Smart Implants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428411 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Smart Implants Market Size

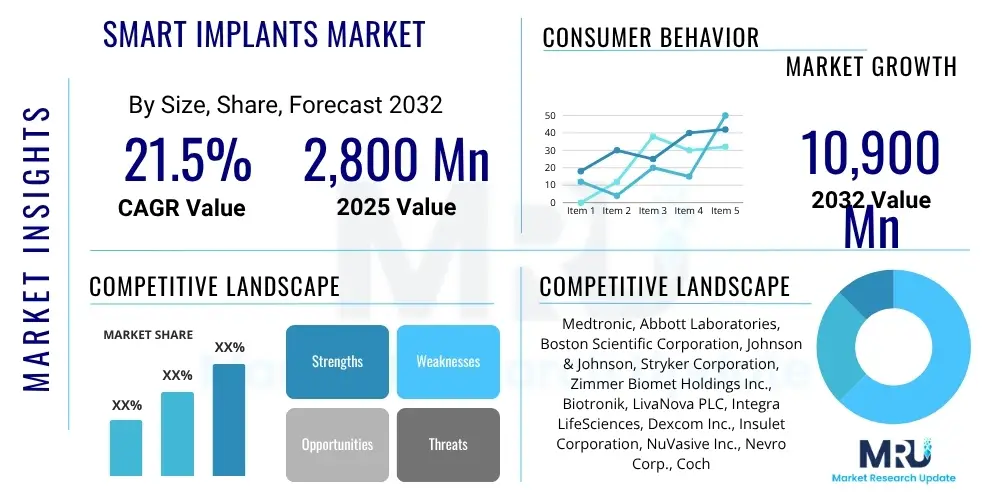

The Smart Implants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2025 and 2032. The market is estimated at USD 2.8 billion in 2025 and is projected to reach USD 10.9 billion by the end of the forecast period in 2032.

Smart Implants Market introduction

The Smart Implants Market represents a transformative segment within medical technology, integrating advanced electronics, sensors, and communication capabilities directly into implantable medical devices. These sophisticated implants go beyond traditional passive functionalities, enabling real-time physiological monitoring, adaptive therapeutic delivery, and seamless data transmission to external systems or healthcare providers. The core objective of these products is to enhance patient outcomes by providing continuous, personalized care, facilitating early intervention, and improving diagnostic accuracy, thereby shifting healthcare paradigms towards proactive and predictive models.

Products within this market encompass a broad spectrum of applications, ranging from cardiac devices like intelligent pacemakers and implantable cardioverter defibrillators (ICDs) that adjust therapies based on cardiac activity, to neurological implants such as deep brain stimulators (DBS) that modulate brain activity in response to symptoms. Orthopedic implants are evolving to monitor bone healing and stress, while advanced drug delivery systems precisely release medications based on real-time biochemical feedback. The integration of miniaturized components, biocompatible materials, and energy-efficient designs is central to the development of these next-generation medical solutions, ensuring long-term safety and efficacy within the human body.

The widespread adoption of smart implants is significantly driven by a confluence of factors, including the global rise in chronic diseases, an expanding geriatric population prone to such conditions, and a growing demand for minimally invasive and personalized treatment options. The inherent benefits of smart implants, such as enhanced diagnostic capabilities, improved therapeutic efficacy through adaptive responses, continuous patient monitoring outside clinical settings, and the potential for reduced hospitalization and healthcare costs, are propelling their market expansion. Furthermore, continuous advancements in biotechnology, materials science, and digital health infrastructure are critical enablers for the innovation and commercialization of these highly advanced medical devices.

Smart Implants Market Executive Summary

The Smart Implants Market is currently experiencing robust growth, driven by an accelerating pace of technological innovation, an increasing global prevalence of chronic illnesses, and a demographic shift towards an aging population. Key business trends include a significant focus on research and development, with major players investing heavily in miniaturization, enhanced biocompatibility, and advanced data processing capabilities, including artificial intelligence and machine learning integration. Strategic partnerships and collaborations between medical device manufacturers, pharmaceutical companies, and technology firms are becoming increasingly common, aimed at developing comprehensive, integrated solutions that combine diagnostic, therapeutic, and connectivity features. Furthermore, the market is characterized by a strong emphasis on cybersecurity measures to protect sensitive patient data, alongside efforts to navigate complex and evolving regulatory landscapes across different geographies, which significantly influences product development cycles and market entry strategies.

Regional trends indicate North America as the dominant market, attributable to its sophisticated healthcare infrastructure, high healthcare expenditure, significant research funding, and the early adoption of advanced medical technologies. Europe also holds a substantial share, propelled by a strong emphasis on healthcare innovation, supportive government initiatives for digital health, and a large aging population. The Asia Pacific region is poised for the fastest growth, driven by improving healthcare access, a vast patient pool, increasing medical tourism, and rising disposable incomes that enable greater investment in advanced treatments. Emerging economies in Latin America, the Middle East, and Africa are showing nascent but promising growth, as healthcare infrastructure develops and awareness regarding the benefits of smart implant technologies increases, albeit constrained by economic factors and varying regulatory maturity.

From a segmentation perspective, neurological implants are projected to exhibit particularly strong growth due to the escalating incidence of neurological disorders and continuous innovation in neuromodulation therapies. The cardiovascular segment remains a foundational and significant contributor, with smart pacemakers and ICDs continually evolving to offer more adaptive and predictive functionalities. The diagnostic implants segment, encompassing continuous glucose monitors and other biometric sensors, is expanding rapidly, reflecting a societal shift towards proactive health management and personalized medicine. Technology-wise, AI-enabled implants and those with advanced wireless communication capabilities are gaining considerable traction, promising unprecedented levels of data insights and remote patient management, thereby revolutionizing how chronic conditions are monitored and treated.

AI Impact Analysis on Smart Implants Market

User inquiries concerning the impact of AI on the Smart Implants Market frequently revolve around the potential for enhanced diagnostic accuracy, personalized therapeutic adjustments, and the autonomous management of chronic conditions. Common questions probe how AI can improve the interpretation of complex physiological data, the security and privacy implications of AI-driven data processing, and the ethical considerations surrounding autonomous medical interventions. There is also significant interest in AI's role in predictive analytics for identifying health deterioration early, optimizing drug delivery schedules, and facilitating seamless integration with existing digital health ecosystems. Overall, users express a blend of optimism for improved health outcomes and caution regarding data governance, system reliability, and the need for human oversight in AI-powered medical devices.

- AI enables real-time data analysis from implantable sensors, providing highly accurate diagnostic insights and early detection of adverse health events.

- Personalized therapeutic delivery is optimized by AI algorithms that adapt treatment parameters based on an individual's unique physiological responses and disease progression.

- Predictive analytics powered by AI allows smart implants to forecast potential health crises, enabling proactive interventions and preventing acute episodes.

- Improved decision support for clinicians is facilitated by AI, offering data-driven recommendations for patient management and treatment adjustments.

- Enhanced operational efficiency of implants through AI-driven power management, extending device longevity and reducing the need for frequent replacements.

- Autonomous closed-loop systems leverage AI to monitor, analyze, and deliver therapy without constant external intervention, optimizing patient comfort and treatment efficacy.

- AI contributes to advanced cybersecurity protocols by identifying and mitigating potential threats to sensitive patient data transmitted from smart implants.

DRO & Impact Forces Of Smart Implants Market

The Smart Implants Market is significantly propelled by several dynamic forces. A primary driver is the rapid advancement in microelectronics, sensor technology, and biocompatible materials, which enables the development of smaller, more efficient, and safer implantable devices capable of complex functions. Concurrently, the increasing global prevalence of chronic diseases such as cardiovascular disorders, diabetes, and neurological conditions, coupled with an expanding geriatric population more susceptible to these ailments, fuels the demand for advanced monitoring and therapeutic solutions that smart implants offer. Furthermore, the growing adoption of remote patient monitoring and telemedicine solutions, particularly accelerated by global health trends, creates a fertile ground for smart implants that can seamlessly integrate with digital health ecosystems, providing continuous data and enabling proactive care management, thereby reducing the burden on conventional healthcare facilities.

Despite these powerful drivers, the market faces notable restraints that could impede its growth trajectory. The inherently high cost associated with the development, manufacturing, and implantation of smart devices, combined with often limited or inconsistent reimbursement policies across different healthcare systems, presents a significant barrier to widespread adoption. Furthermore, smart implants are subject to rigorous and lengthy regulatory approval processes, necessitating extensive clinical trials and robust safety data, which can delay market entry and escalate development expenses. Moreover, the integration of advanced connectivity and data processing capabilities introduces critical concerns regarding cybersecurity and patient data privacy, requiring substantial investment in secure technologies and adherence to stringent data protection regulations, which can be challenging for manufacturers.

Nevertheless, numerous opportunities are emerging that could unlock substantial growth for the Smart Implants Market. The untapped potential in emerging economies, characterized by improving healthcare infrastructure and increasing awareness, offers new avenues for market expansion, particularly as healthcare access becomes more democratized. Continuous innovation in advanced biomaterials and nanotechnologies promises to enhance implant longevity, reduce adverse reactions, and enable even greater miniaturization and functionality. The expanding ecosystem of the Internet of Medical Things (IoMT) and advancements in 5G connectivity provide a robust framework for sophisticated data exchange and real-time intervention, positioning smart implants as pivotal components of future personalized and predictive medicine. Finally, the exploration of novel therapeutic applications, such as targeted gene delivery and regenerative medicine integration, represents significant long-term growth prospects.

Segmentation Analysis

The Smart Implants Market is meticulously segmented to provide a comprehensive understanding of its diverse landscape, reflecting variations in product type, underlying technology, primary application, and end-user base. This segmentation highlights the various niches and specialized areas within the market, each driven by unique clinical needs, technological advancements, and economic factors. Analyzing these segments individually and collectively offers critical insights into market dynamics, growth potential, competitive intensity, and strategic opportunities for stakeholders across the healthcare value chain, allowing for targeted product development and market penetration strategies tailored to specific demands and regulatory environments.

The market's complexity is further elucidated by the interplay between these segments. For instance, the demand for a specific product type, like neurological implants, is directly influenced by the availability of advanced sensor technology and AI-enabled functionalities, which then dictate their application in diagnostics, monitoring, or therapeutic delivery, and ultimately determines their adoption by end-users such as hospitals or specialty clinics. Understanding these interdependencies is crucial for identifying high-growth areas and developing integrated solutions that address multifaceted clinical challenges. As technology evolves, new sub-segments are continually emerging, driven by innovations in areas like energy harvesting for autonomous operation and closed-loop systems for highly adaptive treatments.

This granular segmentation is vital for market participants to tailor their offerings, optimize resource allocation, and address the specific requirements of various patient populations and healthcare providers. It also aids investors in identifying promising areas for strategic investment and facilitates regulatory bodies in developing appropriate guidelines for novel device categories. The continuous evolution of medical science and engineering ensures that these segments remain dynamic, necessitating ongoing market research and adaptive business strategies to capitalize on emerging trends and navigate the evolving competitive landscape effectively.

- By Product Type

- Cardiac Implants (Pacemakers, ICDs, CRTs, Stents)

- Neurological Implants (Deep Brain Stimulators, Spinal Cord Stimulators, Vagus Nerve Stimulators, Retinal Implants)

- Orthopedic Implants (Joint Replacements, Spinal Implants, Trauma Fixation Devices, Bone Growth Stimulators)

- Ophthalmic Implants (Glaucoma Implants, Artificial Iris Implants, Intraocular Lenses)

- Cochlear Implants

- Drug Delivery Implants (Pain Management, Chemotherapy, Insulin Pumps)

- Diagnostic Implants (Continuous Glucose Monitors, pH Sensors, Pressure Monitors)

- By Technology

- Sensor-based Implants

- Wireless Communication Implants (Bluetooth, NFC, Wi-Fi, 5G)

- AI-enabled Implants

- Energy Harvesting Implants

- Closed-Loop Systems

- By Application

- Diagnostics & Monitoring

- Therapeutics & Drug Delivery

- Prosthetics & Rehabilitation

- By End-User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Research Institutes

- Homecare Settings

Value Chain Analysis For Smart Implants Market

The value chain for the Smart Implants Market is a complex and interconnected network, beginning with the foundational upstream activities. This phase primarily involves the sourcing and manufacturing of highly specialized raw materials, including advanced biocompatible polymers, sophisticated ceramics, medical-grade metals, and microelectronic components such as sensors, microprocessors, and miniaturized communication modules. Key players in this segment are typically specialized material science companies and semiconductor manufacturers, whose innovations directly impact the performance, longevity, and safety of the final implantable device. Rigorous quality control and adherence to strict biomedical standards are paramount at this stage, as the integrity of these components is crucial for the overall success of the smart implant.

Moving further along the value chain, the core manufacturing and assembly of smart implants occur, where advanced engineering and biomedical expertise are combined. This includes the intricate process of integrating electronic components into biocompatible casings, ensuring hermetic sealing, and conducting extensive testing for functionality, sterility, and long-term durability. Research and development activities, encompassing clinical trials and regulatory submissions, are central to this stage, forming a significant portion of the cost and time involved in bringing a product to market. This stage often involves collaboration with research institutions and healthcare providers to validate the clinical efficacy and safety of new implantable technologies before commercialization.

The downstream segment of the value chain focuses on the distribution, sales, and post-market support of smart implants. Distribution channels are typically multi-faceted, involving both direct sales forces employed by major medical device manufacturers who engage directly with hospitals and specialist clinics, and indirect channels leveraging third-party distributors for broader market reach, particularly in regional markets. E-commerce platforms are increasingly playing a role for certain non-implantable components or supporting devices. Post-sale activities, including technical support, maintenance, software updates for connected implants, and ongoing patient monitoring services, are critical for ensuring long-term patient satisfaction and device performance. This final stage also includes the crucial feedback loop from healthcare providers and patients, which informs future product iterations and improvements, emphasizing the iterative nature of innovation in this sophisticated market.

Smart Implants Market Potential Customers

The primary potential customers for smart implants are diverse and span across various segments of the healthcare ecosystem, reflecting the broad utility and transformative potential of these advanced medical devices. At the forefront are hospitals and specialized medical centers, including tertiary care facilities and university hospitals, which serve as major adopters due to their capacity for complex surgical procedures, availability of skilled medical professionals, and often, their role as early adopters of innovative technologies. These institutions purchase smart implants to improve patient outcomes, enhance diagnostic capabilities, and offer cutting-edge therapeutic options, thereby attracting patients and reinforcing their reputation as leaders in medical innovation. The demand from these entities is often driven by the prevalence of chronic diseases requiring long-term management and the push for more effective, data-driven treatment modalities.

Ambulatory Surgical Centers (ASCs) and specialty clinics, such as cardiology clinics, neurological centers, and orthopedic practices, represent another significant customer segment. As procedures become less invasive and technological advancements enable outpatient interventions, ASCs are increasingly adopting smart implants to offer efficient, cost-effective, and patient-centric care. These facilities cater to patients seeking specialized treatments and often benefit from streamlined processes and reduced overheads compared to traditional hospitals. Their purchasing decisions are influenced by the ability of smart implants to facilitate quicker patient recovery, minimize complications, and provide superior long-term monitoring and adaptive therapy without the need for extensive hospital stays, aligning with current trends in healthcare towards outpatient care.

Beyond direct healthcare providers, research institutions and academic medical centers also constitute crucial potential customers. These entities acquire smart implants not only for patient care but also for conducting clinical trials, advancing medical research, and developing next-generation implant technologies. Their demand is driven by the need to explore novel applications, understand long-term efficacy, and contribute to the scientific understanding of implantable bioelectronics. Furthermore, government health agencies and large integrated delivery networks (IDNs) may act as significant purchasers, particularly for public health initiatives or to standardize care across a broader population. Ultimately, the end-users, the patients themselves, albeit typically indirectly through physician prescriptions, are the ultimate beneficiaries and a driving force behind the market's growth, as their demand for improved quality of life and effective disease management fuels the adoption of these sophisticated solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2,800 million |

| Market Forecast in 2032 | USD 10,900 million |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Abbott Laboratories, Boston Scientific Corporation, Johnson & Johnson, Stryker Corporation, Zimmer Biomet Holdings Inc., Biotronik, LivaNova PLC, Integra LifeSciences, Dexcom Inc., Insulet Corporation, NuVasive Inc., Nevro Corp., Cochlear Limited, Tandem Diabetes Care Inc., MicroPort Scientific Corporation, Getinge AB, Siemens Healthineers AG, Terumo Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Implants Market Key Technology Landscape

The Smart Implants Market is underpinned by a dynamic and rapidly evolving technology landscape, characterized by significant advancements across multiple scientific and engineering disciplines. Central to this evolution is the relentless pursuit of miniaturization, enabling implants to be smaller, less invasive, and more comfortable for patients, often integrating multiple functionalities within a compact form factor. This miniaturization is intricately linked with breakthroughs in microelectronics, allowing for the embedding of powerful microprocessors, energy-efficient sensors, and advanced communication modules directly into the implantable devices. The development of highly sensitive and specific biosensors capable of real-time monitoring of various physiological parameters, from glucose levels to intracranial pressure, is a cornerstone of this technological foundation.

Another pivotal technological area is the continuous innovation in biocompatible materials. These materials are crucial for ensuring the long-term safety, integration, and functionality of implants within the human body, minimizing adverse immune responses and enhancing device durability. Concurrently, wireless communication technologies, including Bluetooth Low Energy (BLE), Near Field Communication (NFC), Wi-Fi, and increasingly 5G, are indispensable for enabling seamless data transmission between the implant and external devices, such as smartphones, wearables, or healthcare provider systems. This connectivity is vital for remote patient monitoring, adaptive therapy delivery, and over-the-air software updates, dramatically enhancing the utility and responsiveness of smart implants.

Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is revolutionizing how smart implants process and interpret complex biological data. AI-powered analytics enable personalized therapeutic adjustments, predictive diagnostics, and autonomous operation in closed-loop systems, where the implant can sense a physiological change and deliver a corresponding therapy without human intervention. Advancements in energy harvesting technologies, such as thermoelectric, kinetic, or inductive charging, are also gaining traction, aiming to reduce reliance on battery replacement surgeries and extend the operational lifespan of implants. These combined technological innovations are collectively driving the smart implants market towards a future of highly intelligent, adaptive, and patient-centric medical solutions, promising a new era in precision medicine and chronic disease management.

Regional Highlights

- North America: This region consistently leads the Smart Implants Market, driven by its advanced healthcare infrastructure, significant R&D investments, and high disposable income leading to greater adoption of premium medical technologies. The presence of major market players, a favorable regulatory environment for medical device innovation, and a high prevalence of chronic diseases contribute to its dominance. The United States, in particular, showcases strong growth due to robust funding for healthcare research and a culture of early technology adoption.

- Europe: The European market represents a substantial share, characterized by sophisticated healthcare systems, an aging population with increasing demand for advanced medical care, and strong government support for healthcare innovation through initiatives like the European Medical Device Regulation (MDR). Countries such as Germany, the UK, and France are at the forefront of adopting smart implant technologies, backed by extensive research and development activities and a focus on improving patient quality of life through innovative treatments.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC benefits from improving healthcare accessibility, a massive patient pool, increasing healthcare expenditure, and rising awareness of advanced medical treatments. Economic growth in countries like China, India, and Japan, coupled with government initiatives to modernize healthcare facilities and promote medical tourism, are significant accelerators. The region also presents substantial opportunities for new market entrants due to its underserved population and evolving regulatory landscape.

- Latin America: This region is an emerging market for smart implants, with growth primarily fueled by improving healthcare infrastructure, increasing healthcare spending, and a growing demand for advanced medical treatments. Countries such as Brazil, Mexico, and Argentina are gradually adopting these technologies, albeit facing challenges related to economic instability, healthcare access disparities, and varying reimbursement policies. The market here is characterized by an increasing awareness among clinicians and patients regarding the benefits of smart medical devices.

- Middle East and Africa (MEA): The MEA region is at a nascent stage of market development for smart implants but shows promising growth potential. Investments in healthcare infrastructure, particularly in Gulf Cooperation Council (GCC) countries, coupled with an increasing incidence of lifestyle diseases, are driving demand. Challenges include fragmented healthcare systems, limited access to advanced technologies in certain areas, and lower per capita healthcare spending. However, a growing expatriate population and a focus on medical tourism are creating niche opportunities for advanced medical devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Implants Market.- Medtronic

- Abbott Laboratories

- Boston Scientific Corporation

- Johnson & Johnson

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

- Biotronik

- LivaNova PLC

- Integra LifeSciences

- Dexcom Inc.

- Insulet Corporation

- NuVasive Inc.

- Nevro Corp.

- Cochlear Limited

- Tandem Diabetes Care Inc.

- MicroPort Scientific Corporation

- Getinge AB

- Siemens Healthineers AG

- Terumo Corporation

Frequently Asked Questions

What are smart implants and how do they differ from traditiona

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager