables for inter-island power connectivity, often involving specialized solutions for unique geographical challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SAARC Transmission Lines Market.- Kalpataru Power Transmission Ltd.

- Larsen & Toubro (L&T)

- Siemens Energy AG

- ABB Ltd.

- GE Grid Solutions

- Power Grid Corporation of India Limited (PGCIL)

- KEC International Ltd.

- Sterlite Power Transmission Limited

- Adani Transmission Limited

- Skipper Limited

- BHEL (Bharat Heavy Electricals Limited)

- EMCO Ltd.

- Tata Projects Ltd.

- Gammon India Ltd.

- CIELEC Ltd.

- NCC Limited

- Hindustan Construction Company (HCC)

- Transrail Lighting Limited

- Jyoti Structures Ltd.

- Larsen & Toubro Construction Power Transmission & Distribution (L&T PT&D)

- Toshiba Energy Systems & Solutions Corporation

- Hitachi Energy Ltd.

- Sumitomo Electric Industries, Ltd.

- KEI Industries Ltd.

- Finolex Cables Ltd.

Frequently Asked Questions

Analyze common user questions about the SAARC Transmission Lines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the SAARC Transmission Lines Market?

The SAARC Transmission Lines Market is primarily driven by rapid industrialization, increasing urbanization, ambitious renewable energy integration targets, and growing cross-border energy trade initiatives among member countries, all necessitating significant investments in grid expansion and modernization.

What are the main challenges faced by the SAARC Transmission Lines Market?

Key challenges include high capital expenditures for projects, difficulties in land acquisition, stringent environmental regulations, volatility in raw material prices (steel, aluminum, copper), and ensuring grid stability amidst increasing integration of intermittent renewable energy sources.

How is technology impacting the SAARC Transmission Lines Market?

Technology is significantly impacting the market through the adoption of High Voltage Direct Current (HVDC) for long-distance bulk power transfer, deployment of smart grid solutions for enhanced monitoring and control, and advancements in conductor materials like HTLS for increased capacity over existing lines.

Which SAARC country is a major contributor to the transmission lines market?

India is the dominant contributor to the SAARC Transmission Lines Market, driven by its vast electricity demand, extensive renewable energy projects, and ongoing national and inter-regional grid expansion programs, leading to substantial investments in EHV and UHV infrastructure.

What are the opportunities for private players in the SAARC Transmission Lines Market?

Private players have significant opportunities through Public-Private Partnerships (PPPs) for large-scale projects, investments in specialized technologies like HVDC, EPC contracts for renewable energy evacuation, and providing advanced solutions for smart grid deployment and operational efficiency enhancements for utilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager