Submarine Sensor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429733 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Submarine Sensor Market Size

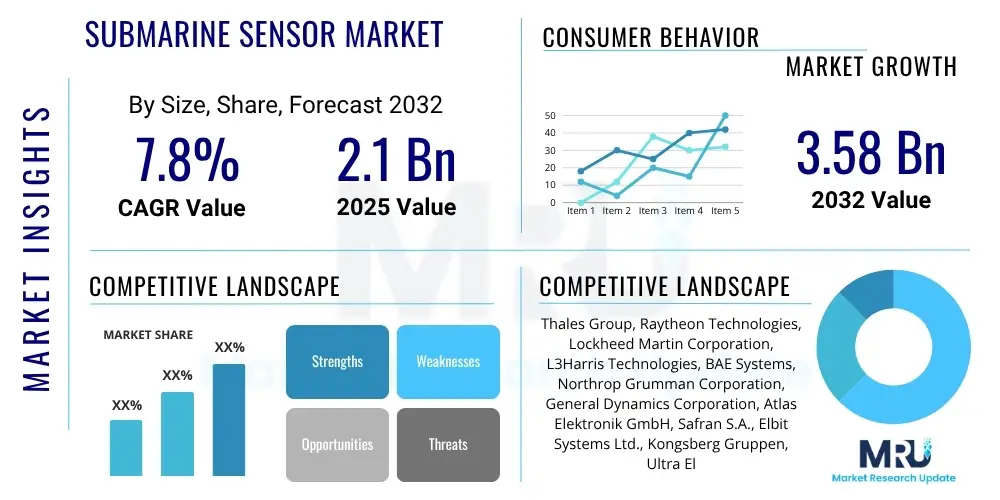

The Submarine Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 2.1 Billion in 2025 and is projected to reach USD 3.58 Billion by the end of the forecast period in 2032.

Submarine Sensor Market introduction

The submarine sensor market constitutes a highly specialized and strategically vital sector within the global defense and maritime industries. Its primary function is to furnish modern submarines with the indispensable capabilities required for comprehensive underwater surveillance, precision navigation, secure communication, and advanced target detection. These sophisticated sensors are fundamental to the operational effectiveness of submarines, enabling them to execute diverse mission profiles with unparalleled stealth and precision. Such missions range from critical intelligence gathering and discreet reconnaissance to robust anti-submarine warfare (ASW) operations and strategic deterrence. The technological portfolio within this market is vast, encompassing an extensive array of devices including, but not limited to, state-of-the-art sonar systems, advanced electronic support measures (ESM), specialized submarine-specific radar, highly sensitive magnetic anomaly detectors (MAD), and a variety of environmental sensors designed for extreme conditions. Collectively, these integrated systems empower submarines to operate covertly, identify potential threats with high fidelity, and collect crucial data from the complex and often hostile underwater environment, cementing their role as indispensable assets in modern naval forces.

The products offered within this market are typically characterized by their extreme sophistication and are often delivered as highly integrated sensor suites. These systems are meticulously engineered to withstand the immense pressures and corrosive conditions encountered in deep-sea environments, while simultaneously maintaining exceptional precision and operational reliability over extended deployments. Sonar remains the foundational and most critical sensor technology, with continuous advancements in both active and passive systems. Modern sonar capabilities now offer significantly enhanced detection ranges, superior target classification capabilities, and improved performance in challenging littoral (coastal) waters where acoustic environments are particularly complex due to varying depths and cluttered backgrounds. Beyond acoustics, non-acoustic sensors are experiencing burgeoning prominence, particularly for highly covert operations. These provide invaluable complementary data streams, allowing for multi-modal sensing that enhances overall situational awareness and reduces reliance on a single detection method, thereby increasing the submarine's survivability and mission success rate.

Major applications for submarine sensors are predominantly concentrated within military and national security domains, driven by evolving naval defense strategies and procurement cycles across the globe. However, a nascent but growing segment exists in specialized scientific research and commercial underwater activities. The benefits derived from these advanced sensor systems are manifold, including substantially improved situational awareness for the crew, significantly enhanced stealth capabilities that make submarines harder to detect, precise targeting solutions for weapon systems, and augmented underwater communication systems that maintain connectivity even in deep-sea operations. These combined benefits directly contribute to safeguarding national security interests, projecting strategic influence, and securing a decisive advantage in the contested maritime battlespace. The relentless pursuit of these advantages, coupled with a proactive response to emerging threats, serves as a powerful catalyst for continuous innovation and investment within this critical market sector.

Driving factors underpinning the robust growth of this market include a pervasive increase in global geopolitical tensions, which compel nations to bolster their defense capabilities, particularly in the underwater domain. This leads directly to increased naval spending by major and emerging global powers, specifically earmarked for the modernization and expansion of their submarine fleets. There is a relentless and competitive pursuit of technological superiority in underwater warfare, where the ability to detect and evade detection is paramount. The imperative for silent and undetectable operations, coupled with the need to effectively counter increasingly sophisticated adversary submarine and anti-submarine platforms, fuels intense innovation and rapid adoption of cutting-edge sensor technologies. Furthermore, the growing global demand for advanced oceanographic research, subsea infrastructure protection, and marine resource exploration also indirectly contributes to the development and refinement of certain sensor types, though military and security applications unequivocally remain the dominant force dictating market dynamics and technological advancements.

Submarine Sensor Market Executive Summary

The global submarine sensor market is navigating a period of profound transformation, marked by dynamic business trends, the shifting landscape of regional defense priorities, and a relentless pace of technological innovation across all key segments. Strategic investments in comprehensive research and development initiatives by leading defense contractors are increasingly channeling resources towards the seamless integration of artificial intelligence (AI) and machine learning (ML) paradigms into advanced sensor data processing algorithms. The overarching objective is to achieve sophisticated predictive analytics capabilities, significantly enhance decision support systems, and crucially, reduce the substantial cognitive and operational workload on human operators, thereby improving overall efficiency and reducing response times in critical scenarios. Furthermore, the market is witnessing a pronounced increase in collaborative ventures between public sector defense agencies and private industry enterprises, fostering an accelerated development environment for next-generation acoustic and non-acoustic sensor technologies. Concurrently, a significant engineering trend is the relentless drive towards miniaturization and enhanced power efficiency for sensor systems, which directly translates into greater payload capacity for submarines and extended mission durations, particularly in the context of increasingly compact and stealth-optimized submarine designs, offering both tactical and logistical advantages.

Regional market trends unequivocally highlight the Asia Pacific as a paramount and rapidly expanding market for submarine sensors. This growth is predominantly fueled by ambitious naval modernization programs underway in key regional players such as China, India, and Australia, all of whom are committing substantial financial resources to new submarine acquisitions and comprehensive upgrades of their existing fleets to meet evolving geopolitical challenges and secure maritime interests. In stark contrast, North America and Europe continue to represent mature yet highly innovative markets. Growth in these regions is primarily sustained by continuous technological breakthroughs and the cyclical replacement of their highly sophisticated naval assets, with an unwavering strategic emphasis on maintaining a decisive technological edge over potential adversaries. Persistent geopolitical instabilities and escalating territorial disputes in various critical maritime regions globally are directly influencing national defense budgets and accelerating procurement decisions, thereby serving as powerful catalysts for robust market growth in these strategically important areas. Markets in the Middle East and Africa, as well as Latin America, are projected to demonstrate steady, albeit less rapid, growth as nations within these regions progressively seek to enhance their foundational maritime security and surveillance capabilities.

Segment trends within the submarine sensor market vividly illustrate a strong and focused emphasis on the development and deployment of advanced sonar systems. This includes a particular focus on multi-static sonar configurations and synthetic aperture sonar (SAS) technologies, both of which offer dramatically improved detection ranges and significantly enhanced target classification performance, especially crucial in challenging littoral and shallow-water environments where traditional sonar systems often face limitations due to complex acoustic conditions. Beyond acoustics, non-acoustic sensors, such as highly sensitive magnetic anomaly detection (MAD) systems and sophisticated electronic warfare (EW) systems, are experiencing a marked increase in adoption. This is driven by their capacity to provide enhanced covertness, critical information gathering capabilities, and diversified detection modalities crucial for operating in contested waters. A pervasive and defining trend is the push towards fully integrated sensor suites, designed to offer a holistic and unified view of the underwater battlespace. This paradigm shift moves away from disparate sensor functionalities towards a cohesive, networked approach, maximizing data fusion and actionable intelligence. Moreover, the escalating demand for sophisticated data fusion and processing capabilities is vigorously driving innovation in embedded software and computational hardware solutions within these advanced sensor systems, ultimately enabling near real-time decision-making and rapid tactical responses.

AI Impact Analysis on Submarine Sensor Market

Common user questions related to the impact of artificial intelligence (AI) on the Submarine Sensor Market frequently center on several critical aspects: how AI fundamentally enhances the interpretation and analysis of vast, complex sensor data; its role in enabling various degrees of autonomous operations for both individual sensors and broader submarine functions; and its potential to dramatically improve the efficiency and accuracy of target classification. Users are particularly eager to comprehend AI's transformative capabilities in processing terabytes of raw acoustic, electromagnetic, and environmental sensor data, moving beyond traditional methods. There is significant interest in how AI can substantially reduce operator fatigue by automating routine tasks, flagging critical events, and providing predictive insights that empower human decision-makers. Conversely, key concerns often revolve around the reliability and robustness of AI systems when deployed in high-stakes military scenarios, the complex ethical implications associated with increasingly autonomous decision-making in combat situations, and the inherent cybersecurity vulnerabilities that sophisticated AI-integrated systems might introduce, potentially creating new vectors for attack. Despite these concerns, widespread expectations include AI leading to significantly more accurate and rapid threat detection, facilitating faster response times for tactical maneuvers, and crucially, enabling submarines to operate with unprecedented effectiveness and stealth in complex, denied, and information-rich environments, thereby fundamentally redefining the parameters of modern submarine warfare and intelligence gathering.

The integration of AI into submarine sensor systems promises to revolutionize underwater operations by fundamentally transforming how information is acquired, processed, and acted upon. Traditional methods often rely heavily on human interpretation of complex acoustic signatures and electromagnetic emissions, a process that is time-consuming and prone to human error, especially under stressful combat conditions or during prolonged surveillance missions. AI algorithms, particularly those leveraging deep learning and neural networks, can sift through enormous volumes of sensor data with unparalleled speed and precision. This enables the rapid identification of subtle anomalies, the classification of ambiguous contacts with higher confidence, and the real-time fusion of data from multiple disparate sensors (e.g., sonar, MAD, ESM) to construct a comprehensive and coherent picture of the underwater battlespace. Such capabilities reduce the cognitive load on operators, allowing them to focus on strategic decision-making rather than data sifting, significantly enhancing the submarine's operational efficiency and responsiveness.

Furthermore, AI's impact extends beyond mere data processing to enabling more sophisticated and adaptive operational capabilities. For instance, AI-powered systems can learn from past encounters and adapt their detection parameters to new, unknown threats, offering a dynamic and evolving defense mechanism. In terms of predictive maintenance, AI analytics can continuously monitor the performance and health of complex sensor arrays, anticipating potential failures before they occur. This allows for proactive maintenance scheduling, minimizing downtime and ensuring maximum operational readiness, which is critical for expensive and strategically vital platforms like submarines. While full autonomous decision-making in lethal scenarios remains a subject of intense debate and ethical consideration, AI is already proving invaluable in providing highly refined decision-support tools. These tools offer operators intelligent recommendations for tactical maneuvers, optimal sensor deployment strategies, or even potential engagement parameters based on complex, multi-layered data analysis, thereby augmenting human capabilities and improving overall mission success rates in the challenging underwater domain.

- Enhanced Data Processing and Fusion: AI algorithms can rapidly process terabytes of diverse sensor data, including acoustic, electromagnetic, and environmental inputs. This enables sophisticated data fusion, synthesizing disparate information streams to generate a holistic and unparalleled situational awareness picture, far exceeding human cognitive capabilities in terms of speed and scale of analysis.

- Automated Anomaly Detection and Classification: AI empowers systems to automatically identify subtle anomalies within sensor data, accurately classify contacts (e.g., distinguishing between different types of vessels or marine life), and significantly reduce the incidence of false positives, thereby vastly improving the efficiency and accuracy of intelligence gathering and real-time threat assessment.

- Predictive Maintenance and Reliability: Leveraging machine learning, AI-powered analytics can continuously monitor the operational health, performance metrics, and subtle degradation patterns of sensor components. This allows for precise prediction of potential failures, enabling proactive and preventative maintenance, which significantly increases the operational uptime, reliability, and lifespan of critical submarine sensor systems.

- Autonomous Navigation and Mission Planning Support: While direct human oversight remains paramount, AI actively assists in optimizing submarine routes for stealth and efficiency, intelligently avoiding underwater obstacles, and dynamically planning sophisticated mission profiles based on real-time environmental data. This substantially improves stealth, operational efficiency, and reduces human error in complex navigation scenarios.

- Cognitive Electronic Warfare (EW): AI profoundly enhances electronic support measures (ESM) by rapidly analyzing complex and dynamic signal environments. It can swiftly identify, classify, and localize various emitters, and critically, develop adaptive countermeasures or effective evasion tactics in near real-time, providing a significant advantage in electronic intelligence and self-protection.

- Operator Augmentation and Advanced Decision Support: AI serves as a powerful augmentation tool for human operators, providing sophisticated decision support systems. It offers actionable recommendations for tactical maneuvers, optimal sensor deployment strategies, or precise target engagement parameters, all derived from complex, multi-modal data analysis, thereby significantly reducing cognitive load and enhancing tactical responsiveness.

- Improved Stealth and Counter-Detection Capabilities: AI algorithms can meticulously analyze environmental data (e.g., thermoclines, salinity gradients, bathymetry) and the submarine's own operational parameters. Based on this analysis, AI can recommend optimal operating depths, speeds, and maneuvers to minimize the submarine's acoustic and non-acoustic signatures, making it demonstrably harder for adversary sensors to detect.

- Cybersecurity and Resilience: AI can contribute to the cybersecurity of sensor systems by actively monitoring network traffic for anomalies, detecting potential intrusions, and bolstering defensive postures against sophisticated cyber threats, ensuring the integrity and confidentiality of sensitive intelligence data.

DRO & Impact Forces Of Submarine Sensor Market

The submarine sensor market is propelled forward by a dynamic confluence of powerful market drivers, fundamentally rooted in evolving global security paradigms, continuous advancements in naval warfare doctrines, and the unwavering imperative for enhanced underwater reconnaissance, surveillance, and defense capabilities. Simultaneously, the market is confronted with a distinct set of significant restraints that temper its growth trajectory. These include the prohibitively high costs associated with fundamental research, intensive development, and the eventual procurement of advanced, bespoke sensor systems, coupled with the often protracted long lead times required for their meticulous integration into the extraordinarily complex and highly specialized submarine platforms. Despite these formidable challenges, substantial opportunities continue to emerge, particularly in the realm of developing innovative hybrid sensor technologies, the transformative application of artificial intelligence for advanced data analysis and predictive insights, and the potential for strategic expansion into non-military applications such as deep-sea exploration and scientific oceanography. The market's overall trajectory and competitive landscape are also shaped by potent impact forces, including the accelerating pace of technological disruption, evolving international regulatory frameworks, and the intensely competitive landscape dominated by a few large, highly specialized defense contractors.

Drivers for the market's robust expansion are primarily and intrinsically linked to overarching national security imperatives and strategic geopolitical objectives. The current global resurgence of naval power projection, particularly evident among major world powers and rapidly emerging economies, necessitates a robust and technologically superior underwater presence. This demands submarine fleets equipped with unparalleled detection, classification, and engagement abilities to assert influence and protect sovereign interests. The increasing proliferation of advanced, quiet submarines by potential adversaries, coupled with the development of sophisticated anti-submarine warfare (ASW) capabilities by peer competitors, creates an urgent demand for increasingly sophisticated and counter-stealth sensor technologies. This is crucial for maintaining a decisive strategic advantage and ensuring effective deterrence. Furthermore, the growing strategic importance of comprehensive maritime domain awareness, vital for safeguarding critical shipping lanes, securing exclusive economic zones, and protecting vital subsea infrastructure (such as communication cables and energy pipelines), drives sustained investment in advanced sensor suites. These systems are designed to effectively and covertly monitor vast underwater territories, detect illicit activities, and respond to emerging threats across extensive maritime geographies.

Restraints present substantial and multifaceted challenges to the market's otherwise promising growth trajectory. The development cycle for cutting-edge submarine sensors is typically protracted, often spanning several years or even decades, and necessitates an enormous financial commitment in terms of research and development capital. This creates formidable barriers to entry for smaller, innovative players and often limits the pool of viable suppliers to a few well-established defense primes. Export controls, stringent national security regulations, and complex international technology transfer agreements further restrict market access and technology dissemination, impacting global sales and collaborative ventures. The inherent technical complexity of integrating diverse and highly sensitive sensor systems into a single, cohesive submarine platform is immense. This process requires ensuring seamless interoperability, minimal acoustic signature to maintain stealth, and robust resilience against extreme operating conditions, presenting a significant engineering and design hurdle. Moreover, the volatile global economic landscape, coupled with fluctuating and often unpredictable national defense budgets, can introduce considerable uncertainties in procurement timelines and overall market stability, directly influencing long-term investment decisions and strategic planning for manufacturers.

Opportunities within the submarine sensor market are abundant and lie in several innovative and transformative areas. The continued advancement and integration of quantum sensing technologies, which promise unprecedented levels of sensitivity for detecting magnetic fields or gravity anomalies, represent a revolutionary frontier for ultra-covert detection. Similarly, biomimetic sensors, drawing inspiration from the sophisticated sensory organs of marine life, hold immense potential for enhanced performance in acoustically challenging or optically opaque underwater environments. The application of advanced materials for improved transducer performance, offering greater efficiency and broader bandwidth for sonar systems, is also a fertile ground for future development. Critically, the growing global interest in and deployment of unmanned underwater vehicles (UUVs) presents a new and rapidly expanding platform for deploying smaller, more specialized, and potentially networked sensor payloads. This could significantly expand the market beyond traditional manned submarines, offering distributed sensing capabilities. Furthermore, strategically leveraging commercial off-the-shelf (COTS) components where feasible, combined with specialized defense-grade enhancements, could offer more cost-effective solutions and potentially accelerate development cycles, thereby directly addressing some of the core cost and timeline restraints and opening new avenues for market penetration, particularly for smaller naval forces.

Segmentation Analysis

The submarine sensor market is comprehensively segmented based on various technical and application-specific criteria, providing a detailed understanding of its diverse components and strategic areas of focus. These segmentations allow for a granular analysis of market dynamics, identifying key growth areas and technological trends across different product types, operational platforms, and end-user applications. The primary aim of this segmentation is to delineate the complex landscape of underwater sensing technologies employed in modern submarines and associated systems.

The segmentation typically considers the type of sensor technology, which includes acoustic and non-acoustic categories, each with distinct operational principles and applications. Acoustic sensors, predominantly sonar, are further differentiated by their operational mode, such as active, passive, and intercept sonar. Non-acoustic sensors encompass a broader range, including electromagnetic, magnetic anomaly detection (MAD), radar, and various environmental and optical sensors. Another crucial segmentation factor is the platform on which these sensors are deployed, primarily manned submarines, but increasingly includes unmanned underwater vehicles (UUVs) and other autonomous underwater systems.

Furthermore, the market can be segmented by application, categorizing the specific missions or functions these sensors serve, such as surveillance, reconnaissance, anti-submarine warfare (ASW), mine detection, navigation, and oceanographic research. This differentiation helps in understanding the demand drivers for specific sensor types based on strategic defense priorities and scientific objectives. Regional segmentation, analyzing market performance across major geographical areas, is also vital for identifying key growth hubs and influencing factors driven by geopolitical dynamics and defense spending patterns.

- By Sensor Type:

- Acoustic Sensors

- Active Sonar (Hull-mounted, Towed Array, Variable Depth Sonar)

- Passive Sonar (Flank Array, Conformal Array, Towed Array)

- Intercept Sonar

- Non-Acoustic Sensors

- Magnetic Anomaly Detectors (MAD)

- Electronic Support Measures (ESM)

- Radar

- Optronics (Periscope-mounted, Mast-mounted)

- Environmental Sensors (Temperature, Salinity, Pressure, Current)

- Laser Imaging and Detection

- Acoustic Sensors

- By Platform:

- Manned Submarines

- Nuclear-Powered Submarines (SSN, SSBN, SSGN)

- Diesel-Electric Submarines (SSK)

- Unmanned Underwater Vehicles (UUVs)

- Remotely Operated Vehicles (ROVs)

- Autonomous Underwater Vehicles (AUVs)

- Manned Submarines

- By Application:

- Surveillance and Reconnaissance

- Anti-Submarine Warfare (ASW)

- Mine Detection and Countermeasures

- Navigation and Obstacle Avoidance

- Targeting and Weapon Guidance

- Oceanographic Research and Mapping

- Communication and Networking

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Submarine Sensor Market

The value chain for the submarine sensor market is an intricate and highly specialized ecosystem, characterized by technologically intensive processes that span from fundamental scientific research and advanced engineering development through to complex final integration, meticulous testing, and comprehensive long-term maintenance and upgrade services. An upstream analysis of this value chain primarily focuses on the critical roles played by raw material suppliers and highly specialized component manufacturers. These entities provide the foundational and often proprietary elements that are indispensable for the fabrication of sophisticated sensor systems. Conversely, downstream analysis is concerned with the subsequent stages, which involve the meticulous integration of these advanced sensors into the overarching submarine platforms by prime defense contractors, their ultimate delivery to national naval forces, and the essential, ongoing maintenance, support, and upgrade services required throughout the decades-long operational life of these critical assets. Given the strategic nature, inherent complexity, and national security implications of these products, distribution channels are overwhelmingly direct, involving government-to-government or direct manufacturer-to-navy agreements, with indirect channels playing a comparatively minor, often sub-contracted, role.

Upstream activities within the submarine sensor value chain are predominantly dominated by a select group of specialized material science companies and advanced electronic component manufacturers. These entities are pivotal, supplying crucial and often proprietary elements such as high-performance piezoelectric ceramics, which are fundamental to the operation of modern sonar transducers, or high-purity rare-earth magnets, essential for sensitive Magnetic Anomaly Detection (MAD) systems. Furthermore, they provide specialized semiconductor components and microprocessors that form the core of advanced signal processing units, enabling real-time data analysis and fusion. Key suppliers also include firms that develop highly durable, pressure-resistant housings, specialized underwater cabling, and robust connectors, all of which are absolutely essential for ensuring the integrity, reliability, and long-term operational lifespan of sensor systems in the extremely harsh deep-sea environment. Innovation within these foundational component industries directly and profoundly impacts the overall performance characteristics, longevity, and cost-effectiveness of the final sensor products. Consequently, establishing and maintaining strong, collaborative, and secure relationships with these specialized upstream suppliers is critically important for all major market players. Academic research institutions and university-affiliated laboratories frequently play an indispensable role in the initial stages of fundamental material science breakthroughs and early-stage technological advancements, feeding into the industrial development pipeline.

Submarine Sensor Market Potential Customers

The predominant potential customers and primary end-users for sophisticated submarine sensor products are unequivocally the national naval forces across the globe. These sovereign entities are driven by inherent defense requirements, mandates for robust maritime security, and strategic geopolitical considerations. Their acquisition of advanced sensors is essential for installation in both newly constructed, state-of-the-art submarines and for the comprehensive modernization and tactical upgrades of their existing fleets, ensuring sustained operational relevance and technological parity or superiority. The demand for these sensors is intricately linked to the dynamic geopolitical landscape, evolving perceptions of national threats, and the strategic imperative of maintaining a formidable and resilient underwater warfare capability to project power and protect national interests. While military applications constitute the overwhelming majority of the market, a smaller yet progressively expanding segment of potential customers includes governmental and commercial entities involved in critical scientific research, deep-sea exploration, comprehensive oceanographic studies, and sustainable underwater resource management, indicating a gradual diversification of the market's reach.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.1 Billion |

| Market Forecast in 2032 | USD 3.58 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thales Group, Raytheon Technologies, Lockheed Martin Corporation, L3Harris Technologies, BAE Systems, Northrop Grumman Corporation, General Dynamics Corporation, Atlas Elektronik GmbH, Safran S.A., Elbit Systems Ltd., Kongsberg Gruppen, Ultra Electronics, Leonardo S.p.A., ECA Group, Sonardyne International Ltd., Teledyne Technologies Incorporated, Furuno Electric Co. Ltd., Saab AB, General Atomics, DRASS S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Submarine Sensor Market Key Technology Landscape

The submarine sensor market is fundamentally defined by a highly advanced and perpetually evolving technological landscape, meticulously shaped by the unwavering imperative to achieve unparalleled superiority in underwater detection, classification, and stealth capabilities. Core technological advancements are primarily concentrated around both acoustic and non-acoustic sensing principles, with ongoing and intensive innovation focused on dramatically enhancing sensor sensitivity, extending detection ranges, boosting data processing power, and improving seamless system integration. The continuous development and application of advanced materials science, sophisticated digital signal processing (DSP) algorithms, and cutting-edge miniaturization techniques are absolutely fundamental to the remarkable progress observed within this highly specialized domain. The overarching strategic goal remains to equip submarines with an unprecedented and superior ability to perceive, interpret, and effectively interact with their extraordinarily complex and dynamic underwater environment, providing a decisive tactical advantage in both overt and covert operations.

In the realm of acoustic sensing, which remains the cornerstone of underwater detection, significant technological advancements are prominently visible in broadband sonar systems. These systems leverage a wider spectrum of frequencies, dramatically improving target classification capabilities by providing richer acoustic signatures and substantially reducing the effects of reverberation, particularly problematic in shallow waters. Synthetic Aperture Sonar (SAS) represents another critically important and rapidly maturing technology. SAS employs highly advanced signal processing techniques to create extraordinarily high-resolution images of the seafloor and submerged objects, far exceeding the capabilities of traditional sonar systems. This makes SAS indispensable for applications such as precise mine detection and detailed underwater mapping, which are vital for navigation and operational safety. Furthermore, multi-static sonar, a revolutionary approach involving geographically distributed multiple transmitters and receivers, is gaining significant traction for its inherent ability to overcome conventional stealth measures employed by adversary submarines and to provide a far more comprehensive and robust acoustic picture of the battlespace. These advanced acoustic systems universally leverage highly sophisticated digital signal processors, advanced array technologies, and high-bandwidth data links to efficiently manage and interpret vast amounts of real-time acoustic data, transforming raw signals into actionable intelligence.

Non-acoustic technologies are concurrently witnessing a rapid and impactful evolution, providing crucial complementary sensing modalities that enhance a submarine's overall situational awareness and stealth. Magnetic Anomaly Detectors (MAD) are becoming progressively more sensitive and increasingly compact, significantly aiding in the passive detection of large metallic objects, such as other submarines, by sensing minute disturbances in the Earth's magnetic field. Electronic Support Measures (ESM) systems are now integrating advanced machine learning algorithms to rapidly identify, analyze, and classify complex electromagnetic signals emitted by surface ships, aircraft, and shore-based radars. This capability provides invaluable intelligence gathering and enhances the submarine's self-protection by detecting potential threats before they become critical. Optical sensors, particularly those innovatively integrated into non-hull penetrating mast systems (known as optronics masts), offer high-resolution visual imaging, low-light capabilities, and infrared detection without compromising the submarine's structural integrity or acoustic stealth. Beyond these, emerging and speculative areas of technology include quantum sensors, which hold the promise of ultra-sensitive detection of magnetic fields or gravity anomalies, potentially offering revolutionary stealth detection capabilities. Biomimetic sensors, drawing profound inspiration from the highly evolved sensory organs of marine life (e.g., lateral lines of fish), are being explored for their potential to provide enhanced performance in acoustically challenging, turbid, or optically opaque underwater environments, signaling a future where sensor systems could achieve unprecedented levels of perception and adaptation.

Regional Highlights

- North America: Dominates the market due to significant defense spending by the United States, extensive research and development in advanced naval technologies, and a strong presence of leading defense contractors. The region prioritizes technological superiority in underwater warfare, driving consistent innovation and procurement of cutting-edge sensor systems for its formidable submarine fleet.

- Europe: A mature market characterized by robust naval modernization programs in countries like the UK, France, Germany, and Italy. There is a strong focus on advanced anti-submarine warfare capabilities, the development of integrated sensor suites, and active participation in international defense collaborations to share costs and expertise. European nations are keen on maintaining naval parity and projecting influence in regional waters.

- Asia Pacific (APAC): The fastest-growing region, driven by escalating geopolitical tensions, significant naval expansion by China and India, and ambitious submarine procurement programs in countries such as Australia, South Korea, and Japan. Increased focus on maritime domain awareness, protection of vital sea lanes, and regional security initiatives are fueling substantial investments in submarine sensors.

- Latin America: Exhibits steady growth, with countries like Brazil, Argentina, and Chile investing in naval upgrades and new submarine acquisitions to protect their extensive maritime territories and economic interests, including vast exclusive economic zones. Demand in this region is focused on enhancing coastal defense, surveillance capabilities, and combating illicit maritime activities.

- Middle East and Africa (MEA): A developing market with increasing strategic interest in maritime security due to critical waterways, energy exports, and persistent piracy concerns. Growth in this region is driven by limited but growing investment in naval assets, particularly submarines, and the formation of regional defense partnerships aimed at bolstering maritime domain awareness and protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Submarine Sensor Market.- Thales Group

- Raytheon Technologies

- Lockheed Martin Corporation

- L3Harris Technologies

- BAE Systems

- Northrop Grumman Corporation

- General Dynamics Corporation

- Atlas Elektronik GmbH

- Safran S.A.

- Elbit Systems Ltd.

- Kongsberg Gruppen

- Ultra Electronics

- Leonardo S.p.A.

- ECA Group

- Sonardyne International Ltd.

- Teledyne Technologies Incorporated

- Furuno Electric Co. Ltd.

- Saab AB

- General Atomics

- DRASS S.p.A.

Frequently Asked Questions

What are the primary types of sensors used in submarines?

Submarines primarily utilize a sophisticated combination of acoustic and non-acoustic sensors to achieve comprehensive underwater situational awareness. Acoustic sensors encompass various forms of sonar, including active sonar (for emitting sound pulses and listening for echoes), passive sonar (for silently listening to underwater sounds), and intercept sonar (for detecting enemy sonar transmissions). Non-acoustic sensors include highly sensitive Magnetic Anomaly Detectors (MAD) for detecting metallic objects, advanced Electronic Support Measures (ESM) for identifying electromagnetic emissions, specialized submarine-specific radar for surface detection, and optronic masts equipped with high-resolution cameras and infrared sensors for stealthy visual surveillance and intelligence gathering. Additionally, environmental sensors provide crucial data on ocean conditions.

How does artificial intelligence enhance submarine sensor capabilities?

Artificial intelligence (AI) significantly enhances submarine sensor capabilities by processing vast, complex datasets from multiple sensors in real-time, far exceeding human analytical speed. This allows for improved target classification accuracy, a substantial reduction in false positives, and the generation of predictive analytics for equipment maintenance and tactical decision-making. AI algorithms can fuse disparate sensor data to create a more comprehensive and accurate picture of the underwater battlespace, reduce operator cognitive load, and optimize mission planning. Furthermore, AI could enable advanced autonomous functions for certain sensor operations and provide intelligent decision support tools, leading to improved operational efficiency, enhanced stealth, and greater effectiveness in challenging underwater environments.

What are the key drivers for growth in the Submarine Sensor Market?

The key drivers for robust growth in the Submarine Sensor Market are multifaceted. Foremost among them are escalating global geopolitical tensions, which compel nations to bolster their naval defense capabilities, particularly in the underwater domain. This leads to continuous naval modernization and expansion programs by major global powers and emerging economies. There is an unwavering imperative for enhanced underwater surveillance and advanced anti-submarine warfare (ASW) capabilities to counter sophisticated threats. The relentless pursuit of technological superiority in underwater warfare, including the demand for superior stealth technologies, precise detection capabilities, and improved situational awareness in complex maritime environments, further fuels market expansion and innovation.

Which regions are leading the demand for submarine sensors?

North America currently holds a dominant position in the Submarine Sensor Market, primarily driven by the substantial defense spending of the United States, its extensive investment in advanced naval research and development, and the strong presence of leading defense contractors and technology innovators. However, the Asia Pacific region is experiencing the fastest and most significant growth. This rapid expansion is fueled by large-scale naval modernization efforts and ambitious submarine procurement programs in countries such as China, India, and Australia, reflecting a strategic shift in global defense priorities and increased investments in regional maritime capabilities to assert influence and address evolving security concerns.

What are the major challenges faced by manufacturers in the Submarine Sensor Market?

Manufacturers in the Submarine Sensor Market confront several significant challenges. These include the prohibitively high costs associated with intensive research and development (R&D) of cutting-edge sensor technologies, the requirement for exceedingly stringent regulatory compliance, and complex international export controls which limit market access. Furthermore, the inherent technical complexity of integrating diverse and highly sensitive sensor systems into stealth-critical submarine platforms, ensuring seamless interoperability, and maintaining a minimal acoustic signature presents substantial engineering hurdles. Long procurement cycles for naval defense contracts, coupled with the constant need for continuous innovation to effectively counter rapidly evolving adversary threats, also pose considerable operational and strategic challenges for manufacturers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager