Skidder Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427812 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Skidder Equipment Market Size

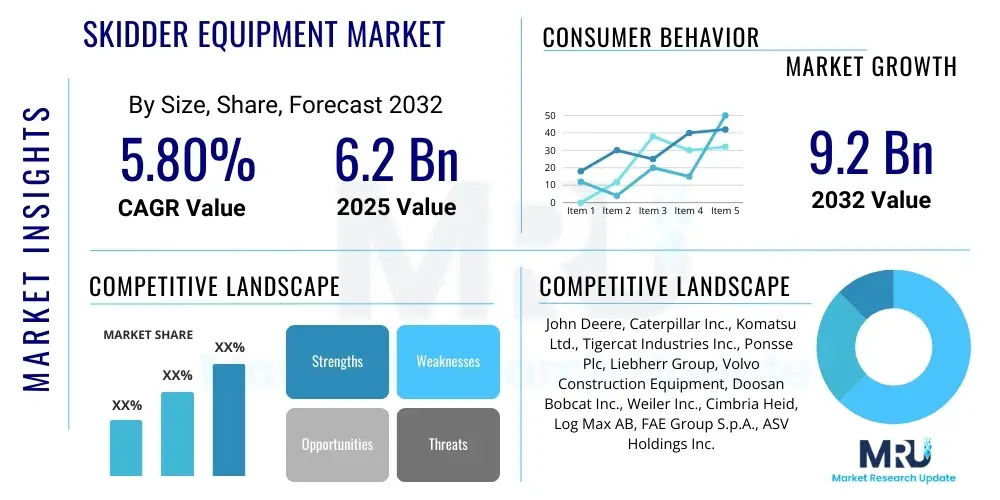

The Skidder Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 6.2 Billion in 2025 and is projected to reach USD 9.2 Billion by the end of the forecast period in 2032.

Skidder Equipment Market introduction

The Skidder Equipment Market encompasses the global trade and utilization of specialized heavy machinery primarily designed for forestry operations, specifically for moving felled trees from the stump to a landing or processing area. Skidders are essential in modern logging, enabling efficient timber extraction across diverse terrains, from dense forests to mountainous regions, while minimizing environmental impact when operated responsibly. The markets growth is inherently linked to global demand for timber and wood-based products, driving the need for sophisticated and durable logging equipment capable of handling demanding operational conditions.

These robust machines, characterized by their powerful engines, articulated chassis, and large tires or tracks, come in various configurations, including grapple skidders, cable skidders, and clambunk skidders, each suited for specific operational requirements and timber types. Grapple skidders, equipped with hydraulic arms, efficiently gather and transport multiple logs, while cable skidders utilize winches to pull logs, particularly effective in challenging or steep terrain. Clambunk skidders, less common, combine features to carry large volumes of shortwood.

Major applications for skidder equipment include commercial logging, forest thinning, land clearing for infrastructure projects, and sustainable forest management initiatives. The inherent benefits of utilizing skidders range from significantly increased operational efficiency and reduced manual labor to enhanced safety for forestry workers and the capability to access and extract timber from previously inaccessible areas. Driving factors for market expansion include sustained demand for construction materials, paper products, and biomass energy, alongside technological advancements aimed at improving machine performance, fuel efficiency, and environmental compliance in the forestry sector.

Skidder Equipment Market Executive Summary

The Skidder Equipment Market is currently experiencing dynamic shifts driven by evolving business practices, regional growth patterns, and technological advancements within various market segments. A key business trend shaping the market is the increasing adoption of telematics and data analytics solutions by forestry companies, which enables real-time monitoring of machine performance, predictive maintenance, and optimized fleet management. Furthermore, there is a noticeable move towards rental and leasing models, particularly among smaller logging contractors, allowing access to advanced equipment without significant upfront capital investment. Consolidation among manufacturers and an emphasis on developing more sustainable and environmentally compliant machinery are also prominent business trends.

Regionally, North America and Europe represent mature markets characterized by stringent environmental regulations and a strong emphasis on sustainable forestry practices, driving demand for high-efficiency and low-emission skidders. Conversely, the Asia-Pacific region, particularly countries like China and India, is emerging as a significant growth hub due to increasing construction activities, expanding pulp and paper industries, and growing demand for wood products. Latin America and Africa also present considerable opportunities, propelled by vast forest resources and developing infrastructure, although these regions may experience slower adoption rates for advanced technologies.

From a segmentation perspective, grapple skidders continue to dominate the market due to their superior efficiency in collecting and transporting large volumes of logs, especially in flatter terrains. However, cable skidders maintain their importance in mountainous or challenging environments where precise log retrieval is crucial. There is an accelerating trend towards higher engine power skidders (150-300 HP and above) to handle larger timber and demanding operational conditions more effectively. Moreover, the market is witnessing growing interest in electric and hybrid skidder prototypes, signaling a future shift towards more sustainable and fuel-efficient power sources, aligning with global environmental concerns and regulatory pressures.

AI Impact Analysis on Skidder Equipment Market

Users frequently inquire about the integration of artificial intelligence into skidder equipment, primarily focusing on how AI can enhance operational efficiency, improve safety, and reduce the environmental footprint of logging operations. Key themes include the potential for autonomous or semi-autonomous skidders, the application of predictive analytics for maintenance and optimal routing, and the role of AI in processing vast amounts of operational data to inform strategic decisions. There is considerable expectation regarding AIs capability to mitigate risks associated with human error and to optimize resource allocation, while also sparking discussions about the necessity for new skill sets among operators and maintenance personnel.

AIs influence on the Skidder Equipment Market is multifaceted, promising a transformation in how timber is harvested and managed. The technology offers solutions for complex operational challenges, moving beyond traditional mechanics to intelligent systems that learn and adapt. This paradigm shift not only affects the machinery itself but also redefines workflow efficiencies and personnel roles within the forestry industry, demanding a proactive approach to technology adoption and workforce development.

- Autonomous Operation: Enabling semi-autonomous or fully autonomous skidders for repetitive tasks, reducing operator fatigue and increasing efficiency in controlled environments.

- Predictive Maintenance: AI algorithms analyze telematics data to predict equipment failures, allowing for proactive maintenance and minimizing costly downtime.

- Optimized Routing: AI-driven route planning considers terrain, log density, and environmental factors to determine the most efficient and least impactful paths for log extraction.

- Enhanced Safety: Object detection and collision avoidance systems, powered by AI, significantly reduce the risk of accidents on logging sites.

- Data Analytics for Operational Insights: AI processes vast datasets from skidders to provide actionable insights into fuel consumption, operator performance, and overall fleet utilization.

- Remote Monitoring and Control: AI facilitates sophisticated remote diagnostics and, in some cases, remote operation, improving accessibility and responsiveness.

DRO & Impact Forces Of Skidder Equipment Market

The Skidder Equipment Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the impact forces determining its trajectory. Key drivers include the consistent global demand for timber and wood-based products, fueled by population growth, urbanization, and construction activities worldwide. Furthermore, advancements in forestry management practices that emphasize efficiency and sustainability, coupled with government initiatives promoting sustainable logging and reforestation, significantly propel market expansion. The rising cost of manual labor also drives the adoption of mechanized logging equipment like skidders, offering greater productivity and safety.

Conversely, several restraints impede market growth. The high initial capital investment required for purchasing skidders poses a significant barrier, particularly for small to medium-sized logging contractors, who may struggle with financing. Stringent environmental regulations aimed at protecting forests and biodiversity can limit logging operations or necessitate the use of more expensive, specialized equipment that complies with these standards. Fluctuations in timber prices due to economic cycles or oversupply can directly impact the profitability of logging operations, subsequently affecting investment in new equipment. Moreover, a shortage of skilled operators capable of handling advanced skidder machinery represents a growing challenge for the industry.

Opportunities within the market largely stem from technological innovation and expanding global reach. The integration of advanced technologies such as AI, telematics, and GPS offers avenues for developing smarter, more efficient, and safer skidders, including the potential for electric or hybrid models that address environmental concerns. Emerging markets in Asia-Pacific, Latin America, and Africa, with their abundant forest resources and developing infrastructure, present substantial growth prospects for skidder manufacturers and rental service providers. The increasing popularity of equipment rental and leasing services also provides a viable alternative for businesses to acquire modern skidders without the burden of full ownership, thus broadening market access.

Segmentation Analysis

The Skidder Equipment Market is comprehensively segmented to provide a detailed understanding of its diverse components, allowing for targeted market strategies and product development. These segmentations are typically based on factors such as the type of skidder, its engine power, the specific application it serves, and the end-user profile. Analyzing these segments helps in identifying niche markets, understanding competitive landscapes, and forecasting demand patterns across different operational contexts and user needs. The distinction between grapple and cable skidders, for instance, highlights the varied operational demands of modern forestry.

Further granularity in segmentation involves considering engine power, which directly correlates with the machines capacity and suitability for different logging tasks and timber sizes. The classification by application distinguishes between primary logging operations and tasks like thinning or forest maintenance, reflecting the specialized requirements for each. Moreover, understanding the primary end-users, whether large-scale forestry companies or independent contractors, reveals differing purchasing behaviors, financial capacities, and technological adoption rates. This multi-dimensional segmentation provides a robust framework for market analysis and strategic planning.

- By Type:

- Grapple Skidder

- Cable Skidder

- Clambunk Skidder

- By Engine Power:

- Less than 150 HP

- 150-300 HP

- More than 300 HP

- By Application:

- Logging

- Forest Management

- Land Clearing

- By End-User:

- Forestry Companies

- Logging Contractors

- Government & Public Sector

- Others (e.g., Construction for land prep)

- By Drive Type:

- Wheeled Skidder

- Tracked Skidder

Skidder Equipment Market Value Chain Analysis

The Skidder Equipment Markets value chain commences with upstream activities involving the sourcing and manufacturing of raw materials and core components. This stage includes suppliers of high-grade steel, engines, hydraulic systems, transmissions, tires, and advanced electronic components. These specialized suppliers ensure the provision of robust, durable, and technologically advanced parts that meet the rigorous demands of forestry machinery. Relationships at this upstream level are often long-term, characterized by mutual dependencies and a focus on quality assurance and innovation to produce reliable and efficient skidder components.

Moving downstream, the value chain encompasses the manufacturing and assembly of skidders by original equipment manufacturers (OEMs). These manufacturers integrate the various components, applying sophisticated engineering and design processes to produce the final skidder units. Post-manufacturing, the products move through distribution channels which can be direct or indirect. Direct channels typically involve OEMs selling directly to large forestry companies or government entities, often for fleet purchases. Indirect channels, which are more prevalent, involve a network of authorized dealers and distributors who provide sales, financing, aftermarket services, and spare parts to a broader range of customers, including smaller contractors and individual loggers.

The distribution channel plays a critical role in market reach, customer support, and brand reputation. Dealers and distributors often have extensive local knowledge and provide essential services such as maintenance, repairs, and technical support, which are crucial for heavy equipment. Furthermore, the value chain extends to end-users who operate the skidders for timber harvesting, forest management, and land clearing. Beyond sales, the value chain also includes aftermarket services, parts supply, and increasingly, equipment rental and leasing services, which add significant value by enhancing equipment accessibility and managing operational costs for end-users throughout the product lifecycle.

Skidder Equipment Market Potential Customers

The primary potential customers for skidder equipment are entities deeply involved in the forestry and timber industries, requiring robust solutions for efficient log extraction. This includes large-scale commercial logging companies that operate extensive timber harvesting operations, often across vast forest tracts. These companies prioritize high-capacity, durable, and technologically advanced skidders to maximize productivity and meet contractual obligations. Their purchasing decisions are influenced by factors such as total cost of ownership, operational efficiency, fleet management capabilities, and environmental compliance, driving demand for innovative and fuel-efficient models.

Independent logging contractors also form a significant customer segment, ranging from small-scale family-owned businesses to medium-sized enterprises. These contractors often work on projects for larger forestry companies or directly for landowners. Their buying preferences lean towards versatile, reliable, and cost-effective skidders that offer a strong return on investment. The availability of financing options, robust dealer support, and accessible aftermarket services are crucial considerations for this segment, with many opting for used equipment or rental solutions to manage capital expenditure.

Beyond traditional logging, government forestry departments and public land management agencies are also potential buyers, utilizing skidders for sustainable forest management, wildfire prevention, and ecological restoration projects. Additionally, construction companies involved in land clearing and site preparation for infrastructure development may also procure or rent skidders for their specific needs. The increasing focus on sustainable forestry and the growing demand for timber from various sectors ensure a diverse and continuously evolving customer base for skidder equipment, with each segment exhibiting unique purchasing drivers and operational requirements.

Skidder Equipment Market Key Technology Landscape

The Skidder Equipment Market is undergoing significant technological evolution, with innovations aimed at enhancing efficiency, safety, sustainability, and operator comfort. A paramount trend is the integration of advanced telematics and GPS systems, which provide real-time data on machine location, operational parameters, fuel consumption, and diagnostic codes. This data is crucial for optimizing fleet management, enabling predictive maintenance, and improving overall operational planning. GPS capabilities also facilitate precise navigation and route optimization, minimizing environmental impact and maximizing productivity in complex forest environments.

Furthermore, the development of sophisticated hydraulic systems and advanced engine technologies is driving improvements in fuel efficiency and power output. Modern skidders are increasingly equipped with intelligent hydraulic controls that adapt to varying loads, providing smoother operation and reducing energy waste. The advent of fuel-efficient diesel engines, compliant with stringent emission standards (e.g., Tier 4 Final/Stage V), is a critical technological advancement addressing environmental concerns and operational costs. Research into electric and hybrid powertrains is also gaining momentum, signaling a long-term shift towards zero-emission and quieter forestry equipment.

Another significant aspect of the technology landscape involves enhanced automation and safety features. Semi-autonomous functions, such as automated grapple control and route guidance, reduce operator fatigue and improve consistency. Advanced safety systems, including proximity sensors, rearview cameras, and intelligent braking systems, are becoming standard to minimize accidents and protect operators. Ergonomic cabin designs, improved visibility, and noise reduction technologies also contribute to a more comfortable and safer working environment, reflecting a holistic approach to technological advancement in the skidder equipment market.

Regional Highlights

- North America: A mature market characterized by high adoption of advanced, high-power skidders and sophisticated forestry management practices. Emphasis on telematics, automation, and environmental compliance drives innovation. Leading countries include the United States and Canada, with a strong presence of major manufacturers and a robust rental market.

- Europe: Driven by stringent environmental regulations, a focus on sustainable forestry, and a demand for fuel-efficient and low-emission equipment. Countries like Sweden, Finland, and Germany are leaders in developing advanced forestry machinery, with a strong preference for ergonomic and technologically integrated skidders.

- Asia-Pacific: The fastest-growing regional market, propelled by rapid industrialization, infrastructure development, and increasing demand for timber and wood products, particularly in China, India, and Southeast Asian nations. While price sensitivity remains, there is a gradual shift towards adopting more modern and efficient equipment.

- Latin America: Rich in forest resources, countries like Brazil and Chile contribute significantly to timber production. The market is growing, with increasing mechanization in logging operations. Demand is for durable and reliable skidders capable of operating in diverse and often challenging terrains.

- Middle East and Africa: An emerging market with developing forestry sectors. Growth is primarily driven by expanding agricultural land, land clearing for infrastructure projects, and initial mechanization efforts. Opportunities exist for robust, easy-to-maintain skidders, with a rising interest in both new and used equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Skidder Equipment Market.- John Deere

- Caterpillar Inc.

- Komatsu Ltd.

- Tigercat Industries Inc.

- Ponsse Plc

- Liebherr Group

- Volvo Construction Equipment

- Doosan Bobcat Inc.

- Weiler Inc.

- Cimbria Heid

- Log Max AB

- FAE Group S.p.A.

- ASV Holdings Inc.

Frequently Asked Questions

What is a skidder and its primary function?

A skidder is a heavy forestry machine designed to transport felled trees or logs from the cutting site (stump) to a landing or processing area. It is crucial for efficient and safe timber extraction in logging operations.

What are the main types of skidder equipment?

The primary types are grapple skidders, which use hydraulic arms to grasp and carry logs, and cable skidders, which employ a winch and cable system to pull logs. Clambunk skidders, less common, combine features to carry bundled logs.

How is AI impacting the Skidder Equipment Market?

AI is transforming skidders through features like predictive maintenance, optimized route planning, enhanced safety systems (e.g., collision avoidance), and potential for semi-autonomous operations, boosting efficiency and reducing operational risks.

What factors are driving the growth of the Skidder Equipment Market?

Key drivers include global demand for timber and wood products, increasing infrastructure development, advancements in sustainable forestry practices, and the need for greater operational efficiency and safety in logging operations.

Who are the leading manufacturers of skidder equipment?

Prominent manufacturers in the skidder equipment market include John Deere, Caterpillar Inc., Komatsu Ltd., Tigercat Industries Inc., and Ponsse Plc, among others, known for their robust and technologically advanced machinery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager