Satellite-based 5G Network Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430325 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Satellite-based 5G Network Market Size

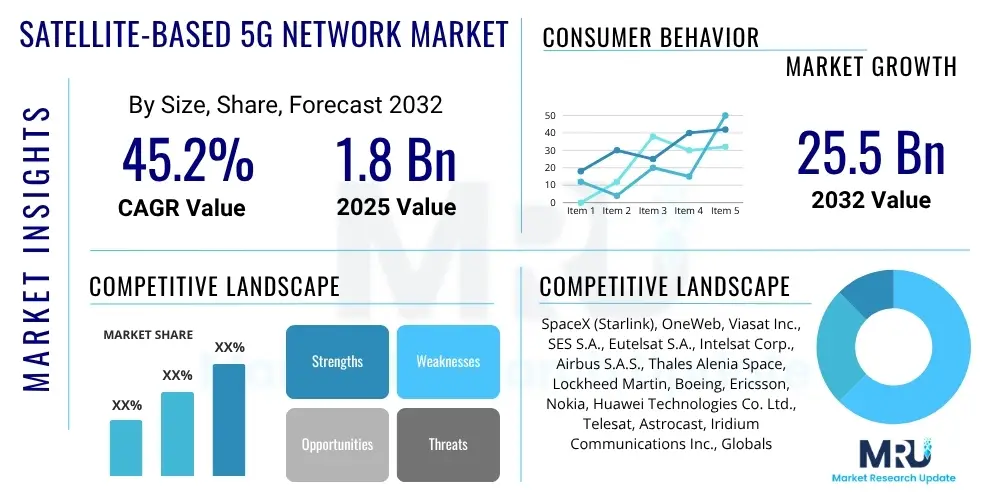

The Satellite-based 5G Network Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 45.2% between 2025 and 2032. The market is estimated at USD 1.8 Billion in 2025 and is projected to reach USD 25.5 Billion by the end of the forecast period in 2032.

Satellite-based 5G Network Market introduction

The Satellite-based 5G Network market represents a critical evolution in global telecommunications, aiming to extend the capabilities and reach of 5G infrastructure beyond traditional terrestrial limitations. This market encompasses the development, deployment, and operation of satellite constellations and associated ground infrastructure designed to integrate seamlessly with 5G networks, providing ubiquitous connectivity. The primary product is the provision of 5G services—including enhanced mobile broadband (eMBB), massive machine-type communications (mMTC), and ultra-reliable low-latency communications (URLLC)—leveraging satellites for backhaul, direct-to-device connectivity, and extending coverage to unserved or underserved areas, particularly remote, rural, maritime, and aerial regions. This integration overcomes geographical constraints, offering unparalleled network resilience and accessibility.

Major applications of satellite-based 5G networks include bridging the digital divide by providing internet access in remote locations, enabling global IoT and M2M communications for diverse industries such as agriculture, logistics, and smart infrastructure, and supporting critical communications for disaster recovery and defense operations. Furthermore, it facilitates enhanced mobile broadband for maritime and aviation sectors, ensuring high-speed, low-latency connectivity even in the most isolated environments. The benefits derived from this market are substantial, including truly global coverage, increased network resilience through diversified infrastructure, reduced infrastructure costs in difficult terrains, and the enablement of new services and applications that require pervasive connectivity, such as autonomous vehicles and smart cities.

Driving factors for the growth of this market are multifold. A significant driver is the escalating global demand for ubiquitous, high-speed connectivity, particularly for emerging applications like IoT, AI-powered services, and augmented reality. The limitations of terrestrial infrastructure in reaching remote areas naturally push for satellite solutions. Moreover, the rapid advancement in satellite technology, specifically the proliferation of Low Earth Orbit (LEO) constellations, which promise lower latency and higher throughput, is making satellite-based 5G a technically and economically viable option. Government initiatives to promote digital inclusion and investment from both public and private sectors in next-generation communication infrastructure further accelerate market expansion.

Satellite-based 5G Network Market Executive Summary

The Satellite-based 5G Network market is experiencing dynamic growth, propelled by the relentless demand for global connectivity and the strategic integration of space-based assets into terrestrial 5G ecosystems. Key business trends indicate a strong focus on strategic partnerships between satellite operators, mobile network operators (MNOs), and technology providers to develop hybrid network architectures. There is an increasing emphasis on standardizing satellite-5G integration through 3GPP Release 17 and beyond, fostering interoperability and accelerating commercial deployments. Furthermore, significant investments are pouring into the launch of large LEO satellite constellations, fundamentally transforming the economics and technical capabilities of satellite communications by offering lower latency and higher bandwidth compared to traditional GEO satellites.

Regional trends reveal that North America and Europe are at the forefront of innovation and commercial adoption, driven by robust R&D, early trials, and the presence of major aerospace and telecommunications companies. The Asia Pacific region is rapidly emerging as a critical growth hub, spurred by substantial government investments in digital infrastructure, the vast geographical expanse requiring connectivity solutions, and a rapidly expanding mobile subscriber base. Latin America, the Middle East, and Africa present immense potential, primarily due to large unserved populations and a pressing need to bridge the digital divide, making satellite-based 5G a crucial enabler for socio-economic development in these regions.

Segment trends highlight that the Low Earth Orbit (LEO) segment by orbit type is projected to witness the most substantial growth, attributed to its inherent advantages in latency and capacity suitable for 5G applications. In terms of components, the services segment, particularly managed and professional services, is expected to expand significantly as operators seek expertise in deploying and maintaining complex satellite-terrestrial integrated networks. Among end-users, Mobile Network Operators (MNOs) will remain the largest segment, leveraging satellite solutions for backhaul and extending rural coverage, while government and defense applications, alongside maritime and aviation, are also rapidly adopting these solutions for critical and remote communications. Enhanced Mobile Broadband (eMBB) and IoT backhaul are poised to be the leading application segments driving market demand.

AI Impact Analysis on Satellite-based 5G Network Market

User inquiries concerning AI's influence on the Satellite-based 5G Network Market primarily revolve around how artificial intelligence can optimize network performance, enable predictive maintenance, enhance security, and facilitate intelligent resource management within these complex hybrid infrastructures. Common questions explore AI's role in dynamic spectrum allocation, beamforming optimization for satellite communications, managing vast amounts of data generated by LEO constellations, and ensuring seamless handovers between satellite and terrestrial networks. There is significant interest in AI's capacity to automate network operations, predict potential outages, and provide personalized service delivery, ultimately addressing concerns about operational complexity, efficiency, and the scalability of integrated 5G environments. Users anticipate AI will be instrumental in making satellite-based 5G networks more autonomous, reliable, and cost-effective, while also raising questions about the ethical implications and data privacy aspects of extensive AI deployment in critical communication infrastructure.

- AI-driven Network Optimization: AI algorithms can dynamically optimize satellite resource allocation, including spectrum, power, and beamforming, to maximize throughput and minimize latency across hybrid terrestrial-satellite 5G networks, ensuring efficient utilization of satellite capacity.

- Predictive Maintenance and Anomaly Detection: AI can analyze telemetry data from satellites and ground stations to predict equipment failures, identify anomalies, and schedule proactive maintenance, thereby enhancing network reliability and reducing downtime for critical infrastructure.

- Automated Orchestration and Management: Artificial intelligence facilitates the automation of complex network orchestration tasks, such as provisioning, configuration, and fault management, enabling seamless integration and operation of heterogeneous satellite and terrestrial network segments.

- Enhanced Cybersecurity: AI-powered threat detection systems can monitor network traffic, identify unusual patterns, and respond to cyber threats in real-time, bolstering the security posture of distributed satellite-based 5G infrastructure against sophisticated attacks.

- Intelligent Traffic Management: AI assists in routing traffic efficiently between satellite and terrestrial paths based on real-time network conditions, user demand, and service requirements, optimizing quality of service (QoS) for various 5G applications.

- Dynamic Spectrum Allocation: AI algorithms can enable cognitive radio capabilities for dynamic and flexible spectrum sharing between satellite and terrestrial components, mitigating interference and improving overall spectrum efficiency.

- Edge Computing Integration: AI at the network edge, potentially leveraging micro-data centers on satellites or ground stations, allows for processing data closer to the source, reducing backhaul requirements and enabling low-latency AI applications.

- Resource Scheduling for LEO Constellations: AI is crucial for managing the handover and scheduling of resources for thousands of fast-moving LEO satellites, ensuring continuous connectivity and efficient use of the constellation's capacity.

- Personalized Service Delivery: AI can analyze user behavior and application requirements to provide tailored 5G services, ensuring optimal performance for diverse use cases ranging from IoT to high-bandwidth video streaming over satellite links.

- Data Analytics and Insights: AI tools provide deep insights into network performance, user patterns, and operational efficiency, empowering operators to make data-driven decisions for network planning, expansion, and service innovation.

- Reduction of Operational Costs: Automation and optimization capabilities powered by AI lead to significant reductions in operational expenditures by minimizing manual intervention and improving the efficiency of network management.

- Resilience and Disaster Recovery: AI can identify network vulnerabilities and reroute traffic through available satellite or terrestrial links during outages, significantly improving network resilience and disaster recovery capabilities.

DRO & Impact Forces Of Satellite-based 5G Network Market

The Satellite-based 5G Network market is influenced by a powerful combination of drivers, restraints, opportunities, and external impact forces. A primary driver is the accelerating global demand for ubiquitous connectivity, particularly in remote and underserved areas where terrestrial infrastructure is economically unfeasible or geographically challenging. The exponential growth of IoT and M2M communications further fuels this demand, requiring pervasive network coverage for diverse applications across industries like smart agriculture, logistics, and environmental monitoring. The imperative to bridge the global digital divide, coupled with the increasing need for enhanced mobile broadband (eMBB) for high-speed data access in critical sectors such as maritime and aviation, are also significant driving forces. Furthermore, the strategic importance of resilient and tactical communications for government and defense applications underscores the value of satellite-based solutions, ensuring continuity of operations in challenging environments.

However, the market faces notable restraints that could temper its growth trajectory. The initial capital expenditure required for deploying extensive satellite constellations, particularly LEO systems, and associated ground infrastructure remains extremely high, posing a significant barrier to entry for new players and demanding substantial investment from existing ones. Regulatory complexities, including international spectrum allocation and licensing procedures, create bureaucratic hurdles and can delay market entry or expansion. Latency concerns, although significantly reduced by LEO satellites compared to GEOs, still present a challenge for ultra-low latency applications crucial for certain 5G use cases. Additionally, potential cybersecurity risks associated with a vast, distributed satellite network and the challenges of managing interference with terrestrial networks pose ongoing technical and operational challenges.

Despite these restraints, numerous opportunities abound for market participants. The ongoing development and deployment of mega LEO satellite constellations by companies like Starlink and OneWeb offer unprecedented capacity and global coverage, creating new avenues for direct-to-device connectivity and seamless integration with terrestrial 5G. The continuous advancements in Non-Terrestrial Network (NTN) integration within 3GPP standards are facilitating greater interoperability and standardization, simplifying deployment. The synergy with edge computing allows for processing data closer to the source, reducing latency and enabling new AI-driven applications. Furthermore, the market presents opportunities in enabling private 5G networks for enterprises in remote industrial settings and providing critical disaster recovery services, ensuring communication resilience when terrestrial networks fail. External impact forces, such as rapid technological advancements in satellite propulsion, antenna design, and ground station capabilities, continue to lower costs and improve performance. The evolving geopolitical landscape influences national investments in space infrastructure, while environmental sustainability goals drive demand for greener satellite technologies. Economic volatility can impact investment cycles, and evolving consumer demands for seamless, high-performance connectivity constantly push the boundaries of network innovation.

Segmentation Analysis

The Satellite-based 5G Network market is comprehensively segmented across various dimensions to provide a granular understanding of its structure, dynamics, and potential growth areas. These segmentations allow for detailed analysis of market behavior, competitive landscapes, and strategic opportunities, catering to diverse needs ranging from technical components to end-user applications. Understanding these segments is crucial for stakeholders to tailor their product offerings, penetrate specific markets, and formulate effective business strategies, reflecting the hybrid and complex nature of integrating space and terrestrial communication technologies.

The market is primarily segmented by Orbit Type, Component, End-User, and Application. Each of these categories further breaks down into sub-segments, representing distinct technological approaches, product offerings, customer groups, and use cases within the evolving satellite-based 5G ecosystem. The rapid technological advancements and increasing investments in the space sector are continually redefining these segments, necessitating a flexible and forward-looking analytical framework to capture emerging trends and innovations.

- Orbit Type

- Low Earth Orbit (LEO): Characterized by satellites orbiting at altitudes between 160 and 2,000 km, offering significantly lower latency and higher bandwidth suitable for real-time 5G applications due to closer proximity to Earth.

- Medium Earth Orbit (MEO): Satellites in MEO orbit at altitudes between 2,000 and 35,786 km, providing a balance between latency and coverage, often used for regional communication services.

- Geostationary Earth Orbit (GEO): Satellites in GEO orbit at approximately 35,786 km, appearing stationary relative to a point on Earth, offering extensive coverage but with higher latency, traditionally used for broadcast and wide-area backhaul.

- Component

- Satellite Payloads: Includes the transponders, antennas, processors, and communication equipment carried aboard satellites that enable 5G signal transmission and reception.

- Ground Segment: Encompasses all terrestrial infrastructure necessary for controlling satellites and communicating with them, including gateways, earth stations, network management systems, and user terminals.

- Services:

- Managed Services: Comprehensive outsourced services covering network operation, maintenance, and optimization for satellite-based 5G infrastructure.

- Professional Services: Consulting, integration, deployment, and training services for designing and implementing satellite-5G solutions.

- Connectivity Services: The actual provision of 5G broadband and communication services to end-users and enterprises via satellite links.

- End-User

- Mobile Network Operators (MNOs): Utilizing satellite-based 5G for backhaul, rural coverage extension, and network resilience to complement their terrestrial networks.

- Enterprises: Businesses across various sectors (e.g., energy, mining, agriculture) requiring reliable connectivity in remote operational areas for IoT, asset tracking, and private network deployments.

- Government & Defense: Agencies requiring secure, resilient, and ubiquitous communication capabilities for national security, disaster response, and tactical operations.

- Maritime: Shipping companies, cruise lines, and offshore platforms needing high-speed internet and communication services while at sea.

- Aviation: Airlines and private jets requiring in-flight connectivity for passengers and operational data transmission.

- Rural & Remote Areas: Communities and individuals in unserved or underserved regions gaining access to high-speed internet through satellite-based solutions.

- Application

- Enhanced Mobile Broadband (eMBB): Providing high-speed data connectivity for mobile users, including video streaming, web browsing, and data-intensive applications, particularly in areas lacking terrestrial coverage.

- Massive Machine Type Communications (mMTC): Supporting a vast number of connected devices for IoT applications, enabling efficient data exchange for sensors, smart devices, and industrial automation across wide geographic areas.

- Ultra-Reliable Low Latency Communications (URLLC): Delivering highly reliable communications with extremely low latency, critical for applications like autonomous vehicles, remote surgery, and industrial control systems, though more challenging for satellite links.

- IoT Backhaul: Providing connectivity for IoT devices where terrestrial infrastructure is absent or unreliable, aggregating data from sensors and transmitting it to central processing systems.

- Disaster Recovery: Offering resilient communication channels that remain operational during natural disasters or network outages, ensuring continuity for emergency services and critical infrastructure.

- Connected Vehicles: Enabling communication for autonomous vehicles, infotainment systems, and telematics in areas without continuous terrestrial network coverage.

Value Chain Analysis For Satellite-based 5G Network Market

The value chain for the Satellite-based 5G Network market is intricate, involving a diverse set of stakeholders across various stages, from initial research and development to final service delivery. Upstream analysis focuses on the foundational elements, including satellite manufacturing, which involves the design, construction, and launch of satellites (LEO, MEO, GEO). Key players in this stage are aerospace companies, specialized satellite manufacturers, and launch service providers. This segment also includes the providers of critical components for satellites, such as payloads, transponders, antennas, and power systems, as well as the developers of core satellite communication technologies and software defined radios.

Midstream activities primarily involve the operation and management of the satellite constellations and the associated ground segment. This encompasses satellite operators who own and manage the constellations, providing wholesale capacity. It also includes ground segment providers responsible for developing and deploying earth stations, gateways, network control centers, and user terminals that interface with both satellites and terrestrial 5G networks. Furthermore, network integrators play a crucial role in ensuring seamless interoperability between the space-based and terrestrial components of the 5G network, often involving complex software and hardware integration, network slicing, and virtualization technologies.

Downstream analysis centers on the distribution channels and end-user engagement. Connectivity services are delivered through various channels, including direct and indirect models. Direct distribution involves satellite operators or specialized service providers offering satellite-based 5G services directly to end-users, such as enterprises in remote locations, government agencies, or maritime and aviation customers. Indirect distribution heavily relies on partnerships with Mobile Network Operators (MNOs) and Internet Service Providers (ISPs), who integrate satellite capabilities into their existing terrestrial 5G offerings to extend coverage, provide backhaul, or enhance network resilience. This hybrid model allows MNOs to leverage satellite infrastructure to bridge connectivity gaps, particularly in rural and remote areas, thereby expanding their customer base and offering comprehensive global coverage solutions to their subscribers.

Satellite-based 5G Network Market Potential Customers

The Satellite-based 5G Network market caters to a broad spectrum of potential customers and end-users, driven by the inherent advantages of satellite communication in providing ubiquitous and resilient connectivity. These customers are primarily entities that operate in geographically challenging areas, require highly reliable communication, or demand global reach beyond the scope of traditional terrestrial networks. Mobile Network Operators (MNOs) represent a significant customer segment, seeking to augment their terrestrial 5G networks by leveraging satellites for backhaul in underserved regions, extending rural coverage, and ensuring network resilience during outages. Their objective is to achieve true national or even global coverage without incurring exorbitant costs for deploying physical fiber or cell towers in difficult terrains.

Enterprises across various industries form another substantial customer base. This includes sectors such as mining, oil and gas, agriculture, logistics, and utilities, which often operate in remote locations and require reliable connectivity for IoT sensors, asset tracking, remote operations, and private 5G networks. For these businesses, satellite-based 5G enables efficient data collection, real-time monitoring, and automation, leading to improved operational efficiency and safety in environments where terrestrial communication is unreliable or non-existent. Furthermore, government and defense organizations are crucial end-users, demanding secure, robust, and highly available communication for critical missions, disaster response, border control, and military operations, where terrestrial infrastructure may be compromised or unavailable.

Additional potential customers include maritime and aviation sectors, where ships, oil rigs, and aircraft require continuous high-speed internet and communication services for operational efficiency, crew welfare, and passenger connectivity. The growing demand for in-flight and at-sea broadband, coupled with real-time data transmission for navigation and logistics, makes satellite-based 5G an indispensable solution for these industries. Finally, individuals and communities in rural and remote areas, often part of the global digital divide, represent a vast untapped market. Satellite-based 5G offers these populations the opportunity to access high-speed internet, enabling education, healthcare, e-commerce, and social connectivity, thereby fostering socio-economic development in regions historically excluded from the digital revolution.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.8 Billion |

| Market Forecast in 2032 | USD 25.5 Billion |

| Growth Rate | 45.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SpaceX (Starlink), OneWeb, Viasat Inc., SES S.A., Eutelsat S.A., Intelsat Corp., Airbus S.A.S., Thales Alenia Space, Lockheed Martin, Boeing, Ericsson, Nokia, Huawei Technologies Co. Ltd., Telesat, Astrocast, Iridium Communications Inc., Globalstar, Kymeta Corporation, Gilat Satellite Networks, Qualcomm Technologies Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Satellite-based 5G Network Market Key Technology Landscape

The Satellite-based 5G Network market is underpinned by a dynamic and evolving technology landscape, driven by continuous innovation in both space and terrestrial communication domains. At its core are advanced satellite technologies, particularly the development and deployment of mega-constellations of Low Earth Orbit (LEO) satellites. These LEO systems, such as Starlink and OneWeb, fundamentally alter the economics and performance of satellite communication by offering significantly lower latency and higher data throughput compared to traditional Geostationary Earth Orbit (GEO) satellites. Key innovations in satellite design include smaller, more agile satellites, mass production capabilities to reduce costs, and sophisticated on-board processing for enhanced flexibility and capacity. Phased array antennas, both on satellites and user terminals, are critical for efficient beam steering and managing multiple simultaneous connections.

Another crucial technological pillar is the seamless integration with terrestrial 5G networks, primarily through the standardization efforts of 3GPP for Non-Terrestrial Networks (NTN). This involves the development of specific interfaces and protocols that allow 5G devices to connect directly to satellites or use satellites for backhaul, ensuring interoperability and global roaming. Technologies like network slicing, derived from 5G core networks, are being adapted to create virtualized, isolated network segments over satellite links, tailored for specific applications such as IoT, eMBB, or URLLC. Software Defined Networking (SDN) and Network Functions Virtualization (NFV) are also pivotal, enabling greater flexibility, automation, and efficient management of the complex hybrid satellite-terrestrial infrastructure, allowing operators to dynamically reconfigure network resources as demand dictates.

Furthermore, advanced modulation and coding schemes (AMCS) are employed to maximize spectral efficiency over satellite links, enhancing data rates and link robustness. Artificial Intelligence (AI) and Machine Learning (ML) play an increasingly vital role in optimizing network operations, from dynamic spectrum allocation and predictive maintenance of satellite components to intelligent traffic management across hybrid networks. Edge computing, potentially deployed in ground stations or even on larger LEO satellites, brings computational power closer to the data source, reducing latency and enabling real-time processing for critical 5G applications. The synergy of these technologies—advanced satellite platforms, NTN integration, SDN/NFV, AI/ML, and edge computing—creates a robust and scalable architecture for the future of ubiquitous 5G connectivity.

Regional Highlights

- North America: This region stands as a leader in the Satellite-based 5G Network market, driven by significant investments from private companies like SpaceX (Starlink) and OneWeb, alongside robust government support for space exploration and advanced telecommunications. The presence of major technology innovators, a high demand for high-speed connectivity, and the early adoption of 5G technologies contribute to its dominance. North America also benefits from a strong defense sector that prioritizes resilient satellite communications.

- Europe: Europe is a key player, characterized by active participation in LEO constellation development through initiatives like OneWeb and Eutelsat, as well as strong research and development in satellite technologies by companies such as Airbus and Thales Alenia Space. The region's focus on digital inclusion, smart cities, and IoT applications, coupled with regulatory frameworks supporting 5G expansion, positions it for substantial growth in integrating satellite solutions into its terrestrial networks.

- Asia Pacific (APAC): The APAC region is poised for explosive growth, fueled by vast unserved rural populations, burgeoning economies, and aggressive government initiatives to bridge the digital divide and deploy advanced 5G infrastructure. Countries like China, India, and Japan are investing heavily in both satellite manufacturing and 5G deployment, recognizing the critical role of satellite-based 5G in extending connectivity across diverse geographical landscapes, including archipelagic nations and mountainous terrains.

- Latin America: This region presents significant opportunities for satellite-based 5G, primarily due to vast geographical areas with limited terrestrial infrastructure and a strong need for improved internet access in rural and remote communities. Governments and MNOs are exploring satellite solutions to extend coverage, enhance educational opportunities, and support economic development, making it a critical market for providers aiming to expand global reach.

- Middle East and Africa (MEA): The MEA region is experiencing rapid growth in telecommunications, with satellite-based 5G offering a viable and often essential solution to connect remote areas and support burgeoning industries like oil and gas, and mining. Governments are increasingly prioritizing digital transformation, and the relatively undeveloped terrestrial infrastructure in many parts of Africa makes satellite-based 5G a compelling and cost-effective approach to achieve widespread connectivity and support economic diversification.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Satellite-based 5G Network Market.- SpaceX (Starlink)

- OneWeb

- Viasat Inc.

- SES S.A.

- Eutelsat S.A.

- Intelsat Corp.

- Airbus S.A.S.

- Thales Alenia Space

- Lockheed Martin

- Boeing

- Ericsson

- Nokia

- Huawei Technologies Co. Ltd.

- Telesat

- Astrocast

- Iridium Communications Inc.

- Globalstar

- Kymeta Corporation

- Gilat Satellite Networks

- Qualcomm Technologies Inc.

Frequently Asked Questions

What is a Satellite-based 5G Network?

A Satellite-based 5G Network integrates satellite communication systems with terrestrial 5G infrastructure to extend network coverage, enhance capacity, and provide reliable connectivity, particularly in remote, rural, maritime, and aerial regions where traditional ground-based networks are challenging to deploy. It leverages satellites for backhaul, direct-to-device communication, and bridging geographical gaps in 5G services, encompassing technologies like LEO, MEO, and GEO satellites seamlessly interfaced with 5G core networks.

What are the primary benefits of integrating satellites into 5G networks?

The primary benefits include truly ubiquitous global coverage, ensuring connectivity even in the most isolated areas, enhanced network resilience and redundancy through diversified communication paths, and significant cost savings in deploying infrastructure in difficult terrains. It also enables new applications requiring pervasive connectivity, such as global IoT, maritime and aviation broadband, and critical communications for disaster recovery, ultimately bridging the digital divide and fostering economic development in underserved regions.

Which orbit types are most relevant for Satellite-based 5G, and why?

Low Earth Orbit (LEO) satellites are becoming highly relevant due to their significantly lower latency and higher bandwidth capabilities, making them ideal for performance-sensitive 5G applications. While Geostationary Earth Orbit (GEO) satellites offer wide coverage for backhaul, their higher latency is less suitable for real-time 5G services. Medium Earth Orbit (MEO) satellites offer a balance but LEO constellations are driving the most transformative changes in direct-to-device and low-latency 5G connectivity due to their proximity to Earth.

What challenges does the Satellite-based 5G Network market face?

The market faces several challenges, including the extremely high initial capital investment required for satellite constellation deployment and associated ground infrastructure. Regulatory complexities surrounding spectrum allocation and international licensing also pose significant hurdles. Technical challenges like managing latency for ultra-reliable low-latency communications (URLLC), ensuring cybersecurity across a distributed network, and mitigating interference with terrestrial networks are also persistent concerns that require ongoing innovation and standardization efforts to overcome.

How does AI impact the development and operation of Satellite-based 5G Networks?

AI significantly impacts satellite-based 5G by enabling advanced network optimization, including dynamic spectrum allocation, efficient beamforming, and intelligent traffic management across hybrid networks. It also powers predictive maintenance for satellites and ground stations, automates complex network orchestration, and enhances cybersecurity through real-time threat detection. AI is crucial for processing the vast amounts of data generated by LEO constellations and ensuring seamless handovers, leading to more autonomous, reliable, and cost-effective network operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager