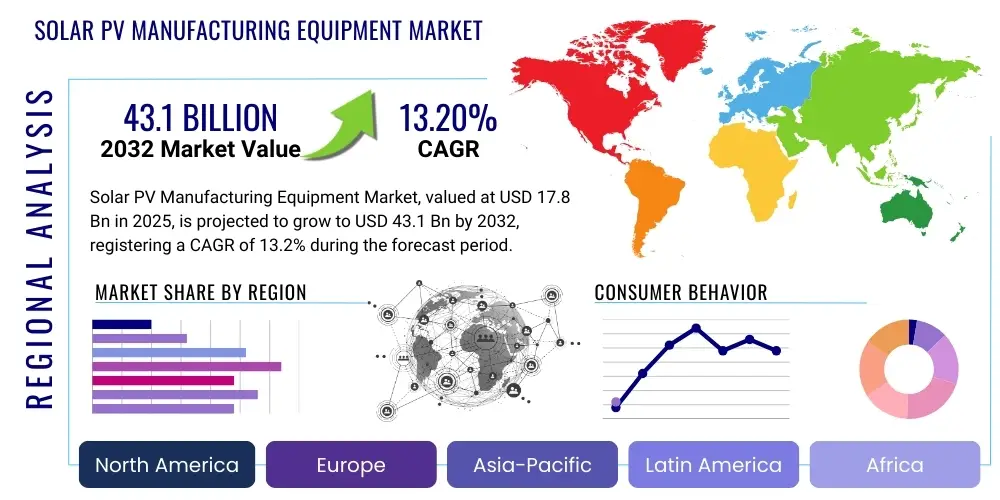

Solar PV Manufacturing Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427358 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Solar PV Manufacturing Equipment Market Size

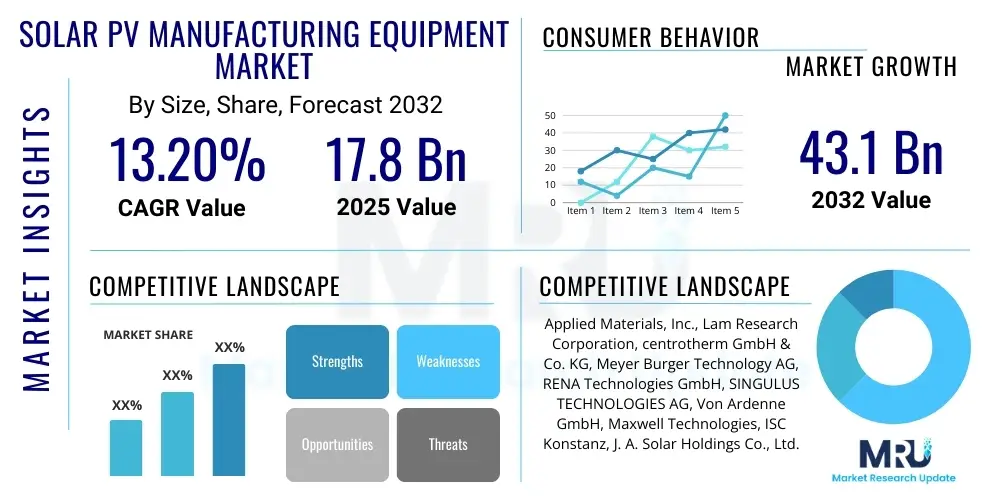

The Solar PV Manufacturing Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.2% between 2025 and 2032. The market is estimated at USD 17.8 Billion in 2025 and is projected to reach USD 43.1 Billion by the end of the forecast period in 2032.

Solar PV Manufacturing Equipment Market introduction

The Solar PV Manufacturing Equipment Market encompasses the specialized machinery, tools, and systems essential for the production of photovoltaic (PV) cells and modules. This includes a comprehensive range of equipment for processing raw materials like polysilicon, forming ingots and wafers, fabricating solar cells through various deposition and etching techniques, and finally assembling these cells into finished solar modules. The market is crucial for enabling the global transition to renewable energy by facilitating the mass production of cost-effective and high-efficiency solar panels, which are the cornerstone of solar power generation. As global energy demands intensify and environmental concerns drive the adoption of clean energy, the demand for advanced and efficient PV manufacturing equipment is escalating, pushing technological boundaries and fostering innovation across the value chain.

Major applications for solar PV manufacturing equipment span the entire solar production lifecycle. This includes the upstream production of high-purity silicon feedstock, midstream wafering and cell processing, and downstream module assembly. The benefits derived from this market are multifaceted, primarily contributing to the reduction in the Levelized Cost of Electricity (LCOE) for solar power, enhanced module efficiency, and improved manufacturing throughput. Advancements in equipment technology directly translate into higher power output, longer product lifespans, and reduced material waste, making solar energy more competitive and accessible. These benefits are instrumental in expanding the deployment of solar energy solutions globally, from utility-scale solar farms to residential rooftop installations.

The market is primarily driven by robust government policies and incentives promoting renewable energy, alongside a growing global consensus on climate change mitigation. Countries worldwide are setting ambitious renewable energy targets, stimulating significant investments in solar power generation capacity. This, in turn, fuels the demand for new and upgraded manufacturing facilities and, consequently, advanced PV manufacturing equipment. Furthermore, continuous technological innovation in solar cell efficiency and manufacturing processes, coupled with declining costs of solar energy, further propels market expansion, making solar PV an increasingly attractive energy source for diverse applications and regions. Energy independence and security considerations also play a pivotal role, encouraging domestic manufacturing capabilities and supply chain resilience.

Solar PV Manufacturing Equipment Market Executive Summary

The Solar PV Manufacturing Equipment Market is experiencing dynamic growth, propelled by robust business trends centered on automation, digitalization, and the pursuit of enhanced production efficiencies. Manufacturers are increasingly investing in state-of-the-art machinery that integrates Industry 4.0 principles, including robotics, artificial intelligence, and advanced analytics, to optimize production lines, reduce operational costs, and improve product quality. There is a discernible trend towards integrated manufacturing solutions that offer end-to-end capabilities, streamlining the production process from raw material to finished module. Furthermore, efforts to diversify supply chains and enhance resilience are prompting investments in new manufacturing hubs outside traditional strongholds, fostering a more distributed global production landscape and mitigating geopolitical risks associated with concentrated supply.

Regionally, the market exhibits a pronounced shift, with Asia-Pacific maintaining its dominance, particularly China, as the global leader in PV manufacturing capacity and equipment demand. However, significant growth and strategic investments are also evident in other regions. Europe and North America are actively pursuing reshoring initiatives, driven by governmental support and a desire to bolster domestic manufacturing capabilities and energy independence. This renewed focus on local production is stimulating demand for advanced equipment in these regions, aiming to create high-efficiency, sustainable manufacturing ecosystems. Emerging markets in Southeast Asia, Latin America, and the Middle East are also contributing to market expansion, driven by increasing energy demands and favorable regulatory environments for solar energy deployment.

Segmentation trends reveal a strong emphasis on advanced cell processing equipment for crystalline silicon PV, particularly for technologies such as TOPCon and HJT (Heterojunction Technology), which offer superior efficiency. The demand for equipment supporting these next-generation technologies is surging as manufacturers strive to achieve higher power output per module. Module assembly equipment is also evolving rapidly, incorporating greater automation and precision for handling larger wafer sizes and complex module designs, including bifacial and half-cut cell modules. Furthermore, there is growing interest and investment in equipment for thin-film PV and novel PV technologies like perovskites, signaling future diversification and the potential for new market segments, though crystalline silicon remains the dominant technology driving current equipment demand.

AI Impact Analysis on Solar PV Manufacturing Equipment Market

The integration of Artificial Intelligence (AI) into the Solar PV Manufacturing Equipment Market is profoundly transforming operational paradigms, addressing critical industry questions regarding efficiency, cost reduction, and quality control. Users and stakeholders are keen to understand how AI can elevate production throughput, minimize waste, and predict equipment failures before they occur. Key themes include the ability of AI to interpret vast datasets generated during manufacturing, from material input characteristics to final module performance, thereby identifying subtle anomalies and optimizing process parameters in real-time. This predictive and prescriptive capability is central to unlocking the next generation of smart PV factories, moving beyond traditional automation to truly intelligent manufacturing environments.

Concerns often revolve around the initial capital investment required for AI integration, the availability of skilled personnel to manage and leverage AI systems, and data security. However, the expectations for AIs influence are overwhelmingly positive, anticipating significant strides in manufacturing precision, accelerated research and development cycles, and enhanced supply chain visibility. AI is expected to enable more agile and responsive manufacturing processes, allowing for quicker adaptation to market demands and material fluctuations. Its capacity for continuous learning ensures that manufacturing processes become progressively more efficient and reliable over time, translating directly into lower manufacturing costs and higher quality solar products.

The impact of AI extends beyond direct manufacturing processes, influencing every stage from design to post-production quality assurance. Machine learning algorithms are now being deployed in predictive maintenance, analyzing sensor data from equipment to forecast potential breakdowns, thereby reducing downtime and extending machinery lifespan. In research and development, AI accelerates material discovery and process optimization, significantly shortening the time-to-market for new PV technologies. The technology also plays a crucial role in quality inspection, employing computer vision for precise defect detection that surpasses human capabilities, ensuring the reliability and performance of solar cells and modules entering the market. This pervasive impact is setting new benchmarks for operational excellence within the solar PV manufacturing sector.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data from manufacturing equipment to predict potential failures, reducing unplanned downtime by up to 30% and extending equipment lifespan.

- Optimized Process Control: Machine learning models continuously fine-tune manufacturing parameters in real-time, leading to improved yield rates, higher cell efficiency, and reduced material waste.

- Automated Quality Inspection: AI-powered computer vision systems perform high-speed, high-accuracy defect detection on wafers and cells, surpassing human inspection capabilities and ensuring consistent product quality.

- Accelerated R&D and Material Discovery: AI speeds up the simulation and testing of new materials and cell designs, significantly shortening development cycles for next-generation PV technologies like perovskites.

- Supply Chain Optimization: AI analyzes global supply and demand data, logistics, and geopolitical factors to optimize inventory management, material sourcing, and production scheduling.

- Energy Consumption Reduction: AI systems identify patterns in energy usage across manufacturing lines, enabling smart adjustments to minimize energy intensity during production processes.

- Digital Twin Creation: AI facilitates the development of digital twins for entire factories or specific equipment, allowing for virtual testing, scenario planning, and continuous optimization without disrupting physical operations.

DRO & Impact Forces Of Solar PV Manufacturing Equipment Market

The Solar PV Manufacturing Equipment Market is primarily driven by several powerful forces. Foremost among these are the global decarbonization efforts and aggressive renewable energy targets set by governments and international bodies. These policies, often accompanied by supportive subsidies, tax credits, and feed-in tariffs, create a stable and growing demand for solar energy, directly stimulating investment in manufacturing capacity. Furthermore, the continuous reduction in the Levelized Cost of Electricity (LCOE) for solar PV, driven by technological advancements and economies of scale, makes solar power increasingly competitive with traditional energy sources, thereby expanding its adoption across various segments. Technological innovation, particularly in cell efficiency and module power output, necessitates upgrades to existing manufacturing equipment and investment in new, more advanced machinery, fueling market growth. The increasing awareness and concern over climate change also play a significant role, fostering a societal push towards sustainable energy solutions.

Despite robust growth drivers, the market faces several notable restraints. High capital expenditure remains a significant barrier for new entrants and even for established players looking to upgrade facilities, given the substantial investment required for advanced machinery and cleanroom environments. The volatility of raw material prices, particularly for polysilicon and other critical components, introduces uncertainty and impacts manufacturing costs. Geopolitical tensions and trade disputes can disrupt global supply chains, leading to delays and increased costs for equipment procurement. Moreover, the industry can be susceptible to periods of oversupply, which can depress module prices and reduce profitability for manufacturers, potentially slowing down investments in new equipment. The rapid pace of technological change, while a driver, also poses a restraint as it can quickly render older equipment obsolete, requiring continuous re-investment.

Opportunities within the Solar PV Manufacturing Equipment Market are abundant and diverse. The burgeoning demand from emerging economies, particularly in Asia, Africa, and Latin America, presents significant avenues for market expansion as these regions scale up their energy infrastructure with renewable sources. The development and commercialization of advanced PV technologies, such as perovskite solar cells, tandem cells, and flexible solar films, open entirely new segments for specialized manufacturing equipment. There is also a substantial opportunity in integrated manufacturing solutions and the adoption of smart factory concepts, leveraging Industry 4.0 and AI to create highly efficient, automated, and sustainable production lines. Additionally, localized manufacturing efforts and supply chain diversification, driven by government incentives in regions like Europe and North America, offer new markets for equipment suppliers looking to cater to these developing domestic industries. The circular economy principles also present opportunities for developing equipment that supports recycling and end-of-life management for solar panels.

Segmentation Analysis

The Solar PV Manufacturing Equipment Market is comprehensively segmented to provide a detailed understanding of its diverse components and evolving landscape. This segmentation is crucial for stakeholders to identify specific growth areas, technological shifts, and regional demand patterns. The market can be analyzed based on various criteria, including the type of equipment, the specific manufacturing process it serves, the underlying solar cell technology, and the scale of application. Each segment reveals unique characteristics in terms of innovation, market maturity, and competitive intensity. Understanding these distinctions allows for targeted strategic planning, product development, and market entry strategies, ensuring that manufacturers and investors can effectively navigate the complex dynamics of the solar PV ecosystem.

- By Equipment Type:

- Polysilicon Production Equipment: Reactors, purifiers, crystal growers.

- Ingot and Wafering Equipment: Ingot furnaces, wire saws, dicing machines.

- Cell Processing Equipment: Diffusion furnaces, PECVD (Plasma Enhanced Chemical Vapor Deposition), PVD (Physical Vapor Deposition), screen printers, etching systems, ion implanters, laser ablation tools.

- Module Assembly Equipment: Stringers, laminators, framing machines, testing equipment.

- By Application:

- Crystalline Silicon PV (c-Si): Dominant segment, including monocrystalline and multicrystalline silicon cells.

- Thin-Film PV: Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), Amorphous Silicon (a-Si).

- By Technology:

- PERC (Passivated Emitter Rear Cell)

- TOPCon (Tunnel Oxide Passivated Contact)

- HJT (Heterojunction Technology)

- IBC (Interdigitated Back Contact)

- Emerging Technologies (e.g., Perovskites, Tandem Cells)

- By End-User:

- Large-Scale PV Manufacturers

- Small and Medium-Sized Enterprises (SMEs)

- Research and Development Institutions

Solar PV Manufacturing Equipment Market Value Chain Analysis

The value chain for the Solar PV Manufacturing Equipment Market is intricate and interconnected, commencing with upstream suppliers who provide the foundational materials and sophisticated components necessary for equipment manufacturing. These upstream elements include producers of high-grade metals, specialized ceramics, precision optics, automation components, and advanced control systems. Suppliers of specialized gases, chemicals, and ultra-pure water systems are also critical, ensuring the pristine environments required for semiconductor-grade processing. Furthermore, the development of sophisticated software for process control, simulation, and data analytics, often provided by specialized technology firms, forms an increasingly vital part of the upstream segment, enabling the intelligence and efficiency of modern PV manufacturing lines. The quality and availability of these upstream inputs directly impact the performance, reliability, and cost-effectiveness of the final manufacturing equipment.

The core of the value chain involves the solar PV manufacturing equipment Original Equipment Manufacturers (OEMs) themselves. These companies design, engineer, and assemble the specialized machinery for various stages of solar cell and module production. Their operations encompass extensive research and development, precision engineering, and rigorous testing to deliver high-performance, high-throughput, and energy-efficient solutions. These OEMs often specialize in particular segments, such as wafering, cell processing, or module assembly, although some offer integrated solutions. They engage in direct sales and provide comprehensive after-sales support, including installation, maintenance, and technical training, forming close relationships with their downstream customers, who are the actual solar cell and module manufacturers. This direct relationship is crucial for understanding evolving customer needs and incorporating feedback into future equipment designs.

Downstream, the value chain extends to the primary users of this equipment: the solar cell and module manufacturers. These companies utilize the equipment to produce the finished PV products that are then sold to project developers, Engineering, Procurement, and Construction (EPC) firms, and distributors. Beyond direct manufacturing, the downstream segment also includes renewable energy project developers and utilities who purchase solar modules for large-scale solar farms or grid integration projects. The distribution channel for solar PV manufacturing equipment is primarily direct, with OEMs selling directly to large-scale PV manufacturers globally. However, for smaller manufacturers or in specific regions, indirect channels involving local agents, distributors, or system integrators might be employed, offering localized sales support and technical services. The efficiency and innovation within the equipment manufacturing sector directly influence the competitiveness and growth of the downstream solar energy industry, demonstrating a symbiotic relationship across the entire value chain.

Solar PV Manufacturing Equipment Market Potential Customers

The primary potential customers in the Solar PV Manufacturing Equipment Market are large-scale solar PV manufacturers, who represent the cornerstone of global solar production capacity. These entities, often integrated giants or specialized cell and module producers, require continuous investment in state-of-the-art equipment to maintain their competitive edge, scale production, and adopt next-generation technologies. Their purchasing decisions are driven by factors such as equipment efficiency, reliability, throughput, and the ability to reduce the Levelized Cost of Electricity (LCOE) for their solar panels. These manufacturers are constantly seeking solutions that offer higher automation, improved process control, and advanced capabilities for producing high-efficiency cells like TOPCon and HJT, along with larger format wafers and bifacial modules. Their substantial production volumes necessitate equipment that can operate with minimal downtime and maximum yield, making long-term service agreements and technical support critical considerations in their procurement processes.

Another significant segment of potential customers includes small and medium-sized enterprises (SMEs) and new entrants into the PV manufacturing sector. These companies may be establishing new production lines, expanding existing facilities, or specializing in niche solar applications. While their individual purchasing power might be less than that of industry giants, their collective demand contributes substantially to market growth, particularly in developing regions or areas focused on localized manufacturing. SMEs often seek cost-effective, modular, and flexible equipment solutions that can be scaled as their operations grow. They also place a high value on ease of operation, comprehensive technical training, and strong local support. The resurgence of domestic manufacturing initiatives in regions like North America and Europe is fostering a new wave of such entrants, driven by national energy security goals and policy support, creating fresh opportunities for equipment suppliers.

Beyond traditional manufacturers, research and development institutions, universities, and specialized innovation centers also constitute an important customer base. These entities acquire advanced PV manufacturing equipment for pioneering new solar cell architectures, testing novel materials, and refining existing production processes. Their demand is often for highly versatile, precise, and customizable equipment that can facilitate experimental setups and pilot production lines rather than mass manufacturing. Integrated energy companies and diversified technology conglomerates, exploring vertical integration into solar PV manufacturing, represent another emerging customer segment. These entities aim to control more of the solar value chain or leverage existing manufacturing expertise. The decision-making process for these varied customer groups is influenced by a combination of technological capabilities, cost-effectiveness, regional incentives, and the overarching strategic objectives of their respective organizations.

Solar PV Manufacturing Equipment Market Key Technology Landscape

The technology landscape for the Solar PV Manufacturing Equipment Market is characterized by rapid innovation, driven by the incessant quest for higher solar cell efficiency, lower manufacturing costs, and enhanced sustainability. A dominant trend is the pervasive adoption of advanced automation and robotics across all stages of production, from wafer handling to module assembly. Robotic systems are increasingly sophisticated, capable of precise material handling, intricate cell interconnection, and high-speed inspection, significantly boosting throughput and reducing labor costs. This automation is complemented by the integration of Industry 4.0 principles, where entire production lines are interconnected, sharing data in real-time. This enables predictive analytics, remote monitoring, and autonomous decision-making through AI and machine learning algorithms, optimizing every facet of the manufacturing process for efficiency and defect reduction.

In terms of specific process technologies, there is intense focus on equipment supporting next-generation crystalline silicon solar cells, such as TOPCon (Tunnel Oxide Passivated Contact) and HJT (Heterojunction Technology). These technologies require highly specialized deposition techniques, including PECVD (Plasma Enhanced Chemical Vapor Deposition) for passivation layers and PVD (Physical Vapor Deposition) for transparent conductive oxides and metal contacts. Advanced laser scribing and doping equipment are also critical for intricate cell designs that maximize light absorption and minimize recombination losses. Equipment for handling larger wafer sizes (e.g., M10, G12) and producing bifacial modules is also standard, necessitating updates in all downstream assembly lines to accommodate increased module dimensions and power outputs. The continuous development of metrology tools capable of ultra-precise measurement and inline quality control is paramount for ensuring consistent product quality at high production speeds.

Beyond crystalline silicon, the technology landscape also includes specialized equipment for thin-film PV production, although this segment represents a smaller portion of the overall market. This involves sophisticated vacuum deposition systems for depositing ultra-thin layers of materials like Cadmium Telluride (CdTe) or Copper Indium Gallium Selenide (CIGS) onto substrates. Furthermore, significant R&D is underway in equipment for emerging PV technologies, such as perovskite solar cells and tandem cells, which promise even higher efficiencies. This includes novel coating techniques, precise temperature control systems, and encapsulation equipment tailored to the unique properties of these materials. The overarching goal across all technological advancements is to enable more energy-efficient production, reduce environmental footprint, and ultimately lower the cost of solar electricity, making solar power an increasingly attractive and sustainable energy solution worldwide.

Regional Highlights

The global Solar PV Manufacturing Equipment Market exhibits significant regional variations, driven by differing government policies, economic development, and strategic energy priorities. Asia-Pacific, particularly China, remains the undisputed global leader in both solar PV manufacturing capacity and demand for related equipment. Chinas dominance is underpinned by massive government support, extensive R&D investments, and a robust supply chain ecosystem, leading to unparalleled production volumes of solar cells and modules. Other countries in the region, such as Vietnam, Malaysia, India, and Thailand, are also rapidly expanding their manufacturing bases, attracting new investments in equipment as companies seek to diversify production away from China or capitalize on growing domestic and regional demand. India, with its ambitious renewable energy targets and "Make in India" initiatives, is emerging as a significant market for new PV manufacturing equipment, aiming to reduce reliance on imports and foster local production capabilities. Southeast Asia continues to grow as a manufacturing hub, offering competitive labor costs and favorable trade agreements.

Europe is witnessing a strong resurgence in PV manufacturing, fueled by the European Green Deal, energy security concerns, and a strategic desire to re-establish a local solar supply chain. While historically focused on R&D, there is now substantial investment in establishing Gigafactories for solar cell and module production, particularly leveraging advanced technologies like HJT and TOPCon. Countries such as Germany, France, and Italy are providing incentives and funding to scale up domestic manufacturing, creating a significant demand for cutting-edge, highly automated PV manufacturing equipment. This push for "Made in Europe" solar products aims to reduce dependence on external supply chains, enhance technological sovereignty, and ensure high environmental and labor standards in production. The emphasis is on producing high-efficiency, sustainable modules that cater to the demanding European market and export opportunities.

North America, primarily the United States, is also experiencing a significant boost in PV manufacturing, largely driven by supportive policies like the Inflation Reduction Act (IRA). The IRA offers substantial tax credits and incentives for domestic manufacturing of solar components, from polysilicon to modules, creating a powerful economic impetus for new factory construction and expansion. This has led to numerous announcements of new manufacturing facilities, signaling a strong demand for advanced PV manufacturing equipment. Companies are looking to establish vertically integrated operations within the US to capitalize on these incentives, leading to investment in the full spectrum of equipment needed for solar cell and module production. Similarly, Canada is also exploring opportunities to expand its solar manufacturing footprint. The focus in North America is on building a resilient, high-tech domestic supply chain to support large-scale solar deployment and ensure energy independence.

- Asia-Pacific: Dominates global manufacturing, led by China. Significant growth in India, Vietnam, Malaysia, and Thailand due to expansion and diversification.

- Europe: Resurgent manufacturing driven by energy security, Green Deal policies, and incentives for high-efficiency cell and module production. Germany, France, and Italy are key players.

- North America: Strong growth driven by policy support (e.g., US Inflation Reduction Act), fostering domestic manufacturing across the PV value chain.

- Middle East & Africa: Emerging market with increasing renewable energy adoption, leading to initial investments in localized manufacturing capabilities.

- Latin America: Growing interest in establishing local PV manufacturing, supported by national energy policies and abundant solar resources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solar PV Manufacturing Equipment Market.- Applied Materials, Inc.

- Lam Research Corporation

- centrotherm GmbH & Co. KG

- Meyer Burger Technology AG

- RENA Technologies GmbH

- SINGULUS TECHNOLOGIES AG

- Von Ardenne GmbH

- Maxwell Technologies

- ISC Konstanz

- J. A. Solar Holdings Co., Ltd. (Integrated Manufacturer with Equipment Capabilities)

Frequently Asked Questions

What is the primary driver for the Solar PV Manufacturing Equipment Market?

The primary driver for the Solar PV Manufacturing Equipment Market is the accelerating global transition to renewable energy, fueled by ambitious government targets for solar power deployment, declining solar energy costs, and increasing environmental concerns. These factors collectively stimulate significant investment in new and upgraded PV manufacturing capacity worldwide.

How does government policy influence market growth?

Government policies significantly influence market growth by providing incentives such as subsidies, tax credits, and feed-in tariffs, which make solar power more economically viable. Additionally, policies like the US Inflation Reduction Act or Europes Green Deal directly support domestic manufacturing, driving demand for PV manufacturing equipment within specific regions.

What role does automation play in PV manufacturing equipment?

Automation plays a critical role in PV manufacturing equipment by enhancing production efficiency, reducing labor costs, improving product quality, and enabling higher throughput. Advanced robotics, AI, and Industry 4.0 integration facilitate precise material handling, optimized process control, and real-time defect detection, leading to more competitive solar products.

Which regions are leading in solar PV manufacturing equipment adoption?

Asia-Pacific, particularly China, leads in solar PV manufacturing equipment adoption due to its vast existing production capacity and ongoing expansions. However, North America and Europe are experiencing significant growth, driven by strategic reshoring initiatives and robust government support to build localized, high-tech solar manufacturing supply chains.

What are the main technological advancements expected in this market?

Key technological advancements expected in this market include continued integration of AI and machine learning for process optimization and predictive maintenance, specialized equipment for high-efficiency cell technologies like TOPCon and HJT, and advanced systems for larger wafer sizes. Further development in equipment for emerging PV technologies such as perovskites is also anticipated.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager