Sapphire Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430655 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Sapphire Glass Market Size

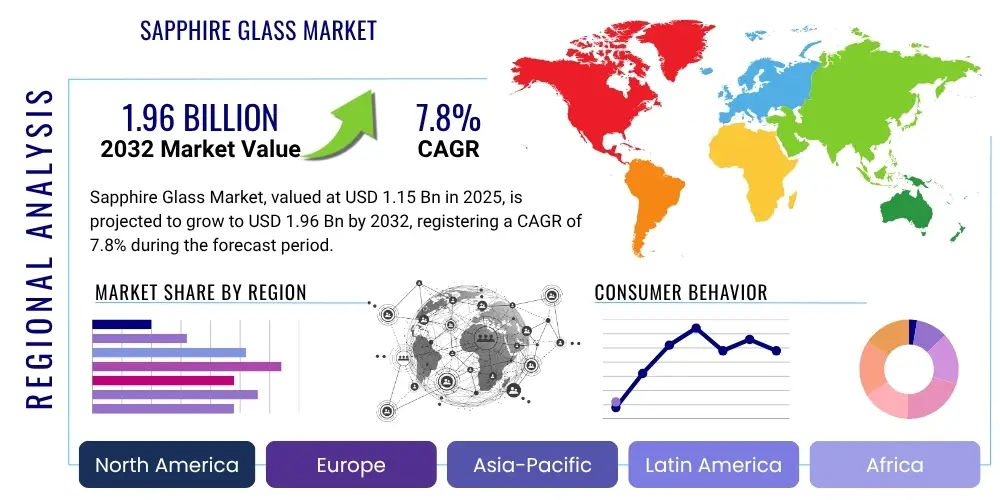

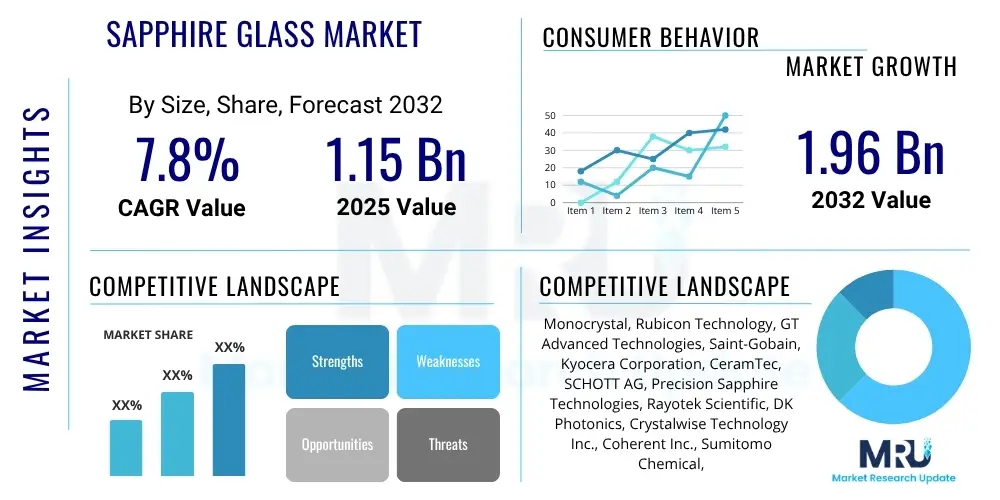

The Sapphire Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at $1.15 Billion in 2025 and is projected to reach $1.96 Billion by the end of the forecast period in 2032.

Sapphire Glass Market introduction

The Sapphire Glass Market encompasses the production and distribution of synthetic sapphire, a single-crystal form of aluminum oxide (Al2O3), which is renowned for its exceptional hardness, high scratch resistance, optical transparency, and chemical inertness. Unlike conventional glass, sapphire glass possesses superior mechanical, thermal, and optical properties, making it an ideal material for high-performance applications where durability and clarity are paramount. This unique combination of attributes positions sapphire glass as a critical component across various advanced technological sectors.

The primary applications of sapphire glass are extensive and diverse, ranging from consumer electronics to highly specialized industrial and defense systems. In consumer electronics, it is widely used for smartphone camera lenses, smartwatch covers, and fingerprint sensors, offering unparalleled protection against scratches and impacts. Beyond this, its adoption extends to LED substrates, high-performance optical windows, medical implants, aerospace components such as missile domes and infrared windows, and various industrial applications requiring extreme resilience. The driving factors behind its market growth include the escalating demand for robust and visually superior display covers and protective layers in electronic devices, the continuous innovation in LED technology, and the stringent performance requirements of the medical and defense industries.

Sapphire Glass Market Executive Summary

The Sapphire Glass Market is experiencing robust expansion driven by significant business trends, including the increasing integration of advanced materials in consumer electronics and the sustained growth of high-performance sectors like aerospace, defense, and medical devices. Key market players are investing heavily in research and development to enhance manufacturing efficiency and reduce production costs, aiming to make sapphire glass more accessible for a broader range of applications. Furthermore, strategic collaborations and mergers among crystal growers and component fabricators are shaping the competitive landscape, fostering innovation, and streamlining the supply chain. These dynamics reflect a market poised for substantial technological advancement and commercial scaling.

Regional trends indicate that Asia Pacific holds a dominant position in the sapphire glass market, primarily due to its expansive manufacturing base for consumer electronics and LEDs, coupled with a rapidly growing technological infrastructure. North America and Europe also contribute significantly, driven by strong demand from the aerospace, defense, and medical industries, alongside ongoing innovation in high-end consumer products. Emerging economies in Latin America and the Middle East and Africa are witnessing gradual adoption, particularly in industrial and niche consumer segments, signaling future growth opportunities as technological penetration increases. These regional disparities highlight the market's diverse drivers and varying stages of maturity across the globe.

Segment trends reveal that the consumer electronics sector remains the largest and fastest-growing application area for sapphire glass, propelled by the demand for durable covers for smartphones, smartwatches, and camera lenses. The LED segment also exhibits strong growth as sapphire substrates continue to be essential for efficient light production. In parallel, the medical and aerospace sectors demonstrate consistent demand for sapphire glass due to its unparalleled properties in critical environments, emphasizing reliability and performance over cost. These segment-specific trajectories underscore the versatility of sapphire glass and its indispensable role in diverse high-value applications, guiding strategic investments and product development efforts.

AI Impact Analysis on Sapphire Glass Market

User inquiries concerning AI's influence on the Sapphire Glass Market frequently center on its potential to revolutionize manufacturing processes, enhance product quality, and accelerate material innovation. Common themes include how AI can optimize crystal growth parameters to improve yield and reduce defects, the application of machine learning for advanced quality control and inspection, and AI's role in the design and discovery of novel sapphire-based composite materials or coatings. There is also significant interest in AI's capacity to streamline supply chain logistics and predict market demand, thereby impacting cost structures and market responsiveness. Users anticipate that AI integration will lead to more efficient, cost-effective, and higher-quality sapphire glass production, ultimately expanding its applicability and market penetration.

- AI-driven optimization of crystal growth processes, leading to improved yield and reduced energy consumption.

- Enhanced automated defect detection and quality control using machine learning algorithms, ensuring higher product standards.

- Accelerated material design and discovery for novel sapphire composites or coatings through AI simulations.

- Predictive maintenance for manufacturing equipment, minimizing downtime and increasing operational efficiency.

- Supply chain optimization and demand forecasting, enabling more agile and cost-effective production planning.

- Development of smart sapphire components with integrated AI functionalities for advanced sensing or protection.

DRO & Impact Forces Of Sapphire Glass Market

The Sapphire Glass Market is significantly shaped by a combination of key drivers, restraints, opportunities, and pervasive impact forces. A primary driver is the surging demand for highly durable and scratch-resistant protective covers and optical components in the rapidly expanding consumer electronics industry, particularly for smartphones, smartwatches, and advanced camera systems. Additionally, the increasing adoption of sapphire substrates in high-brightness LED manufacturing and the specialized requirements of the medical, aerospace, and defense sectors for robust optical windows and components further fuel market growth. Technological advancements aimed at improving crystal growth techniques and reducing manufacturing costs are also playing a crucial role in expanding market accessibility and application diversity.

Conversely, significant restraints hinder the market's full potential. The high manufacturing cost of synthetic sapphire, primarily due to the energy-intensive and time-consuming crystal growth processes, remains a substantial barrier, limiting its widespread adoption in more cost-sensitive applications. Furthermore, the limited production capacity and the technical complexities associated with scaling up sapphire manufacturing pose challenges to meeting escalating demand. Competition from alternative advanced materials like strengthened aluminosilicates (e.g., Gorilla Glass) or advanced ceramics, which offer comparable performance at potentially lower costs, also presents a notable restraint, compelling sapphire manufacturers to continuously innovate and optimize their offerings.

Opportunities within the Sapphire Glass Market are substantial and multifaceted. The emergence of new application areas, such as augmented reality/virtual reality (AR/VR) devices, advanced automotive displays, and next-generation medical implants, presents lucrative avenues for market expansion. Continuous research and development efforts focused on developing more cost-effective and scalable sapphire manufacturing techniques, such as laser-assisted growth or novel doping strategies, could significantly enhance market penetration. Additionally, investments in developing ultra-thin and flexible sapphire solutions could unlock entirely new product categories and market segments. These opportunities underscore the potential for transformative growth if current technological and economic hurdles can be effectively addressed.

Segmentation Analysis

The Sapphire Glass Market is broadly segmented based on its type, application, manufacturing process, and geographic region, reflecting the diverse end-uses and production methodologies within the industry. This detailed segmentation provides a granular understanding of market dynamics, allowing for a precise analysis of growth drivers, competitive landscapes, and emerging opportunities across different market verticals. Each segment is influenced by distinct technological requirements, economic factors, and consumer preferences, contributing uniquely to the overall market trajectory.

- By Type

- Optical Sapphire: Used in high-performance lenses, windows, and prisms where transparency and purity are critical.

- Electronic Sapphire: Primarily used as substrates for LEDs, RFICs, and other semiconductor devices due to its excellent dielectric properties and thermal conductivity.

- By Application

- Consumer Electronics: Includes smartphone displays, smartwatch covers, camera lens covers, and fingerprint sensors.

- LED: Serves as a primary substrate material for gallium nitride (GaN) based LED manufacturing.

- Medical: Utilized in surgical instruments, endoscopes, and implants due to its biocompatibility and durability.

- Aerospace and Defense: Employed in missile domes, aircraft windows, and sensor protection for extreme environments.

- Industrial: Used in bearings, viewports, and laser optics for high-wear and high-temperature industrial applications.

- Others: Encompasses luxury watches, high-end scientific instruments, and specialized research applications.

- By Manufacturing Process

- Kyropoulos Method: A common method known for producing large, high-quality sapphire crystals.

- Heat Exchanger Method (HEM): Widely used for growing large boules with high crystalline quality and uniformity.

- Czochralski Method: Offers good crystal quality but is generally more complex for sapphire.

- Other Methods: Includes Edge-defined Film-fed Growth (EFG), Laser Heated Pedestal Growth (LHPG), and various solution growth techniques.

Value Chain Analysis For Sapphire Glass Market

The value chain for the Sapphire Glass Market begins with upstream activities focused on the procurement and processing of raw materials. This primarily involves sourcing high-purity alumina powder, which serves as the fundamental precursor for synthetic sapphire crystal growth. Specialized equipment manufacturers provide the advanced furnaces and machinery essential for various crystal growth techniques, such as Kyropoulos, HEM, or Czochralski methods. Key players in this upstream segment include suppliers of raw materials and sophisticated crystal growth equipment, whose innovations directly impact the quality, cost, and efficiency of the initial sapphire boule production. Ensuring a consistent supply of high-grade alumina and reliable machinery is critical for the stability and growth of the entire value chain.

Moving downstream, the value chain encompasses the complex stages of sapphire processing and fabrication. Once sapphire boules are grown, they undergo a series of precise cutting, grinding, lapping, and polishing operations to achieve the desired dimensions, surface finish, and optical clarity. This stage is highly specialized, requiring advanced machinery and technical expertise to transform raw sapphire into finished components like wafers, windows, lenses, or customized shapes. Subsequent steps may include thin-film coating for anti-reflection or enhanced durability, and final inspection and quality assurance. Fabricators and component manufacturers constitute the core of this downstream segment, adding significant value through their precise engineering and manufacturing capabilities. Their ability to deliver custom solutions efficiently is paramount to meeting diverse end-user demands.

Distribution channels for sapphire glass products are varied, catering to the specific needs of different end-use industries. Direct sales are common for large-volume orders and specialized applications, where original equipment manufacturers (OEMs) or key industrial clients directly procure components from sapphire fabricators. This direct approach allows for close collaboration on product specifications and quality control. Indirect channels involve distributors and specialized resellers who supply smaller quantities or cater to niche markets, often providing value-added services such as inventory management and technical support. The choice of distribution channel often depends on the product's complexity, the volume required, and the geographic reach of the end-users. An efficient blend of direct and indirect channels is essential for maximizing market penetration and ensuring timely delivery of these high-performance materials.

Sapphire Glass Market Potential Customers

Potential customers and end-users of sapphire glass are concentrated across several high-technology and high-performance sectors, driven by the material's unparalleled durability, optical clarity, and resistance to harsh environments. In the consumer electronics segment, major smartphone manufacturers, smartwatch brands, and camera module suppliers are primary buyers, seeking sapphire for premium device screens, camera lens covers, and biometric sensors that require superior scratch resistance. The LED lighting industry represents another significant customer base, with LED chip manufacturers purchasing sapphire wafers as essential substrates for epitaxial growth of GaN-based light-emitting diodes, ensuring optimal performance and efficiency.

Beyond consumer applications, the medical device industry is a growing market for sapphire glass, where manufacturers of surgical instruments, endoscopic equipment, and implantable devices utilize its biocompatibility, chemical inertness, and hardness. Aerospace and defense contractors represent a critical segment, demanding sapphire for high-performance optical windows, sensor protection, and missile domes due to its ability to withstand extreme thermal and mechanical stresses. Furthermore, various industrial sectors, including manufacturers of high-pressure viewports, laser systems, and semiconductor processing equipment, rely on sapphire glass for its exceptional mechanical strength and resistance to corrosive chemicals and high temperatures. These diverse customer groups underscore the broad utility and indispensable nature of sapphire glass in advanced technological applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $1.15 Billion |

| Market Forecast in 2032 | $1.96 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Monocrystal, Rubicon Technology, GT Advanced Technologies, Saint-Gobain, Kyocera Corporation, CeramTec, SCHOTT AG, Precision Sapphire Technologies, Rayotek Scientific, DK Photonics, Crystalwise Technology Inc., Coherent Inc., Sumitomo Chemical, II VI Incorporated (now Coherent Corp.), JSC Fomos Materials, Hansol Technics, Wafer World Inc., Advanced Crystal Technology, Valley Design, AlfaLight Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sapphire Glass Market Key Technology Landscape

The technology landscape for the Sapphire Glass Market is characterized by advanced crystal growth methods and sophisticated post-growth processing techniques essential for producing high-quality and application-specific sapphire components. The dominant crystal growth technologies include the Heat Exchanger Method (HEM), which is renowned for growing large boules with high crystalline quality and uniformity, and the Kyropoulos method, favored for its ability to produce large-diameter crystals. Other significant methods, such as the Czochralski method and Edge-defined Film-fed Growth (EFG), are also employed, each offering distinct advantages in terms of crystal size, shape, and cost-effectiveness for particular applications. Continuous research in these growth techniques aims to reduce energy consumption, accelerate growth rates, and improve yield, directly impacting the overall cost and scalability of sapphire production.

Beyond crystal growth, advanced fabrication and finishing technologies are crucial in the sapphire glass value chain. This involves precision cutting techniques, such as wire sawing, to slice boules into wafers or blanks, followed by intricate grinding, lapping, and chemical mechanical polishing (CMP) to achieve the required flatness, parallelism, and pristine surface finish. For optical applications, specialized optical polishing is critical to meet stringent surface quality and transmission specifications. Furthermore, thin-film deposition technologies, including physical vapor deposition (PVD) and chemical vapor deposition (CVD), are used to apply anti-reflection coatings, hydrophobic layers, or other functional coatings to enhance the performance and durability of finished sapphire components. Innovations in these processing technologies are vital for delivering sapphire products that meet the increasingly demanding specifications of modern electronic, optical, and industrial applications.

Regional Highlights

- North America: This region is a significant market for sapphire glass, driven by strong demand from the aerospace and defense sectors for high-performance optical windows and sensor protection. The presence of leading technology companies and a robust research and development ecosystem also fuels innovation in new applications, particularly in medical devices and high-end consumer electronics.

- Europe: European countries exhibit a mature market for sapphire glass, largely supported by the automotive industry for specialized lighting and sensor covers, as well as the medical sector for surgical tools and implants. Germany and France are key contributors, known for their advanced manufacturing capabilities and emphasis on precision engineering.

- Asia Pacific (APAC): The APAC region is the largest and fastest-growing market for sapphire glass, primarily due to its dominance in the global consumer electronics manufacturing landscape, especially for smartphones, smartwatches, and LED lighting. Countries like China, South Korea, Japan, and Taiwan are major production hubs and significant consumers of sapphire substrates and components.

- Latin America: This region represents an emerging market for sapphire glass, with increasing adoption in industrial applications and a gradual rise in demand within the consumer electronics sector as technological penetration expands. Growth is projected to be steady, driven by infrastructure development and rising disposable incomes.

- Middle East and Africa (MEA): The MEA region is a developing market for sapphire glass, with demand predominantly stemming from defense applications, industrial projects, and niche high-end consumer goods. Investment in manufacturing and technological advancements in the region is expected to foster future growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sapphire Glass Market.- Monocrystal

- Rubicon Technology

- GT Advanced Technologies

- Saint-Gobain

- Kyocera Corporation

- CeramTec

- SCHOTT AG

- Precision Sapphire Technologies

- Rayotek Scientific

- DK Photonics

- Crystalwise Technology Inc.

- Coherent Inc.

- Sumitomo Chemical

- II VI Incorporated (now Coherent Corp.)

- JSC Fomos Materials

- Hansol Technics

- Wafer World Inc.

- Advanced Crystal Technology

- Valley Design

- AlfaLight Inc.

Frequently Asked Questions

What is sapphire glass and how is it used?

Sapphire glass is a synthetic crystalline form of aluminum oxide known for its extreme hardness, scratch resistance, and optical clarity. It is primarily used in applications requiring high durability and transparency, such as smartphone camera lenses, smartwatch covers, LED substrates, and aerospace optical components.

Why is sapphire glass more expensive than regular glass?

Sapphire glass is more expensive due to its complex and energy-intensive manufacturing process, which involves growing large single crystals from high-purity alumina at extremely high temperatures. The subsequent cutting, grinding, and polishing also require specialized equipment and expertise, contributing to the higher cost.

What are the main advantages of sapphire glass over other transparent materials?

The main advantages of sapphire glass include its superior hardness (second only to diamond), exceptional scratch and impact resistance, high optical clarity, chemical inertness, and high thermal conductivity. These properties make it ideal for demanding applications where traditional glass or plastics would fail.

Which industries are the primary consumers of sapphire glass?

The primary consumers of sapphire glass are the consumer electronics industry (for protective covers and lenses), the LED industry (for substrates), and the aerospace, defense, and medical sectors (for optical components, sensors, and implants).

What are the key trends driving growth in the sapphire glass market?

Key trends driving market growth include increasing demand for durable and premium protective covers in consumer electronics, expanding adoption in high-performance optical and sensing applications, and ongoing technological advancements aimed at reducing production costs and enhancing material properties.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Sapphire Glass Market Size Report By Type (High Grade Transparency, General Transparency, Others), By Application (LED, Optical Wafers, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Chemically-strengthened and Sapphire Glass Market Statistics 2025 Analysis By Application (Smartphones & Tablets, Automotive, Interior Architecture, Electronics, Others), By Type (Chemically-strengthened Glass, Sapphire Glass), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Sapphire Glass Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (General Transparency, High Grade Transparency, Others), By Application (Optical Wafers, LED, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager