Solid Control Drilling Waste Management Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427779 | Date : Oct, 2025 | Pages : 254 | Region : Global | Publisher : MRU

Solid Control Drilling Waste Management Market Size

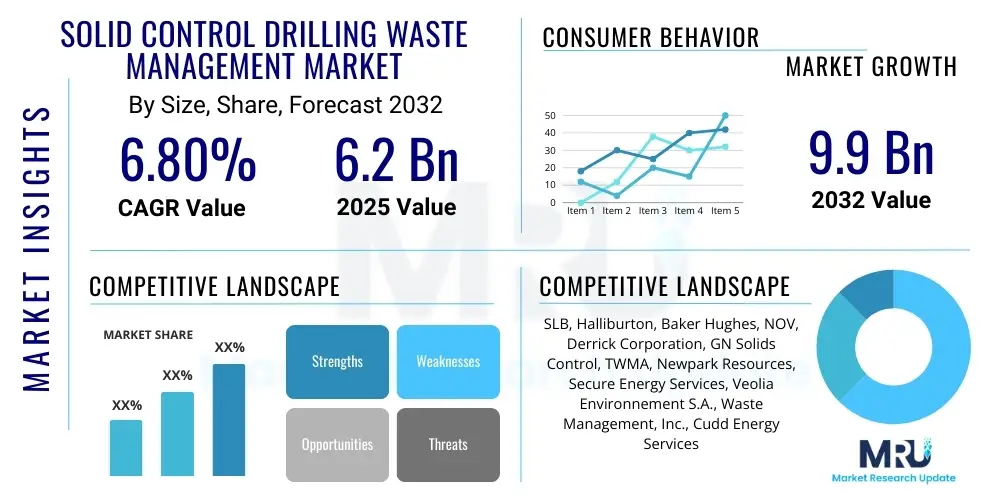

The Solid Control Drilling Waste Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 6.2 Billion in 2025 and is projected to reach USD 9.9 Billion by the end of the forecast period in 2032.

Solid Control Drilling Waste Management Market introduction

The Solid Control Drilling Waste Management Market encompasses a suite of specialized equipment, technologies, and services designed to handle and process waste generated during oil and gas drilling operations. These products and services are crucial for separating solids from drilling fluids, treating contaminated water, and safely managing drill cuttings and other byproducts. Major applications span both onshore and offshore exploration and production activities, where they ensure operational efficiency and environmental compliance. The primary benefits include reduced environmental impact, adherence to stringent regulatory standards, improved drilling fluid properties for enhanced wellbore stability, and significant cost savings through waste minimization and fluid recycling. The market is primarily driven by escalating global energy demand, increased drilling activities, particularly in unconventional reservoirs, and a growing emphasis on sustainable practices and stringent environmental regulations.

Solid Control Drilling Waste Management Market Executive Summary

The Solid Control Drilling Waste Management Market is experiencing robust growth, fueled by several interconnected business, regional, and segment trends. Business trends highlight a strong industry shift towards integrated waste management solutions, digitalization, and automation, aiming to optimize operational efficiency and minimize environmental footprints. Companies are increasingly investing in advanced analytics and IoT-enabled equipment to provide real-time monitoring and predictive maintenance, enhancing service delivery and reducing downtime. Regionally, North America continues to dominate due to extensive unconventional drilling activities and sophisticated regulatory frameworks, while the Middle East and Asia Pacific are emerging as high-growth areas, driven by new exploration projects and developing environmental consciousness. Segment trends indicate a rising demand for advanced solids control equipment, such as high-G centrifuges and thermal desorption units, as well as a significant uptake in rental and waste treatment services. The market also sees a growing preference for closed-loop systems that prioritize fluid recovery and waste-to-value solutions, aligning with global sustainability goals and economic incentives for resource optimization.

AI Impact Analysis on Solid Control Drilling Waste Management Market

The integration of Artificial Intelligence (AI) within the Solid Control Drilling Waste Management Market addresses common user questions regarding efficiency, cost reduction, regulatory compliance, and predictive capabilities. Users are keen to understand how AI can streamline complex waste handling processes, optimize resource allocation, and provide real-time insights to prevent environmental incidents. The primary themes revolving around AIs influence include its ability to enhance operational precision, enable predictive maintenance for solids control equipment, and facilitate more accurate waste characterization and treatment. Stakeholders expect AI to significantly reduce human error, improve decision-making through data-driven analytics, and ultimately lower overall operational expenditures while upholding environmental standards.

AIs potential for transformational impact lies in its capacity to process vast amounts of data from drilling operations, including fluid properties, equipment performance, and waste composition, allowing for dynamic adjustments to solids control parameters. This leads to more efficient separation of drilling cuttings and better preservation of drilling fluid integrity, which is critical for drilling success and cost management. Furthermore, AI-powered systems can simulate various waste treatment scenarios, helping operators select the most environmentally sound and economically viable options, thereby bolstering compliance and minimizing ecological footprints. The technology also promises to elevate safety standards by identifying potential equipment failures or hazardous conditions before they escalate, providing a proactive approach to operational risk management.

The long-term expectations for AI in this market segment include a shift towards fully autonomous waste management systems that can adapt to changing geological conditions and regulatory demands without extensive human intervention. This advanced level of automation will not only further reduce operational costs but also ensure consistent adherence to best practices across diverse drilling environments. The ability of AI to analyze historical data and learn from past operations will be instrumental in continuously refining waste management strategies, making the entire process more sustainable and robust against unforeseen challenges. As the industry increasingly embraces digital transformation, AI is poised to become an indispensable tool for achieving superior environmental performance and operational excellence in solid control drilling waste management.

- Enhanced Predictive Maintenance: AI algorithms analyze equipment sensor data to predict failures, minimizing downtime and optimizing maintenance schedules for solids control machinery.

- Real-time Data Analytics: AI processes drilling fluid parameters, waste volumes, and treatment efficacy in real time, enabling immediate operational adjustments for improved efficiency.

- Optimized Equipment Operation: AI systems can fine-tune shale shaker G-forces, centrifuge speeds, and mud cleaner settings based on fluid properties, maximizing solids removal and fluid recovery.

- Automated Compliance Monitoring: AI tools monitor waste discharge parameters against regulatory limits, generating alerts for potential non-compliance and ensuring adherence to environmental standards.

- Waste Minimization Strategies: AI-driven insights help identify sources of excessive waste generation and recommend process modifications to reduce the overall volume of drilling waste.

- Improved Fluid Management: AI assists in maintaining optimal drilling fluid properties by precisely controlling the addition of additives and managing solids contamination, extending fluid life.

- Enhanced Safety Protocols: AI analyzes operational data to identify potential hazards or deviations from safe operating procedures, proactively alerting personnel to risks.

DRO & Impact Forces Of Solid Control Drilling Waste Management Market

The Solid Control Drilling Waste Management Market is influenced by a dynamic interplay of drivers, restraints, and opportunities, alongside significant impact forces. Key drivers include increasingly stringent environmental regulations governing drilling waste disposal, a global rise in oil and gas exploration and production activities—especially in unconventional and offshore fields—and a growing industry focus on sustainable operations and corporate social responsibility. Technological advancements in solids control equipment and waste treatment solutions also significantly propel market growth by offering more efficient and environmentally friendly alternatives. These factors collectively push operators to adopt sophisticated waste management strategies to avoid penalties, enhance public image, and improve operational economics. The pressure to reduce the environmental footprint while maximizing resource recovery further solidifies the markets upward trajectory.

However, the market also faces considerable restraints, such as the high capital expenditure required for acquiring advanced solids control equipment and implementing comprehensive waste management systems. Fluctuations in crude oil and natural gas prices directly impact drilling activity and, consequently, investment in waste management solutions, leading to market volatility. Operational complexities, particularly in remote or challenging drilling environments, and the scarcity of skilled personnel capable of operating and maintaining advanced waste management technologies, also pose significant hurdles. These restraints necessitate innovative financing models and robust training programs to mitigate their impact and ensure sustained market expansion. Balancing cost efficiency with environmental compliance remains a perpetual challenge for industry participants, demanding continuous innovation in both technology and business models.

Opportunities for growth are abundant within the market, particularly stemming from the increasing development of unconventional oil and gas resources, such as shale gas and tight oil, which generate substantial volumes of drilling waste requiring specialized treatment. Furthermore, the growing emphasis on "waste-to-value" solutions, which convert drilling waste into reusable products or energy, presents a lucrative avenue for market players. The ongoing digitalization and automation of drilling operations offer opportunities for integrating smart waste management systems that enhance efficiency and traceability. Emerging markets, with their burgeoning energy demands and evolving regulatory landscapes, also represent untapped potential for solid control drilling waste management providers, promising new avenues for expansion and technological adoption. The overarching impact forces include intense regulatory pressure from governments and environmental agencies, continuous technological innovation driving equipment advancements, and global economic cycles that dictate energy demand and investment levels in the oil and gas sector.

Segmentation Analysis

The Solid Control Drilling Waste Management Market is comprehensively segmented to provide a detailed understanding of its diverse components and growth dynamics. These segments help analyze market trends based on equipment type, service offerings, application areas, and end-user categories, allowing stakeholders to identify specific growth opportunities and tailor strategies. Understanding these distinctions is crucial for manufacturers, service providers, and investors to navigate the complexities of the market effectively and respond to the varied needs of drilling operators worldwide. Each segment exhibits unique characteristics and growth drivers, reflecting the specialized demands of different drilling environments and waste types. The segmentation allows for a granular assessment of the markets structure and its potential evolution over the forecast period.

The markets segmentation by type typically differentiates between equipment sales and various waste management services. Equipment encompasses a range of machinery designed for primary, secondary, and tertiary solids removal, while services include collection, treatment, disposal, and fluid recovery operations. Application segmentation distinguishes between onshore and offshore drilling activities, each presenting unique challenges and regulatory requirements for waste management. Further segmentation by waste type often includes drilling mud, drill cuttings, produced water, and various chemical additives, each demanding specific handling and treatment protocols. This multi-faceted segmentation provides a robust framework for market analysis, illuminating the intricate relationships between technological offerings, operational demands, and regulatory landscapes across the global energy sector.

- By Type:

- Equipment (Shale Shakers, Decanter Centrifuges, Cuttings Dryers, Mud Cleaners, Vacuum Degassers, Desanders, Desilters)

- Services (Waste Collection & Transportation, Waste Treatment & Disposal, Fluid Recovery & Recycling, Rental Services, Consultancy Services)

- By Application:

- Onshore Drilling

- Offshore Drilling (Shallow Water, Deepwater, Ultra-Deepwater)

- By Waste Type:

- Drilling Mud (Water-Based Mud, Oil-Based Mud)

- Drill Cuttings

- Produced Water

- Chemical Additives

- Other Wastes (e.g., Contaminated Soil, Spills)

- By End-User:

- Oil & Gas Exploration & Production (E&P) Companies

- Drilling Contractors

- Environmental Service Providers

- National Oil Companies (NOCs)

Solid Control Drilling Waste Management Market Value Chain Analysis

The value chain for the Solid Control Drilling Waste Management Market is a complex network involving multiple stages, from raw material sourcing to the ultimate disposal or recycling of treated waste, ensuring efficient resource flow and environmental compliance. Upstream analysis focuses on the suppliers of critical components and raw materials necessary for manufacturing solids control equipment, such as steel, polymers, electronic components, and various chemicals used in drilling fluids and waste treatment processes. These suppliers play a vital role in determining the quality, cost, and availability of the foundational elements of the industry. Robust relationships with reliable upstream partners are essential for maintaining production schedules and innovation in equipment design. The effectiveness of this initial stage significantly impacts the overall cost-efficiency and technological capability of the waste management solutions offered downstream.

Midstream activities involve the design, manufacturing, and assembly of solid control equipment, including shale shakers, centrifuges, cuttings dryers, and mud cleaners, by specialized equipment providers. It also encompasses the development and integration of advanced technologies like automation and digital monitoring systems into these machines. Following manufacturing, these products and services are distributed through various channels, including direct sales from manufacturers to drilling operators, via third-party distributors, or through specialized rental companies that provide equipment and often operational support on a project basis. These distribution channels are crucial for market penetration and ensuring that the right equipment and expertise reach diverse drilling sites globally. The efficiency of the midstream operations directly influences the availability and technological sophistication of waste management solutions, addressing the dynamic needs of the oil and gas industry.

Downstream analysis centers on the end-users—primarily oil and gas exploration and production companies and drilling contractors—who utilize these solid control systems and waste management services at their drilling sites. This stage also includes specialized waste treatment and disposal companies that handle the post-processing of drilling waste, often employing advanced techniques like thermal desorption, bioremediation, or solidification. The value chain extends further to include indirect services such as environmental consulting, regulatory compliance monitoring, and technological support, which ensure the effective and compliant operation of waste management systems. The integration of direct and indirect channels fosters a comprehensive ecosystem that supports the entire lifecycle of drilling waste, emphasizing efficiency, environmental responsibility, and value recovery from waste streams.

Solid Control Drilling Waste Management Market Potential Customers

The Solid Control Drilling Waste Management Market primarily caters to a specific segment of the oil and gas industry that actively engages in exploration and production (E&P) activities. The core potential customers are large international oil companies (IOCs), national oil companies (NOCs), and independent oil and gas operators who are directly responsible for drilling wells and managing their associated waste streams. These entities require robust and reliable solutions to comply with stringent environmental regulations, optimize drilling performance, and minimize their operational footprint. Their demand is driven by the need to efficiently separate solids from drilling fluids to recycle valuable mud, reduce disposal volumes, and ensure safe and environmentally sound operations across various challenging terrains and offshore environments. The scale of their operations and the complexity of their drilling projects directly translate into a significant need for comprehensive waste management services and advanced solid control equipment.

Beyond the direct operators, drilling contractors represent another crucial segment of potential customers. These companies are hired by E&P firms to execute drilling projects and often bear the responsibility for day-to-day operations, including effective solid control and initial waste handling. They seek integrated solutions that enhance drilling efficiency, reduce non-productive time, and lower overall operational costs while maintaining high standards of environmental stewardship. Drilling contractors frequently opt for rental services and operational support from solid control drilling waste management providers to gain access to cutting-edge technology without significant capital investment, allowing them to remain agile and competitive. Their continuous need for efficient and compliant waste management is a direct reflection of ongoing global drilling activities, making them a sustained and substantial customer base for the market.

Furthermore, specialized environmental service providers and industrial waste management companies also constitute a segment of potential customers, particularly for advanced waste treatment and disposal technologies. These companies often partner with drilling operators or contractors to manage the more complex aspects of waste disposal, such as thermal treatment of oil-based drill cuttings, solidification of contaminated soils, or the processing of produced water. Their role involves ensuring that waste is treated to meet specific regulatory standards before final disposal or, increasingly, to recover valuable resources. As environmental regulations become more stringent and the focus on sustainability intensifies, the demand from these specialized service providers for innovative and effective solid control drilling waste management solutions is expected to grow, further broadening the customer base and driving technological advancements in the market.

Solid Control Drilling Waste Management Market Key Technology Landscape

The Solid Control Drilling Waste Management Market is characterized by a dynamic and evolving technology landscape, driven by the continuous need for enhanced efficiency, reduced environmental impact, and cost-effectiveness in oil and gas drilling operations. At its core are mechanical separation technologies, including highly efficient shale shakers, which represent the first line of defense in solids removal by vibrating screens to separate larger solids from drilling fluid. Building upon this, desanders and desilters utilize hydrocyclone technology for removing progressively finer particles. Decanter centrifuges further refine the fluid by separating very fine solids and recovering base fluids, particularly crucial for expensive oil-based muds. These foundational technologies are continuously being innovated with higher G-forces, improved screen designs, and more robust materials to enhance separation efficiency and prolong equipment lifespan, directly impacting drilling fluid recycling rates and waste volumes.

Beyond mechanical separation, advanced treatment technologies play a significant role in managing and processing the residual drilling waste. Cuttings dryers, such as vertical cuttings dryers (VCDs) or high-speed centrifuges, are employed to recover valuable liquid from drill cuttings, minimizing the volume of waste destined for disposal and often allowing for the recycling of recovered oil or water. Thermal desorption units (TDUs) represent a more sophisticated approach, using heat to separate hydrocarbons from drill cuttings, effectively rendering the solids non-hazardous and recoverable, while also recovering valuable oil for reuse. Other critical technologies include dewatering systems for treating produced water, flocculation and coagulation units for enhanced solids settlement, and solidification/stabilization techniques for rendering hazardous waste inert for safe disposal. These technologies are vital for adhering to strict environmental regulations and reducing the ecological footprint of drilling activities, providing comprehensive solutions for diverse waste streams.

The latest technological advancements are increasingly integrating digitalization, automation, and real-time monitoring capabilities into solid control and waste management systems. Internet of Things (IoT) sensors are deployed on equipment to collect data on performance, fluid properties, and waste parameters, which are then analyzed using advanced analytics and artificial intelligence (AI). This enables predictive maintenance, optimized equipment operation, and automated decision-making, leading to significant improvements in operational efficiency, waste minimization, and regulatory compliance. Furthermore, the development of closed-loop systems aims to maximize the recovery and reuse of drilling fluids and water, thereby reducing fresh water consumption and the volume of waste requiring disposal. Innovations in waste-to-value solutions, such as converting drill cuttings into construction materials or other industrial products, are also gaining traction, signaling a future where drilling waste management contributes to a circular economy, further reshaping the technological landscape.

Regional Highlights

The global Solid Control Drilling Waste Management Market exhibits distinct regional dynamics, influenced by varying levels of oil and gas exploration, diverse regulatory landscapes, and differing technological adoption rates. North America, particularly the United States and Canada, stands as a dominant market, driven by extensive unconventional drilling activities in shale plays and a mature regulatory framework that mandates advanced waste management practices. The region benefits from significant investment in new drilling technologies and a robust infrastructure for specialized waste services, leading to continuous innovation and high market penetration of sophisticated solids control equipment. The demand here is consistently high due to ongoing E&P efforts and a strong emphasis on environmental compliance, making it a critical hub for market growth and technological development. Similarly, the growing focus on enhanced oil recovery and unconventional resources in the region further contributes to the demand for efficient waste management solutions, ensuring sustained market expansion.

The Middle East and Africa (MEA) region is emerging as a rapidly growing market, propelled by large-scale conventional and unconventional oil and gas projects and increasing governmental focus on environmental sustainability. Countries like Saudi Arabia, UAE, and Nigeria are witnessing substantial investment in new drilling activities and upgrading existing infrastructure, which translates into a rising demand for solid control and waste treatment services. As regulatory bodies in these nations adopt more stringent environmental standards, the necessity for advanced waste management solutions becomes paramount, creating significant opportunities for market players. Meanwhile, the Asia Pacific region, led by China, India, and Australia, is also experiencing substantial growth due to expanding energy consumption, new offshore discoveries, and a push towards stricter environmental regulations. These countries are investing in new drilling projects and modernizing their E&P operations, fostering a demand for efficient and compliant waste management technologies to support their energy expansion goals.

- North America: Dominant market share driven by extensive unconventional drilling (shale gas, tight oil) in the US and Canada, advanced regulatory frameworks, and significant technological adoption.

- Middle East & Africa (MEA): Rapid growth due to large-scale conventional and unconventional projects in Saudi Arabia, UAE, and Nigeria, coupled with increasing environmental regulations and investment in oil and gas infrastructure.

- Asia Pacific: Emerging as a high-growth region with rising energy demand and new offshore exploration in China, India, and Australia, leading to increased drilling activities and evolving environmental policies.

- Europe: Stable market with mature oil and gas fields (e.g., Norway, UK) and stringent environmental regulations driving demand for advanced and environmentally friendly waste management solutions, particularly in the North Sea.

- Latin America: Growing market potential, especially in Brazil and Mexico, due to offshore pre-salt discoveries and a resurgence in exploration activities, necessitating efficient solid control and waste management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solid Control Drilling Waste Management Market.- SLB

- Halliburton

- Baker Hughes

- NOV (National Oilwell Varco)

- Derrick Corporation

- GN Solids Control

- TWMA

- Newpark Resources

- Secure Energy Services

- Veolia Environnement S.A.

- Waste Management, Inc.

- Cudd Energy Services

Frequently Asked Questions

What is solid control drilling waste management?

Solid control drilling waste management encompasses the equipment, technologies, and services used to separate solids from drilling fluids, treat contaminated water, and manage drill cuttings generated during oil and gas exploration and production to ensure environmental compliance and operational efficiency.

Why is solid control crucial in drilling operations?

Solid control is crucial for maintaining optimal drilling fluid properties, preventing equipment wear, reducing drilling costs, complying with environmental regulations, and minimizing the volume of waste requiring disposal, thereby enhancing overall operational sustainability.

What are the key drivers for market growth?

Key drivers include stringent environmental regulations globally, increased oil and gas drilling activities (especially unconventional and offshore), a growing industry focus on sustainability and corporate social responsibility, and continuous technological advancements in waste treatment solutions.

How does technology, particularly AI, impact this market?

Technology, especially AI, significantly impacts the market by enabling predictive maintenance for equipment, real-time data analysis for optimized operations, automated compliance monitoring, and more efficient waste minimization strategies, leading to enhanced efficiency and reduced environmental footprint.

What are the primary challenges faced by the market?

The primary challenges include high capital investment costs for advanced equipment, volatility in oil and gas prices impacting drilling budgets, complex operational requirements in diverse environments, and the shortage of skilled personnel to operate sophisticated waste management systems effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager