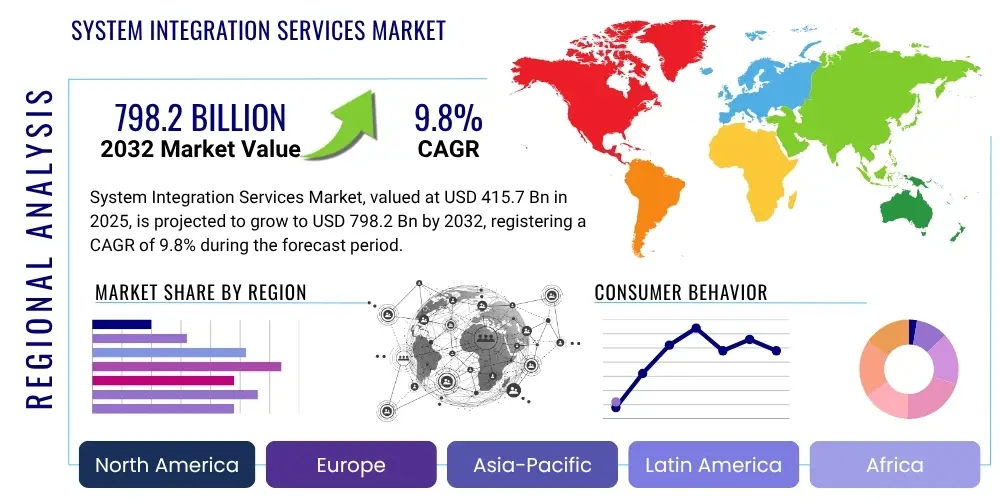

System Integration Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430086 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

System Integration Services Market Size

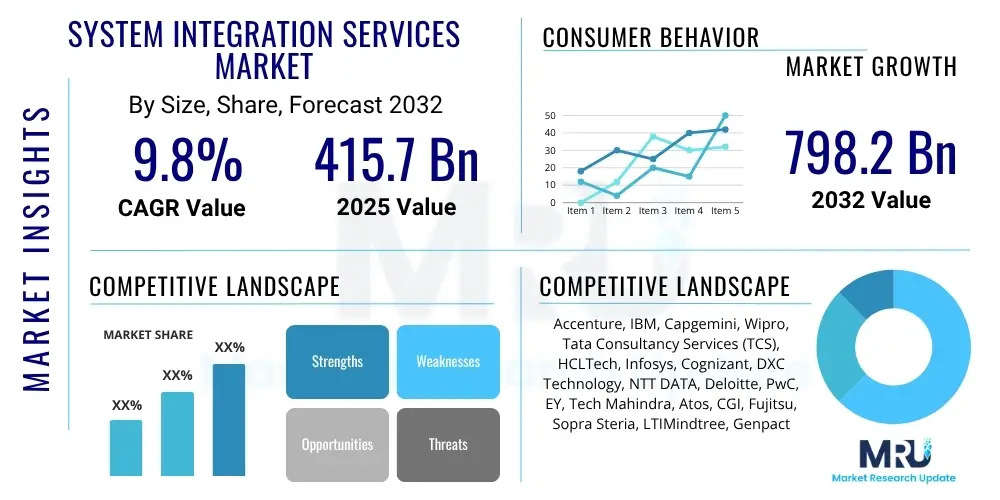

The System Integration Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2025 and 2032. The market is estimated at $415.7 billion in 2025 and is projected to reach $798.2 billion by the end of the forecast period in 2032.

System Integration Services Market introduction

The System Integration Services market encompasses a broad range of solutions and expertise aimed at connecting disparate IT systems, applications, data sources, and business processes to create a unified, coherent, and optimized operational environment. These services are crucial for modern enterprises striving for digital transformation, enhanced operational efficiency, and a holistic view of their business functions. System integration addresses the complexities arising from diverse technologies and platforms, ensuring seamless communication and data flow across an organization's IT landscape.

The core product description involves designing, implementing, and maintaining integrated systems that can include enterprise resource planning (ERP) systems, customer relationship management (CRM) software, cloud platforms, legacy systems, and emerging technologies like IoT and AI. Major applications span across virtually every industry, from banking and financial services to healthcare, telecommunications, manufacturing, and government. These services are pivotal for organizations looking to modernize their infrastructure, improve data accuracy, streamline workflows, and reduce operational silos that often hinder productivity and innovation.

The benefits derived from effective system integration are substantial, including improved data consistency, enhanced business process automation, reduced manual effort, faster decision-making through unified data insights, and ultimately, a more agile and competitive business. Key driving factors propelling this market include the accelerating pace of digital transformation initiatives globally, the widespread adoption of cloud computing, the proliferation of Internet of Things (IoT) devices generating vast amounts of data, and the increasing need for robust cybersecurity measures to protect integrated environments. Furthermore, the drive for operational excellence and cost optimization continues to fuel demand for sophisticated integration solutions.

System Integration Services Market Executive Summary

The System Integration Services market is experiencing robust growth, driven by an imperative for digital transformation and technological modernization across industries. Current business trends indicate a strong shift towards cloud-native integration, microservices architectures, and the adoption of hybrid integration platforms (HIPs) that combine on-premise and cloud capabilities. Enterprises are increasingly seeking comprehensive solutions that not only connect systems but also enable advanced analytics, hyperautomation, and AI-driven insights to optimize their business processes and customer experiences. The focus is on creating resilient, scalable, and secure IT ecosystems that can adapt quickly to market changes and innovation.

Regional trends highlight North America and Europe as mature markets with high adoption rates, primarily driven by legacy system modernization and the early embrace of cloud and digital initiatives. The Asia Pacific (APAC) region, however, is emerging as a significant growth engine, fueled by rapid industrialization, increasing digital penetration, and substantial investments in IT infrastructure from countries like China, India, and Japan. Latin America, the Middle East, and Africa are also demonstrating considerable potential, propelled by growing digital economies, smart city initiatives, and the need for scalable IT solutions to support expanding business operations.

Segmentation trends reveal a strong demand for application integration, cloud integration, and data integration services, reflecting the complex interplay between diverse software landscapes and data sources. Furthermore, advisory and consulting services within system integration are gaining traction as organizations require expert guidance to navigate complex integration challenges and strategize their digital roadmaps. Enterprises of all sizes, from small and medium-sized businesses (SMEs) seeking agile, cost-effective integration solutions to large enterprises undertaking massive IT overhauls, contribute to the diverse demand spectrum within the System Integration Services market, underscoring its foundational role in the modern digital economy.

AI Impact Analysis on System Integration Services Market

User inquiries about AI's influence on System Integration Services primarily revolve around the automation capabilities of AI, its potential to simplify complex integration tasks, and the implications for job roles. Many users are keen to understand how AI can streamline data mapping, reduce manual coding, predict integration issues before they arise, and enhance the overall efficiency of integration projects. There are also significant questions regarding the ethical considerations of AI in handling sensitive integrated data, the cybersecurity risks associated with AI-driven integration tools, and the necessary skill sets required for professionals in this evolving landscape. Expectations are high for AI to deliver greater precision, speed, and cost-effectiveness in system integration, transforming it from a labor-intensive process into a more intelligent, autonomous function.

- AI-driven automation of data mapping and transformation, reducing manual effort.

- Predictive analytics for identifying potential integration failures and bottlenecks before they occur.

- Enhanced API management and orchestration through intelligent automation.

- Optimization of integration workflows and routing based on real-time data analysis.

- Intelligent error detection and resolution within complex integrated systems.

- Facilitation of hyperautomation by connecting disparate automation technologies.

- Personalized integration solutions tailored to specific business needs using machine learning.

DRO & Impact Forces Of System Integration Services Market

The System Integration Services market is significantly influenced by a confluence of driving factors, restraints, and opportunities, all shaped by various impact forces. The primary drivers include the global imperative for digital transformation, pushing organizations to modernize their IT infrastructure and embrace cloud-first strategies. The exponential growth of data generated by IoT devices, along with the need for advanced analytics, necessitates robust data integration solutions. Furthermore, the increasing complexity of cybersecurity threats underscores the demand for secure and seamlessly integrated systems, making comprehensive system integration a strategic priority for businesses seeking competitive advantage and operational resilience in a rapidly evolving technological landscape.

However, the market also faces notable restraints. The inherent complexity of integrating diverse legacy systems with modern cloud-native applications poses significant challenges, often leading to prolonged project timelines and cost overruns. A persistent shortage of skilled professionals capable of navigating these intricate integration landscapes further exacerbates these issues, making it difficult for organizations to find the right talent. High initial investment costs for comprehensive integration projects can also deter smaller enterprises or those with limited IT budgets, slowing down adoption rates despite the long-term benefits.

Despite these challenges, substantial opportunities exist, particularly with the advent of AI and Machine Learning (ML) in integration platforms, enabling smarter, more automated, and predictive integration solutions. The expansion of hybrid cloud strategies and the growth of Integration Platform as a Service (iPaaS) offerings provide flexible and scalable integration options. The ongoing adoption of Industry 4.0 initiatives across manufacturing and other sectors, coupled with the rising trend of hyperautomation, creates new avenues for system integrators to deliver value. Impact forces such as rapid technological advancements, evolving regulatory landscapes, and global economic shifts continuously shape the demand and supply dynamics of the System Integration Services market, compelling providers to innovate and adapt their offerings.

Segmentation Analysis

The System Integration Services market is broadly segmented to provide a comprehensive understanding of its diverse offerings and target audiences. These segmentations allow for detailed analysis of market dynamics, specific demand patterns, and tailored strategic approaches for providers. The market can be categorized by the type of service offered, the deployment model adopted, the end-user industry served, and the size of the organization seeking integration solutions. This granular view helps identify key growth areas and niche opportunities within the broader integration landscape.

- Service Type:

- Application Integration

- Data Integration

- Cloud Integration

- Enterprise Application Integration (EAI)

- Consulting Services

- Infrastructure Integration

- Business Process Integration

- Deployment:

- On-Premise

- Cloud

- Hybrid

- End-User:

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare & Life Sciences

- IT & Telecommunications

- Retail & E-commerce

- Manufacturing

- Government & Public Sector

- Energy & Utilities

- Media & Entertainment

- Organization Size:

- Small & Medium-sized Enterprises (SMEs)

- Large Enterprises

Value Chain Analysis For System Integration Services Market

The value chain for the System Integration Services market begins with upstream activities involving various technology providers and tool developers. These include software vendors supplying operating systems, enterprise applications, databases, and specialized integration platforms such as iPaaS (Integration Platform as a Service) and API management solutions. Hardware providers, offering servers, networking equipment, and infrastructure components, also form a critical part of this upstream segment. Additionally, companies developing analytics tools, cybersecurity solutions, and automation technologies contribute essential building blocks for complex integration projects. The strength of these foundational elements directly impacts the quality and capabilities of the integration services offered downstream.

Further along the value chain, system integrators acquire these technologies and leverage their expertise to design, implement, and manage customized integration solutions. This phase often involves extensive consulting, architecture planning, development, testing, and deployment. Integrators act as intermediaries, bridging the gap between diverse technologies and specific business requirements. Their ability to deliver comprehensive, scalable, and secure solutions is paramount. Distribution channels play a vital role here, with many system integrators engaging directly with clients through their sales teams, while others may partner with technology vendors or operate through value-added resellers (VARs) who provide localized support and specialized services.

Downstream activities primarily involve the end-users, which are the businesses and organizations that consume these integration services. These customers utilize the integrated systems to achieve operational efficiencies, enhance data flow, improve decision-making, and support their digital transformation goals. Post-implementation support, maintenance, and ongoing optimization services are also crucial components of the downstream value chain, ensuring the long-term effectiveness and evolution of the integrated environment. The direct distribution channel emphasizes close collaboration between the integrator and the client, allowing for highly customized solutions and continuous feedback. Indirect channels, through partners, extend reach and provide specialized expertise to a broader market, ensuring that even complex requirements can be met through a network of specialized providers.

System Integration Services Market Potential Customers

Potential customers for System Integration Services span across nearly every sector and organizational size, driven by the universal need to optimize IT infrastructure and streamline business processes. Large enterprises, grappling with decades of technological accumulation including legacy systems, multiple ERPs, and cloud applications, represent a primary customer segment. These organizations often require extensive integration projects to achieve a unified view of their data, automate complex workflows, and support global operations. The sheer scale and complexity of their IT environments necessitate expert system integrators to ensure seamless connectivity and performance.

Small and Medium-sized Enterprises (SMEs) are also a rapidly growing segment of potential customers. While their integration needs may be less complex than those of large corporations, SMEs increasingly adopt cloud-based solutions, SaaS applications, and digital tools to enhance competitiveness. They often lack in-house IT expertise for intricate integrations, creating significant demand for external system integration services that can connect their chosen applications efficiently and cost-effectively, enabling them to scale operations and improve productivity without substantial capital investment in IT staff. This demand is further fueled by the increasing affordability and accessibility of integration platforms.

Moreover, organizations undergoing significant digital transformation initiatives, regardless of their current IT maturity, are prime buyers of system integration services. This includes companies transitioning from on-premise to cloud environments, implementing new CRM or ERP systems, adopting IoT solutions, or enhancing their data analytics capabilities. Industries such as BFSI, healthcare, manufacturing, and retail are particularly active, driven by regulatory compliance, customer experience enhancement, and operational efficiency mandates. Essentially, any entity looking to leverage technology more effectively by breaking down data silos and automating inter-system communications is a potential customer for system integration services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $415.7 billion |

| Market Forecast in 2032 | $798.2 billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Accenture, IBM, Capgemini, Wipro, Tata Consultancy Services (TCS), HCLTech, Infosys, Cognizant, DXC Technology, NTT DATA, Deloitte, PwC, EY, Tech Mahindra, Atos, CGI, Fujitsu, Sopra Steria, LTIMindtree, Genpact |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

System Integration Services Market Key Technology Landscape

The System Integration Services market is characterized by a dynamic and evolving technology landscape, driven by the need for more agile, scalable, and intelligent integration solutions. Integration Platform as a Service (iPaaS) stands out as a foundational technology, offering cloud-based platforms that facilitate seamless connectivity between diverse applications and data sources without extensive on-premise infrastructure. Complementing iPaaS, robust API management platforms are essential for designing, securing, and scaling APIs, which serve as the communication backbone for modern integrated systems. The widespread adoption of microservices architecture further influences this landscape, promoting loosely coupled services that are easier to integrate and deploy, enhancing flexibility and resilience.

Containerization technologies, such as Docker and Kubernetes, have become critical for deploying and managing these microservices, providing consistency across different environments and simplifying the integration process. Beyond core connectivity, the integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities is rapidly transforming the market. AI/ML tools are used for intelligent data mapping, predictive anomaly detection, automating integration workflows, and providing insights for proactive system optimization. Robotic Process Automation (RPA) also plays a significant role, particularly in business process integration, by automating repetitive tasks across integrated systems, thereby enhancing efficiency and reducing manual errors.

Furthermore, event-driven architectures are gaining prominence, enabling real-time data synchronization and responsive system interactions, which are crucial for applications like IoT and real-time analytics. Data virtualization and data fabric technologies are also becoming more prevalent, offering unified access to disparate data sources without physical data movement, simplifying complex data integration challenges. The convergence of these technologies enables system integrators to deliver comprehensive solutions that not only connect systems but also empower businesses with intelligent automation, real-time insights, and greater operational agility, addressing the complex demands of today's digital enterprises.

Regional Highlights

- North America: This region holds a significant market share, driven by a high concentration of technology companies, early adoption of cloud and digital transformation initiatives, and substantial investments in IT modernization. The presence of major players and strong economic conditions contribute to sustained growth, particularly in financial services, healthcare, and telecom sectors.

- Europe: Characterized by mature economies and stringent data privacy regulations, Europe sees steady growth, fueled by the modernization of legacy systems, increased cloud adoption, and the push for Industry 4.0 in manufacturing. Countries like Germany, the UK, and France are key contributors, focusing on secure and compliant integration solutions.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC benefits from rapid economic development, increasing digital penetration, and significant government and private sector investments in IT infrastructure across countries like China, India, Japan, and Australia. The expansion of manufacturing, e-commerce, and financial services sectors drives strong demand for system integration.

- Latin America: This region is experiencing considerable growth, propelled by the digital transformation efforts across various industries, the adoption of cloud services, and the need for scalable IT solutions to support expanding economies. Brazil and Mexico are leading the charge, with increasing demand for robust integration to optimize business processes.

- Middle East and Africa (MEA): Growth in MEA is driven by smart city initiatives, diversification of economies away from oil, and increasing investments in IT infrastructure, particularly in the UAE, Saudi Arabia, and South Africa. Digitalization efforts across banking, government, and retail sectors are creating new opportunities for system integration services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the System Integration Services Market.- Accenture

- IBM

- Capgemini

- Wipro

- Tata Consultancy Services (TCS)

- HCLTech

- Infosys

- Cognizant

- DXC Technology

- NTT DATA

- Deloitte

- PwC

- EY

- Tech Mahindra

- Atos

- CGI

- Fujitsu

- Sopra Steria

- LTIMindtree

- Genpact

Frequently Asked Questions

What are System Integration Services?

System Integration Services involve connecting disparate IT systems, applications, data, and business processes to create a unified and optimized operational environment. These services ensure seamless communication and data flow across an organization's technology landscape, enhancing efficiency and reducing data silos.

Why is System Integration important for businesses?

System Integration is crucial for businesses as it improves operational efficiency, automates workflows, ensures data consistency, supports digital transformation, and provides a holistic view of business operations. It helps organizations unlock greater agility, reduce costs, and make faster, more informed decisions.

What types of System Integration Services are commonly offered?

Common System Integration Services include application integration, data integration, cloud integration, enterprise application integration (EAI), infrastructure integration, and business process integration. Consulting services for strategic planning and implementation are also a significant component.

How does AI impact the System Integration Services market?

AI significantly impacts system integration by automating data mapping, predicting potential integration issues, enhancing API management, and optimizing workflows. AI-driven tools bring greater precision, speed, and cost-effectiveness, transforming complex integration tasks into more intelligent and autonomous processes.

Which industries are the largest adopters of System Integration Services?

The largest adopters of System Integration Services are typically industries with complex IT environments and high data volumes, such as Banking, Financial Services, and Insurance (BFSI), Healthcare & Life Sciences, IT & Telecommunications, Manufacturing, and Retail & E-commerce.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager