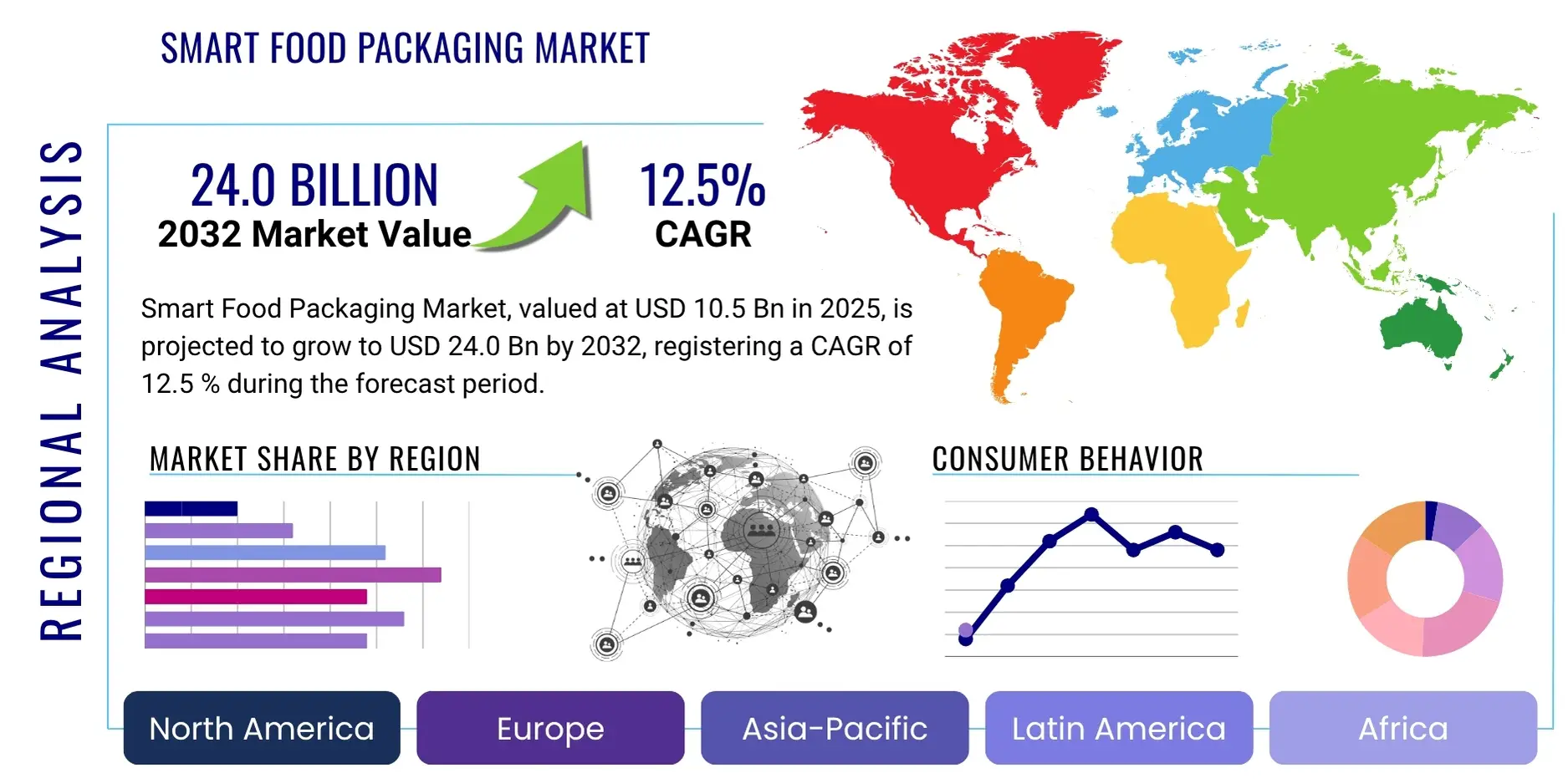

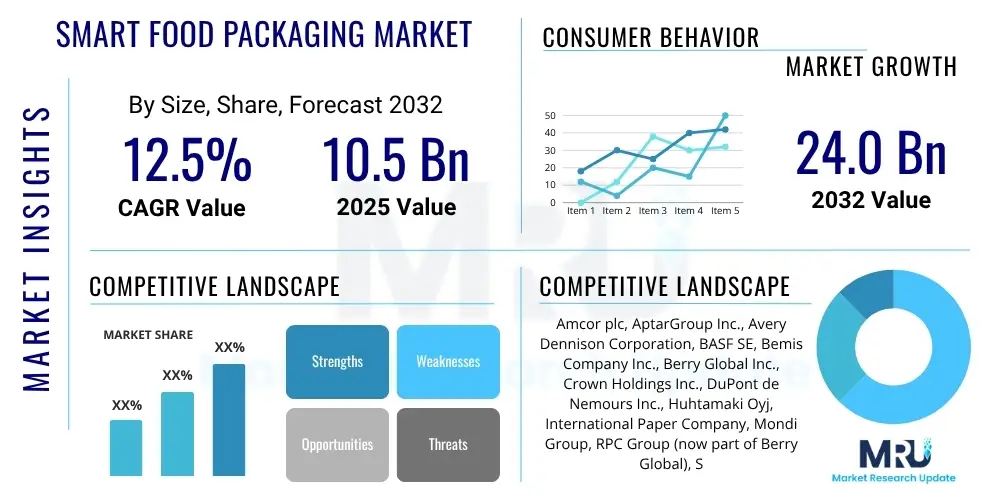

Smart Food Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428144 | Date : Oct, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Smart Food Packaging Market Size

The Smart Food Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 10.5 Billion in 2025 and is projected to reach USD 24.0 Billion by the end of the forecast period in 2032.

Smart Food Packaging Market introduction

The Smart Food Packaging Market encompasses innovative packaging solutions designed to monitor and communicate information about food products, extending shelf life, enhancing safety, and improving quality throughout the supply chain. This sophisticated technology integrates features like sensors, indicators, and data carriers directly into packaging materials, allowing for real-time tracking of conditions such as temperature, humidity, and gas composition. These advancements are crucial for perishable goods, ensuring optimal freshness and reducing food waste by providing transparent insights into product integrity from production to consumption. The fundamental objective is to move beyond passive protection, transforming packaging into an active component that interacts with its contents and environment, providing critical data to consumers and supply chain stakeholders.

Products within this market range from active packaging that actively changes the condition of the packed food, such as oxygen scavengers or moisture absorbers, to intelligent packaging that senses and communicates information, like freshness indicators or RFID tags. Major applications span a wide array of food categories including fresh produce, meat, poultry, seafood, dairy products, and ready-to-eat meals, where maintaining freshness and ensuring safety are paramount. The versatility of smart packaging allows it to be tailored to specific product needs, addressing challenges inherent in different food matrices and distribution networks. This adaptability is key to its growing adoption across various segments of the food industry, driven by both consumer expectations and regulatory mandates for improved food safety and quality assurance.

The benefits derived from smart food packaging are extensive, contributing significantly to reduced food spoilage, enhanced consumer confidence through transparency, and optimized logistics for producers and retailers. By providing real-time data on a product's condition, it enables more precise inventory management, minimizing losses from premature spoilage and improving supply chain efficiency. Key driving factors for market growth include a global increase in demand for fresh, minimally processed, and ready-to-eat foods, coupled with rising consumer awareness regarding food safety and traceability. Furthermore, stringent food waste reduction targets set by governments and environmental organizations, along with continuous technological advancements in sensor technology, IoT, and data analytics, are accelerating the adoption of these intelligent solutions across the food and beverage industry.

Smart Food Packaging Market Executive Summary

The Smart Food Packaging Market is experiencing dynamic growth, characterized by significant business trends that underscore a shift towards digitalization and sustainability within the food industry. Key business trends include the increasing integration of IoT and AI technologies into packaging solutions, enabling sophisticated data collection and analysis for predictive maintenance and real-time monitoring. There is a strong emphasis on developing sustainable smart packaging materials, particularly bioplastics and recycled content, to align with global environmental goals and consumer preferences for eco-friendly products. Furthermore, strategic collaborations between technology providers, packaging manufacturers, and food companies are becoming more prevalent, fostering innovation and accelerating market penetration for advanced smart packaging solutions. The market is also witnessing a rise in personalized packaging experiences, leveraging data to offer customized information and interactive features to end-users.

From a regional perspective, the market exhibits varied growth trajectories and adoption rates. Asia Pacific is poised for the fastest growth, driven by burgeoning populations, increasing disposable incomes, rapid urbanization, and a growing demand for convenience and packaged foods. North America and Europe, while being more mature markets, continue to lead in technological innovation and regulatory frameworks that support smart packaging. These regions are characterized by a high degree of consumer awareness regarding food safety and a strong focus on reducing food waste, which acts as a significant catalyst for smart packaging adoption. Latin America, the Middle East, and Africa are emerging as promising markets, with increasing investments in food infrastructure and a growing appreciation for the benefits of extended shelf life and enhanced product quality.

Segmentation trends reveal that active packaging, which directly interacts with the food to extend shelf life, currently holds a dominant share, primarily driven by the widespread use of oxygen scavengers and moisture absorbers. However, intelligent packaging, incorporating sensors, indicators, and connectivity features, is projected to experience a higher growth rate due to rapid advancements in IoT, RFID, and NFC technologies. Within intelligent packaging, freshness indicators and time-temperature indicators are seeing increasing adoption for their ability to provide visual cues about product quality. By application, the demand for smart packaging in perishable categories such as meat, poultry, seafood, and fresh fruits & vegetables remains robust, as these segments benefit most from extended shelf life and real-time quality monitoring. The market is also witnessing increased traction in the dairy and convenience food sectors, driven by the need for enhanced product safety and consumer engagement.

AI Impact Analysis on Smart Food Packaging Market

Common user questions related to the impact of AI on the Smart Food Packaging Market frequently revolve around how AI can enhance food safety, minimize food waste, and improve supply chain efficiency. Consumers and industry stakeholders alike are keen to understand AI's role in providing real-time quality assurance, predicting spoilage, and enabling greater transparency and traceability throughout the food journey. There is a strong interest in AI-powered solutions for automated inspection, dynamic shelf-life assessment, and personalized consumer information, addressing concerns about foodborne illnesses, sustainability, and informed purchasing decisions. The key themes include leveraging AI for predictive analytics, optimizing operational processes, and creating more interactive and trustworthy packaging experiences, with expectations for significant improvements in food security and environmental impact.

AI's influence on smart food packaging extends to transforming how products are monitored, managed, and consumed. By integrating machine learning algorithms with data collected from various sensors embedded in packaging, AI can analyze complex patterns and detect subtle changes indicative of spoilage or contamination far earlier than traditional methods. This capability is pivotal for perishable goods, allowing for dynamic adjustments in logistics and storage conditions, thereby preventing significant quantities of food from going to waste. Furthermore, AI facilitates the development of intelligent systems that can learn from vast datasets of environmental conditions, food characteristics, and consumer interactions, leading to more resilient and responsive packaging solutions that adapt to real-world challenges.

The implementation of AI in smart food packaging is also revolutionizing supply chain management by providing unparalleled levels of visibility and control. AI algorithms can optimize routes, manage inventory levels based on predicted shelf life, and alert stakeholders to potential issues before they escalate. This predictive power enhances operational efficiency, reduces transportation costs, and ensures that products reach consumers at their peak freshness. Beyond logistics, AI contributes to a more personalized consumer experience, enabling packaging to provide dynamic information, recipe suggestions, or even reordering prompts based on individual preferences and usage patterns, thus deepening engagement and building brand loyalty in an increasingly competitive market.

- Predictive Spoilage Detection: AI algorithms analyze sensor data (temperature, gas levels, humidity) to predict food spoilage rates with high accuracy, enabling proactive intervention and reducing waste.

- Optimized Inventory Management: AI-driven insights into product freshness and demand patterns allow retailers and manufacturers to optimize inventory levels, minimizing stockouts and overstocking.

- Enhanced Traceability and Transparency: AI integrates with blockchain and IoT sensors to provide end-to-end traceability, offering consumers and regulators transparent information about a product's origin, journey, and quality.

- Automated Quality Control: AI-powered vision systems can inspect packaging and product quality on production lines, identifying defects or contamination faster and more consistently than human operators.

- Dynamic Shelf-Life Monitoring: Leveraging real-time data, AI continuously updates and displays the actual remaining shelf life of products, offering more accurate information than static expiry dates.

- Personalized Consumer Interaction: AI enables smart packaging to deliver customized content, such as nutritional facts, allergen alerts, or recipe ideas, based on user preferences and product condition via QR codes or NFC.

- Improved Supply Chain Efficiency: AI optimizes logistics, routing, and storage conditions by predicting potential disruptions and suggesting the most efficient paths for perishable goods, reducing transit times and spoilage.

- Waste Reduction Strategies: By providing precise information on food quality and expected spoilage, AI supports targeted donation programs, dynamic pricing strategies, and better consumption planning, significantly contributing to global food waste reduction goals.

DRO & Impact Forces Of Smart Food Packaging Market

The Smart Food Packaging Market is propelled by several robust drivers, with increasing consumer demand for fresh and safe food at the forefront. As consumers become more health-conscious and seek products with extended freshness, the onus is on manufacturers to adopt technologies that can deliver on these expectations. This demand is further amplified by growing awareness regarding food waste, prompting both consumers and regulatory bodies to seek innovative solutions that prolong shelf life and ensure product integrity. Regulatory pressures worldwide, particularly in developed economies, mandating improved food safety standards and traceability, also serve as significant drivers, compelling the industry to invest in smart packaging technologies. Furthermore, continuous technological advancements in fields such as IoT, AI, and sensor development are making these sophisticated packaging solutions more feasible, cost-effective, and scalable, fostering broader adoption across the food and beverage sector.

Despite the strong driving forces, the market faces several significant restraints that could impede its growth. High initial investment costs associated with implementing smart packaging technologies, including specialized materials, sensors, and data management systems, represent a substantial barrier for many small and medium-sized enterprises (SMEs). The lack of standardized protocols and interoperability across different smart packaging solutions and supply chain systems creates complexities in integration and widespread adoption. Technical challenges related to sensor accuracy, data security, and power requirements for active components also pose hurdles. Additionally, consumer awareness and acceptance of these advanced packaging formats, particularly concerning their functionality and potential environmental impact, still require significant educational efforts. The potential for increased production costs being passed on to consumers is another restraint, as price sensitivity can limit market penetration.

Opportunities within the Smart Food Packaging Market are abundant and diverse, pointing towards considerable future growth. Emerging markets, particularly in Asia Pacific and Latin America, present vast untapped potential as economic development leads to increased consumption of packaged foods and a greater focus on food safety. The growing trend towards sustainable and biodegradable packaging materials offers a significant opportunity for integrating smart features into eco-friendly solutions, aligning with global environmental concerns. The rise of personalized nutrition and the demand for tailored food products create avenues for smart packaging to deliver customized information and interactive experiences. Continued innovation in advanced sensor technology, combined with the increasing integration of blockchain for enhanced traceability, will unlock new functionalities and applications. Furthermore, the expansion of e-commerce for food delivery services provides a fertile ground for smart packaging to ensure product quality and consumer trust during transit, offering real-time updates and quality verification.

The impact forces within the Smart Food Packaging Market are dynamic and influence its competitive landscape. The bargaining power of buyers is moderate to high, as large food manufacturers and retailers can exert significant pressure on packaging suppliers regarding pricing, quality, and customization. Conversely, the bargaining power of suppliers, especially those providing specialized sensors, active compounds, and advanced materials, is also moderate, given the proprietary nature of some core technologies. The threat of new entrants is moderate, as high capital investment, R&D costs, and the need for specialized expertise create barriers, but technological advancements can lower some entry points. The threat of substitute products, such as traditional packaging combined with external monitoring solutions, is moderate; however, smart packaging's integrated and real-time benefits differentiate it. Finally, competitive rivalry among existing players is high, driven by continuous innovation, strategic partnerships, and aggressive marketing efforts to capture market share in this evolving sector.

Segmentation Analysis

The Smart Food Packaging Market is comprehensively segmented to provide a detailed understanding of its diverse components and growth dynamics. These segmentations are crucial for identifying specific market drivers, challenges, and opportunities across different technological approaches, material compositions, and end-user applications. The primary categorization typically involves distinguishing between active and intelligent packaging, reflecting the two main functional paradigms of smart solutions. Furthermore, the market is dissected by the types of materials used, acknowledging the critical role of material science in packaging innovation, and by the various food and beverage applications, highlighting the specific needs and benefits that smart packaging addresses across different product categories.

Understanding these segments allows market players to tailor their product offerings, develop targeted marketing strategies, and allocate resources effectively. For instance, the demand for intelligent packaging with advanced sensors is distinct from the market for active packaging focused on chemical interaction. Similarly, the material choices for meat packaging differ significantly from those for dairy products or fresh produce, influenced by factors such as barrier properties, breathability, and aesthetic considerations. The application-based segmentation further helps to pinpoint high-growth areas and specific pain points within the food industry that smart packaging can effectively resolve, from extending the shelf life of highly perishable seafood to ensuring the freshness of convenience foods during transit. This granular analysis is essential for strategic planning and competitive positioning within the evolving smart food packaging landscape.

- By Technology: This segment distinguishes between the two core functional types of smart packaging solutions.

- Active Packaging: This involves packaging systems that incorporate components that actively interact with the food or the environment within the package to improve its quality, extend shelf life, or enhance safety. Examples include oxygen scavengers (which absorb oxygen to prevent oxidation), moisture absorbers (to control humidity), antimicrobial packaging (to inhibit microbial growth), and aroma emitters/absorbers. These solutions directly modify the package's internal atmosphere or interact with the food product itself.

- Intelligent Packaging: This category includes systems that monitor the condition of the packaged food or the environment around it and communicate information. These solutions do not directly interact with the food's chemistry but provide data or indicators.

- Sensors & Indicators: These are devices that detect and display information about the quality or safety of the food. Examples include time-temperature indicators (TTIs) that irreversibly change color based on temperature exposure, freshness indicators (e.g., pH sensors for meat spoilage), and gas sensors (e.g., CO2 or O2 levels).

- RFID (Radio-Frequency Identification): Tags that use electromagnetic fields to automatically identify and track items, crucial for supply chain management, inventory tracking, and anti-counterfeiting.

- NFC (Near Field Communication): A subset of RFID, enabling communication between devices over short distances (typically 4 cm or less) for consumer engagement, product authentication, and access to additional product information via smartphones.

- QR Codes & Barcodes (Advanced): While traditional, their integration with digital platforms for dynamic content, traceability, and consumer interaction positions them within the intelligent packaging sphere.

- By Material: This segmentation highlights the various base materials used for manufacturing smart packaging, each offering distinct properties and functionalities.

- Plastics: Dominant in the market due to their versatility, barrier properties, and cost-effectiveness. Includes PET, PP, PE, PVC, and others, often enhanced with active or intelligent components.

- Bioplastics: Environmentally friendly alternatives derived from renewable biomass sources, such as PLA (polylactic acid), PHA (polyhydroxyalkanoates), and starch-based polymers. Growing in demand due to sustainability concerns.

- Paper & Paperboard: Used for various applications, especially in secondary packaging, often laminated or coated to provide barrier properties. Smart features are integrated via printing or embedded elements.

- Glass: Valued for its inertness and transparency, primarily used for beverages and preserves. Smart coatings or labels can add intelligent functionalities.

- Metal: Cans and foils provide excellent barrier properties. Smart features can be incorporated through printing or embedded sensors/tags.

- By Application: This segment categorizes the market based on the specific food and beverage products that utilize smart packaging solutions, reflecting varying needs for preservation and information.

- Fruits & Vegetables: Crucial for extending shelf life, monitoring ripeness, and preventing spoilage due to their high perishability. Often uses modified atmosphere packaging, ethylene absorbers, and freshness indicators.

- Meat, Poultry & Seafood: Highly perishable products requiring strict temperature control and spoilage detection. Benefits greatly from oxygen scavengers, antimicrobial packaging, and time-temperature indicators.

- Dairy Products: Includes milk, yogurt, cheese, prone to microbial growth. Smart packaging helps monitor freshness, temperature abuse, and microbial contamination.

- Beverages: Especially sensitive to oxygen and light. Smart caps or labels can indicate freshness or tampering.

- Bakery & Confectionery: Focus on moisture control and preventing staling. Moisture absorbers and humidity sensors are key.

- Convenience Foods: Ready-to-eat meals, processed snacks. Demand for extended shelf life, portion control, and clear freshness indicators.

- Others: Includes condiments, sauces, pet food, and various specialty food items that can benefit from smart packaging solutions.

Value Chain Analysis For Smart Food Packaging Market

The value chain for the Smart Food Packaging Market is complex and highly integrated, beginning with the upstream suppliers of raw materials and specialized components. This initial stage involves companies providing basic packaging materials such as polymers, paperboard, glass, and metal, which form the foundation of smart packaging. Crucially, it also includes specialized technology providers who supply the advanced components that make packaging "smart"—such as miniature sensors (e.g., temperature, gas, pH), RFID/NFC chips, time-temperature indicators, and active compounds (e.g., oxygen scavengers, antimicrobial agents). Furthermore, software and data analytics providers play a vital upstream role, developing the platforms and algorithms necessary for processing and interpreting the data generated by intelligent packaging solutions. The quality, cost, and availability of these specialized inputs significantly impact the efficiency and innovation capacity of the entire value chain.

Moving downstream, the value chain encompasses the packaging manufacturers who integrate these raw materials and smart components into final packaging products. These manufacturers perform research and development to design functional, compliant, and cost-effective smart packaging solutions, including laminating, coating, printing, and embedding electronic components. Following this, the processed smart packaging is supplied to various food processors and manufacturers across different segments, such as fresh produce, meat & poultry, dairy, and convenience foods. These food companies are the direct end-users of the smart packaging, integrating it into their production lines to protect, preserve, and provide information about their products. Their requirements for specific functionalities, durability, and regulatory compliance drive the innovation and customization efforts of packaging manufacturers. The performance of smart packaging directly affects the quality and safety of the food products reaching the market.

The distribution channel for smart food packaging solutions can involve both direct and indirect routes. Direct distribution typically occurs when large food and beverage manufacturers procure customized smart packaging solutions directly from specialized packaging suppliers or technology integrators. This ensures close collaboration, tailored designs, and efficient supply chain management for high-volume orders. Indirect distribution, on the other hand, involves intermediaries such as packaging distributors, wholesalers, and third-party logistics providers who facilitate the supply of standard or semi-customized smart packaging options to a broader range of food companies, including SMEs. These indirect channels also play a role in disseminating new technologies and expanding market reach. Effective distribution is critical to ensure that smart packaging reaches the right customers efficiently, while also managing the complexities of temperature-sensitive components and specialized handling requirements. This integrated approach ensures that smart packaging fulfills its promise of enhancing food safety, quality, and supply chain transparency from production to point of sale.

Smart Food Packaging Market Potential Customers

The primary potential customers and end-users of smart food packaging solutions span a broad spectrum of the food and beverage industry, reflecting the diverse benefits these technologies offer in terms of product safety, quality, and shelf life extension. At the core, food and beverage manufacturers represent the largest customer segment. This includes companies producing highly perishable goods such as fresh meat, poultry, seafood, dairy products, and fruits & vegetables, where spoilage is a significant concern. Manufacturers of convenience foods, ready-to-eat meals, and processed snacks also increasingly adopt smart packaging to meet consumer demands for freshness, extended shelf life, and enhanced product information. These manufacturers leverage smart packaging to reduce product loss, comply with stringent food safety regulations, and improve brand reputation by delivering consistently high-quality products to market.

Beyond the direct manufacturers, retailers, including supermarkets, hypermarkets, and increasingly e-commerce food platforms, constitute another critical segment of potential customers. Retailers benefit immensely from smart packaging through reduced waste from spoiled inventory, improved stock rotation based on real-time freshness data, and enhanced consumer trust. The ability to offer products with verifiable freshness indicators can significantly differentiate their offerings and reduce financial losses associated with expired goods. E-commerce platforms, in particular, find smart packaging invaluable for ensuring product integrity during transit and providing transparency to online shoppers, addressing common concerns about the quality of delivered groceries and prepared meals.

Furthermore, logistics and supply chain companies are emerging as significant users, leveraging smart packaging for improved traceability and efficiency. These entities utilize intelligent packaging solutions, such as RFID tags and temperature sensors, to monitor goods in transit, optimize storage conditions, and quickly identify and isolate problematic batches in case of contamination or temperature excursions. This capability enhances operational efficiency, reduces cold chain breaches, and strengthens the overall resilience of the food supply chain. Additionally, pharmaceutical companies that handle food-grade ingredients or specialized nutraceutical products also represent a niche but important customer segment, seeking the same level of integrity, traceability, and quality assurance that smart packaging offers to ensure product efficacy and regulatory compliance. The versatility of smart packaging ensures its appeal across various stakeholders focused on delivering safe, fresh, and high-quality food products to consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 10.5 Billion |

| Market Forecast in 2032 | USD 24.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, AptarGroup Inc., Avery Dennison Corporation, BASF SE, Bemis Company Inc., Berry Global Inc., Crown Holdings Inc., DuPont de Nemours Inc., Huhtamaki Oyj, International Paper Company, Mondi Group, RPC Group (now part of Berry Global), Sealed Air Corporation, Sonoco Products Company, WestRock Company, Stora Enso Oyj, Constantia Flexibles Group GmbH, SEE (formerly Sealed Air), Digimarc Corporation, Insignia Technologies Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Food Packaging Market Key Technology Landscape

The Smart Food Packaging Market is underpinned by a diverse and rapidly evolving technological landscape that integrates cutting-edge advancements from various scientific and engineering disciplines. Key among these are sensor technologies, which form the bedrock of intelligent packaging by enabling the detection of changes in temperature, humidity, gas composition (e.g., oxygen, carbon dioxide), and pH levels. These sensors can be chemical, biological, or physical, and their miniaturization and cost-effectiveness are crucial for widespread adoption. Time-Temperature Indicators (TTIs) and Freshness Indicators (FIs) represent a significant portion of this segment, offering visual, irreversible changes that directly correlate with product degradation or temperature abuse, providing immediate cues to consumers and supply chain managers about product quality and safety.

Connectivity and data communication technologies are equally vital for transforming packaging into an interactive and informative tool. Radio-Frequency Identification (RFID) and Near Field Communication (NFC) tags allow for wireless data transfer, enabling automated tracking, inventory management, anti-counterfeiting measures, and enhanced consumer engagement through smartphone interactions. QR codes, while simpler, are increasingly integrated with dynamic digital platforms to provide real-time product information, traceability data, and personalized content. The Internet of Things (IoT) plays a transformative role by connecting these intelligent packages to cloud-based platforms, facilitating the collection, storage, and analysis of vast amounts of data from across the supply chain, thereby enabling proactive decision-making and optimization.

Furthermore, active packaging technologies represent another critical facet, focusing on components that actively modify the package environment to extend shelf life. This includes oxygen scavengers that absorb residual oxygen to prevent oxidation and microbial growth, moisture absorbers that control humidity to prevent condensation and maintain crispness, and antimicrobial agents embedded in packaging films to inhibit bacterial contamination. The integration of advanced materials science, such as biodegradable polymers infused with smart capabilities, and the application of artificial intelligence (AI) and machine learning for predictive analytics and automated quality control, are pushing the boundaries of what smart food packaging can achieve. Blockchain technology is also gaining traction for enhancing the traceability and transparency of the food supply chain, providing an immutable record of a product's journey, which smart packaging can verify at various touchpoints.

Regional Highlights

- North America: This region stands as a significant market for smart food packaging, characterized by early adoption of advanced technologies and a strong emphasis on food safety and waste reduction. The United States and Canada are at the forefront, driven by a high disposable income, sophisticated retail infrastructure, and a robust regulatory environment that encourages innovations in food preservation and traceability. Consumers in North America are increasingly health-conscious and demand fresh, high-quality products with transparent information, fueling the growth of intelligent packaging solutions like freshness indicators and RFID tags. Significant investments in research and development, coupled with the presence of major packaging and technology companies, further solidify the region's leadership in the smart food packaging market, particularly for meat, poultry, and convenience foods.

- Europe: Europe represents a mature yet dynamically growing market for smart food packaging, heavily influenced by stringent food safety regulations, a strong focus on sustainability, and a widespread commitment to reducing food waste. Countries like Germany, the UK, France, and the Netherlands are key contributors, demonstrating high consumer awareness regarding product quality and environmental impact. The region leads in the adoption of active packaging solutions, particularly those involving modified atmosphere packaging and antimicrobial technologies, driven by a preference for fresh, minimally processed foods. European initiatives to promote circular economy principles also accelerate the development and adoption of smart packaging made from recycled or biodegradable materials, enhancing both environmental credentials and product information capabilities through NFC and QR code integration.

- Asia Pacific (APAC): The Asia Pacific region is anticipated to be the fastest-growing market for smart food packaging, propelled by its enormous population, rapidly expanding economies, increasing urbanization, and evolving dietary habits. Countries like China, India, Japan, and Australia are witnessing a surge in demand for packaged and processed foods, coupled with a growing middle class that prioritizes food safety and quality. The region's diverse climate zones and long supply chains make smart packaging solutions, such as temperature and humidity sensors, crucial for mitigating spoilage. Significant investments in food infrastructure, coupled with technological advancements and the increasing penetration of e-commerce, are fostering an environment ripe for the adoption of both active and intelligent packaging, particularly in fresh produce, dairy, and ready-to-eat segments.

- Latin America: The Latin American market for smart food packaging is in a nascent but rapidly developing stage, driven by increasing foreign investment, modernization of the food industry, and rising consumer awareness regarding food quality and hygiene. Brazil, Mexico, and Argentina are key countries where urbanization and changes in retail landscapes are boosting the demand for packaged foods. While price sensitivity remains a factor, there is a growing appreciation for the benefits of extended shelf life and reduced waste offered by smart packaging. The focus initially tends to be on basic active packaging solutions, such as oxygen scavengers, and low-cost intelligent indicators, but as economic conditions improve and technological access increases, more sophisticated IoT and sensor-based solutions are expected to gain traction.

- Middle East and Africa (MEA): The MEA region presents an emerging but promising market for smart food packaging, influenced by growing populations, increasing disposable incomes, and significant concerns about food security and waste. Countries in the GCC (Gulf Cooperation Council) states, along with South Africa, are leading the adoption, driven by climate challenges that necessitate robust food preservation and the growth of modern retail formats. The reliance on food imports further underscores the need for effective packaging solutions to maintain quality during transit. While the market is still developing, there is a clear trend towards investing in technologies that can extend shelf life, monitor cold chains, and enhance food safety, particularly for fresh produce and meat products. The adoption of smart packaging is also seen as a strategic move to address food loss and improve the overall efficiency of the regional food supply chain.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Food Packaging Market.- Amcor plc

- AptarGroup Inc.

- Avery Dennison Corporation

- BASF SE

- Bemis Company Inc.

- Berry Global Inc.

- Crown Holdings Inc.

- DuPont de Nemours Inc.

- Huhtamaki Oyj

- International Paper Company

- Mondi Group

- RPC Group (now part of Berry Global)

- Sealed Air Corporation

- Sonoco Products Company

- WestRock Company

- Stora Enso Oyj

- Constantia Flexibles Group GmbH

- SEE (formerly Sealed Air)

- Digimarc Corporation

- Insignia Technologies Ltd.

Frequently Asked Questions

Analyze common user questions about the Smart Food Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is smart food packaging?

Smart food packaging refers to innovative packaging systems that go beyond traditional containment and protection by actively monitoring, sensing, recording, or communicating information about the product's condition and environment. It encompasses two main types: active packaging, which interacts with the food to extend shelf life (e.g., oxygen scavengers), and intelligent packaging, which senses and communicates information about the food's quality or safety (e.g., freshness indicators, RFID tags). These technologies aim to enhance food safety, minimize waste, and provide real-time data to consumers and supply chain stakeholders, leading to improved quality and transparency throughout the food journey.

What are the main benefits of smart food packaging?

The primary benefits of smart food packaging are multi-faceted, addressing critical challenges in the food industry. Firstly, it significantly extends the shelf life of perishable goods by actively controlling the internal atmosphere or signaling spoilage, leading to a substantial reduction in food waste. Secondly, it enhances food safety by providing real-time indicators of temperature abuse or bacterial growth, assuring consumers of product integrity and preventing foodborne illnesses. Thirdly, smart packaging improves supply chain efficiency through better inventory management, traceability, and optimized logistics. Lastly, it boosts consumer engagement and trust by offering transparent information about product freshness, origin, and quality, often through interactive digital interfaces.

How does intelligent packaging differ from active packaging?

Intelligent packaging and active packaging, while both forms of smart packaging, differ fundamentally in their mode of action. Active packaging directly interacts with the food or the environment within the package to improve its quality, extend its shelf life, or enhance safety. Examples include oxygen scavengers that absorb oxygen, moisture absorbers, or antimicrobial films. Its function is to modify the package's internal conditions. In contrast, intelligent packaging monitors the condition of the packaged food or its surrounding environment and communicates this information. It senses changes (e.g., temperature, gas levels) and displays data or indicators (e.g., time-temperature indicators, RFID tags), without directly changing the food's chemistry or the package's atmosphere. Its primary role is to provide information for decision-making.

What role does AI play in smart food packaging?

Artificial Intelligence (AI) plays a transformative role in smart food packaging by enabling advanced data analysis, predictive capabilities, and enhanced decision-making. AI algorithms can process vast amounts of data collected from sensors (e.g., temperature, humidity, gas) embedded in intelligent packaging to accurately predict spoilage rates, optimize inventory management, and dynamically monitor a product's remaining shelf life. Furthermore, AI enhances traceability and transparency by integrating with IoT and blockchain, providing real-time, verifiable information about a product's journey. It also powers automated quality control systems, identifies defects, and can personalize consumer interactions by delivering tailored information, thereby maximizing efficiency, minimizing waste, and boosting consumer trust in the food supply chain.

What are the challenges faced by the smart food packaging market?

The smart food packaging market faces several significant challenges despite its promising growth. High initial investment costs for implementing advanced technologies, including specialized sensors, RFID/NFC tags, and data management systems, can be prohibitive for many businesses, especially SMEs. A lack of industry-wide standardization and interoperability among different smart packaging solutions and supply chain systems creates integration complexities and slows widespread adoption. Technical hurdles, such as ensuring sensor accuracy, maintaining data security, and managing power requirements for active components, also pose difficulties. Moreover, consumer awareness and acceptance, along with the perception of increased production costs being passed on to consumers, are crucial factors that need to be addressed for market expansion and deeper penetration. Addressing these challenges through collaborative efforts and technological advancements is key to unlocking the full potential of smart food packaging.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager