Satellite Phased Array Antenna Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430203 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Satellite Phased Array Antenna Market Size

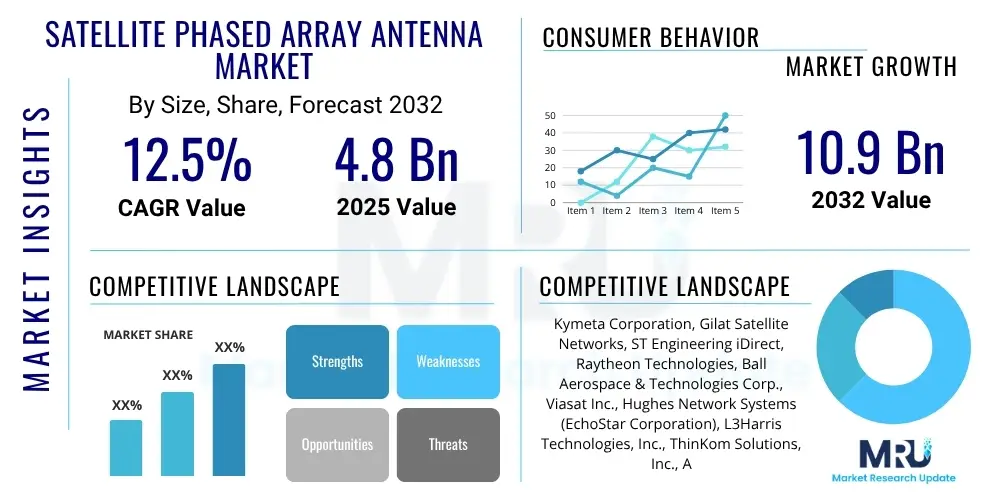

The Satellite Phased Array Antenna Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 4.8 billion in 2025 and is projected to reach USD 10.9 billion by the end of the forecast period in 2032.

Satellite Phased Array Antenna Market introduction

The Satellite Phased Array Antenna Market encompasses advanced antenna systems capable of electronically steering a radio beam without physical movement, offering significant advantages over traditional mechanical dish antennas. These sophisticated systems are pivotal for modern satellite communication, providing rapid beam agility, multi-beam capabilities, and enhanced reliability. The core product, a phased array antenna, comprises multiple radiating elements whose individual phase and amplitude are controlled to form and steer a collective beam in a desired direction, enabling seamless tracking of satellites, particularly in Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) constellations.

Major applications for satellite phased array antennas span across diverse sectors, including commercial broadband connectivity, defense and intelligence, maritime and aviation communications, and earth observation missions. They are integral to delivering high-throughput internet access in remote areas, facilitating secure military communications, enabling real-time data transmission for navigation, and supporting the burgeoning market for satellite-based Internet of Things (IoT) services. The inherent benefits of these antennas, such as low profile, rapid beam switching, resistance to physical wear and tear, and software-defined reconfigurability, make them indispensable for next-generation satellite systems requiring dynamic connectivity solutions.

The market's expansion is significantly driven by the escalating demand for ubiquitous high-speed internet connectivity, particularly from LEO satellite constellations which require agile antennas to track fast-moving satellites. Further driving factors include the increasing adoption of satellite communication in the defense sector for enhanced surveillance and secure data links, the proliferation of connected devices necessitating global IoT coverage, and advancements in semiconductor technologies that reduce the size, weight, and power consumption of these complex antenna systems. These combined forces are propelling the satellite phased array antenna market into a period of substantial growth and innovation.

Satellite Phased Array Antenna Market Executive Summary

The Satellite Phased Array Antenna Market is currently experiencing robust growth, primarily fueled by transformative shifts in the satellite communication industry and increasing geopolitical considerations. Business trends indicate a strong move towards LEO and MEO constellations, which necessitate agile, electronically steerable antennas for seamless handover and global coverage. Companies are heavily investing in research and development to achieve greater miniaturization, lower power consumption, and reduced manufacturing costs, aiming to make phased array antennas more accessible for a wider range of applications. Furthermore, the integration of 5G networks with satellite backhaul and the growing demand for connectivity in underserved regions are creating significant commercial opportunities, pushing market players to innovate and expand their product portfolios to meet diverse user requirements.

Regional trends reveal North America and Asia Pacific as key growth engines within this market. North America benefits from substantial government and defense spending on advanced satellite systems, coupled with a robust ecosystem of technology developers and satellite operators. The region is at the forefront of LEO constellation deployment and related ground segment innovations. Asia Pacific, driven by rapid economic development, increasing internet penetration, and ambitious national space programs, is witnessing a surge in demand for satellite-based communication services, particularly for commercial broadband and maritime connectivity. Europe is also a significant player, with strong governmental support for space initiatives and a focus on developing advanced communication technologies for both civilian and military applications, fostering competition and innovation.

Segmentation trends highlight several critical areas of market evolution. By type, active phased array antennas (APAA) are gaining prominence due to their superior performance, multi-beam capabilities, and enhanced reliability, despite higher initial costs. In terms of frequency bands, Ku-band and Ka-band remain dominant for commercial broadband, while X-band and S-band are crucial for defense and specialized applications. The market for Q/V-band antennas is emerging, driven by the need for higher throughput in next-generation satellite systems. Application-wise, satellite communication continues to hold the largest share, with significant growth observed in earth observation and navigation segments, underscoring the versatility and critical importance of phased array antenna technology across a broad spectrum of industries.

AI Impact Analysis on Satellite Phased Array Antenna Market

Users frequently inquire about how artificial intelligence (AI) will enhance the performance, efficiency, and autonomy of satellite phased array antennas, often expressing interest in aspects such as adaptive beamforming, predictive maintenance, and real-time resource optimization. There is a strong expectation that AI will unlock new capabilities, leading to more intelligent and resilient satellite communication systems. Common concerns revolve around the complexity of integrating AI, potential cybersecurity vulnerabilities, and the need for robust algorithms to manage highly dynamic environments. Users anticipate that AI will significantly reduce operational overhead, improve network reliability, and enable more sophisticated communication services, thereby transforming the overall value proposition of phased array antenna technology in satellite networks.

- AI-driven adaptive beamforming optimizes signal direction and strength in real-time, enhancing communication quality and mitigating interference, particularly crucial for tracking fast-moving LEO satellites and adapting to dynamic channel conditions.

- Predictive maintenance powered by AI algorithms analyzes antenna performance data to forecast potential failures, enabling proactive repairs and minimizing downtime, thereby improving system reliability and reducing operational costs.

- AI-enabled resource allocation dynamically manages antenna resources, such as power and bandwidth, across multiple beams and users, maximizing throughput and efficiency for complex communication scenarios.

- Enhanced threat detection and mitigation through AI allows phased array antennas to identify and counter jamming or spoofing attempts more effectively, bolstering security and resilience in contested environments.

- Automated network orchestration facilitated by AI simplifies the management of large-scale satellite constellations and ground networks, reducing human intervention and accelerating deployment and configuration processes.

- Improved spectral efficiency is achieved by AI-driven algorithms that optimize frequency reuse and minimize inter-beam interference, allowing for greater data transmission capacity within existing spectrum allocations.

DRO & Impact Forces Of Satellite Phased Array Antenna Market

The Satellite Phased Array Antenna Market is significantly influenced by a confluence of driving factors, restrictive elements, and emerging opportunities, all shaped by various impact forces. The primary drivers include the exponential growth in demand for high-speed, ubiquitous satellite broadband, spurred by the rapid deployment of mega-constellations in Low Earth Orbit (LEO) and Medium Earth Orbit (MEO). These constellations necessitate highly agile, electronically steerable antennas that can rapidly switch between satellites to maintain continuous connectivity. Additionally, increasing investments in defense modernization programs globally, focusing on secure and resilient satellite communication for surveillance, reconnaissance, and command and control, further propel market expansion. The growing adoption of satellite internet services in remote and underserved areas, as well as for mobility platforms like aircraft and maritime vessels, also acts as a powerful catalyst for this market.

Despite the strong growth trajectory, several restraints challenge the market. The high initial cost associated with the research, development, and manufacturing of advanced phased array antennas poses a significant barrier to entry and adoption, particularly for smaller players. The complexity of these systems, requiring specialized expertise in RF design, material science, and software integration, contributes to extended development cycles and higher production costs. Furthermore, regulatory hurdles related to spectrum allocation and international coordination for satellite operations can introduce delays and complexities. The ongoing miniaturization efforts, while beneficial, often come with engineering challenges related to thermal management and power efficiency within compact form factors, which can impact performance and reliability if not adequately addressed.

Opportunities within the market are abundant and diverse. The convergence of 5G technology with satellite networks presents a substantial opportunity for hybrid communication solutions, extending 5G coverage to remote areas and providing robust backhaul. The burgeoning Internet of Things (IoT) ecosystem, requiring global connectivity for myriad sensors and devices, opens new avenues for phased array antenna applications. Emerging markets in Asia Pacific, Latin America, and Africa are experiencing increasing demand for satellite broadband, driving regional market expansion. Advancements in materials science, such as the development of metamaterials and gallium nitride (GaN) components, are expected to reduce costs and enhance antenna performance, making these technologies more commercially viable. These opportunities, coupled with ongoing technological innovation, are shaping the competitive landscape and fostering strategic partnerships across the value chain.

Segmentation Analysis

The Satellite Phased Array Antenna Market is comprehensively segmented across various dimensions, including antenna type, operating frequency bands, diverse applications, distinct platforms, and target end-users. This granular segmentation provides critical insights into market dynamics, identifying specific growth areas, technological preferences, and demand patterns across different sectors. Understanding these segments is vital for stakeholders to tailor their product development, marketing strategies, and investment decisions, ensuring they address the nuanced needs of the market effectively and capitalize on emerging trends and opportunities. The market's complexity and rapid evolution underscore the importance of such detailed analysis.

- By Type

- Active Phased Array Antenna (APAA): Features integrated Transmit/Receive (T/R) modules at each antenna element, offering superior beamforming capabilities, higher efficiency, and better reliability.

- Passive Phased Array Antenna (PPAA): Utilizes phase shifters to control the beam, generally simpler and less expensive, but with limitations in multi-beam capability and efficiency compared to APAA.

- By Frequency Band

- Ku-band: Predominantly used for commercial fixed and mobile satellite services, including television broadcasting and internet access.

- Ka-band: Offers higher throughput and is increasingly utilized for broadband internet, VHTS (Very High Throughput Satellite) systems, and military applications.

- X-band: Primarily employed for military and government communications, including radar and secure data links, known for its robustness in adverse weather.

- C-band: Traditionally used for satellite television and data backhaul, offering good resistance to rain fade but requiring larger antennas.

- S-band: Used for mobile satellite services, remote sensing, and specific defense applications due to its propagation characteristics.

- Q/V-band: Emerging bands offering significantly higher bandwidth for future ultra-high-throughput satellite systems, currently under research and development.

- By Application

- Satellite Communication: Encompasses broadband internet, cellular backhaul, enterprise connectivity, and maritime/aeronautical communications.

- Earth Observation: For remote sensing, environmental monitoring, weather forecasting, and geographical mapping using satellite imagery.

- Navigation: Enhances global positioning systems (GPS, Galileo, GLONASS) and provides resilient navigation solutions for critical infrastructure.

- Surveillance: Used in defense and intelligence for reconnaissance, target tracking, and border monitoring.

- Others: Includes scientific research, space debris tracking, and inter-satellite links.

- By Platform

- Spaceborne: Antennas deployed on satellites (LEO, MEO, GEO) for communication, earth observation, and navigation.

- Ground-based: Antennas installed on fixed ground stations, mobile terminals, or portable devices for receiving and transmitting satellite signals.

- Airborne: Antennas integrated into aircraft (commercial, military, UAVs) for in-flight connectivity, surveillance, and secure communication.

- Maritime: Antennas designed for ships and offshore platforms, providing reliable connectivity for crew welfare, operational data, and security.

- By End-User

- Commercial: Includes telecommunications providers, internet service providers, media and entertainment, and commercial mobility sectors.

- Government and Defense: Encompasses military, intelligence agencies, government bodies, and public safety organizations for secure communications and surveillance.

- Telecommunication: Specifically refers to the infrastructure and service providers leveraging satellite backhaul and direct-to-device connectivity.

- Aviation: Airlines, aircraft manufacturers, and air traffic control for in-flight internet, cockpit communication, and air traffic management.

Value Chain Analysis For Satellite Phased Array Antenna Market

The value chain for the Satellite Phased Array Antenna Market is intricate, involving multiple specialized stages from foundational material development to final deployment and service provision. It begins with the upstream segment, which includes the research and development of advanced materials and components essential for antenna construction. This involves semiconductor manufacturers supplying GaN and GaAs technologies for T/R modules, material science companies providing low-loss substrates and advanced composites, and specialized manufacturers producing RF integrated circuits, phase shifters, and power amplifiers. These foundational elements are critical as they directly influence the performance, cost, and miniaturization capabilities of the final antenna product, with innovation at this stage having ripple effects throughout the entire chain.

Moving downstream, the value chain encompasses the antenna manufacturers and system integrators who assemble these components into complete phased array antenna systems. This segment involves complex design, fabrication, and testing processes to ensure the antennas meet stringent performance specifications for various applications. Further downstream are the satellite operators and service providers who purchase these antennas for integration into their ground stations, airborne platforms, maritime terminals, or directly into satellite communication terminals for end-users. The distribution channel is often characterized by a mix of direct sales from manufacturers to large integrators or government agencies, and indirect channels through original equipment manufacturers (OEMs) who embed these antennas into larger systems, or value-added resellers (VARs) who provide customized solutions to specific end-user segments.

Direct distribution often occurs for large-volume contracts with major satellite operators, defense departments, or telecommunication giants, where manufacturers engage directly to provide tailored solutions and support. Indirect distribution channels are more prevalent for commercial off-the-shelf (COTS) products or components, where antennas are sold through a network of distributors to smaller system integrators or specialized application providers. The interplay between these upstream and downstream activities, coupled with efficient distribution mechanisms, is crucial for market efficiency and the rapid deployment of advanced satellite communication solutions. Ensuring robust partnerships and seamless information flow across these stages is paramount for sustaining innovation and meeting the evolving demands of the global satellite communication landscape.

Satellite Phased Array Antenna Market Potential Customers

The potential customers for Satellite Phased Array Antennas are diverse and span across both public and private sectors, driven by the escalating need for reliable, high-speed, and agile satellite connectivity. Key end-users include commercial satellite operators who are building out extensive LEO and MEO constellations, requiring advanced ground terminals for seamless handoffs and high-throughput data transfer to users globally. Telecommunication service providers represent another significant customer base, as they seek to leverage satellite backhaul to extend 5G networks and broadband internet access to remote and underserved areas, complementing terrestrial infrastructure. The aviation industry is a rapidly growing segment, with airlines investing in phased array antennas for in-flight connectivity, entertainment, and operational data transmission, demanding compact and low-profile solutions for aircraft integration.

The government and defense sectors are perennial major buyers of phased array antennas, utilizing them for critical applications such as secure military communications, intelligence, surveillance, and reconnaissance (ISR), border security, and resilient navigation systems. These entities prioritize robust performance, anti-jamming capabilities, and secure data links, often necessitating custom-designed or highly ruggedized solutions. Additionally, maritime industries, including commercial shipping, offshore energy platforms, and cruise lines, are increasingly adopting these antennas for ship-to-shore communications, crew welfare, and operational efficiency, requiring durable systems capable of operating in harsh marine environments. The burgeoning Internet of Things (IoT) market also represents a growing customer segment, as satellite phased array antennas enable global connectivity for a vast array of sensors and devices in agriculture, logistics, and environmental monitoring, extending the reach of IoT solutions far beyond terrestrial networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.8 Billion |

| Market Forecast in 2032 | USD 10.9 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 | Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kymeta Corporation, Gilat Satellite Networks, ST Engineering iDirect, Raytheon Technologies, Ball Aerospace & Technologies Corp., Viasat Inc., Hughes Network Systems (EchoStar Corporation), L3Harris Technologies, Inc., ThinKom Solutions, Inc., Airbus S.A.S., Thales Group, Honeywell International Inc., Israel Aerospace Industries (IAI), Phasor Solutions Ltd. (acquired by Intelsat), T-COM Corporation, Space Micro Inc., Intellian Technologies Inc., Meta Materials Inc., Cobham Satcom, Wavestream (part of Gilat) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Satellite Phased Array Antenna Market Key Technology Landscape

The technological landscape of the Satellite Phased Array Antenna Market is characterized by continuous innovation aimed at enhancing performance, reducing size, weight, and power (SWaP), and decreasing manufacturing costs. A significant trend involves the increasing adoption of Gallium Nitride (GaN) and Gallium Arsenide (GaAs) semiconductor technologies in Transmit/Receive (T/R) modules. These advanced materials offer superior power efficiency, higher output power, and better thermal management compared to traditional silicon-based components, enabling the development of more compact and powerful active phased array antennas essential for high-throughput applications and multi-beam capabilities. Miniaturization efforts are also driven by advancements in System-in-Package (SiP) and Monolithic Microwave Integrated Circuit (MMIC) designs, allowing for tighter integration of components and reducing the overall footprint of the antenna systems, which is critical for airborne and mobile platforms.

Another crucial technological development is the emergence of reconfigurable intelligent surfaces (RIS) and metamaterials. These innovative materials are being explored for their potential to dynamically control electromagnetic waves, offering new avenues for ultra-thin, lightweight, and cost-effective beamforming solutions that can be integrated into a wider range of platforms. Software-defined antennas (SDA) represent a paradigm shift, moving much of the antenna's functionality from hardware to software. This approach enables unprecedented flexibility, allowing antennas to adapt their beam patterns, frequencies, and protocols on the fly, making them highly versatile for diverse missions and future-proof against evolving communication standards. Furthermore, advanced digital signal processing (DSP) and artificial intelligence (AI) algorithms are increasingly being integrated to enhance beam steering precision, enable adaptive interference cancellation, and optimize resource allocation across multiple beams and users, significantly boosting the overall efficiency and resilience of satellite communication systems.

Regional Highlights

- North America: This region is a dominant force in the Satellite Phased Array Antenna Market, primarily driven by substantial government and defense investments in advanced satellite communication and surveillance systems. The presence of leading aerospace and defense contractors, along with innovative commercial satellite operators like SpaceX (Starlink) and Amazon (Project Kuiper), fuels significant research and development. The region's robust technological infrastructure and early adoption of LEO constellations position it at the forefront of market growth, particularly for high-throughput broadband and secure military applications.

- Europe: The European market demonstrates steady growth, supported by initiatives from the European Space Agency (ESA) and national space programs focused on satellite navigation (Galileo) and earth observation (Copernicus). Investments in secure communication for defense and robust commercial broadband solutions for underserved areas contribute significantly. Key countries like the UK, France, and Germany are hubs for antenna manufacturing and satellite technology development, with a strong emphasis on international collaboration and advanced material research to enhance antenna performance and reduce costs.

- Asia Pacific (APAC): APAC is emerging as a rapidly expanding market due to escalating demand for internet connectivity, particularly in developing economies, and ambitious national space programs in countries like China, India, and Japan. The region's large population, increasing disposable income, and growing adoption of mobile and satellite broadband services are driving the need for advanced ground terminals. Significant investments in satellite manufacturing and launch capabilities, coupled with increasing defense budgets, are further accelerating the deployment and adoption of phased array antennas for both commercial and government applications.

- Latin America: This region presents a growing market opportunity, primarily driven by the need for reliable broadband internet access in rural and remote areas where terrestrial infrastructure is limited. The expansion of satellite communication services for oil and gas, agriculture, and maritime sectors also contributes to market growth. While investment levels are lower compared to North America or APAC, the increasing availability of affordable satellite services is stimulating demand for efficient and adaptable phased array antenna solutions.

- Middle East and Africa (MEA): The MEA region is experiencing increasing demand for satellite communication driven by expanding telecommunications infrastructure, oil and gas operations, and national security requirements. Countries in the Middle East are investing heavily in advanced communication technologies for defense and smart city initiatives, while Africa leverages satellite solutions for connectivity in vast, sparsely populated regions. The market here is characterized by a mix of government-led projects and commercial ventures focused on providing reliable broadband and secure communication links.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Satellite Phased Array Antenna Market.- Kymeta Corporation

- Gilat Satellite Networks

- ST Engineering iDirect

- Raytheon Technologies

- Ball Aerospace & Technologies Corp.

- Viasat Inc.

- Hughes Network Systems (EchoStar Corporation)

- L3Harris Technologies, Inc.

- ThinKom Solutions, Inc.

- Airbus S.A.S.

- Thales Group

- Honeywell International Inc.

- Israel Aerospace Industries (IAI)

- Phasor Solutions Ltd. (acquired by Intelsat)

- T-COM Corporation

- Space Micro Inc.

- Intellian Technologies Inc.

- Meta Materials Inc.

- Cobham Satcom

- Wavestream (part of Gilat)

Frequently Asked Questions

What are the primary benefits of satellite phased array antennas compared to traditional dish antennas?

Satellite phased array antennas offer superior agility through electronic beam steering, eliminating mechanical movement for faster tracking of satellites and seamless handoffs in LEO/MEO constellations. They also provide multi-beam capabilities, enabling simultaneous communication with multiple satellites or users, along with a low-profile form factor, enhanced reliability due to fewer moving parts, and software-defined reconfigurability for adaptive operations.

Which applications are driving the most significant growth in the Satellite Phased Array Antenna Market?

The most significant growth drivers include the increasing demand for high-throughput commercial broadband internet, particularly from the proliferation of LEO satellite mega-constellations like Starlink and Project Kuiper. Additionally, expanding applications in defense and intelligence for secure communications, surveillance, and reconnaissance, as well as the growing need for global connectivity in maritime and aviation sectors, are propelling market expansion.

How is artificial intelligence (AI) impacting the development and performance of phased array antennas?

AI is profoundly impacting phased array antennas by enabling advanced adaptive beamforming for real-time signal optimization, predictive maintenance to enhance system reliability, and dynamic resource allocation for improved spectral efficiency. AI also facilitates smarter interference cancellation and bolsters cybersecurity, making these antennas more autonomous, efficient, and resilient in complex communication environments.

What are the key technological advancements shaping the future of satellite phased array antennas?

Key technological advancements include the widespread adoption of Gallium Nitride (GaN) and Gallium Arsenide (GaAs) semiconductors for more efficient T/R modules, leading to smaller and more powerful designs. The emergence of metamaterials and reconfigurable intelligent surfaces for ultra-thin antennas, alongside software-defined antenna architectures for increased flexibility, and advanced digital signal processing with AI integration are critical for future innovation.

Which regions are expected to be the fastest-growing markets for satellite phased array antennas?

The Asia Pacific (APAC) region is anticipated to be one of the fastest-growing markets, driven by rapid economic development, increasing internet penetration, ambitious national space programs, and rising demand for satellite broadband services. North America will also maintain strong growth due to continued investment in LEO constellations and robust defense spending, while Europe shows steady expansion with significant governmental and commercial initiatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager