Search and Rescue Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430225 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Search and Rescue Equipment Market Size

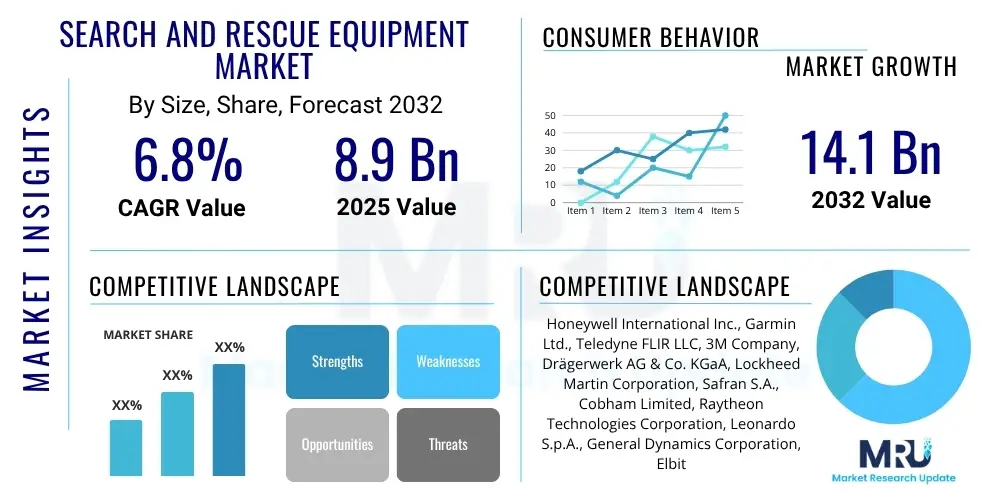

The Search and Rescue Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $8.9 billion in 2025 and is projected to reach $14.1 billion by the end of the forecast period in 2032.

Search and Rescue Equipment Market introduction

The Search and Rescue (SAR) Equipment Market encompasses a broad spectrum of advanced tools and technologies designed to locate, access, stabilize, and transport individuals in distress across diverse environments, from urban collapse zones to remote wilderness areas and vast marine expanses. These critical instruments are indispensable for emergency services, military operations, disaster response teams, and various humanitarian organizations globally. The core objective of SAR equipment is to enhance the efficiency, safety, and success rate of rescue missions, thereby minimizing casualties and mitigating the impact of emergencies.

Products within this market range from sophisticated communication devices, personal protective equipment (PPE), and medical supplies to advanced detection and navigation systems, as well as specialized robotics and unmanned aerial vehicles (UAVs). Major applications include disaster management, urban search and rescue (USAR), wilderness search and rescue, maritime operations, and combat search and rescue. The inherent benefits of employing high-quality SAR equipment are manifold, including significantly reduced response times, improved situational awareness for responders, enhanced safety protocols for both rescuers and victims, and ultimately, a higher probability of survival for those in peril. These tools enable responders to operate effectively in hazardous conditions, overcome complex logistical challenges, and provide immediate critical care.

Driving factors propelling the growth of this market include the escalating frequency and intensity of natural disasters worldwide, increased geopolitical instabilities necessitating robust combat SAR capabilities, and substantial governmental investments in emergency preparedness and disaster resilience infrastructure. Furthermore, continuous technological advancements, particularly in areas such as sensor technology, communication networks, and artificial intelligence, are leading to the development of more sophisticated, efficient, and versatile rescue solutions, fueling demand across various end-user segments. Public awareness campaigns and the professionalization of emergency services also contribute to the adoption of advanced equipment.

Search and Rescue Equipment Market Executive Summary

The Search and Rescue (SAR) Equipment Market is experiencing dynamic shifts, driven by persistent global challenges such as climate change induced natural disasters, rising geopolitical tensions, and an increasing focus on public safety and emergency preparedness. Business trends indicate a strong emphasis on integration and miniaturization, with manufacturers developing multi-functional, lightweight, and interoperable devices that can seamlessly connect with existing command and control systems. There is also a notable trend towards subscription-based models for software and data analytics services associated with advanced SAR platforms, ensuring continuous updates and support for critical systems. Furthermore, public-private partnerships are becoming more prevalent, fostering innovation and facilitating the rapid deployment of new technologies.

Regionally, North America continues to dominate the market due to robust government funding for defense and emergency services, high awareness of disaster preparedness, and the presence of major technology developers. Europe follows, driven by stringent safety regulations and significant investments in cross-border SAR capabilities and urban resilience programs. The Asia Pacific region is projected to exhibit the fastest growth, primarily attributed to its susceptibility to a wide range of natural disasters, rapid urbanization leading to increased demand for urban SAR, and substantial infrastructure development projects in emerging economies like China and India. Latin America, the Middle East, and Africa are also showing nascent growth, spurred by improving economic conditions and increased international humanitarian aid.

Segmentation trends highlight the increasing prominence of robotics and drones as critical tools in SAR operations, offering capabilities for remote sensing, aerial surveillance, and hazardous environment exploration without endangering human rescuers. Communication equipment, particularly satellite-based systems and mesh networks, remains a foundational segment, crucial for maintaining connectivity in remote or damaged areas. Personal Protective Equipment (PPE) is also seeing continuous innovation, focusing on enhanced comfort, durability, and integration with communication and sensor technologies. The market is increasingly segmenting by application type, with specialized equipment tailored for urban, wilderness, maritime, and disaster management scenarios, reflecting a nuanced approach to rescue challenges.

AI Impact Analysis on Search and Rescue Equipment Market

User inquiries regarding the impact of AI on the Search and Rescue Equipment Market frequently revolve around its potential to enhance situational awareness, automate mundane or dangerous tasks, and improve overall response efficiency. Common questions explore how AI can process vast amounts of data from sensors, drones, and communication networks to provide real-time actionable insights, predict disaster patterns, and optimize resource allocation. Users are also keen on understanding the role of AI in autonomous rescue operations, such as guiding drones for victim detection or enabling robotic platforms for debris clearance. Concerns often include the reliability and ethical implications of AI in life-critical situations, data privacy, the potential for job displacement among human rescuers, and the challenges of integrating complex AI systems with existing, often disparate, SAR infrastructure.

- Enhanced Situational Awareness: AI processes data from multiple sensors (thermal, LiDAR, acoustic) to create comprehensive 3D maps of disaster zones, identifying hazards and potential victim locations more rapidly.

- Predictive Analytics: AI algorithms analyze historical data, weather patterns, and geographical information to forecast potential disaster zones, allowing for proactive deployment of resources.

- Autonomous Operations: AI-powered drones and robots can conduct aerial surveillance, search collapsed structures, or navigate hazardous terrain autonomously, reducing risk to human rescuers.

- Optimized Resource Allocation: AI algorithms can recommend the most efficient deployment of personnel and equipment based on real-time data, victim distribution, and access routes.

- Improved Communication & Interoperability: AI-driven language processing and translation tools facilitate communication between diverse rescue teams and local populations, while AI can also bridge disparate communication systems.

- Advanced Victim Detection: AI image recognition and sound analysis can differentiate between human signatures and environmental noise or debris, significantly improving the speed and accuracy of victim location.

- Decision Support Systems: AI provides rescuers with critical insights and recommendations for complex scenarios, assisting in making rapid, informed decisions under pressure.

- Training and Simulation: AI-driven simulations offer realistic training environments for SAR teams, allowing them to practice complex scenarios and improve response strategies.

DRO & Impact Forces Of Search and Rescue Equipment Market

The Search and Rescue Equipment Market is shaped by a confluence of powerful drivers, inherent restraints, promising opportunities, and competitive impact forces. A primary driver is the alarming increase in the frequency and severity of natural disasters globally, ranging from earthquakes and tsunamis to floods and wildfires, necessitating robust and rapidly deployable rescue capabilities. Compounding this, rising geopolitical instabilities and instances of urban terrorism amplify the need for sophisticated combat and urban search and rescue tools. Substantial government initiatives and escalating defense budgets focused on emergency preparedness, homeland security, and disaster resilience provide significant funding for research, development, and procurement of advanced SAR equipment. Furthermore, continuous technological advancements, particularly in areas like sensor fusion, drone capabilities, and communication networks, are creating more effective and efficient solutions, driving market demand.

Despite robust growth, several restraints impede the market's full potential. The high initial acquisition cost of advanced SAR equipment, particularly for sophisticated robotics, satellite communication systems, and integrated command centers, can be prohibitive for smaller agencies or developing nations. Interoperability challenges remain a significant hurdle, as diverse equipment from various manufacturers often struggles to communicate or integrate seamlessly, leading to operational inefficiencies during multi-agency responses. Stringent regulatory approvals and certification processes for new technologies can delay market entry and adoption. Moreover, the complexities associated with equipment maintenance, specialized training requirements, and the need for frequent upgrades pose ongoing financial and logistical burdens. Environmental limitations, such as extreme weather conditions or difficult terrain, can also restrict the effective deployment and performance of certain advanced equipment, requiring specialized robust designs.

Opportunities for market expansion are substantial, particularly in the integration of artificial intelligence and machine learning for predictive analysis, allowing for proactive resource staging and optimized response strategies. The development of fully autonomous or semi-autonomous SAR systems, leveraging advanced robotics and AI, presents a transformative opportunity to conduct missions in environments too hazardous for human rescuers. Emerging economies, particularly in Asia Pacific and Latin America, represent untapped markets with growing awareness and investment in disaster preparedness infrastructure. Furthermore, the trend towards modular and customizable equipment designs allows for greater flexibility and adaptability to specific disaster scenarios, catering to diverse operational needs and budgets. Collaborations between public safety agencies, private technology firms, and academic institutions are fostering innovation and accelerating product development, creating novel solutions for complex rescue challenges.

Segmentation Analysis

The Search and Rescue Equipment Market is extensively segmented to cater to the diverse requirements of emergency response across various operational domains and technological applications. This segmentation provides a granular understanding of market dynamics, enabling manufacturers to tailor products and services to specific end-user needs and allowing agencies to procure specialized tools for their distinct challenges. The market can be broadly categorized by equipment type, application area, and the end-user agencies deploying these critical tools, reflecting the multifaceted nature of SAR operations globally.

- By Type:

- Communication Equipment: Satellite Phones, Radios, Beacons, Mesh Networks, Data Transmitters

- Personal Protective Equipment (PPE): Helmets, Goggles, Breathing Apparatus, Specialized Suits (e.g., Hazmat, Cold Weather), Gloves, Footwear

- Medical Equipment: First Aid Kits, Stretchers, Defibrillators, Trauma Bags, Resuscitation Devices, Mass Casualty Incident Kits

- Detection Equipment: Thermal Imagers, Night Vision Devices, Metal Detectors, Gas Detectors, Life Detectors (e.g., seismic, acoustic), Chemical/Biological Detectors

- Navigation & Positioning Equipment: GPS Devices, Sonar Systems, Radar Systems, Inertial Navigation Systems, Digital Mapping Tools

- Robotics & Drones: Unmanned Aerial Vehicles (UAVs), Unmanned Ground Vehicles (UGVs), Remotely Operated Vehicles (ROVs), Autonomous Underwater Vehicles (AUVs)

- Others: Lifting & Cutting Tools, Lighting Equipment, Decontamination Units, Temporary Shelter Systems

- By Application:

- Disaster Management: Earthquakes, Floods, Wildfires, Hurricanes, Tsunamis, Industrial Accidents

- Urban Search and Rescue (USAR): Collapsed Structures, Confined Spaces, High-Angle Rescue

- Wilderness Search and Rescue: Mountain Rescue, Cave Rescue, Forest Search, Avalanche Response

- Combat Search and Rescue (CSAR): Military Operations, Hostile Environments, Personnel Recovery

- Maritime Search and Rescue: Open Sea, Coastal Areas, Inland Waterways, Underwater Recovery

- Others: Vehicle Extrication, Technical Rescue, Public Event Security

- By End User:

- Government Agencies: Military & Defense Forces, Police Departments, Fire & Emergency Medical Services, Coast Guard, National Disaster Response Teams

- Non-Governmental Organizations (NGOs): Red Cross, Doctors Without Borders, International Search and Rescue Advisory Group (INSARAG) Teams

- Commercial & Industrial: Oil & Gas Platforms, Mining Operations, Construction Sites, Large Event Management

- Others: Volunteer Rescue Groups, Research Institutions

Value Chain Analysis For Search and Rescue Equipment Market

The value chain for the Search and Rescue Equipment Market begins with extensive upstream activities, primarily involving the sourcing of specialized raw materials and the manufacturing of intricate components. This includes advanced materials such as aerospace-grade composites for drones, robust polymers for protective gear, high-grade metals for structural tools, and sophisticated electronics for sensors and communication systems. Key upstream players include manufacturers of microprocessors, advanced battery technologies, optical lenses, and specialized fabrics, all of whom contribute to the core technological building blocks of SAR equipment. The quality and reliability of these upstream components are paramount, as they directly impact the performance and durability of the final rescue tools, often under extreme operational conditions.

Midstream activities involve the design, assembly, and integration of these components into complete SAR equipment systems. This stage requires significant research and development investments to ensure products meet stringent performance standards, regulatory compliance, and user requirements. Manufacturers focus on creating integrated solutions that offer interoperability, user-friendliness, and ruggedness. This includes assembling complex communication devices, integrating multiple sensor types into detection systems, and constructing durable and ergonomic personal protective equipment. Branding, quality control, and obtaining necessary certifications (e.g., NATO, ISO standards) are crucial at this stage, establishing product reliability and market credibility for the specialized applications within SAR. This phase often involves specialized engineering teams and highly skilled labor to ensure precision and functionality.

Downstream activities center on the distribution, sales, and post-sales support of SAR equipment to the ultimate end-users. The distribution channel is multifaceted, primarily involving direct sales to large government agencies, military branches, and major NGOs through tenders and long-term contracts. Specialized distributors and resellers play a significant role in reaching smaller agencies, volunteer groups, and commercial clients, often providing localized support and maintenance. Online platforms are also gaining traction for less complex items. Post-sales services, including maintenance, repairs, upgrades, and comprehensive training programs, are critical given the life-saving nature of the equipment. Direct distribution often provides a higher degree of customization and technical support, while indirect channels offer broader market reach and accessibility, ensuring that critical equipment is available to various types of rescue organizations globally, from national forces to local volunteer groups.

Search and Rescue Equipment Market Potential Customers

The Search and Rescue Equipment Market serves a diverse and critical base of end-users who require highly specialized tools to fulfill their life-saving missions. The primary segment of potential customers consists of various governmental agencies at national, regional, and local levels. This includes military and defense forces, particularly their specialized units engaged in combat search and rescue (CSAR) and personnel recovery operations, where robust and reliable equipment is paramount. Police departments, fire and emergency medical services (EMS), and coast guard units are also major buyers, requiring a wide array of tools for urban, wilderness, and maritime incidents, respectively. National disaster response teams and civil defense organizations, often operating under federal mandates, constitute another significant customer base, procuring equipment for large-scale disaster management scenarios such as earthquakes, floods, and pandemics.

Beyond governmental entities, non-governmental organizations (NGOs) represent a substantial and growing segment of potential customers. Prominent international organizations such as the Red Cross, Doctors Without Borders, and various search and rescue advisory groups like INSARAG (International Search and Rescue Advisory Group) regularly procure specialized equipment for humanitarian aid missions and disaster relief efforts worldwide. These organizations often operate in resource-constrained environments and require durable, portable, and easily deployable solutions. Their purchasing decisions are often influenced by factors such as equipment reliability, ease of use, and global logistical support, as they frequently operate across diverse geographical and political landscapes.

Furthermore, the market extends to commercial and industrial sectors where employee safety and emergency preparedness are critical. This includes companies operating in high-risk environments such as offshore oil and gas platforms, mining operations, large construction sites, and chemical processing plants. These entities invest in SAR equipment for internal emergency response teams to manage localized incidents, evacuate personnel, and provide immediate medical assistance. Private security firms managing large public events or critical infrastructure also constitute a niche but growing customer segment. Finally, volunteer rescue groups and local community emergency teams, though often operating with limited budgets, contribute to the demand for essential, entry-level, and specialized SAR tools, often relying on donations or smaller grants for their procurement needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $8.9 billion |

| Market Forecast in 2032 | $14.1 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Garmin Ltd., Teledyne FLIR LLC, 3M Company, Drägerwerk AG & Co. KGaA, Lockheed Martin Corporation, Safran S.A., Cobham Limited, Raytheon Technologies Corporation, Leonardo S.p.A., General Dynamics Corporation, Elbit Systems Ltd., BAE Systems plc, L3Harris Technologies Inc., Zodiac Nautic International, Orolia SAS, ACR Electronics Inc., Rescue Technology, MSA Safety Inc., Survitec Group Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Search and Rescue Equipment Market Key Technology Landscape

The Search and Rescue Equipment Market is heavily reliant on a rapidly evolving technology landscape, constantly integrating cutting-edge innovations to enhance operational capabilities and improve victim outcomes. Core technologies include advanced Global Positioning System (GPS) and other Global Navigation Satellite Systems (GNSS), which provide highly accurate positioning data crucial for navigation in unfamiliar or obscured terrains. LiDAR (Light Detection and Ranging) and sophisticated radar systems are increasingly being deployed, particularly on drones and ground robots, to create detailed 3D maps of disaster sites, penetrate smoke or fog, and detect objects or victims hidden beneath debris. Advanced sensor technologies, encompassing thermal imaging, acoustic, seismic, and chemical sensors, are pivotal for detecting life signs, hazardous materials, and structural instabilities, often integrated into handheld devices or autonomous platforms.

Communication systems form the backbone of any effective SAR operation, with satellite phones, mesh radio networks, and secure data transmission systems ensuring uninterrupted connectivity between ground teams, command centers, and aerial assets, especially in areas with compromised infrastructure. The burgeoning fields of robotics and unmanned systems, including Unmanned Aerial Vehicles (UAVs or drones), Unmanned Ground Vehicles (UGVs), and Remotely Operated Vehicles (ROVs), are transforming SAR by enabling remote reconnaissance, hazardous environment exploration, and even direct victim assistance. These platforms are often equipped with high-resolution cameras, thermal imagers, and specialized manipulators, extending the reach and safety of rescue teams. Developments in battery technology are critical for extending the operational endurance of these power-intensive devices, providing longer deployment times.

Artificial Intelligence (AI) and Machine Learning (ML) are emerging as transformative technologies, enabling predictive analytics for disaster response, automated victim detection through image and sound recognition, and intelligent navigation for autonomous SAR vehicles. AI-driven data fusion combines information from disparate sensors to provide a holistic view of the operational environment, enhancing situational awareness for commanders. Augmented Reality (AR) and Virtual Reality (VR) are also finding applications, particularly in training simulations and providing real-time data overlays for field rescuers, aiding in complex decision-making. Lastly, advancements in materials science contribute to the development of lighter, more durable, and more protective personal protective equipment (PPE), capable of withstanding extreme conditions while maintaining wearer comfort and mobility, thus completing a comprehensive technological ecosystem designed for optimal rescue performance.

Regional Highlights

- North America: This region maintains a dominant share in the Search and Rescue Equipment Market, primarily driven by robust governmental investments in homeland security, defense, and emergency preparedness. The United States and Canada are leading adopters of advanced SAR technologies due to their exposure to diverse natural disasters, well-established emergency response infrastructure, and the presence of numerous key market players and R&D facilities. High per capita spending on advanced equipment and a strong focus on technological integration further bolster market growth.

- Europe: Europe represents a mature market with significant demand for sophisticated SAR equipment, particularly within its highly integrated emergency services and cross-border cooperation initiatives. Countries like Germany, the UK, France, and Scandinavia are at the forefront of adopting innovative technologies, driven by stringent safety regulations and a proactive approach to disaster management. Investments in urban resilience and maritime SAR capabilities are key regional drivers.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for SAR equipment, fueled by its vulnerability to frequent and devastating natural disasters (e.g., earthquakes, tsunamis, typhoons) and rapid urbanization in countries like China, India, and Japan. Increasing government spending on disaster preparedness infrastructure and the modernization of emergency services in emerging economies are creating substantial opportunities for market expansion. Local manufacturing capabilities are also increasing.

- Latin America: This region exhibits moderate growth, influenced by its susceptibility to seismic activity, floods, and hurricanes. Countries like Mexico, Chile, and Brazil are gradually increasing their investments in modern SAR equipment, often supported by international aid and collaborations. The market here is characterized by a growing awareness of disaster risk reduction and the need for standardized rescue protocols.

- Middle East and Africa (MEA): The MEA market for SAR equipment is in its nascent stages but shows promising growth potential. This growth is driven by increasing geopolitical tensions necessitating robust combat SAR capabilities, significant investments in infrastructure development, and growing awareness of emergency preparedness in oil-rich nations. Challenges such as political instability and limited budgetary allocations in some African countries present hurdles, but humanitarian efforts and international partnerships continue to drive demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Search and Rescue Equipment Market.- Honeywell International Inc.

- Garmin Ltd.

- Teledyne FLIR LLC

- 3M Company

- Drägerwerk AG & Co. KGaA

- Lockheed Martin Corporation

- Safran S.A.

- Cobham Limited

- Raytheon Technologies Corporation

- Leonardo S.p.A.

- General Dynamics Corporation

- Elbit Systems Ltd.

- BAE Systems plc

- L3Harris Technologies Inc.

- Zodiac Nautic International

- Orolia SAS

- ACR Electronics Inc.

- Rescue Technology

- MSA Safety Inc.

- Survitec Group Ltd.

Frequently Asked Questions

What is Search and Rescue Equipment?

Search and Rescue Equipment comprises specialized tools and technologies designed to locate, access, stabilize, and transport individuals in distress across diverse environments. This includes communication devices, personal protective gear, medical supplies, detection systems, navigation tools, and advanced robotics, all crucial for efficient and safe rescue operations.

What are the primary drivers of the Search and Rescue Equipment Market?

The market is primarily driven by the increasing frequency and intensity of natural disasters, growing geopolitical instabilities, significant government investments in emergency preparedness, and continuous technological advancements leading to more effective and versatile rescue solutions.

How is AI impacting Search and Rescue operations?

AI significantly impacts SAR by enhancing situational awareness through data fusion, enabling predictive analytics for resource deployment, facilitating autonomous operations with drones and robots, improving victim detection accuracy, and providing decision support for complex rescue scenarios, ultimately boosting efficiency and safety.

Which regions are key contributors to the Search and Rescue Equipment Market?

North America currently dominates the market due to high governmental spending and advanced infrastructure. Europe is a mature market driven by stringent regulations. The Asia Pacific region is projected for rapid growth due to its vulnerability to natural disasters and increasing investments in emergency preparedness.

What challenges does the Search and Rescue Equipment Market face?

Key challenges include the high initial cost of advanced equipment, persistent interoperability issues between different systems, stringent regulatory approval processes, complexities in equipment maintenance and specialized training requirements, and environmental limitations affecting equipment performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager