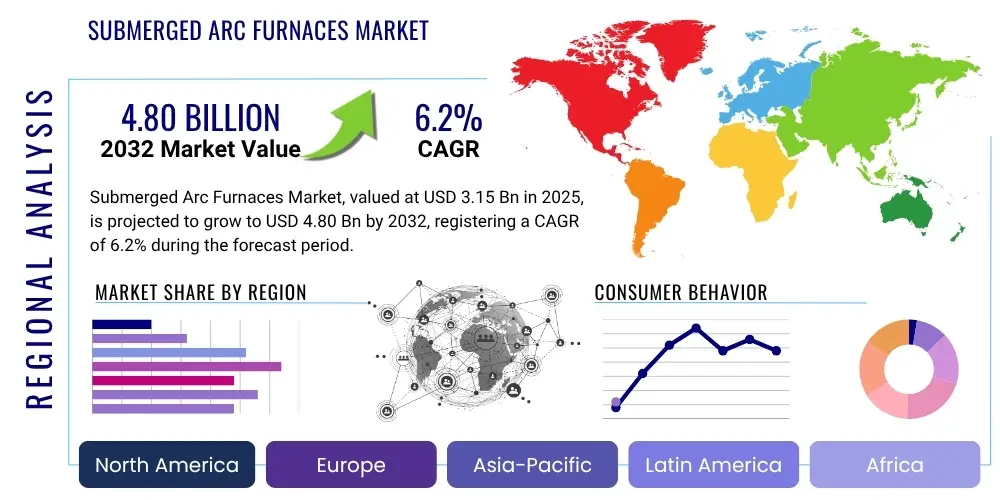

Submerged Arc Furnaces Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429406 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Submerged Arc Furnaces Market Size

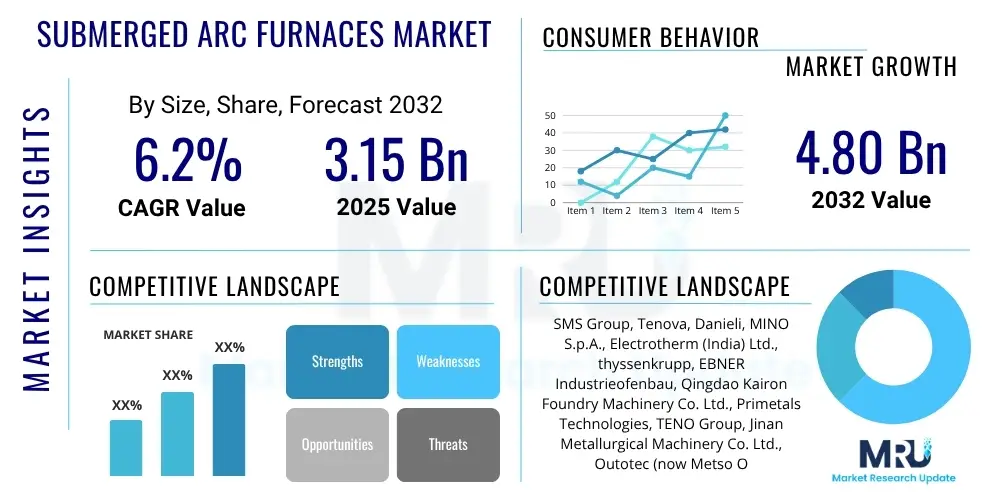

The Submerged Arc Furnaces Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2032. The market is estimated at $3.15 Billion in 2025 and is projected to reach $4.80 Billion by the end of the forecast period in 2032.

Submerged Arc Furnaces Market introduction

Submerged Arc Furnaces (SAFs) represent a critical industrial technology extensively utilized in high-temperature thermochemical processes for producing ferroalloys, calcium carbide, phosphorus, and other essential materials. These furnaces are characterized by electrodes submerged in the charge, generating heat through electrical resistance and arc discharge. This design facilitates efficient smelting, achieving the high temperatures necessary for reducing metal oxides and promoting various chemical reactions. The controlled environment within an SAF, often sealed or semi-sealed, allows for better energy utilization and minimizes heat loss, contributing to operational efficiency and product consistency.

The primary function of a Submerged Arc Furnace is to convert raw materials like ores, reductants (coke, coal, wood chips), and fluxes into valuable products through carbothermic reduction. The benefits of using SAFs are substantial, encompassing their ability to handle large volumes of material, operate continuously for extended periods, and produce high-quality alloys with specific compositions. Their robustness makes them suitable for demanding industrial applications, offering significant advantages over other smelting methods in terms of scale and reliability. The inherent flexibility of SAFs also allows for processing a diverse range of raw materials, adapting to varying feedstocks and production requirements.

Major applications for Submerged Arc Furnaces span across metallurgical industries, where they are indispensable for manufacturing ferroalloys like ferrosilicon, ferrochrome, and ferromanganese, crucial for steel production. Beyond metallurgy, SAFs are vital in the chemical sector for producing calcium carbide, a precursor for acetylene and various organic chemicals, and elemental phosphorus, used in fertilizers and detergents. Driving factors for the SAF market include accelerated industrialization in emerging economies, the growing demand for specialty steels, continuous infrastructure development worldwide, and the increasing focus on energy efficiency and environmental compliance within the metals and mining sectors. Technological advancements aiming at lower emissions and enhanced automation further propel market expansion.

Submerged Arc Furnaces Market Executive Summary

The Submerged Arc Furnaces market is experiencing robust growth driven by sustained demand from the global steel industry, which relies heavily on ferroalloys produced by SAFs, and the expanding chemical sector. Key business trends indicate a strong emphasis on automation, digitalization, and process optimization to enhance energy efficiency and reduce operational costs. Manufacturers are increasingly investing in advanced control systems, predictive maintenance technologies, and smart furnace designs to improve overall equipment effectiveness and environmental performance. Strategic collaborations and mergers and acquisitions are also common as companies seek to consolidate market share and leverage technological synergies, ensuring a competitive edge in a capital-intensive industry. Furthermore, the push towards green steel and sustainable production practices is influencing furnace design and operation, favoring solutions that minimize carbon footprint.

Regional trends highlight Asia Pacific as the dominant market for Submerged Arc Furnaces, primarily due to rapid industrialization, extensive infrastructure projects, and the presence of major steel and ferroalloy producers in countries like China and India. The region is witnessing significant investment in new furnace installations and upgrades of existing facilities. Europe and North America, while mature markets, are focusing on modernization, regulatory compliance, and the adoption of advanced, energy-efficient SAF technologies to meet stringent environmental standards and maintain competitiveness. Latin America and the Middle East & Africa are emerging as promising markets, driven by their rich mineral resources, growing domestic industrial bases, and increasing demand for value-added metallurgical products, fostering new opportunities for SAF manufacturers and service providers.

Segment trends underscore the continued dominance of ferroalloys production as the largest application segment, with high carbon ferrochrome, ferrosilicon, and ferromanganese leading the demand. The increasing production of specialty steels and stainless steels, which require precise alloy compositions, directly translates into higher demand for specialized SAFs capable of producing diverse ferroalloy grades. Additionally, there is a rising trend in the production of silicon metal, driven by its use in aluminum alloys and the rapidly expanding solar photovoltaic industry. Technological advancements in furnace design are focusing on improving energy recovery, reducing electrode consumption, and integrating advanced gas cleaning systems to comply with evolving environmental regulations, impacting all application segments and pushing for more sustainable operational models across the industry.

AI Impact Analysis on Submerged Arc Furnaces Market

User inquiries about AI's impact on the Submerged Arc Furnaces market primarily revolve around optimizing operational efficiency, enhancing predictive maintenance, improving energy management, and ensuring product quality and safety. There is significant interest in how AI can transform traditional SAF operations into more autonomous, intelligent, and sustainable systems. Users are keen to understand how AI algorithms can analyze vast datasets from sensors to predict equipment failures, optimize raw material blending, fine-tune power consumption, and even autonomously adjust furnace parameters for optimal performance. Concerns often include the initial investment costs, the complexity of integration with existing legacy systems, and the need for skilled personnel to manage and interpret AI-driven insights, alongside the potential for significant gains in productivity and environmental compliance.

- AI-powered predictive maintenance reduces downtime and extends equipment lifespan by analyzing sensor data to forecast potential failures in critical components like electrodes, transformers, and refractory linings.

- Real-time process optimization through AI algorithms adjusts power input, raw material feed rates, and gas flow based on current conditions, leading to improved energy efficiency and consistent product quality.

- Enhanced raw material management utilizing AI for analyzing feedstock characteristics, enabling optimal blending and charging strategies to maximize yield and minimize impurities.

- Advanced quality control systems leverage AI for analyzing spectroscopic data and other real-time measurements to ensure ferroalloy and chemical product specifications are met consistently, reducing off-spec production.

- AI-driven energy management systems continuously monitor power consumption patterns and market prices, optimizing furnace operation schedules to reduce electricity costs and carbon footprint.

- Improved safety protocols are achieved by AI analyzing operational data to detect anomalies and potential hazards, providing early warnings to operators and preventing accidents.

- Digital twin technology, often supported by AI, creates virtual models of SAFs, allowing for simulation of operational scenarios, testing of process changes, and training without impacting actual production.

- Automated furnace control systems, augmented by AI, can reduce the need for constant manual intervention, improving operational stability and consistency while freeing operators for higher-level tasks.

- AI-enabled exhaust gas analysis and optimization contribute to better emission control and compliance with environmental regulations by fine-tuning combustion and off-gas treatment processes.

- Supply chain optimization benefits from AI by forecasting demand for raw materials and finished products, leading to more efficient inventory management and logistics for SAF operations.

DRO & Impact Forces Of Submerged Arc Furnaces Market

The Submerged Arc Furnaces market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities. Key drivers include the ever-increasing global demand for steel and stainless steel, which directly fuels the need for various ferroalloys like ferrosilicon, ferrochrome, and ferromanganese, primary products of SAFs. Rapid industrialization and urbanization in emerging economies, particularly across Asia Pacific, are leading to substantial infrastructure development, further escalating the demand for these foundational materials. Additionally, the growth of specific industries such as automotive, construction, and renewable energy (e.g., silicon for solar panels) continually contributes to the market's expansion, ensuring a steady requirement for high-quality, specialty alloys produced in SAFs. The inherent efficiency and scalability of SAF technology for high-temperature reduction processes make it indispensable for these applications.

However, the market also faces considerable restraints that temper its growth trajectory. The high capital expenditure required for installing new SAF facilities or upgrading existing ones presents a significant barrier to entry for new players and can limit expansion for smaller firms. Furthermore, Submerged Arc Furnaces are energy-intensive, and volatile electricity prices, coupled with increasing environmental regulations regarding carbon emissions and air quality, pose operational challenges and add to production costs. Concerns over the environmental impact of SAF operations, including greenhouse gas emissions, particulate matter, and waste generation, necessitate continuous investment in abatement technologies and compliance, which can strain profitability. The availability and fluctuating prices of key raw materials like metallurgical coke, quartz, and various ores also introduce market instability and procurement complexities, impacting operational continuity and cost structures.

Despite these challenges, numerous opportunities exist for market players to innovate and grow. Technological advancements in furnace design, automation, and energy recovery systems present avenues for improving efficiency, reducing environmental footprint, and lowering operational costs. The increasing focus on circular economy principles and sustainable production practices opens doors for developing SAFs capable of processing recycled materials or utilizing alternative, greener reductants. Emerging economies, with their ongoing industrial expansion and growing demand for refined metals, represent untapped markets for new SAF installations and technology transfers. Moreover, the development of advanced materials requiring specific alloy compositions will continue to drive research and development in SAF technology, leading to more specialized and higher-value product offerings. The adoption of digital technologies, including AI and IoT, for process optimization and predictive maintenance also creates significant value creation opportunities.

Segmentation Analysis

The Submerged Arc Furnaces market is comprehensively segmented to provide a detailed understanding of its diverse applications, operational types, and end-user industries. This segmentation aids in identifying key market drivers, niche opportunities, and strategic areas for investment and technological development. The market can be broadly categorized based on the type of furnace, the product manufactured, and the end-use application, each exhibiting unique growth patterns and demand characteristics influenced by regional industrial landscapes and technological advancements. Understanding these segments is crucial for stakeholders to tailor their product offerings, marketing strategies, and R&D efforts effectively, ensuring alignment with specific market needs and maximizing profitability in this specialized industrial equipment sector.

- By Type

- Open Submerged Arc Furnaces: Traditional design, widely used, offers flexibility but with higher emissions.

- Semi-Closed Submerged Arc Furnaces: Partial gas collection, improved energy efficiency and environmental control.

- Closed Submerged Arc Furnaces: Full gas collection, highest energy efficiency, lower emissions, capable of generating excess gas for power generation.

- By Product

- Ferrochrome: High Carbon Ferrochrome, Medium Carbon Ferrochrome, Low Carbon Ferrochrome, Silicochrome. Essential for stainless steel production.

- Ferrosilicon: Used as a deoxidizer and alloying agent in steel and cast iron.

- Silicon Metal: Key component for aluminum alloys, silicones, and photovoltaic cells.

- Ferromanganese: High Carbon Ferromanganese, Medium Carbon Ferromanganese, Low Carbon Ferromanganese, Silicomanganese. Primarily used as a deoxidizer and desulfurizer in steelmaking.

- Calcium Carbide: Used for acetylene production, desulfurization in steel, and chemical synthesis.

- Elemental Phosphorus: Essential for fertilizers, detergents, and chemical intermediates.

- Other Ferroalloys: Including ferrotitanium, ferronickel, etc.

- By Application

- Steel Industry: Largest consumer, for alloying and deoxidation in steel and stainless steel production.

- Chemical Industry: For producing calcium carbide, elemental phosphorus, and other industrial chemicals.

- Foundry Industry: For producing cast iron and other metal castings.

- Solar Industry: For silicon metal production, crucial for photovoltaic cells.

- Others: Including applications in ceramics, refractories, and non-ferrous metals.

Value Chain Analysis For Submerged Arc Furnaces Market

The value chain for the Submerged Arc Furnaces market commences with the upstream segment, which primarily involves the extraction and processing of essential raw materials. This includes mining operations for various metallic ores such as chromite, manganese, quartz, and ilmenite, as well as the production of reductants like metallurgical coke, coal, and wood chips. Critical consumables like graphite electrodes and refractory materials are also integral to the upstream supply. Suppliers in this segment focus on providing high-quality, consistent, and cost-effective inputs, which directly impacts the operational efficiency and product quality of SAFs. Reliability of supply and stable pricing from these upstream providers are crucial for the overall profitability and sustainability of SAF operators.

Further along the value chain, the core manufacturing segment involves the design, engineering, fabrication, and installation of Submerged Arc Furnaces by specialized equipment manufacturers. These companies are responsible for developing advanced furnace technologies, including power systems, electrode handling mechanisms, gas cleaning systems, and automation controls. They collaborate with clients to provide customized solutions based on specific production capacities and product requirements. Post-installation services, maintenance, and spare parts supply also form a significant part of this segment, ensuring the long-term operational integrity and performance of the furnaces. This segment is characterized by high technical expertise, significant R&D investment, and strong relationships with both upstream suppliers and downstream end-users.

The downstream segment of the Submerged Arc Furnaces value chain primarily consists of the end-user industries that utilize the products generated by SAFs. These include large-scale steel manufacturers, specialty ferroalloy producers, chemical companies, and foundry operations. The distribution channel for SAF products can be both direct and indirect. Direct sales involve manufacturers selling furnaces directly to major industrial clients, often accompanied by extensive engineering, procurement, and construction (EPC) services. Indirect distribution involves working through engineering firms, system integrators, or regional distributors who facilitate sales and support for smaller clients or specific project requirements. The ultimate demand for SAFs is driven by the consumption trends in these downstream industries, making market intelligence and demand forecasting from these sectors critical for SAF manufacturers.

Submerged Arc Furnaces Market Potential Customers

The primary potential customers for the Submerged Arc Furnaces market are large industrial entities that require high-temperature processing for the production of various metals, alloys, and chemicals. Steel manufacturers represent the largest segment of end-users, as they extensively use ferroalloys produced by SAFs as essential deoxidizers, desulfurizers, and alloying agents to impart specific properties to steel, such as strength, corrosion resistance, and ductility. Without a consistent supply of these ferroalloys, modern steel production, particularly of specialty and stainless steels, would be significantly hampered. These customers are often integrated producers, or they procure ferroalloys from dedicated ferroalloy producers that operate SAFs.

Beyond the steel industry, ferroalloy producers themselves constitute a significant customer base. These companies specialize in manufacturing a wide range of ferroalloys like ferrosilicon, ferrochrome, ferromanganese, and silicon metal, which are then supplied to the steel, aluminum, and chemical industries. Their demand for SAFs is driven by the need for high-capacity, energy-efficient, and environmentally compliant furnaces capable of meeting stringent product specifications and escalating production volumes. The global shift towards higher quality materials and increasingly complex metallurgical processes necessitates investment in advanced SAF technology to maintain competitiveness and expand product portfolios.

The chemical industry also forms a crucial segment of potential customers, particularly those involved in the production of calcium carbide and elemental phosphorus. Calcium carbide is a vital intermediate for acetylene gas and various organic chemicals, while elemental phosphorus is indispensable in the manufacture of fertilizers, detergents, and phosphoric acid. These chemical manufacturers require SAFs capable of precise temperature control and efficient handling of specific raw materials to ensure product purity and yield. Additionally, companies in the solar industry, which require high-purity silicon metal for photovoltaic cells, represent a growing customer base, emphasizing the versatility and critical role of SAF technology across diverse industrial sectors. The ongoing demand for these foundational industrial products ensures a steady and robust market for Submerged Arc Furnaces.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $3.15 Billion |

| Market Forecast in 2032 | $4.80 Billion |

| Growth Rate | CAGR 6.2% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SMS Group, Tenova, Danieli, MINO S.p.A., Electrotherm (India) Ltd., thyssenkrupp, EBNER Industrieofenbau, Qingdao Kairon Foundry Machinery Co. Ltd., Primetals Technologies, TENO Group, Jinan Metallurgical Machinery Co. Ltd., Outotec (now Metso Outotec), Paul Wurth (now SMS Group), Dongfang Electric Corporation, Siemens AG, Hatch, Glencore, Samancor Chrome, OM Holdings, South32 |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Submerged Arc Furnaces Market Key Technology Landscape

The Submerged Arc Furnaces market is characterized by a dynamic technology landscape continually evolving to address efficiency, environmental, and cost pressures. A core aspect involves advanced electrode management systems, which are crucial for optimizing electrode consumption, a significant operational cost. These systems incorporate automated slipping, precise positioning, and real-time monitoring of electrode wear to ensure stable arc conditions and maximize efficiency. Innovations in electrode materials and joining technologies also contribute to longer electrode life and improved furnace performance, reducing the frequency of costly replacements and enhancing overall furnace availability. The reliability of power supply systems, including transformers and reactive power compensation units, is another critical technological focus, aimed at ensuring stable and efficient power delivery to the furnace.

Modern SAFs increasingly integrate sophisticated automation and control systems, often leveraging programmable logic controllers (PLCs), distributed control systems (DCS), and supervisory control and data acquisition (SCADA) platforms. These systems enable precise control over key operational parameters such as power input, raw material feeding, gas flow, and temperature profiles, leading to optimized reaction kinetics, consistent product quality, and reduced energy consumption. The advent of digital twin technology allows for virtual modeling and simulation of furnace operations, providing insights for process optimization, predictive maintenance, and operator training without interrupting actual production. Furthermore, sensors and IoT devices are deployed extensively to collect vast amounts of real-time data, feeding into these control systems and enabling data-driven decision-making.

Environmental compliance and energy recovery technologies are also central to the SAF technology landscape. Gas cleaning systems, including baghouses, electrostatic precipitators, and scrubbers, are essential for capturing particulate matter and gaseous emissions from furnace off-gases, ensuring adherence to increasingly stringent air quality regulations. Concurrently, energy recovery systems are being developed and implemented to capture the significant heat content from off-gases, converting it into steam or electricity. This not only improves the overall energy efficiency of the SAF plant but also reduces the operational carbon footprint, aligning with global sustainability goals. Research into alternative reductants and raw material pre-treatment technologies also aims to enhance process efficiency and environmental performance, pushing the boundaries of what SAFs can achieve.

Regional Highlights

- Asia Pacific (APAC): The Asia Pacific region stands as the largest and fastest-growing market for Submerged Arc Furnaces, primarily driven by robust industrialization, significant infrastructure development, and a burgeoning steel industry, especially in countries like China, India, and Southeast Asian nations. This region accounts for a substantial portion of global ferroalloy and silicon metal production, fueled by high demand from construction, automotive, and electronics sectors. Continuous investments in new furnace installations and modernization of existing plants to meet escalating demand and adhere to environmental regulations are characteristic of the APAC market.

- Europe: A mature market, Europe emphasizes technological advancements, energy efficiency, and stringent environmental compliance in its SAF operations. The focus is on upgrading existing facilities with state-of-the-art automation, gas cleaning, and energy recovery systems. While new installations are fewer, there is strong demand for specialized ferroalloys and silicon metal, particularly for high-end automotive, aerospace, and renewable energy applications. European manufacturers are leaders in developing advanced, sustainable SAF technologies.

- North America: Similar to Europe, North America is a mature market driven by modernization and efficiency improvements. The region prioritizes automation, digital integration, and emissions control to enhance productivity and reduce operational costs. Demand for SAFs is stable, supported by the specialty steel and chemicals industries, with a focus on high-quality, domestically produced ferroalloys. Investments are directed towards optimizing existing facilities rather than significant greenfield projects.

- Latin America: Rich in mineral resources, Latin America represents an emerging market with growing potential. Countries like Brazil and Chile have significant mining operations, which naturally leads to an increase in domestic ferroalloy and metallurgical production. Investments in SAFs are driven by efforts to add value to raw materials locally, reduce reliance on imports, and support regional industrial expansion. The market shows a steady adoption of both new installations and technology upgrades.

- Middle East and Africa (MEA): This region is witnessing gradual growth in the SAF market, primarily propelled by national industrialization strategies, diversification away from oil economies, and growing demand for steel and construction materials. Countries with significant mineral reserves, such as South Africa (for chrome) and those in the GCC (for steel production), are investing in ferroalloy production capabilities. The market is characterized by a mix of new furnace projects and the adoption of energy-efficient technologies to capitalize on abundant local resources and meet rising domestic demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Submerged Arc Furnaces Market.- SMS Group

- Tenova

- Danieli

- MINO S.p.A.

- Electrotherm (India) Ltd.

- thyssenkrupp

- EBNER Industrieofenbau

- Qingdao Kairon Foundry Machinery Co. Ltd.

- Primetals Technologies

- TENO Group

- Jinan Metallurgical Machinery Co. Ltd.

- Outotec (now Metso Outotec)

- Paul Wurth (now SMS Group)

- Dongfang Electric Corporation

- Siemens AG

- Hatch

- Glencore

- Samancor Chrome

- OM Holdings

- South32

Frequently Asked Questions

What is a Submerged Arc Furnace (SAF) and its primary purpose?

A Submerged Arc Furnace is an industrial electric furnace designed for high-temperature thermochemical reactions, primarily used in the production of ferroalloys, calcium carbide, and elemental phosphorus. Its electrodes are submerged in the charge, generating intense heat to melt and reduce raw materials, making it crucial for the metallurgical and chemical industries.

Which industries are the major consumers of materials produced by SAFs?

The steel industry is the largest consumer, relying on SAFs for various ferroalloys (e.g., ferrosilicon, ferrochrome) used as deoxidizers and alloying agents. The chemical industry also heavily utilizes SAF products like calcium carbide and elemental phosphorus for industrial chemicals and fertilizers. Other significant consumers include the foundry and solar industries.

What are the main drivers for the growth of the Submerged Arc Furnaces market?

Key drivers include the global increase in steel demand, rapid industrialization and infrastructure development in emerging economies, and the growing need for specialty alloys in sectors like automotive and renewable energy. Technological advancements improving energy efficiency and environmental performance also contribute to market expansion.

What are the biggest challenges facing the Submerged Arc Furnaces market?

Major challenges include the high capital investment required for SAF installations, volatile electricity prices, stringent environmental regulations on emissions, and fluctuations in the cost and availability of raw materials. These factors can significantly impact operational costs and profitability for SAF operators.

How is artificial intelligence impacting Submerged Arc Furnace operations?

AI is transforming SAF operations by enabling predictive maintenance for critical components, optimizing real-time process parameters for energy efficiency and product quality, and enhancing raw material management. AI-driven systems contribute to reduced downtime, lower operational costs, improved safety, and better environmental compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager