Subsea Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428932 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Subsea Equipment Market Size

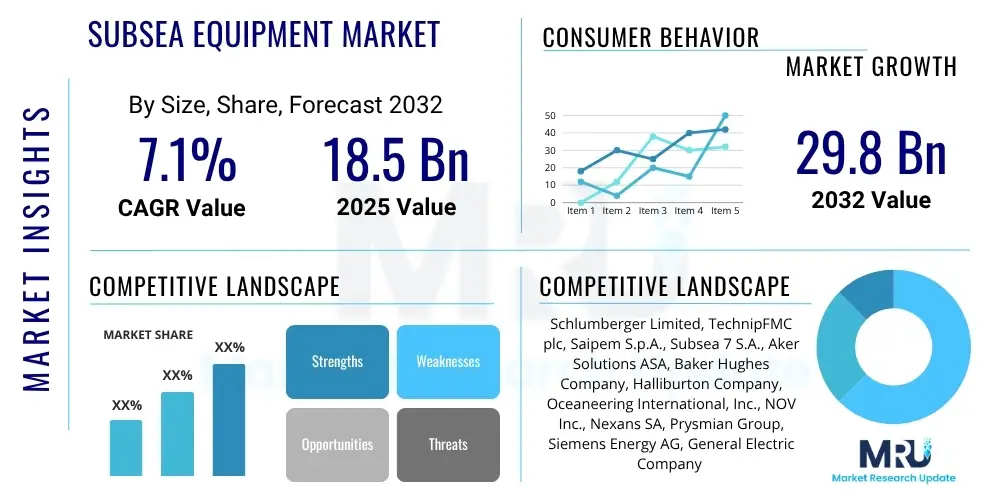

The Subsea Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2025 and 2032. The market is estimated at USD 18.5 Billion in 2025 and is projected to reach USD 29.8 Billion by the end of the forecast period in 2032.

Subsea Equipment Market introduction

The Subsea Equipment Market encompasses a broad range of technologies, systems, and components designed for installation and operation on the seabed or within the water column, primarily supporting offshore exploration, production, and processing activities. These sophisticated systems are critical for extracting hydrocarbon resources from challenging deepwater and ultra-deepwater environments, ensuring the safe and efficient transportation of oil and gas, and increasingly, facilitating offshore renewable energy generation. The market includes everything from intricate wellhead systems and Christmas trees to complex processing units, control systems, and robust infrastructure for power and data transmission, all engineered to withstand extreme pressures, temperatures, and corrosive marine conditions. This equipment plays a pivotal role in the global energy landscape, enabling access to previously unreachable reserves and supporting the evolving energy transition.

Major applications for subsea equipment traditionally revolve around the oil and gas industry, where it is indispensable for drilling, completion, production, and intervention operations in offshore fields. Beyond hydrocarbons, the scope is expanding significantly to include renewable energy sectors, particularly offshore wind, where subsea cables, foundations, and monitoring systems are essential. Emerging applications also include ocean mining, defense and security, and scientific research. The benefits derived from subsea equipment are manifold: it enhances operational safety by removing personnel from hazardous topside environments, reduces capital expenditure and operating costs compared to surface facilities, minimizes environmental impact through advanced leak detection and containment capabilities, and allows for the development of marginal fields that would otherwise be uneconomical. These advantages, combined with continuous technological innovation, underscore the market's strategic importance.

The market's sustained growth is largely driven by several key factors. A primary driver is the persistent global demand for energy, which necessitates the development of new and existing offshore oil and gas fields, particularly in deepwater and ultra-deepwater locations where subsea technology is indispensable. Furthermore, advancements in subsea processing and automation capabilities are making these operations more efficient and economically viable. The rapid expansion of the offshore wind industry is also a significant growth catalyst, requiring extensive subsea infrastructure for power export and turbine foundations. Lastly, the increasing focus on operational efficiency, reliability, and environmental stewardship across the energy sector compels investment in advanced subsea solutions that promise enhanced performance and reduced ecological footprints.

Subsea Equipment Market Executive Summary

The Subsea Equipment Market is poised for substantial growth driven by a confluence of evolving business trends, significant regional developments, and dynamic shifts within its core segments. Business trends indicate a strong move towards digitalization, automation, and integrated subsea solutions, aimed at improving operational efficiency, reducing costs, and enhancing safety in increasingly complex offshore projects. There is also a pronounced emphasis on sustainability and environmental compliance, pushing manufacturers to develop more eco-friendly and energy-efficient subsea systems. Strategic partnerships and collaborations between technology providers, oil and gas operators, and renewable energy developers are becoming more common to leverage expertise and share risks in large-scale projects. Furthermore, a focus on life-of-field solutions, including advanced monitoring, predictive maintenance, and efficient decommissioning technologies, is shaping new business models and service offerings.

Regionally, the market exhibits diverse growth patterns. North America, particularly the US Gulf of Mexico, remains a mature but vital market for deepwater oil and gas developments, with ongoing investments in advanced subsea production systems. Europe is a leader in offshore wind energy and subsea infrastructure, with countries like Norway and the UK continuing to invest in both hydrocarbon and renewable subsea technologies, often pioneering new solutions. The Asia Pacific region is emerging as a significant growth hub, driven by increasing energy demand, new deepwater discoveries in countries like Australia, Malaysia, and Indonesia, and substantial investments in offshore wind capacity, particularly in China, South Korea, and Vietnam. Latin America, propelled by Brazil's pre-salt discoveries, represents a robust market for ultra-deepwater subsea equipment, while the Middle East and Africa regions are witnessing renewed interest in offshore exploration and production, creating new opportunities for subsea deployments, especially in East and West Africa.

Segment-wise, the market is experiencing notable shifts. The subsea production systems segment, including Christmas trees and manifold systems, continues to be a cornerstone, but demand for advanced subsea processing systems (e.g., boosting, separation, compression) is rapidly increasing due to their ability to enhance recovery and extend field life. The subsea umbilicals, risers, and flowlines (SURF) segment is expanding with requirements for deeper waters and harsher environments, necessitating stronger and more flexible materials. Growth in the offshore wind sector is driving demand for specialized subsea power cables and associated connection systems. Moreover, the subsea control systems segment is undergoing significant innovation, incorporating more intelligent and autonomous capabilities to enable remote operation and predictive maintenance. Overall, the market is characterized by a drive towards greater integration, standardization, and the adoption of digital technologies across all equipment categories to optimize performance and reduce total cost of ownership.

AI Impact Analysis on Subsea Equipment Market

User inquiries regarding Artificial Intelligence (AI) in the Subsea Equipment Market frequently revolve around how AI can enhance operational efficiency, improve safety protocols, and reduce maintenance costs. There is considerable interest in AI's role in predictive maintenance, real-time data analysis for operational optimization, and enabling greater autonomy for subsea vehicles and systems. Users also express concerns about the complexity of integrating AI into existing infrastructure, data security, and the availability of skilled personnel to manage advanced AI-driven systems. The overarching expectation is that AI will revolutionize subsea operations by making them more intelligent, resilient, and cost-effective, while simultaneously posing challenges related to implementation scalability and data governance within a highly regulated environment.

- Enhanced predictive maintenance through machine learning algorithms analyzing sensor data for equipment health.

- Optimized subsea asset performance by real-time data processing and adaptive control systems.

- Improved safety and risk management via AI-powered anomaly detection and autonomous inspection.

- Reduced operational costs through automated data interpretation and decision support.

- Development of autonomous underwater vehicles (AUVs) with advanced navigation and decision-making capabilities.

- Facilitation of remote operations and digital twins for comprehensive subsea field management.

- Better resource allocation and project planning by leveraging AI for complex scenario modeling.

DRO & Impact Forces Of Subsea Equipment Market

The Subsea Equipment Market is shaped by a dynamic interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers include the escalating global energy demand which necessitates the exploitation of deepwater and ultra-deepwater reserves, where subsea technology is critical for viable extraction. Technological advancements in subsea processing, automation, and materials science are continuously expanding the operational envelopes and improving the economics of subsea projects. Furthermore, the rapid growth of the offshore renewable energy sector, particularly offshore wind, creates significant demand for specialized subsea infrastructure, including cables, foundations, and monitoring systems. The inherent benefits of subsea systems, such as enhanced safety, reduced topside footprints, and improved environmental performance compared to traditional surface facilities, also drive their adoption. These factors collectively push innovation and investment within the market, fostering development of more robust, efficient, and intelligent subsea solutions.

However, several restraints temper market growth. Volatile global oil and gas prices historically impact investment decisions for new offshore projects, creating periods of uncertainty and deferred spending. High capital expenditure (CAPEX) associated with subsea equipment and installation can be a barrier for new projects, especially in challenging deepwater environments. Stringent environmental regulations and increasing public scrutiny over offshore activities can lead to complex permitting processes and higher compliance costs. Geopolitical instabilities and supply chain disruptions can also affect project timelines and material availability. The technical complexity and specialized expertise required for designing, installing, and maintaining subsea systems pose significant operational challenges, contributing to high operational expenditures (OPEX) and potential project delays. Addressing these restraints requires strategic planning, cost optimization, and robust risk management.

Opportunities within the market are abundant and diverse. The increasing focus on carbon capture, utilization, and storage (CCUS) projects, many of which involve subsea infrastructure for injection and storage, presents a nascent but significant growth area. The decommissioning of aging subsea infrastructure in mature basins offers a new segment for specialized subsea tools and services. Further development of autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) for inspection, maintenance, and repair (IMR) tasks promises to enhance efficiency and safety while reducing human intervention. The integration of digital technologies, including AI, machine learning, and digital twins, is unlocking new efficiencies in subsea asset management and predictive maintenance. Moreover, the expanding blue economy, encompassing ocean mining, aquaculture, and marine research, is creating niche opportunities for adaptable subsea equipment. Understanding the impact forces such as the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and competitive rivalry is essential for strategic positioning in this evolving market.

Segmentation Analysis

The Subsea Equipment Market is rigorously segmented to provide a granular understanding of its diverse components, applications, and operational characteristics. This segmentation allows for precise market analysis, enabling stakeholders to identify key growth areas, understand competitive dynamics, and tailor strategies effectively. The market can be broadly categorized by equipment type, application, and water depth, each revealing unique market demands and technological advancements. A comprehensive segmentation helps in evaluating the market's current landscape and forecasting its future trajectory, reflecting the intricate needs of the offshore energy industry and emerging sectors.

- By Component:

- Subsea Production Systems (SPS)

- Subsea Trees

- Manifolds

- Jumpers

- Connectors

- Production Control Systems

- Subsea Processing Systems (SPS)

- Subsea Separation

- Subsea Pumping

- Subsea Gas Compression

- Subsea Umbilicals, Risers, and Flowlines (SURF)

- Umbilicals

- Risers

- Flowlines

- Pipelines

- Subsea Control Systems

- Hydraulic Control Systems

- Electrical Control Systems

- Electro-Hydraulic Control Systems

- Subsea Well Access Systems

- Blowout Preventers (BOPs)

- Workover Systems

- Other Subsea Equipment (e.g., wellheads, mooring systems, autonomous underwater vehicles)

- Subsea Production Systems (SPS)

- By Application:

- Oil and Gas

- Exploration

- Production

- Intervention

- Offshore Wind

- Fixed-Bottom

- Floating

- Ocean Mining

- Defense and Security

- Others (e.g., scientific research, aquaculture)

- Oil and Gas

- By Water Depth:

- Shallow Water (<300 meters)

- Deepwater (300-1,500 meters)

- Ultra-Deepwater (>1,500 meters)

Value Chain Analysis For Subsea Equipment Market

The value chain for the Subsea Equipment Market is intricate, spanning from raw material sourcing and component manufacturing to complex system integration, installation, and long-term operational support. At the upstream stage, specialized manufacturers produce high-grade materials such as corrosion-resistant alloys, advanced polymers, and specialized electronics that are critical for the durability and performance of subsea equipment in harsh environments. These materials are then supplied to component manufacturers who fabricate intricate parts like valves, actuators, sensors, and connectors, adhering to stringent industry standards and specifications. This segment demands deep engineering expertise and significant investment in research and development to meet the evolving technical requirements of deepwater operations and new applications in renewable energy.

The midstream segment of the value chain involves the design, fabrication, and assembly of complete subsea systems. This includes specialized companies that integrate various components into functional subsea Christmas trees, manifolds, processing modules, and control systems. Engineering, Procurement, and Construction (EPC) contractors play a crucial role here, managing the complex process of designing, procuring, fabricating, installing, and commissioning subsea infrastructure. These integrators often work closely with operators to customize solutions for specific field characteristics. The downstream segment encompasses the installation, operation, maintenance, and eventual decommissioning of subsea equipment. Specialized marine vessels, remotely operated vehicles (ROVs), and highly skilled subsea engineers are essential for these phases, which often involve complex logistics and advanced technological capabilities to ensure the long-term integrity and performance of the subsea assets. This part of the value chain also includes ongoing monitoring, intervention, and repair services that extend the lifespan and optimize the efficiency of subsea fields.

Distribution channels within the subsea equipment market are predominantly direct, characterized by high-value, long-term contracts between equipment manufacturers and energy operators or large EPC contractors. Due to the highly specialized nature and significant investment involved, direct sales and project-specific partnerships are the norm. Manufacturers often work directly with oil and gas companies, offshore wind developers, or prime contractors to deliver bespoke solutions. Indirect channels are less common but can include specialized regional distributors for smaller components or maintenance parts, or through strategic alliances where technology providers offer their solutions as part of a broader integrated offering. The complexity of subsea projects necessitates a collaborative approach throughout the value chain, with close coordination between all stakeholders to ensure successful project execution and optimal asset performance throughout the life of the field.

Subsea Equipment Market Potential Customers

Potential customers and end-users of subsea equipment are primarily entities involved in the exploration, production, and transportation of offshore energy resources, as well as those developing marine infrastructure. The largest segment of buyers traditionally comprises international oil companies (IOCs) such as Shell, ExxonMobil, Chevron, and BP, and national oil companies (NOCs) like Petrobras, Equinor, and Saudi Aramco, which invest heavily in offshore oil and gas fields, particularly in deepwater and ultra-deepwater regions. These companies require complete subsea production systems, processing units, and extensive subsea infrastructure to extract hydrocarbons efficiently and safely. Their procurement decisions are driven by factors such as reservoir characteristics, operational depth, environmental regulations, and the need for reliable, high-performance equipment to maximize recovery and reduce operational costs. Their demand dictates significant portions of the market's growth and technological direction.

Beyond traditional oil and gas, a rapidly growing customer base includes developers and operators of offshore wind farms. Companies like Ørsted, Siemens Gamesa, Vestas, and other utility providers investing in renewable energy projects require substantial subsea equipment, primarily for power export cables, inter-array cables, and specialized subsea foundations (e.g., monopiles, jackets, floating platforms). The expansion of offshore wind capacity globally is creating a robust demand for highly specialized electrical subsea components and installation services. Marine construction and engineering companies, acting as EPC contractors, often serve as intermediaries, procuring equipment from manufacturers for integration into larger subsea projects. Additionally, defense and security agencies utilize subsea sensors, communication systems, and remotely operated vehicles for surveillance and underwater asset protection, while oceanographic research institutions and emerging sectors like deep-sea mining also represent niche, albeit growing, customer segments for specialized subsea instrumentation and robotic systems. The diversity of these end-users underscores the broad applicability and increasing relevance of subsea technology across the marine economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 18.5 Billion |

| Market Forecast in 2032 | USD 29.8 Billion |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger Limited, TechnipFMC plc, Saipem S.p.A., Subsea 7 S.A., Aker Solutions ASA, Baker Hughes Company, Halliburton Company, Oceaneering International, Inc., NOV Inc., Nexans SA, Prysmian Group, Siemens Energy AG, General Electric Company (GE Oil & Gas), Dril-Quip, Inc., OneSubsea (Schlumberger/Aker Solutions JV), Wärtsilä Corporation, National Oilwell Varco, Inc., Kongsberg Gruppen ASA, Fugro N.V., Helix Energy Solutions Group, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Subsea Equipment Market Key Technology Landscape

The Subsea Equipment Market is characterized by a rapidly evolving technology landscape, driven by the increasing complexity of offshore operations, the push for enhanced efficiency, and the growing focus on environmental sustainability. One of the primary technological advancements is the development of advanced subsea processing capabilities, including subsea boosting, separation, and compression. These systems move processing functions from topside platforms to the seabed, reducing facility size, enhancing recovery rates, and extending the economic life of fields, especially in deepwater environments. Miniaturization and modularization are also key trends, allowing for more compact and flexible subsea layouts that are easier to install and maintain. Furthermore, the use of advanced materials, such as titanium alloys and composite materials, provides increased resistance to corrosion, high pressure, and extreme temperatures, extending the lifespan and reliability of subsea components.

Digitalization is profoundly transforming the subsea technology landscape. This includes the widespread adoption of smart sensors for real-time data acquisition, enabling continuous monitoring of equipment performance, pipeline integrity, and environmental conditions. Coupled with this is the emergence of advanced data analytics, artificial intelligence (AI), and machine learning algorithms that process vast amounts of subsea data to provide predictive maintenance insights, optimize operational parameters, and detect anomalies before they lead to critical failures. The concept of "digital twins" is gaining traction, where virtual models of physical subsea assets are used for simulating performance, testing scenarios, and planning interventions, significantly improving decision-making and reducing risks. These digital tools are crucial for enabling remote operation centers, allowing for expert intervention and control from onshore locations, thereby improving safety and reducing operational costs.

Automation and autonomous systems represent another significant area of technological innovation. Remotely Operated Vehicles (ROVs) and Autonomous Underwater Vehicles (AUVs) are becoming more sophisticated, capable of performing complex inspection, maintenance, and repair (IMR) tasks with greater precision and autonomy. Advances in battery technology, underwater communication, and AI-driven navigation are extending the endurance and capabilities of these vehicles, reducing the need for costly support vessels and human intervention. Furthermore, the integration of subsea power distribution and control systems is leading to all-electric subsea architectures, which offer higher efficiency, reduced umbilical sizes, and simplified control compared to traditional hydraulic systems. These technological advancements collectively contribute to a more resilient, efficient, and environmentally responsible subsea industry, addressing the evolving demands of both hydrocarbon extraction and renewable energy generation.

Regional Highlights

- North America: This region, particularly the US Gulf of Mexico and Canada, represents a mature but strategically vital market for subsea equipment. Deepwater oil and gas exploration and production continue to drive demand for advanced subsea production systems, processing units, and robust SURF infrastructure. Innovation in ultra-deepwater technology and enhanced oil recovery techniques are key focus areas. The burgeoning offshore wind sector on the East and West coasts also contributes to market growth, particularly for subsea cables and foundations.

- Europe: A global leader in offshore renewable energy, Europe, especially the UK, Norway, and the North Sea region, is a significant market for subsea equipment. Strong investments in offshore wind farms drive demand for subsea power cables, export systems, and specialized installation services. Concurrently, the mature oil and gas basins in the North Sea continue to require subsea equipment for field life extension, enhanced recovery, and decommissioning activities, fostering innovation in subsea processing and environmental solutions.

- Asia Pacific (APAC): This region is projected to be one of the fastest-growing markets due to increasing energy demand, new offshore hydrocarbon discoveries in countries like Australia, Malaysia, Indonesia, and Vietnam, and aggressive expansion of offshore wind capacity, especially in China, South Korea, and Japan. Governments' supportive policies and investments in renewable energy infrastructure are strong drivers. The region presents significant opportunities for both established and emerging subsea technology providers.

- Latin America: Dominated by Brazil's prolific pre-salt oil and gas fields, Latin America is a critical market for ultra-deepwater subsea equipment. Continued investment by Petrobras and international operators in these challenging environments fuels demand for advanced subsea production systems, long-distance flowlines, and highly reliable control systems. Mexico and Guyana also show increasing potential for offshore developments.

- Middle East and Africa (MEA): The Middle East is witnessing renewed investment in offshore oil and gas production, particularly in shallow to deepwater fields, to meet global energy demands. Africa, with significant discoveries in countries like Angola, Nigeria, and Mozambique, and emerging potential in East Africa, offers substantial opportunities for subsea equipment. The development of gas fields for LNG export also drives demand for associated subsea infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Subsea Equipment Market.- Schlumberger Limited

- TechnipFMC plc

- Saipem S.p.A.

- Subsea 7 S.A.

- Aker Solutions ASA

- Baker Hughes Company

- Halliburton Company

- Oceaneering International, Inc.

- NOV Inc.

- Nexans SA

- Prysmian Group

- Siemens Energy AG

- General Electric Company (GE Oil & Gas)

- Dril-Quip, Inc.

- OneSubsea (Schlumberger/Aker Solutions JV)

- Wärtsilä Corporation

- Kongsberg Gruppen ASA

- Fugro N.V.

- Helix Energy Solutions Group, Inc.

- Wood Group PLC

Frequently Asked Questions

What is subsea equipment and why is it important?

Subsea equipment refers to specialized systems and components installed on the seabed or in the water column for offshore energy operations. It is crucial for extracting oil and gas from deepwater reserves, enabling offshore wind power generation, enhancing safety, reducing environmental impact, and extending the life of offshore fields by moving operations underwater.

Which factors are driving the growth of the Subsea Equipment Market?

Key drivers include persistent global energy demand, increased exploration and production activities in deepwater and ultra-deepwater regions, rapid expansion of the offshore wind energy sector, and continuous technological advancements improving efficiency and reliability of subsea systems. The focus on operational safety and environmental sustainability also fuels adoption.

How does AI impact subsea operations?

AI significantly enhances subsea operations by enabling predictive maintenance, optimizing asset performance through real-time data analysi

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager