Subsea Flowlines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427689 | Date : Oct, 2025 | Pages : 254 | Region : Global | Publisher : MRU

Subsea Flowlines Market Size

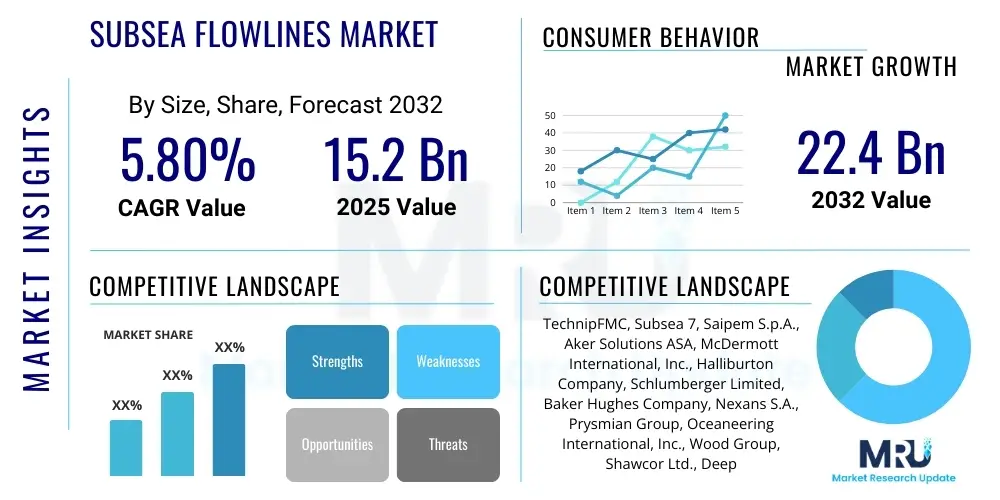

The Subsea Flowlines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 15.2 billion in 2025 and is projected to reach USD 22.4 billion by the end of the forecast period in 2032.

Subsea Flowlines Market introduction

The Subsea Flowlines Market encompasses the critical infrastructure for the offshore oil and gas industry, designed to transport hydrocarbons, injection fluids, and control signals between subsea wells, manifolds, and production facilities. These complex pipeline systems are fundamental to the efficient and safe extraction of offshore resources, playing a pivotal role in linking subsea production systems to surface platforms or onshore processing plants. The increasing global demand for energy, coupled with the ongoing exploration and development of deepwater and ultra-deepwater reserves, continues to drive the necessity for advanced and resilient subsea flowline solutions.

Subsea flowlines are engineered to withstand extreme environmental conditions, including high pressures, low temperatures, and corrosive marine environments. They typically consist of rigid or flexible pipelines, jumpers, and risers, each tailored for specific applications such as product export, water injection, gas lift, or chemical injection. The inherent benefits of these systems include enhanced operational reliability, reduced environmental footprint compared to surface infrastructure, and the capability to unlock remote and challenging oil and gas fields, thereby maximizing resource recovery and extending the economic life of offshore assets.

Major applications of subsea flowlines primarily revolve around oil and gas exploration, development, and production. They are essential for connecting individual wells to subsea manifolds, then routing the commingled fluids to a floating production storage and offloading (FPSO) vessel, a fixed platform, or directly to shore via export pipelines. The continuous technological advancements in materials science, welding techniques, and installation methodologies further bolster the market, enabling projects in increasingly hostile and deeper water environments. These innovations ensure the integrity and longevity of subsea infrastructure, making the extraction of deep-sea resources both feasible and economically viable.

Subsea Flowlines Market Executive Summary

The Subsea Flowlines Market is experiencing dynamic shifts, primarily driven by evolving business trends focused on cost optimization, digitalization, and the pursuit of operational efficiency. Energy companies and service providers are increasingly investing in integrated subsea solutions, leveraging advanced data analytics, remote monitoring, and autonomous systems to enhance project delivery and asset management. The industry is also witnessing a trend towards standardized designs and modularization to reduce capital expenditure and accelerate project timelines. Furthermore, the push for decarbonization and energy transition is prompting greater emphasis on environmentally friendly materials and installation practices, alongside the exploration of new applications in carbon capture, utilization, and storage (CCUS) and offshore hydrogen transport.

Regional trends significantly influence the market landscape. Asia-Pacific and Latin America are emerging as robust growth hubs, fueled by new deepwater discoveries and ongoing development projects, particularly in countries like Brazil, Guyana, Malaysia, and Australia. North America, specifically the U.S. Gulf of Mexico, remains a mature but active market, with sustained investment in deepwater production. Conversely, traditional regions such as the North Sea are witnessing a revitalization through life extension projects, decommissioning activities, and the integration of renewable energy infrastructure. Africa, particularly West Africa, continues to attract investment for its significant offshore hydrocarbon reserves, albeit with persistent geopolitical and economic challenges.

Segmentation trends within the Subsea Flowlines Market highlight a growing preference for flexible flowlines in complex tie-back scenarios and marginal fields due to their adaptability and ease of installation. However, rigid flowlines maintain their dominance for long-distance trunklines and high-pressure, high-temperature (HP/HT) applications where structural integrity and larger diameters are paramount. The market is further segmented by fluid type, water depth, and material, with increasing adoption of composite materials and advanced insulation technologies to address specific operational challenges. The interplay of these trends underscores a market characterized by both innovation and strategic adaptation to meet global energy demands while navigating environmental and economic pressures.

AI Impact Analysis on Subsea Flowlines Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Subsea Flowlines Market frequently revolve around how AI can enhance operational efficiency, improve safety, and extend the lifespan of critical subsea infrastructure. Users are keen to understand AIs role in predictive maintenance, real-time monitoring, and optimizing inspection schedules to minimize downtime and prevent catastrophic failures. There is significant interest in AIs potential to analyze vast amounts of sensor data from subsea systems, identify anomalies, and provide actionable insights that traditional methods might miss. Additionally, questions often arise about AIs contribution to environmental protection, such as early leak detection, and its capacity to revolutionize the design and engineering phases of subsea projects.

The key themes emerging from these inquiries highlight a collective expectation that AI will be a transformative force, enabling more intelligent and resilient subsea operations. Users anticipate that AI will move the industry beyond reactive maintenance to proactive asset management, thereby reducing operational expenditures and improving overall system reliability. Concerns often touch upon data security, the accuracy of AI models in complex marine environments, and the need for skilled personnel to implement and manage AI-driven solutions effectively. The overarching desire is for AI to deliver tangible benefits in terms of cost savings, increased production uptime, and enhanced worker safety, alongside meeting stringent environmental compliance requirements.

Furthermore, there is a strong emphasis on AIs ability to facilitate remote operations and autonomous interventions, which are becoming increasingly crucial in deepwater and ultra-deepwater environments where human access is challenging and hazardous. The integration of AI with digital twins and advanced simulation technologies is also a frequently discussed topic, underscoring the industrys drive towards creating comprehensive digital representations of physical assets for enhanced decision-making throughout the entire asset lifecycle. These discussions underscore a clear demand for AI to provide sophisticated analytical capabilities that support robust asset integrity management and optimize the performance of subsea flowline networks.

- Predictive Maintenance: AI algorithms analyze sensor data (pressure, temperature, flow rates, vibration) to predict equipment failures and material degradation, enabling proactive maintenance scheduling and minimizing unscheduled downtime.

- Operational Optimization: AI-driven models process real-time operational data to optimize flow rates, pressure management, and chemical injection, maximizing production efficiency and reducing energy consumption across the subsea network.

- Enhanced Safety & Integrity: AI systems monitor flowline integrity, detecting minor anomalies, corrosion, or fatigue cracks early, thereby preventing failures, ensuring environmental protection, and enhancing personnel safety.

- Design & Engineering Efficiency: AI and machine learning tools facilitate rapid simulation and optimization of flowline designs, material selection, and installation methodologies, leading to more robust, cost-effective, and efficient subsea infrastructure.

- Environmental Monitoring: AI-powered leak detection systems, utilizing acoustic, chemical, and visual data, provide early warnings of potential spills, allowing for swift response and mitigating environmental impact.

- Autonomous Inspection & Monitoring: AI enables autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) to perform intelligent inspections, process vast amounts of visual and sensor data, and generate detailed integrity reports with minimal human intervention.

DRO & Impact Forces Of Subsea Flowlines Market

The Subsea Flowlines Market is shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces. Key drivers include the persistent global demand for energy, which necessitates the exploitation of increasingly remote and challenging offshore oil and gas reserves, particularly in deepwater and ultra-deepwater fields. Technological advancements in subsea engineering, materials science, and installation techniques are also crucial drivers, enabling projects that were once considered technically or economically unfeasible. Furthermore, the economic viability of new discoveries and extensions of existing fields continues to fuel investment in subsea infrastructure, with companies seeking to maximize recovery from mature assets and bring new production online efficiently.

However, several restraints temper market growth. The inherent high capital expenditure (CAPEX) associated with subsea projects, including design, manufacturing, installation, and commissioning of flowlines, presents a significant barrier. Volatility in global oil and gas prices directly impacts investment decisions, leading to project delays or cancellations during periods of low prices. Stringent environmental regulations and growing public pressure to reduce carbon emissions also pose challenges, necessitating compliance with strict standards and potentially increasing project costs. The complex logistical and technical challenges of operating in harsh subsea environments, coupled with the need for specialized vessels and skilled personnel, further contribute to the operational difficulties.

Opportunities within the market are emerging from several fronts. The increasing focus on decarbonization and the energy transition is opening new avenues for subsea flowlines in applications such as carbon capture, utilization, and storage (CCUS) projects, where flowlines transport captured CO2 to injection sites. Offshore hydrogen transport and renewable energy integration, particularly for offshore wind power, also present long-term growth prospects. Digitalization, including the adoption of digital twins, advanced analytics, and AI, offers opportunities for optimizing asset performance, enhancing predictive maintenance, and streamlining project execution. These innovations promise to deliver significant operational efficiencies and cost reductions, making subsea developments more attractive.

Segmentation Analysis

The Subsea Flowlines Market is comprehensively segmented to address the diverse technical requirements and operational contexts within the offshore energy industry. This segmentation allows for a detailed understanding of market dynamics, specific technological demands, and the varying preferences of end-users across different operational environments. The primary methods of segmentation are typically based on flowline type, product application, water depth, and the materials used in construction, reflecting the highly specialized nature of subsea engineering. Each segment presents unique challenges and opportunities, influencing market growth and technological development. This granular analysis provides stakeholders with critical insights into market penetration, competitive landscapes, and future investment areas, enabling strategic decision-making and tailored solution development across the subsea industry value chain.

- By Type:

- Rigid Flowlines: Characterized by high strength, durability, and suitability for long-distance, high-pressure, high-temperature (HP/HT) applications. These are typically steel pipes, installed using reel-lay or J-lay methods.

- Flexible Flowlines: Offer greater installation flexibility, adaptable to complex subsea layouts, and ideal for dynamic risers, jumpers, and challenging deepwater environments. They consist of multiple layers of thermoplastic and metallic materials.

- By Application:

- Production Flowlines: Transport crude oil and natural gas from subsea wells to production facilities.

- Injection Flowlines: Used for injecting water, gas, or chemicals into reservoirs to enhance oil recovery or for gas lift operations.

- Export Flowlines: Large-diameter pipelines that transport processed hydrocarbons from offshore facilities to onshore terminals.

- Service/Umbilical Lines: Carry hydraulic fluid, electrical power, and communication signals for controlling subsea equipment.

- By Water Depth:

- Shallow Water: Projects typically in depths up to 300 meters, often involving established infrastructure and simpler installation.

- Deepwater: Projects in depths ranging from 300 to 1,500 meters, requiring specialized technology and expertise.

- Ultra-Deepwater: Projects exceeding 1,500 meters, representing the frontier of subsea engineering with extreme pressure and temperature challenges.

- By Material:

- Carbon Steel: Widely used for its cost-effectiveness and strength, especially in rigid flowlines, often with corrosion-resistant coatings.

- Stainless Steel & Alloys: Employed in corrosive environments or for HP/HT applications requiring enhanced material integrity.

- Thermoplastics & Composites: Increasingly used in flexible flowlines and specialized applications for their corrosion resistance, light weight, and fatigue performance.

- By End-Use:

- Oil & Gas Operators: Major exploration and production companies that own and operate subsea assets.

- EPC Contractors: Engineering, Procurement, and Construction firms responsible for integrated project delivery.

Subsea Flowlines Market Value Chain Analysis

The value chain for the Subsea Flowlines Market is a complex, multi-tiered structure involving a diverse set of stakeholders, from raw material suppliers to final installation and operational service providers. The upstream segment of this value chain primarily involves the sourcing and processing of raw materials such as steel, high-grade alloys, polymers, and composite materials, which are crucial for manufacturing the robust and durable components of subsea flowlines. Specialized material science companies and metallurgical firms play a vital role here, ensuring the supply of materials that can withstand extreme pressures, corrosive environments, and high temperatures inherent in subsea operations. Quality control and material certification are paramount at this stage to guarantee the integrity of the final product.

Moving downstream, the value chain encompasses the engineering, manufacturing, and fabrication of flowline components. This includes the production of rigid pipe sections, flexible risers, subsea jumpers, and associated connection systems. Leading subsea equipment manufacturers and fabrication yards, often part of integrated service companies, are responsible for designing and constructing these highly specialized products. Their expertise in advanced welding techniques, corrosion protection, insulation, and quality assurance processes is critical. The engineering phase involves intricate design work to meet project-specific requirements, considering factors like fluid dynamics, thermal management, and structural integrity under dynamic loading. This stage also includes the development of advanced monitoring and control systems integrated within the flowline infrastructure.

The distribution channel in the Subsea Flowlines Market is predominantly direct, with manufacturers and integrated service providers engaging directly with oil and gas operators and Engineering, Procurement, and Construction (EPC) contractors. EPC contractors often act as key intermediaries, managing the entire project lifecycle from design to installation and commissioning, thereby consolidating various aspects of the value chain. Indirect channels are less common but may involve specialized consultancies providing technical advisory services or smaller component suppliers feeding into larger manufacturing entities. Post-installation, the value chain extends to operation, maintenance, inspection, and decommissioning services, which are critical for ensuring the long-term performance and safety of subsea assets. This comprehensive value chain reflects the significant capital investment, technical complexity, and specialized expertise required to develop and maintain subsea flowline infrastructure.

Subsea Flowlines Market Potential Customers

The primary potential customers and end-users of subsea flowlines are predominantly global and national oil and gas exploration and production (E&P) companies, alongside major integrated energy firms. These entities are directly responsible for the discovery, development, and extraction of hydrocarbon resources from offshore fields, making subsea flowlines indispensable components of their operational infrastructure. Their extensive portfolios often include deepwater and ultra-deepwater assets, where the deployment of advanced subsea systems is essential for economic viability and technical feasibility. These customers require robust, reliable, and technologically advanced flowline solutions that can ensure maximum uptime, optimal fluid transport, and compliance with stringent safety and environmental regulations throughout the assets lifecycle.

In addition to the direct operators, Engineering, Procurement, and Construction (EPC) contractors represent a significant segment of potential customers. These contractors are commissioned by oil and gas companies to manage the entire lifecycle of subsea field developments, from initial design and engineering to procurement of materials, fabrication, installation, and commissioning. EPC firms often act as the direct purchasers of subsea flowlines and associated equipment, integrating them into comprehensive subsea production systems. Their purchasing decisions are influenced by project specifications, cost-effectiveness, schedule adherence, and the track record of suppliers in delivering high-quality, compliant solutions. The relationship between manufacturers and EPC contractors is crucial for project success and market penetration.

Furthermore, national oil companies (NOCs) in resource-rich regions, such as Brazils Petrobras, Saudi Aramco, and Norways Equinor, are significant buyers, often driving large-scale, long-term subsea development programs. Independent E&P companies, focusing on smaller or more specialized fields, also form a segment of the customer base, often seeking cost-efficient and modular subsea solutions. As the energy transition progresses, there is an emerging customer base for flowline technologies in nascent sectors like carbon capture, utilization, and storage (CCUS) projects and offshore hydrogen transport, where specialized flowlines will be required to transport CO2 or hydrogen. These diverse customer segments underscore the broad applicability and critical importance of subsea flowlines across the evolving energy landscape.

Subsea Flowlines Market Key Technology Landscape

The Subsea Flowlines Market is continuously driven by advancements in materials science, engineering methodologies, and digital technologies aimed at enhancing performance, integrity, and cost-efficiency in increasingly challenging offshore environments. A cornerstone of this landscape is the development of advanced materials, including high-strength low-alloy steels, corrosion-resistant alloys (CRAs), and composite materials, which enable flowlines to withstand extreme pressures, high temperatures, and aggressive corrosive media while offering improved fatigue resistance and lighter weight. Innovations in welding techniques, such as friction stir welding and narrow-gap welding, are critical for ensuring the structural integrity and reliability of rigid flowlines, reducing fabrication time and improving joint quality for long-distance pipelines.

Thermal insulation technology also plays a crucial role, particularly for deepwater and ultra-deepwater applications where maintaining fluid temperature is essential to prevent hydrate formation and wax deposition. Advanced insulation systems, including multi-layer polymer coatings and vacuum-insulated pipe-in-pipe (PIP) solutions, are designed to provide superior thermal performance and mechanical protection over extended operating periods. Furthermore, the integration of real-time monitoring and inspection technologies is paramount for asset integrity management. This includes fiber optic sensing systems embedded within flowlines for continuous temperature, pressure, and strain monitoring, as well as advanced acoustic and ultrasonic inspection tools deployed by remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) to detect anomalies and assess damage.

The digital transformation is profoundly impacting the subsea flowlines market, with the increasing adoption of digital twin technology. Digital twins create virtual replicas of physical flowline systems, enabling operators to simulate performance, predict maintenance needs, and optimize operational parameters based on real-time data analysis. Artificial intelligence (AI) and machine learning (ML) algorithms are being applied to analyze vast datasets from sensors, enhancing predictive maintenance capabilities, identifying potential failure modes, and optimizing inspection schedules. Robotic and autonomous systems for installation, repair, and intervention further reduce human exposure to hazardous environments and improve operational efficiency. These technological advancements collectively contribute to safer, more efficient, and more reliable subsea flowline operations, expanding the frontiers of offshore energy production and enabling new applications in energy transition initiatives.

Regional Highlights

- North America: The U.S. Gulf of Mexico remains a mature yet highly active region for subsea flowlines, driven by ongoing deepwater exploration and production activities. Investments are sustained by the development of new discoveries and the maintenance of existing infrastructure, with a strong focus on advanced technologies for deepwater challenges and stringent regulatory compliance. Canada also contributes, particularly off the coast of Newfoundland and Labrador.

- Europe: The North Sea, encompassing areas off Norway, the UK, and Denmark, continues to be a significant market, characterized by mature fields requiring life extension projects, decommissioning activities, and the integration of subsea infrastructure for carbon capture and storage (CCS) projects. Norway, in particular, is a leader in subsea technology innovation and deployment, emphasizing digitalization and environmental sustainability.

- Asia-Pacific: This region is experiencing substantial growth due to new oil and gas discoveries in Australia, Malaysia, Indonesia, and India. Rising energy demand and increasing investment in offshore E&P, particularly deepwater and gas developments, are propelling the demand for subsea flowlines. Countries like Australia and Malaysia are key hubs for subsea project development and technology adoption.

- Latin America: Led by Brazils pre-salt deepwater discoveries, Latin America is a powerhouse for the subsea flowlines market. Significant investments are being made in developing these complex fields, requiring specialized rigid and flexible flowlines to manage high pressures and challenging reservoir conditions. Guyana is also emerging as a major growth area with new offshore oil developments driving demand.

- Africa: West Africa, notably off the coasts of Nigeria, Angola, and Ghana, continues to be a key region for subsea flowline deployment, driven by substantial deepwater oil and gas reserves. While geopolitical factors and oil price volatility can influence investment, the long-term potential for resource development ensures sustained demand for subsea infrastructure in the region.

- Middle East: While traditionally dominated by onshore and shallow-water offshore production, countries like Saudi Arabia and UAE are expanding their offshore capabilities, with some projects venturing into deeper waters. The region is increasingly adopting advanced subsea technologies to maximize resource recovery and maintain its position as a global energy supplier.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Subsea Flowlines Market.- TechnipFMC

- Subsea 7

- Saipem S.p.A.

- Aker Solutions ASA

- McDermott International, Inc.

- Halliburton Company

- Schlumberger Limited

- Baker Hughes Company

- Nexans S.A.

- Prysmian Group

- Oceaneering International, Inc.

- Wood Group (John Wood Group PLC)

- Shawcor Ltd.

- DeepOcean Group

- National Oilwell Varco (NOV)

Frequently Asked Questions

What are subsea flowlines and their primary purpose?

Subsea flowlines are critical pipelines and associated components installed on the seabed, designed to transport various fluids and signals in offshore energy production. Their primary purpose is to efficiently and safely convey hydrocarbons (oil and gas), injection fluids (water, gas, chemicals), and control signals between subsea wells, manifolds, and surface production facilities or onshore processing plants. They are indispensable for connecting the entire subsea production system and enabling the extraction of offshore resources, particularly in deepwater and ultra-deepwater environments.

What are the main factors driving the growth of the Subsea Flowlines Market?

The Subsea Flowlines Market is primarily driven by the persistent global demand for energy, which necessitates the development of new and existing offshore oil and gas fields, especially in deepwater regions. Technological advancements in subsea engineering, materials science, and installation techniques enable increasingly complex projects. Additionally, the need for enhanced oil recovery (EOR) in mature fields, the increasing focus on operational efficiency through digitalization, and emerging applications in carbon capture and offshore hydrogen transport also contribute significantly to market growth.

What are the key challenges faced by the Subsea Flowlines Market?

The Subsea Flowlines Market faces several significant challenges, including high capital expenditure (CAPEX) associated with subsea projects, which can be sensitive to volatile oil and gas prices. The extreme environmental conditions of deepwater operations, such as high pressure, low temperature, and corrosion, demand highly specialized and durable materials and installation methods. Stringent environmental regulations, logistical complexities, and the need for highly skilled technical personnel also pose considerable hurdles to market growth and project execution.

How is technology impacting the evolution of subsea flowlines?

Technology is profoundly impacting subsea flowlines by introducing advanced materials for improved durability and performance, such as corrosion-resistant alloys and composites. Digitalization, including the adoption of digital twins and real-time monitoring systems, enhances asset integrity management, enables predictive maintenance, and optimizes operational efficiency. Furthermore, Artificial Intelligence (AI) is revolutionizing data analysis for anomaly detection and operational optimization, while autonomous vehicles are improving inspection and intervention capabilities, making subsea operations safer, more efficient, and more reliable.

Which regions are key contributors to the Subsea Flowlines Market?

Several regions are key contributors to the Subsea Flowlines Market. North America, particularly the U.S. Gulf of Mexico, remains a significant hub for deepwater activities. Latin America, led by Brazils pre-salt discoveries and emerging opportunities in Guyana, is a major growth driver. The Asia-Pacific region, with developing fields in Australia, Malaysia, and Indonesia, is also experiencing robust expansion. Europe, specifically the North Sea, continues to be active with life extension projects and new energy transition initiatives, while West Africa maintains importance due to its substantial deepwater reserves.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager