Soil Compaction Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430506 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Soil Compaction Equipment Market Size

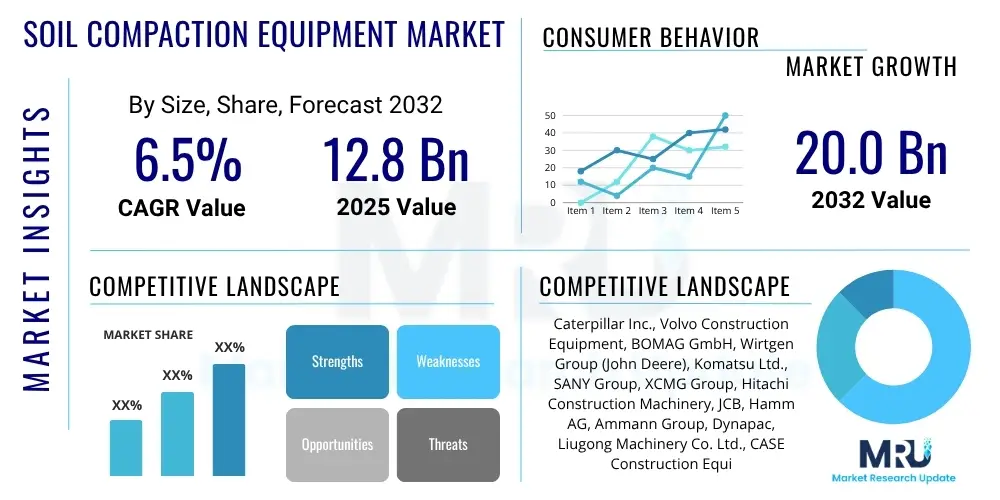

The Soil Compaction Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 12.8 billion in 2025 and is projected to reach USD 20.0 billion by the end of the forecast period in 2032.

Soil Compaction Equipment Market introduction

The Soil Compaction Equipment Market encompasses a wide range of heavy machinery designed to increase soil density, improve load-bearing capacity, reduce settlement, and enhance the overall stability of construction sites, roadbeds, and other infrastructure projects. These essential machines are crucial for creating stable foundations and ensuring the longevity and safety of structures built upon compacted ground. The market primarily deals with equipment such as vibratory rollers, static rollers, plate compactors, and rammers, each suited for specific soil types and project scales, ranging from small residential developments to large-scale public works.

Major applications for soil compaction equipment span across various sectors, including extensive road construction, commercial and residential building construction, railway and airport runway development, landfill compaction, and pipeline trench backfill. The primary benefits derived from effective soil compaction include enhanced structural integrity, prevention of soil erosion, improved drainage, and optimized material usage, all contributing to cost-effectiveness and project durability. The market is primarily driven by escalating global infrastructure spending, rapid urbanization in developing economies, and continuous technological advancements aimed at improving equipment efficiency, automation, and environmental sustainability.

Soil Compaction Equipment Market Executive Summary

The Soil Compaction Equipment Market is currently experiencing robust growth, propelled by significant global investments in infrastructure development, particularly in emerging economies. Key business trends indicate a strong shift towards advanced compaction technologies, including intelligent compaction systems that offer real-time data and GPS mapping for optimized soil density. The demand for rental equipment is also escalating, providing flexibility and cost-efficiency for construction companies. Furthermore, manufacturers are focusing on producing more fuel-efficient and electrically powered machinery to meet stringent environmental regulations and operational sustainability goals.

Regionally, the Asia Pacific market is poised for exceptional growth, driven by ambitious projects in countries like China, India, and Southeast Asian nations, where urbanization and industrialization are proceeding at a rapid pace. North America and Europe, while mature markets, show steady demand, fueled by maintenance of existing infrastructure and adoption of technologically advanced, eco-friendly equipment. Emerging markets in Latin America and the Middle East and Africa are also witnessing increased adoption due to growing investment in public infrastructure, mining, and oil and gas sector development.

Segment trends highlight the dominance of vibratory rollers due to their versatility and efficiency across diverse soil types. There is also a notable increase in demand for remote-controlled and autonomous compaction solutions, enhancing safety on construction sites and reducing labor costs. The medium to heavy operating weight categories are expected to maintain their significant market share, driven by large-scale commercial and civil engineering projects, while light compaction equipment continues to be vital for residential and landscaping applications, reflecting a diversified market landscape.

AI Impact Analysis on Soil Compaction Equipment Market

Users frequently inquire about the transformative potential of Artificial Intelligence within the soil compaction equipment sector, particularly concerning how AI can enhance operational efficiency, precision, and safety. There is significant interest in understanding how AI algorithms can optimize compaction patterns, predict maintenance needs, and facilitate autonomous operations to address labor shortages and improve project timelines. Key themes revolve around the integration of real-time data analysis, machine learning for adaptive compaction, and the overall intelligence augmentation of heavy machinery, pointing towards a future of smarter, more responsive construction processes.

- Enhanced Precision Compaction: AI algorithms analyze soil data from sensors to determine optimal compaction force and passes, minimizing over-compaction and under-compaction, leading to superior quality and consistency.

- Predictive Maintenance: AI-powered systems monitor equipment performance, detecting anomalies and predicting potential failures before they occur, reducing downtime and maintenance costs.

- Autonomous Operation: AI facilitates self-driving compaction equipment, enabling machines to operate independently or with minimal human oversight, improving safety and addressing labor scarcity.

- Optimized Fuel Efficiency: AI-driven route planning and operational adjustments can minimize idle time and optimize engine performance, leading to significant fuel savings and reduced emissions.

- Real-time Data Analytics: AI processes large volumes of data from various sensors (GPS, accelerometers, temperature, moisture) to provide real-time insights into compaction progress and soil conditions.

- Improved Operator Assistance: AI can provide intelligent recommendations and warnings to human operators, enhancing their decision-making and reducing operational errors.

- Safety Enhancements: Autonomous features and AI-powered hazard detection systems can significantly reduce the risk of accidents on construction sites, especially in challenging environments.

- Adaptive Compaction: Machine learning allows compaction equipment to adapt to varying soil conditions automatically, ensuring optimal results without constant manual adjustments.

DRO & Impact Forces Of Soil Compaction Equipment Market

The Soil Compaction Equipment Market is driven by several significant factors, primarily the global impetus for infrastructure development, including extensive road networks, commercial complexes, and urban housing. Rapid urbanization, particularly in developing nations, necessitates robust foundational infrastructure, directly translating into increased demand for efficient compaction machinery. Technological advancements, such as the integration of intelligent compaction systems and telematics, further stimulate market growth by offering improved efficiency, precision, and operational safety, making advanced equipment a compelling investment for construction firms aiming for higher productivity and reduced project timelines.

However, the market also faces considerable restraints, including the high initial capital investment required for purchasing advanced compaction equipment, which can be prohibitive for smaller contractors. The scarcity of skilled labor capable of operating and maintaining sophisticated machinery poses another significant challenge, affecting adoption rates and operational efficiency. Furthermore, stringent environmental regulations regarding emissions and noise pollution necessitate continuous innovation and significant R&D expenditures from manufacturers, potentially increasing product costs and slowing market expansion in some regions. Economic uncertainties and fluctuations in raw material prices also contribute to market volatility.

Opportunities within the market abound, particularly with the growing adoption of smart compaction technologies that integrate GPS, IoT, and data analytics for optimized soil density and verifiable results. The increasing demand for rental equipment provides a flexible solution for companies to access high-quality machinery without substantial upfront investment, fostering market accessibility. Moreover, the electrification of heavy equipment presents a lucrative avenue for sustainable development, addressing environmental concerns and reducing operating costs over the long term. Expanding into emerging markets with rapidly growing infrastructure needs also offers significant growth prospects for manufacturers and service providers.

Segmentation Analysis

The Soil Compaction Equipment Market is comprehensively segmented based on various critical attributes, including the type of equipment, its operating weight, specific application areas, and the end-user demographics. This segmentation allows for a detailed analysis of market dynamics, identifying key growth drivers and prevailing trends within each sub-segment. Understanding these distinct categories is essential for manufacturers to tailor their product offerings, for distributors to optimize their sales strategies, and for construction firms to select the most appropriate machinery for their diverse project requirements, ensuring optimal performance and efficiency across the industry value chain.

- By Type

- Vibratory Rollers

- Single Drum Vibratory Rollers

- Double Drum Vibratory Rollers

- Static Rollers (Smooth Wheel Rollers)

- Pneumatic Tired Rollers

- Plate Compactors (Vibratory Plates)

- Forward Plate Compactors

- Reversible Plate Compactors

- Tampers/Rammers

- Trench Rollers

- Landfill Compactors

- Vibratory Rollers

- By Operating Weight

- Light Compaction Equipment (Less than 3 Tons)

- Medium Compaction Equipment (3 to 10 Tons)

- Heavy Compaction Equipment (More than 10 Tons)

- By Application

- Road Construction

- Building & Civil Construction

- Landscaping & Residential Projects

- Mining & Quarrying

- Waste Management (Landfills)

- Agricultural Land Development

- Pipeline & Trenching

- By End-User

- Construction Companies

- Equipment Rental Companies

- Government & Public Works Departments

- Mining Companies

- Agriculture & Forestry

- Industrial & Commercial Developers

Value Chain Analysis For Soil Compaction Equipment Market

The value chain for the Soil Compaction Equipment Market begins with extensive upstream activities, involving the procurement of raw materials and the manufacturing of essential components. This stage includes suppliers of high-grade steel, engines (diesel, electric), hydraulic systems, electronic components for controls and telematics, and specialized rubber for tires and vibration dampeners. Key manufacturers then assemble these components, focusing on robust engineering, performance optimization, and integration of advanced technologies like intelligent compaction systems and IoT connectivity. The quality and reliability of these upstream suppliers directly impact the final product's performance and durability.

Further along the chain, downstream activities primarily involve the distribution, sales, and aftermarket support of the compaction equipment. This includes a robust network of authorized dealers and independent distributors who handle sales, provide financing options, and offer maintenance services and spare parts. Equipment rental companies play a significant role, particularly for smaller contractors or projects requiring specialized machinery for a limited duration, allowing for greater market accessibility and flexibility. The aftermarket services, including repairs, genuine spare parts, and extended warranty programs, are crucial for customer satisfaction and maintaining equipment longevity, driving repeat business and brand loyalty.

Distribution channels for soil compaction equipment are predominantly characterized by a blend of direct and indirect approaches. Major manufacturers often maintain direct sales forces for large fleet orders or strategic accounts, fostering direct relationships with key clients such as large construction conglomerates or government agencies. However, the majority of sales occur through a well-established network of independent dealers and distributors who provide local sales, service, and support, leveraging their regional expertise and customer relationships. The emergence of online platforms and digital marketplaces is also beginning to offer alternative avenues for product visibility and sales, though direct interaction and demonstration remain vital given the capital-intensive nature of the equipment.

Soil Compaction Equipment Market Potential Customers

The primary potential customers and end-users of soil compaction equipment are diverse, stemming from various sectors that require ground preparation and stabilization. Construction contractors form the largest segment, encompassing general contractors, civil engineering firms, and specialized road construction companies responsible for building highways, bridges, airports, and commercial structures. These entities rely heavily on compaction equipment to ensure the structural integrity and longevity of their projects, adhering to strict engineering specifications and safety standards. The scale and type of equipment required often vary based on project size and complexity, influencing purchasing decisions.

Another significant customer base includes equipment rental companies, which serve a broad array of smaller contractors, developers, and municipalities who prefer to rent machinery rather than incur high capital expenditures for outright purchase. Rental firms continuously invest in a diverse fleet of compaction equipment to meet fluctuating demand and offer flexible solutions, including short-term and long-term rental agreements. Government agencies and public works departments also represent substantial buyers, procuring equipment for public infrastructure projects, road maintenance, and urban development initiatives, often through competitive bidding processes that prioritize reliability, efficiency, and adherence to environmental standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 12.8 Billion |

| Market Forecast in 2032 | USD 20.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Volvo Construction Equipment, BOMAG GmbH, Wirtgen Group (John Deere), Komatsu Ltd., SANY Group, XCMG Group, Hitachi Construction Machinery, JCB, Hamm AG, Ammann Group, Dynapac, Liugong Machinery Co. Ltd., CASE Construction Equipment, Sakai Heavy Industries Ltd., Fayat Group, Terex Corporation, Shantui Construction Machinery Co. Ltd., MBW Inc., Weber MT GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Soil Compaction Equipment Market Key Technology Landscape

The Soil Compaction Equipment Market is rapidly evolving with the integration of several advanced technologies aimed at enhancing efficiency, precision, and operational intelligence. A prominent technological trend is the widespread adoption of Intelligent Compaction (IC) systems, which combine GPS/GNSS positioning, accelerometers, and infrared temperature sensors to provide real-time feedback on compaction progress and material stiffness. These systems enable operators to achieve optimal compaction uniformly, reduce passes, minimize fuel consumption, and generate verifiable compaction reports, thereby improving project quality and reducing costs. IC technology is becoming a standard feature in many modern vibratory rollers, significantly impacting project execution and quality assurance.

Another crucial technological development is the incorporation of telematics and Internet of Things (IoT) solutions into compaction equipment. Telematics systems allow for remote monitoring of machine performance, location tracking, fuel consumption, and diagnostic data, providing fleet managers with critical insights for optimized fleet utilization, preventative maintenance scheduling, and improved operational efficiency. IoT sensors further extend this capability by collecting granular data on various machine parameters and environmental conditions, which can then be analyzed using cloud-based platforms to generate actionable intelligence, supporting better asset management and predictive analytics across construction sites.

Furthermore, the market is witnessing increasing advancements in automation and semi-autonomous features, driven by the demand for enhanced safety and addressing skilled labor shortages. Technologies such as remote control operation allow operators to manage equipment from a safe distance, particularly in hazardous environments. The long-term outlook points towards fully autonomous compaction solutions, where AI and advanced robotics enable machines to operate independently, optimizing compaction patterns based on dynamic site conditions. Electrification is also gaining traction, with manufacturers introducing electric and hybrid compaction equipment to reduce emissions, noise pollution, and operating costs, aligning with global sustainability initiatives and stricter environmental regulations.

Regional Highlights

- North America: This region is characterized by a mature construction market with a strong emphasis on technological adoption and efficiency. Key drivers include significant investments in infrastructure upgrades and repairs, particularly for roads, bridges, and urban development projects. The U.S. and Canada lead in adopting intelligent compaction systems and telematics, driven by stringent quality standards and a focus on operational cost reduction. Demand for equipment rentals is also high, supporting diverse project scales.

- Europe: European countries exhibit steady demand, propelled by ongoing infrastructure maintenance, urban renewal projects, and a strong commitment to environmental sustainability. The market is highly regulated, leading to a strong focus on fuel-efficient, low-emission, and electric compaction equipment. Germany, France, and the UK are key markets, showcasing strong demand for technologically advanced and eco-friendly machinery, often favoring compact and versatile equipment for dense urban environments.

- Asia Pacific (APAC): APAC is the fastest-growing market for soil compaction equipment, primarily due to rapid urbanization, industrialization, and massive government investments in infrastructure development across countries like China, India, and Southeast Asian nations (e.g., Indonesia, Vietnam). This region is characterized by large-scale projects, including new road networks, smart cities, and industrial corridors, driving substantial demand for heavy and medium compaction equipment. The region is also becoming a manufacturing hub for these machines.

- Latin America: This region presents a developing market with increasing investments in infrastructure, mining, and oil and gas sectors. Countries like Brazil, Mexico, and Argentina are experiencing growth in public works and private construction, leading to a rising demand for compaction equipment. Market growth is influenced by economic stability and government policies aimed at stimulating infrastructure development, though it may face challenges from economic fluctuations and access to financing.

- Middle East and Africa (MEA): The MEA market is expanding, driven by significant investments in urban development, diversification projects away from oil dependency, and the development of large-scale infrastructure for events and tourism. Saudi Arabia, UAE, and Qatar are prominent markets, undertaking ambitious construction projects. Africa's long-term infrastructure needs, particularly in sub-Saharan regions, also offer substantial growth potential, albeit with varying paces due to political and economic factors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Soil Compaction Equipment Market.- Caterpillar Inc.

- Volvo Construction Equipment

- BOMAG GmbH

- Wirtgen Group (John Deere)

- Komatsu Ltd.

- SANY Group

- XCMG Group

- Hitachi Construction Machinery

- JCB

- Hamm AG

- Ammann Group

- Dynapac

- Liugong Machinery Co. Ltd.

- CASE Construction Equipment

- Sakai Heavy Industries Ltd.

- Fayat Group

- Terex Corporation

- Shantui Construction Machinery Co. Ltd.

- MBW Inc.

- Weber MT GmbH

Frequently Asked Questions

What is soil compaction equipment used for?

Soil compaction equipment is primarily used in construction and civil engineering to increase the density of soil or other granular materials, thereby improving its load-bearing capacity, reducing settlement, preventing frost damage, and enhancing overall stability for foundations, roads, and other infrastructure projects. It is crucial for creating durable and safe structures.

What are the main types of soil compaction equipment?

The main types include vibratory rollers (single drum, double drum), static rollers (smooth wheel, pneumatic tired), plate compactors (forward, reversible), rammers (tampers), and trench rollers. Each type is designed for specific soil conditions, project scales, and compaction requirements, from granular to cohesive soils.

How do intelligent compaction systems benefit construction projects?

Intelligent compaction (IC) systems integrate GPS, accelerometers, and infrared temperature sensors to provide real-time feedback on compaction progress and soil stiffness. Benefits include optimized compaction quality, reduced passes, minimized fuel consumption, verifiable results for quality assurance, and increased operational efficiency, leading to significant cost and time savings.

What is the market outlook for soil compaction equipment?

The market outlook is positive, driven by rising global infrastructure investments, rapid urbanization, and increasing adoption of advanced technologies like intelligent compaction and telematics. Emerging economies, particularly in Asia Pacific, are expected to be key growth drivers, while developed markets focus on replacing aging fleets with more efficient and sustainable equipment, including electrified models.

What are the key factors driving the growth of the soil compaction equipment market?

Key growth drivers include substantial government and private sector investments in infrastructure development (roads, railways, buildings), the accelerating pace of urbanization worldwide, continuous technological advancements leading to more efficient and automated machinery, and a rising demand for rental equipment solutions for flexible project execution and cost management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager