Structural Composites Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427857 | Date : Oct, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Structural Composites Market Size

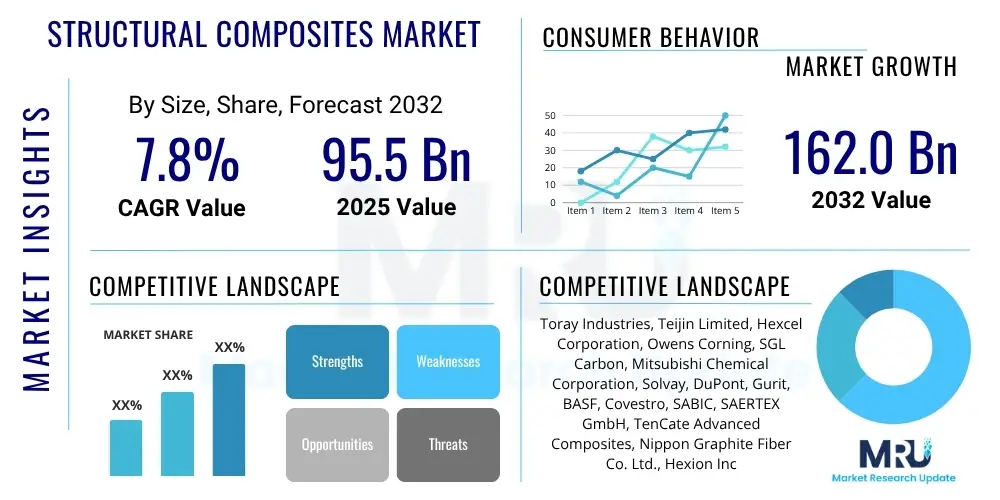

The Structural Composites Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 95.5 Billion in 2025 and is projected to reach USD 162.0 Billion by the end of the forecast period in 2032.

Structural Composites Market introduction

Structural composites represent an advanced class of materials engineered for superior mechanical properties, particularly high strength-to-weight ratios, stiffness, and durability. These materials typically consist of reinforcing fibers embedded within a matrix material, creating a synergistic effect where the strengths of individual components are combined to achieve performance unattainable by monolithic materials. Common reinforcing fibers include carbon, glass, and aramid, while matrix materials range from thermosets like epoxy and polyester to thermoplastics such as PEEK and polyamide, each offering distinct advantages in terms of processing, performance, and application suitability. The inherent design flexibility of structural composites allows for tailored material properties, enabling engineers to optimize components for specific load conditions, environmental resistance, and aesthetic requirements across diverse sectors. This versatility underscores their criticality in modern engineering, facilitating advancements that prioritize efficiency and longevity.

The primary applications of structural composites span a wide array of high-performance industries, where their unique attributes provide significant benefits. In aerospace and defense, they are crucial for manufacturing lighter aircraft components, satellites, and ballistic protection, directly contributing to fuel efficiency and enhanced operational capabilities. The automotive sector leverages composites for vehicle lightweighting, which improves fuel economy and reduces emissions, alongside boosting crashworthiness and design freedom for electric vehicles. The burgeoning wind energy industry relies heavily on composites for constructing robust and aerodynamic wind turbine blades, which are essential for maximizing energy capture and operational lifespan. Furthermore, structural composites are increasingly utilized in construction for high-performance architectural elements, bridge components, and seismic reinforcement, offering strength, corrosion resistance, and extended service life compared to traditional materials. Other notable applications include marine vessels, sporting goods, and pressure vessels, all benefiting from the superior performance envelope of these engineered materials.

The market for structural composites is driven by an escalating global demand for high-performance, lightweight materials across multiple industrial verticals. Key driving factors include stringent regulatory pressures for emission reductions and fuel efficiency, particularly in the automotive and aerospace industries, which necessitate innovative materials solutions. The rapid expansion of renewable energy infrastructure, especially wind power, is a significant catalyst, as composites are indispensable for large-scale turbine blade manufacturing. Moreover, ongoing advancements in materials science and manufacturing technologies, such as automated fiber placement and additive manufacturing, are enabling more cost-effective production and expanding the range of applications for composites. The increasing focus on sustainability and circular economy principles is also driving innovation in bio-based and recyclable composites, further broadening their market appeal and future potential. These confluence of factors collectively underpin the robust growth trajectory observed in the structural composites market.

Structural Composites Market Executive Summary

The Structural Composites Market is experiencing dynamic growth driven by evolving business trends, significant regional shifts, and diverse segmental developments. Business trends indicate a strong emphasis on sustainability, with increasing investment in bio-based resins, recyclable fibers, and energy-efficient manufacturing processes to meet environmental regulations and consumer demand for eco-friendly products. There's also a clear push towards digitalization and automation in composite manufacturing, leveraging Industry 4.0 technologies like smart sensors, AI, and advanced robotics to optimize production efficiency, reduce waste, and enhance quality control. Mergers and acquisitions remain prevalent as companies seek to consolidate market share, acquire specialized technologies, and expand their geographical footprint, driving innovation and competitive dynamics across the value chain. Furthermore, the market is witnessing a surge in research and development activities focused on developing novel composite materials with enhanced properties, such as self-healing capabilities, multifunctionality, and improved fire resistance, catering to more demanding applications and pushing the boundaries of material performance.

Regional trends highlight Asia Pacific as the leading and fastest-growing market, primarily fueled by robust industrialization, significant investments in infrastructure development, and the burgeoning manufacturing sectors in countries like China, India, and Japan. The region's expanding automotive, construction, and wind energy industries are key contributors to its market dominance. North America and Europe also hold substantial market shares, characterized by advanced technological adoption, a strong presence of aerospace and defense industries, and a growing focus on electric vehicles and sustainable energy solutions. These regions are at the forefront of innovation in high-performance composites, driven by stringent regulatory frameworks and a mature industrial base. Latin America, the Middle East, and Africa are emerging markets, showing promising growth potential due to increasing industrialization, infrastructure projects, and diversification efforts in their respective economies. The strategic location of manufacturing facilities and regional trade agreements continue to influence market dynamics and investment patterns globally.

Segmental trends reveal distinctive growth patterns across different material types, manufacturing processes, and end-use industries. In terms of fiber type, carbon fiber composites are experiencing rapid growth due to their unparalleled strength-to-weight ratio, particularly in aerospace, high-performance automotive, and sporting goods, despite their higher cost. Glass fiber composites, while more cost-effective, maintain a significant market share, driven by their widespread use in wind energy, construction, and general industrial applications. For resin types, thermoset composites, especially epoxy and polyester, continue to dominate due to their excellent mechanical properties and ease of processing, though thermoplastic composites are gaining traction owing to their recyclability, rapid processing cycles, and improved impact resistance. Regarding manufacturing processes, advanced techniques like automated fiber placement (AFP) and resin transfer molding (RTM) are witnessing increased adoption for complex geometries and higher volume production. Lastly, the aerospace and defense and wind energy sectors are projected to remain the largest end-use segments, with the electric vehicle segment in automotive showing exponential growth as a key future driver for structural composites.

AI Impact Analysis on Structural Composites Market

Common user questions regarding AI's impact on the Structural Composites Market often revolve around how artificial intelligence can enhance design, optimize manufacturing processes, improve material performance, and contribute to cost reduction and sustainability. Users are keen to understand AI's role in predicting material behavior, streamlining complex production workflows, and enabling the creation of novel composite structures. Concerns frequently touch upon the investment required for AI implementation, the availability of skilled personnel, and the challenges of integrating AI into existing legacy systems. There is a clear expectation that AI will unlock new efficiencies and innovation, ultimately transforming the entire lifecycle of structural composite materials from conceptualization to end-of-life management, thereby leading to more robust, efficient, and sustainable solutions. The potential for AI to accelerate material discovery and characterization, reducing the traditionally long development cycles, is also a significant area of interest, promising to bring next-generation composites to market faster and more economically. Moreover, the integration of AI-driven predictive maintenance in composite structures is seen as a critical advancement for enhancing safety and extending the lifespan of high-value assets.

Based on this analysis, the key themes indicate that users anticipate AI to be a transformative force, primarily focused on optimization, prediction, and automation. The expectation is that AI will move beyond simple data analysis to become an integral part of the design-to-manufacture pipeline, enabling generative design for complex composite geometries that are topologically optimized for performance and material usage. Furthermore, AI's role in process control, particularly in intricate manufacturing techniques like automated fiber placement (AFP) and resin transfer molding (RTM), is seen as crucial for minimizing defects, improving consistency, and reducing waste. Users also foresee AI facilitating the development of "smart composites" with integrated sensors and self-monitoring capabilities, enhancing their operational intelligence. The ability of AI to analyze vast datasets from simulations, material testing, and in-service performance is expected to significantly shorten R&D cycles and accelerate the qualification of new materials and designs. This integration promises a paradigm shift from traditional empirical methods to data-driven, intelligent material engineering and production.

- AI optimizes composite design through generative algorithms, enabling lightweight and high-performance structures.

- Predictive analytics powered by AI enhances manufacturing process control, minimizing defects and improving material consistency.

- Machine learning algorithms accelerate material discovery and characterization, leading to novel composite formulations.

- AI-driven simulation tools improve the accuracy of performance prediction for composite structures under various loads.

- Computer vision and AI enhance quality inspection, detecting micro-defects invisible to human inspection in real-time.

- AI facilitates predictive maintenance for composite components in service, extending lifespan and reducing downtime.

- Supply chain optimization through AI improves material sourcing, inventory management, and logistics for composite raw materials.

- AI contributes to sustainability by optimizing material usage, reducing waste, and improving composite recycling processes.

DRO & Impact Forces Of Structural Composites Market

The Structural Composites Market is shaped by a confluence of powerful drivers, inherent restraints, and burgeoning opportunities that collectively determine its growth trajectory and competitive landscape. Key drivers include the relentless pursuit of lightweighting in critical industries such as aerospace, automotive, and wind energy, where structural composites offer unparalleled strength-to-weight ratios, directly translating into fuel efficiency, reduced emissions, and enhanced operational performance. Furthermore, the increasing demand for high-performance materials capable of withstanding extreme environmental conditions, combined with advancements in manufacturing technologies like automation and simulation, propels the adoption of these advanced materials. Strict regulatory mandates for environmental protection and safety also compel industries to adopt superior materials that reduce their carbon footprint and enhance product longevity. These factors collectively create a strong pull for structural composites, establishing them as indispensable components in modern engineering applications. The continuous evolution of material science, leading to new fiber and resin systems with improved properties, further amplifies this market momentum, fostering innovation across the value chain and expanding the scope of composite applications into new and emerging sectors.

Despite the compelling advantages, the market faces several significant restraints. The high initial cost of raw materials, particularly carbon fibers and specialized resins, remains a primary barrier to widespread adoption, especially in price-sensitive applications. The complexity and relatively slower manufacturing processes for many advanced composites, compared to conventional metallic materials, can lead to higher production costs and longer lead times. Additionally, the challenges associated with the repair, recycling, and end-of-life management of composite materials pose environmental and economic hurdles, as current recycling technologies are often energy-intensive and not yet fully scalable or cost-effective. The need for specialized skills and significant capital investment in advanced manufacturing equipment further limits market entry and expansion for some players. Furthermore, the lack of standardized design codes and comprehensive material databases for composites, compared to metals, can sometimes impede faster design and qualification processes, contributing to engineering conservatism and slower adoption in certain traditional industries, requiring extensive testing and validation processes for new designs.

Opportunities within the Structural Composites Market are abundant and diverse, promising sustained growth and innovation. The emergence of new application areas, such as urban air mobility, hydrogen storage tanks, and advanced defense systems, represents significant untapped potential for high-performance composites. The growing emphasis on sustainable and circular economy principles is driving research and development into bio-based resins, natural fibers, and more efficient recycling technologies, creating a niche for eco-friendly composite solutions. The development of 'smart composites' with integrated sensors for structural health monitoring, self-healing capabilities, and active functionalities opens doors to intelligent material systems that can adapt and respond to their environment, offering enhanced safety and performance. Furthermore, the increasing adoption of Industry 4.0 technologies, including artificial intelligence, machine learning, and additive manufacturing, is revolutionizing composite design and production, enabling customization, accelerating prototyping, and reducing manufacturing costs. These technological advancements, coupled with expanding global infrastructure projects and the electrification of transportation, position the structural composites market for substantial future expansion and diversification, making it a critical area for ongoing investment and innovation.

Segmentation Analysis

The Structural Composites Market is intricately segmented across various dimensions, providing a granular view of its diverse landscape and enabling targeted market strategies. These segmentations typically categorize the market by the type of reinforcing fiber, the matrix resin utilized, the manufacturing process employed, and the specific end-use industry applications. Understanding these segments is crucial for identifying growth hotspots, assessing competitive intensity, and tailoring product development to meet specific industrial requirements. Each segment exhibits unique demand drivers, technological preferences, and market dynamics, reflecting the multifaceted nature of structural composites. The interplay between these segments also reveals opportunities for cross-sectional innovation and market expansion, as material advancements in one area can often translate into benefits for another. For instance, the development of faster curing resins or more efficient manufacturing processes can significantly impact multiple end-use sectors simultaneously, driving overall market growth and efficiency. This comprehensive segmentation allows for a detailed analysis of market trends and forecasts, guiding strategic decision-making for stakeholders across the value chain, from raw material suppliers to end-product manufacturers.

- Fiber Type

- Carbon Fiber

- Glass Fiber

- Aramid Fiber

- Other Fibers (e.g., Basalt, Boron, Natural Fibers)

- Resin Type

- Thermoset Composites

- Epoxy

- Polyester

- Vinyl Ester

- Phenolic

- Other Thermosets

- Thermoplastic Composites

- Polypropylene (PP)

- Polyamide (PA)

- Polyether Ether Ketone (PEEK)

- Polyphenylene Sulfide (PPS)

- Other Thermoplastics

- Thermoset Composites

- Manufacturing Process

- Lay-up (Hand Lay-up, Spray Lay-up)

- Filament Winding

- Pultrusion

- Injection Molding

- Resin Transfer Molding (RTM)

- Compression Molding

- Automated Fiber Placement/Tape Laying (AFP/ATL)

- Vacuum Infusion

- Other Processes (e.g., Additive Manufacturing)

- End-Use Industry

- Aerospace & Defense

- Automotive

- Wind Energy

- Construction & Infrastructure

- Marine

- Sporting Goods

- Electrical & Electronics

- Pressure Vessels

- Other Industries (e.g., Medical, Industrial Machinery)

- Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Structural Composites Market

The value chain for the Structural Composites Market is a complex and highly integrated network, beginning with the upstream supply of raw materials and extending through various processing stages to the final end-use applications. Upstream activities are dominated by manufacturers of reinforcing fibers, such as carbon fiber, glass fiber, and aramid fiber producers, alongside suppliers of matrix resins, including epoxy, polyester, and thermoplastic polymer manufacturers. These raw material suppliers form the foundational layer, providing the specialized components that dictate the ultimate properties and performance of the structural composites. Innovation at this stage, particularly in developing high-performance fibers or cost-effective resin systems, directly impacts the downstream capabilities and market competitiveness. The quality, availability, and cost of these foundational materials are critical, as they significantly influence the production efficiency and final product pricing, requiring strong relationships and collaboration between material developers and composite manufacturers to ensure consistent supply and quality control. This early stage also includes the production of preforms and prepregs, which are semi-finished materials that streamline subsequent manufacturing steps, offering enhanced material consistency and reduced waste in later processes.

Midstream activities involve the conversion of raw materials into composite parts and components. This segment encompasses a diverse range of processes and specialized manufacturers, including compounders who combine fibers and resins into moldable forms, and fabricators who utilize various techniques such as lay-up, filament winding, pultrusion, resin transfer molding (RTM), and automated fiber placement (AFP) to produce intricate composite structures. These manufacturers often specialize in specific processes or end-use applications, developing expertise in areas like aerospace-grade components, automotive body panels, or wind turbine blades. The efficiency and precision of these manufacturing processes are paramount, as they directly influence the structural integrity, dimensional accuracy, and cost-effectiveness of the final composite product. Investment in advanced manufacturing technologies and automation is a key trend in this segment, aimed at improving production throughput, reducing labor costs, and achieving higher quality standards. Moreover, the integration of digital tools for design, simulation, and quality control is becoming increasingly important for optimizing these complex manufacturing operations and ensuring consistent output.

Downstream activities involve the distribution, assembly, and integration of composite components into final products for various end-use industries. This stage includes component assemblers who integrate composite parts with other materials to create complete systems, and original equipment manufacturers (OEMs) in sectors such as aerospace, automotive, wind energy, construction, and marine, who are the ultimate consumers of these structural composites. Distribution channels for structural composites can be both direct and indirect. Direct sales are common for high-value, custom-engineered components, where composite manufacturers work closely with OEMs to meet specific design and performance requirements. Indirect distribution typically involves distributors, agents, and specialized composite material suppliers who cater to smaller businesses or offer a broader range of standard composite materials and forms. The efficiency of the distribution network and the proximity to end-users are crucial for timely delivery and reducing logistics costs. The post-sales service, including technical support, repair, and end-of-life solutions like recycling or disposal, also forms an increasingly important part of the value chain, driven by sustainability concerns and extended product lifecycles. This holistic view of the value chain underscores the collaborative nature of the structural composites market, where successful innovation and market penetration often rely on strong partnerships and seamless coordination across all stages.

Structural Composites Market Potential Customers

The potential customers for structural composites are predominantly high-performance industries and sectors that prioritize lightweighting, durability, strength, and design flexibility over traditional materials. The aerospace and defense sector represents a cornerstone customer base, with aircraft manufacturers, space agencies, and defense contractors requiring composites for aircraft structures, satellite components, missile systems, and ballistic protection. Their demand is driven by the critical need for fuel efficiency, reduced emissions, extended range, and enhanced performance in extreme operational environments. Similarly, the automotive industry, particularly manufacturers of luxury vehicles, electric vehicles (EVs), and high-performance cars, is a significant consumer. They utilize composites for chassis components, body panels, battery enclosures, and interior structures to reduce vehicle weight, improve crash safety, enhance fuel economy or EV range, and facilitate complex aerodynamic designs. The continuous innovation in these sectors, particularly the shift towards electrification and autonomous driving, ensures a sustained and growing demand for advanced composite solutions that offer superior mechanical and thermal properties.

Beyond aerospace and automotive, the wind energy industry stands as a major and rapidly expanding customer segment, with wind turbine manufacturers being substantial buyers of structural composites. Composites are indispensable for the fabrication of long, lightweight, and aerodynamic wind turbine blades, which are crucial for maximizing energy capture and ensuring the operational longevity of turbines. As the global push for renewable energy intensifies, so does the demand for larger, more efficient blades, driving innovation in composite materials and manufacturing techniques. The construction and infrastructure sector also represents a growing customer base, with applications ranging from lightweight and corrosion-resistant bridge decks, seismic strengthening for buildings, and advanced architectural facades. Marine vessel manufacturers, including those producing high-performance yachts, commercial vessels, and naval ships, rely on composites for hulls, superstructures, and interior components to achieve weight reduction, improve fuel efficiency, and enhance resistance to harsh marine environments. The robust properties and extended lifespan offered by composites make them highly attractive for these long-term infrastructure and marine investments. Furthermore, industries like sporting goods, pressure vessels for gas storage, and even certain electrical and electronics applications leverage structural composites for their unique balance of performance and lightweight characteristics, broadening the customer spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 95.5 Billion |

| Market Forecast in 2032 | USD 162.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toray Industries, Teijin Limited, Hexcel Corporation, Owens Corning, SGL Carbon, Mitsubishi Chemical Corporation, Solvay, DuPont, Gurit, BASF, Covestro, SABIC, SAERTEX GmbH, TenCate Advanced Composites, Nippon Graphite Fiber Co. Ltd., Hexion Inc., Ashland Global Holdings Inc., Vectorply Corporation, Chomarat, Plasan Carbon Composites. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Structural Composites Market Key Technology Landscape

The Structural Composites Market is characterized by a rapidly evolving technological landscape, driven by the continuous pursuit of enhanced performance, increased efficiency, and reduced costs in composite manufacturing. Advanced manufacturing technologies are at the forefront of this evolution, including Automated Fiber Placement (AFP) and Automated Tape Laying (ATL), which enable precise and rapid deposition of fibers, creating complex geometries with superior material utilization and reduced manual labor. These automated processes are critical for producing high-volume, high-performance components for aerospace and automotive sectors, ensuring consistency and minimizing defects. Resin Transfer Molding (RTM) and Vacuum Infusion Processes (VIP) are also gaining traction for their ability to produce complex, near-net-shape parts with high fiber volume fractions and excellent surface finish, reducing post-processing requirements. Further, pultrusion continues to be vital for producing continuous, high-strength profiles efficiently, finding applications in construction and wind energy. These manufacturing innovations are fundamental to scaling composite production and making these advanced materials more accessible and competitive against traditional alternatives, offering engineers greater design freedom and structural integrity.

Material science innovations form another pivotal aspect of the technology landscape. Research and development efforts are focused on developing next-generation fibers with improved strength-to-weight ratios, higher temperature resistance, and enhanced durability, such as ultra-high modulus carbon fibers and advanced glass fibers. Concurrently, new resin systems are emerging, including tougher epoxies, faster-curing unsaturated polyesters, and high-performance thermoplastics like PEEK and PPS, which offer benefits like improved impact resistance, recyclability, and faster processing cycles. The development of hybrid composites, combining different types of fibers and matrix materials, allows for tailored properties to meet specific application demands, balancing performance and cost. Furthermore, the advent of functional and smart composites, which integrate sensors, actuators, and self-healing capabilities, is transforming how structural composites perform in service. These intelligent materials can monitor their own health, detect damage, and even autonomously repair minor flaws, extending their operational lifespan and enhancing safety in critical applications. Nanocomposites, incorporating nanoparticles into the matrix, are also gaining attention for their potential to enhance mechanical properties, thermal stability, and electrical conductivity, opening up new avenues for material design.

The digitalization and automation of the entire composite lifecycle, often referred to as Industry 4.0, are profoundly impacting the market. This includes the widespread adoption of advanced simulation and modeling tools, which allow engineers to virtually test and optimize composite designs before physical prototyping, significantly reducing development time and costs. Digital twin technology is enabling real-time monitoring of manufacturing processes and in-service performance, facilitating predictive maintenance and optimizing operational efficiency. Artificial intelligence (AI) and machine learning (ML) are being integrated into design optimization, material characterization, process control, and quality inspection, enabling faster material discovery, more efficient production, and higher quality output. Robotics and collaborative robots (cobots) are enhancing automation in tasks such as material handling, fiber placement, and assembly, improving precision and reducing reliance on manual labor. These digital technologies, combined with the push for sustainable composites, including bio-based resins and advanced recycling techniques, are collectively driving the Structural Composites Market towards a future of highly efficient, intelligent, and environmentally responsible material solutions. The integration of big data analytics provides unprecedented insights into material behavior and manufacturing parameters, leading to continuous process improvements and accelerated innovation cycles.

Regional Highlights

The global Structural Composites Market exhibits significant regional variations in terms of production, consumption, and growth drivers, reflecting differing industrial landscapes, regulatory environments, and technological adoption rates. Asia Pacific stands as the dominant and fastest-growing region, fueled by rapid industrialization, extensive infrastructure development projects, and a booming manufacturing sector, particularly in countries like China, India, Japan, and South Korea. This region benefits from lower manufacturing costs, increasing foreign investments, and a surge in demand from the automotive, wind energy, and construction sectors, making it a critical hub for both production and consumption of structural composites. The emphasis on high-volume production for mass market applications and increasing domestic demand for lightweight solutions contribute significantly to its market leadership. The burgeoning electric vehicle market and substantial investments in renewable energy, particularly wind power, further solidify APAC's position as a powerhouse in the structural composites domain, with continuous expansion in production capacities and technological advancements.

- Asia Pacific: Leads the market due to robust industrial growth in China, India, and Southeast Asian countries. High demand from automotive (especially EVs), wind energy, and construction sectors.

- North America: A mature market driven by the aerospace & defense industry, advanced automotive applications, and a growing focus on infrastructure repair and renewable energy. Significant R&D investment and technological innovation.

- Europe: Strong market due to stringent environmental regulations, advanced manufacturing capabilities, and significant adoption in aerospace, automotive, and wind energy sectors. Germany, France, and the UK are key contributors.

- Latin America: Emerging market with increasing industrialization and infrastructure projects, particularly in Brazil and Mexico. Growing demand in automotive and construction sectors.

- Middle East & Africa (MEA): Growing demand for structural composites in infrastructure development, oil & gas, and renewable energy projects. Regional diversification efforts are creating new opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Structural Composites Market.- Toray Industries

- Teijin Limited

- Hexcel Corporation

- Owens Corning

- SGL Carbon

- Mitsubishi Chemical Corporation

- Solvay

- DuPont

- Gurit

- BASF

- Covestro

- SABIC

- SAERTEX GmbH

- TenCate Advanced Composites

- Nippon Graphite Fiber Co. Ltd.

- Hexion Inc.

- Ashland Global Holdings Inc.

- Vectorply Corporation

- Chomarat

- Plasan Carbon Composites

Frequently Asked Questions

Analyze common user questions about the Structural Composites market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are structural composites and why are they important?

Structural composites are advanced materials combining reinforcing fibers (e.g., carbon, glass) with a matrix material (e.g., epoxy, polyester) to achieve superior strength-to-weight ratios, stiffness, and durability. They are crucial for lightweighting, fuel efficiency, and high-performance applications in industries like aerospace, automotive, and wind energy, offering benefits unattainable by traditional materials.

Which industries are the primary consumers of structural composites?

The primary consumers include the aerospace & defense industry for aircraft and satellite components, the automotive sector for lightweighting and EV parts, the wind energy sector for turbine blades, and the construction industry for high-performance infrastructure. Marine, sporting goods, and pressure vessel manufacturing also represent significant end-use segments.

What are the key drivers for the growth of the Structural Composites Market?

Key drivers include the increasing global demand for lightweight and high-performance materials to enhance fuel efficiency and reduce emissions, advancements in manufacturing technologies (e.g., automation), and the rapid expansion of renewable energy infrastructure like wind power. Stringent environmental regulations also push for sustainable and durable material solutions.

What challenges does the Structural Composites Market face?

Major challenges include the high cost of raw materials (especially carbon fiber), the complexity and slower processing times compared to metals, and difficulties associated with the repair, recycling, and end-of-life management of composite materials. The need for specialized manufacturing skills and significant capital investment also acts as a restraint.

How is AI impacting the Structural Composites Market?

AI is profoundly impacting the market by optimizing composite design through generative algorithms, enhancing manufacturing process control, accelerating material discovery and characterization, and improving quality inspection. AI also facilitates predictive maintenance for composite components in service and optimizes supply chain operations, driving efficiency and innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager