Softwood Veneer and Plywood Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430277 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Softwood Veneer and Plywood Market Size

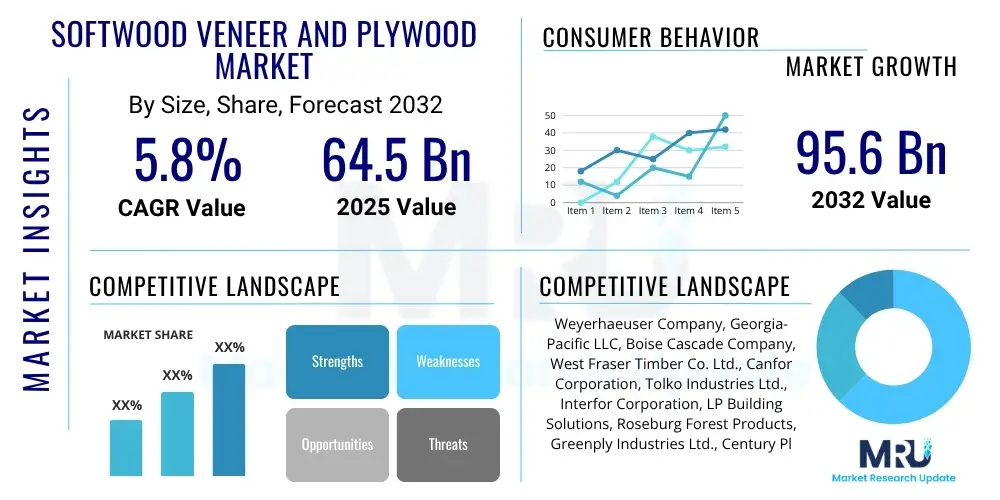

The Softwood Veneer and Plywood Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at $64.5 billion in 2025 and is projected to reach $95.6 billion by the end of the forecast period in 2032.

Softwood Veneer and Plywood Market introduction

The Softwood Veneer and Plywood Market encompasses the production and distribution of fundamental engineered wood products derived primarily from coniferous trees such as pine, spruce, and fir. These materials are highly valued across numerous industries for their excellent strength-to-weight ratio, workability, and cost-effectiveness. The market is dynamic, evolving with advancements in manufacturing processes and increasing demand for sustainable building solutions, which positions these products as essential components in modern construction and manufacturing landscapes globally.

Softwood veneer involves thin sheets of wood, typically produced by rotary cutting logs, which are then used for decorative purposes, furniture manufacturing, and as core layers in plywood. Softwood plywood, an aggregate product, consists of multiple layers of these veneers bonded together with strong adhesives, with the grain of successive layers typically oriented at right angles to enhance dimensional stability and structural integrity. This layered construction provides superior resistance to warping, splitting, and shrinking compared to solid wood, making it a preferred material for diverse applications where reliability and durability are paramount.

The primary applications for softwood veneer and plywood span across various sectors, including residential and commercial construction for framing, sheathing, subflooring, and roofing; furniture manufacturing for panels and components; industrial packaging for crates and pallets; and specialized uses in vehicle interiors and marine construction. Key benefits of these products include high structural strength, durability against environmental stresses, excellent nail and screw holding capacity, and relatively light weight. The market is significantly driven by factors such as robust growth in global construction activities, increasing emphasis on sustainable and renewable building materials, continuous innovation in product grades and bonding technologies, and expanding applications in diverse end-use industries.

Softwood Veneer and Plywood Market Executive Summary

The Softwood Veneer and Plywood Market is experiencing substantial growth, underpinned by a confluence of favorable business, regional, and segmental trends. Globally, the industry is witnessing a pronounced shift towards sustainable forestry practices and the adoption of certified wood products, reflecting a broader environmental consciousness among consumers and regulatory bodies. Automation and technological integration in manufacturing processes are becoming increasingly vital, enhancing efficiency, reducing waste, and improving the consistency and quality of the final products. Market consolidation among key players is a noticeable business trend, leading to larger, more diversified entities capable of leveraging economies of scale and extensive distribution networks to meet burgeoning global demand. Furthermore, there is a growing focus on developing high-performance and specialty plywood grades tailored for specific, demanding applications, signaling a move towards value-added product offerings.

From a regional perspective, the Asia Pacific region stands out as a primary engine of growth, fueled by rapid urbanization, significant infrastructure development projects, and a booming construction sector, particularly in economies such as China, India, and various Southeast Asian nations. This region's immense population and economic expansion translate into an escalating demand for basic and advanced building materials. In contrast, mature markets in North America and Europe, while experiencing slower growth rates, maintain steady demand, largely driven by ongoing residential renovation, repair activities, and a consistent need for sustainable and engineered wood products in established construction industries. These regions also lead in the adoption of advanced manufacturing technologies and stringent environmental standards, influencing global best practices.

Segment-wise, the construction sector remains the unequivocal dominant application segment for both softwood veneer and plywood, absorbing a significant majority of the market's output. Within construction, residential building activities, including new home constructions and extensive renovation projects, are critical demand drivers. Structural plywood, renowned for its load-bearing capabilities and robustness, continues to hold the largest market share in terms of volume, indispensable for foundational and framework applications. Concurrently, the market for specialty plywood, which includes products like marine-grade plywood or those with enhanced fire resistance, is observing steady growth. This growth is attributed to their specific performance attributes that cater to niche applications requiring superior durability, moisture resistance, or aesthetic qualities, indicating a diversification in product requirements across various end-use industries beyond general construction.

AI Impact Analysis on Softwood Veneer and Plywood Market

User queries regarding AI's impact on the Softwood Veneer and Plywood Market frequently center on its potential to revolutionize manufacturing efficiency, optimize resource utilization, and significantly enhance product quality. Common themes include the automation of labor-intensive tasks, the reduction of material waste through precision processing, and improvements in supply chain predictability. There is significant interest in how AI can facilitate predictive maintenance for machinery, thereby minimizing costly downtime, and its role in advanced defect detection during the veneer and plywood production stages. While the advantages are clear, users also express concerns about the initial investment required for AI implementation, the complexity of integrating these technologies into existing operations, and the potential implications for the workforce, necessitating reskilling or upskilling.

The core expectation from AI in this domain is its capacity to transform traditional wood processing into a more data-driven, precise, and resource-efficient industry. Stakeholders envision AI algorithms analyzing vast datasets from forest to finished product, enabling more accurate yield predictions, optimizing log allocation, and tailoring production schedules to real-time market demand. This would lead to substantial operational savings, improved material recovery rates, and a more responsive manufacturing ecosystem. Furthermore, AI's analytical prowess can contribute to the development of innovative products by identifying optimal wood combinations and adhesive formulations, pushing the boundaries of material science in engineered wood products.

- Enhanced quality control through automated visual inspection and defect detection in veneers and finished plywood panels, reducing human error.

- Optimized raw material utilization via AI-driven cutting patterns and log scanning technologies that maximize yield from each log, minimizing waste.

- Improved supply chain management and demand forecasting through predictive analytics, leading to optimized inventory levels and reduced logistics costs.

- Predictive maintenance for manufacturing equipment, utilizing sensor data to anticipate machinery failures and schedule maintenance proactively, thereby reducing unscheduled downtime.

- Automation of grading and sorting processes for both veneer sheets and plywood panels, ensuring consistent product classification based on predefined quality parameters.

- Development of smart factories with integrated AI systems for real-time monitoring and control of production lines, optimizing energy consumption and process parameters.

DRO & Impact Forces Of Softwood Veneer and Plywood Market

The Softwood Veneer and Plywood Market is profoundly influenced by a complex interplay of drivers, restraints, opportunities, and broader impact forces that shape its trajectory. Key drivers include the consistent growth in global construction and housing sectors, particularly in emerging economies undergoing rapid urbanization, which directly escalates the demand for structural and aesthetic wood products. The increasing global emphasis on sustainable building materials, where wood products are favored for their renewable nature and lower carbon footprint compared to alternatives like steel and concrete, further propels market expansion. Moreover, continuous innovation in product development, encompassing new bonding agents for enhanced durability and specific performance characteristics, alongside the development of specialty grades for niche applications, significantly contributes to market dynamism. These elements collectively foster an environment conducive to sustained market growth by addressing both traditional and evolving construction needs.

However, the market also faces significant restraints. Volatility in raw material prices, primarily the cost of suitable softwood timber, presents a persistent challenge, impacting manufacturers' profit margins and pricing strategies. Stringent environmental regulations related to deforestation, sustainable logging practices, and emissions from manufacturing processes impose additional costs and operational complexities, particularly concerning chemical usage in adhesives and waste management. The consistent availability of high-quality timber is another restraint, influenced by forest management policies, climate change impacts, and natural disasters. Furthermore, intense competition from alternative building materials such as Oriented Strand Board (OSB), Medium Density Fiberboard (MDF), and various non-wood composites poses a threat, as these alternatives often offer competitive pricing or specific performance advantages in certain applications, necessitating continuous innovation and differentiation within the softwood plywood sector.

Despite these restraints, numerous opportunities are emerging. The expansion into untapped emerging markets, particularly in regions with burgeoning construction industries and developing infrastructure, offers significant growth potential for softwood veneer and plywood manufacturers. The increasing demand for customized and specialty products, such as moisture-resistant, fire-retardant, or architecturally specific grades of plywood, presents lucrative avenues for product differentiation and premium pricing. Advancements in bonding agent technologies, including the development of low-VOC (Volatile Organic Compound) and formaldehyde-free adhesives, cater to stricter environmental standards and consumer health concerns, thereby opening new market segments. Additionally, the growing adoption of prefabrication and modular construction techniques, which rely heavily on consistent, factory-produced wood panels, creates a sustained demand for high-quality, engineered softwood products, streamlining construction processes and reducing on-site labor requirements. These opportunities encourage strategic investments in research and development and market expansion.

Segmentation Analysis

The Softwood Veneer and Plywood Market is comprehensively segmented to reflect the diverse range of product offerings, application areas, and end-use industries that define its operational landscape. This segmentation provides a granular view of market dynamics, allowing for a detailed analysis of demand patterns, competitive landscapes, and growth opportunities within specific niches. Understanding these segments is critical for stakeholders to tailor their product development, marketing, and distribution strategies effectively, ensuring that they address the precise needs and preferences of their target customer bases across various sectors. The intricate structure of the market necessitates a clear classification to discern dominant trends and anticipate future shifts in demand.

Each segment, whether categorized by product type, application, grade, or end-use industry, exhibits unique characteristics and growth drivers. For instance, product type segmentation differentiates between various forms of veneer and plywood, each possessing distinct structural and aesthetic properties. Application segmentation highlights the primary uses of these materials, from structural components in large construction projects to decorative elements in furniture. Grade-based segmentation acknowledges the varying quality and performance specifications required by different end-users, while end-use industry segmentation provides insight into the specific sectors driving demand, such as residential construction versus industrial packaging. This multi-dimensional approach to market segmentation enables a thorough evaluation of where value is created and captured across the entire softwood veneer and plywood value chain, empowering businesses to identify their most promising avenues for growth and investment in a competitive environment.

- By Product Type:

- Softwood Veneer (e.g., Rotary Cut Veneer, Sliced Cut Veneer)

- Softwood Plywood (e.g., Structural Plywood, Non-Structural Plywood, Marine Plywood, Sanded Plywood, Rough Sawn Plywood)

- By Application:

- Construction (Residential Construction, Commercial Construction, Industrial Construction, Infrastructure Projects)

- Furniture Manufacturing (Cabinets, Tables, Chairs, Shelving)

- Packaging (Crates, Pallets, Boxes)

- Industrial Uses (Vehicle Components, Boat Building, Formwork, Concrete Forms)

- Others (e.g., DIY Projects, Crafts, Decorative Panels)

- By Grade:

- Appearance Grade (A-A, A-B, B-B)

- Structural Grade (C-D, C-X, D-E)

- Underlayment Grade

- Sheathing Grade

- By End-Use Industry:

- Building and Construction Sector

- Automotive Industry

- Shipping and Logistics Industry

- Furniture and Interior Design Industry

- Other Manufacturing Industries

Value Chain Analysis For Softwood Veneer and Plywood Market

The value chain for the Softwood Veneer and Plywood Market begins with upstream activities focused on raw material sourcing and initial processing. This critical stage primarily involves sustainable forestry operations and efficient logging practices, where coniferous timber is harvested. Following harvesting, logs undergo transportation to processing mills, where they are typically debarked and conditioned to optimize peeling or slicing. The quality, species, and availability of softwood logs are paramount, directly influencing the cost structure, product quality, and environmental footprint of the entire value chain. Strategic partnerships with forest owners and certified logging companies are essential for ensuring a consistent and responsibly sourced supply of raw materials, meeting both production demands and sustainability certifications.

Downstream analysis of the value chain concentrates on the distribution and ultimate consumption of softwood veneer and plywood products. Once manufactured, these products move through various channels including wholesalers, distributors, large-scale building material suppliers, and specialized retailers. The marketing and sales strategies deployed at this stage are crucial for reaching diverse customer segments, which range from large construction companies requiring bulk orders to individual homeowners for DIY projects. Effective downstream operations require robust logistics, inventory management, and customer service to ensure timely delivery and market responsiveness, adapting to regional demands and specific project requirements. Innovation in distribution channels, such as e-commerce platforms, is increasingly becoming a factor in market reach.

Distribution channels in the Softwood Veneer and Plywood Market are typically a hybrid of direct and indirect approaches. Direct sales involve manufacturers supplying large industrial clients, such as major construction firms or furniture factories, offering customized products and bulk pricing. This channel allows for closer relationships, direct feedback, and tailored solutions. Indirect channels, conversely, utilize a network of intermediaries including independent distributors, wholesalers, and retail chains like lumberyards and home improvement stores, to achieve broader market penetration. These intermediaries provide local availability, warehousing, and often offer value-added services such as cutting and delivery, making products accessible to smaller contractors and individual consumers across diverse geographical regions. The effectiveness of these combined channels is pivotal for maximizing market coverage and ensuring product accessibility.

Softwood Veneer and Plywood Market Potential Customers

The Softwood Veneer and Plywood Market serves a broad spectrum of potential customers, primarily comprising end-users and buyers from various industrial and commercial sectors. These key customer groups are drawn to softwood veneer and plywood for their inherent structural integrity, versatility, cost-effectiveness, and often, their aesthetic appeal. The demand for these products is intrinsically linked to economic cycles, particularly the health of the construction and manufacturing industries, which are the predominant consumers. Manufacturers in this market consistently aim to meet the diverse specifications and volume requirements of these varied customer segments, adapting their production and product offerings to align with evolving industry standards and market trends, ensuring a steady and reliable supply of high-quality engineered wood solutions.

Leading among the market's potential customers are residential and commercial builders, encompassing developers of single-family homes, multi-unit residential complexes, office buildings, and retail spaces. These entities utilize plywood for structural sheathing, subflooring, roofing, and concrete formwork due to its strength, ease of installation, and adherence to building codes. Infrastructure developers, engaged in public works projects such as bridges and utilities, also constitute a significant customer base, leveraging plywood for temporary structures and robust support. Furthermore, furniture manufacturers are substantial buyers, integrating softwood veneer for decorative surfaces and plywood as core components for cabinets, shelving, and other furniture pieces, valuing its stability and workability in production processes.

Beyond construction and furniture, packaging companies represent a critical customer segment, using plywood for manufacturing durable crates, pallets, and industrial containers required for shipping and logistics. Industrial product fabricators, including those in the automotive and marine sectors, rely on specific grades of plywood for vehicle components, boat building, and other specialized applications that demand moisture resistance, high strength, or specific dimensional stability. Finally, the growing segment of DIY (Do-It-Yourself) enthusiasts and small-scale craftspeople also form a significant customer base, purchasing smaller quantities of softwood plywood and veneer for home improvement projects, furniture making, and artistic endeavors, driven by its accessibility and versatility for a wide array of personal projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $64.5 Billion |

| Market Forecast in 2032 | $95.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Weyerhaeuser Company, Georgia-Pacific LLC, Boise Cascade Company, West Fraser Timber Co. Ltd., Canfor Corporation, Tolko Industries Ltd., Interfor Corporation, LP Building Solutions, Roseburg Forest Products, Greenply Industries Ltd., Century Plyboards (India) Ltd., Sonae Arauco, UPM-Kymmene Corporation, Sveza Group, Chongqing Fuling Wood Industry Co., Ltd., Pacific Woodtech, Sierra Pacific Industries, Collins Companies, PotlatchDeltic Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Softwood Veneer and Plywood Market Key Technology Landscape

The Softwood Veneer and Plywood Market is continuously evolving with the integration of advanced technologies aimed at enhancing efficiency, improving product quality, and meeting stringent environmental standards. Modern manufacturing processes heavily rely on sophisticated timber processing machinery, including high-speed rotary peelers and precision veneer dryers, which optimize yield from logs and ensure consistent moisture content in veneers. Automated grading systems, often incorporating digital imaging and laser scanning, play a crucial role in accurately classifying veneers and plywood panels based on appearance, structural integrity, and defect detection. These systems minimize human error and accelerate the sorting process, contributing to greater overall productivity and product consistency across different grades.

Furthermore, adhesive technologies have seen significant advancements, with a growing emphasis on developing low-VOC (Volatile Organic Compound) and formaldehyde-free bonding agents. These innovations address increasing environmental regulations and consumer health concerns, enabling the production of greener and safer plywood products. Hot presses, equipped with advanced temperature and pressure control systems, ensure optimal bonding strength and curing times for plywood panels, which is critical for product durability and performance. Robotics and automation are increasingly being utilized for material handling, stacking, and packaging, reducing labor costs and improving workplace safety within manufacturing facilities, streamlining the flow of materials through various production stages.

The adoption of advanced manufacturing techniques extends to CNC (Computer Numerical Control) cutting for precise panel dimensions and specialized shapes, catering to customized product requirements. Energy-efficient manufacturing processes are also gaining traction, with mills implementing technologies that reduce energy consumption during drying and pressing, aligning with sustainability goals. Beyond the factory floor, the market is witnessing the integration of sensor-based monitoring and data analytics for real-time process optimization. These technologies enable predictive maintenance for machinery, identify potential bottlenecks, and provide insights for continuous improvement across the entire production value chain, from log input to finished product output, ensuring enhanced operational performance and cost-effectiveness in a competitive global market.

Regional Highlights

- North America: This region represents a mature market for softwood veneer and plywood, characterized by a steady demand primarily driven by residential construction, renovation, and repair activities. There is a strong emphasis on sustainable forestry practices, with a high adoption rate of certified wood products, reflecting environmental awareness and stringent regulatory frameworks. Manufacturers in North America often leverage advanced processing technologies to enhance efficiency and maintain product quality, positioning the region as a leader in engineered wood product innovation and responsible resource management. The market is supported by a robust supply chain and a well-established distribution network, ensuring widespread availability of products.

- Europe: The European market is highly influenced by strict environmental regulations and a strong preference for certified and eco-friendly wood products. Demand is significant across both the construction and furniture sectors, with a growing focus on low-emission materials and sustainable building solutions. Europe leads in innovation regarding eco-friendly adhesives and processing techniques, aiming to reduce the environmental footprint of plywood production. The region's market is fragmented but highly competitive, with a strong emphasis on product quality, performance, and adherence to various European standards and certifications for construction materials.

- Asia Pacific (APAC): The Asia Pacific region stands as the largest and fastest-growing market for softwood veneer and plywood globally. This rapid expansion is primarily propelled by extensive urbanization, significant infrastructure development, and a booming construction sector across countries like China, India, and various Southeast Asian nations. The region's massive population and economic growth create an insatiable demand for building materials. While domestic production is substantial, there is also considerable import activity to meet the diverse and escalating needs of its vast construction and manufacturing industries, with a growing trend towards adopting advanced production technologies to keep pace with demand and improve quality.

- Latin America: This region is an emerging market for softwood veneer and plywood, with growing construction activities contributing to increased demand. While some countries possess significant timber resources, the market often relies on imports for specific grades and specialty products. Economic stability and governmental investments in infrastructure projects are key drivers for market growth. There is an ongoing effort to develop domestic processing capabilities and foster sustainable forestry practices, yet challenges remain in terms of infrastructure and consistent supply chains. The region shows considerable potential for future expansion as economic development progresses and construction demands rise.

- Middle East and Africa (MEA): The MEA region exhibits growth influenced by significant infrastructure development projects, especially in the Gulf Cooperation Council (GCC) countries, as part of their economic diversification strategies. The region is largely dependent on imports of softwood veneer and plywood due to limited local timber resources suitable for large-scale production. Growing construction of residential, commercial, and hospitality sectors drives demand. The market is sensitive to global pricing and shipping costs. There is an increasing focus on acquiring high-quality materials for ambitious architectural and urban development projects, leading to diverse sourcing strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Softwood Veneer and Plywood Market.- Weyerhaeuser Company

- Georgia-Pacific LLC

- Boise Cascade Company

- West Fraser Timber Co. Ltd.

- Canfor Corporation

- Tolko Industries Ltd.

- Interfor Corporation

- LP Building Solutions

- Roseburg Forest Products

- Greenply Industries Ltd.

- Century Plyboards (India) Ltd.

- Sonae Arauco

- UPM-Kymmene Corporation

- Sveza Group

- Chongqing Fuling Wood Industry Co., Ltd.

- Pacific Woodtech

- Sierra Pacific Industries

- Collins Companies

- PotlatchDeltic Corporation

- Roy O Martin Lumber Company

Frequently Asked Questions

Analyze common user questions about the Softwood Veneer and Plywood market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of softwood veneer and plywood?

Softwood veneer and plywood are extensively used in construction for structural elements like sheathing, subflooring, and roofing, as well as in furniture manufacturing for components, packaging for crates and pallets, and various industrial applications due to their versatility and strength.

How does sustainability impact the softwood veneer and plywood market?

Sustainability significantly drives market trends, with increasing demand for products sourced from certified, responsibly managed forests. This focus ensures reduced environmental impact, promotes renewable resources, and aligns with growing consumer and regulatory preferences for eco-friendly building materials.

What are the main types of softwood plywood available?

Key types include structural plywood, designed for load-bearing applications in construction; non-structural plywood, used for general utility and non-load-bearing purposes; and marine plywood, specifically engineered for superior moisture resistance in high-humidity or wet environments.

Which regions exhibit the highest growth in the softwood veneer and plywood market?

The Asia Pacific region, particularly countries like China and India, demonstrates the highest growth due to rapid urbanization, extensive infrastructure development, and a booming construction industry, leading to substantial demand for engineered wood products.

What role does technology play in modern softwood veneer and plywood production?

Technology, including automated grading systems, advanced rotary peelers, energy-efficient dryers, and low-VOC adhesives, is crucial for improving manufacturing efficiency, enhancing product quality, reducing waste, and ensuring compliance with stringent environmental and performance standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager