Syringes and Injectable Drugs Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428066 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Syringes and Injectable Drugs Packaging Market Size

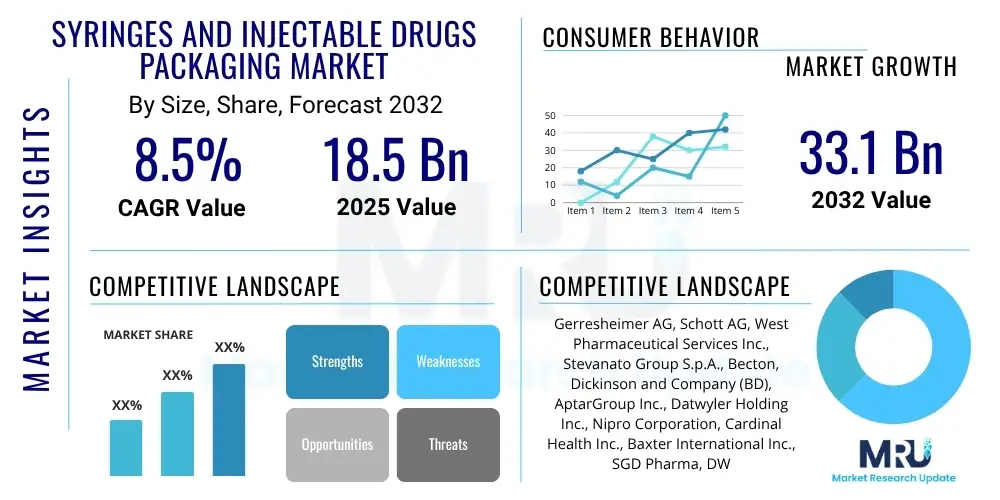

The Syringes and Injectable Drugs Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 18.5 Billion in 2025 and is projected to reach USD 33.1 Billion by the end of the forecast period in 2032.

Syringes and Injectable Drugs Packaging Market introduction

The Syringes and Injectable Drugs Packaging Market encompasses a diverse range of primary packaging solutions vital for the safe and effective delivery of parenteral medications. This sector is undergoing significant evolution, driven by the increasing global demand for biologics, vaccines, and advanced drug delivery systems, alongside a growing emphasis on patient safety and convenience. The packaging solutions primarily include prefilled syringes, vials, ampoules, and cartridges, manufactured from materials such as glass (Type I borosilicate) and various plastics (COC, COP, PP), each selected for its inertness, barrier properties, and compatibility with sensitive drug formulations. The primary function of these packaging systems is to maintain the sterility, stability, and efficacy of injectable drugs from manufacturing through administration, preventing contamination and ensuring accurate dosing.

Major applications for syringes and injectable drugs packaging span across critical therapeutic areas, including chronic disease management (diabetes, autoimmune disorders), oncology, infectious diseases (vaccines), cardiovascular conditions, and emergency medicine. The inherent benefits of specialized packaging, such as enhanced drug stability, reduced risk of medication errors, improved patient adherence through user-friendly designs (e.g., prefilled syringes for self-administration), and extended product shelf life, contribute significantly to their market growth. Furthermore, the stringent regulatory landscape governing pharmaceutical products necessitates robust packaging solutions that meet global standards for quality, integrity, and safety. These factors collectively act as powerful driving forces propelling innovation and expansion within the market, as pharmaceutical companies continuously seek advanced packaging that offers superior protection, patient convenience, and cost-effectiveness for their sophisticated drug portfolios.

Syringes and Injectable Drugs Packaging Market Executive Summary

The Syringes and Injectable Drugs Packaging Market is characterized by robust growth, primarily fueled by an aging global population, the rising prevalence of chronic diseases, and advancements in biotechnology leading to more injectable therapies. Business trends indicate a strong focus on strategic collaborations, mergers, and acquisitions among packaging manufacturers and pharmaceutical companies, aiming to enhance technological capabilities, broaden product portfolios, and secure supply chains. There is a discernible shift towards sustainable packaging materials and processes, driven by environmental concerns and corporate social responsibility initiatives, alongside an increasing adoption of smart packaging solutions that integrate features like anti-counterfeiting, temperature monitoring, and dosage tracking. Furthermore, the market is witnessing a surge in contract manufacturing organizations (CMOs) offering specialized packaging services, particularly for complex biologics and personalized medicines, allowing pharmaceutical companies to streamline their operations and leverage specialized expertise.

Regionally, North America and Europe continue to hold significant market shares due to established pharmaceutical industries, advanced healthcare infrastructures, and stringent regulatory frameworks that promote high-quality packaging standards. However, the Asia Pacific region is emerging as the fastest-growing market, driven by increasing healthcare expenditure, a large patient pool, expanding generic drug manufacturing capabilities, and improving access to modern medical treatments. Emerging economies in Latin America and the Middle East & Africa also present substantial growth opportunities as their healthcare systems develop and populations gain access to more advanced injectable therapies. Within market segments, prefilled syringes are experiencing the most rapid growth, attributed to their convenience, reduced risk of contamination, and suitability for self-administration, particularly for chronic conditions. Glass remains a predominant material due to its inertness, but plastic-based alternatives, especially Cyclic Olefin Copolymers (COCs) and Cyclic Olefin Polymers (COPs), are gaining traction for their lighter weight, shatter resistance, and design flexibility, offering an attractive alternative for specific drug formulations and delivery devices.

AI Impact Analysis on Syringes and Injectable Drugs Packaging Market

The integration of Artificial Intelligence (AI) across the pharmaceutical value chain, including the Syringes and Injectable Drugs Packaging Market, is poised to revolutionize operational efficiencies, quality control, and strategic decision-making. Users frequently question how AI can enhance the precision and speed of packaging line operations, minimize human error, and ensure compliance with ever-evolving regulatory standards. Concerns often revolve around the initial investment required for AI implementation, data security, and the need for a skilled workforce to manage and interpret AI-driven insights. However, there is also widespread anticipation regarding AI's potential to dramatically improve defect detection in manufacturing, optimize supply chain logistics for temperature-sensitive drugs, and even contribute to the development of novel, patient-centric packaging designs. The key themes highlight a desire for AI to not only automate but also intelligently augment processes, leading to superior product quality, reduced waste, and faster time-to-market for critical injectable therapies.

- Enhanced Quality Control: AI-powered vision systems detect microscopic defects in syringes and vials with unprecedented accuracy, minimizing product recalls.

- Predictive Maintenance: AI algorithms analyze machine performance data to predict equipment failures, reducing downtime and optimizing production schedules.

- Supply Chain Optimization: AI improves inventory management, demand forecasting, and logistics for temperature-sensitive injectable packaging, ensuring timely delivery and reducing spoilage.

- Accelerated Material R&D: AI assists in simulating and testing new packaging materials and designs, shortening development cycles and identifying optimal solutions faster.

- Process Automation & Efficiency: AI-driven robotics and automation streamline packaging assembly, filling, and inspection processes, increasing throughput and consistency.

- Personalized Packaging Solutions: AI could enable customization of packaging features based on patient needs or specific drug characteristics, supporting personalized medicine initiatives.

- Regulatory Compliance & Documentation: AI can help manage and analyze vast amounts of data for regulatory submissions, ensuring compliance and faster approvals.

- Anti-Counterfeiting Measures: AI-enabled track-and-trace systems and authentication technologies bolster efforts against counterfeit injectable drugs, enhancing patient safety.

DRO & Impact Forces Of Syringes and Injectable Drugs Packaging Market

The Syringes and Injectable Drugs Packaging Market is shaped by a dynamic interplay of drivers, restraints, and opportunities, alongside significant impact forces that influence its strategic direction and competitive landscape. A primary driver is the escalating global prevalence of chronic diseases such as diabetes, cardiovascular conditions, and autoimmune disorders, which necessitates long-term medication regimens often administered via injection. This is further compounded by the rapidly expanding biologics market, encompassing vaccines, monoclonal antibodies, and gene therapies, which predominantly require sterile, precise, and often cold-chain-compatible injectable packaging. Technological advancements in drug delivery, including the development of auto-injectors, pen injectors, and wearable drug delivery devices, are creating demand for compatible and user-friendly primary packaging, while the growing geriatric population, with its increased healthcare needs, continues to fuel demand. The desire for self-administration of drugs, driven by patient convenience and healthcare cost containment, particularly in home care settings, also acts as a powerful catalyst for innovation in prefilled syringe and cartridge formats. These forces collectively underscore a sustained and increasing need for sophisticated and reliable packaging solutions.

However, the market faces several significant restraints that could impede its growth trajectory. The high initial investment costs associated with developing and implementing advanced packaging solutions, particularly those involving specialized materials and integrated safety features, can be prohibitive for some manufacturers. The complex and continuously evolving global regulatory landscape for pharmaceutical packaging, demanding rigorous testing and documentation, adds to the cost and time involved in bringing new products to market. Furthermore, volatility in the prices of key raw materials, such as Type I borosilicate glass and pharmaceutical-grade plastics, can impact production costs and profit margins. Environmental concerns surrounding the disposal of single-use plastic packaging are also pushing for more sustainable alternatives, presenting both a challenge and an opportunity for innovation. Despite these hurdles, substantial opportunities exist, particularly in emerging markets where healthcare infrastructure is rapidly expanding and access to modern medicines is improving. The ongoing development of smart packaging technologies, integrating features like RFID, NFC, and temperature sensors, offers pathways for enhanced drug traceability and patient adherence. The shift towards personalized medicine and the growth of home healthcare are creating niches for highly customized and convenient packaging solutions, while the exploration of novel biodegradable and recyclable materials presents a long-term sustainability advantage. The market is also heavily influenced by competitive rivalry among a diverse set of global and regional players, the bargaining power of major pharmaceutical buyers who dictate specifications and volumes, and the bargaining power of specialized raw material suppliers. The threat of new entrants remains moderate due to high capital requirements and regulatory barriers, while the threat of substitutes is relatively low given the critical nature of injectable drug delivery and the lack of viable alternatives for many therapies.

Segmentation Analysis

The Syringes and Injectable Drugs Packaging Market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation helps in identifying specific growth drivers, competitive landscapes, and emerging trends within various product types, materials, applications, and end-user categories. The market's complexity reflects the varied requirements of injectable drug formulations, patient populations, and regulatory environments, necessitating tailored packaging solutions that prioritize sterility, stability, and ease of use. Understanding these segments is crucial for strategic planning, product development, and market entry strategies for both packaging manufacturers and pharmaceutical companies.

- By Type

- Prefilled Syringes (Glass, Plastic)

- Vials (Glass, Plastic)

- Ampoules (Glass)

- Cartridges (Glass, Plastic)

- Bottles

- Other Injectable Packaging (e.g., Bags, Pouches)

- By Material

- Glass (Type I Borosilicate)

- Plastic

- Cyclic Olefin Copolymers (COC)

- Cyclic Olefin Polymers (COP)

- Polypropylene (PP)

- Polyethylene (PE)

- Polycarbonate (PC)

- Polyvinyl Chloride (PVC)

- Elastomers (Rubber Stoppers, Plunger Tips)

- By Application

- Vaccines

- Insulin

- Monoclonal Antibodies (mAbs)

- Other Biologics

- Oncology

- Anesthetics

- Anticoagulants

- Cardiology

- Pain Management

- Other Therapeutic Areas

- By End-User

- Pharmaceutical & Biotechnology Companies

- Contract Manufacturing Organizations (CMOs)

- Hospitals & Clinics

- Diagnostic Laboratories

- Research & Academic Institutes

- Homecare Settings

Value Chain Analysis For Syringes and Injectable Drugs Packaging Market

The value chain for the Syringes and Injectable Drugs Packaging Market is a multi-layered ecosystem, commencing with the procurement of specialized raw materials and extending all the way to the end-user administration of packaged injectable drugs. At the upstream end, key participants include manufacturers of high-quality glass (primarily Type I borosilicate glass for its chemical inertness and barrier properties), specialized plastic resin producers (supplying COC, COP, PP for their shatter resistance and low extractables), and elastomer suppliers for stoppers, plungers, and caps. These raw material providers must adhere to stringent pharmaceutical-grade specifications, ensuring purity, consistency, and compliance with global regulatory standards, as even minor imperfections can compromise drug stability and patient safety. The packaging component manufacturers then process these raw materials into primary packaging items such as prefilled syringes, vials, ampoules, and cartridges, often integrating advanced features like barrier coatings, integrated safety mechanisms, and precise dimensions.

Moving downstream, these primary packaging components are supplied to pharmaceutical and biotechnology companies, as well as Contract Manufacturing Organizations (CMOs). These entities are responsible for the sterile filling, finishing, and secondary packaging of the injectable drugs. Their operations involve highly automated aseptic filling lines, stringent quality control checks, and adherence to Good Manufacturing Practices (GMP). The distribution channel typically involves a mix of direct and indirect approaches. Large pharmaceutical companies often engage in direct procurement and distribution for their high-volume products, maintaining tight control over the supply chain. Indirect channels involve specialized pharmaceutical distributors and wholesalers who manage the logistics, storage, and delivery of packaged injectables to hospitals, clinics, pharmacies, and increasingly, directly to patients for homecare. This intricate network ensures that temperature-sensitive and high-value medications reach their destination intact and efficacious. The efficiency and integrity of this value chain are paramount, as any disruption or compromise can have severe implications for patient health and drug marketability, emphasizing the critical role of each stakeholder from raw material sourcing to final drug administration.

Syringes and Injectable Drugs Packaging Market Potential Customers

The potential customers for the Syringes and Injectable Drugs Packaging Market are diverse, primarily comprising entities within the pharmaceutical, biotechnology, and healthcare sectors that require specialized, sterile, and compliant packaging for their injectable drug products. Pharmaceutical and biotechnology companies represent the largest segment of end-users, as they develop, manufacture, and market a vast array of injectable medications, including biologics, vaccines, and small molecule drugs. These companies demand packaging solutions that ensure drug stability, extend shelf life, provide ease of administration, and meet stringent regulatory requirements across different global markets. Their purchasing decisions are often influenced by packaging material compatibility with their drug formulations, manufacturing scalability, and the inclusion of patient-centric features such as safety mechanisms and user-friendly designs for self-administration.

Another significant customer base includes Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs). These organizations provide outsourced manufacturing, filling, and packaging services to pharmaceutical and biotech companies, especially for complex or niche injectable products, or during periods of high demand. CMOs require a wide range of packaging options to cater to their diverse client needs, often seeking flexible, efficient, and technologically advanced packaging solutions. Furthermore, hospitals, clinics, and other healthcare providers are indirect but crucial customers, as their demand for safe, easy-to-use, and error-reducing injectable drug presentations heavily influences the choices made by pharmaceutical manufacturers. Diagnostic laboratories and research institutions also utilize injectable packaging for various reagents and experimental compounds, albeit often in smaller volumes. The growth of home healthcare and personalized medicine further expands the customer base to include patients and caregivers who increasingly administer injectable therapies themselves, driving demand for prefilled, safe, and convenient packaging formats.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 18.5 Billion |

| Market Forecast in 2032 | USD 33.1 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gerresheimer AG, Schott AG, West Pharmaceutical Services Inc., Stevanato Group S.p.A., Becton, Dickinson and Company (BD), AptarGroup Inc., Datwyler Holding Inc., Nipro Corporation, Cardinal Health Inc., Baxter International Inc., SGD Pharma, DWK Life Sciences, Comar Inc., Vetter Pharma International GmbH, Shandong Medicinal Glass Co. Ltd., B. Braun Melsungen AG, RPC Group Plc, Ypsomed Holding AG, Credence MedSystems Inc., Catalent Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Syringes and Injectable Drugs Packaging Market Key Technology Landscape

The Syringes and Injectable Drugs Packaging Market is characterized by a rapidly evolving technological landscape, driven by the need for enhanced drug stability, patient safety, and convenience, alongside manufacturing efficiency and regulatory compliance. One of the most critical technological advancements is in aseptic filling and finishing lines, which employ highly sophisticated robotics and isolation technologies (e.g., Restricted Access Barrier Systems – RABS, or isolators) to prevent microbial contamination during the filling of sterile injectable drugs. This precision engineering ensures that drug products remain uncontaminated, a paramount concern for parenteral medications. Another significant area is the development of advanced barrier technologies, which include specialized polymer coatings (such as those based on silicon dioxide or parylene) applied to glass or plastic containers to improve drug stability by reducing oxygen ingress or preventing drug-container interactions. These coatings are vital for sensitive biologics and vaccines that require maximum protection against degradation.

Furthermore, the market is seeing extensive innovation in smart packaging solutions, incorporating technologies like RFID (Radio-Frequency Identification), NFC (Near Field Communication) tags, and embedded temperature sensors. These smart features enable real-time tracking of individual drug packages throughout the supply chain, facilitate anti-counterfeiting efforts, and monitor critical environmental conditions, especially important for cold-chain logistics. The advent of advanced materials, particularly cyclic olefin copolymers (COCs) and cyclic olefin polymers (COPs), offers alternatives to traditional glass, providing advantages such as shatter resistance, reduced extractables, and greater design flexibility for complex drug delivery devices like auto-injectors and pen injectors. Concurrently, the integration of passive and active safety features directly into syringe and vial designs, such as needle shields, retractable needles, and tamper-evident seals, is a major technological focus. These features are designed to prevent accidental needle sticks, deter misuse, and ensure product integrity, significantly improving patient and healthcare worker safety. The continuous pursuit of such technological advancements is fundamental to meeting the evolving demands of modern medicine and addressing the complexities of injectable drug delivery.

Regional Highlights

- North America: This region holds a dominant share in the market, driven by a well-established pharmaceutical and biotechnology industry, high healthcare expenditure, significant R&D investments, and a strong regulatory framework. The presence of leading drug manufacturers and a growing demand for advanced drug delivery systems, especially prefilled syringes for chronic disease management, contributes to its leadership.

- Europe: Europe represents another major market, characterized by stringent regulatory standards, an aging population, and a strong focus on innovation in pharmaceutical packaging. Countries like Germany, France, and the UK are at the forefront of adopting advanced packaging technologies and manufacturing high-quality injectable drug containers, fueled by a robust biotech sector and increasing demand for personalized medicine.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to increasing healthcare investments, a large and expanding patient pool, improving healthcare infrastructure, and the booming generic and biosimilar drug manufacturing industry. Countries such as China, India, and Japan are experiencing rapid growth driven by rising disposable incomes, greater access to healthcare, and the expansion of domestic pharmaceutical production capabilities.

- Latin America: This region presents significant growth opportunities, with improving economic conditions, expanding healthcare access, and increasing government initiatives to modernize healthcare facilities. Brazil and Mexico are key markets, witnessing rising demand for advanced injectable therapies and packaging solutions, albeit with challenges related to infrastructure and regulatory harmonization.

- Middle East and Africa (MEA): The MEA region is an emerging market, driven by increasing healthcare expenditure, a growing burden of non-communicable diseases, and strategic investments in pharmaceutical manufacturing capacities, particularly in countries like Saudi Arabia and UAE. However, market development is often challenged by political instability and varying levels of healthcare infrastructure across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Syringes and Injectable Drugs Packaging Market.- Gerresheimer AG

- Schott AG

- West Pharmaceutical Services Inc.

- Stevanato Group S.p.A.

- Becton, Dickinson and Company (BD)

- AptarGroup Inc.

- Datwyler Holding Inc.

- Nipro Corporation

- Cardinal Health Inc.

- Baxter International Inc.

- SGD Pharma

- DWK Life Sciences

- Comar Inc.

- Vetter Pharma International GmbH

- Shandong Medicinal Glass Co. Ltd.

- B. Braun Melsungen AG

- RPC Group Plc

- Ypsomed Holding AG

- Credence MedSystems Inc.

- Catalent Inc.

Frequently Asked Questions

Analyze common user questions about the Syringes and Injectable Drugs Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Syringes and Injectable Drugs Packaging Market?

The market's growth is primarily driven by the rising global prevalence of chronic diseases, increasing demand for biologics and vaccines, an aging population requiring more injectable therapies, and growing patient preference for convenient self-administration solutions like prefilled syringes.

Which packaging material is predominantly used in the injectable drugs market?

Type I borosilicate glass is predominantly used due to its excellent chemical inertness, barrier properties, and optical clarity. However, advanced plastics like Cyclic Olefin Copolymers (COC) and Cyclic Olefin Polymers (COP) are gaining significant traction for their shatter resistance and design flexibility.

What role do prefilled syringes play in the current market landscape?

Prefilled syringes are a rapidly growing segment, offering significant advantages in terms of patient safety (reduced medication errors), convenience (ready-to-use), and extended drug stability. They are increasingly preferred for vaccines, biologics, and self-administered therapies for chronic conditions.

What are the key challenges faced by manufacturers in this market?

Manufacturers face challenges such as stringent regulatory requirements, high capital investment for advanced aseptic manufacturing, raw material price volatility, and the need to develop sustainable packaging solutions amidst growing environmental concerns.

How is technological innovation impacting the future of injectable drug packaging?

Technological innovation is leading to advanced barrier coatings for enhanced drug stability, integrated safety features to prevent needle-stick injuries, and smart packaging solutions for improved traceability and patient adherence. AI and automation are also transforming manufacturing efficiency and quality control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager