Satellite Modem Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427933 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Satellite Modem Market Size

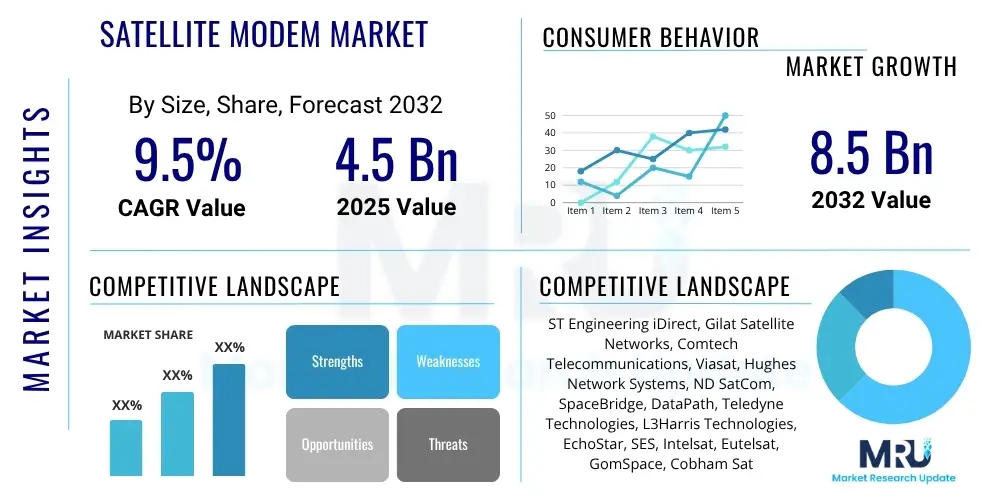

The Satellite Modem Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at USD 4.5 Billion in 2025 and is projected to reach USD 8.5 Billion by the end of the forecast period in 2032.

Satellite Modem Market introduction

The satellite modem market encompasses devices essential for converting digital data into radio signals for satellite transmission and vice-versa, facilitating crucial communication links where terrestrial infrastructure is limited or unavailable. These devices are integral to a wide array of applications, including high-speed internet access in remote areas, maritime and aeronautical communications, military operations, and backhaul solutions for cellular networks. The fundamental benefit of satellite modems lies in their ability to provide ubiquitous coverage, supporting global connectivity and enabling critical services across diverse geographies and challenging environments.

Satellite modems serve as the critical interface between terrestrial networks and satellite systems, enabling the transmission of data, voice, and video over long distances without relying on ground-based cables. Their robust design ensures reliable performance even in harsh conditions, making them indispensable for industries such as oil and gas, disaster recovery, and precision agriculture. The core product description revolves around their capability to modulate and demodulate signals, ensuring efficient and secure data transfer across various frequency bands and modulation schemes. The inherent flexibility and scalability of satellite modem technology allow for tailored solutions to meet specific bandwidth and latency requirements for different users and applications, from consumer broadband to enterprise-grade connectivity.

Major applications of satellite modems span across telecommunications for rural broadband and 5G backhaul, media and entertainment for broadcast contribution and distribution, maritime and aeronautical sectors for ship-to-shore and in-flight connectivity, and government and defense for secure communications and surveillance. The market is significantly driven by the escalating demand for reliable connectivity in unserved and underserved regions, the proliferation of Internet of Things (IoT) devices requiring global reach, and the rapid advancements in satellite technology, including High Throughput Satellites (HTS) and Low Earth Orbit (LEO) constellations. These driving factors underscore the expanding role of satellite modems in the global digital infrastructure, bridging connectivity gaps and supporting innovation.

Satellite Modem Market Executive Summary

The satellite modem market is experiencing robust growth, driven by key business trends such as the increasing adoption of satellite-based broadband services, particularly in developing economies and remote locations. The proliferation of IoT and M2M communications, coupled with the rising demand for mobile backhaul and enterprise connectivity, further propels market expansion. Regional trends highlight significant investment and deployment activities in North America and Asia Pacific, fueled by advanced satellite infrastructure and a growing need for resilient communication solutions. Meanwhile, segments trends indicate a strong move towards software-defined modems and flexible, high-capacity solutions to cater to diverse application requirements.

Business trends within the satellite modem market are characterized by a shift towards more sophisticated, software-defined modem platforms that offer greater flexibility, scalability, and efficiency. Manufacturers are focusing on developing products capable of handling higher throughputs and supporting advanced modulation schemes to leverage the capabilities of new satellite constellations, including LEO and MEO systems. This innovation is crucial for applications such as 5G network backhaul, which demands ultra-low latency and high bandwidth. Additionally, there is a growing emphasis on integrated solutions that combine modem technology with network management software, enabling service providers to offer more comprehensive and managed services to their end-users. This trend towards integrated solutions simplifies deployment and operation, fostering broader market adoption.

Regional trends reveal that North America continues to be a dominant force, driven by significant defense spending, advanced telecommunication infrastructure, and a robust commercial satellite industry. Asia Pacific is emerging as the fastest-growing region, propelled by expanding digital economies, increasing internet penetration efforts, and substantial government investments in satellite communication for rural development and disaster management. Europe also shows steady growth, particularly in maritime and government sectors. Conversely, regions like Latin America and the Middle East & Africa are experiencing accelerated adoption of satellite modems due to their expansive landmasses, challenging terrains, and urgent need for reliable connectivity solutions, especially in energy and resource exploration sectors.

Regarding segment trends, the market is witnessing a strong demand for broadband modems and VSAT (Very Small Aperture Terminal) modems, which are central to providing high-speed internet access to consumers and enterprises. The rise of LEO constellations is driving innovation in modem designs, focusing on solutions that can handle dynamic beam switching and lower latency requirements. Furthermore, specific applications like maritime communication are driving demand for ruggedized and compact modems, while military and defense sectors prioritize secure, resilient, and multi-band capabilities. The increasing complexity of satellite networks is also fostering the development of modems with advanced Quality of Service (QoS) features and network optimization capabilities, allowing for efficient allocation of bandwidth and improved user experience across various services and applications.

AI Impact Analysis on Satellite Modem Market

Common user questions related to the impact of AI on the Satellite Modem Market frequently revolve around how artificial intelligence can enhance modem performance, optimize network efficiency, and introduce new capabilities. Users are keen to understand if AI can lead to smarter bandwidth allocation, proactive fault detection, and improved security, questioning the extent to which AI will automate operations and adapt to dynamic network conditions. There's also curiosity about AI's role in processing the vast amounts of data generated by satellite constellations and whether it can contribute to the development of more autonomous and resilient satellite communication systems, impacting both the operational costs and the overall quality of service. Concerns often touch upon the integration challenges, data privacy, and the skill sets required to leverage AI effectively in this specialized domain.

- AI-driven optimization of bandwidth allocation, dynamically adjusting resources based on real-time traffic demand and Quality of Service (QoS) requirements.

- Predictive maintenance for satellite modem hardware and network components, identifying potential failures before they occur to minimize downtime.

- Enhanced security protocols through AI-powered anomaly detection, identifying and mitigating cyber threats in satellite communication links.

- Automated network management and orchestration, reducing operational complexity and human intervention for routine tasks.

- Intelligent beamforming and signal processing, optimizing signal strength and coverage for improved link reliability and spectral efficiency.

- Cognitive satellite modems capable of learning and adapting to varying environmental conditions and network loads for optimal performance.

- Data analytics and insights generation from satellite communication data, enabling better decision-making for network planning and service development.

- AI-enabled automation of ground segment operations, including antenna pointing and tracking, to improve efficiency and reduce operational costs.

DRO & Impact Forces Of Satellite Modem Market

The satellite modem market is influenced by a dynamic interplay of driving forces, inherent restraints, and emerging opportunities, collectively shaping its growth trajectory. Key drivers include the escalating global demand for ubiquitous connectivity, particularly in remote and underserved regions, coupled with the rapid expansion of IoT and M2M communications requiring satellite backhaul. Restraints, however, such as the high initial investment costs for satellite infrastructure and spectrum limitations, pose challenges. Opportunities are significantly arising from the deployment of LEO/MEO satellite constellations and the increasing adoption of satellite technology in emerging applications like 5G integration and autonomous vehicles, creating a compelling landscape for innovation and expansion.

Drivers: The most significant driver is the ever-growing need for reliable, high-speed internet access across geographical boundaries, especially where terrestrial networks are economically unfeasible or physically impossible to deploy. This includes remote rural communities, maritime vessels, aircraft, and critical infrastructure in challenging terrains. The proliferation of IoT devices across various industries, from smart agriculture to industrial monitoring, also necessitates satellite connectivity for global data transmission, directly boosting the demand for compatible modems. Furthermore, the push for 5G backhaul solutions via satellite offers a robust, low-latency alternative, expanding the addressable market for advanced satellite modems capable of handling high data rates and supporting new network architectures. Government and defense sectors also continually invest in satellite communication for secure and resilient connectivity, acting as a consistent demand driver.

Restraints: Despite the strong drivers, several factors impede market growth. The substantial upfront investment required for developing and deploying satellite constellations, ground infrastructure, and sophisticated modem technologies can be a barrier for new entrants and can increase the cost for end-users. Spectrum availability and regulatory complexities surrounding its allocation and usage present another significant restraint, as limited spectrum can constrain bandwidth capacity and lead to congestion. The increasing competition from terrestrial alternatives, such as fiber optics and expanding cellular networks, particularly in urban and suburban areas, also acts as a restraint, limiting the market penetration of satellite solutions in more accessible regions. Technical challenges related to latency in geostationary satellite systems, although mitigated by LEO constellations, can still be a concern for real-time interactive applications.

Opportunities: The market is ripe with opportunities, predominantly driven by technological advancements and new satellite deployments. The emergence of LEO and MEO satellite constellations, offering lower latency and higher throughput, is revolutionizing satellite communication, opening doors for services previously unfeasible, such as high-performance cloud computing and real-time gaming over satellite. The increasing demand for resilient communication in disaster recovery scenarios, emergency services, and humanitarian aid operations provides a niche but critical market segment for satellite modems. Moreover, the integration of satellite communication into the broader 5G ecosystem and its potential role in connecting autonomous vehicles and smart cities represent substantial long-term growth avenues. Developing regions, with their large unserved populations and rapidly expanding economies, also present significant untapped markets for satellite broadband and related modem technologies, offering lucrative growth prospects.

Segmentation Analysis

The satellite modem market is comprehensively segmented to reflect its diverse applications, technological variations, and end-user requirements, providing a granular view of market dynamics. This segmentation aids in understanding specific market niches and growth opportunities across different product types, application areas, and geographical regions. A thorough analysis of these segments reveals the evolving preferences and demands shaping the industry landscape, from high-capacity broadband solutions to specialized modems for specific vertical markets.

- By Type:

- VSAT Modems (Very Small Aperture Terminal Modems)

- SCPC Modems (Single Channel Per Carrier Modems)

- Broadband Modems

- RTP Modems (Return Channel Satellite Terminal Protocol Modems)

- Rack-mount Modems

- Portable Modems

- Integrated Modems

- Software-Defined Modems

- By Application:

- Telecommunication (including 5G Backhaul)

- Media & Entertainment (Broadcast, Content Distribution)

- Maritime

- Aeronautical

- Government & Defense

- Energy (Oil & Gas, Utilities)

- Mining

- Agriculture

- Emergency & Disaster Response

- Other Industrial Applications

- By End-User:

- Enterprise

- Government

- Consumer

- Industrial

- By Frequency Band:

- C-band

- Ku-band

- Ka-band

- X-band

- L-band

- V-band

- Q-band

- By Channel Type:

- Half-duplex

- Full-duplex

- By Data Rate:

- Low Data Rate

- Medium Data Rate

- High Data Rate

- Very High Data Rate

Value Chain Analysis For Satellite Modem Market

The value chain for the satellite modem market is intricate, involving various stakeholders from raw material suppliers to end-users, each contributing to the final product and service delivery. It typically begins with upstream activities involving component manufacturing and technology development, moving through modem assembly and integration, and culminating in downstream processes of distribution, installation, and ongoing support. Understanding this chain is crucial for identifying areas of efficiency, potential bottlenecks, and opportunities for collaboration, ensuring a seamless flow of products and services to the market.

Upstream analysis focuses on the foundational elements required for satellite modem production. This includes the suppliers of semiconductors, integrated circuits, RF components, power management units, and various other electronic parts that constitute the modem's core. Research and development activities, often conducted by specialized technology firms and universities, play a vital role in innovating new modulation techniques, processing capabilities, and form factors. These upstream providers are critical for ensuring the quality, performance, and cost-effectiveness of the components, which directly impacts the modem's overall functionality and market competitiveness. Strong relationships with these suppliers are essential for consistent production and the integration of cutting-edge technologies.

Downstream analysis encompasses the stages following modem manufacturing, leading to the end-user. This involves modem manufacturers assembling and testing the devices, followed by their distribution through various channels. Direct distribution involves manufacturers selling directly to large enterprises, government agencies, or satellite service providers who integrate the modems into their broader communication solutions. Indirect distribution relies on a network of distributors, resellers, and value-added integrators (VAIs) who package the modems with other equipment and services, providing localized sales, installation, and technical support. Satellite service providers play a pivotal role, offering connectivity services that leverage these modems, thereby bridging the gap between hardware and actual satellite communication capabilities. Ultimately, the efficiency of these downstream channels dictates market reach and customer satisfaction.

Satellite Modem Market Potential Customers

Potential customers for satellite modems are incredibly diverse, spanning across various industries and governmental bodies that rely on robust and ubiquitous connectivity, especially in areas where traditional terrestrial networks are inadequate or nonexistent. These end-users, or buyers, encompass a broad spectrum from individual consumers in remote regions seeking broadband internet to large multinational corporations requiring reliable communication for their global operations. Their needs drive the development of specialized modem solutions tailored to specific application environments and performance demands, highlighting the market's extensive reach and critical importance across multiple sectors.

A significant segment of potential customers includes telecommunication service providers and mobile network operators (MNOs) who utilize satellite modems for cellular backhaul, extending their network coverage to remote or difficult-to-reach areas, and for providing resilient communication links. Government agencies and defense organizations are also major buyers, leveraging satellite modems for secure tactical communications, surveillance, disaster relief efforts, and border control. The maritime sector, including commercial shipping, cruise lines, and fishing fleets, relies heavily on satellite modems for ship-to-shore communications, navigation, and crew welfare. Similarly, the aeronautical industry uses these modems for in-flight connectivity, air traffic control, and aircraft operational communications.

Beyond these primary sectors, the energy industry, encompassing oil and gas exploration, mining operations, and utility companies, represents a substantial customer base, requiring ruggedized and reliable satellite modems for remote site monitoring, data transmission, and operational control. Media and entertainment companies use modems for broadcast contribution, content distribution, and remote news gathering. Furthermore, enterprises with distributed operations, such as retail chains, financial institutions with branch offices in remote locations, and construction companies, procure satellite modems to ensure continuous business operations and data synchronization. Even individual consumers in rural or underserved areas, who lack access to high-speed terrestrial internet, represent a growing market segment for consumer-grade satellite broadband modems, particularly with the advent of LEO satellite services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.5 Billion |

| Market Forecast in 2032 | USD 8.5 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ST Engineering iDirect, Gilat Satellite Networks, Comtech Telecommunications, Viasat, Hughes Network Systems, ND SatCom, SpaceBridge, DataPath, Teledyne Technologies, L3Harris Technologies, EchoStar, SES, Intelsat, Eutelsat, GomSpace, Cobham Satcom, Novelsat, Kontron, Kratos Defense & Security Solutions, Advantech Wireless. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Satellite Modem Market Key Technology Landscape

The satellite modem market's technological landscape is constantly evolving, driven by advancements in satellite infrastructure, signal processing, and network management. Key technologies used in this market include advanced modulation and coding schemes (ModCods), dynamic bandwidth allocation algorithms, and robust error correction techniques, all aimed at maximizing spectral efficiency and link reliability. The shift towards software-defined radio (SDR) architectures and virtualization is also prominent, enabling greater flexibility and upgradability. Furthermore, the integration of cutting-edge technologies like DVB-S2X, Adaptive Coding and Modulation (ACM), and Automatic Repeat Request (ARQ) significantly enhances performance and optimizes resource utilization across diverse satellite communication platforms.

One of the foundational technological pillars is the development of sophisticated waveform technologies, such as those compliant with DVB-S2X standards, which allow for higher throughput and greater efficiency over satellite links. These standards incorporate finer granularity in modulation and coding schemes, enabling modems to adapt more precisely to varying link conditions. Adaptive Coding and Modulation (ACM) is critical, as it allows the modem to dynamically adjust its modulation and coding rates in real-time based on the satellite link quality. This maximizes data throughput when conditions are good and maintains link integrity when conditions degrade, optimizing the use of available bandwidth and power. Efficient error correction mechanisms, such as Low-Density Parity-Check (LDPC) codes, are also vital for robust data transmission, minimizing retransmissions and ensuring data integrity even in challenging environments.

The rise of High Throughput Satellites (HTS) and Non-Geostationary Orbit (NGSO) constellations like LEO and MEO has necessitated advancements in modem capabilities, focusing on multi-beam support, beam hopping, and lower latency performance. Software-Defined Radio (SDR) and Network Functions Virtualization (NFV) are becoming increasingly prevalent, transforming physical modem hardware into flexible, software-centric platforms. This allows for rapid deployment of new features, remote upgrades, and the ability to dynamically configure modem functionalities to meet changing network demands without requiring hardware replacements. Additionally, advanced traffic management and Quality of Service (QoS) mechanisms, often integrated with AI/ML algorithms, enable intelligent prioritization of data traffic, ensuring critical applications receive the necessary bandwidth and low latency, further enhancing the overall user experience and network efficiency. These technological leaps are instrumental in driving the market forward and addressing the complex demands of modern satellite communication.

Regional Highlights

- North America: North America holds a significant share in the Satellite Modem Market, driven by robust investments in advanced satellite communication technologies, particularly for military and defense applications, and the expansion of broadband services in rural areas. The presence of major satellite operators and service providers, coupled with high demand for secure and reliable connectivity solutions across various industries like oil and gas, maritime, and aviation, further propels market growth. The region benefits from strong governmental support for satellite research and development, alongside the early adoption of new satellite constellations and ground infrastructure. The continuous demand for high-bandwidth solutions for enterprise connectivity and data backhaul also plays a crucial role in maintaining North America's market leadership.

- Europe: The European market for satellite modems is characterized by steady growth, primarily fueled by the increasing demand for maritime communication, government and public safety networks, and expanding satellite broadband penetration in less-connected regions. European countries are actively investing in their own satellite programs and supporting the development of advanced ground segment technologies. Strict regulatory frameworks often encourage the adoption of highly reliable and secure communication solutions, favoring advanced satellite modem technologies. The region's focus on sustainable and resilient infrastructure, along with the growing adoption of IoT in industries such as agriculture and utilities, contributes to the demand for diverse satellite modem solutions.

- Asia Pacific (APAC): The Asia Pacific region is anticipated to be the fastest-growing market for satellite modems, attributed to the rapid digital transformation, increasing internet penetration efforts, and significant investments in telecommunication infrastructure across countries like China, India, and Australia. The vast geographical expanse and diverse terrain in APAC make satellite communication an indispensable solution for bridging connectivity gaps in remote and rural areas. Expanding industries such as media and entertainment, disaster management, and rapidly developing maritime trade routes also drive the demand for high-performance and cost-effective satellite modem solutions. Government initiatives to promote digital inclusion and smart city projects further stimulate market growth in this dynamic region.

- Latin America: Latin America presents a promising market for satellite modems, primarily driven by the need for enhanced connectivity in unserved and underserved remote communities, extensive mining operations, and the oil and gas sector. The region's challenging topography and vast distances often make terrestrial infrastructure deployment difficult, positioning satellite communication as a vital alternative. Growth is also supported by the increasing adoption of satellite broadband services for consumers and enterprises, coupled with the rising demand for reliable communication in disaster-prone areas. Investments in improving communication infrastructure and expanding access to digital services across the region contribute to a favorable market environment for satellite modem providers.

- Middle East and Africa (MEA): The Middle East and Africa region is witnessing substantial growth in the satellite modem market, propelled by increasing governmental spending on defense and security, the expansion of oil and gas exploration activities, and the critical need for communication infrastructure development in vast, remote areas. Countries in the Middle East are heavily investing in satellite technologies for broadcast, enterprise connectivity, and smart city initiatives, while African nations are leveraging satellite solutions to overcome infrastructure deficits and provide essential connectivity for education, healthcare, and economic development. The demand for reliable, resilient, and secure communication links for various industrial and humanitarian purposes continues to fuel the adoption of satellite modems across MEA.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Satellite Modem Market.- ST Engineering iDirect

- Gilat Satellite Networks

- Comtech Telecommunications Corp.

- Viasat, Inc.

- Hughes Network Systems (EchoStar Corporation)

- ND SatCom GmbH

- SpaceBridge Inc.

- DataPath, Inc.

- Teledyne Technologies Inc.

- L3Harris Technologies, Inc.

- SES S.A.

- Intelsat S.A.

- Eutelsat Communications S.A.

- GomSpace A/S

- Cobham Satcom

- Novelsat Ltd.

- Kontron (formerly part of Iridium Communications Inc.)

- Kratos Defense & Security Solutions, Inc.

- Advantech Wireless Technologies Inc.

- Newtec (now part of ST Engineering iDirect)

Frequently Asked Questions

What is a satellite modem and how does it work?

A satellite modem is a device that modulates and demodulates signals for transmission and reception via a satellite. It converts digital data into radio frequency (RF) signals for uplink to a satellite and converts RF signals from the satellite back into digital data for downlink, acting as a crucial interface between terrestrial networks and satellite systems for internet, voice, and video communication.

What are the primary applications of satellite modems?

Satellite modems are primarily used for providing internet access in remote and rural areas, maritime and aeronautical communications, military and government secure links, cellular backhaul (especially for 5G), disaster recovery, and data transmission for critical infrastructure like oil & gas, mining, and agriculture.

How do LEO satellite constellations impact the satellite modem market?

LEO (Low Earth Orbit) satellite constellations significantly impact the market by enabling lower latency and higher throughput services compared to traditional geostationary satellites. This drives demand for new modem designs capable of fast beam switching, advanced signal processing, and enhanced mobility to support applications requiring real-time interaction and high-bandwidth data, such as cloud services and gaming.

What are the key technological advancements in satellite modems?

Key advancements include DVB-S2X standards for higher spectral efficiency, Adaptive Coding and Modulation (ACM) for dynamic link optimization, Software-Defined Radio (SDR) architectures for flexibility and upgradability, and the integration of AI/ML for intelligent network management, traffic prioritization, and predictive maintenance.

What are the main challenges facing the satellite modem market?

Major challenges include high initial investment costs for satellite infrastructure, limited spectrum availability and associated regulatory complexities, increasing competition from terrestrial communication alternatives, and ensuring interoperability across diverse satellite platforms and network architectures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager