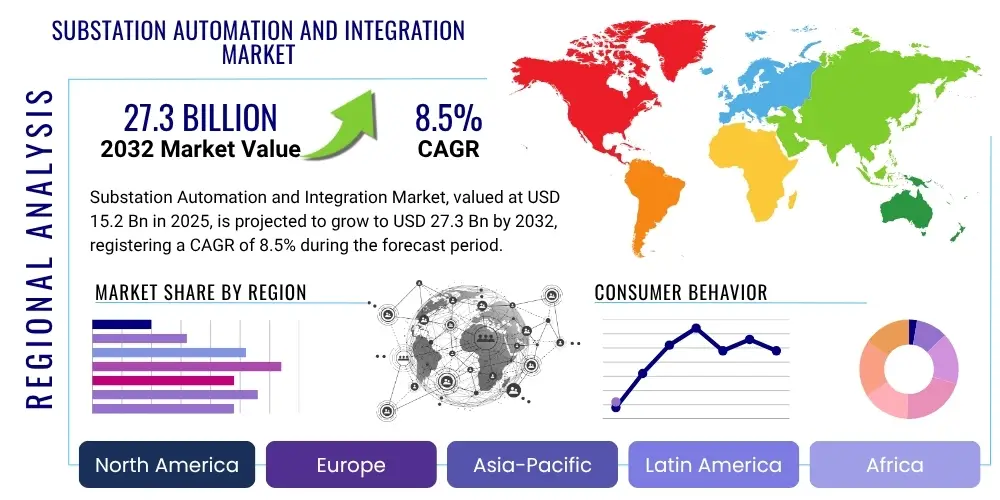

Substation Automation and Integration Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429410 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Substation Automation and Integration Market Size

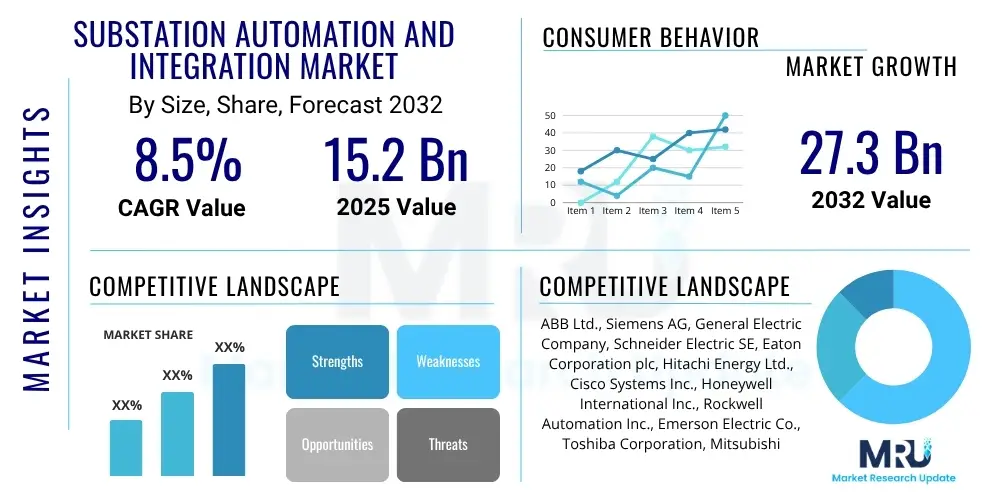

The Substation Automation and Integration Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at $15.2 Billion in 2025 and is projected to reach $27.3 Billion by the end of the forecast period in 2032.

Substation Automation and Integration Market introduction

The Substation Automation and Integration (SAI) market encompasses the technologies, systems, and services dedicated to monitoring, controlling, and protecting electrical substations with minimal human intervention. This advanced approach leverages intelligent electronic devices (IEDs), communication networks, and supervisory control and data acquisition (SCADA) systems to enhance grid reliability, efficiency, and security. The product description of SAI solutions typically includes remote terminal units, digital relays, communication processors, human-machine interface (HMI) software, and cyber security modules, all designed to work synergistically within a unified architecture.

Major applications of substation automation span across various segments of the power industry, including transmission substations, distribution substations, and industrial power systems. These applications are critical for managing power flow, isolating faults, and restoring services promptly, thereby minimizing outages and ensuring stable electricity supply. The primary benefits derived from the adoption of SAI include improved operational efficiency through automated processes, enhanced grid stability and resilience, reduced operational costs due to predictive maintenance and optimized resource allocation, and elevated safety standards for personnel by limiting direct exposure to high-voltage equipment. These advantages collectively drive the market’s expansion, positioning SAI as a cornerstone for modernizing global power infrastructure.

Key driving factors propelling the Substation Automation and Integration market forward include the increasing demand for smart grid solutions globally, fueled by the imperative to integrate renewable energy sources efficiently and manage distributed generation. The aging electrical infrastructure in many developed economies necessitates modernization efforts, with automation being a critical component of these upgrades. Furthermore, growing concerns over grid reliability and security, coupled with regulatory mandates promoting grid efficiency and automation, are compelling utilities and industries to invest in sophisticated substation automation systems. The continuous technological advancements in communication protocols, data analytics, and intelligent devices further amplify market growth by offering more robust and scalable solutions.

Substation Automation and Integration Market Executive Summary

The Substation Automation and Integration market is experiencing robust growth, driven by an accelerating global shift towards smart grid technologies and the urgent need to modernize aging power infrastructure. Business trends indicate a strong emphasis on digital transformation, with companies increasingly investing in advanced analytics, cloud-based solutions, and enhanced cybersecurity measures to protect critical infrastructure. Strategic partnerships and mergers among technology providers and utility companies are also becoming prevalent, aimed at offering comprehensive end-to-end solutions and expanding market reach. There is a clear focus on improving operational efficiency, reducing downtime, and ensuring grid stability through automation, which is reshaping business models across the power sector.

Regional trends reveal significant disparities and growth opportunities. Asia Pacific is emerging as a primary growth engine, propelled by rapid industrialization, urbanization, and substantial investments in new power generation and transmission projects, particularly in developing economies like China and India. North America and Europe, while mature markets, are witnessing sustained growth driven by grid modernization initiatives, the integration of distributed energy resources, and the replacement of legacy systems. Latin America and the Middle East and Africa regions are also showing promising potential, fueled by increasing electricity demand, infrastructure development projects, and a growing focus on improving energy access and reliability. Each region presents unique challenges and opportunities, influencing localized strategies for market penetration and product development.

Segment trends underscore the evolving landscape of substation automation. The hardware segment, including intelligent electronic devices (IEDs) and communication devices, remains foundational, but the software and services segments are experiencing faster growth, driven by the demand for sophisticated control systems, data analytics, and continuous support. Communication technologies are advancing rapidly, with a shift towards more robust, secure, and standardized protocols like IEC 61850 enabling seamless integration and interoperability. Furthermore, the increasing adoption of renewable energy sources is boosting the demand for automation solutions capable of managing variable power inputs and ensuring grid stability, making this a pivotal area for future innovation and investment within the market.

AI Impact Analysis on Substation Automation and Integration Market

Common user questions regarding AI's impact on the Substation Automation and Integration Market frequently revolve around how artificial intelligence can enhance grid reliability, optimize operational efficiency, and bolster cybersecurity. Users are keen to understand AI's capabilities in predictive maintenance, fault detection, and real-time decision-making, as well as its potential to manage complex renewable energy integration and distributed energy resources more effectively. Concerns often include the data requirements for effective AI deployment, the need for robust AI models, the costs associated with implementation, and the potential implications for the workforce. Expectations are high for AI to transform substation operations by enabling more autonomous and intelligent grid management, leading to significant improvements in performance and resilience.

- AI enhances predictive maintenance by analyzing sensor data to forecast equipment failures, minimizing unplanned downtime.

- Grid optimization is improved through AI algorithms that balance load, generation, and storage in real-time for maximum efficiency.

- Enhanced fault detection and isolation speed up restoration times by precisely pinpointing fault locations and automatically reconfiguring the grid.

- Advanced cybersecurity is achieved through AI-driven anomaly detection, identifying and mitigating cyber threats to substation infrastructure.

- AI facilitates the seamless integration of renewable energy by predicting generation patterns and optimizing their dispatch into the grid.

- Improved decision-making for grid operators is supported by AI insights into complex operational scenarios and potential risks.

- Automated incident response protocols are developed and executed faster with AI, reducing human error and reaction times.

- Energy management becomes more efficient through AI-driven load forecasting and demand-side management strategies.

- Operational costs are reduced through optimized resource allocation, fewer manual interventions, and extended asset life cycles.

- Workforce training and upskilling are necessitated as AI systems require specialized expertise for deployment, monitoring, and maintenance.

- Data processing and analysis capabilities are significantly accelerated, allowing for comprehensive insights from vast datasets.

DRO & Impact Forces Of Substation Automation and Integration Market

The Substation Automation and Integration market is significantly influenced by a dynamic interplay of drivers, restraints, opportunities, and various impact forces that shape its trajectory. Key drivers include the global push for smart grid implementation to enhance energy efficiency and reliability, the imperative to integrate a growing share of renewable energy sources into existing grids, and the modernization of aging power infrastructure across developed nations. Simultaneously, the expanding industrial sector and rapid urbanization in emerging economies are creating a substantial demand for robust and automated power delivery systems. These factors collectively propel investment in advanced automation technologies, enabling utilities to meet increasing energy demands while maintaining grid stability and operational excellence.

However, the market also faces considerable restraints that could impede its growth. High initial capital investment required for upgrading or installing new automation systems poses a significant barrier, particularly for smaller utilities or those in developing regions with limited financial resources. Cybersecurity concerns represent another critical restraint; as substations become more interconnected and automated, they become more vulnerable to cyberattacks, necessitating substantial investment in robust security measures. Furthermore, a shortage of skilled professionals capable of designing, implementing, and maintaining these complex systems, coupled with challenges related to the interoperability and standardization of various devices and protocols from different vendors, can slow down adoption rates and integration efforts.

Despite these challenges, numerous opportunities exist to foster market expansion. The continuous development of microgrids and distributed energy resources offers new avenues for localized automation and integration solutions. Advancements in artificial intelligence, machine learning, and the Internet of Things (IoT) are creating innovative possibilities for predictive analytics, remote monitoring, and autonomous operation, enhancing the intelligence and efficiency of substations. Moreover, proactive government initiatives and supportive regulatory frameworks promoting grid modernization and sustainable energy practices in developing economies present fertile ground for market penetration and growth. The increasing focus on energy resilience and sustainability further opens doors for advanced, integrated solutions.

Segmentation Analysis

The Substation Automation and Integration market is segmented across several critical dimensions, including components, type, communication technology, and industry vertical, each revealing distinct growth patterns and market dynamics. This comprehensive segmentation allows for a granular understanding of the market's structure, identifying key areas of demand and technological adoption. The component segmentation differentiates between the physical hardware, the intricate software systems, and the essential services required for effective automation. Meanwhile, the classification by substation type highlights the varying needs and complexities of transmission versus distribution substations, influencing the deployment of specific automation solutions. The communication technology segment underscores the vital role of data exchange, distinguishing between wired and wireless solutions, each with its own advantages and limitations in terms of reliability, speed, and deployment flexibility. Finally, the industry vertical segmentation clarifies the diverse end-user applications, ranging from large-scale utility operations to specialized industrial processes, each with unique operational requirements and automation priorities.

- By Component

- Hardware

- Intelligent Electronic Devices (IEDs)

- Relays

- Switches

- Circuit Breakers

- Sensors

- Transformers

- Capacitors

- Communication Devices

- Remote Terminal Units (RTUs)

- Merger Units

- Software

- SCADA Systems

- Human Machine Interface (HMI)

- Data Historian

- Analytics Software

- Cybersecurity Software

- Automation Software

- Communication Protocol Software

- Services

- Consulting

- Integration and Deployment

- Maintenance and Support

- Training

- Managed Services

- Hardware

- By Type

- Transmission Substations

- Distribution Substations

- By Communication Technology

- Wired Communication

- Fiber Optic

- Ethernet

- Serial Communication (RS-232, RS-485)

- Wireless Communication

- Radio Frequency (RF)

- Cellular (4G, 5G)

- Satellite

- Wi-Fi

- Wired Communication

- By Industry Vertical

- Utilities

- Electric Power Generation

- Transmission and Distribution

- Industrial

- Oil and Gas

- Mining

- Manufacturing

- Chemicals

- Pulp and Paper

- Commercial

- Transportation

- Others

- Utilities

Value Chain Analysis For Substation Automation and Integration Market

The value chain for the Substation Automation and Integration market is a complex ecosystem involving multiple stages, from foundational component manufacturing to the final deployment and ongoing maintenance of sophisticated systems. At the upstream end, the value chain begins with research and development, followed by the manufacturing of critical hardware components such as intelligent electronic devices (IEDs), sensors, relays, transformers, and communication modules. This stage also includes the development of specialized software platforms, including SCADA systems, human-machine interface (HMI) applications, and cybersecurity solutions, which form the brain of any automation system. Key players at this stage are technology developers, hardware manufacturers, and software vendors who provide the essential building blocks for substation automation. Their ability to innovate, ensure quality, and adhere to industry standards like IEC 61850 is crucial for the overall market's progression and efficiency.

Moving downstream, the value chain encompasses system integration, engineering, procurement, and construction (EPC) services, which are vital for bringing disparate components and software together into a cohesive, functional substation automation system. System integrators play a pivotal role, customizing solutions to meet specific utility or industrial requirements, ensuring seamless interoperability, and managing complex project deployments. This stage also involves extensive testing, commissioning, and validation of the integrated systems to guarantee performance and reliability. Distribution channels for these solutions are typically multi-faceted, involving both direct sales from major manufacturers to large utilities and indirect channels through a network of specialized system integrators, value-added resellers (VARs), and channel partners who often provide localized support and expertise. The choice of distribution channel often depends on the project's scale, complexity, and regional market characteristics, with larger, more complex projects often favoring direct engagement, while smaller or specialized deployments might leverage indirect partners.

Substation Automation and Integration Market Potential Customers

The primary end-users and buyers of Substation Automation and Integration (SAI) solutions are predominantly entities involved in the generation, transmission, and distribution of electricity. Electric utilities, encompassing national power grids, independent system operators (ISOs), and municipal utilities, represent the largest customer segment. These organizations are continuously seeking to enhance grid reliability, improve operational efficiency, minimize power outages, and integrate renewable energy sources, making SAI solutions indispensable for their infrastructure modernization efforts. Their investment decisions are often driven by regulatory compliance, energy security mandates, and the need to manage aging infrastructure, which collectively creates a sustained demand for advanced automation capabilities. The vast scale of their operations and the critical nature of their services underscore their significance as key customers in this market.

Beyond traditional utilities, the industrial sector constitutes another significant customer base for substation automation. Heavy industries such as oil and gas, mining, manufacturing, and chemicals operate extensive private power networks and require robust substation automation systems to ensure uninterrupted power supply for their continuous and often power-intensive operations. For these industrial entities, substation automation is crucial for protecting valuable assets, optimizing energy consumption, and maintaining safety within their facilities. The specific needs of industrial customers often involve customized solutions that can withstand harsh operating environments and integrate with their existing industrial control systems. Additionally, large commercial campuses, data centers, and renewable energy developers also represent growing segments of potential customers, as they too require efficient and reliable power management to support their operations and contribute to grid stability, further diversifying the market's end-user landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $15.2 Billion |

| Market Forecast in 2032 | $27.3 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, General Electric Company, Schneider Electric SE, Eaton Corporation plc, Hitachi Energy Ltd., Cisco Systems Inc., Honeywell International Inc., Rockwell Automation Inc., Emerson Electric Co., Toshiba Corporation, Mitsubishi Electric Corporation, Alstom SA, S&C Electric Company, NovaTech LLC, Nari Group Corporation, Oracle Corporation, Schweitzer Engineering Laboratories Inc. (SEL), Landis Gyr AG, Power Grid Corporation of India Limited (PGCIL) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Substation Automation and Integration Market Key Technology Landscape

The Substation Automation and Integration market is underpinned by a sophisticated array of technologies that enable intelligent and efficient operation of electrical grids. Supervisory Control and Data Acquisition (SCADA) systems form the backbone, providing real-time data acquisition, monitoring, and control capabilities across the substation infrastructure. Complementing SCADA are Intelligent Electronic Devices (IEDs), which include protective relays, meters, and various controllers that process local information and execute control commands. The adoption of the IEC 61850 communication standard has been a pivotal technological development, facilitating seamless interoperability between different vendors' equipment and enabling a standardized, object-oriented approach to substation communication and data modeling. This standard greatly enhances the flexibility and scalability of automation systems, simplifying integration and reducing commissioning times.

Further enhancing the technological landscape is the increasing integration of the Internet of Things (IoT), which connects a multitude of sensors and devices within the substation, generating vast amounts of operational data. This data, when combined with advanced analytics and cloud computing platforms, enables predictive maintenance, anomaly detection, and optimized asset management, moving away from reactive maintenance towards a more proactive approach. Cybersecurity technologies are paramount, including intrusion detection systems, firewalls, and encryption protocols, designed to protect critical substation assets from cyber threats and ensure the integrity and confidentiality of operational data. The advent of advanced metering infrastructure (AMI) further integrates data from the edge of the grid, providing a more holistic view of power consumption and distribution, which is crucial for demand-side management and load balancing. These interwoven technologies collectively contribute to a smarter, more resilient, and efficient power grid, forming the foundation of modern substation automation.

Regional Highlights

- North America: This region is characterized by extensive grid modernization initiatives, driven by the need to upgrade aging infrastructure and integrate renewable energy sources. Countries like the United States and Canada are investing heavily in advanced substation automation to enhance reliability, reduce transmission losses, and improve cybersecurity. Regulatory support and a mature technological landscape further accelerate adoption.

- Europe: European countries are at the forefront of smart grid development and renewable energy integration, propelling the demand for substation automation. Strict environmental regulations and targets for carbon emission reduction are fostering investments in efficient and automated power management systems, particularly in Germany, the UK, and Scandinavian countries.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to rapid industrialization, urbanization, and significant investments in new power generation and transmission infrastructure, especially in China, India, Japan, and Southeast Asian nations. The region's expanding energy demand and focus on modernizing its power grids drive the adoption of substation automation technologies.

- Latin America: This region is experiencing steady growth in substation automation, primarily driven by the need to improve energy access, reduce power outages, and upgrade existing, often outdated, electrical grids. Investments in renewable energy projects and rural electrification also contribute to market expansion in countries like Brazil and Mexico.

- Middle East and Africa (MEA): The MEA region is witnessing increasing investments in power infrastructure, particularly within the oil and gas sector and rapidly urbanizing areas. Countries in the Gulf Cooperation Council (GCC) are focusing on diversifying their energy sources and enhancing grid reliability, thereby driving the adoption of advanced substation automation solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Substation Automation and Integration Market.- ABB Ltd.

- Siemens AG

- General Electric Company

- Schneider Electric SE

- Eaton Corporation plc

- Hitachi Energy Ltd.

- Cisco Systems Inc.

- Honeywell International Inc.

- Rockwell Automation Inc.

- Emerson Electric Co.

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Alstom SA

- S&C Electric Company

- NovaTech LLC

- Nari Group Corporation

- Oracle Corporation

- Schweitzer Engineering Laboratories Inc. (SEL)

- Landis Gyr AG

- Power Grid Corporation of India Limited (PGCIL)

Frequently Asked Questions

What is Substation Automation and Integration (SAI)?

Substation Automation and Integration (SAI) refers to the comprehensive system of technologies, hardware, and software used to monitor, control, and protect electrical substations autonomously. It integrates intelligent electronic devices (IEDs), communication networks, and supervisory control and data acquisition (SCADA) systems to enhance grid efficiency, reliability, and security with minimal human intervention.

Why is Substation Automation and Integration important for the power grid?

SAI is crucial for modern power grids as it improves operational efficiency by automating processes, enhances grid stability and resilience by quickly detecting and isolating faults, reduces operational costs through predictive maintenance, and facilitates the seamless integration of renewable energy sources. It is essential for modernizing aging infrastructure and meeting increasing energy demands.

What are the key drivers for the growth of the SAI market?

The primary drivers include the global push for smart grid implementation, the imperative to integrate renewable energy into existing grids, the modernization of aging electrical infrastructure, and increasing demand from industrialization and urbanization. Regulatory mandates and advancements in automation technologies also significantly contribute to market growth.

What are the main challenges facing the Substation Automation and Integration market?

Key challenges include the high initial capital investment required for deployment, significant cybersecurity risks associated with interconnected systems, a shortage of skilled professionals for installation and maintenance, and issues concerning the interoperability and standardization of diverse vendor equipment and protocols.

How does AI impact Substation Automation and Integration?

AI significantly impacts SAI by enabling advanced predictive maintenance, optimizing grid operations in real-time, enhancing fault detection and isolation, and strengthening cybersecurity through anomaly detection. AI also facilitates the efficient integration of renewable energy and improves decision-making for grid operators, leading to more autonomous and intelligent grid management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Substation Automation and Integration Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Substation Automation And Integration Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Intelligent Electronic Devices, Communication Networks, SCADA Systems), By Application (Power Industry, Industrial, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager