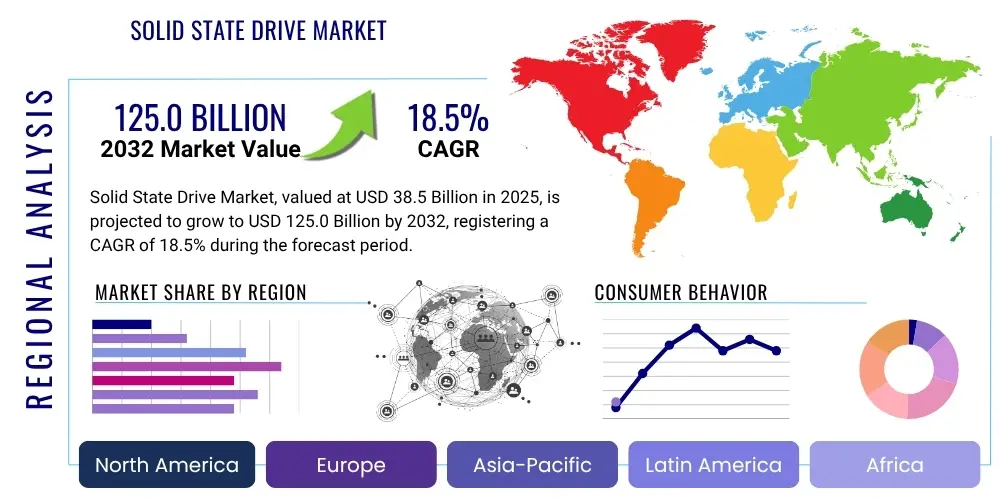

Solid State Drive Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429242 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Solid State Drive Market Size

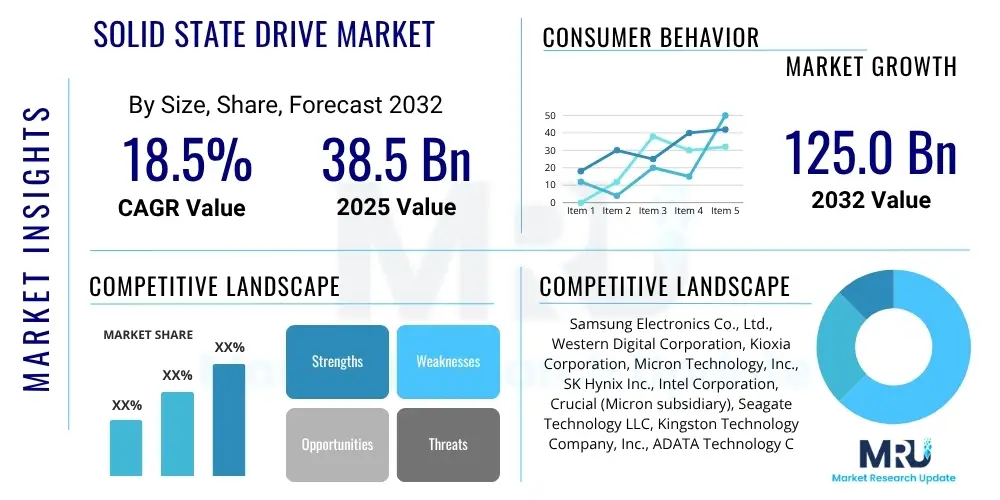

The Solid State Drive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 38.5 Billion in 2025 and is projected to reach USD 125.0 Billion by the end of the forecast period in 2032.

Solid State Drive Market introduction

The Solid State Drive (SSD) market encompasses the global production and consumption of non-volatile storage devices that utilize integrated circuits to store data persistently, typically using flash memory. Unlike traditional Hard Disk Drives (HDDs) which rely on spinning platters and read/write heads, SSDs offer superior performance characteristics including faster boot times, quicker application loading, enhanced data transfer speeds, and improved overall system responsiveness. These attributes stem from their lack of moving mechanical parts, which also contributes to increased durability, reduced power consumption, and silent operation, making them highly desirable across a diverse range of computing applications.

Major applications for Solid State Drives span across client devices, enterprise infrastructure, and specialized industrial and automotive systems. In client computing, SSDs are widely adopted in laptops, desktop PCs, and high-performance gaming systems, significantly enhancing user experience. For enterprise applications, SSDs are critical components in data centers, cloud computing environments, servers, and storage arrays, where their speed and reliability are paramount for managing vast quantities of data and supporting mission-critical operations. The increasing demands for high-speed data processing, low latency, and energy efficiency are primary driving factors propelling the widespread adoption of SSD technology across various sectors.

The benefits derived from Solid State Drives extend beyond mere speed; they include increased shock resistance, lower heat generation, and a smaller form factor compared to their HDD counterparts. These advantages enable more compact and innovative device designs, from ultrabooks to edge computing devices. The continuous advancement in NAND flash technology, including advancements in 3D NAND and Quad-Level Cell (QLC) memory, coupled with developments in interface standards like NVMe (Non-Volatile Memory Express) over PCIe, further cements the SSD's position as the preferred storage solution for modern computing needs. These innovations are continually pushing the boundaries of capacity, cost-effectiveness, and performance, making SSDs accessible to a broader range of consumers and enterprises.

Solid State Drive Market Executive Summary

The Solid State Drive market is undergoing a period of robust expansion, driven by escalating data generation, the pervasive digital transformation across industries, and the increasing demand for high-performance computing. Key business trends indicate a strategic shift towards higher capacity QLC-based SSDs to address cost-effectiveness, alongside the continued dominance of NVMe interfaces for superior speed in enterprise and high-end client segments. Original Equipment Manufacturers (OEMs) and cloud service providers are significantly investing in SSD infrastructure to enhance efficiency and scalability. Furthermore, supply chain dynamics and raw material pricing, particularly for NAND flash, remain crucial factors influencing market stability and competitive strategies among major players.

From a regional perspective, Asia Pacific continues to be the dominant market for SSDs, fueled by its robust electronics manufacturing base, rapid industrialization, and a large consumer market for computing devices. North America and Europe also demonstrate significant market shares, characterized by strong adoption in data centers, enterprise storage, and advanced gaming applications, coupled with increasing investments in AI and IoT infrastructure. Emerging economies in Latin America, and the Middle East and Africa are witnessing accelerated SSD adoption as digitalization initiatives gain momentum and infrastructure development progresses, presenting substantial growth opportunities for market participants.

Segmentation trends reveal NVMe SSDs, particularly those leveraging PCIe Gen4 and Gen5, are experiencing the fastest growth due to their unmatched performance suitable for AI/ML workloads, real-time analytics, and high-fidelity gaming. Enterprise SSDs, driven by hyperscale data centers and cloud service providers, constitute a significant revenue share, emphasizing reliability and endurance. The client SSD segment remains vibrant, with a steady upgrade cycle in personal computers and laptops. Advancements in memory technologies like 3D NAND, coupled with reductions in manufacturing costs, are making higher-capacity SSDs more affordable, influencing consumer purchasing decisions and broadening the market reach for advanced storage solutions.

AI Impact Analysis on Solid State Drive Market

User inquiries concerning the impact of Artificial Intelligence on the Solid State Drive market frequently revolve around how AI workloads influence storage requirements, the specific types of SSDs best suited for AI applications, and the potential for AI to drive innovation in SSD design and functionality. Users are keenly interested in understanding if current SSD technologies can keep pace with the massive data throughput and low-latency demands of AI training and inference, alongside concerns regarding the endurance of flash memory under intensive AI operations. The overarching themes include performance bottlenecks, data integrity, power efficiency in AI-centric data centers, and the role of SSDs in enabling edge AI deployments.

- AI workloads demand extremely high read/write speeds and low latency, driving increased adoption of NVMe SSDs, particularly PCIe Gen4 and Gen5 variants.

- The massive datasets used in AI training necessitate higher capacity SSDs, accelerating the development and deployment of QLC (Quad-Level Cell) technology for cost-effective, dense storage.

- AI inference at the edge requires compact, power-efficient, and robust SSDs, expanding market opportunities for M.2 and other small form factor solutions.

- SSD endurance becomes a critical factor due to continuous data logging and model updates in AI systems, pushing manufacturers to innovate in wear-leveling algorithms and controller technologies.

- AI applications are driving demand for specialized enterprise SSDs with enhanced reliability, consistent performance, and features like namespace isolation for multi-tenant AI environments.

- AI-driven analytics and machine learning can be leveraged in SSD controllers themselves to optimize performance, predict failures, and manage data more efficiently, leading to smarter storage solutions.

- The growth of AI-powered data centers fuels the need for extremely scalable and high-throughput storage networks, further solidifying SSDs as the core storage medium.

- AI's role in autonomous vehicles and smart infrastructure creates new niches for industrial-grade SSDs that can withstand harsh environmental conditions and provide guaranteed data integrity.

DRO & Impact Forces Of Solid State Drive Market

The Solid State Drive market is primarily driven by the exponential growth of data across all sectors, necessitating faster and more reliable storage solutions. The increasing adoption of cloud computing, artificial intelligence, machine learning, and IoT applications significantly boosts demand for high-performance SSDs, especially in data centers and enterprise environments. Furthermore, the rising popularity of gaming, content creation, and high-definition media consumption among consumers fuels the demand for client SSDs that offer quicker load times and improved system responsiveness. Continuous technological advancements in NAND flash memory, such as 3D NAND and QLC, alongside interface innovations like NVMe over PCIe, are consistently enhancing SSD performance and capacity while reducing costs, making them more accessible and attractive to a broader market segment.

Despite robust growth, the market faces certain restraints. The relatively higher cost per gigabyte of SSDs compared to traditional HDDs remains a barrier for budget-sensitive consumers and enterprises, particularly for bulk cold storage needs where speed is not the primary concern. Fluctuations in NAND flash memory supply and pricing, often influenced by geopolitical factors, natural disasters, or manufacturing yield issues, can lead to market volatility and impact production costs and retail prices. Moreover, the finite write cycles of flash memory, despite significant advancements in endurance, still pose a perceived limitation for certain ultra-intensive write applications, although controller technologies and wear-leveling algorithms continually mitigate this concern. Competition from other storage technologies and evolving hybrid storage solutions also present challenges.

Significant opportunities exist within the Solid State Drive market, particularly in the expanding segments of edge computing, autonomous vehicles, and industrial IoT, which require robust, low-latency, and high-endurance storage solutions outside traditional data centers. The proliferation of 5G technology is expected to create new use cases that demand real-time data processing and storage at the network edge, further propelling SSD adoption. The ongoing development of advanced security features, such as hardware-based encryption and secure erase functionalities, presents opportunities for SSD manufacturers to cater to stringent data privacy and compliance requirements. Furthermore, the integration of computational storage and storage-class memory (SCM) technologies with SSDs promises to redefine storage architectures, enabling unprecedented levels of performance and efficiency for next-generation applications. These drivers, restraints, and opportunities collectively shape the competitive landscape and strategic direction of the Solid State Drive market, indicating a dynamic environment poised for continued innovation and expansion.

Segmentation Analysis

The Solid State Drive market is comprehensively segmented based on various critical parameters including type, form factor, technology, capacity, application, and end-user. This granular segmentation provides a detailed understanding of market dynamics, growth drivers, and competitive landscapes across diverse product offerings and consumer demands. The market is witnessing a continuous evolution in product specifications and application areas, driven by advancements in flash memory technology, controller design, and interface standards. Each segment exhibits unique growth trajectories and influences the overall market strategy of key players. This analytical breakdown helps stakeholders identify lucrative investment opportunities and tailor product development to specific market needs, ensuring a responsive and innovative approach to storage solutions.

- By Type

- SATA SSD: Cost-effective, widely compatible with older systems.

- NVMe SSD: High-performance, low-latency, utilizes PCIe interface for superior speed.

- PCIe Gen3 NVMe SSD: Mainstream high-performance solution.

- PCIe Gen4 NVMe SSD: Next-generation performance, doubling Gen3 speeds.

- PCIe Gen5 NVMe SSD: Emerging, offering even higher bandwidth for demanding applications.

- By Form Factor

- 2.5-inch: Standard form factor, compatible with traditional drive bays.

- M.2: Compact form factor, ideal for ultrabooks, laptops, and mini-PCs.

- U.2: Enterprise-grade form factor for high-performance storage servers.

- mSATA: Mini-SATA, used in smaller embedded systems.

- Add-in Card (AIC): PCIe-based cards for maximum performance in workstations and servers.

- By Technology

- Single-Level Cell (SLC): Highest endurance, lowest capacity, highest cost (enterprise/industrial).

- Multi-Level Cell (MLC): Balanced endurance and cost, common in older consumer drives.

- Triple-Level Cell (TLC): Good balance of cost, capacity, and performance, widely adopted.

- Quad-Level Cell (QLC): Highest capacity, lowest cost per GB, emerging for bulk storage.

- By Capacity

- Less than 250GB: Entry-level, for OS drives and basic computing.

- 250GB-500GB: Mid-range, common for general users.

- 500GB-1TB: Popular for mainstream gaming and professional use.

- 1TB-2TB: High-capacity, for power users and large media libraries.

- Above 2TB: Enterprise, content creators, and enthusiasts.

- By Application

- Enterprise: Data Centers, Servers, Hyperscale Cloud, Storage Arrays.

- Client: Personal Computers, Laptops, Gaming Consoles, Workstations.

- Industrial: Embedded systems, harsh environments, factory automation.

- Automotive: Infotainment, ADAS, telematics.

- By End-User

- Consumer: Individual users for personal computing and gaming.

- Commercial: Businesses, enterprises, government organizations.

- Industrial/OEM: Manufacturers integrating SSDs into their products.

Value Chain Analysis For Solid State Drive Market

The value chain for the Solid State Drive market is complex, beginning with upstream raw material suppliers and extending through manufacturing, distribution, and end-user consumption. Upstream analysis involves the procurement of essential components such as NAND flash memory chips, controller ICs, DRAM, passive components, and PCBs. Key raw material suppliers, predominantly NAND flash manufacturers, hold significant power in the value chain, as NAND supply and pricing heavily influence the cost structure of SSDs. These suppliers invest heavily in R&D and fabrication plants (fabs) to develop next-generation memory technologies, constantly striving for higher density, lower cost per bit, and improved performance, which are critical differentiators in the final product.

Midstream activities involve the assembly and integration of these components by SSD manufacturers. This stage includes sophisticated processes such as firmware development, quality assurance testing, and packaging. Manufacturers often collaborate closely with controller IC designers to optimize performance and ensure compatibility with various NAND flash types. Branding, marketing, and sales strategies are also integral to this stage, aimed at positioning products effectively within competitive consumer, enterprise, and industrial markets. Downstream analysis focuses on the distribution channels and end-users. SSDs reach end-users through a combination of direct sales, particularly for enterprise clients and OEMs, and indirect channels such as distributors, retailers (both online and brick-and-mortar), and system integrators. The choice of distribution channel often depends on the target market segment, with consumer SSDs heavily relying on retail, while enterprise solutions often involve direct sales teams and value-added resellers.

Both direct and indirect distribution channels play crucial roles in market penetration. Direct channels allow manufacturers to build strong relationships with large enterprise customers and OEMs, offering customized solutions and direct technical support. This approach often involves large volume sales and long-term contracts. Indirect channels, on the other hand, provide broader market reach, particularly for consumer and small to medium-sized business (SMB) segments. Retailers and e-commerce platforms enable widespread availability and offer convenient purchasing options for individual consumers. System integrators frequently bundle SSDs into complete computer systems or storage solutions, adding value for end-users. The efficiency of this distribution network is vital for ensuring timely delivery and broad accessibility of SSD products, thereby impacting overall market growth and competitive dynamics.

Solid State Drive Market Potential Customers

Potential customers for Solid State Drives span a broad spectrum, reflecting the diverse applications and benefits of SSD technology across various industries and consumer segments. Enterprise users, including large corporations, data centers, cloud service providers, and government agencies, constitute a significant customer base. These entities require high-performance, high-capacity, and highly reliable storage solutions for mission-critical applications, large-scale data analytics, virtualization, and cloud infrastructure. Their purchasing decisions are primarily driven by factors such as performance consistency, endurance, power efficiency, security features, and total cost of ownership (TCO) over the lifespan of the storage units. They often procure SSDs in bulk directly from manufacturers or through specialized value-added resellers.

Consumer end-users form another substantial segment, comprising individual buyers for personal computers, laptops, gaming systems, and external storage solutions. This demographic is motivated by improved system responsiveness, faster boot times, quicker application loading, and enhanced gaming experiences. Affordability, ease of installation, and reputable brand names are key influencers for consumer purchases. The gaming community, in particular, represents a high-growth niche within the consumer segment, continuously seeking cutting-edge SSDs to minimize load screens and optimize game performance. The growing trend of DIY PC building and system upgrades further solidifies this customer base.

Beyond traditional computing, specialized industries present burgeoning opportunities. Original Equipment Manufacturers (OEMs) in sectors such as industrial automation, automotive, medical devices, and telecommunications are increasingly integrating ruggedized, high-endurance SSDs into their products. These applications demand storage solutions that can withstand extreme temperatures, vibrations, and continuous operation while ensuring data integrity. For instance, automotive customers require SSDs for infotainment systems, advanced driver-assistance systems (ADAS), and autonomous driving platforms. Similarly, edge computing deployments across various verticals, including smart cities and IoT deployments, are emerging as significant end-users, requiring robust and efficient storage at the point of data creation. This diverse customer landscape underscores the pervasive utility and evolving demand for Solid State Drives in an increasingly data-centric world.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 38.5 Billion |

| Market Forecast in 2032 | USD 125.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces | >|

| Segments Covered | >|

| Key Companies Covered | Samsung Electronics Co., Ltd., Western Digital Corporation, Kioxia Corporation, Micron Technology, Inc., SK Hynix Inc., Intel Corporation, Crucial (Micron subsidiary), Seagate Technology LLC, Kingston Technology Company, Inc., ADATA Technology Co., Ltd., SanDisk (Western Digital subsidiary), Toshiba Memory (now Kioxia), Transcend Information, Inc., PNY Technologies, Inc., Corsair Memory, Inc., Sabrent, HP Inc., Dell Technologies Inc., IBM Corporation, Pure Storage Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solid State Drive Market Key Technology Landscape

The Solid State Drive market's technological landscape is primarily defined by continuous innovation in NAND flash memory, controller design, and interface protocols. The transition from planar 2D NAND to 3D NAND technology has been a pivotal development, allowing for increased storage density and improved endurance by stacking memory cells vertically. Within 3D NAND, advancements are seen in the number of layers (e.g., 96-layer, 128-layer, 176-layer, and beyond) and the shift from Triple-Level Cell (TLC) to Quad-Level Cell (QLC) memory. QLC flash offers significantly higher capacity at a lower cost per bit, making it attractive for bulk storage applications, though often with a trade-off in endurance and raw performance compared to TLC or MLC. Future developments are exploring Penta-Level Cell (PLC) for even greater density.

Controller technology is equally crucial, acting as the brain of the SSD. Modern controllers incorporate sophisticated algorithms for wear-leveling, error correction (e.g., LDPC - Low-Density Parity Check), garbage collection, and caching, which are vital for optimizing performance, extending lifespan, and ensuring data integrity. The integration of powerful multi-core processors within controllers enables them to handle intense I/O operations and manage complex memory architectures efficiently. Furthermore, advancements in firmware play a significant role, allowing for ongoing performance enhancements and feature additions post-manufacturing, ensuring adaptability to evolving workloads and system requirements. These innovations in controller and firmware design are essential for maximizing the potential of the underlying NAND flash memory and delivering a superior user experience.

Interface protocols have also undergone significant evolution, with NVMe (Non-Volatile Memory Express) over PCIe (Peripheral Component Interconnect Express) becoming the standard for high-performance SSDs, largely replacing the older SATA interface. NVMe is specifically designed for flash memory, offering substantially lower latency and higher bandwidth compared to SATA, which was originally developed for HDDs. The progression from PCIe Gen3 to Gen4 and now Gen5 doubles the theoretical bandwidth with each generation, enabling SSDs to achieve unprecedented sequential read/write speeds, critical for demanding applications like AI, machine learning, and 8K video editing. Emerging technologies such as Storage-Class Memory (SCM), often utilizing technologies like Intel Optane (based on 3D XPoint) or Z-NAND, bridge the gap between DRAM and NAND flash, offering ultra-low latency and higher endurance for specialized enterprise applications, further diversifying the technological landscape of the Solid State Drive market.

Regional Highlights

The global Solid State Drive market exhibits significant regional variations in adoption rates, growth drivers, and competitive landscapes, shaped by economic development, technological infrastructure, and consumer preferences. Each major geographical region contributes uniquely to the overall market trajectory, with some regions leading in terms of production and innovation, while others excel in consumption and rapid adoption. Understanding these regional nuances is crucial for market participants seeking to formulate effective market entry strategies, optimize supply chains, and tailor product offerings to specific local demands. The distribution of data centers, the prevalence of advanced computing industries, and the rate of digital transformation initiatives are key factors influencing regional market dynamics.

North America stands as a mature and prominent market for Solid State Drives, characterized by early adoption of advanced technologies and significant investment in cloud infrastructure and hyperscale data centers. The presence of major technology companies, coupled with robust research and development activities, drives continuous innovation in SSD design and application. The region also boasts a strong consumer market for high-performance PCs and gaming systems. Europe follows closely, with a growing demand for SSDs in enterprise storage, automotive electronics, and industrial applications, driven by stringent data regulations and a focus on industrial automation. Both regions are at the forefront of AI and IoT adoption, which further fuels the demand for high-speed, reliable storage solutions.

Asia Pacific (APAC) is the largest and fastest-growing market for Solid State Drives globally. This phenomenal growth is primarily attributed to its expansive manufacturing base for consumer electronics and computing devices, particularly in countries like China, South Korea, Taiwan, and Japan. Rapid urbanization, increasing disposable incomes, and widespread digitalization across various industries also contribute to high SSD adoption rates. Furthermore, the burgeoning demand for smartphones, laptops, and data centers in emerging economies within APAC significantly propels market expansion. Latin America and the Middle East & Africa (MEA) are emerging markets, showing substantial growth potential as these regions accelerate their digital transformation efforts, invest in IT infrastructure, and witness increasing internet penetration and consumer electronics adoption. These regions represent untapped opportunities for SSD manufacturers to expand their market footprint.

- North America: High adoption in cloud data centers, enterprise storage, and advanced gaming; significant R&D investments; strong presence of key technology players.

- Europe: Growing demand in automotive, industrial automation, and enterprise segments; driven by digital transformation and data regulatory compliance; focus on energy-efficient solutions.

- Asia Pacific (APAC): Dominant market share and fastest growth; major manufacturing hub for electronics; increasing consumer demand in countries like China, India, Japan, and South Korea; large-scale data center expansion.

- Latin America: Emerging market with increasing IT infrastructure investments; growing internet penetration and demand for personal computing devices; opportunities in digitalization initiatives.

- Middle East & Africa (MEA): Rapid digital transformation and smart city initiatives; investments in data centers and cloud services; growing consumer electronics market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solid State Drive Market.- Samsung Electronics Co., Ltd.

- Western Digital Corporation

- Kioxia Corporation

- Micron Technology, Inc.

- SK Hynix Inc.

- Intel Corporation

- Crucial (Micron subsidiary)

- Seagate Technology LLC

- Kingston Technology Company, Inc.

- ADATA Technology Co., Ltd.

- SanDisk (Western Digital subsidiary)

- Transcend Information, Inc.

- PNY Technologies, Inc.

- Corsair Memory, Inc.

- Sabrent

- HP Inc.

- Dell Technologies Inc.

- IBM Corporation

- Pure Storage Inc.

- NetApp, Inc.

Frequently Asked Questions

What is a Solid State Drive (SSD) and how does it differ from a Hard Disk Drive (HDD)?

An SSD is a non-volatile storage device that uses integrated circuits and flash memory to store data, featuring no moving parts. This contrasts with an HDD, which uses spinning platters and read/write heads. SSDs offer significantly faster speeds, greater durability, lower power consumption, and silent operation due to their solid-state nature.

Which factors are primarily driving the growth of the Solid State Drive market?

Key drivers include the exponential growth of data, increasing adoption of cloud computing, artificial intelligence (AI), and machine learning (ML), the rising demand for high-performance computing in gaming and enterprise, and continuous technological advancements in NAND flash and NVMe interfaces that reduce costs and improve performance.

What impact does AI have on Solid State Drive technology and market demand?

AI significantly impacts the SSD market by driving demand for ultra-fast, high-capacity, and low-latency NVMe SSDs for training and inference workloads. It also accelerates the development of QLC SSDs for cost-effective data storage and emphasizes endurance advancements due to intensive read/write cycles, influencing both enterprise and edge computing segments.

Which regions are key contributors to the Solid State Drive market, and why?

Asia Pacific (APAC) is the largest and fastest-growing market due to its robust electronics manufacturing base and high consumer adoption. North America and Europe are significant contributors, driven by extensive data center infrastructure, early technology adoption, and strong enterprise and gaming sectors. Latin America and MEA are emerging with increasing digitalization.

What are the main types of Solid State Drives available today?

The main types include SATA SSDs, which are generally more affordable and compatible with older systems, and NVMe SSDs, which offer superior performance through the PCIe interface and come in generations like PCIe Gen3, Gen4, and the emerging Gen5, catering to high-speed applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager