SLI Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428155 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

SLI Battery Market Size

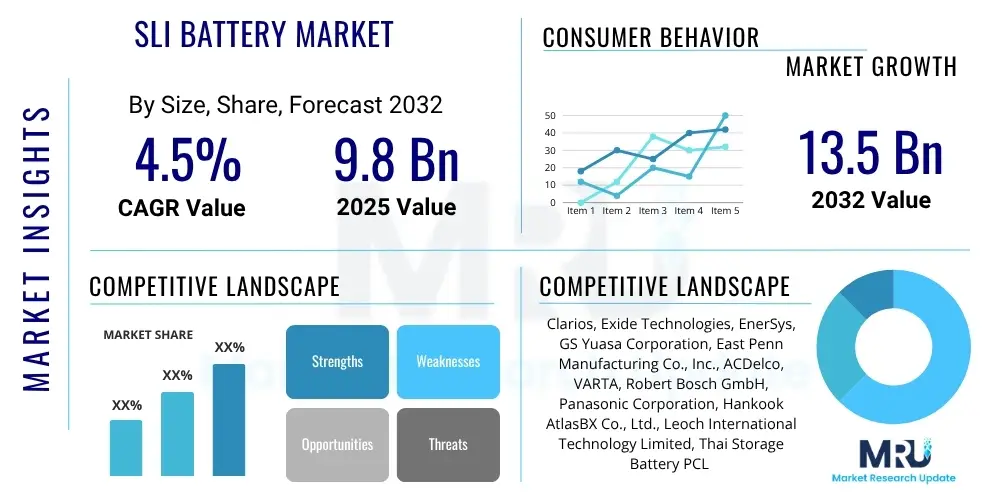

The SLI Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2025 and 2032. The market is estimated at USD 9.8 billion in 2025 and is projected to reach USD 13.5 billion by the end of the forecast period in 2032.

SLI Battery Market introduction

SLI (Starting, Lighting, Ignition) batteries remain an indispensable component in the vast majority of internal combustion engine (ICE) vehicles globally, serving critical functions that enable vehicle operation. These specialized lead-acid batteries are engineered to deliver a powerful, short burst of current necessary to crank the engine, initiating the combustion process. Beyond starting, they are responsible for supplying consistent power to vehicle lights, various electronic accessories, and onboard computer systems when the engine is idle or operating at low revolutions per minute. Their design prioritizes high discharge rates and robust performance, ensuring reliability across diverse climatic and operational conditions, solidifying their status as a foundational element of modern automotive technology despite the ongoing shift towards electrification.

The primary applications for SLI batteries span a wide spectrum of vehicles, including passenger cars, light-duty and heavy-duty commercial trucks, motorcycles, and specialized off-road or marine vehicles. The inherent benefits of SLI batteries, such as their proven reliability track record, cost-effectiveness in manufacturing and purchase, and ubiquitous availability through extensive global distribution networks, contribute to their enduring market presence. Key driving factors propelling the SLI battery market include the consistent and robust growth in global vehicle production, particularly in emerging economies, alongside the continuously expanding global vehicle parc which creates a perennial demand for replacement batteries, given their finite operational lifespan. Moreover, advancements in lead-acid technology that enhance durability and performance also contribute to sustained demand.

SLI Battery Market Executive Summary

The SLI battery market is currently experiencing a dynamic phase, characterized by a steady underlying demand coupled with significant technological evolution and shifting regional market emphasis. Dominant business trends underscore a concerted industry effort to enhance battery performance metrics, specifically focusing on extending operational lifespans, improving cold-cranking amperage (CCA) capabilities for reliable starting in harsh conditions, and optimizing charge acceptance rates. This focus is driven by increasingly demanding vehicle specifications, consumer expectations for greater reliability, and the growing complexity of onboard electronic systems in modern vehicles. Manufacturers are also prioritizing sustainable production practices and improved recyclability to address environmental concerns and regulatory pressures, aiming for a more environmentally conscious product lifecycle.

Regional trends reveal a bifurcated growth pattern: mature automotive markets in North America and Europe primarily rely on a robust aftermarket for replacement batteries and a gradual transition towards advanced lead-acid technologies like EFB and AGM to support sophisticated start-stop vehicle architectures. In stark contrast, the Asia Pacific region, particularly countries like China and India, exhibits vigorous growth fueled by soaring new vehicle production volumes and rapidly expanding vehicle ownership, creating substantial demand in both OEM and aftermarket segments. Segment trends highlight a resilient demand for conventional flooded lead-acid batteries, but also a discernible migration towards more advanced absorbed glass mat (AGM) and enhanced flooded battery (EFB) types, which are integral to modern fuel-efficient start-stop vehicles, indicating a technological upgrade within the lead-acid battery paradigm to meet evolving automotive requirements and environmental standards.

AI Impact Analysis on SLI Battery Market

The intersection of Artificial Intelligence (AI) and the traditional SLI battery market, while not immediately obvious given the mature nature of lead-acid technology, is increasingly drawing attention from industry stakeholders and consumers alike. Common user questions frequently probe into how AI might revolutionize the relatively established manufacturing processes for SLI batteries, seeking improvements in efficiency, quality control, and predictive maintenance. There is also significant curiosity regarding AI's potential to enhance the lifespan and performance characteristics of these batteries, perhaps through advanced material science research guided by AI, or by optimizing charge-discharge cycles within vehicle battery management systems. Users are keen to understand if AI can inject "smart" capabilities into conventional power sources, extending their utility and relevance in an increasingly electrified automotive landscape, even as they acknowledge the primary role of AI in next-generation battery chemistries. This forward-looking perspective seeks to integrate AI not just into future EV batteries but also to refine and extend the capabilities of current, essential SLI technologies, addressing concerns about reliability, environmental impact, and overall cost-effectiveness.

- AI algorithms can precisely monitor and analyze production line data in real-time, identifying anomalies and predicting equipment failures to minimize downtime and optimize manufacturing throughput for SLI batteries. This leads to reduced operational costs and improved consistency in product quality.

- Through machine learning models, AI can enhance the quality assurance process by detecting subtle defects in battery components or assembly stages that might be missed by traditional inspection methods, leading to higher product consistency and fewer warranty claims. This ensures greater customer satisfaction and brand reputation.

- AI-powered predictive maintenance strategies can forecast the remaining useful life of SLI batteries more accurately by analyzing historical performance data, usage patterns, and environmental conditions, enabling proactive replacement and preventing unexpected vehicle breakdowns. This improves vehicle reliability for end-users.

- The integration of AI into vehicle diagnostic systems can provide drivers and service technicians with immediate, actionable insights into the SLI battery's health, charge status, and potential issues, improving overall vehicle reliability and user experience. This empowers users with better battery management.

- AI can significantly accelerate research and development efforts in material science, exploring new lead alloys, electrolyte additives, and separator designs that could lead to SLI batteries with extended cycle life, improved cold-cranking performance, and enhanced deep-discharge capabilities. This pushes the boundaries of traditional lead-acid technology.

- Supply chain and logistics for SLI battery components and finished products can be optimized using AI-driven analytics, leading to more efficient inventory management, reduced transportation costs, and better responsiveness to market demand fluctuations. This enhances operational efficiency across the value chain.

- AI-based market analysis tools can provide sophisticated demand forecasting for SLI batteries, taking into account seasonal variations, economic indicators, and vehicle parc trends, thereby assisting manufacturers in optimizing production schedules and distribution strategies. This leads to more precise inventory planning.

- AI can contribute to environmental sustainability by optimizing recycling processes for lead-acid batteries, making them more efficient in recovering valuable materials and reducing waste, aligning with circular economy principles. This supports eco-friendly manufacturing.

- Even in hybrid vehicles, where a smaller SLI battery often powers ancillary systems, AI can optimize its interaction with the main traction battery and vehicle's electrical load, ensuring its longevity and efficient operation. This extends the applicability of SLI technology in evolving vehicle platforms.

DRO & Impact Forces Of SLI Battery Market

The SLI battery market is fundamentally driven by several robust factors that ensure its continued relevance and growth. Foremost among these drivers is the unwavering demand from the global automotive sector, underpinned by consistent new vehicle production volumes, particularly in burgeoning economies across Asia Pacific and Latin America. The sheer size of the existing global vehicle parc, comprising billions of internal combustion engine vehicles, necessitates a perennial aftermarket for replacement SLI batteries, given their finite operational lifespan, typically ranging from three to five years depending on usage and climate. Furthermore, continuous technological advancements, such as the development of Enhanced Flooded Batteries (EFB) and Absorbed Glass Mat (AGM) technologies, which offer superior performance and durability for modern vehicles with start-stop systems and higher electrical loads, also contribute significantly to market expansion by meeting evolving automotive demands.

However, the market also faces considerable restraints, primarily the accelerating global shift towards electric vehicles (EVs) which utilize fundamentally different battery chemistries for propulsion, albeit still requiring a 12V auxiliary battery, often a sophisticated lead-acid type, for ancillary systems. This long-term transition poses a significant challenge to the conventional SLI market for ICE vehicles. The volatility and fluctuating prices of key raw materials, especially lead, represent another significant constraint, impacting production costs, profit margins, and ultimately consumer pricing. Additionally, increasing competition from alternative battery technologies, even within the 12V auxiliary segment for EVs, could pose future restraints.

Opportunities for growth are abundant, particularly in emerging markets where increasing disposable incomes and expanding middle classes are fueling higher rates of vehicle ownership, thereby stimulating both OEM and aftermarket demand. There is also a substantial opportunity in developing more sustainable and recyclable SLI battery solutions to meet evolving environmental standards and consumer preferences for eco-friendly products, potentially leading to advanced recycling programs and material recovery. The development of maintenance-free SLI batteries and those with extended warranties also presents avenues for market expansion by enhancing consumer convenience and confidence. The ongoing demand for heavier duty SLI batteries for commercial and agricultural vehicles also presents a consistent opportunity.

The impact forces shaping the SLI battery market are diverse and influential. Stringent environmental regulations, particularly regarding lead usage and battery recycling, compel manufacturers to invest in cleaner production processes and efficient closed-loop recycling programs. This regulatory pressure fosters innovation in material science and manufacturing practices geared towards sustainability. The intensely competitive landscape within the SLI battery industry continuously pushes companies to innovate in terms of product design, performance, lifespan, and cost-effectiveness to gain or maintain market share. Moreover, the evolving consumer demand for more reliable, maintenance-free, and higher-performance batteries for increasingly complex vehicle electrical systems also acts as a significant force, compelling manufacturers to adapt and refine their product offerings to cater to these sophisticated requirements.

Segmentation Analysis

The SLI battery market exhibits a complex and multifaceted segmentation, allowing for a granular understanding of its various components and underlying dynamics. This segmentation is crucial for market participants to identify lucrative niches, tailor product development, and refine marketing and distribution strategies effectively. The breakdown by different criteria offers insights into how technological advancements, consumer preferences, and automotive industry shifts influence demand across diverse product categories and end-use applications, providing a comprehensive framework for strategic decision-making and competitive positioning within the global market landscape. Each segment carries distinct characteristics, growth trajectories, and competitive intensities, necessitating a tailored approach to capture specific market value and address unique customer needs across different regions and vehicle types.

- By Battery Type: This segment differentiates SLI batteries based on their internal construction, chemical composition, and technological characteristics, catering to varying vehicle requirements and performance demands.

- Flooded Lead-Acid Batteries: These are the most traditional and widely used SLI batteries, characterized by liquid electrolyte (sulfuric acid and water) that requires occasional maintenance (checking and topping up electrolyte levels). They offer robust construction, proven reliability, and cost-effectiveness. Flooded batteries are prevalent in older vehicles and some newer basic models, providing reliable starting power for standard applications without advanced electrical loads or start-stop systems. Their simple design contributes to their affordability.

- Enhanced Flooded Batteries (EFB): EFBs represent an advancement over conventional flooded batteries, specifically designed to offer improved cycle life and charge acceptance, making them suitable for entry-level start-stop vehicles. They feature thicker plates, specialized separators (often with a polyfleece scrim), and often higher compression of active material to prevent shedding, enhancing durability and partial state-of-charge operation. EFBs provide a cost-effective solution for vehicle manufacturers seeking to improve fuel efficiency and reduce emissions with basic start-stop functionality.

- Absorbed Glass Mat (AGM) Batteries: AGMs are premium SLI batteries where the electrolyte is absorbed into a fiberglass mat, allowing for a completely sealed, maintenance-free, and spill-proof design. They excel in deep cycling capabilities (handling repeated charge and discharge cycles), vibration resistance, and superior cold-cranking power, making them ideal for advanced start-stop systems, luxury vehicles, and vehicles with high electrical loads (e.g., numerous electronic accessories). AGMs offer superior performance, longer lifespan, and enhanced safety compared to EFBs and flooded types, justifying their higher price point.

- By Vehicle Type: This segmentation highlights the specific categories of vehicles that predominantly utilize SLI batteries, reflecting diverse power requirements, market volumes, and operational environments.

- Passenger Cars: This constitutes the largest segment, encompassing a vast array of vehicles such as sedans, SUVs, hatchbacks, and coupes. Demand is consistently driven by both new car sales (OEM segment) and the extensive aftermarket for replacements due to the sheer volume of passenger vehicles on roads globally. The varied electrical loads and performance expectations in this segment drive demand for all battery types from flooded to AGM.

- Commercial Vehicles: This broad category includes light-duty commercial vehicles (vans, pickups), medium-duty trucks, and heavy-duty trucks. These vehicles often require more robust, higher-capacity, and durable SLI batteries due to heavier electrical loads, demanding operational conditions, and the need for consistent reliability in fleet operations. Their higher operational hours and frequent starts often necessitate batteries designed for more severe use.

- Motorcycles: A distinct segment requiring smaller, compact, and often lighter SLI batteries optimized for fitting into confined spaces. These batteries must also offer good vibration resistance due to the nature of motorcycle operation. Both flooded and AGM types are used, with AGM gaining popularity for its maintenance-free benefits.

- Other Vehicles: This diverse category encompasses a variety of niche applications such as agricultural machinery (tractors, harvesters), construction equipment (excavators, loaders for starting auxiliary engines), All-Terrain Vehicles (ATVs), snowmobiles, marine vessels (boats, yachts), and small industrial equipment or generators. Each of these applications has unique battery specifications, often requiring enhanced durability and resistance to harsh environmental conditions.

- By Sales Channel: This categorizes how SLI batteries reach the end-user, illustrating the primary distribution pathways and their distinct market dynamics.

- OEM (Original Equipment Manufacturer): This channel involves direct sales to vehicle manufacturers for installation as standard equipment in new vehicles rolling off the production line. This segment is highly dependent on global automotive production volumes, long-term supply contracts, and stringent quality and performance specifications set by vehicle manufacturers. Relationships here are typically long-term and strategic.

- Aftermarket: This channel encompasses sales of replacement batteries to consumers, repair shops, and fleet operators for existing vehicles once their original battery expires or needs replacement. This is a massive and stable segment driven by the aging global vehicle parc, typical battery lifespan, and routine maintenance cycles. It involves a wide network of distributors, wholesalers, independent retailers, and service centers.

- By End-Use: While overwhelmingly automotive, this segment acknowledges other potential applications.

- Automotive: The dominant end-use, covering all vehicles powered by internal combustion engines (ICE) that require starting power and auxiliary electricity, including passenger cars, commercial vehicles, and motorcycles. This category encompasses both OEM and aftermarket demand.

- Industrial: This represents a smaller, niche segment where SLI batteries are used for starting small industrial engines, providing auxiliary power for specific machinery, backup power in certain industrial equipment, or in material handling equipment like forklifts (though traction batteries are more common for motive power, SLI might be for starting or control systems).

Value Chain Analysis For SLI Battery Market

The value chain for the SLI battery market is a complex ecosystem, beginning with the extraction and processing of fundamental raw materials and culminating in the delivery of finished products to diverse end-users. The upstream segment of the value chain is critical, involving the procurement of primary components such as lead, which is typically sourced from mining operations or, increasingly, from recycled batteries, showcasing a growing emphasis on circular economy principles. Other essential materials include sulfuric acid for the electrolyte, plastics for battery casings (predominantly polypropylene), and various alloys (like calcium, tin, silver) and chemicals for plate grids and active materials. Reliable access to these raw materials at stable prices is paramount for manufacturers, making strong supplier relationships, efficient sourcing strategies, and effective hedging against price volatility key competitive differentiators for sustained production and profitability.

Following raw material procurement, the manufacturing and assembly phase constitutes the core of the value chain where value is significantly added. This stage involves sophisticated processes including lead smelting and refining, grid casting or stamping, precise plate pasting with active materials, specialized curing processes, cell assembly, inter-cell welding, and final battery enclosure with robust terminals and ventilation systems (for flooded types). Quality control and technological innovation are vital here, influencing battery performance, lifespan, safety, and cost-effectiveness. Manufacturers invest significantly in automation, precision engineering, and rigorous testing protocols to ensure consistent product quality, optimize production efficiency, and adhere to stringent industry standards and environmental regulations, striving for zero-defect output and enhanced product durability. Research and development in this stage also focus on improving energy density and cold-cranking capabilities.

The downstream segment focuses on distribution and sales, which bifurcate into two primary channels: direct sales to Original Equipment Manufacturers (OEMs) and indirect sales to the aftermarket. OEM sales involve long-term contracts with major automotive manufacturers for integration into new vehicles. These relationships demand high volumes, consistent quality, and just-in-time delivery. The aftermarket, which is often larger by volume and value, relies on an extensive network of independent distributors, wholesalers, auto parts retailers (both brick-and-mortar and online platforms), independent repair shops, and authorized service centers. This robust, multi-tiered distribution infrastructure is essential for ensuring wide product availability, convenient access for consumers requiring replacement batteries, and efficient logistics for battery collection and recycling, driven by the sheer scale of the global vehicle parc and the necessity for timely replacements.

SLI Battery Market Potential Customers

The primary and most significant customer segment for SLI batteries comprises the global automotive industry, specifically the Original Equipment Manufacturers (OEMs). These manufacturers integrate SLI batteries as a standard component into every new internal combustion engine (ICE) vehicle produced, ranging from compact passenger cars and SUVs to heavy-duty commercial trucks and specialized agricultural vehicles. For OEMs, factors such as consistent supply volume, highly competitive pricing, strict compliance with specific vehicle electrical system requirements, and guaranteed long-term reliability and performance are paramount in their purchasing decisions, often leading to long-standing contractual relationships and collaborative product development with battery suppliers. The demand from this segment is directly correlated with global vehicle production volumes, making it a critical barometer for the SLI battery market's health and future trajectory.

Beyond the OEM segment, a vast and continuously growing customer base exists within the aftermarket. This includes millions of individual vehicle owners who require replacement SLI batteries as their existing ones reach the end of their operational life, typically every 3-5 years, influenced by driving conditions, climate, and maintenance. This segment is characterized by a high volume of transactions and a strong emphasis on brand reputation, product availability, ease of purchase, and warranty support. Fleet operators, managing diverse collections of vehicles for commercial, logistical, or governmental purposes, also represent a significant aftermarket customer group, often purchasing batteries in bulk and prioritizing extreme durability, consistent performance, and extended lifespans to minimize vehicle downtime and operational costs across their extensive vehicle rosters.

The distribution to these aftermarket customers is facilitated by a broad and intricate network of auto parts retailers, encompassing both large national and international chains as well as smaller independent stores, alongside rapidly growing online e-commerce platforms. Additionally, authorized dealership service centers and a multitude of independent automotive repair shops serve as crucial points of sale and installation for replacement SLI batteries. Furthermore, niche potential customers include operators of specialized vehicles such as agricultural machinery, construction equipment, marine vessels, and recreational vehicles (RVs). Although smaller in overall volume, these segments contribute to a steady demand for robust and often specialized SLI battery types specifically designed for their unique operational conditions, demanding performance requirements, and environmental exposures, underscoring the pervasive need for reliable starting and auxiliary power across various mobility and industrial applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 9.8 Billion |

| Market Forecast in 2032 | USD 13.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Clarios, Exide Technologies, EnerSys, GS Yuasa Corporation, East Penn Manufacturing Co., Inc., ACDelco, VARTA, Robert Bosch GmbH, Panasonic Corporation, Hankook AtlasBX Co., Ltd., Leoch International Technology Limited, Thai Storage Battery PCL (3K Batteries), Amara Raja Batteries Ltd., FIAMM Energy Technology S.p.A., Camel Group Co., Ltd., Sebang Global Battery Co., Ltd., Showa Denko Materials Co., Ltd. (formerly Hitachi Chemical), Banner Batteries, CSB Battery Co., Ltd., Trojan Battery Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SLI Battery Market Key Technology Landscape

The SLI battery market's technological landscape, while rooted in the mature lead-acid chemistry, is far from static, with continuous innovations focused on maximizing performance, extending lifespan, and enhancing reliability under increasingly demanding operational conditions. A significant area of development lies in the refinement of plate alloys. Manufacturers are consistently researching and adopting advanced lead alloys, such as calcium-calcium, lead-tin-calcium, and even silver alloys, which are designed to significantly reduce water loss (minimizing maintenance requirements), improve corrosion resistance for extended durability, and enhance conductivity for superior cold-cranking performance. These metallurgical advancements directly impact the battery's ability to withstand harsh temperatures and frequent charge-discharge cycles, thus improving overall longevity and ensuring reliable starts in diverse climates.

Another crucial technological frontier involves advancements in separator materials and construction within the battery cells. Traditional paper or plastic separators are being augmented or replaced by more advanced solutions, including specialized polyethylene envelopes that effectively prevent internal short circuits and reduce the shedding of active material from the plates, which is a common cause of battery failure. For more demanding applications, particularly in Enhanced Flooded Batteries (EFB) and Absorbed Glass Mat (AGM) batteries, glass mat technology (which absorbs the electrolyte, immobilizing it) plays a pivotal role. These innovations contribute significantly to the battery's ability to resist vibration, prevent stratification of the electrolyte (a common issue in flooded batteries), and maintain performance during partial state-of-charge operation, which is critical for vehicles equipped with sophisticated start-stop systems that frequently cycle the battery.

Furthermore, the continuous drive for improved manufacturing processes and design optimizations remains a cornerstone of technological progress across the SLI battery industry. This includes innovations in grid design, such as radial grids or expanded metal grids, which enhance current flow, increase power density, and improve overall electrical efficiency. Advancements in active material formulations, including the precise use of specific carbon additives to the lead paste, are also being explored to significantly improve charge acceptance and deep-cycling capabilities, particularly relevant for EFB and AGM technologies which endure more rigorous operational cycles. These collective technological refinements aim to deliver SLI batteries that are not only more powerful, durable, and reliable but also more environmentally friendly through optimized material usage and improved recyclability, ensuring their continued relevance and competitive edge in the evolving automotive ecosystem.

Regional Highlights

- North America: This region represents a highly mature and significant market for SLI batteries, characterized by a substantial existing vehicle parc and a strong focus on the aftermarket segment for replacement batteries. Consumers in North America often prioritize reliability, robust cold-cranking performance, and long warranty periods, which drive demand for high-quality products. The increasing adoption of vehicles with sophisticated start-stop technology is steadily driving a shift towards more advanced lead-acid batteries, specifically Enhanced Flooded Batteries (EFB) and Absorbed Glass Mat (AGM) types, which can better withstand the frequent engine shutdowns and restarts, contributing to fuel efficiency. Automotive innovation and a preference for vehicles with higher electrical loads also contribute to the demand for premium battery solutions, maintaining the region's prominent market share despite the gradual shift towards electric vehicles (EVs).

- Europe: The European SLI battery market is another mature yet dynamic region, heavily influenced by stringent environmental regulations and a strong emphasis on fuel efficiency, which often leads to the widespread integration of start-stop systems in vehicles. Similar to North America, the aftermarket for replacement batteries forms a significant portion of overall demand, supported by a large and aging vehicle fleet. Europe has been a pioneer in adopting start-stop technology across a wide range of vehicles, which has, in turn, fueled substantial demand for high-performance EFB and AGM batteries. These advanced technologies are crucial for helping vehicle manufacturers meet ambitious CO2 emission targets set by regulatory bodies. The region also benefits from a robust automotive manufacturing base, contributing to consistent OEM demand, while a strong focus on battery recycling and sustainable production practices further shapes the market landscape, pushing for eco-friendly solutions.

- Asia Pacific (APAC): The Asia Pacific region stands out as the fastest-growing and largest market for SLI batteries globally, driven by explosive growth in vehicle production and an unprecedented increase in vehicle ownership, particularly in rapidly developing economies like China, India, and Southeast Asian countries. This region accounts for a substantial share of both the OEM market, fueled by buoyant new vehicle sales, and the aftermarket, as the expanding vehicle parc ages and requires regular battery replacements. The increasing disposable incomes, rapid urbanization, and improving infrastructure contribute to higher demand for passenger and commercial vehicles. While traditional flooded batteries still dominate due to cost-effectiveness and prevalent vehicle types, there is a rising trend towards more advanced EFB and AGM batteries as vehicle sophistication, consumer demand for advanced features, and environmental awareness grow across the region, particularly in more developed markets like Japan, South Korea, and Australia.

- Latin America: The SLI battery market in Latin America demonstrates stable and consistent growth, primarily buoyed by expanding automotive manufacturing capabilities and rising disposable incomes that lead to increased vehicle sales across the region. Brazil and Mexico are key contributors to both vehicle production and battery demand within the region, hosting significant automotive manufacturing plants. The aftermarket for replacement batteries constitutes a critical and often dominant segment, driven by the aging vehicle fleet and the need for reliable power sources in diverse climatic conditions, which can be challenging. Economic stability, governmental policies supporting the automotive sector, and regional trade agreements play a vital role in shaping market dynamics and investment. While traditional flooded batteries remain popular due to their affordability, there is a gradual uptake of higher-performance alternatives as vehicle technology advances and consumer preferences evolve.

- Middle East and Africa (MEA): The MEA region is an emerging market for SLI batteries, characterized by increasing vehicle sales, significant infrastructure development, and a growing tourism sector, all contributing to automotive demand. The harsh climatic conditions in many parts of the Middle East, with extreme temperatures and sandy environments, place significant demands on battery durability and performance, favoring robust and reliable SLI solutions that can withstand such conditions. In Africa, urbanization, economic development, and improvements in road networks are driving higher vehicle ownership rates, fueling both OEM and aftermarket demand. Both segments are expanding, with a particular emphasis on batteries that can provide consistent starting power and withstand challenging environmental factors for a diverse range of passenger and commercial vehicles. Imports play a crucial role in meeting the region's demand, alongside localized manufacturing efforts in some countries, as the market matures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SLI Battery Market.- Clarios (formerly Johnson Controls Power Solutions)

- Exide Technologies

- EnerSys

- GS Yuasa Corporation

- East Penn Manufacturing Co., Inc.

- ACDelco (General Motors brand)

- VARTA (a Clarios brand)

- Robert Bosch GmbH

- Panasonic Corporation

- Hankook AtlasBX Co., Ltd.

- Leoch International Technology Limited

- Thai Storage Battery PCL (3K Batteries)

- Amara Raja Batteries Ltd.

- FIAMM Energy Technology S.p.A.

- Camel Group Co., Ltd.

- Sebang Global Battery Co., Ltd.

- Showa Denko Materials Co., Ltd. (formerly Hitachi Chemical)

- Banner Batteries

- CSB Battery Co., Ltd.

- Trojan Battery Company

Frequently Asked Questions

What is an SLI battery and its primary function in modern vehicles?

An SLI (Starting, Lighting, Ignition) battery is a crucial lead-acid battery designed for internal combustion engine (ICE) vehicles. Its primary function is to deliver a massive surge of electrical current for a short duration to crank the engine and initiate combustion. Additionally, it provides stable power for the vehicle's electrical systems, including lights, radio, dashboard, and various accessories, when the engine is off or idling, ensuring constant electrical supply and optimal vehicle operation. It is indispensable for the reliable functioning of a conventional vehicle's electrical system and engine start-up sequence.

What are the distinct technological types of SLI batteries available in the market today?

The market primarily offers three distinct types: traditional Flooded Lead-Acid batteries, which are cost-effective, require occasional maintenance, and are common in older vehicles or basic new models; Enhanced Flooded Batteries (EFB), designed with improved cycle life and charge acceptance for entry-level start-stop vehicles; and Absorbed Glass Mat (AGM) batteries, a premium solution offering superior deep cycling, vibration resistance, and cold-cranking performance, ideal for advanced start-stop systems, luxury vehicles, and those with high electrical demands. Each type caters to specific performance, maintenance, and budget requirements within the automotive sector.

What factors significantly influence the lifespan and performance of an SLI battery?

Several critical factors impact an SLI battery's lifespan and performance, including driving habits (frequent short trips prevent full charging, leading to sulfation), ambient temperature (extreme heat and cold accelerate degradation), battery type and quality (AGM generally lasts longer than flooded), maintenance practices (regular cleaning of terminals, checking connections), and the overall health of the vehicle's electrical system (e.g., faulty alternator can overcharge or undercharge). Overcharging, deep discharging, and excessive vibration can also severely reduce its longevity, making proper vehicle maintenance and appropriate battery selection essential for extending battery life and ensuring reliable operation.

How does the SLI battery market adapt to the automotive industry's shift towards electric vehicles (EVs)?

While propulsion in EVs relies on high-voltage traction batteries, SLI battery manufacturers are adapting by focusing on specialized 12V auxiliary batteries for EVs, which power essential low-voltage systems like lights, infotainment, and safety features. Furthermore, the robust aftermarket demand for SLI batteries in the vast existing fleet of internal combustion engine vehicles ensures continued relevance for the foreseeable future. Innovation in advanced lead-acid technologies like AGM, offering improved cycle life, faster recharge, and reliability, also helps manufacturers address the evolving needs of hybrid and sophisticated start-stop ICE vehicles, ensuring the technology remains a critical part of the automotive ecosystem, even in its transition.

What are the key drivers and restraints shaping the global SLI battery market?

Key drivers include consistent global new vehicle production, particularly in emerging markets, and the vast existing vehicle parc creating strong aftermarket replacement demand due to the finite lifespan of batteries. Technological advancements in lead-acid chemistry, enhancing performance and durability for modern vehicles, also contribute to market growth. Major restraints include the long-term industry shift towards electric vehicles, which reduces future demand for conventional SLI batteries in propulsion applications, and the volatility in raw material prices, particularly lead, which can impact production costs and market stability. Environmental regulations also significantly influence market dynamics, pushing for more sustainable production and recycling practices, shaping technological development.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager