Silage Additives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430488 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Silage Additives Market Size

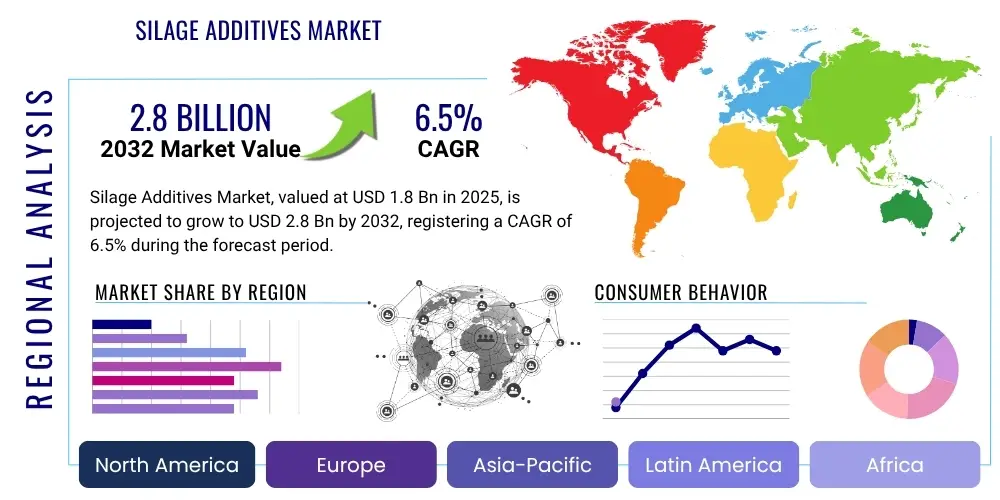

The Silage Additives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 1.8 Billion in 2025 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2032.

Silage Additives Market introduction

The Silage Additives Market plays a pivotal role in modern animal agriculture by enhancing the quality and preservation of ensiled forage. Silage, a fermented feed, is crucial for livestock nutrition, especially during periods when fresh forage is scarce. Silage additives are substances applied to forage during ensiling to promote desirable fermentation, inhibit spoilage, and improve the nutritional value and palatability of the final product. These additives can include bacterial inoculants, enzymes, organic acids, and non-protein nitrogen compounds, each designed to address specific challenges in the ensiling process, ensuring maximum nutrient retention and minimizing dry matter losses.

The primary applications of silage additives span various livestock categories, including dairy cattle, beef cattle, sheep, goats, and other ruminants. For dairy farms, improved silage quality directly translates to enhanced milk production and reproductive efficiency. In beef operations, better feed conversion and growth rates are observed, leading to economic advantages. The benefits are multifaceted, encompassing improved animal performance, reduced feed waste due to spoilage, better digestibility of nutrients, and enhanced aerobic stability of the silage once opened, thereby preventing reheating and nutrient degradation. These advantages contribute significantly to the profitability and sustainability of livestock farming.

Several driving factors propel the growth of the Silage Additives Market. A rising global demand for livestock products, such as meat and dairy, necessitates efficient and high-quality animal feed solutions. Farmers are increasingly adopting modern farming practices that prioritize animal health, welfare, and productivity, leading to greater awareness and usage of silage additives. Furthermore, unpredictable weather patterns and climate change concerns drive the need for reliable forage preservation methods, making silage additives indispensable. Innovations in additive formulations, coupled with supportive government policies promoting sustainable agriculture, further contribute to market expansion.

Silage Additives Market Executive Summary

The Silage Additives Market is experiencing robust growth driven by evolving business trends, increasing regional demands, and significant advancements across various segments. Business trends indicate a strong focus on enhancing feed efficiency and animal health, with livestock producers investing in premium silage solutions to optimize production outcomes. There is a discernible shift towards biological additives, particularly bacterial inoculants, as farmers seek environmentally friendly and effective methods for forage preservation. Consolidation among key players and strategic partnerships aimed at expanding product portfolios and geographic reach are also prominent trends, fostering innovation and competitive dynamics within the industry. The market is also witnessing a greater emphasis on customized additive solutions tailored to specific crop types and climatic conditions, reflecting a maturing and sophisticated customer base.

Regional trends highlight varying growth patterns and adoption rates. North America and Europe currently represent mature markets, characterized by high adoption rates due to advanced farming practices, significant livestock populations, and strong regulatory frameworks supporting feed quality. These regions are also hubs for research and development, continuously introducing new and improved additive formulations. The Asia Pacific region, particularly countries like China, India, and Australia, is emerging as a high-growth market, propelled by rapidly expanding livestock industries, increasing disposable incomes, and a growing awareness among farmers regarding the benefits of modern silage management. Latin America and the Middle East and Africa are also showing promising growth, albeit from a smaller base, driven by efforts to modernize agricultural practices and improve food security.

Segmentation trends reveal dynamic shifts within the market. Bacterial inoculants, especially lactic acid bacteria, continue to dominate the market due to their proven efficacy in promoting rapid pH decline and improving silage fermentation. However, enzyme-based additives and organic acids are gaining traction for their specific benefits in breaking down complex carbohydrates and inhibiting spoilage microorganisms, respectively. Crop type segmentation shows strong demand for additives used in corn and alfalfa silage, which are staple forages globally. The dry form of additives remains popular for ease of application and storage, while liquid forms are favored for precision spraying systems. The dairy cattle application segment consistently holds the largest share, reflecting the high value placed on optimizing milk production through superior nutrition, though demand from beef cattle and small ruminants is also steadily increasing, contributing to overall market diversification and resilience.

AI Impact Analysis on Silage Additives Market

User questions regarding the impact of AI on the Silage Additives Market frequently revolve around how artificial intelligence can optimize silage production, predict spoilage, and personalize additive recommendations. Users are keen to understand if AI can make the ensiling process more efficient and reduce waste, especially concerning the variable nature of forage quality and environmental conditions. Concerns often include the accessibility and cost of AI technologies for smaller farms, as well as the practical implementation challenges. Expectations are high for AI to provide data-driven insights that lead to better decision-making, improved animal nutrition, and sustainable agricultural practices. There is a strong desire to leverage AI for predictive capabilities, ensuring optimal additive selection and application, thereby maximizing forage preservation and minimizing losses, which directly impacts farm profitability and resource efficiency.

- AI driven sensors can monitor forage characteristics in real time, influencing additive dosage and type.

- Predictive analytics powered by AI can forecast silage quality and spoilage risk based on environmental data.

- Precision agriculture integration allows AI algorithms to optimize additive application for specific field conditions.

- Automated decision support systems can recommend ideal additive combinations and ensiling protocols.

- Supply chain optimization using AI can improve logistics for additive distribution and raw material sourcing.

- Enhanced research and development through AI can accelerate discovery of novel, more effective additive formulations.

- Robotics and autonomous machinery can utilize AI for precise and uniform application of additives during harvest.

DRO & Impact Forces Of Silage Additives Market

The Silage Additives Market is significantly shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively constitute its Impact Forces. A primary driver is the escalating global demand for high-quality animal protein, which directly translates to an increased need for efficient and nutritious animal feed. Livestock producers are increasingly aware of the economic benefits of improved feed conversion rates and enhanced animal health, leading to greater adoption of silage additives. Furthermore, the volatility of weather patterns and the imperative for year-round feed availability underscore the critical role of effective forage preservation methods, with silage additives providing a reliable solution. Technological advancements in additive formulations, including the development of multi-strain bacterial inoculants and targeted enzyme complexes, also continually fuel market expansion, offering more effective and specialized products to farmers globally.

However, the market also faces considerable restraints that temper its growth trajectory. The relatively high cost of advanced silage additives can be a significant barrier for small-scale farmers, particularly in developing regions where budget constraints are more pronounced. A lack of comprehensive awareness and education regarding the benefits and proper application of these additives remains an issue in certain farming communities, hindering widespread adoption. Moreover, the presence of alternative feed preservation methods, such as haylage and dry hay production, offers competition, while stringent regulatory frameworks governing feed additives in various regions can impede product innovation and market entry for new players, leading to prolonged approval processes and increased development costs. The perishable nature of some biological additives and challenges related to their storage and transport also pose operational hurdles.

Despite these challenges, substantial opportunities exist for market growth and innovation. Emerging markets in Asia Pacific, Latin America, and Africa present vast untapped potential as livestock industries in these regions modernize and scale up production. The growing emphasis on sustainable agriculture and environmental stewardship creates avenues for the development of eco-friendly and biologically active additives that align with green farming practices. Furthermore, the integration of precision agriculture technologies, including AI-driven sensors and data analytics, offers opportunities for optimized additive application and customized solutions, enhancing efficacy and reducing waste. Investments in research and development for novel additive formulations, such as those incorporating probiotics, prebiotics, and essential oils, promise to unlock new product categories and cater to evolving animal nutrition demands, addressing specific health and productivity challenges in livestock.

Segmentation Analysis

The Silage Additives Market is comprehensively segmented to provide a detailed understanding of its various facets, enabling targeted strategies for market players and stakeholders. This segmentation categorizes the market based on critical parameters such as product type, crop type, form, function, and application. Each segment offers unique insights into consumer preferences, technological advancements, and regional demands, highlighting specific growth areas and competitive landscapes. Understanding these segments is crucial for identifying key trends, developing tailored product offerings, and optimizing distribution channels to meet the diverse needs of livestock producers across the globe. The granular analysis of these segments helps in forecasting market trajectory and identifying potential investment opportunities.

- By Type

- Bacterial Inoculants

- Lactic Acid Bacteria (LAB)

- Propionic Acid Bacteria

- Bacillus Species

- Enzymes

- Cellulase

- Hemicellulase

- Amylase

- Xylanase

- Organic Acids

- Formic Acid

- Propionic Acid

- Acetic Acid

- Benzoic Acid

- Non-Protein Nitrogen (NPN)

- Urea

- Anhydrous Ammonia

- Chemical Additives

- Salts

- Antioxidants

- Other Types (e.g., Fungi, Essential Oils, Antioxidants)

- Bacterial Inoculants

- By Crop Type

- Corn Silage

- Alfalfa Silage

- Sorghum Silage

- Oat Silage

- Barley Silage

- Grass Silage

- Other Forages (e.g., Legumes, Cereal Grains)

- By Form

- Liquid

- Dry (Powder, Granules)

- By Function

- Fermentation Enhancers

- Aerobic Stability Enhancers

- Nutritional Value Enhancers

- Palatability Enhancers

- Mould and Yeast Inhibitors

- By Application

- Dairy Cattle

- Beef Cattle

- Sheep

- Goats

- Other Ruminants (e.g., Buffalo, Deer)

Value Chain Analysis For Silage Additives Market

The value chain for the Silage Additives Market begins with upstream activities involving the sourcing and processing of raw materials. This includes the cultivation and harvesting of microbial strains for bacterial inoculants, the extraction and purification of enzymes, and the chemical synthesis of organic acids and other compounds. Research and development forms a crucial upstream component, focusing on identifying new active ingredients, optimizing formulations for efficacy and stability, and ensuring product safety and compliance with regulatory standards. Suppliers of these core ingredients and technologies play a foundational role, dictating quality and cost at the initial stages of the value chain. Efficiency in raw material procurement and innovation in biotechnological processes are key to maintaining a competitive edge and ensuring a steady supply of high-quality ingredients for additive manufacturers.

Moving downstream, the value chain encompasses the manufacturing, distribution, and eventual application of silage additives. Manufacturers process the raw materials into finished products, often involving fermentation, blending, drying, and packaging. Quality control and assurance are paramount at this stage to ensure product efficacy and consistency. The distribution channel is multifaceted, comprising both direct and indirect routes. Direct sales often occur through manufacturers' own sales forces engaging directly with large-scale farming operations, cooperatives, or national distributors. Indirect channels involve a network of regional distributors, agricultural retailers, feed mills, and veterinarians who serve smaller farms and provide local support and advice. The complexity of these channels requires robust logistics and inventory management to ensure timely delivery and product integrity across diverse geographic locations.

The final stage of the value chain involves the end-user application and post-sale support. Farmers and livestock producers are the ultimate consumers, applying the additives during the ensiling process to their forages. The effectiveness of the additive is heavily reliant on proper application techniques, storage, and adherence to recommended dosages. Therefore, providing comprehensive technical support, training, and educational resources to farmers is critical for maximizing product performance and customer satisfaction. Post-sale services, including troubleshooting and follow-up, contribute to customer loyalty and brand reputation. The efficiency of the entire value chain, from raw material sourcing to final application and support, directly impacts the quality of ensiled feed, animal health, and ultimately, the profitability of the livestock industry, emphasizing the interconnectedness of all stakeholders in delivering value.

Silage Additives Market Potential Customers

The primary potential customers for silage additives are diverse and encompass a wide range of livestock operations that rely on ensiled forage for animal nutrition. Foremost among these are dairy farmers, who require consistently high-quality feed to optimize milk production, maintain herd health, and ensure reproductive efficiency. Dairy operations, ranging from large commercial farms to smaller family-owned dairies, represent a significant segment due to their intensive feeding regimes and the direct correlation between feed quality and economic output. The emphasis on maximizing nutrient intake and digestibility in dairy cows makes silage additives an indispensable tool for these producers, helping them meet stringent production targets and manage feed costs effectively.

Another substantial group of potential customers includes beef cattle producers. These operations, whether for cow-calf, backgrounding, or feedlot systems, utilize silage to support growth rates, improve feed conversion, and enhance the overall health of their animals. For beef farmers, consistent feed quality from silage contributes to faster finishing times and better meat quality, directly impacting profitability. Additionally, producers of sheep and goats, particularly those involved in commercial lamb and kid production, constitute a growing customer base. These smaller ruminants also benefit significantly from high-quality silage, especially during winter months or dry seasons when fresh pasture is unavailable, improving wool production, reproductive success, and overall animal vigor.

Beyond the major ruminant categories, other specialized livestock operations, such as those raising buffalo, deer, or even specific equine breeds, can also be potential customers for silage additives, albeit on a smaller scale. Furthermore, feed manufacturers and agricultural cooperatives often act as intermediaries, purchasing additives in bulk for resale to their network of farmer clients or for inclusion in proprietary feed blends. Extension services and agricultural consultants also play a crucial role in influencing farmer decisions, making them indirect but important stakeholders in the market. The common thread among all these potential customers is the need for efficient, cost-effective, and nutritionally superior feed preservation methods to sustain and grow their livestock enterprises in a competitive agricultural landscape, underscoring the broad applicability and demand for silage additive solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.8 Billion |

| Market Forecast in 2032 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Cargill, Inc., Chr. Hansen Holding A/S, DuPont de Nemours, Inc., Lallemand Inc., Addcon GmbH, Biomin GmbH, Kemin Industries, Inc., Schaumann Agri GmbH, Micron Bio-Systems, ForFarmers N.V., Volac International Limited, Provita Eurotech Ltd., Archer Daniels Midland Company (ADM), Kerry Group plc, Sil-All, Dairyland Seed Co. Inc., DLF Seeds A/S, Mycogen Seeds, Barenbrug Holding B.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Silage Additives Market Key Technology Landscape

The Silage Additives Market is continuously evolving with significant technological advancements aimed at improving efficacy, stability, and ease of application. One of the most prominent technological landscapes revolves around microbial biotechnology, particularly in the development of advanced bacterial inoculants. This includes the isolation and characterization of new strains of lactic acid bacteria (LAB) and other beneficial microorganisms that offer superior fermentation profiles, better aerobic stability, and enhanced pathogen inhibition. Innovations focus on multi-strain inoculants tailored to specific forage types and environmental conditions, incorporating synergistic effects to optimize silage quality. Encapsulation technologies are also gaining traction to improve the viability and shelf-life of these living microorganisms, ensuring their effectiveness from manufacturing to application.

Another crucial technological area involves enzyme engineering and production. Researchers are developing novel enzyme complexes that can effectively break down complex plant cell walls (e.g., cellulase, hemicellulase) and starches (e.g., amylase) in forage, thereby increasing the availability of fermentable sugars for beneficial bacteria and improving nutrient digestibility for animals. The focus is on producing enzymes that are stable under diverse silage pH conditions and temperatures, and that can work synergistically with bacterial inoculants to accelerate the ensiling process and enhance feed quality. These enzymatic advancements contribute to reducing fiber content and improving the energy value of silage, directly impacting animal performance and feed conversion efficiency, offering significant economic advantages to livestock producers globally.

Furthermore, the integration of smart farming technologies and precision agriculture is profoundly impacting the application and monitoring of silage additives. This includes the use of sensors at harvest to analyze forage moisture content, dry matter, and nutrient composition in real-time, allowing for dynamic adjustment of additive dosage and type. Data analytics and machine learning algorithms are being employed to predict optimal additive combinations and application rates based on historical data, weather forecasts, and specific farm conditions. Automated application systems on harvesting machinery ensure uniform distribution of additives, minimizing waste and maximizing effectiveness. These technological innovations not only enhance the efficiency and precision of additive use but also contribute to more sustainable and data-driven livestock farming practices, aligning with broader trends in agricultural technology and smart agriculture initiatives.

Regional Highlights

- North America: This region is a mature market for silage additives, characterized by large-scale livestock operations, advanced farming practices, and high adoption rates of modern feed preservation techniques. The United States and Canada are key contributors, driven by significant dairy and beef cattle industries and continuous investment in research and development for new additive formulations. Stringent quality standards and a strong emphasis on animal productivity further bolster market demand.

- Europe: Europe represents another well-established market, with countries like Germany, France, and the UK being major consumers. The region benefits from a developed agricultural sector, high awareness among farmers about feed quality, and supportive agricultural policies. The focus on sustainable farming and animal welfare also encourages the adoption of biological and eco-friendly additive solutions.

- Asia Pacific (APAC): This region is projected to be the fastest-growing market due to rapidly expanding livestock industries in countries such as China, India, Australia, and New Zealand. Increasing demand for meat and dairy products, coupled with the modernization of farming practices and growing awareness of feed preservation benefits, drives significant market expansion. Government support for agricultural development and foreign investments also contribute to this growth.

- Latin America: Countries like Brazil, Argentina, and Mexico are key markets in Latin America, driven by their substantial beef and dairy cattle populations. The region is witnessing a gradual shift towards modern farming techniques and improved feed management, leading to increased adoption of silage additives. Economic growth and efforts to enhance food security further stimulate market demand.

- Middle East and Africa (MEA): This region is an emerging market with considerable growth potential. While starting from a smaller base, increasing investments in livestock farming, efforts to reduce reliance on imported feed, and the adoption of technologies to cope with harsh climatic conditions are driving the demand for silage additives. Gulf Cooperation Council (GCC) countries and South Africa are notable players.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Silage Additives Market.- BASF SE

- Cargill, Inc.

- Chr. Hansen Holding A/S

- DuPont de Nemours, Inc.

- Lallemand Inc.

- Addcon GmbH

- Biomin GmbH

- Kemin Industries, Inc.

- Schaumann Agri GmbH

- Micron Bio-Systems

- ForFarmers N.V.

- Volac International Limited

- Provita Eurotech Ltd.

- Archer Daniels Midland Company (ADM)

- Kerry Group plc

- Sil-All (a product of Alltech Inc.)

- Dairyland Seed Co. Inc.

- DLF Seeds A/S

- Mycogen Seeds

- Barenbrug Holding B.V.

Frequently Asked Questions

What are silage additives?

Silage additives are substances applied to forage during ensiling to promote desirable fermentation, inhibit spoilage, and enhance the nutritional value and aerobic stability of the feed for livestock.

Why are silage additives important for livestock farmers?

Silage additives are crucial for improving feed quality, reducing nutrient losses, preventing spoilage, and enhancing animal performance, leading to better milk production, growth rates, and overall farm profitability.

What types of silage additives are most commonly used?

The most common types include bacterial inoculants (e.g., lactic acid bacteria), enzymes (e.g., cellulase), organic acids (e.g., formic acid), and non-protein nitrogen (e.g., urea), each with specific functions.

How do silage additives improve aerobic stability?

Additives, particularly those containing propionic acid bacteria or specific lactic acid bacteria strains, inhibit the growth of yeasts and molds, preventing spoilage and heating when silage is exposed to air.

What role does technology play in the future of silage additives?

Technology, including AI and precision agriculture, enables real-time forage analysis, optimized additive application, and the development of more effective and targeted formulations, enhancing efficiency and sustainability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager