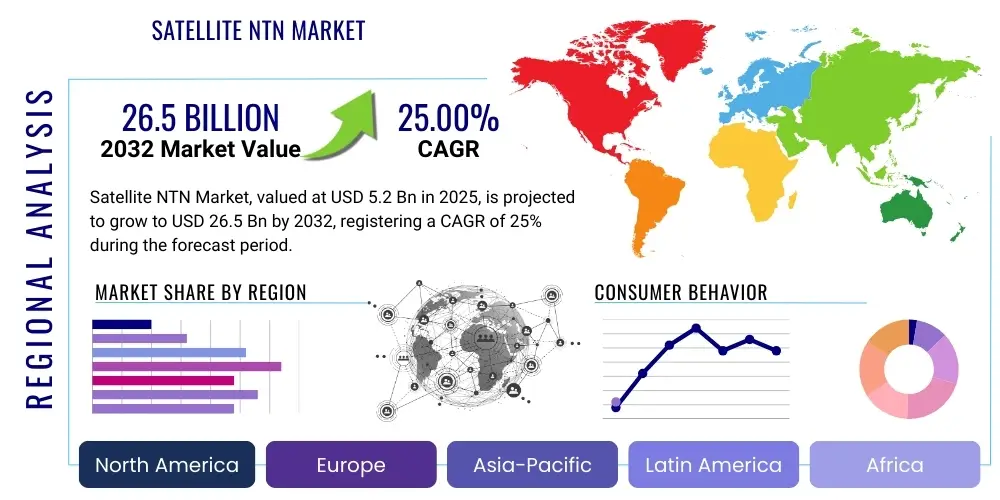

Satellite NTN Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427620 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Satellite NTN Market Size

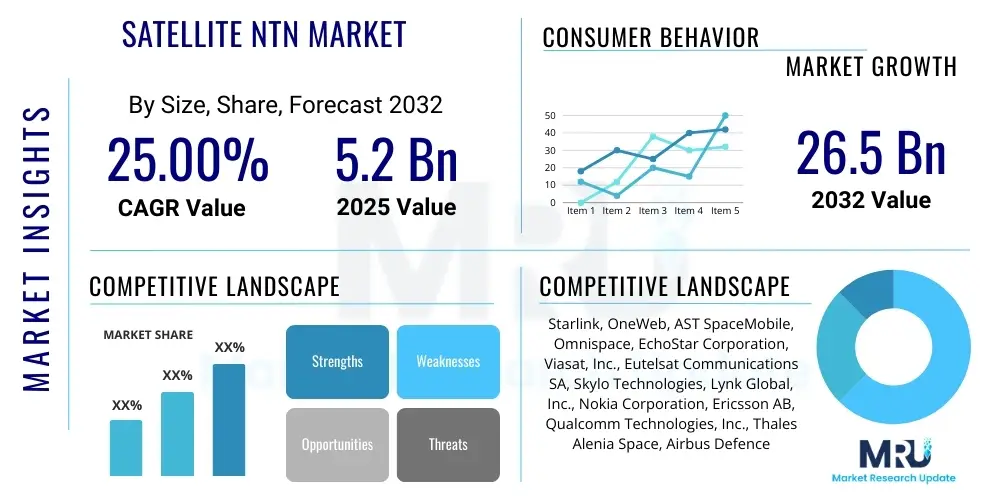

The Satellite NTN Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.0% between 2025 and 2032. The market is estimated at USD 5.2 billion in 2025 and is projected to reach USD 26.5 billion by the end of the forecast period in 2032. This robust growth trajectory is significantly driven by the escalating global demand for ubiquitous connectivity, the imperative for seamless 5G integration, and the rapid proliferation of Internet of Things (IoT) devices requiring pervasive network coverage. Investments in advanced satellite constellations, coupled with innovations in ground segment technologies and direct-to-device capabilities, are pivotal in expanding the markets reach across diverse industries and geographical regions, unlocking substantial revenue streams.

Satellite NTN Market introduction

The Satellite Non-Terrestrial Network (NTN) market represents a transformative frontier in global communication infrastructure, offering solutions beyond traditional terrestrial limitations. Satellite NTN encompasses systems utilizing space-borne or airborne vehicles, primarily satellites (Low Earth Orbit (LEO), Medium Earth Orbit (MEO), Geostationary Earth Orbit (GEO)), alongside High-Altitude Platform Stations (HAPS) and Unmanned Aerial Vehicles (UAVs), to provide ubiquitous, resilient, and often low-latency connectivity. These networks are crucial for bridging the digital divide, extending access to remote and underserved regions where terrestrial infrastructure is economically or logistically impractical. The markets product offerings span the entire communication stack, including space-borne hardware (satellites, payloads), sophisticated ground segment infrastructure (gateways, user terminals), and comprehensive connectivity and value-added services. This integrated ecosystem ensures continuous communication irrespective of geographical location, meeting the growing demand for always-on connectivity.

Major applications for Satellite NTN are broad, encompassing direct-to-device connectivity for standard smartphones (for basic messaging and emergency services), extensive Internet of Things (IoT) and Machine-to-Machine (M2M) communications (for asset tracking, environmental monitoring, smart agriculture), high-bandwidth broadband for maritime vessels, commercial airlines, and remote enterprise operations, as well as secure communication for defense and government agencies. Key benefits of Satellite NTN include unparalleled global coverage, significant network resilience through redundant pathways, enhanced reliability, and the capacity to support emerging use cases demanding persistent, pervasive, and secure connectivity. These advantages are vital for industries operating in mobile or isolated environments. The markets growth is driven by escalating global demand for ubiquitous connectivity, the strategic imperative for seamless 5G integration, the accelerating proliferation of IoT devices requiring global reach, and the increasing recognition of resilient communication networks as critical national infrastructure for economic development and national security.

Satellite NTN Market Executive Summary

The Satellite NTN market is undergoing profound transformation, characterized by dynamic business trends reshaping its competitive and operational landscapes. A dominant trend is the intense investment and rapid deployment of large Low Earth Orbit (LEO) satellite constellations, fundamentally altering the economics and performance of satellite broadband by offering significantly lower latency and higher throughput globally. This has spurred a vibrant competitive environment, attracting both established aerospace giants and agile new space startups. A pivotal shift towards direct-to-device (D2D) connectivity aims to enable standard smartphones to connect directly to satellites, bypassing terrestrial cellular towers. This innovation is drawing substantial strategic interest from Mobile Network Operators (MNOs) eager to expand coverage, offer premium services in unserved areas, and enhance network resilience. Strategic collaborations, partnerships, and consolidation between satellite operators, MNOs, technology providers, and cloud service providers are increasingly vital for developing end-to-end solutions, integrating NTN capabilities into existing architectures, and accelerating the widespread adoption of nascent 5G NTN standards, driving innovation and market expansion.

Regionally, North America and Europe currently lead the market, underpinned by robust technological infrastructures, significant R&D investments, and strong governmental support for advanced satellite communication across defense and commercial sectors. However, the Asia Pacific (APAC) region is rapidly emerging as the fastest-growing market, propelled by immense demand for enhanced connectivity in vast rural areas, explosive growth of IoT ecosystems, and aggressive government initiatives for digital inclusion. Latin America, the Middle East, and Africa also present substantial long-term growth opportunities, driven by urgent needs for fundamental communication solutions and resilient networks in challenging terrains. Segment-wise, LEO satellites are projected to command the largest market share due to superior performance in latency and bandwidth, making them ideal for modern broadband, IoT, and D2D applications. The services segment, encompassing connectivity, managed services, and system integration, is anticipated to maintain the largest revenue share, reflecting the growing complexity of deploying and managing NTN solutions. Concurrently, component segments like satellite payloads and ground equipment are experiencing continuous innovation to support market demands.

AI Impact Analysis on Satellite NTN Market

The pervasive integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping the Satellite Non-Terrestrial Network (NTN) market, directly addressing user questions about the efficiency, resilience, and operational intelligence of these complex global communication systems. Users are keenly interested in how AI automates the intricate management of vast satellite constellations, optimizes dynamic resource allocation, and enhances network security across vast distances. There is a significant focus on AIs capability to facilitate predictive maintenance for both space and ground infrastructure, minimizing downtime and ensuring continuous service availability. Furthermore, the immense volume of data generated by satellites—from network telemetry to Earth observation imagery—presents a challenge AI is uniquely positioned to handle, transforming raw data into actionable insights for diverse applications. Expectations are high for AI to not only improve NTN service reliability and performance but also to enable new capabilities, such as highly autonomous operations and sophisticated threat detection, critical for the next generation of satellite communications. The underlying theme of user inquiry centers on how AI will make NTNs smarter, more adaptable, and ultimately, more valuable.

AI’s influence permeates almost every layer of the Satellite NTN ecosystem, from initial design and simulation to real-time operational management and long-term service optimization. In the space segment, AI algorithms are instrumental in optimizing satellite maneuver planning, managing inter-satellite links (ISLs) for robust mesh networks in orbit, and dynamically adjusting beamforming patterns for optimal signal strength and coverage based on real-time demand. For the ground segment, AI enhances network orchestration, automates fault detection and recovery, and optimizes gateway operations, ensuring seamless terrestrial-non-terrestrial connectivity. AI-driven analytics are crucial for processing telemetry data to predict equipment failures, enabling proactive maintenance and extending asset lifespan. Moreover, in cybersecurity, AI provides advanced capabilities for real-time threat detection, anomaly identification, and automated response mechanisms, safeguarding data integrity and confidentiality across NTNs. This transformative synergy between AI and NTN technologies builds a highly intelligent, self-optimizing, and resilient communication infrastructure, meeting escalating demands for global, pervasive, and secure connectivity.

- Network Resource Optimization: AI algorithms dynamically allocate spectrum, power, and bandwidth across constellations, maximizing network efficiency, minimizing congestion, and ensuring optimal QoS.

- Predictive Maintenance and Anomaly Detection: Machine learning models analyze telemetry data to predict hardware failures, enabling proactive maintenance and reducing downtime.

- Enhanced Cybersecurity and Threat Intelligence: AI identifies and responds to cyber threats in real-time, safeguarding critical NTN infrastructure and data transmission.

- Autonomous Operations and Network Management: AI facilitates automated network configuration, intelligent fault diagnosis, self-healing capabilities, and dynamic routing, reducing human intervention and operational costs.

- Advanced Data Processing and Actionable Analytics: AI processes vast satellite-generated data, extracting insights for applications like Earth observation, weather forecasting, and environmental monitoring.

- Dynamic Beamforming and Coverage Optimization: AI optimizes satellite antenna patterns to precisely target geographic areas, improving signal strength and providing adaptive coverage.

- Intelligent Traffic Management: AI optimizes traffic routing and load balancing across mixed terrestrial-NTN networks, ensuring efficient data flow and enhancing user experience for hybrid 5G architectures.

DRO & Impact Forces Of Satellite NTN Market

The Satellite NTN markets trajectory is intricately shaped by a powerful combination of driving forces, inherent restraints, and compelling opportunities, all operating under various external impact forces. A primary driver is the accelerating global demand for ubiquitous connectivity, particularly pronounced in remote, rural, and maritime regions where terrestrial infrastructure is unfeasible. The aggressive integration of 5G capabilities, mandating pervasive network coverage, ultra-low latency, and massive machine-type communications, further propels NTN adoption as an essential component of future communication ecosystems. Moreover, the exponential growth of the Internet of Things (IoT) and Machine-to-Machine (M2M) communication, requiring extensive and reliable global reach for myriad applications from precision agriculture to environmental monitoring, acts as a powerful market catalyst. The increasing strategic importance of resilient communication networks for national security, disaster management, and critical infrastructure protection also significantly fuels market expansion. The emergent imperative for direct-to-device connectivity, promising seamless communication for standard smartphones, is poised to revolutionize consumer access, dramatically expanding the potential user base.

Despite immense potential, the Satellite NTN market contends with formidable restraints. The exceptionally high initial capital expenditure required for designing, manufacturing, launching, and maintaining large-scale satellite constellations, coupled with inherent complexities of orbital mechanics, presents a substantial barrier. Regulatory complexities, including international spectrum allocation and diverse national licensing frameworks, create an intricate web of operational challenges. While LEO constellations mitigate this, latency issues can still concern highly time-sensitive applications compared to terrestrial fiber. Intense competition from established terrestrial networks and potential technological obsolescence also act as significant restraints. However, compelling opportunities abound, particularly in addressing immense unserved markets in developing regions, providing essential connectivity for emergency services, and enabling advanced applications such as resilient cellular backhaul, smart agriculture, and autonomous vehicles. Critical impact forces include continuous technological advancements in satellite miniaturization, propulsion systems, and software-defined satellites, which collectively drive down costs and enhance capabilities. The evolving competitive landscape, with new entrants and innovative business models, along with geopolitical factors influencing space policy, further dictates the markets trajectory.

Segmentation Analysis

The Satellite NTN market is meticulously segmented to provide a granular and comprehensive understanding of its multifaceted dynamics, enabling precise market sizing, competitive analysis, and strategic opportunity identification across various dimensions. This detailed segmentation scheme dissects the market based on critical attributes, including the type of satellite orbit employed, the constituent components of the NTN ecosystem, the underlying communication technologies, the diverse application areas it serves, and the distinct categories of end-users. Such a breakdown is indispensable for stakeholders to identify specific growth vectors, understand varying customer needs, and tailor product and service offerings to particular market niches. By analyzing these segments individually, it becomes possible to discern evolving preferences, technological shifts, and emerging demands that collectively influence the overall market landscape, from the design of new satellite systems to the deployment of advanced connectivity solutions globally.

Specifically, the market can be segmented by the orbital characteristics of satellites, delineating between Low Earth Orbit (LEO) systems (low latency, high bandwidth), Medium Earth Orbit (MEO) systems (balance of coverage and latency), Geostationary Earth Orbit (GEO) systems (broad coverage from fixed position), and Highly Elliptical Orbit (HEO) for specialized polar region coverage. Component-based segmentation categorizes the market into the space segment (e.g., satellites, payloads), the ground segment (e.g., gateways, user terminals, network operations centers), and the comprehensive array of services provided (e.g., connectivity, managed services). Technology segmentation distinguishes between supported communication standards such as 2G, 3G, 4G, 5G, and various IoT-specific protocols like NB-IoT and LoRa. Furthermore, application-based segmentation scrutinizes deployment of NTNs across sectors like direct-to-device mobile connectivity, extensive IoT/M2M deployments, critical maritime and aviation communications, defense and government networks, and enterprise solutions for remote operations. Finally, end-user segmentation separates the market into consumer, enterprise, and government & defense categories, each with unique requirements and service expectations from Satellite NTN solutions, highlighting varied market opportunities.

- By Orbit:

- Low Earth Orbit (LEO): Lower latency, higher data rates for broadband and IoT.

- Medium Earth Orbit (MEO): Balance of latency and coverage, used for enterprise and government services.

- Geostationary Earth Orbit (GEO): Wide, continuous coverage from fixed position, for broadcast and fixed broadband.

- Highly Elliptical Orbit (HEO): Specialized coverage in polar regions or areas needing extended dwell times.

- By Component:

- Satellite (Space Segment): Includes manufacturing, payloads, transponders, and launch services.

- Ground Segment: Encompasses gateways, ground stations, user terminals, network operations centers, and infrastructure.

- Services: Comprises connectivity, managed, professional, and value-added services.

- By Technology:

- 2G/3G: Basic voice and low-bandwidth data for remote IoT or emergency services.

- 4G/LTE: Higher data rates, supporting mobile broadband and advanced IoT.

- 5G: Future of NTN integration, enabling enhanced mobile broadband, ultra-reliable low-latency, and massive IoT.

- NB-IoT (Narrowband IoT): Optimized for low-power, long-range IoT devices with small data payloads.

- LoRa (Long Range): Low-power, wide-area network for specific IoT deployments.

- Other IoT Standards: Various proprietary and open standards for specific M2M communication.

- By Application:

- Smartphones (Direct-to-Device): Basic messaging, emergency services, or limited data to standard phones.

- IoT/M2M Communication: Connecting devices for asset tracking, environmental sensing, smart agriculture, remote monitoring.

- Maritime: Broadband internet, operational communications, and crew welfare for ships, platforms, surveillance.

- Aviation: In-flight connectivity, air traffic control support, and operational data for aircraft.

- Defense & Government: Secure, resilient, global communication for military, intelligence, public safety.

- Enterprise Communication: Supporting remote offices, temporary sites, and critical infrastructure with reliable connectivity.

- Emergency & Disaster Relief: Rapid deployment communication in areas affected by disasters.

- By End-User:

- Consumer: Individual users accessing satellite connectivity for personal devices, especially without terrestrial coverage.

- Enterprise: Businesses utilizing NTN for remote operations, fleet management, and secure communications.

- Government & Defense: Military, intelligence, and public safety requiring highly secure, global, and resilient communications.

Satellite NTN Market Value Chain Analysis

The value chain for the Satellite NTN market is a sophisticated and highly integrated ecosystem, extending from initial conceptualization to ultimate service delivery. The upstream segment is dominated by specialized activities including extensive research and development (R&D), precise manufacturing of satellites (comprising buses, payloads, transponders), and critical launch services. This involves aerospace manufacturers, specialized component suppliers (e.g., for advanced antennas, high-power amplifiers), and launch service providers. Companies in this segment invest heavily in cutting-edge materials science, propulsion systems, and software-defined satellite technologies to enhance capability and reduce costs. The innovation and efficiency within this upstream directly impact overall cost, technological capabilities, and service offerings further down the chain, representing a significant barrier to entry due to capital intensity and technological complexity. Additionally, development of ground control systems and network management software, vital for commanding the satellite fleet, falls within this initial phase, ensuring operational readiness and longevity.

Moving downstream, the value chain transitions towards service delivery and customer engagement. This segment primarily encompasses satellite operators, responsible for managing constellations and ground infrastructure. These operators then interface with service providers who package raw satellite capacity into marketable communication solutions like broadband and IoT connectivity. Integrators play a crucial role, often customizing NTN solutions with terrestrial networks for bespoke, end-to-end connectivity in specific industries. Distribution channels are multifaceted: direct sales are common for large enterprise, defense, and government clients requiring tailored, mission-critical solutions. Indirect channels are rapidly growing, involving strategic partnerships with Mobile Network Operators (MNOs) and Internet Service Providers (ISPs), who leverage NTN capabilities to extend coverage, provide resilient backhaul, or offer direct-to-device services. This allows NTN providers to tap into established customer bases. Value-added resellers (VARs) and system integrators further aid in reaching niche markets and providing localized support, ensuring sophisticated NTN technology is accessible and effectively utilized globally.

Satellite NTN Market Potential Customers

The Satellite NTN market boasts an exceptionally broad and expanding potential customer base, reflecting the universal and growing demand for ubiquitous, reliable, and resilient connectivity. End-users and buyers span from individual consumers seeking basic emergency communication to large government entities requiring secure global networks. Mobile Network Operators (MNOs) constitute a critical segment, driven by their imperative to expand geographic coverage into remote and rural areas where terrestrial infrastructure is unfeasible. MNOs also leverage NTN for enhanced network resilience, providing backhaul redundancy, and offering premium "everywhere" connectivity. Similarly, Internet Service Providers (ISPs) and large enterprise clients across industries such as mining, oil & gas, construction, and utilities, rely on NTN for primary or backup connectivity, facilitating remote operations and real-time data exchange in isolated environments. These enterprise customers prioritize guaranteed uptime, robust security, and scalable connectivity globally.

Beyond these foundational segments, specialized industries are increasingly key potential customers. The maritime sector, including commercial shipping and offshore operations, represents significant demand for broadband internet, operational communications, and crew welfare across vast ocean expanses. The aviation industry utilizes NTN for in-flight Wi-Fi, critical air traffic management, and operational data exchange for aircraft globally. Defense and government organizations are consistently major buyers, demanding highly secure, resilient, and global communication for intelligence, tactical operations, and disaster response. Moreover, the rapidly expanding Internet of Things (IoT) and Machine-to-Machine (M2M) market presents immense growth opportunity, with customers like smart agriculture, global logistics, and environmental monitoring agencies seeking ubiquitous, low-power connectivity. Finally, the transformative emergence of direct-to-device (D2D) capabilities positions individual consumers as a mass-market segment, enabling standard smartphones to access satellite communication for basic messaging, emergency calls, and essential data services in vast areas currently without cellular coverage, democratizing access to global connectivity.

Satellite NTN Market Key Technology Landscape

The Satellite NTN market is defined by a dynamic and continuously evolving technology landscape, characterized by rapid advancements enhancing capabilities, reducing costs, and expanding application spectrum. Central to this evolution are innovations in satellite constellations, particularly the proliferation of Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) systems. These constellations are engineered to deliver significantly lower latency and higher bandwidth compared to traditional Geostationary Earth Orbit (GEO) satellites, ideal for modern interactive applications. This is enabled by satellite miniaturization, leading to widespread adoption of small satellites and CubeSats, more cost-effective to produce and launch. Furthermore, software-defined satellites (SDN) and highly reconfigurable payloads offer unprecedented flexibility to adapt communication services and allocate resources dynamically in orbit, optimizing performance and extending operational life. Inter-satellite links (ISL), utilizing optical or radio frequency technologies, are crucial for creating robust mesh networks in space, reducing reliance on ground stations, enhancing resilience, and improving data routing efficiency. These advancements underscore a shift towards more agile, adaptable, and cost-efficient space-based communication infrastructure.

On the terrestrial side, the ground segment of the NTN ecosystem is also undergoing significant technological transformation. Key technologies include sophisticated ground station antennas capable of tracking fast-moving LEO satellites, such as phased array antennas and electronically steerable arrays, essential for continuous connectivity. A cornerstone of future NTN development is deep integration with 5G non-terrestrial network (NTN) standards, defined by 3GPP Release 17 and beyond. These standards ensure seamless interoperability between terrestrial 5G networks and satellite systems, facilitating direct-to-device connectivity for smartphones, and enabling a unified communication experience. Efficient spectrum sharing technologies are vital for coexisting with existing terrestrial services. Moreover, the increasing adoption of cloud-native architectures, virtualization (NFV, SDN), and edge computing in ground segment operations enables more flexible, scalable, and cost-efficient network management. The pervasive application of Artificial Intelligence and Machine Learning (AI/ML) profoundly impacts the landscape, optimizing network performance, enhancing cybersecurity, enabling autonomous operations, and extracting actionable intelligence from satellite data, ensuring reliability, efficiency, and future-proof nature of these complex global systems.

Regional Highlights

- North America: Leads the market with significant investments in LEO constellations, robust government and defense spending on secure satellite communications, and active involvement of major aerospace and telecom players in developing 5G NTN solutions. The region benefits from extensive R&D and early adoption of advanced satellite technologies and has a high concentration of key market participants.

- Europe: Characterized by strong regulatory frameworks, active participation in European Space Agency (ESA) programs, and a strategic focus on integrating satellite communication with terrestrial 5G networks. Key players are investing in pan-European NTN initiatives, promoting both commercial and public sector applications, including enhanced maritime connectivity.

- Asia Pacific: Emerges as a high-growth region due to vast unserved rural populations, increasing demand for IoT connectivity across various industries, and government-led digital transformation initiatives. Countries like China, India, and Japan are heavily investing in indigenous satellite capabilities, fostering local innovation, and developing direct-to-device solutions.

- Latin America: Presents significant opportunities for both basic and advanced connectivity in remote and underserved geographical areas, particularly for agriculture, mining, and disaster relief operations. Governments are increasingly recognizing NTN as a vital means to bridge the digital divide and foster economic development.

- Middle East & Africa: Driven by the critical need for reliable communication infrastructure in challenging terrains and for supporting national economic diversification efforts away from traditional oil revenues. Investments are rising in satellite broadband for rural connectivity, oil & gas operations, and national security applications across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Satellite NTN Market.- Starlink (SpaceX)

- OneWeb

- AST SpaceMobile

- Omnispace

- EchoStar Corporation

- Viasat, Inc.

- Eutelsat Communications SA

- Skylo Technologies

- Lynk Global, Inc.

- Nokia Corporation

- Ericsson AB

- Qualcomm Technologies, Inc.

- Thales Alenia Space

- Airbus Defence and Space

Frequently Asked Questions

What is Satellite Non-Terrestrial Network (NTN)?

Satellite NTN refers to communication systems that utilize space-borne assets like satellites to provide network coverage, extending connectivity beyond traditional terrestrial infrastructure. It enables ubiquitous mobile and fixed communication services, particularly in remote areas, for maritime, aviation, and emerging direct-to-device applications, effectively bridging digital divides.

How does 5G integrate with Satellite NTN?

5G integrates with Satellite NTN through standardization efforts by 3GPP (Release 17 and beyond), which define specifications for non-terrestrial networks to function as integral parts of the 5G ecosystem. This integration aims to provide seamless end-to-end 5G services, enhance coverage, improve resilience, and support new use cases like direct-to-device connectivity and massive IoT at a global scale.

What are the primary challenges in the Satellite NTN market?

Key challenges include the high initial capital expenditure for deploying and maintaining satellite constellations, complex international regulatory frameworks for spectrum allocation and licensing, potential latency issues (though reduced by LEOs), and ensuring seamless interoperability with existing terrestrial networks. Additionally, intense competition and cybersecurity concerns pose significant hurdles.

Which applications benefit most from Satellite NTN?

Applications benefiting most include global IoT and M2M communications, maritime and aviation broadband, emergency and disaster relief communications, military and government secure networks, and providing connectivity to remote and rural areas. Emerging direct-to-device capabilities for smartphones also represent a major beneficiary, ensuring basic connectivity everywhere.

Who are the major players in the Satellite NTN market?

Major players include satellite operators such as Starlink (SpaceX), OneWeb, AST SpaceMobile, Omnispace, EchoStar, Viasat, and Eutelsat. Additionally, telecommunication equipment providers like Nokia, Ericsson, and Qualcomm, along with aerospace manufacturers like Thales Alenia Space and Airbus Defence and Space, are significant contributors to the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager