Smart Gas Meter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428003 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Smart Gas Meter Market Size

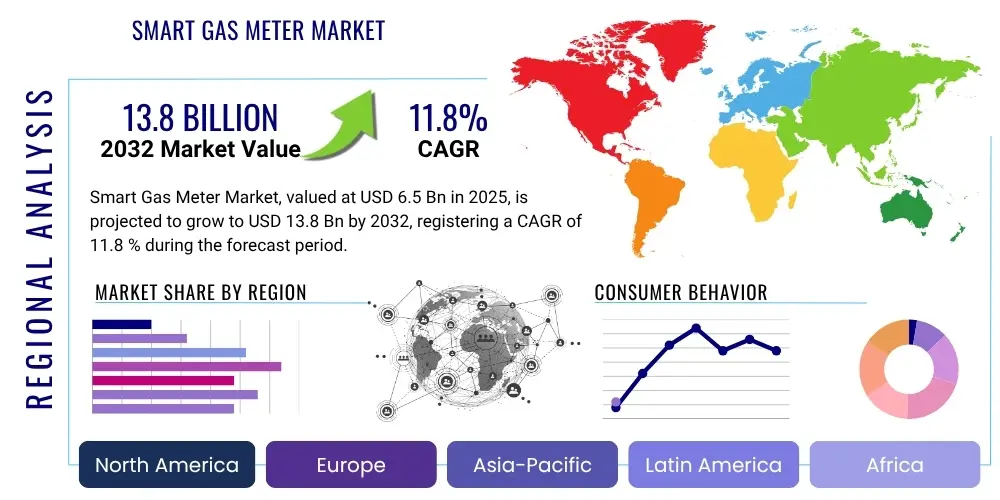

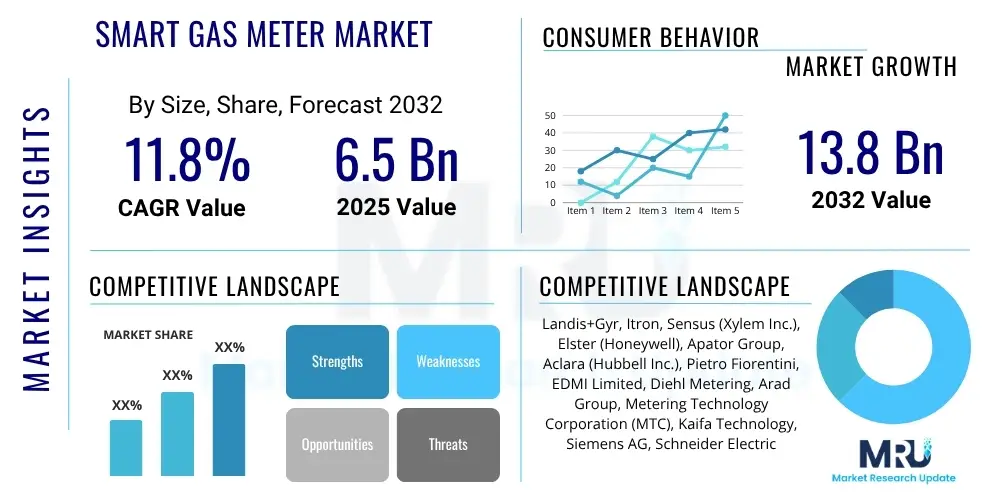

The Smart Gas Meter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2025 and 2032. The market is estimated at USD 6.5 Billion in 2025 and is projected to reach USD 13.8 Billion by the end of the forecast period in 2032.

Smart Gas Meter Market introduction

The Smart Gas Meter Market is experiencing robust expansion, driven by a global imperative for enhanced energy efficiency, improved grid management, and reduction of carbon emissions. Smart gas meters represent a significant technological leap from traditional analog meters, offering advanced functionalities such as remote data collection, real-time consumption monitoring, and sophisticated analytics. These devices integrate communication modules that allow for seamless data transmission to utility providers and consumers, fostering greater transparency and control over gas usage. The primary objective is to modernize gas distribution networks, minimize non-revenue gas (NRG) losses, and empower consumers with actionable insights to optimize their energy consumption patterns.

Product descriptions of smart gas meters typically highlight features such as automatic meter reading (AMR) or advanced metering infrastructure (AMI) capabilities, ensuring accurate billing and eliminating the need for manual readings. They often incorporate tamper detection mechanisms, shut-off valves, and advanced diagnostic tools, significantly enhancing safety and operational efficiency for utility companies. Major applications span across residential, commercial, and industrial sectors, where these meters are deployed to manage gas supply, monitor consumption, and facilitate billing processes more effectively. The versatility of these meters allows for integration into broader smart city initiatives and Internet of Things (IoT) ecosystems, further extending their utility.

The benefits derived from smart gas meters are multifaceted, impacting both consumers and utility providers. For consumers, benefits include access to real-time consumption data, enabling informed decisions to reduce bills and carbon footprints, along with more accurate and transparent billing. Utility companies profit from operational cost reductions through automated meter reading, improved network monitoring, leak detection, and enhanced customer service. Key driving factors fueling market growth include stringent government regulations mandating smart meter deployment, increasing focus on energy conservation, the growing adoption of smart grid technologies, and the rising demand for real-time data for better resource management. Additionally, technological advancements in communication infrastructure and sensor technology are making smart meters more accessible and cost-effective.

Smart Gas Meter Market Executive Summary

The Smart Gas Meter Market is characterized by dynamic business trends, marked by significant investment from utility providers and technology developers in infrastructure upgrades and innovative solutions. A notable trend is the shift towards advanced metering infrastructure (AMI) solutions, which offer two-way communication capabilities, enabling utilities to remotely monitor, control, and analyze gas consumption data with unprecedented precision. This transition is fostering a more data-driven approach to utility management, optimizing resource allocation, and enhancing customer engagement. Furthermore, strategic collaborations and partnerships between meter manufacturers, communication technology providers, and software developers are becoming increasingly common to deliver integrated, end-to-end smart metering solutions that address complex operational requirements and regulatory demands.

Regionally, the market exhibits varied growth trajectories, with Europe and North America leading in adoption due to robust regulatory frameworks, established smart grid initiatives, and substantial government funding for modernization projects. The Asia Pacific region is rapidly emerging as a high-growth market, driven by urbanization, increasing energy demand, and government policies promoting energy efficiency in developing economies like China and India. Latin America, the Middle East, and Africa are also showing nascent but promising growth, primarily propelled by new infrastructure developments and efforts to reduce non-revenue gas losses. Each region's unique energy landscape and regulatory environment influence the pace and scope of smart gas meter deployments, creating diverse opportunities for market players.

Segmentation trends reveal significant growth across all end-user sectors, with the residential segment remaining the largest, driven by mass deployments in households. However, the commercial and industrial segments are also experiencing accelerated adoption, as businesses seek to optimize energy usage and reduce operational costs. Technologically, there is a strong inclination towards advanced communication modules such as Narrowband IoT (NB-IoT) and LoRaWAN, offering cost-effective and wide-area coverage for data transmission. The market is also witnessing increasing demand for integrated software platforms that provide comprehensive data analytics, visualization, and billing functionalities. The push for interoperability and standardization across different meter types and communication protocols is a key trend shaping future product development and market dynamics, ensuring seamless integration and scalability of smart metering systems.

AI Impact Analysis on Smart Gas Meter Market

The integration of Artificial Intelligence (AI) into the Smart Gas Meter Market is poised to revolutionize operational efficiencies, data processing capabilities, and predictive analytics, addressing common user questions about how technology can enhance safety, accuracy, and overall utility management. Users frequently inquire about AI's role in detecting anomalies, optimizing gas distribution, improving maintenance schedules, and bolstering cybersecurity for critical infrastructure. The primary themes revolving around AI's influence include its capacity to transform raw consumption data into actionable intelligence, its potential to identify subtle patterns indicative of leaks or tampering, and its promise to create more resilient and responsive gas networks. Expectations are high for AI to move beyond basic data collection to sophisticated predictive models that can preempt issues and streamline resource allocation, leading to significant cost savings and improved service delivery.

AI algorithms, particularly machine learning, are instrumental in processing the vast amounts of data generated by smart gas meters. This advanced data analysis allows utilities to identify consumption anomalies that might indicate leaks, inefficient appliance usage, or even potential tampering, which traditional methods often miss. By learning from historical consumption patterns and external factors like weather, AI can build accurate predictive models for demand forecasting, optimizing gas supply and preventing shortages or oversupply. This capability not only enhances operational efficiency but also contributes significantly to network stability and safety, providing a proactive approach to gas management rather than a reactive one.

Furthermore, AI applications extend to predictive maintenance for smart gas meters and the underlying infrastructure. By analyzing meter performance data, AI can predict potential equipment failures before they occur, enabling utilities to schedule maintenance proactively and avoid costly outages or service disruptions. This translates into longer asset lifecycles and reduced operational expenditures. The implementation of AI also enhances customer service by offering personalized insights into energy usage, helping consumers understand and manage their consumption more effectively. This intelligent feedback loop fosters greater engagement and can lead to sustained behavioral changes that contribute to energy conservation goals, addressing user expectations for more personalized and impactful energy management tools.

- AI enables advanced anomaly detection for leaks, tampering, and inefficient usage patterns, significantly improving safety and reducing non-revenue gas.

- Machine learning algorithms enhance demand forecasting accuracy, optimizing gas supply management and preventing service disruptions.

- Predictive maintenance driven by AI minimizes downtime and extends the lifespan of smart gas meters and infrastructure components.

- AI-powered data analytics transform raw consumption data into actionable insights for both utilities and consumers, promoting energy efficiency.

- Enhanced cybersecurity measures can be developed using AI to detect and respond to unusual network activities, protecting critical infrastructure.

- Personalized energy consumption recommendations for consumers, fostering greater engagement and promoting energy conservation.

- Optimization of gas distribution networks through real-time data analysis and AI-driven routing, improving overall system efficiency.

DRO & Impact Forces Of Smart Gas Meter Market

The Smart Gas Meter Market is shaped by a complex interplay of drivers, restraints, and opportunities, all influenced by various impact forces that dictate its growth trajectory. Key drivers include the stringent regulatory mandates imposed by governments worldwide, compelling utility providers to adopt smart metering technologies to modernize their infrastructure and improve efficiency. The growing global emphasis on energy conservation and environmental sustainability further propels market expansion, as smart meters offer a tangible solution for reducing carbon footprints and optimizing resource consumption. Additionally, the increasing demand for real-time consumption data, driven by both utilities seeking operational insights and consumers desiring greater control over their energy usage, serves as a significant impetus. The declining costs of sensor technology and communication modules also make smart meter deployment more economically viable, accelerating adoption rates.

Despite these strong drivers, the market faces several significant restraints. High initial investment costs associated with large-scale deployment of smart gas meters and the accompanying Advanced Metering Infrastructure (AMI) represent a major barrier for many utility companies, especially in developing regions. Concerns around data privacy and cybersecurity are paramount, as smart meters collect sensitive consumption data, making robust security protocols essential but also complex and costly to implement. The lack of standardized communication protocols and interoperability issues between different smart meter systems can hinder seamless integration and mass deployment. Furthermore, the complexity of integrating new smart meter systems with legacy IT infrastructure within utility companies often presents considerable technical and logistical challenges, delaying adoption.

Amidst these challenges, numerous opportunities for market growth emerge. The integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics, anomaly detection, and demand forecasting presents a substantial avenue for innovation and value creation. The expansion into developing economies, particularly in Asia Pacific and parts of Africa, offers untapped growth potential as these regions embark on infrastructure modernization. Opportunities also lie in the integration of smart gas meters with broader smart home and smart city ecosystems, creating a more interconnected and intelligent urban environment. Furthermore, the development of new, more efficient sensing technologies and the provision of enhanced data analytics services as a value-add can differentiate market players and stimulate demand, transforming raw data into highly valuable insights for both utilities and end-users. These factors collectively illustrate the dynamic and evolving nature of the smart gas meter landscape.

Segmentation Analysis

The Smart Gas Meter Market is comprehensively segmented across various dimensions to provide granular insights into its structure and growth dynamics. These segmentations typically encompass criteria such as meter type, application, technology, end-user, connectivity, and component, allowing for a detailed understanding of market trends, competitive landscapes, and emerging opportunities. Each segment offers distinct characteristics and growth drivers, reflecting the diverse requirements of different customer groups and the evolving technological advancements within the industry. Analyzing these segments is crucial for stakeholders to identify key growth areas and tailor their strategies effectively.

- By Type: Diaphragm Gas Meters, Rotary Gas Meters, Ultrasonic Gas Meters, Thermal Mass Flow Meters, Others

- By Application: Residential, Commercial, Industrial

- By Technology: Advanced Metering Infrastructure (AMI), Automatic Meter Reading (AMR), Communication Modules (e.g., NB-IoT, LoRaWAN, Cellular, RF Mesh)

- By End-User: Utilities, Commercial & Industrial Enterprises, Public Sector

- By Connectivity: Cellular (2G/3G/4G/5G, NB-IoT, LTE-M), Radio Frequency (RF), LPWAN (LoRaWAN, Sigfox), Wired (Ethernet, Powerline Communication)

- By Component: Meters (Hardware), Communication Modules, Software (Data Management, Billing, Analytics), Services (Installation, Maintenance, Consulting)

Value Chain Analysis For Smart Gas Meter Market

The value chain for the Smart Gas Meter Market is intricate, spanning from raw material suppliers to end-users, involving multiple stages of production, distribution, and service delivery. The upstream segment primarily involves the procurement of essential raw materials and components, such as sensors, microcontrollers, communication chips, enclosures, and various electronic parts. These are sourced from a global network of specialized suppliers, forming the foundational layer for meter manufacturing. Key activities at this stage include research and development for new sensor technologies and component miniaturization, ensuring the reliability, accuracy, and longevity of the meters. Strong relationships with high-quality component providers are critical for maintaining product standards and managing supply chain costs, particularly given the specialized nature of some electronic components and communication modules.

Midstream activities revolve around the manufacturing and assembly of smart gas meters, where various components are integrated into a functional device. This stage involves sophisticated manufacturing processes, quality control, calibration, and firmware programming. Meter manufacturers often specialize in different types of meters (e.g., ultrasonic, diaphragm) and incorporate various communication technologies (e.g., NB-IoT, LoRaWAN, cellular). Following manufacturing, meters undergo rigorous testing to ensure compliance with international standards and regulatory requirements. The midstream also includes the development of software solutions, such as Meter Data Management (MDM) systems and analytics platforms, which are crucial for processing and utilizing the data collected by the meters. These software solutions are often developed by specialized IT firms or in-house by meter manufacturers.

The downstream segment encompasses the distribution, installation, and ongoing services for smart gas meters. Distribution channels can be direct, where manufacturers sell directly to large utility companies, or indirect, involving distributors, system integrators, and value-added resellers who manage local sales and support. Installation services are often provided by utility companies themselves, specialized contractors, or third-party service providers, requiring trained personnel to ensure proper deployment and commissioning. Post-installation, the value chain extends to ongoing maintenance, data analytics services, customer support, and cybersecurity management. Direct channels offer manufacturers greater control over sales and customer relationships, while indirect channels provide wider market reach, especially in diverse regional markets. Both direct and indirect models are essential for maximizing market penetration and providing comprehensive support throughout the lifecycle of smart gas meter deployment, ensuring seamless operation and customer satisfaction for the utility providers.

Smart Gas Meter Market Potential Customers

The primary potential customers for smart gas meters are predominantly utility companies, ranging from large national energy providers to smaller municipal gas distributors. These entities are the direct purchasers and deployers of smart meters, driven by mandates to modernize their infrastructure, enhance operational efficiency, and improve billing accuracy. Utility companies seek smart gas meters to reduce operational costs associated with manual meter readings, minimize non-revenue gas losses due to leaks or tampering, and comply with evolving regulatory standards related to energy conservation and grid modernization. Their buying decisions are influenced by factors such as total cost of ownership, reliability, scalability, security features, and the ability to seamlessly integrate with existing billing and data management systems, as well as the long-term support and service offerings from meter manufacturers.

Beyond traditional utility providers, the market for smart gas meters is expanding to include various commercial and industrial enterprises. Businesses in sectors such as manufacturing, hospitality, and real estate are increasingly investing in smart metering solutions to gain granular insights into their gas consumption, enabling them to identify inefficiencies, optimize energy usage, and implement cost-saving measures. For these end-users, the direct financial benefits of reduced energy expenditure and improved operational control are significant drivers. They often seek solutions that can integrate with their existing building management systems and provide detailed analytics for energy performance benchmarking and sustainability reporting. The shift towards corporate social responsibility and environmental targets also influences their adoption of advanced energy management tools.

Another emerging segment of potential customers includes smart city developers and urban planners who integrate smart gas metering into broader smart infrastructure initiatives. These projects aim to create more efficient, sustainable, and livable urban environments, where smart meters play a crucial role in managing resources intelligently. Additionally, private consumers, while typically not direct purchasers of meters, are the ultimate beneficiaries and indirectly drive demand through their growing expectation for transparent billing, real-time consumption data access, and personalized energy management tools. Government agencies and regulatory bodies also act as indirect customers by setting standards, providing incentives, and mandating the adoption of smart meters, thereby creating a fertile ground for market growth and influencing the purchasing decisions of utility companies across different regions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 6.5 Billion |

| Market Forecast in 2032 | USD 13.8 Billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Landis+Gyr, Itron, Sensus (Xylem Inc.), Elster (Honeywell), Apator Group, Aclara (Hubbell Inc.), Pietro Fiorentini, EDMI Limited, Diehl Metering, Arad Group, Metering Technology Corporation (MTC), Kaifa Technology, Siemens AG, Schneider Electric, Badger Meter, Mueller Systems, Inc., Suntront Tech Co., Ltd., Goldcard Smart Group Co., Ltd., Innogy SE, Wasion Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Gas Meter Market Key Technology Landscape

The Smart Gas Meter Market is underpinned by a rapidly evolving technological landscape, characterized by advancements in sensing, communication, and data processing capabilities. At the core are highly accurate gas flow sensors, which have progressed from traditional mechanical diaphragms and rotary meters to advanced ultrasonic and thermal mass flow technologies. Ultrasonic meters, for instance, offer high precision, no moving parts, and reduced maintenance, making them ideal for long-term deployment. These sensing technologies are continuously being refined to improve accuracy, durability, and resistance to environmental factors, ensuring reliable data collection even in challenging conditions. The miniaturization of these sensors also contributes to more compact and aesthetically pleasing meter designs, facilitating easier integration into various settings.

Communication technologies form the backbone of smart gas meter functionality, enabling the transmission of consumption data from the meter to utility back-office systems. The market is witnessing a strong shift towards low-power wide-area networks (LPWAN) such as NB-IoT (Narrowband Internet of Things) and LoRaWAN (Long Range Wide Area Network), which offer extended battery life, deep indoor penetration, and cost-effective coverage over vast geographical areas. Alongside these, cellular technologies (2G/3G/4G/5G, LTE-M) and Radio Frequency (RF) mesh networks continue to play a crucial role, providing varying degrees of bandwidth and latency suitable for different deployment scenarios. The selection of communication technology often depends on factors like network availability, data transmission frequency, cost, and specific regulatory requirements of a region, influencing the overall architecture of smart metering infrastructure.

Beyond hardware, sophisticated software platforms and data analytics tools are integral to the smart gas meter ecosystem. Meter Data Management (MDM) systems are critical for collecting, validating, estimating, and editing (VEE) the enormous volumes of data generated by smart meters, ensuring data integrity for billing and operational purposes. Advanced analytics platforms leverage this data to provide actionable insights into consumption patterns, identify anomalies, predict demand, and facilitate proactive maintenance. Cloud computing and edge computing are increasingly being adopted to process and store data efficiently, enabling real-time analysis and rapid response capabilities. Furthermore, robust cybersecurity solutions are essential to protect sensitive consumer data and critical infrastructure from cyber threats, ensuring the overall resilience and trustworthiness of the smart gas metering system. The convergence of these hardware and software innovations is creating a powerful ecosystem that drives efficiency, safety, and intelligence in gas distribution.

Regional Highlights

- North America: A mature market driven by significant government investments in smart grid infrastructure, strong regulatory mandates for energy efficiency, and a high adoption rate of advanced metering infrastructure (AMI). The region, particularly the United States and Canada, benefits from strong technological innovation and a focus on reducing non-revenue gas losses.

- Europe: A leading market due to ambitious EU directives on energy efficiency and smart meter rollouts, with countries like the UK, France, and Italy implementing large-scale deployment programs. Emphasis on reducing carbon emissions and transitioning to a low-carbon economy further propels market growth, supported by robust communication infrastructure.

- Asia Pacific (APAC): Emerging as the fastest-growing market, primarily fueled by rapid urbanization, increasing energy demand, and government initiatives promoting smart cities and energy conservation in countries such as China, India, Japan, and South Korea. Investments in new utility infrastructure and the push for digital transformation are key drivers.

- Latin America: Showing nascent growth, driven by the need for infrastructure modernization, reducing technical and commercial losses, and improving customer service. Countries like Brazil and Mexico are implementing pilot projects and gradually scaling up deployments, though economic volatility can sometimes impact investment.

- Middle East and Africa (MEA): Experiencing growth propelled by ambitious national visions for economic diversification, smart city development (e.g., in UAE, Saudi Arabia), and increasing investments in energy infrastructure to meet growing demand. Challenges include varying regulatory environments and the need for significant initial capital expenditure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Gas Meter Market.- Landis+Gyr

- Itron

- Sensus (Xylem Inc.)

- Elster (Honeywell)

- Apator Group

- Aclara (Hubbell Inc.)

- Pietro Fiorentini

- EDMI Limited

- Diehl Metering

- Arad Group

- Metering Technology Corporation (MTC)

- Kaifa Technology

- Siemens AG

- Schneider Electric

- Badger Meter

- Mueller Systems, Inc.

- Suntront Tech Co., Ltd.

- Goldcard Smart Group Co., Ltd.

- Innogy SE

- Wasion Group

Frequently Asked Questions

Analyze common user questions about the Smart Gas Meter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of smart gas meters for consumers?

Smart gas meters offer consumers several key benefits, primarily through enhanced transparency and control over their gas consumption. Users gain access to real-time data, allowing them to monitor their usage patterns, identify peak consumption periods, and make informed decisions to reduce their energy bills. This immediate feedback promotes energy conservation habits and empowers individuals to manage their household budgets more effectively. Furthermore, smart meters eliminate estimated bills, ensuring accurate billing based on actual consumption, which enhances trust and reduces billing disputes. They also facilitate easier switching between energy providers and can integrate with smart home systems, creating a more interconnected and responsive living environment. This combination of accuracy, insight, and control significantly improves the customer experience and fosters a proactive approach to personal energy management.

Beyond financial savings and billing accuracy, smart gas meters contribute to environmental sustainability by encouraging reduced energy consumption and supporting broader carbon reduction initiatives. The ability to detect leaks more rapidly enhances safety within homes and communities, providing an important layer of protection that traditional meters lack. Automated meter readings also remove the need for manual visits, offering convenience and privacy. Ultimately, smart gas meters empower consumers to be active participants in the energy ecosystem, providing them with the tools to manage their impact on both their wallets and the planet, while benefiting from a more reliable and secure gas supply infrastructure.

How do smart gas meters contribute to energy efficiency and environmental sustainability?

Smart gas meters are instrumental in driving energy efficiency and environmental sustainability through several mechanisms. By providing real-time and granular data on gas consumption, they enable both utility providers and consumers to identify inefficient usage patterns and areas of potential waste. Consumers, equipped with this information, can adjust their behavior, optimize appliance usage, and make energy-conscious choices, leading to a direct reduction in overall gas consumption. For utilities, the data facilitates more accurate demand forecasting, allowing for better management of gas supply and distribution, thereby minimizing losses and optimizing the entire energy value chain. This precise understanding of consumption helps in designing more targeted energy-saving programs and incentives.

From an environmental perspective, reducing gas consumption directly translates to a decrease in greenhouse gas emissions, particularly carbon dioxide, a major contributor to climate change. Smart meters support the transition to a low-carbon economy by making energy use more transparent and controllable. Their ability to detect leaks quickly not only enhances safety but also prevents the escape of methane, a potent greenhouse gas, into the atmosphere. Furthermore, by improving grid stability and efficiency, smart meters indirectly support the integration of renewable energy sources into the broader energy mix. This holistic contribution to energy conservation and emission reduction underscores their vital role in achieving national and international environmental sustainability targets, promoting a greener and more responsible approach to energy utilization.

What security challenges are associated with smart gas meter deployment, and how are they addressed?

The deployment of smart gas meters introduces several significant security challenges, primarily due to their interconnected nature and the sensitive data they handle. Key concerns include cybersecurity risks such as data breaches, unauthorized access to consumption data, and potential tampering or hacking of meters to manipulate readings or disrupt supply. The communication networks used by smart meters (e.g., cellular, LPWAN) can be vulnerable to various cyberattacks, including denial-of-service, eavesdropping, and malware injection, which could compromise the integrity and reliability of the entire gas distribution system. Furthermore, ensuring the privacy of consumer data collected by these devices is paramount, as unauthorized disclosure could lead to personal and financial risks.

To address these challenges, a multi-layered security approach is typically implemented. This involves robust encryption protocols for all data transmission to prevent eavesdropping and ensure data integrity. Authentication mechanisms are used to verify the identity of devices and users accessing the system, preventing unauthorized control. Tamper detection features built into the meters physically or digitally alert utilities to attempts at manipulation. Advanced cybersecurity frameworks, including intrusion detection systems and firewalls, are deployed at the network and server levels to monitor for suspicious activities and protect against cyberattacks. Regular security audits, software updates, and adherence to international security standards (e.g., IEC 62443) are also critical. Utilities often partner with cybersecurity experts to continuously assess and strengthen their infrastructure, ensuring the resilience and trustworthiness of the smart gas metering ecosystem against evolving threats and maintaining consumer confidence in the technology.

What role does advanced metering infrastructure (AMI) play in the smart gas meter ecosystem?

Advanced Metering Infrastructure (AMI) plays a pivotal and foundational role in the smart gas meter ecosystem, acting as the intelligent backbone that connects smart meters to utility back-office systems. AMI is more than just remote meter reading; it represents a comprehensive system that enables two-way communication between the utility and the meters. This two-way communication capability is crucial because it allows utilities to not only collect granular consumption data automatically and frequently (e.g., hourly or daily) but also to send commands to meters, such as remote service disconnections/reconnections or firmware updates. This bidirectional data flow vastly improves operational efficiency, eliminates the need for manual readings, and significantly enhances the responsiveness of the gas network to changing demands or emergency situations.

Beyond basic data collection and command transmission, AMI facilitates advanced functionalities that are critical for modern gas management. It supports sophisticated data analytics, enabling utilities to identify consumption patterns, detect anomalies (like leaks or tampering) in real-time, and perform accurate demand forecasting. This capability is essential for optimizing gas supply, managing network assets, and reducing non-revenue gas. AMI also integrates with other utility systems, such as billing, customer information, and outage management systems, creating a holistic view of the grid. By providing the infrastructure for seamless, secure, and reliable communication, AMI empowers utilities to make data-driven decisions, enhance customer service through transparent billing and personalized insights, and build a more resilient, efficient, and intelligent gas distribution network that is prepared for future challenges and innovations in energy management.

How is artificial intelligence enhancing the capabilities of smart gas meters?

Artificial intelligence (AI) is significantly enhancing the capabilities of smart gas meters by moving beyond simple data collection to sophisticated analysis and predictive intelligence. One of the primary enhancements is in anomaly detection. AI algorithms can analyze vast datasets of consumption patterns, factoring in variables like weather and historical usage, to identify unusual spikes or drops in gas flow that might indicate leaks, equipment malfunctions, or even illicit tampering. This capability provides real-time alerts to utilities, allowing for rapid investigation and remediation, thereby improving safety and reducing non-revenue gas losses far more effectively than traditional rule-based systems.

Furthermore, AI is transforming demand forecasting and network optimization. Machine learning models can predict future gas consumption with greater accuracy by learning from complex historical data and real-time environmental inputs. This enables utility providers to optimize gas procurement, storage, and distribution, ensuring a stable supply while minimizing operational costs. AI also contributes to predictive maintenance for the meters themselves and the broader infrastructure. By analyzing meter performance data, AI can foresee potential failures or maintenance needs, allowing utilities to schedule proactive interventions, extend asset lifecycles, and avoid costly service disruptions. The integration of AI thus elevates smart gas meters from data transmitters to intelligent sensors that contribute actively to the efficiency, safety, and resilience of the entire gas distribution network, providing deeper insights for both utilities and consumers for more sustainable energy management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Smart Gas Meter (Intelligent Gas Meter) Market Size Report By Type (Automatic Meter Reading (AMR), Advanced Metering Infrastructure (AMI)), By Application (Residential, Commercial, Industrial), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Smart Gas Meter Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (CPU Card Type, RF Card Type, Other), By Application (Residential, Commercial, Industrial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager