Ski Gear and Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430381 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Ski Gear and Equipment Market Size

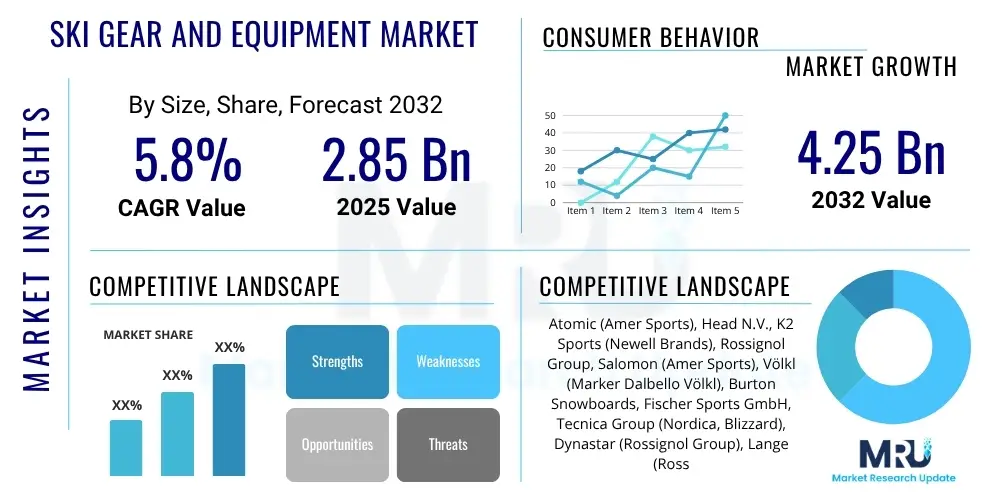

The Ski Gear and Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 2.85 Billion in 2025 and is projected to reach USD 4.25 Billion by the end of the forecast period in 2032.

Ski Gear and Equipment Market introduction

The Ski Gear and Equipment Market encompasses a comprehensive array of specialized products meticulously designed to cater to a diverse range of winter sports, including alpine skiing, nordic skiing, snowboarding, and increasingly, backcountry and freestyle disciplines. This expansive market segment includes fundamental items such as high-performance skis and snowboards, precision bindings, ergonomically designed boots, lightweight poles, advanced helmets, UV-protective goggles, and a wide variety of technical apparel including insulated jackets, pants, base layers, and gloves. Each product category is developed with an intense focus on leveraging cutting-edge materials and innovative engineering to optimize the user experience across all skill levels, from novice enthusiasts embarking on their first slopes to elite athletes competing at professional levels. The intrinsic value proposition of these products lies in their ability to significantly enhance safety, improve athletic performance, and maximize comfort in challenging mountainous environments, thereby enriching the overall enjoyment and accessibility of winter sports. The design philosophy behind modern ski and snowboard equipment emphasizes a delicate balance between durability, weight reduction, flexibility, and rigidity, tailored to specific terrains and styles of riding. This constant pursuit of perfection ensures that participants can fully engage with their chosen activity, confident in the reliability and capability of their gear. The market's dynamism is underscored by continuous research and development efforts aimed at pushing technological boundaries, introducing novel features, and adopting sustainable manufacturing practices to meet evolving consumer expectations and environmental mandates.

Major applications for ski gear and equipment extend beyond purely recreational pursuits to include competitive winter sports, professional mountain guiding, and backcountry exploration. Recreational skiing and snowboarding form the largest segment, attracting millions annually to resorts worldwide. Participants in this category seek comfortable, forgiving, and aesthetically pleasing gear that enhances their leisure time. Conversely, competitive athletes in disciplines such as slalom, downhill, freestyle, and cross-country require highly specialized equipment engineered for maximal speed, precision, and impact resistance. This segment drives significant innovation, as performance gains, even marginal ones, can translate into competitive advantages. The burgeoning interest in backcountry and touring skiing has further expanded the market's application scope, demanding lightweight, durable, and highly versatile equipment suitable for uphill travel and variable snow conditions away from groomed resorts. For professionals working in mountainous environments, such as ski patrollers, avalanche safety experts, and mountain guides, equipment must meet stringent safety standards and offer unparalleled reliability in extreme conditions. These diverse applications highlight the market's broad reach and its capacity to cater to distinct user requirements, ensuring that there is specialized gear available for virtually every winter mountain activity imaginable.

The underlying benefits derived from high-quality ski gear are multifaceted, contributing directly to increased participation and consumer satisfaction. Foremost among these is enhanced safety, with advancements in helmet technology, binding release mechanisms, and avalanche safety equipment significantly reducing the risk of injuries and fatalities. Superior thermal insulation and moisture-wicking properties of technical apparel ensure comfort and protection against harsh elements, allowing for extended periods of outdoor activity. From a performance perspective, well-designed skis, boots, and bindings offer improved maneuverability, better edge control, and efficient power transfer, enabling skiers to execute turns with greater precision and confidence. These performance enhancements are critical for skill development and progression, making the sport more rewarding. Driving factors propelling the market forward include the sustained global growth in winter tourism, which benefits from increased accessibility and improved infrastructure at ski destinations worldwide. Furthermore, a global uptick in disposable incomes, particularly within key demographic groups, empowers consumers to invest in premium equipment. The market also benefits from a growing health and wellness trend, as winter sports are increasingly recognized for their physical and mental health benefits. Technological advancements, such as the integration of smart features and sustainable materials, act as strong motivators for consumers to upgrade their equipment, ensuring a consistent demand for innovative products and contributing to the market's robust growth trajectory over the forecast period. The appeal of winter sports as both a recreational pastime and a competitive endeavor continues to expand, fostering a dynamic and innovative industry.

Ski Gear and Equipment Market Executive Summary

The Ski Gear and Equipment Market is currently navigating a period of significant evolution, shaped by dynamic business trends, diverse regional developments, and intricate segment-specific shifts. Current business trends reflect a strong and sustained industry-wide push towards sustainability, a critical imperative driven by both consumer demand and environmental consciousness. Manufacturers are increasingly prioritizing the integration of recycled, recyclable, and bio-based materials into product lines, alongside the adoption of more energy-efficient and low-impact production processes. This shift is not merely an ethical stance but a strategic business move, as brands that effectively communicate their commitment to environmental stewardship gain a significant competitive advantage and resonance with a growing segment of environmentally conscious consumers. Furthermore, the market is witnessing a pronounced trend towards personalization and customization, allowing consumers to tailor their equipment choices—from ski stiffness and boot fit to apparel layering systems—to their precise body mechanics, skill levels, and aesthetic preferences. This bespoke approach enhances the user experience and fosters stronger brand loyalty, moving beyond one-size-fits-all solutions. The digitalization of retail, characterized by advanced e-commerce platforms and virtual fitting tools, continues to revolutionize how consumers research, select, and purchase gear, complementing the essential expert advice offered by traditional brick-and-mortar specialty stores. Innovation cycles are also accelerating, with a constant introduction of new technologies designed to improve safety, performance, and comfort, ensuring that the market remains vibrant and engaging for both seasoned participants and newcomers. These trends collectively underpin a forward-looking industry that is responsive to global challenges and opportunities.

Regional trends reveal a complex mosaic of market maturity and burgeoning growth across different geographical landscapes. North America and Europe, with their deeply embedded ski cultures, extensive resort infrastructure, and high disposable incomes, continue to represent the largest and most established markets. These regions demonstrate stable demand, driven by a combination of recreational participation, competitive sports, and a strong appetite for premium, high-performance equipment. The demand in these mature markets is often influenced by generational participation, with families introducing younger members to winter sports, ensuring a continuous pipeline of new enthusiasts. In stark contrast, the Asia Pacific region, particularly China and South Korea, is experiencing explosive growth. This surge is fueled by massive government investments in winter sports infrastructure, spurred by events like the Winter Olympics, and a rapidly expanding middle class eager to embrace new leisure activities. Japan, with its renowned powder snow and mature ski industry, also contributes significantly to regional demand, particularly in the high-end segment. These emerging markets represent crucial future growth engines, offering substantial opportunities for international brands to expand their presence and localized product offerings. Latin America and the Middle East & Africa, while currently smaller in scale, present niche opportunities, with increasing interest in specific mountain regions and the development of indoor ski facilities catering to unique local conditions. Understanding these regional nuances is paramount for effective market penetration and sustainable growth strategies.

Segmentation trends within the Ski Gear and Equipment Market underscore distinct shifts in consumer preferences and activity types. The enduring appeal of traditional alpine skiing and snowboarding continues to drive significant demand for core equipment such as skis, boots, bindings, and technical outerwear. However, a notable and accelerating trend is the surge in popularity of backcountry and ski touring, driven by a desire among enthusiasts for more remote, adventurous, and less crowded experiences. This has led to a significant increase in demand for specialized lightweight touring skis, pin bindings, adaptable boots, and crucial avalanche safety equipment like transceivers, probes, and shovels. This segment's growth reflects a broader movement towards experiential outdoor recreation. Furthermore, there is a consistent and growing demand for high-performance equipment across all categories, as consumers at every skill level seek gear that optimizes their potential and enhances their enjoyment. The market for protective gear, including advanced helmets and back protectors, is also expanding, driven by increased safety awareness and a willingness to invest in personal protection. Apparel trends emphasize technical performance, versatility, and increasingly, sustainable materials and manufacturing processes. The online retail segment continues its upward trajectory, offering unparalleled convenience and a wider selection, challenging traditional brick-and-mortar stores to innovate their in-store experiences, focusing on expert fitting services, personalized advice, and community engagement. These segment-specific trends highlight a dynamic market where differentiation, innovation, and responsiveness to evolving consumer passions are key determinants of success.

AI Impact Analysis on Ski Gear and Equipment Market

Users frequently inquire about how Artificial Intelligence (AI) can fundamentally transform the ski gear and equipment market, with common questions revolving around enhanced personalization, predictive analytics for performance, and the integration of smart safety features. Consumers are keen to understand AI's capability to analyze individual skier biomechanics and style to recommend or even custom-design equipment that perfectly matches their unique profile, moving beyond traditional sizing charts. There's significant interest in AI's role in real-time performance tracking, not just logging data, but providing actionable insights and virtual coaching to improve technique. Furthermore, safety concerns are paramount, leading to questions about AI-powered systems that can detect early signs of fatigue, predict injury risks, or even automate emergency responses in the event of an accident. The overarching theme of user inquiries suggests a high expectation for AI to deliver more intuitive, safer, and ultimately more enjoyable winter sports experiences, while also acknowledging potential concerns regarding data privacy, the cost implications of such advanced technologies, and the need for seamless integration into existing gear without adding unnecessary complexity or weight. Users want to know if AI can truly bridge the gap between amateur enthusiasm and professional-level insights and safety protocols.

The practical implications of AI across the Ski Gear and Equipment Market value chain are profound and far-reaching, influencing every stage from conceptualization to the consumer's experience on the mountain. In the realm of product development and manufacturing, AI-driven computational fluid dynamics (CFD) and finite element analysis (FEA) can rapidly simulate and optimize ski and snowboard designs, materials, and constructions. This allows manufacturers to iterate faster, reduce prototyping costs, and develop lighter, stronger, and more aerodynamically efficient products with superior performance characteristics, customized for specific snow conditions or riding styles. AI also enhances supply chain management by predicting demand more accurately, optimizing inventory levels, and streamlining logistics, thereby reducing waste and improving efficiency. In retail, AI-powered recommendation engines can analyze browsing history, purchase patterns, and stated preferences to suggest highly personalized gear combinations, significantly improving the customer's purchasing journey both online and in physical stores. Virtual fitting tools utilizing AI and augmented reality (AR) are also emerging, allowing consumers to virtually try on apparel or even assess boot fit with greater precision before making a purchase, thereby minimizing returns and enhancing satisfaction.

On the mountain, AI is poised to revolutionize the actual skiing and snowboarding experience. Integrated AI systems within smart bindings, boots, or even apparel can collect vast amounts of sensor data – including pressure distribution, edge angle, speed, body posture, and even biometric data. This data is then processed by AI algorithms to provide real-time, personalized feedback through smartwatches or connected smartphone apps, offering insights into technique, balance, and energy expenditure. For instance, an AI coach could identify inefficiencies in a turn and suggest specific adjustments. In terms of safety, AI can power advanced avalanche transceivers that learn patterns of snowpack stability or personal locator beacons that better estimate injury severity and communicate with emergency services. AI-driven fall detection systems within helmets or protective gear could automatically alert predefined contacts or rescue teams upon detecting a severe impact, significantly reducing response times in critical situations. Furthermore, AI could contribute to personalized lift line management at resorts, optimizing flow and reducing wait times through predictive modeling. These advancements promise a future where ski gear is not merely passive equipment but an active, intelligent partner in enhancing performance, maximizing safety, and enriching the overall winter sports adventure.

- Personalized Equipment Recommendations: AI analyzes individual biometric data, skill level, riding style, and terrain preferences to suggest or customize skis, boots, and bindings for optimal fit and performance, significantly enhancing consumer satisfaction.

- Real-time Performance Analytics and Coaching: Embedded AI sensors in gear provide instantaneous feedback on speed, turn radius, airtime, balance, and body mechanics, delivering actionable insights and virtual coaching through connected apps to improve technique and progression.

- Enhanced Safety and Risk Mitigation: AI-powered systems can detect falls, analyze impact forces, monitor fatigue levels, and even integrate with avalanche safety devices, automating emergency alerts and providing predictive safety warnings in challenging conditions.

- Smart Manufacturing and Design Optimization: AI algorithms accelerate R&D by simulating material properties and aerodynamic designs, leading to lighter, stronger, and more efficient equipment while also optimizing production processes and reducing waste in the supply chain.

- Predictive Maintenance and Longevity: AI can monitor the wear and tear of equipment components, anticipating potential failures and recommending proactive maintenance, thereby extending product lifespan and ensuring consistent safety and performance.

- Intelligent Retail Experience: AI-driven recommendation engines, virtual try-on tools, and personalized marketing campaigns enhance the online and in-store shopping journey, making it easier for customers to find and purchase the perfect gear.

- Adaptive Gear and Features: Future AI integration could lead to truly adaptive gear, such as skis or boots that automatically adjust stiffness or dampening based on real-time snow conditions and skier input, providing a dynamic and optimized experience.

DRO & Impact Forces Of Ski Gear and Equipment Market

The Ski Gear and Equipment Market is influenced by a powerful combination of drivers, significant restraints, and promising opportunities, all shaped by a dynamic array of impact forces that dictate its overall trajectory. Among the primary drivers is the escalating global interest in outdoor recreational activities and adventure sports, a trend significantly amplified by a post-pandemic surge in desire for healthy, active lifestyles. Winter sports, in particular, offer a unique blend of physical challenge, natural beauty, and social interaction, appealing to a broad demographic. This growing participation is further supported by rising disposable incomes in key economies, allowing more individuals and families to invest in premium equipment and winter vacations. Technological advancements represent another critical driver, with continuous innovation in material science, design, and digital integration leading to the development of lighter, stronger, safer, and more performance-oriented equipment. Features such as advanced binding release systems, MIPS-equipped helmets, and breathable waterproof fabrics not only enhance the user experience but also motivate consumers to upgrade their gear regularly. Moreover, the substantial investments in ski resort infrastructure, including new lifts, expanded terrain, and improved snowmaking capabilities, contribute to greater accessibility and appeal of winter destinations, directly stimulating demand for associated gear and equipment. The professionalization and increased viewership of winter sports events also generate excitement and inspire participation, particularly among younger generations who aspire to emulate elite athletes.

Despite these strong drivers, the market faces several notable restraints that temper its growth potential. Foremost among these is the escalating impact of climate change, manifesting as unpredictable snowfall patterns, shorter ski seasons, and a greater reliance on artificial snow, particularly in lower-altitude resorts. This environmental volatility introduces uncertainty for operators and consumers alike, potentially discouraging participation and investment. The high initial cost of premium ski and snowboard gear can also serve as a significant barrier to entry for new participants, especially when coupled with additional expenses such as lift tickets, lessons, and accommodation. While rental options exist, the perception of expense can deter sustained engagement. Furthermore, the inherent seasonality of winter sports results in fluctuating demand, presenting complex challenges for manufacturers and retailers in terms of inventory management, production scheduling, and workforce utilization. Intense competition within the market, characterized by numerous well-established brands and innovative newcomers, can lead to price pressures and reduced profit margins. The relatively long lifespan of durable equipment like skis and boots also means that repurchase cycles can be extended, requiring brands to continually innovate and differentiate their products to stimulate upgrade cycles and maintain consumer interest in a saturated market segment. Global economic downturns or geopolitical instabilities can also impact discretionary spending, further restraining market growth.

Nevertheless, the market is rich with opportunities that promise significant future expansion and innovation. The most prominent opportunity lies in the continued expansion into emerging markets, especially within the Asia Pacific region. Countries like China, with its rapidly growing middle class and government-led initiatives to promote winter sports, offer vast untapped potential for both entry-level and high-performance gear. Other developing markets, as they improve their infrastructure and foster a winter sports culture, also represent long-term growth avenues. The growing consumer demand for sustainable and eco-friendly products presents a major strategic opportunity for manufacturers to innovate with recycled materials, cleaner production processes, and circular economy models. Brands that successfully align with these environmental values can build stronger brand loyalty and differentiate themselves in a competitive landscape. Furthermore, the increasing popularity of niche segments such as backcountry skiing, ski touring, and freestyle snowboarding is opening up demand for highly specialized equipment designed for specific conditions and disciplines. This diversification allows manufacturers to tap into new enthusiast communities. The integration of smart technologies, IoT devices, and AI into ski gear offers groundbreaking opportunities for enhanced safety, real-time performance tracking, and personalized user experiences, catering to tech-savvy consumers seeking advanced insights and convenience. Lastly, the focus on health and wellness, combined with the inherently adventurous nature of winter sports, ensures a steady stream of new participants and continued engagement from existing enthusiasts, solidifying the market's long-term growth prospects through continuous product evolution and market adaptation.

Segmentation Analysis

The Ski Gear and Equipment Market undergoes comprehensive segmentation to accurately capture the diverse needs, preferences, and purchasing behaviors of its global consumer base, providing a granular view essential for strategic market analysis and targeted business development. This detailed categorization allows manufacturers, retailers, and marketers to precision-engineer their product lines, craft highly relevant marketing campaigns, and optimize their distribution networks. The core segmentation criteria typically include classification by product type, reflecting the physical components of the sport; by end-user, delineating the skill level and intent of the participant; by distribution channel, indicating how products reach the consumer; and by application, specifying the particular winter sport discipline. Each of these overarching segments is further subdivided into intricate subsegments, facilitating a nuanced understanding of market dynamics and identifying specific niches with significant growth potential or unmet consumer demands. For instance, analyzing product types not only distinguishes between skis and boots but also differentiates specialized types like powder skis from racing skis, recognizing their distinct design requirements and target users. This systematic approach to market segmentation is instrumental in enabling market players to refine their competitive strategies, allocate resources effectively, and capitalize on evolving consumer trends, ensuring they remain agile and responsive in a dynamic industry landscape.

Breaking down the market by product type offers critical insights into manufacturing complexities and consumer priorities. Hardgoods, such as skis, snowboards, bindings, and boots, represent substantial investments in materials science, engineering, and ergonomic design, with innovation focused on enhancing performance, durability, and safety features. Sub-segments within skis, for example, might include alpine skis (further divided into carving, all-mountain, freeride, and race skis), nordic skis (cross-country, classic, skate), and specialized backcountry touring skis, each tailored to distinct terrains and styles. Softgoods, encompassing technical apparel like jackets, pants, base layers, gloves, and helmets and goggles, prioritize comfort, weather protection (waterproofing, breathability, insulation), and aesthetic appeal. The end-user segmentation is equally vital, distinguishing between recreational skiers/snowboarders who prioritize comfort, ease of use, and versatility, and professional/competitive athletes who demand cutting-edge, high-performance equipment that offers a competitive edge. This segmentation also often includes beginners, intermediates, and advanced users, recognizing their different learning curves and equipment requirements. The choice of distribution channel—whether through specialty sports stores, large retail chains, or burgeoning online platforms—is heavily influenced by the product type and end-user segment, with complex items requiring expert fitting often sold through specialized outlets, while apparel and accessories might see strong sales via e-commerce. The interconnectedness of these segmentation layers underscores the strategic importance of a holistic approach to market understanding.

The application-based segmentation further refines market understanding by categorizing products based on the specific winter sports activity they are designed for. This includes alpine skiing, which remains a cornerstone, encompassing downhill, slalom, and general resort skiing. Nordic skiing, with its focus on cross-country and endurance, requires distinctly different gear emphasizing lightness and glide. Snowboarding, a popular and dynamic discipline, has its own dedicated range of boards, boots, and bindings, often with specific designs for freestyle, freeride, or all-mountain riding. The growing popularity of backcountry and touring skiing necessitates specialized equipment built for both ascent and descent in ungroomed terrain, highlighting versatility and lightness. Each application demands unique product features and performance characteristics, driving distinct innovation pathways for manufacturers. Furthermore, ancillary product segments, such as avalanche safety gear, waxing tools, and carrying bags, cater to specific needs within these applications, broadening the overall market scope. Analyzing the growth and shifts within each of these segments allows market players to identify emerging trends, forecast demand for particular product categories, and allocate their research and development resources most effectively. This comprehensive segmentation provides a robust framework for understanding the complexities and opportunities within the diverse Ski Gear and Equipment Market, enabling data-driven decision-making for sustainable growth and competitive advantage.

- By Product Type:

- Skis: Alpine Skis (Carving, All-Mountain, Freeride, Race, Powder), Nordic Skis (Cross-Country, Classic, Skate, Backcountry Nordic), Backcountry/Touring Skis (AT Skis, Telemark Skis), Freestyle Skis (Park & Pipe), Snowblades.

- Snowboards: All-Mountain Snowboards, Freestyle Snowboards, Freeride Snowboards, Powder Snowboards, Splitboards, Race Snowboards.

- Bindings: Alpine Bindings (System, Demo, Alpine Touring compatible), Nordic Bindings (NNN, SNS, Prolink), Touring Bindings (Tech/Pin, Frame), Snowboard Bindings (Strap-in, Step-in, Hybrid).

- Boots: Alpine Boots (Frontside, All-Mountain, Freeride, Race, Touring compatible), Nordic Boots (Classic, Skate, Combi, Backcountry), Touring Boots (Pin, Frame, Walk Mode), Snowboard Boots (Lace, BOA, Hybrid).

- Poles: Alpine Poles (Fixed Length, Adjustable), Nordic Poles (Fixed Length, Adjustable), Touring Poles (Collapsible, Adjustable).

- Helmets: Ski Helmets (Alpine, Nordic), Snowboard Helmets, Backcountry Helmets (with avalanche tech), integrating MIPS or similar safety systems.

- Goggles: Cylindrical Goggles, Spherical Goggles, Toric Goggles, Photochromic Lenses, Interchangeable Lens Systems, OTG (Over The Glasses) compatibility.

- Apparel: Jackets (Shell, Insulated, 3-in-1), Pants (Shell, Insulated, Bib), Base Layers (Merino Wool, Synthetic), Mid Layers (Fleece, Down, Synthetic), Gloves & Mittens (Insulated, Shell), Socks (Wool, Synthetic), Neck Gaiters, Balaclavas.

- Protection Gear: Back Protectors, Knee Pads, Wrist Guards, Hip Pads, Avalanche Airbag Systems, Protective Shorts.

- Accessories: Ski Bags, Boot Bags, Wax & Tools, Edge Tuners, Avalanche Transceivers, Probes, Shovels, Hydration Packs, Action Cameras, Traction Devices.

- By End User:

- Recreational Skiers/Snowboarders: Emphasizing comfort, ease of use, durability, and versatility for general resort use and leisure.

- Professional/Competitive Skiers/Snowboarders: Demanding high-performance, specialized, and often custom-fit equipment for racing, freestyle competitions, or extreme freeriding.

- Beginners: Seeking forgiving, stable, and easily maneuverable equipment that facilitates learning and builds confidence.

- Intermediate: Looking for equipment that supports skill progression, offering a balance of performance, control, and comfort across various conditions.

- Advanced: Requiring responsive, precise, and durable gear capable of handling challenging terrain, high speeds, and expert maneuvers.

- By Distribution Channel:

- Specialty Stores: Offering expert advice, fitting services, and a curated selection of high-end and technical gear (e.g., local ski shops).

- Hypermarkets/Supermarkets: Providing more accessible, often entry-level or budget-friendly options, with less specialized service (e.g., large general retailers).

- Online Retailers: Offering convenience, broader selection, competitive pricing, and global reach for all product types (e.g., brand websites, multi-brand e-commerce platforms).

- Sporting Goods Stores: Large chains carrying a wide range of sports equipment, often including seasonal ski and snowboard gear (e.g., Decathlon, REI).

- Rental Stores: Located at resorts or independent, providing equipment for short-term use, often featuring durable, easy-to-use models suitable for various skill levels.

- By Application:

- Alpine Skiing: Equipment optimized for groomed slopes, varied terrain within resorts, and racing disciplines.

- Nordic Skiing: Gear specifically designed for cross-country trails, focusing on glide, lightweight construction, and energy efficiency.

- Backcountry/Touring Skiing: Equipment engineered for uphill travel, off-piste descents, and adaptability to unpredictable snow conditions in ungroomed environments.

- Freestyle Skiing/Snowboarding: Specialized gear for terrain parks, half-pipes, and aerial maneuvers, emphasizing durability, flexibility, and pop.

- Snowboarding: Boards, boots, and bindings designed for diverse riding styles including carving, freeride, freestyle, and powder.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.85 Billion |

| Market Forecast in 2032 | USD 4.25 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atomic (Amer Sports), Head N.V., K2 Sports (Newell Brands), Rossignol Group, Salomon (Amer Sports), Völkl (Marker Dalbello Völkl), Burton Snowboards, Fischer Sports GmbH, Tecnica Group (Nordica, Blizzard), Dynastar (Rossignol Group), Lange (Rossignol Group), Elan Skis, G3 (Genuine Guide Gear), Black Crows, DPS Skis, Line Skis (K2 Sports), Armada Skis (Amer Sports), Marker (Marker Dalbello Völkl), Dalbello (Marker Dalbello Völkl), Mammut Sports Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ski Gear and Equipment Market Key Technology Landscape

The Ski Gear and Equipment Market is profoundly influenced by a dynamic and evolving technology landscape, continuously driven by the pursuit of enhanced performance, superior safety, and unparalleled comfort for winter sports enthusiasts. A foundational aspect of this landscape is the advanced material science deployed in the manufacturing of hardgoods. Manufacturers are extensively incorporating lightweight yet exceptionally strong materials such as carbon fiber, various high-performance composite laminates (e.g., fiberglass, basalt, aramid), and aerospace-grade aluminum alloys into the construction of skis, snowboards, bindings, and boots. These materials significantly contribute to reducing the overall weight of the equipment, thereby improving maneuverability and reducing fatigue, while simultaneously boosting torsional stiffness and responsiveness for precise control. Furthermore, proprietary core constructions, often involving a blend of different wood types, foam, or honeycomb structures, are engineered to optimize flex patterns and damping characteristics, ensuring a smooth and stable ride across diverse snow conditions. The development of eco-friendly and sustainable materials, including bio-based resins, recycled plastics, and sustainably sourced wood, is gaining considerable traction as brands respond to consumer demand for environmentally responsible products, balancing high performance with ecological stewardship and minimizing the industry's carbon footprint throughout the product lifecycle, from sourcing to disposal. These material innovations are not merely incremental but represent fundamental shifts in how equipment is conceived and built, directly impacting the end-user's experience.

Regional Highlights

The Asia Pacific (APAC) region is unequivocally projected to be the fastest-growing market for ski gear and equipment, driven by transformative economic and social shifts. This phenomenal growth is primarily spearheaded by significant government initiatives and massive infrastructure investments in countries like China, particularly spurred by the legacy of the Winter Olympics. China's rapidly expanding middle class, with its increasing disposable income and growing aspiration for leisure and sports activities, is creating millions of new skiers and snowboarders, leading to an exponential surge in demand for entry-level and intermediate equipment. Japan and South Korea, with their already established ski cultures, world-renowned resorts, and sophisticated consumer bases, continue to contribute robustly to regional demand, especially for high-end and technologically advanced products. While local manufacturing is strong, there is a substantial and growing appetite for international premium brands, indicating a market that values quality, brand prestige, and advanced features. Other emerging markets within APAC, such as India with its Himalayan regions, also present long-term growth opportunities as their winter sports infrastructure and participation rates gradually develop. Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but are experiencing gradual and localized growth. In Latin America, countries like Chile and Argentina, with their significant mountain ranges, offer distinct skiing seasons that complement the Northern Hemisphere, attracting international tourists and fostering local participation. In the MEA region, a niche but growing market is emerging, driven by the development of unique indoor ski facilities and increasing interest in mountain adventure sports in select areas, often catering to affluent consumers seeking novel recreational experiences. The diverse growth rates and consumer profiles across these regions necessitate highly adaptable market strategies, from mass-market expansion in China to premium positioning in established European markets.

- North America: Mature and significant market (US, Canada) characterized by a deeply embedded ski/snowboard culture, extensive resort infrastructure, high disposable incomes, and strong demand for innovative and performance-oriented gear.

- Europe: Dominant market, particularly the Alpine countries (France, Switzerland, Austria, Italy, Germany), with a rich skiing heritage, high participation rates, strong focus on technical precision and sustainable practices, and a growing backcountry segment.

- Asia Pacific (APAC): Fastest-growing region, primarily driven by China's massive government investment in winter sports infrastructure and burgeoning middle class, alongside established and sophisticated markets in Japan and South Korea, leading to substantial demand for both entry-level and premium equipment.

- Latin America: Emerging market with potential in Andean countries (Chile, Argentina), offering unique Southern Hemisphere ski seasons and increasing interest in outdoor adventure tourism, appealing to both local and international visitors.

- Middle East & Africa (MEA): Niche but expanding market, predominantly supported by the development of indoor ski facilities and growing interest in mountain sports in select countries, catering to a specific demographic seeking unique recreational experiences.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ski Gear and Equipment Market.- Atomic (a brand of Amer Sports Corporation)

- Head N.V.

- K2 Sports (a subsidiary of Newell Brands)

- Rossignol Group (includes Rossignol, Dynastar, Lange, Look)

- Salomon (a brand of Amer Sports Corporation)

- Völkl (a brand of Marker Dalbello Völkl)

- Burton Snowboards

- Fischer Sports GmbH

- Tecnica Group (includes Nordica, Blizzard, Tecnica)

- Dynastar (a brand of Rossignol Group)

- Lange (a brand of Rossignol Group)

- Elan Skis

- G3 (Genuine Guide Gear)

- Black Crows

- DPS Skis

- Line Skis (a brand of K2 Sports)

- Armada Skis (a brand of Amer Sports Corporation)

- Marker (a brand of Marker Dalbello Völkl)

- Dalbello (a brand of Marker Dalbello Völkl)

- Mammut Sports Group (specializing in mountaineering and outdoor equipment, including avalanche safety gear)

- Arcteryx (focused on high-performance outdoor apparel and equipment)

Frequently Asked Questions

What are the primary factors driving the growth of the Ski Gear and Equipment Market?

The robust growth of the Ski Gear and Equipment Market is fundamentally propelled by several key factors. Foremost among these is the increasing global participation in winter sports and general outdoor recreational activities, driven by a greater emphasis on health, wellness, and experiential travel. Significant technological advancements in material science and equipment design consistently introduce lighter, stronger, safer, and more performance-oriented products, motivating consumers to upgrade. Furthermore, rising disposable incomes in key developing and developed economies enable a broader demographic to invest in often premium-priced gear. The continuous expansion and modernization of ski resort infrastructure worldwide, coupled with targeted governmental initiatives to promote winter sports tourism (especially in regions like Asia Pacific), also act as substantial catalysts for market expansion. These synergistic drivers create a sustained demand environment for innovative and high-quality ski and snowboard equipment.

How is climate change impacting the Ski Gear and Equipment Market, and what are companies doing to adapt?

Climate change poses a significant and escalating challenge to the Ski Gear and Equipment Market, primarily through unpredictable and shorter winter seasons, reduced natural snowfall, and fluctuating temperatures that impact snow quality. This environmental volatility can deter participation, increase operational costs for resorts (due to reliance on artificial snowmaking), and disrupt seasonal demand patterns for equipment. In response, companies are adopting multifaceted adaptation strategies. Many are investing heavily in the development of sustainable products, utilizing recycled materials, bio-based components, and implementing eco-friendlier manufacturing processes to appeal to environmentally conscious consumers and reduce their carbon footprint. Additionally, there's a trend towards diversifying product portfolios to include gear for non-snow-dependent outdoor activities, thus mitigating seasonal revenue dependence. Furthermore, brands are focusing on durable, long-lasting equipment to promote responsible consumption, and collaborating with resorts on climate advocacy and sustainable tourism initiatives.

Which geographical regions are exhibiting the most significant growth and market potential for ski gear and equipment?

The Asia Pacific (APAC) region is unequivocally projected to be the fastest-growing market for ski gear and equipment, showcasing immense potential driven primarily by China. Massive government investments in winter sports infrastructure, a rapidly expanding middle class with increasing disposable income, and a burgeoning interest in skiing and snowboarding are fueling unprecedented demand in China. Japan and South Korea also contribute significantly with their established ski cultures and sophisticated consumer bases. While North America and Europe remain large, mature, and stable markets with sustained demand for premium and technically advanced gear, APAC represents the critical engine for future global market expansion. Latin America, particularly countries with the Andes mountains like Chile and Argentina, and certain niche markets within the Middle East & Africa (often driven by indoor ski facilities), also demonstrate gradual growth and localized opportunities.

What key technological innovations are currently shaping the future of ski gear and equipment?

The future of ski gear and equipment is being actively shaped by a convergence of advanced technological innovations. Paramount among these are breakthroughs in material science, integrating ultra-lightweight yet robust composites like carbon fiber and advanced polymers to enhance performance, reduce weight, and boost durability. The widespread adoption of smart technology and IoT sensors is revolutionizing the user experience, enabling real-time performance analytics, virtual coaching, and enhanced safety features (e.g., fall detection, avalanche safety integration). Furthermore, advancements in ergonomic design ensure superior comfort and a customized fit, particularly for boots and helmets. Manufacturers are also focusing on sustainable manufacturing processes and the incorporation of eco-friendly materials, addressing growing consumer demand for environmentally responsible products. The potential for Artificial Intelligence (AI) to personalize equipment design and optimize user experience is also a burgeoning area of development, promising a new era of intelligent winter sports gear.

What types of customers are the primary focus for manufacturers and retailers in the Ski Gear and Equipment Market?

Manufacturers and retailers in the Ski Gear and Equipment Market target a diverse range of customers, segmented primarily by skill level and intended use. The largest segment comprises individual recreational skiers and snowboarders, from beginners seeking forgiving, easy-to-use gear to intermediate and advanced enthusiasts desiring performance-enhancing equipment for varied terrain. A crucial focus is also on professional and competitive athletes who demand highly specialized, often custom-fitted, cutting-edge gear for optimal performance in racing or freestyle disciplines. Beyond individual consumers, institutional buyers are also key, including ski resorts and rental shops that procure durable, versatile equipment in bulk for their rental fleets, as well as ski schools and tour operators requiring robust gear for instruction and guiding. The growing segment of backcountry and touring enthusiasts also represents a focused customer group, demanding lightweight, reliable, and safety-integrated equipment for off-piste adventures. This multifaceted customer base necessitates a broad product offering and tailored marketing strategies from industry players.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager